Equities

US Equities Fall For A Second Straight Week, With the S&P 500 Down 0.30% This Week, Nasdaq -0.28%, Russell 2000 -0.80%

Disappointing volumes for US ECMs, with less-than-ideal market conditions: this week saw just $1bn in IPOs, $2bn in SPAC IPOs, $1bn in Accelerated Book Builds / Blocks, and $425m in convertibles

Published ET

Value has caught up with growth over the past 6 weeks | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.08%; Nasdaq Composite up 0.59%; Wilshire 5000 up 0.05%

- 41.8% of S&P 500 stocks were up today, with 66.1% of stocks above their 200-day moving average (DMA) and 56.4% above their 50-DMA

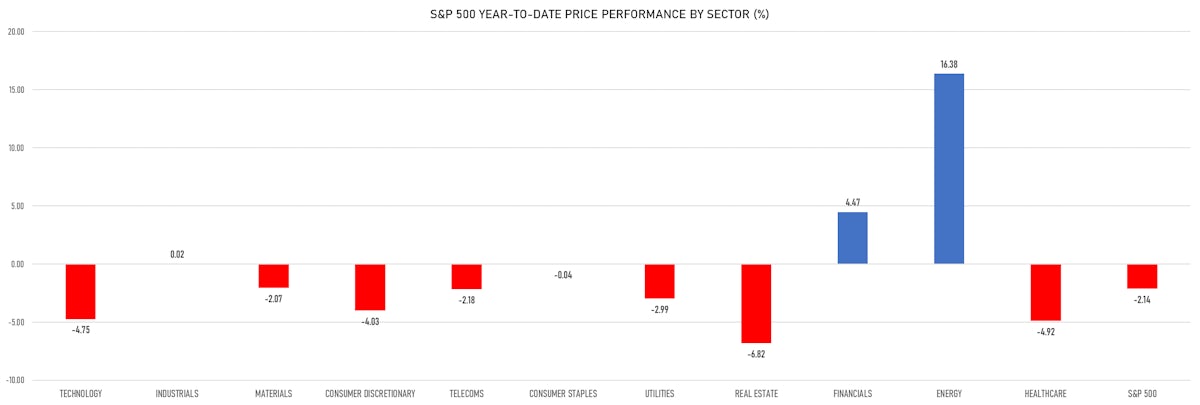

- Top performing sectors in the S&P 500: energy up 2.45% and technology up 0.89%

- Bottom performing sectors in the S&P 500: real estate down -1.18% and financials down -1.01%

- The number of shares in the S&P 500 traded today was 637m for a total turnover of US$ 83 bn

- The S&P 500 Value Index was down -0.1%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was up 0.5% and mid-caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.5); the 3-month average volume is 2.2m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -1.01%; UK FTSE 100 down -0.28%; Hang Seng SH-SZ-HK 300 Index down -0.82%; Japan's TOPIX 500 down -1.44%

