Equities

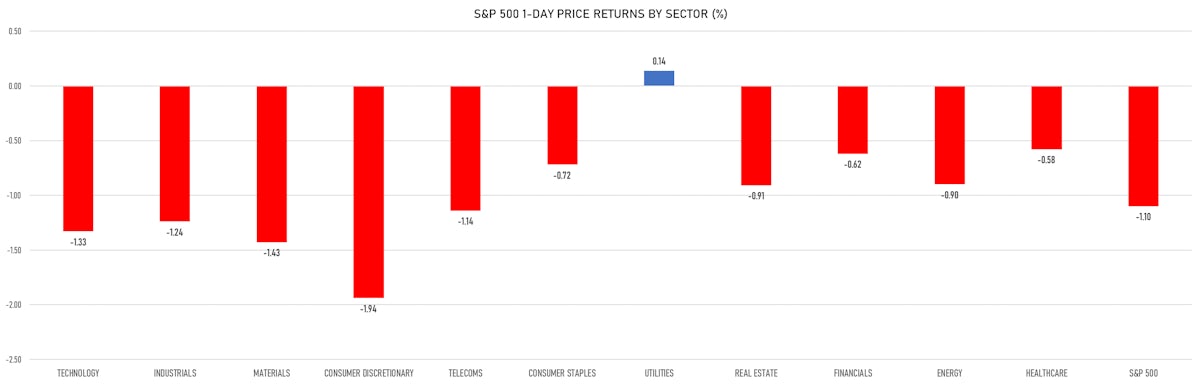

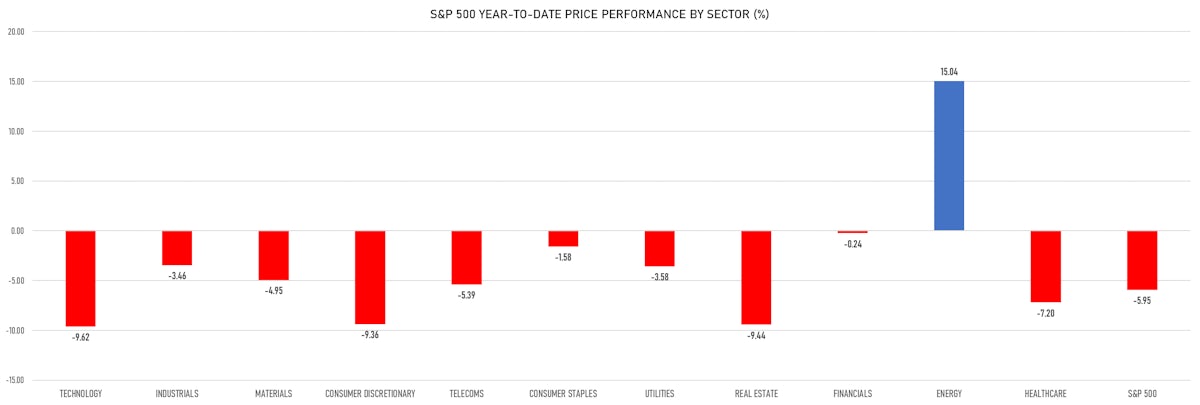

Tough Day For US Equities Brings S&P 500 Drawdown To 7%, With Consumer Discretionary Down Another 1.9%

