Equities

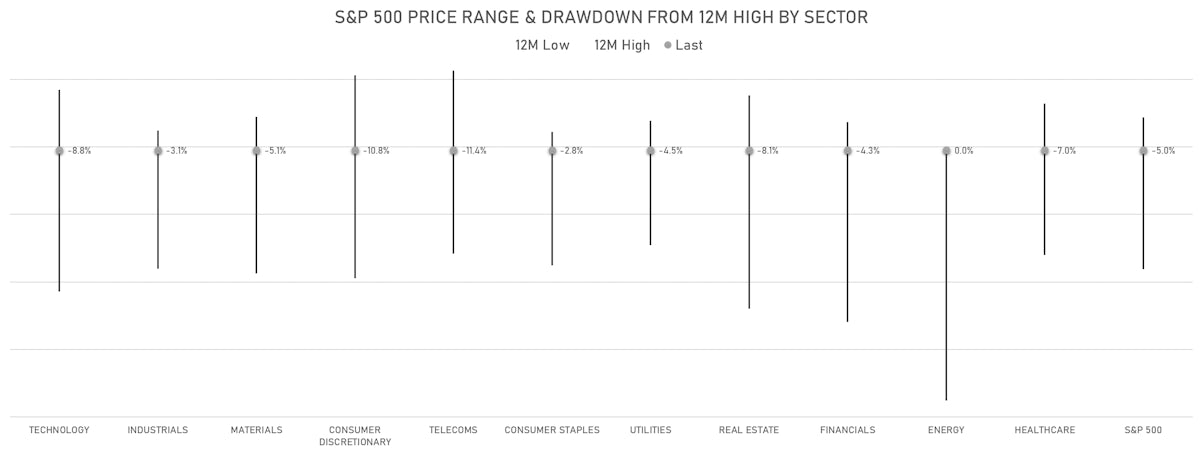

Broad Slide For US Equities Takes S&P 500 Drawdown To 5% Below All-Time Highs

The S&P 500 energy was the lone positive sub-index today, hitting its highest level since 2019, as Brent crude front-month futures reached prices not seen since 2014; real market tightness in the spot market is likely to materialize later this year, with some OPEC+ members unable to meet their current production quotas

Published ET

Current drawdowns for S&P 500 Sub Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

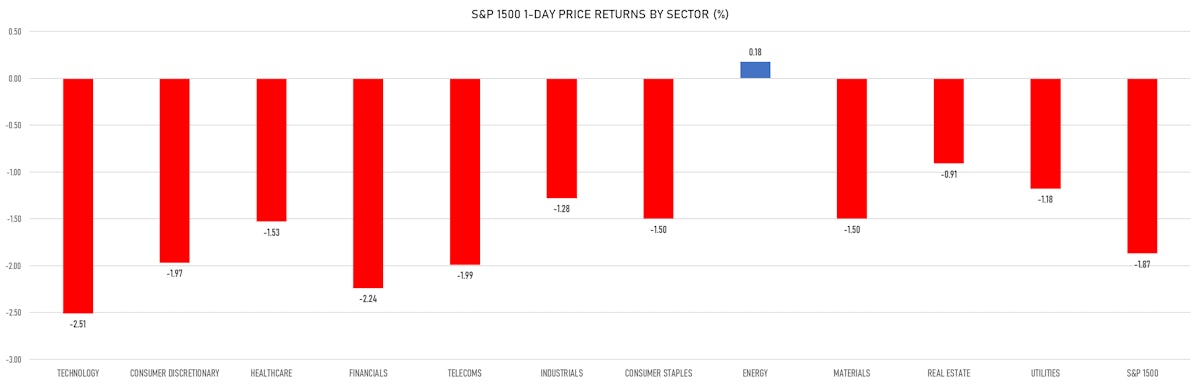

- Daily performance of US indices: S&P 500 down -1.84%; Nasdaq Composite down -2.60%; Wilshire 5000 down -2.04%

- 11.3% of S&P 500 stocks were up today, with 60.6% of stocks above their 200-day moving average (DMA) and 49.9% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.40% and real estate down -0.71%