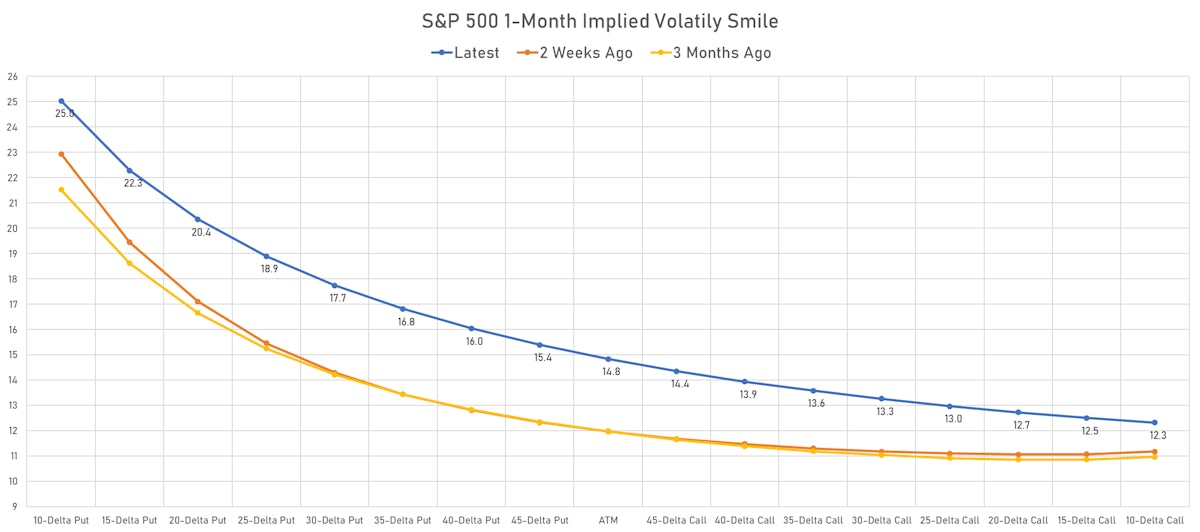

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.8%, down from 15.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.3%, up from 12.3%

NOTABLE US EARNINGS RELEASES

- JPMorgan Chase & Co (JPM | Financials): beat EPS median estimate (3.33 act. vs. 2.99 est.) and missed revenue median estimate (29,257m act. vs. 29,849m est.), down -6.15% today, closed at $ 157.89 / share and traded at $ 157.59 (-0.19%) after hours

- Wells Fargo & Co (WFC | Financials): beat EPS median estimate (1.38 act. vs. 1.10 est.) and beat revenue median estimate (20,856m act. vs. 18,637m est.), up 3.68% today, closed at $ 58.06 / share and traded at $ 58.20 (+0.24%) after hours

- Citigroup Inc (C | Financials): beat EPS median estimate (1.46 act. vs. 1.38 est.) and beat revenue median estimate (17,017m act. vs. 16,818m est.), down -1.25% today, closed at $ 66.93 / share and traded at $ 67.04 (+0.16%) after hours

- BlackRock Inc (BLK | Financials): beat EPS median estimate (10.42 act. vs. 10.25 est.) and missed revenue median estimate (5,106m act. vs. 5,197m est.), down -2.19% today, closed at $ 848.60 / share and traded at $ 848.82 (+0.03%) after hours

- First Republic Bank (FRC | Financials): beat EPS median estimate (2.02 act. vs. 1.91 est.) and beat revenue median estimate (1,400m act. vs. 1,350m est.), down -4.22% today, closed at $ 192.06 / share and traded at $ 192.00 (-0.03%) after hours

TOP WINNERS

- Prometheus Biosciences Inc (RXDX), up 17.1% to $35.29 / 12-Month Price Range: $ 16.11-40.49 / Short interest (% of float): 7.2%; days to cover: 4.5

- Melco Resorts & Entertainment Ltd (MLCO), up 16.6% to $11.10 / YTD price return: +9.0% / 12-Month Price Range: $ 8.87-23.65 / Short interest (% of float): 1.7%; days to cover: 2.4

- Las Vegas Sands Corp (LVS), up 14.2% to $42.99 / YTD price return: +14.2% / 12-Month Price Range: $ 33.75-66.77

- Fathom Digital Manufacturing Corp (FATH), up 13.9% to $7.89 / YTD price return: -.4% / 12-Month Price Range: $ 5.04-11.00 / Short interest (% of float): 0.6%; days to cover: 0.3

- Planet Labs PBC (PL), up 13.8% to $6.36 / YTD price return: +3.4% / 12-Month Price Range: $ 4.95-12.15 / Short interest (% of float): 1.7%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Atara Biotherapeutics Inc (ATRA), up 12.9% to $16.07 / YTD price return: +2.0% / 12-Month Price Range: $ 11.81-21.85 / Short interest (% of float): 10.7%; days to cover: 12.1

