Equities

US Equities Slide On Profit Taking As 4Q 2021 Earnings Season Gets Under Way

The risk-off move has been fairly limited so far, with 44% of S&P 500 stocks rising today and over 60% still above their 50-day moving average

Published ET

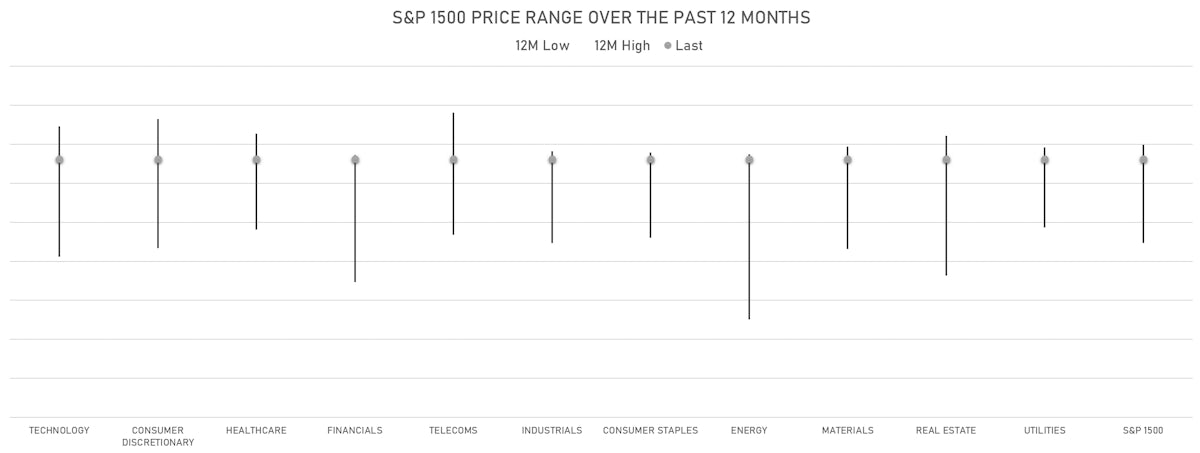

Range Of Prices For S&P 1500 Sectors Over The Past Year | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

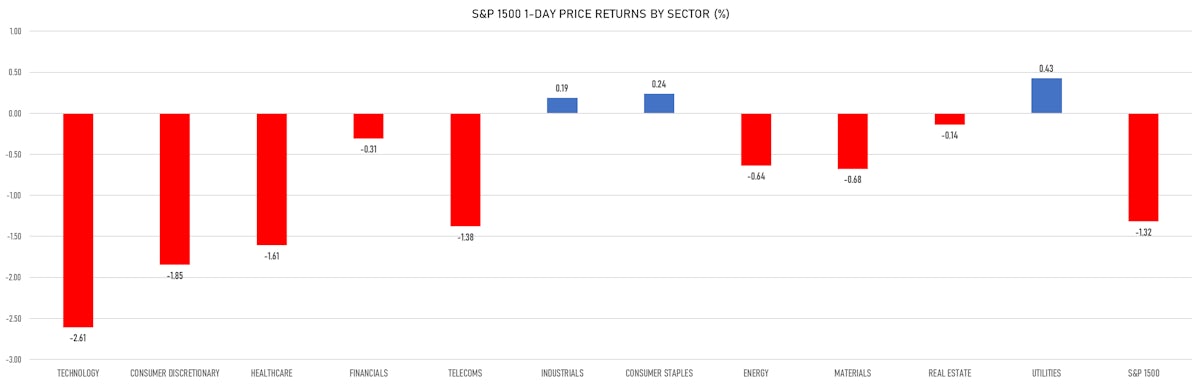

- Daily performance of US indices: S&P 500 down -1.42%; Nasdaq Composite down -2.51%; Wilshire 5000 down -1.52%

- 44.0% of S&P 500 stocks were up today, with 70.3% of stocks above their 200-day moving average (DMA) and 61.2% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 0.45% and consumer staples up 0.22%

