Equities

S&P 500 Drawdown Reaches 6%, With The Technology Sector Now Down 10% From Its Peak

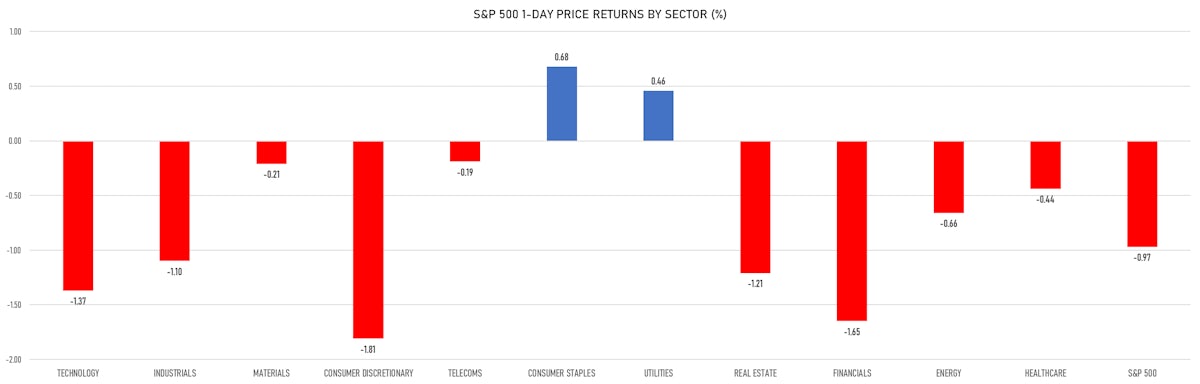

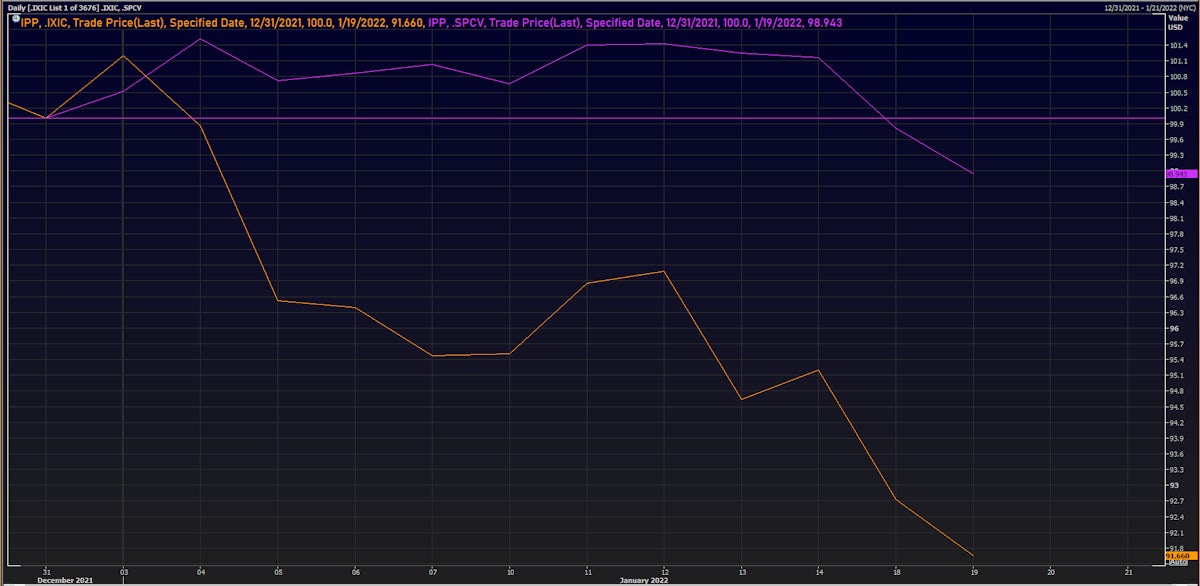

Overall, that is not a large drawdown considering the volatility of tech stocks; value keeps overperforming growth, with the top performing sectors today being utilities and consumer staples

Published ET

S&P 1500 Value Index vs Nasdaq Composite Index YTD (Rebased to 100 on 31 December 2021) | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.97%; Nasdaq Composite down -1.15%; Wilshire 5000 down -1.01%

