Equities

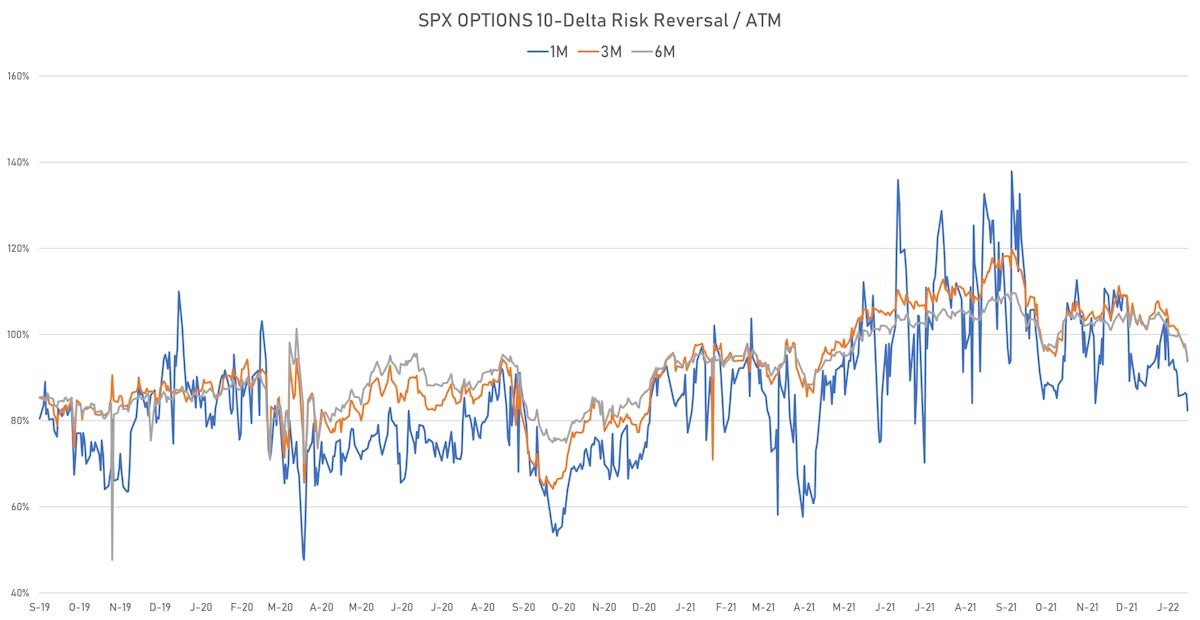

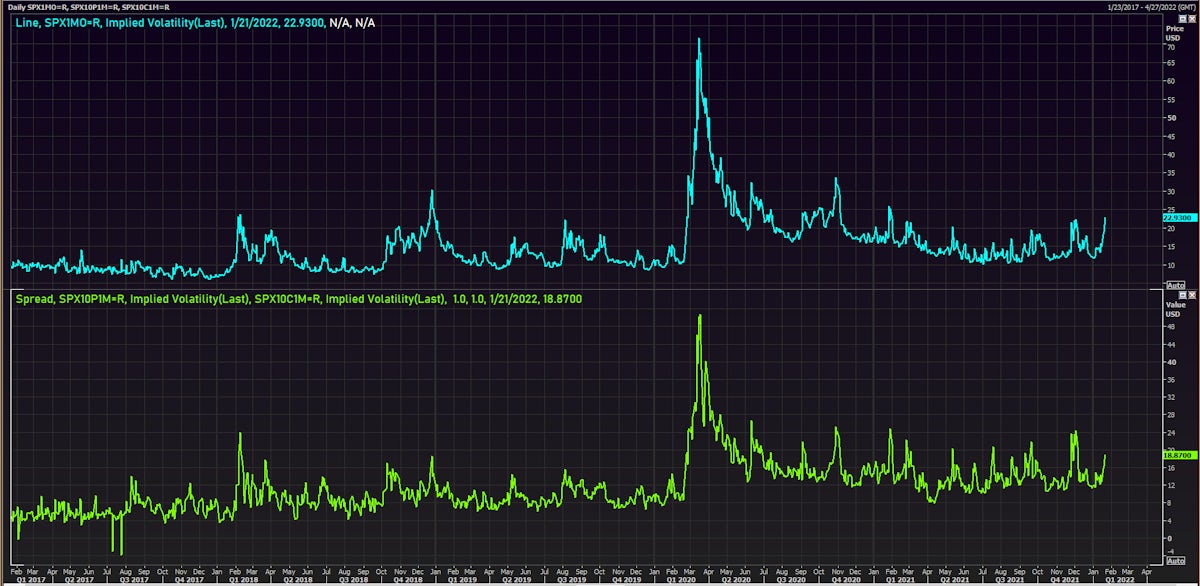

Sentiment In US Equities Very Depressed Although Implied Volatility, Skew Not At Extreme Levels

The tech meltdown and higher volatility has led to a more wholesale degrossing for long-short equity hedge funds, with net positioning and gross positioning now low according to some prime brokers

Published ET

S&P 500 1-Month ATM Implied Volatility (top) & Skew Measured As 10-Delta Put - 10-Delta Call IV (bottom) | Source: Refinitiv

QUICK SUMMARY

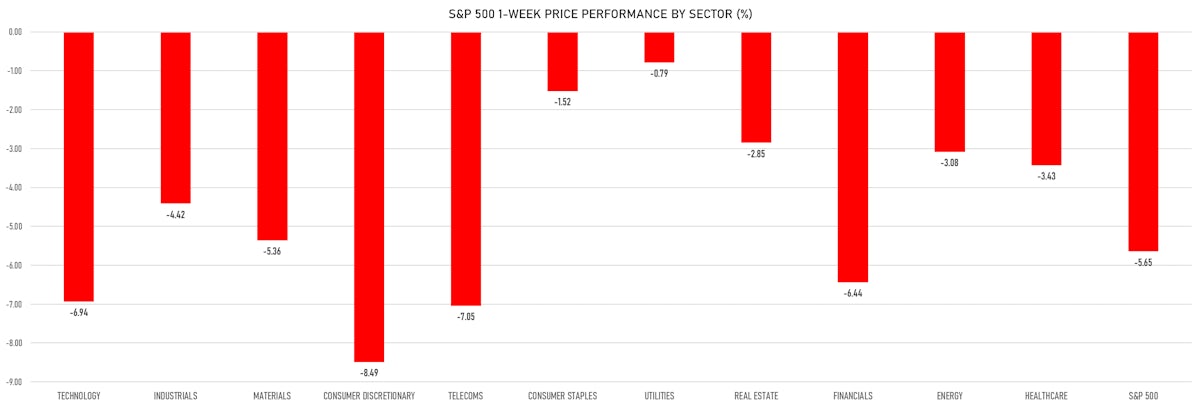

- Daily performance of US indices: S&P 500 down -1.89%; Nasdaq Composite down -2.72%; Wilshire 5000 down -2.04%

- 19.6% of S&P 500 stocks were up today, with 50.1% of stocks above their 200-day moving average (DMA) and 32.3% above their 50-DMA

- Top performing sectors in the S&P 500: consumer staples up 0.02% and real estate down -0.04%

- Bottom performing sectors in the S&P 500: telecoms down -3.88% and consumer discretionary down -3.10%

- The number of shares in the S&P 500 traded today was 944m for a total turnover of US$ 128 bn

- The S&P 500 Value Index was down -1.3%, while the S&P 500 Growth Index was down -2.5%; the S&P small caps index was down -1.4% and mid-caps were down -1.7%

- The volume on CME's INX (S&P 500 Index) was 3.2m (3-month z-score: 1.6); the 3-month average volume is 2.3m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -1.84%; UK FTSE 100 down -1.20%; Hang Seng SH-SZ-HK 300 Index down -0.53%; Japan's TOPIX 500 down -0.63%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 22.9%, up from 20.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.1%, up from 14.0%