- Bottom performing sectors in the S&P 500: technology down -2.65% and consumer discretionary down -2.08%

- The number of shares in the S&P 500 traded today was 585m for a total turnover of US$ 79 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was down -2.5%; the S&P small caps index was up 0.0% and mid-caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.0); the 3-month average volume is 2.2m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.03%; UK FTSE 100 up 0.16%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -1.03%, Japan's TOPIX 500 down -1.29%

VOLATILITY

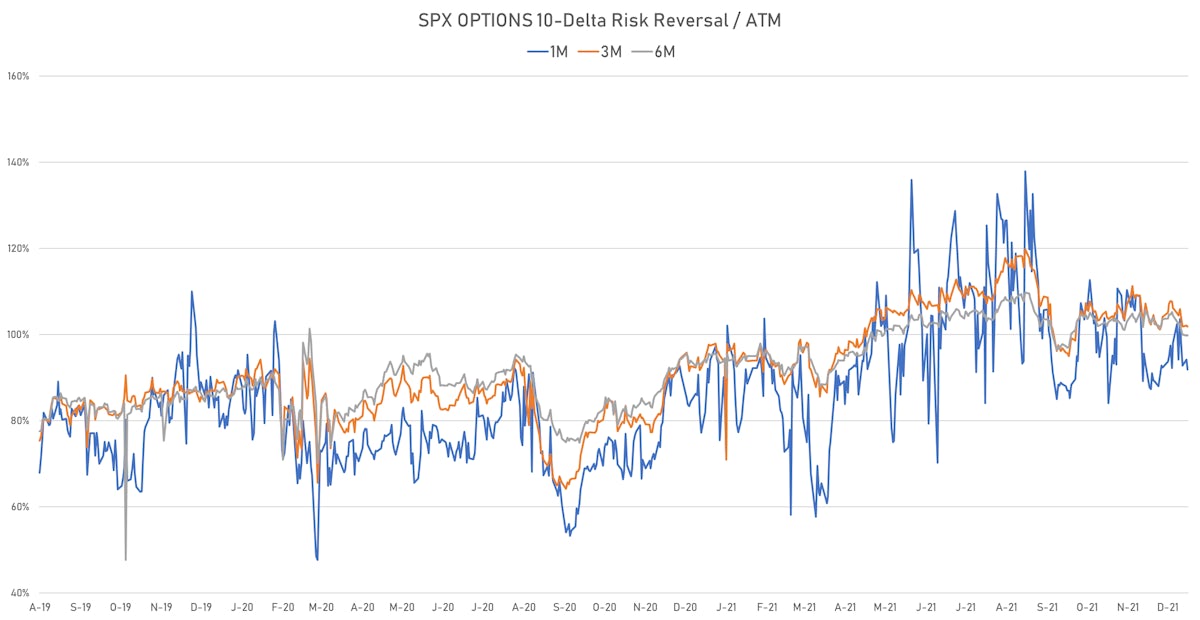

- 1-month at-the-money implied volatility on the S&P 500 at 15.7%, up from 13.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.3%, up from 12.2%

NOTABLE US EARNINGS RELEASES

- Delta Air Lines Inc (DAL | Industrials): missed EPS median estimate (0.22 act. vs. 0.23 est.) and beat revenue median estimate (9,470m act. vs. 9,137m est.), up 2.12% today, closed at $ 41.47 / share and traded at $ 40.60 (-2.10%) after hours

TOP WINNERS

- Virgin Orbit Holdings Inc (BBIG), up 31.3% to $3.53 / YTD price return: +31.5% / 12-Month Price Range: $ 1.40-12.49 / Short interest (% of float): 31.7%; days to cover: 1.8

- Accolade Inc (RMTI), up 27.7% to $0.47 / YTD price return: -7.3% / 12-Month Price Range: $ 0.34-1.98 / Short interest (% of float): 2.0%; days to cover: 1.7

- Amylyx Pharmaceuticals Inc (ONCS), up 20.1% to $0.98 / 12-Month Price Range: $ 0.80-8.16 / Short interest (% of float): 3.0%; days to cover: 1.6