- Bottom performing sectors in the S&P 500: technology down -2.49% and financials down -2.30%

- The number of shares in the S&P 500 traded today was 753m for a total turnover of US$ 96 bn

- The S&P 500 Value Index was down -1.3%, while the S&P 500 Growth Index was down -2.4%; the S&P small caps index was down -2.6% and mid caps were down -2.1%

- The volume on CME's INX (S&P 500 Index) was 2.7m (3-month z-score: 0.9); the 3-month average volume is 2.3m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -0.97%; UK FTSE 100 down -0.63%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.18%, Japan's TOPIX 500 down -2.55%

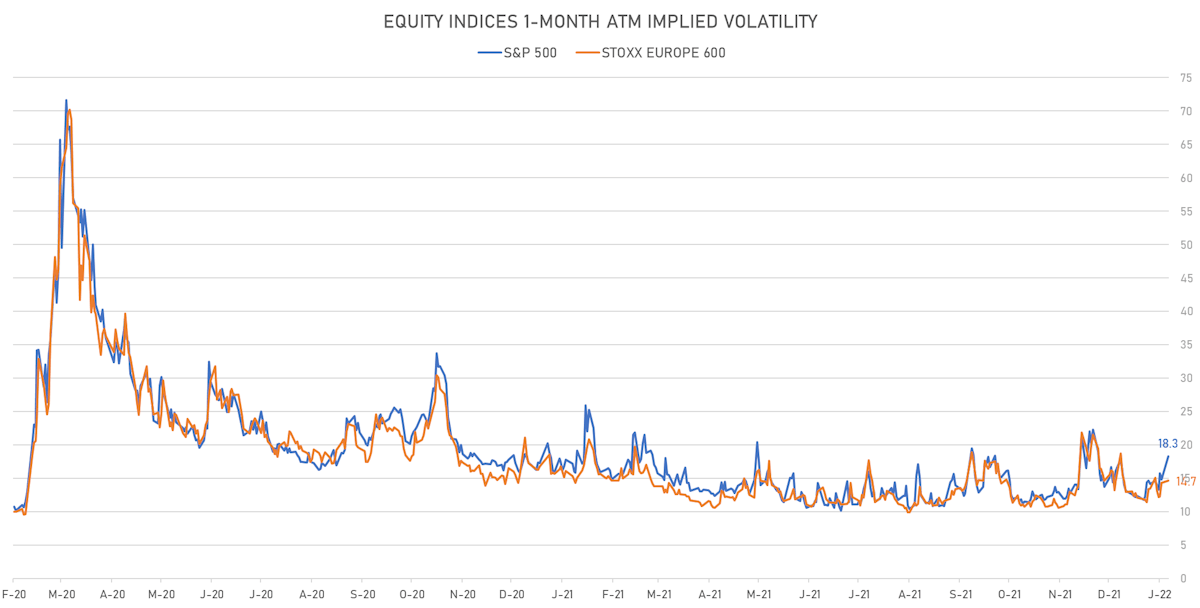

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 18.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.7%, up from 13.3%

NOTABLE US EARNINGS RELEASES

- Charles Schwab Corp (SCHW | Financials): missed EPS median estimate (0.86 act. vs. 0.88 est.) and missed revenue median estimate (4,708m act. vs. 4,799m est.), down -3.53% today, closed at $ 92.16 / share and traded at $ 95.53 (+3.66%) after hours

- Goldman Sachs Group Inc (GS | Financials): missed EPS median estimate (10.81 act. vs. 11.55 est.) and beat revenue median estimate (12,639m act. vs. 11,948m est.), down -6.97% today, closed at $ 354.40 / share and traded at $ 381.19 (+7.56%) after hours

- PNC Financial Services Group Inc (PNC | Financials): missed EPS median estimate (2.86 act. vs. 3.24 est.) and missed revenue median estimate (5,127m act. vs. 5,137m est.), down -2.39% today, closed at $ 216.88 / share and traded at $ 222.49 (+2.59%) after hours