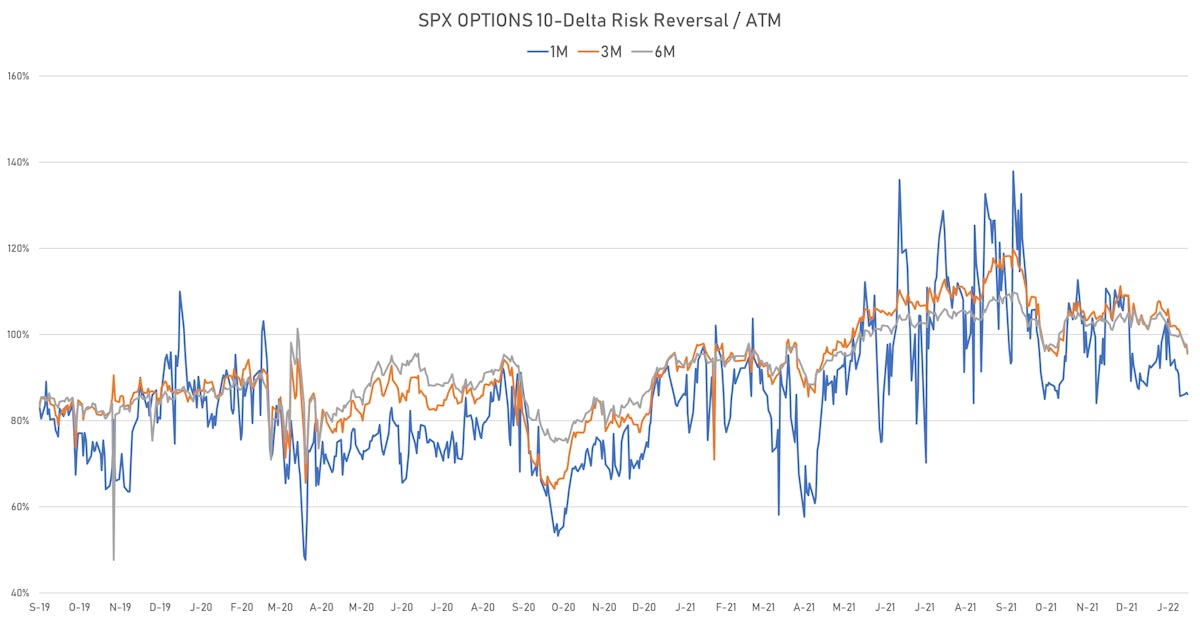

Volume hasn't been terribly high and neither has volatility, though the skew in 1-month 10-delta SPX options has gone down sharply since the start of the year

Published ET

S&P 500 Price Performance Year-To-Date | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.10%; Nasdaq Composite down -1.30%; Wilshire 5000 down -1.16%

- 16.0% of S&P 500 stocks were up today, with 53.5% of stocks above their 200-day moving average (DMA) and 38.2% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 0.14% and healthcare down -0.58%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.94% and materials down -1.43%

- The number of shares in the S&P 500 traded today was 636m for a total turnover of US$ 80 bn

- The S&P 500 Value Index was down -0.9%, while the S&P 500 Growth Index was down -1.3%; the S&P small caps index was down -2.1% and mid caps were down -1.8%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.5); the 3-month average volume is 2.3m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.51%; UK FTSE 100 down -0.06%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.81%, Japan's TOPIX 500 down -1.51%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 20.8%, up from 18.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.0%, down from 15.2%

NOTABLE US EARNINGS RELEASES

- Netflix Inc (NFLX | Technology): beat EPS median estimate (1.33 act. vs. 0.80 est.) and missed revenue median estimate (7,709m act. vs. 7,712m est.), down -1.48% today, closed at $ 508.25 / share and traded at $ 515.50 (+1.43%) after hours

- Union Pacific Corp (UNP | Industrials): beat EPS median estimate (2.66 act. vs. 2.61 est.) and beat revenue median estimate (5,733m act. vs. 5,611m est.), up 1.08% today, closed at $ 242.07 / share and traded at $ 238.40 (-1.52%) after hours

- Travelers Companies Inc (TRV | Financials): beat EPS median estimate (5.20 act. vs. 3.93 est.) and beat revenue median estimate (7,995m act. vs. 7,735m est.), up 3.19% today, closed at $ 165.18 / share and traded at $ 159.99 (-3.14%) after hours

- Fifth Third Bancorp (FITB | Financials): missed EPS median estimate (0.90 act. vs. 0.91 est.) and missed revenue median estimate (1,991m act. vs. 2,020m est.), down -2.81% today, closed at $ 46.62 / share and traded at $ 47.98 (+2.92%) after hours

- Baker Hughes Co (BKR | Energy): missed EPS median estimate (0.25 act. vs. 0.28 est.) and beat revenue median estimate (5,519m act. vs. 5,499m est.), up 1.64% today, closed at $ 26.72 / share and traded at $ 26.10 (-2.32%) after hours

- Northern Trust Corp (NTRS | Financials): beat EPS median estimate (1.91 act. vs. 1.82 est.) and beat revenue median estimate (1,677m act. vs. 1,648m est.), down -4.62% today, closed at $ 120.02 / share and traded at $ 125.98 (+4.97%) after hours

- KeyCorp (KEY | Financials): beat EPS median estimate (0.64 act. vs. 0.56 est.) and beat revenue median estimate (1,947m act. vs. 1,805m est.), down -1.80% today, closed at $ 25.13 / share and traded at $ 25.33 (+0.80%) after hours