- Butterfly Network Inc (GTNa), up 19.5% to $21.55 / YTD price return: +12.9% / 12-Month Price Range: $ 14.99-23.75 / Short interest (% of float): 0.0%; days to cover: 0.2

- Illumina Inc (XTLB), up 17.0% to $2.89 / YTD price return: +11.4% / 12-Month Price Range: $ 2.56-6.69 / Short interest (% of float): 0.1%; days to cover: 0.2

- Solid Power Inc (CLDS), up 16.0% to $25.67 / YTD price return: -1.5% / 12-Month Price Range: $ 14.79-29.22 / Short interest (% of float): 3.4%; days to cover: 5.2

- EQRx Inc (FUSN), up 14.9% to $6.28 / YTD price return: +8.4% / 12-Month Price Range: $ 4.09-13.30 / Short interest (% of float): 0.4%; days to cover: 3.8

- Digital World Acquisition Corp (JOAN), up 14.1% to $10.70 / YTD price return: +24.1% / 12-Month Price Range: $ 8.51-17.50 / Short interest (% of float): 25.3%; days to cover: 6.3

- Lithium Americas Corp (TKAT), up 13.9% to $3.80 / YTD price return: +4.7% / 12-Month Price Range: $ 1.65-74.11 / Short interest (% of float): 11.8%; days to cover: 0.7

- Oatly Group AB (YTRA), up 13.2% to $1.88 / YTD price return: +3.1% / 12-Month Price Range: $ 1.64-2.94 / Short interest (% of float): 0.1%; days to cover: 0.4

BIGGEST LOSERS

- Pacific Biosciences of California Inc (NXGL), down 11.3% to $2.77 / YTD price return: -28.2% / 12-Month Price Range: $ 2.55-4.66 / Short interest (% of float): 0.2% (the stock is currently on the short sale restriction list)

- Albertsons Companies Inc (QTT), down 9.7% to $2.61 / YTD price return: -4.6% / 12-Month Price Range: $ 2.35-56.40 / Short interest (% of float): 3.4%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Fathom Digital Manufacturing Corp (CFLT), down 9.4% to $62.95 / YTD price return: -33.0% / 12-Month Price Range: $ 37.71-94.97 / Short interest (% of float): 11.1%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- 360 DigiTech Inc (HYZN), down 8.0% to $5.27 / YTD price return: -19.5% / 12-Month Price Range: $ 5.09-19.95 / Short interest (% of float): 9.6%; days to cover: 3.2

- Apellis Pharmaceuticals Inc (HLGN), down 7.5% to $5.28 / 12-Month Price Range: $ 5.78-16.35 / Short interest (% of float): 0.1%; days to cover: 0.9

- Olink Holding AB (publ) (ECOR), down 7.5% to $.77 / YTD price return: -26.5% / 12-Month Price Range: $ .52-3.63 / Short interest (% of float): 1.6%; days to cover: 1.8

- Sprouts Farmers Market Inc (PEAR), down 6.8% to $4.52 / YTD price return: -3.2% / 12-Month Price Range: $ 4.85-14.60 / Short interest (% of float): 0.4%; days to cover: 0.8

- Sema4 Holdings Corp (JWEL), down 6.6% to $4.39 / YTD price return: -2.2% / 12-Month Price Range: $ 4.22-25.78 / Short interest (% of float): 1.3%; days to cover: 0.4

- BioNTech SE (CD), down 6.2% to $5.48 / YTD price return: -16.3% / 12-Month Price Range: $ 5.30-27.47 / Short interest (% of float): 4.6%; days to cover: 3.6

- Ero Copper Corp (COMS), down 6.0% to $.65 / 12-Month Price Range: $ .61-6.54 / Short interest (% of float): 1.7%; days to cover: 1.2