- Truist Financial Corp (TFC | Financials): beat EPS median estimate (1.13 act. vs. 1.11 est.) and beat revenue median estimate (5,600m act. vs. 5,589m est.), down -0.36% today, closed at $ 67.17 / share and traded at $ 67.45 (+0.42%) after hours

- Bank of New York Mellon Corp (BK | Financials): missed EPS median estimate (1.01 act. vs. 1.01 est.) and beat revenue median estimate (4,015m act. vs. 3,973m est.), down -1.07% today, closed at $ 62.92 / share and traded at $ 63.61 (+1.10%) after hours

- Interactive Brokers Group Inc (IBKR | Financials): beat EPS median estimate (0.83 act. vs. 0.82 est.) and missed revenue median estimate (603m act. vs. 673m est.), down -3.77% today, closed at $ 71.93 / share and traded at $ 74.75 (+3.92%) after hours

- Signature Bank (SBNY | Financials): beat EPS median estimate (4.34 act. vs. 3.98 est.) and beat revenue median estimate (569m act. vs. 553m est.), down -2.65% today, closed at $ 355.70 / share and traded at $ 365.25 (+2.68%) after hours

TOP WINNERS

- Activision Blizzard Inc (ATVI), up 25.9% to $82.31 / YTD price return: +23.7% / 12-Month Price Range: $ 56.40-104.53

- Digital World Acquisition Corp (DWAC), up 21.8% to $86.31 / YTD price return: +67.8% / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 11.9%; days to cover: 0.8

- Exscientia PLC (EXAI), up 12.0% to $21.05 / YTD price return: +6.5% / 12-Month Price Range: $ 17.02-30.38 / Short interest (% of float): 0.8%; days to cover: 11.9

- Houghton Mifflin Harcourt Co (HMHC), up 9.7% to $17.73 / YTD price return: +10.1% / 12-Month Price Range: $ 4.49-17.93 / Short interest (% of float): 1.9%; days to cover: 2.6

- Danaos Corp (DAC), up 7.9% to $79.87 / YTD price return: +7.0% / 12-Month Price Range: $ 24.20-89.41

- ProShares UltraPro Short QQQ (SQQQ), up 7.2% to $35.90 / YTD price return: +20.9% / 12-Month Price Range: $ 28.15-83.90 / Short interest (% of float): 8.2%; days to cover: 0.1

- Fathom Digital Manufacturing Corp (FATH), up 7.1% to $8.45 / YTD price return: +6.7% / 12-Month Price Range: $ 5.04-11.00

- Bancolombia SA (CIB), up 6.9% to $35.53 / YTD price return: +12.5% / 12-Month Price Range: $ 27.64-39.49 / Short interest (% of float): 0.5%; days to cover: 2.0

- Loandepot Inc (LDI), up 6.3% to $5.21 / YTD price return: +8.5% / 12-Month Price Range: $ 4.24-38.68 / Short interest (% of float): 6.4%; days to cover: 0.8

- Blink Charging Co (BLNK), up 6.3% to $24.85 / YTD price return: -6.3% / 12-Month Price Range: $ 22.52-64.50 / Short interest (% of float): 38.1%; days to cover: 6.1

BIGGEST LOSERS

- Silvergate Capital Corp (SI), down 25.2% to $103.34 / YTD price return: -30.3% / 12-Month Price Range: $ 56.00-239.26 / Short interest (% of float): 5.6%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Solo Brands Inc (DTC), down 14.6% to $13.61 / YTD price return: -12.9% / 12-Month Price Range: $ 13.46-23.39 / Short interest (% of float): 16.4%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Unilever PLC (UL), down 14.4% to $46.45 / YTD price return: -13.6% / 12-Month Price Range: $ 50.60-61.81 / Short interest (% of float): 0.1%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- BioNTech SE (BNTX), down 13.7% to $169.23 / YTD price return: -34.4% / 12-Month Price Range: $ 90.29-464.00 (the stock is currently on the short sale restriction list)