- M&T Bank Corp (MTB | Financials): beat EPS median estimate (3.37 act. vs. 3.29 est.) and beat revenue median estimate (1,512m act. vs. 1,469m est.), down -5.44% today, closed at $ 166.35 / share and traded at $ 176.27 (+5.96%) after hours

- Regions Financial Corp (RF | Financials): missed EPS median estimate (0.43 act. vs. 0.50 est.) and beat revenue median estimate (1,634m act. vs. 1,626m est.), down -5.20% today, closed at $ 22.42 / share and traded at $ 23.50 (+4.82%) after hours

- American Airlines Group Inc (AAL | Industrials): beat EPS median estimate (-1.42 act. vs. -1.45 est.) and beat revenue median estimate (9,427m act. vs. 9,400m est.), down -3.18% today, closed at $ 16.76 / share and traded at $ 17.26 (+2.98%) after hours

- First Horizon Corp (FHN | Financials): beat EPS median estimate (0.40 act. vs. 0.34 est.) and beat revenue median estimate (738m act. vs. 730m est.), down -1.14% today, closed at $ 17.39 / share and traded at $ 17.59 (+1.15%) after hours

- People's United Financial Inc (PBCT | Financials): beat EPS median estimate (0.36 act. vs. 0.31 est.) and missed revenue median estimate (469m act. vs. 472m est.), down -5.16% today, closed at $ 19.30 / share and traded at $ 20.50 (+6.22%) after hours

- Synovus Financial Corp (SNV | Financials): beat EPS median estimate (1.35 act. vs. 1.06 est.) and beat revenue median estimate (509m act. vs. 491m est.), down -3.80% today, closed at $ 49.05 / share and traded at $ 51.30 (+4.59%) after hours

- Bank Ozk (OZK | Financials): beat EPS median estimate (1.17 act. vs. 0.96 est.) and beat revenue median estimate (296m act. vs. 273m est.), down -3.14% today, closed at $ 47.23 / share and traded at $ 50.00 (+5.86%) after hours

- Webster Financial Corp (WBS | Financials): beat EPS median estimate (1.31 act. vs. 1.07 est.) and beat revenue median estimate (317m act. vs. 307m est.), down -0.20% today, closed at $ 61.31 / share and traded at $ 61.43 (+0.20%) after hours

TOP WINNERS

- Amtd International Inc (HKIB), up 16.6% to $4.70 / YTD price return: +48.3% / 12-Month Price Range: $ 3.00-9.75 / Short interest days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Vertical Aerospace Ltd (EVTL), up 11.7% to $8.22 / YTD price return: +22.1% / 12-Month Price Range: $ 6.73-18.44 / Short interest (% of float): 0.2%; days to cover: 1.1

- Luminar Technologies Inc (LAZR), up 11.5% to $15.00 / YTD price return: -11.3% / 12-Month Price Range: $ 13.42-40.98 / Short interest (% of float): 12.2%; days to cover: 5.4

- Full Truck Alliance Co Ltd (YMM), up 10.9% to $9.23 / YTD price return: +10.3% / 12-Month Price Range: $ 7.16-22.80 / Short interest (% of float): 2.1%; days to cover: 3.1

- SoFi Technologies Inc (SOFI), up 9.4% to $15.00 / YTD price return: -5.1% / 12-Month Price Range: $ 12.02-28.26 / Short interest (% of float): 10.6%; days to cover: 2.0

- Novocure Ltd (NVCR), up 9.2% to $70.10 / YTD price return: -6.6% / 12-Month Price Range: $ 60.57-232.76 / Short interest (% of float): 6.4%; days to cover: 8.6

- Trip.com Group Ltd (TCOM), up 7.4% to $25.21 / YTD price return: +2.4% / 12-Month Price Range: $ 21.40-45.19

- Ci&T Inc (CINT), up 7.1% to $13.52 / YTD price return: +13.7% / 12-Month Price Range: $ 9.88-22.50 / Short interest (% of float): 0.3%; days to cover: 0.2

- 360 DigiTech Inc (QFIN), up 7.1% to $21.86 / YTD price return: -4.7% / 12-Month Price Range: $ 14.79-45.00 / Short interest (% of float): 4.1%; days to cover: 3.2

- Dave Inc (DAVE), up 7.1% to $7.24 / YTD price return: -29.4% / 12-Month Price Range: $ 4.62-10.37 / Short interest (% of float): 0.4%; days to cover: 5.4