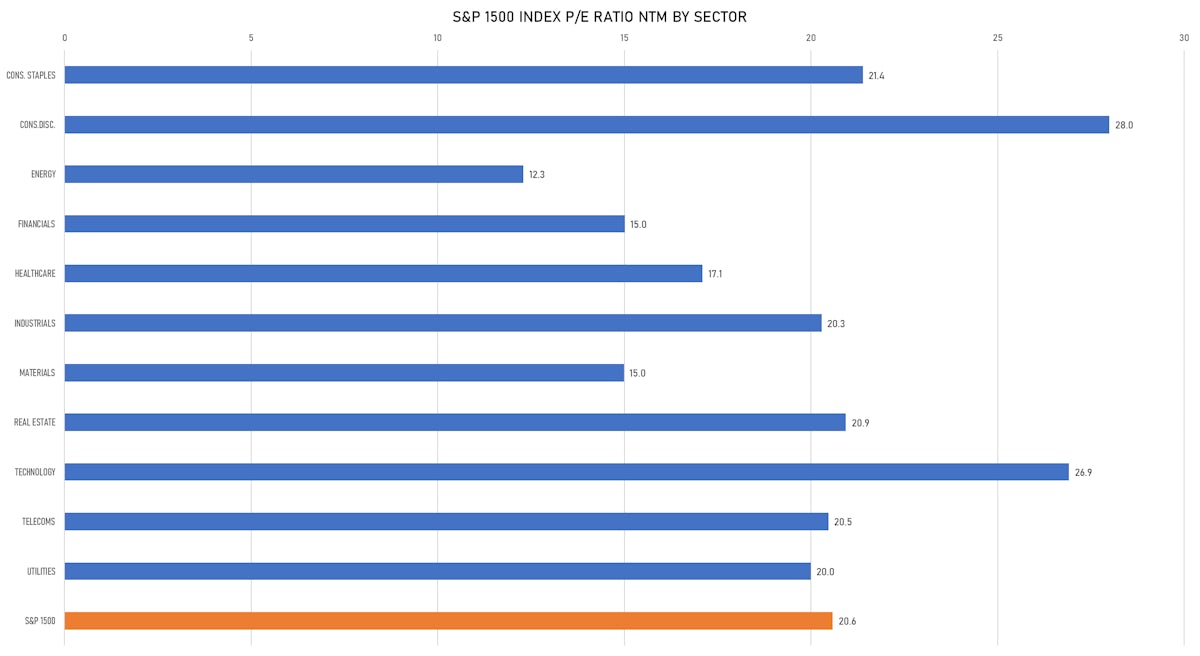

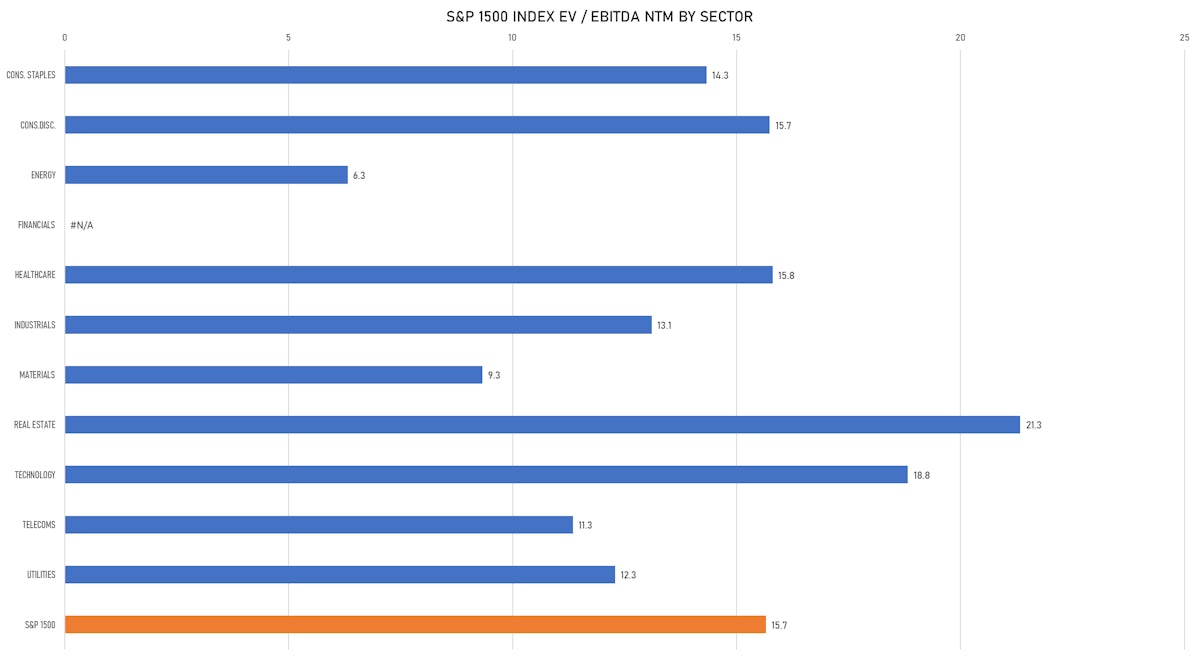

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Andretti Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: WNNR.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets LLC

- TPG Partners LLC (Asset Management | Fort Worth, Texas), raised US$ 1,000 M, placing 34 M class a common shares. Financial advisors on the transaction: Samuel A. Ramirez & Co., Evercore Group, R Seelaus & Company Inc, Amerivet Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, CL King & Associates Inc, BMO Capital Markets, Drexel Hamilton LLC, SMBC Nikko Securities America Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, MUFG Securities Americas Inc, Blaylock Van LLC, Mizuho Securities USA LLC, BofA Securities Inc, Barclays Capital Inc, Siebert Williams Shank & Co, UBS Securities LLC, Goldman Sachs & Co, Keefe Bruyette & Woods Inc

- Jinko Solar Co Ltd (Semiconductors | Shanghai, China (Mainland)), raised US$ 1,572 M, placing 2,000 M class a ordinary shares. Financial advisors on the transaction: CITIC Securities Co Ltd, China Securities Co Ltd

- Homevista Decor & Furnishing Pvt Ltd / India - Consumer Products and Services / Listing Exchange: National / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- 468 Spac II SE / Luxembourg - Financials / Listing Exchange: Frankfurt / Ticker: N/A / Gross proceeds (including overallotment): US$ 228.84m (offering in EURO) / Bookrunners: Not Applicable

- Primavera & ABC International-Backed Special Purpose Acquisition Co / Hong Kong - Financials / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