- HeadHunter Group PLC (HHR), down 13.6% to $40.55 / YTD price return: -20.6% / 12-Month Price Range: $ 27.72-68.18 / Short interest (% of float): 0.1%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Sana Biotechnology Inc (SANA), down 13.4% to $9.85 / 12-Month Price Range: $ 10.78-44.60 / Short interest (% of float): 5.9%; days to cover: 13.4 (the stock is currently on the short sale restriction list)

- Direxion Daily Semiconductor Bull 3X Shares (SOXL), down 13.2% to $55.98 / YTD price return: -17.7% / 12-Month Price Range: $ 27.50-74.21 / Short interest (% of float): 2.1%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- Roivant Sciences Ltd (ROIV), down 12.7% to $6.94 / 12-Month Price Range: $ 5.80-16.76 (the stock is currently on the short sale restriction list)

- Valneva SE (VALN), down 12.5% to $32.77 / 12-Month Price Range: $ 24.16-67.84 / Short interest (% of float): 0.1%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- B Riley Financial Inc (RILY), down 12.3% to $70.90 / YTD price return: -20.2% / 12-Month Price Range: $ 40.27-91.24 / Short interest (% of float): 9.7%; days to cover: 8.3 (the stock is currently on the short sale restriction list)

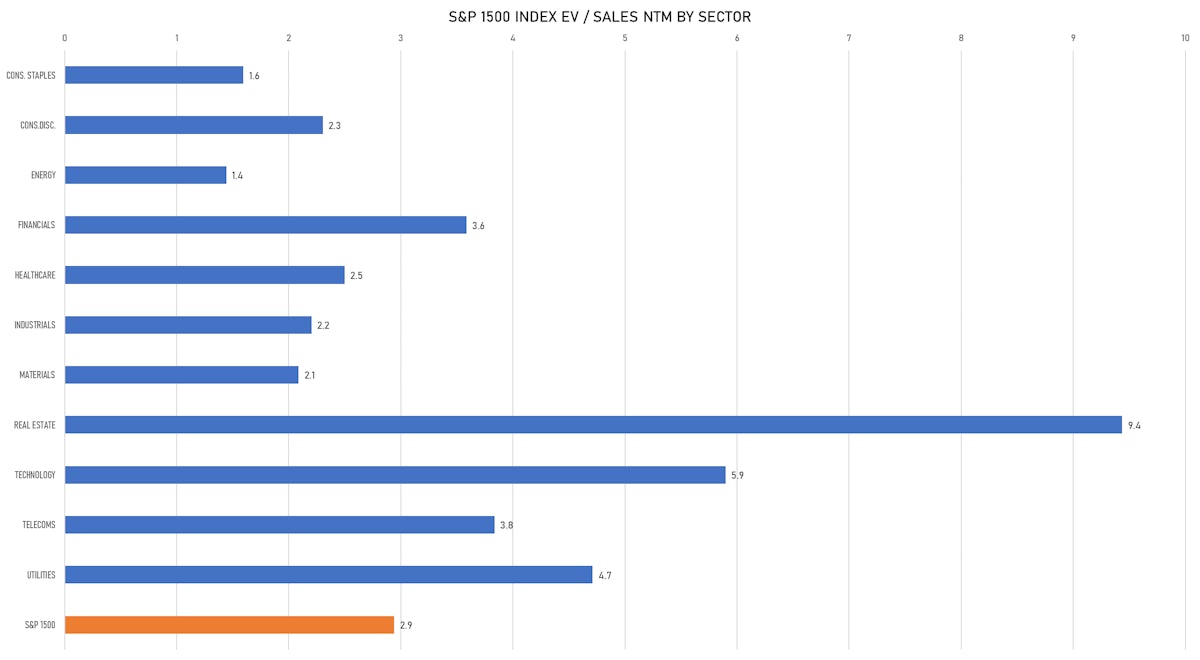

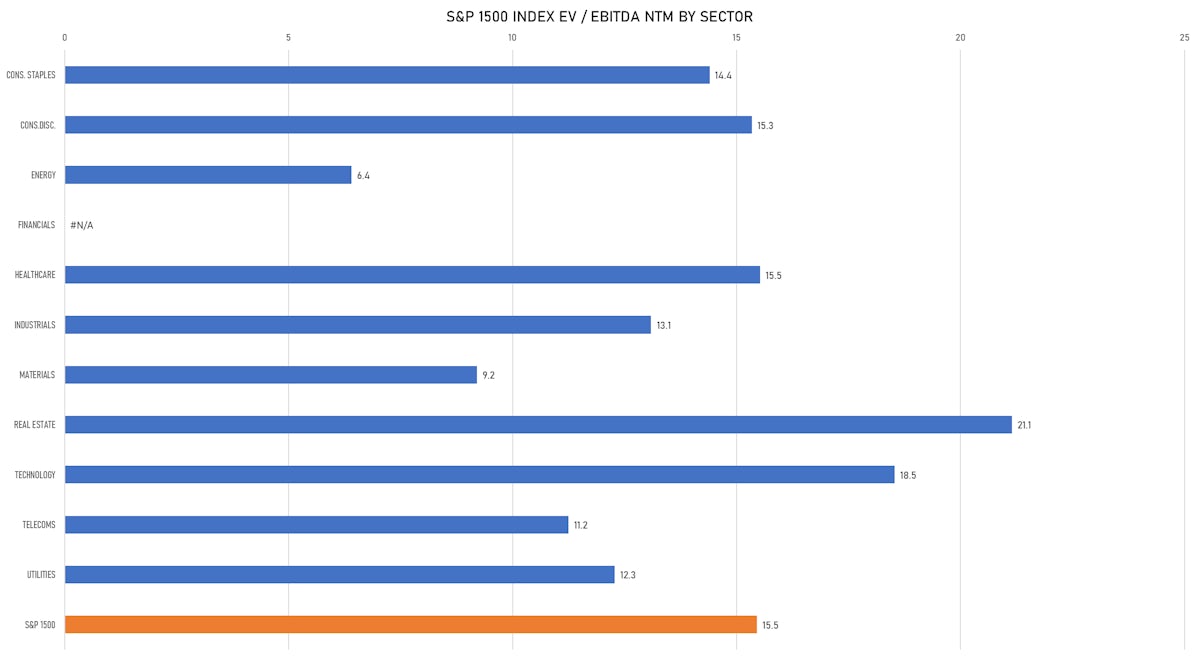

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Jiangxi Jinko Pv Material Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,575.25m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Aquila Acquisition Corp / Hong Kong - Financials / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley Asia Ltd (HK), CMB International Capital Corp