- SIGNA Sports United NV (SSU), up 11.5% to $8.45 / 12-Month Price Range: $ 6.97-11.40 / Short interest (% of float): 0.3%; days to cover: 1.6

- Onto Innovation Inc (ONTO), up 11.3% to $105.96 / YTD price return: +4.7% / 12-Month Price Range: $ 52.17-104.41 / Short interest (% of float): 2.0%; days to cover: 3.0

- Allogene Therapeutics Inc (ALLO), up 11.0% to $13.28 / 12-Month Price Range: $ 11.54-39.12 / Short interest (% of float): 10.2%; days to cover: 5.7

- Weatherford International PLC (WFRD), up 9.7% to $32.61 / YTD price return: +17.6% / 12-Month Price Range: $ 6.10-34.95 / Short interest (% of float): 0.6%; days to cover: 1.2

BIGGEST LOSERS

- Dingdong (Cayman) Ltd (DDL), down 14.8% to $8.63 / YTD price return: -46.6% / 12-Month Price Range: $ 10.12-46.00 / Short interest (% of float): 0.3%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- Brilliant Earth Group Inc (BRLT), down 10.8% to $12.42 / YTD price return: -31.2% / 12-Month Price Range: $ 10.63-20.39 / Short interest (% of float): 9.8%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Revolve Group Inc (RVLV), down 10.1% to $46.57 / YTD price return: -16.9% / 12-Month Price Range: $ 31.38-89.60 / Short interest (% of float): 11.5%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- CureVac NV (CVAC), down 9.4% to $24.48 / YTD price return: -28.7% / 12-Month Price Range: $ 26.96-133.00 / Short interest (% of float): 5.0%; days to cover: 5.6 (the stock is currently on the short sale restriction list)

- ADC Therapeutics SA (ADCT), down 9.3% to $17.22 / 12-Month Price Range: $ 18.33-34.48 / Short interest (% of float): 15.2%; days to cover: 38.2 (the stock is currently on the short sale restriction list)

- Shockwave Medical Inc (SWAV), down 9.1% to $166.98 / 12-Month Price Range: $ 91.47-249.73 / Short interest (% of float): 3.6%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Virgin Orbit Holdings Inc (VORB), down 9.1% to $8.55 / 12-Month Price Range: $ 5.88-11.28 / Short interest (% of float): 0.8%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- DigitalOcean Holdings Inc (DOCN), down 9.1% to $59.49 / YTD price return: -25.9% / 12-Month Price Range: $ 35.35-133.40 / Short interest (% of float): 13.7%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Mechel PAO (MTL_p), down 9.0% to $1.72 / 12-Month Price Range: $ .45-2.43 / Short interest (% of float): 0.0%; days to cover: 0.1

- Montrose Environmental Group Inc (MEG), down 8.8% to $54.25 / YTD price return: -23.1% / 12-Month Price Range: $ 35.56-80.42 / Short interest (% of float): 5.0%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