BIGGEST LOSERS

- Peloton Interactive Inc (PTON), down 23.9% to $24.22 / YTD price return: -32.3% / 12-Month Price Range: $ 29.11-166.57 / Short interest (% of float): 9.7%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Valneva SE (VALN), down 20.7% to $37.66 / YTD price return: -32.2% / 12-Month Price Range: $ 24.16-67.84 / Short interest (% of float): 0.1%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- EQRx Inc (EQRX), down 16.2% to $4.55 / YTD price return: -33.3% / 12-Month Price Range: $ 5.38-11.10 / Short interest (% of float): 0.5%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Taskus Inc (TASK), down 15.3% to $30.13 / YTD price return: -44.2% / 12-Month Price Range: $ 26.66-85.49 / Short interest (% of float): 11.7%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Arrival SA (ARVL), down 11.7% to $5.11 / YTD price return: -31.1% / 12-Month Price Range: $ 5.78-29.98 / Short interest (% of float): 9.0%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Thor Industries Inc (THO), down 11.0% to $89.05 / YTD price return: -14.2% / 12-Month Price Range: $ 92.20-152.20 / Short interest (% of float): 10.8%; days to cover: 7.8 (the stock is currently on the short sale restriction list)

- Alpha Metallurgical Resources Inc (AMR), down 10.7% to $62.18 / YTD price return: +1.9% / 12-Month Price Range: $ 11.04-73.05 / Short interest (% of float): 4.4%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Winnebago Industries Inc (WGO), down 10.2% to $64.68 / YTD price return: -13.7% / 12-Month Price Range: $ 61.13-87.53 / Short interest (% of float): 12.6%; days to cover: 7.0 (the stock is currently on the short sale restriction list)

- Yoshitsu Co Ltd (TKLF), down 9.8% to $29.53 / 12-Month Price Range: $ 13.00-43.00 (the stock is currently on the short sale restriction list)

- ChemoCentryx Inc (CCXI), down 9.7% to $26.64 / YTD price return: -26.8% / 12-Month Price Range: $ 9.53-70.29 / Short interest (% of float): 10.0%; days to cover: 4.2 (the stock is currently on the short sale restriction list)