- 23.4% of S&P 500 stocks were up today, with 57.2% of stocks above their 200-day moving average (DMA) and 44.4% above their 50-DMA

- Top performing sectors in the S&P 500: consumer staples up 0.68% and utilities up 0.46%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.81% and financials down -1.65%

- The number of shares in the S&P 500 traded today was 637m for a total turnover of US$ 82 bn

- The S&P 500 Value Index was down -0.8%, while the S&P 500 Growth Index was down -1.1%; the S&P small caps index was down -1.7% and mid-caps were down -1.4%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.4); the 3-month average volume is 2.3m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.23%; UK FTSE 100 up 0.35%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 2.05% on PBOC rate cut, while Japan's TOPIX 500 up 1.02%

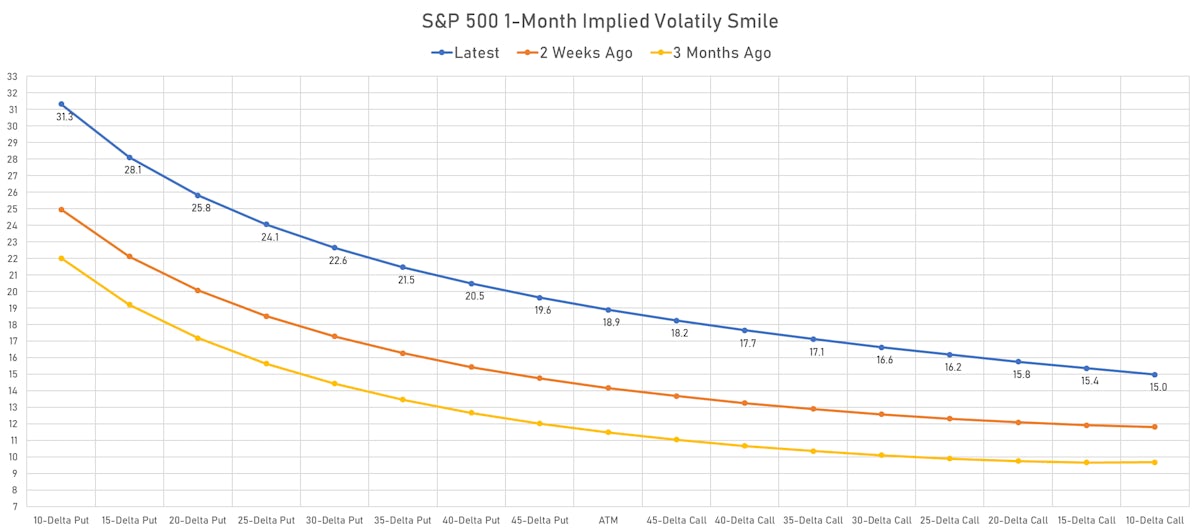

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 18.9%, up from 18.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 15.2%, up from 14.7%

NOTABLE US EARNINGS RELEASES

- UnitedHealth Group Inc (UNH | Healthcare): beat EPS median estimate (4.48 act. vs. 4.31 est.) and beat revenue median estimate (73,743m act. vs. 72,991m est.), up 0.33% today, closed at $ 462.52 / share and traded at $ 461.00 (-0.33%) after hours

- Procter & Gamble Co (PG | Consumer Non-Cyclicals): beat EPS median estimate (1.66 act. vs. 1.66 est.) and beat revenue median estimate (20,953m act. vs. 20,287m est.), up 3.36% today, closed at $ 162.00 / share and traded at $ 156.51 (-3.39%) after hours

- Bank of America Corp (BAC | Financials): beat EPS median estimate (0.82 act. vs. 0.77 est.) and missed revenue median estimate (22,060m act. vs. 22,219m est.), up 0.39% today, closed at $ 46.44 / share and traded at $ 46.18 (-0.56%) after hours

- Morgan Stanley (MS | Financials): beat EPS median estimate (2.08 act. vs. 1.93 est.) and beat revenue median estimate (14,524m act. vs. 14,494m est.), up 1.83% today, closed at $ 95.73 / share and traded at $ 93.79 (-2.03%) after hours