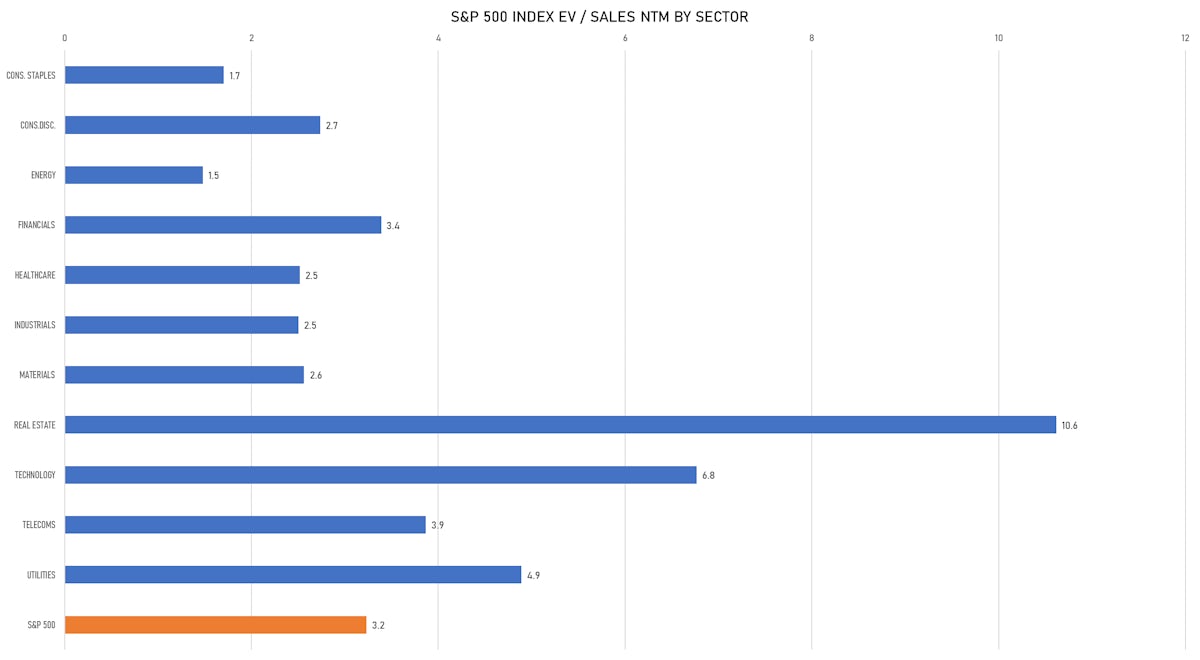

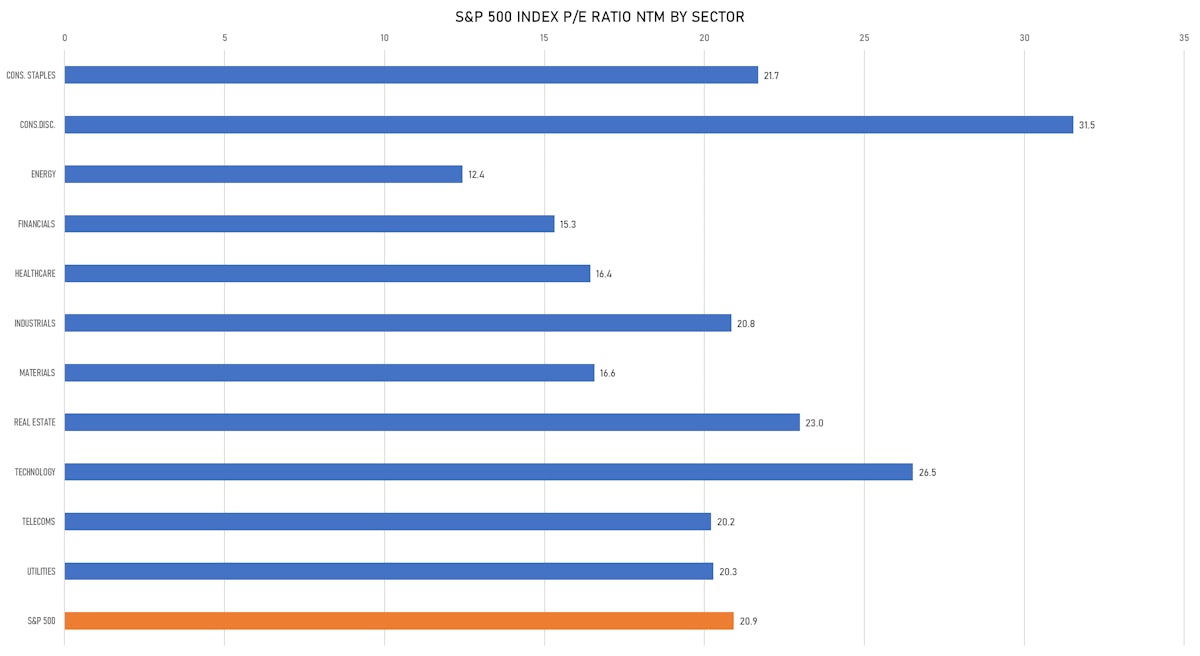

VALUATION MULTIPLES BY SECTORS

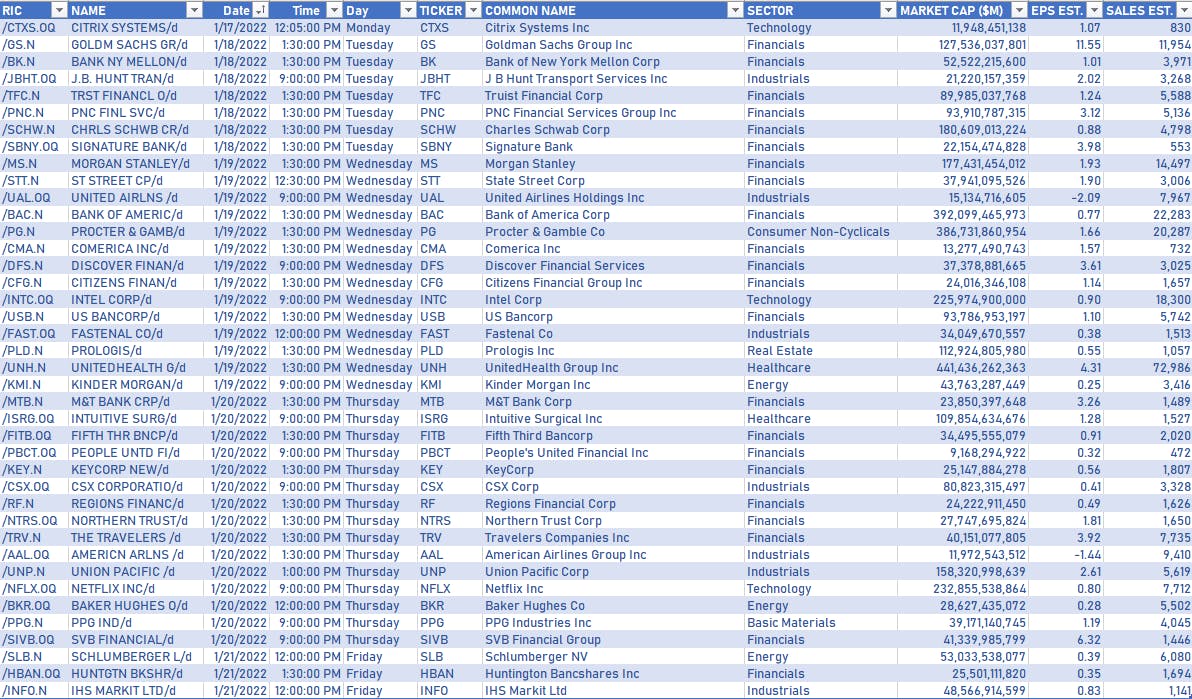

S&P 500 COMPANIES REPORTING NEXT WEEK

NEW IPOs ANNOUNCED OR PRICED

- Relativity Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: RACYU / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Alliance Global Partners

- LG Energy Solution Ltd / South Korea - Energy and Power / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 10,749m (offering in U.S. Dollar) / Bookrunners: Daishin Securities Co Ltd, Shinyoung Securities Co, Ltd, Goldman Sachs & Co, Morgan Stanley & Co, Citigroup, HI Investment & Securities Co Ltd, Shinhan Investment Corp, Merrill Lynch International Limited, Hana Financial Investment Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- Jiangsu Smartwin Electronics Technology Co Ltd / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: 301106 / Gross proceeds (including overallotment): US$ 107.84m (offering in Chinese Yuan) / Bookrunners: Haitong Securities Co Ltd