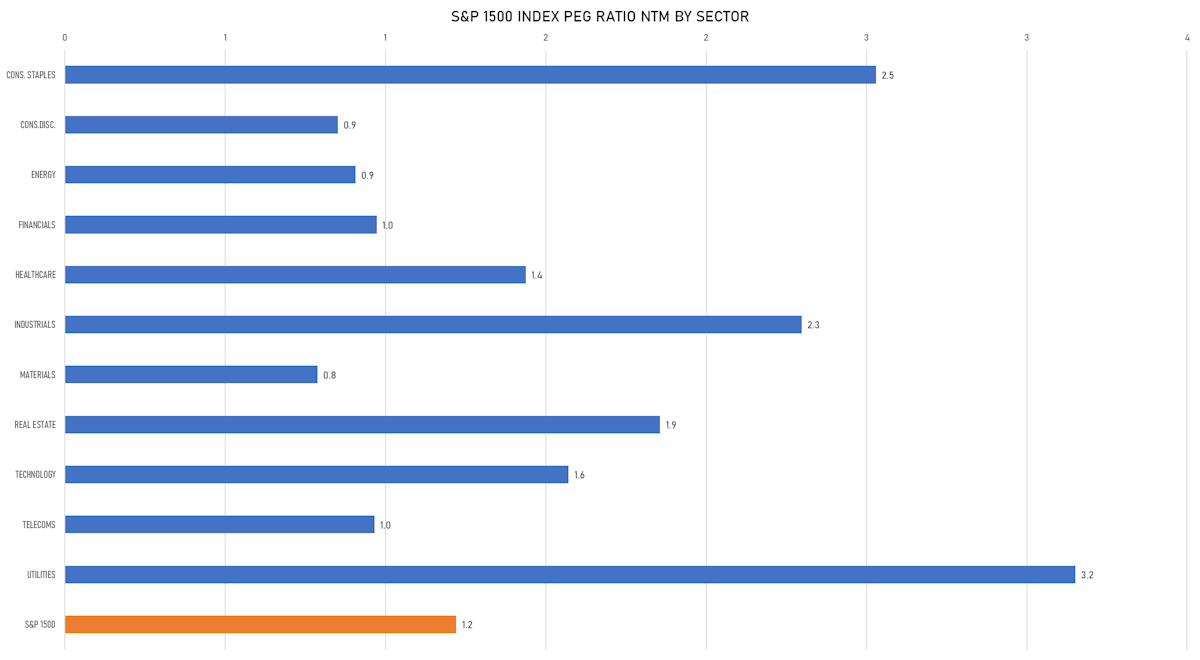

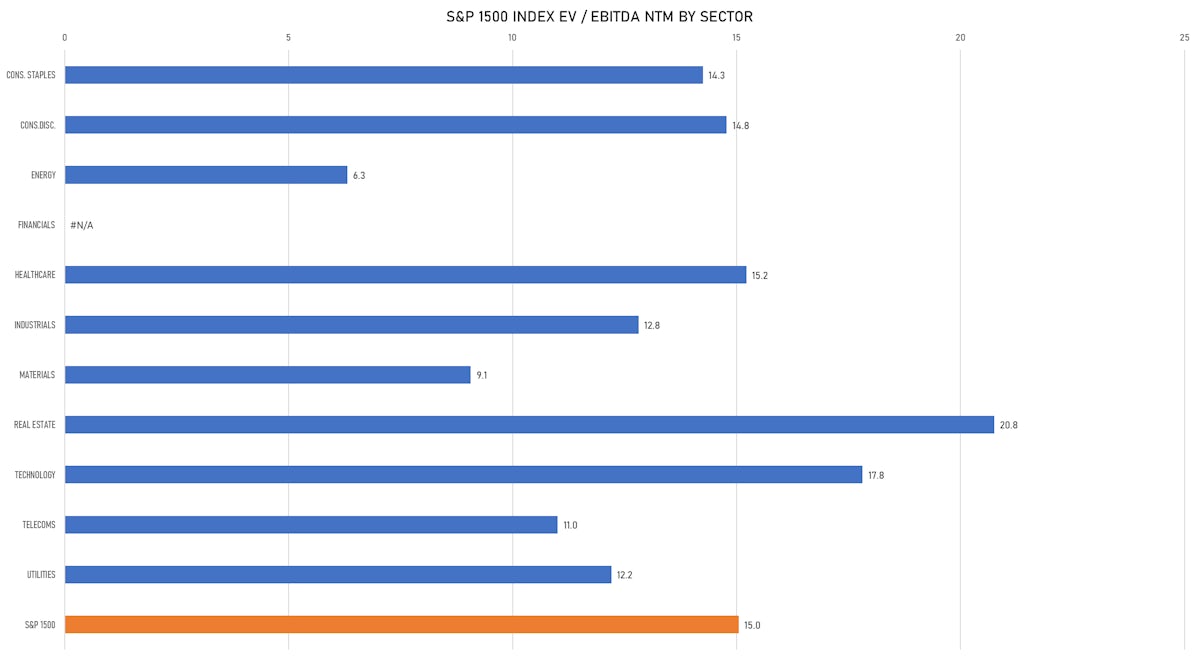

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Valuence Merger Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: VMCAU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: SVB Leerink LLC

- Intrepid Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: IACIU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Intrepid Partners LLC

SECONDARIES / FOLLOW-ONS

- American Homes 4 Rent / United States of America - Real Estate / Listing Exchange: New York / Ticker: AMH / Gross proceeds (including overallotment): US$ 900.45m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, BofA Securities Inc

- Enviva Inc / United States of America - Materials / Listing Exchange: New York / Ticker: EVA / Gross proceeds (including overallotment): US$ 301.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, BMO Capital Markets, RBC Capital Markets LLC, HSBC Securities (USA) Inc, JP Morgan Securities LLC, Barclays Capital Inc, Truist Securities Inc

- OMV Petrom SA / Romania - Energy and Power / Listing Exchange: Bucharest / Ticker: SNP / Gross proceeds (including overallotment): US$ 224.53m (offering in Romanian Lei) / Bookrunners: Erste Group Bank AG, Auerbach Grayson & Co, Banca Comerciala Romana, Swiss Capital SA

- Marlowe PLC / United Kingdom - Financials / Listing Exchange: London AIM / Ticker: MRL / Gross proceeds (including overallotment): US$ 176.88m (offering in British Pound) / Bookrunners: Cenkos Securities PLC, Stifel Nicolaus Europe Ltd, Joh Berenberg Gossler & Co KG(London Branch)

- AP Memory Technology Corp / Taiwan - High Technology / Listing Exchange: Luxembourg / Ticker: 6531 / Gross proceeds (including overallotment): US$ 150.05m (offering in U.S. Dollar) / Bookrunners: Credit Suisse