- Landmark Cars Pvt Ltd / India - Retail / Listing Exchange: Unknown / Ticker: - / Gross proceeds (including overallotment): US$ 107.76m (offering in Indian Rupee) / Bookrunners: Not Applicable

SECONDARIES / FOLLOW-ONS

- Eging Photovoltaic Technology Co Ltd / China - High Technology / Listing Exchange: Shanghai / Ticker: 600537 / Gross proceeds (including overallotment): US$ 205.16m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- LXi REIT PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: LXI / Gross proceeds (including overallotment): US$ 171.02m (offering in British Pound) / Bookrunners: Jefferies International Ltd, Peel Hunt LLP, Alvarium Securities Ltd

- Xinjiang Xuefeng Sci-Tech (Group) Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 603227 / Gross proceeds (including overallotment): US$ 141.68m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- EBOS Group Ltd (Other Consumer Products | Christchurch, New Zealand), raised US$ 529 M, placing 23 M ordinary or common shares. Financial advisors on the transaction: Not Applicable

- Nippon Paint Holdings Co Ltd (Chemicals | Osaka-Shi, Osaka, Japan), raised US$ 1,269 M, placing 140 M ordinary or common shares. Financial advisors on the transaction: Nomura International PLC, Morgan Stanley & Co. International plc, SMBC Nikko Capital Markets, Merrill Lynch International Ltd