SECONDARIES / FOLLOW-ONS

- Ares Capital Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ARCC / Gross proceeds (including overallotment): US$ 214.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, RBC Capital Markets LLC, Morgan Stanley & Co LLC, BofA Securities Inc, UBS Securities LLC

- PT Allo Bank Indonesia Tbk / Indonesia - Financials / Listing Exchange: Indonesia / Ticker: BBHI / Gross proceeds (including overallotment): US$ 341.27m (offering in Indonesian Rupiah) / Bookrunners: Not Applicable

- Nippon Building Fund Inc / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 8951 / Gross proceeds (including overallotment): US$ 277.29m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Daiwa Securities Co Ltd

- JL MAG Rare-Earth Co Ltd / China - Materials / Listing Exchange: Hong Kong / Ticker: 300748 / Gross proceeds (including overallotment): US$ 275.40m (offering in Hong Kong Dollar) / Bookrunners: DBS Asia Capital Ltd, CLSA Asia-Pacific Markets Ltd, BNP Paribas Securities (Asia) Ltd

- Digital 9 Infrastructure PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: DGI9 / Gross proceeds (including overallotment): US$ 274.02m (offering in British Pound) / Bookrunners: JP Morgan Cazenove

- Shandong Fengyuan Chemical Co Ltd / China - Materials / Listing Exchange: ShenzSME / Ticker: 002805 / Gross proceeds (including overallotment): US$ 133.69m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Phoenix Group Holdings PLC (Insurance | London, United Kingdom), raised US$ 602 M, placing 66 M ordinary or common shares. Financial advisors on the transaction: Merrill Lynch International Ltd