- US Bancorp (USB | Financials): missed EPS median estimate (1.07 act. vs. 1.10 est.) and missed revenue median estimate (5,684m act. vs. 5,735m est.), down -7.75% today, closed at $ 57.37 / share and traded at $ 61.65 (+7.46%) after hours

- Discover Financial Services (DFS | Financials): beat EPS median estimate (3.64 act. vs. 3.55 est.) and missed revenue median estimate (2,936m act. vs. 3,038m est.), down -4.22% today, closed at $ 118.50 / share and traded at $ 122.90 (+3.71%) after hours

- State Street Corp (STT | Financials): beat EPS median estimate (2.00 act. vs. 1.89 est.) and missed revenue median estimate (2,995m act. vs. 3,006m est.), down -7.06% today, closed at $ 93.88 / share and traded at $ 101.01 (+7.59%) after hours

- Fastenal Co (FAST | Industrials): beat EPS median estimate (0.40 act. vs. 0.38 est.) and beat revenue median estimate (1,532m act. vs. 1,515m est.), down -0.63% today, closed at $ 58.02 / share and traded at $ 57.50 (-0.90%) after hours

- Citizens Financial Group Inc (CFG | Financials): beat EPS median estimate (1.17 act. vs. 1.13 est.) and beat revenue median estimate (1,720m act. vs. 1,674m est.), down -2.35% today, closed at $ 54.36 / share and traded at $ 55.65 (+2.37%) after hours

- Comerica Inc (CMA | Financials): beat EPS median estimate (1.66 act. vs. 1.57 est.) and beat revenue median estimate (750m act. vs. 732m est.), down -2.85% today, closed at $ 96.67 / share and traded at $ 99.15 (+2.57%) after hours

- Alcoa Corp (AA | Basic Materials): missed EPS median estimate (2.50 act. vs. 2.56 est.) and beat revenue median estimate (3,340m act. vs. 3,327m est.), down -0.70% today, closed at $ 59.63 / share and traded at $ 60.19 (+0.94%) after hours

- BOK Financial Corp (BOKF | Financials): missed EPS median estimate (1.71 act. vs. 1.83 est.) and missed revenue median estimate (423m act. vs. 455m est.), down -7.08% today, closed at $ 107.51 / share and traded at $ 115.74 (+7.66%) after hours

- Sterling Bancorp (STL | Financials): beat EPS median estimate (0.64 act. vs. 0.53 est.) and beat revenue median estimate (259m act. vs. 249m est.), down -3.21% today, closed at $ 28.37 / share and traded at $ 29.32 (+3.35%) after hours

TOP WINNERS

- Zogenix Inc (ZGNX), up 65.7% to $25.92 / YTD price return: +59.5% / 12-Month Price Range: $ 11.03-23.69

- Valneva SE (VALN), up 45.0% to $47.52 / YTD price return: -14.4% / 12-Month Price Range: $ 24.16-67.84 / Short interest (% of float): 0.1%; days to cover: 0.6

- Harmony Gold Mining Company Ltd (HMY), up 16.3% to $4.20 / YTD price return: +2.2% / 12-Month Price Range: $ 3.00-5.76 / Short interest (% of float): 1.6%; days to cover: 1.5

- SoFi Technologies Inc (SOFI), up 13.7% to $13.71 / YTD price return: -13.3% / 12-Month Price Range: $ 12.02-28.26 / Short interest (% of float): 10.6%; days to cover: 2.0

- Orla Mining Ltd (ORLA), up 13.2% to $4.03 / 12-Month Price Range: $ 2.83-5.02 / Short interest (% of float): 2.0%; days to cover: 33.1

- Gold Fields Ltd (GFI), up 12.8% to $11.10 / 12-Month Price Range: $ 7.75-12.53 / Short interest (% of float): 0.9%; days to cover: 1.4

- First Majestic Silver Corp (AG), up 12.7% to $11.88 / YTD price return: +6.9% / 12-Month Price Range: $ 9.86-24.01 / Short interest (% of float): 8.4%; days to cover: 3.8

- AngloGold Ashanti Ltd (AU), up 12.2% to $20.78 / YTD price return: -1.0% / 12-Month Price Range: $ 14.57-26.77 / Short interest (% of float): 2.2%; days to cover: 3.4