SECONDARIES

- Spirit Realty Capital Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: SRC / Gross proceeds (including overallotment): US$ 390.32m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, BofA Securities Inc

- B&M European Value Retail SA / United Kingdom - Retail / Listing Exchange: London / Ticker: BME / Gross proceeds (including overallotment): US$ 319.95m (offering in British Pound) / Bookrunners: Goldman Sachs International

- Bank Of Qingdao Co Ltd / China - Financials / Listing Exchange: Hong Kong / Ticker: 3866 / Gross proceeds (including overallotment): US$ 265.84m (offering in Hong Kong Dollar) / Bookrunners: CLSA Asia-Pacific Markets Ltd, Intesa SanPaolo Spa-HK Branch, China Merchants Securities (HK) Co Ltd, China International Capital Corp HK Securities Ltd, AMTD Global Markets Ltd

- Team17 Group PLC / United Kingdom - High Technology / Listing Exchange: London AIM / Ticker: TM17 / Gross proceeds (including overallotment): US$ 107.50m (offering in British Pound) / Bookrunners: Berenberg

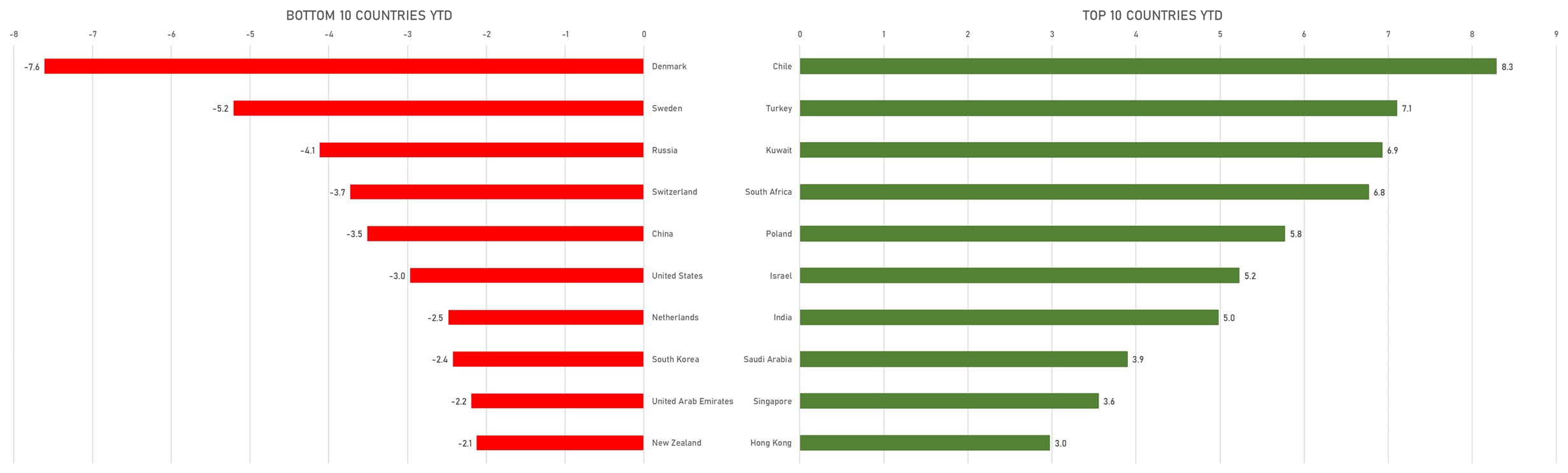

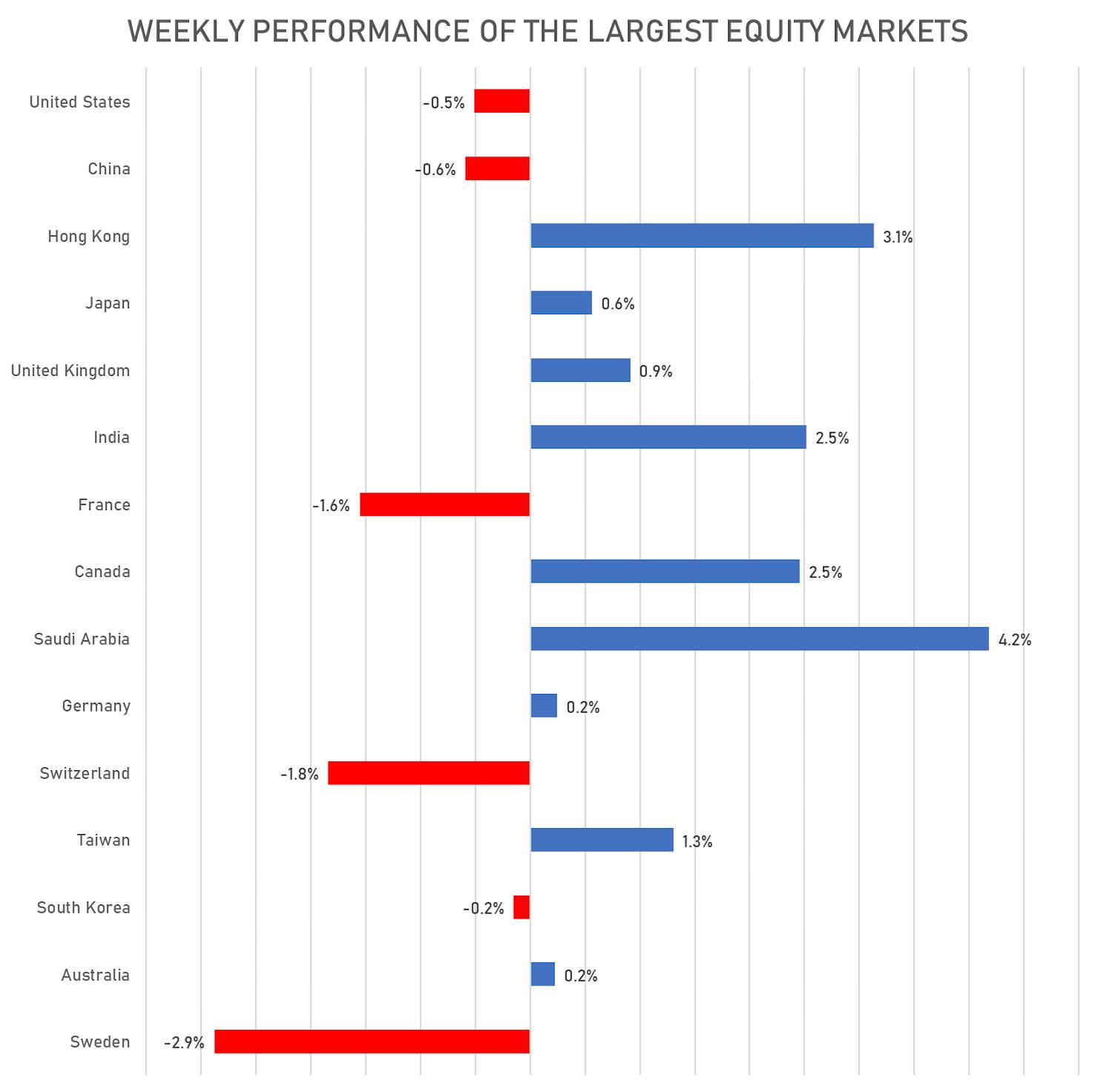

WEEKLY PERFORMANCE OF MAIN EQUITY MARKETS

TOP / BOTTOM GLOBAL YTD US$ TOTAL RETURNS