- FREYR Battery SA (FREY), up 12.1% to $9.70 / 12-Month Price Range: $ 7.71-15.28 / Short interest (% of float): 4.0%; days to cover: 2.6

- Hecla Mining Co (HL), up 11.8% to $5.78 / YTD price return: +10.7% / 12-Month Price Range: $ 4.50-9.44

BIGGEST LOSERS

- Dingdong (Cayman) Ltd (DDL), down 23.8% to $6.10 / YTD price return: -62.3% / 12-Month Price Range: $ 7.75-46.00 / Short interest (% of float): 0.3%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- EQRx Inc (EQRX), down 13.5% to $5.43 / YTD price return: -20.4% / 12-Month Price Range: $ 5.55-11.10 / Short interest (% of float): 0.5%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Solo Brands Inc (DTC), down 13.3% to $11.80 / YTD price return: -24.5% / 12-Month Price Range: $ 13.46-23.39 / Short interest (% of float): 16.4%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- REE Automotive Ltd (REE), down 12.6% to $4.22 / YTD price return: -24.0% / 12-Month Price Range: $ 3.40-16.66 / Short interest (% of float): 1.3%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Tritium Dcfc Ltd (DCFC), down 11.0% to $8.01 / YTD price return: -19.7% / 12-Month Price Range: $ 8.51-11.00 / Short interest (% of float): 0.5%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Digital World Acquisition Corp (DWAC), down 10.3% to $77.45 / YTD price return: +50.6% / 12-Month Price Range: $ 9.84-175.00 / Short interest (% of float): 11.9%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Cerence Inc (CRNC), down 9.8% to $63.51 / YTD price return: -17.1% / 12-Month Price Range: $ 63.00-139.00 / Short interest (% of float): 11.2%; days to cover: 5.4

- Direxion Daily Semiconductor Bull 3X Shares (SOXL), down 9.2% to $50.82 / YTD price return: -25.3% / 12-Month Price Range: $ 27.50-74.21 / Short interest (% of float): 2.1%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- United Natural Foods Inc (UNFI), down 9.1% to $41.08 / YTD price return: -16.3% / 12-Month Price Range: $ 21.78-57.89

- Super Micro Computer Inc (SMCI), down 8.7% to $42.15 / 12-Month Price Range: $ 30.52-47.99

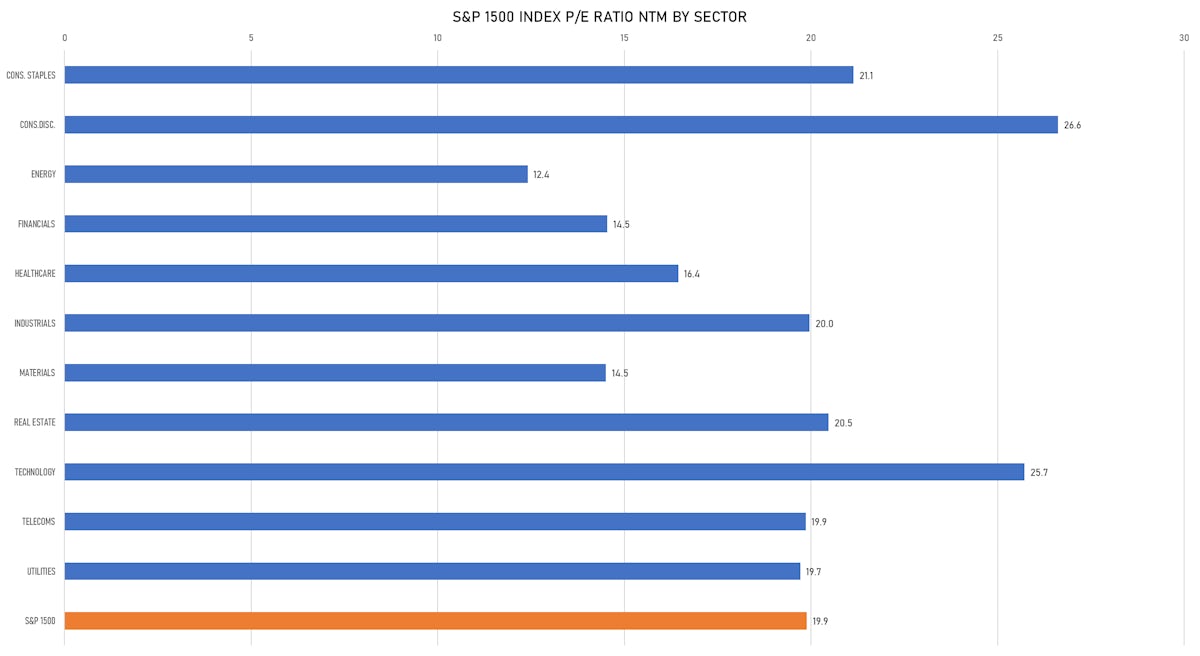

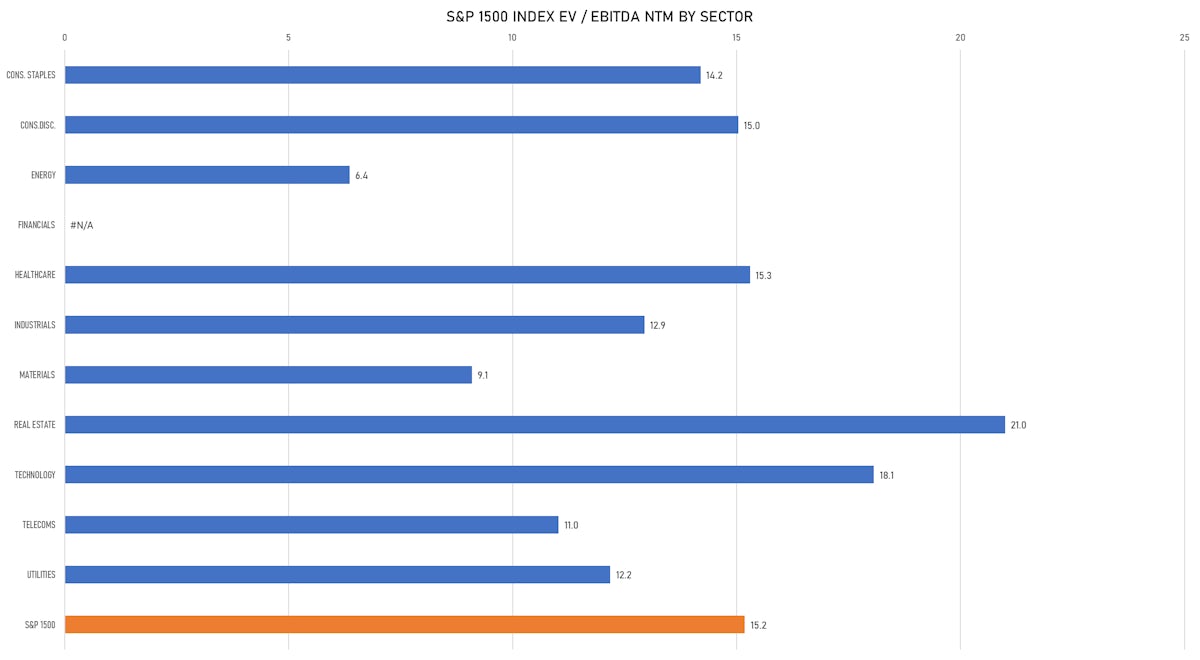

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Fractal Analytics Pvt Ltd / India - High Technology / Listing Exchange: National / Ticker: - / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

SECONDARIES / FOLLOW-ONS

- Signature Bank / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SBNY / Gross proceeds (including overallotment): US$ 739.20m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC, Morgan Stanley & Co LLC

- PT Allo Bank Indonesia Tbk / Indonesia - Financials / Listing Exchange: Indonesia / Ticker: BBHI / Gross proceeds (including overallotment): US$ 334.44m (offering in Indonesian Rupiah) / Bookrunners: Not Applicable

- Vedanta Ltd / India - Materials / Listing Exchange: National / Ticker: VDAN / Gross proceeds (including overallotment): US$ 161.06m (offering in Indian Rupee) / Bookrunners: Not Applicable

- Metropole Television SA / France - Media and Entertainment / Listing Exchange: Euro Paris / Ticker: MMTF5 / Gross proceeds (including overallotment): US$ 121.70m (offering in EURO) / Bookrunners: Societe Generale SA, Natixis