NOTABLE US EARNINGS RELEASES

- Schlumberger NV (SLB | Energy): beat EPS median estimate (0.41 act. vs. 0.39 est.) and beat revenue median estimate (6,225m act. vs. 6,080m est.), down -1.86% today, closed at $ 36.36 / share and traded at $ 36.35 (-0.03%) after hours

- Huntington Bancshares Inc (HBAN | Financials): missed EPS median estimate (0.26 act. vs. 0.27 est.) and missed revenue median estimate (1,653m act. vs. 1,694m est.), down -8.99% today, closed at $ 15.18 / share and traded at $ 15.46 (+1.84%) after hours

- Ally Financial Inc (ALLY | Financials): beat EPS median estimate (2.02 act. vs. 1.96 est.) and beat revenue median estimate (2,199m act. vs. 2,074m est.), down -3.92% today, closed at $ 47.06 / share and traded at $ 47.11 (+0.11%) after hours

TOP WINNERS

- Dave Inc (DAVE), up 30.2% to $9.43 / YTD price return: -8.0% / 12-Month Price Range: $ 4.62-10.37 / Short interest (% of float): 0.4%; days to cover: 5.4

- Peloton Interactive Inc (PTON), up 11.7% to $27.06 / YTD price return: -24.3% / 12-Month Price Range: $ 23.25-166.57 / Short interest (% of float): 9.7%; days to cover: 1.6

- Fathom Digital Manufacturing Corp (FATH), up 10.0% to $10.24 / YTD price return: +29.3% / 12-Month Price Range: $ 5.04-11.00 / Short interest (% of float): 2.9%; days to cover: 0.3

- Intra-Cellular Therapies Inc (ITCI), up 9.8% to $42.66 / YTD price return: -18.5% / 12-Month Price Range: $ 28.40-55.20 / Short interest (% of float): 5.1%; days to cover: 5.1

- Amtd International Inc (HKIB), up 8.5% to $5.10 / YTD price return: +60.9% / 12-Month Price Range: $ 3.00-9.75 / Short interest (% of float): 0.0%; days to cover: 1.0

- ProShares UltraPro Short QQQ (SQQQ), up 8.2% to $41.79 / YTD price return: +40.7% / 12-Month Price Range: $ 28.15-83.90 / Short interest (% of float): 8.2%; days to cover: 0.1

- Compania Cervecerias Unidas SA (CCU), up 5.6% to $17.64 / YTD price return: +7.5% / 12-Month Price Range: $ 15.03-21.82 / Short interest (% of float): 1.4%; days to cover: 6.6

- Banco de Chile (BCH), up 5.5% to $19.76 / YTD price return: +25.8% / 12-Month Price Range: $ 15.60-25.12 / Short interest (% of float): 0.2%; days to cover: 3.1

- LumiraDx Ltd (LMDX), up 5.4% to $10.00 / YTD price return: +12.2% / 12-Month Price Range: $ 7.15-11.09 / Short interest (% of float): 0.2%; days to cover: 4.9

- Playa Hotels & Resorts NV (PLYA), up 5.2% to $7.35 / YTD price return: -7.9% / 12-Month Price Range: $ 5.15-9.46 / Short interest (% of float): 1.0%; days to cover: 1.2

BIGGEST LOSERS

- Netflix Inc (NFLX), down 21.8% to $397.50 / YTD price return: -34.0% / 12-Month Price Range: $ 478.54-700.99 (the stock is currently on the short sale restriction list)

- Microstrategy Inc (MSTR), down 17.8% to $375.89 / YTD price return: -31.0% / 12-Month Price Range: $ 411.58-1,315.00 / Short interest (% of float): 19.2%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- SunPower Corp (SPWR), down 17.0% to $15.80 / YTD price return: -24.3% / 12-Month Price Range: $ 18.55-57.52 (the stock is currently on the short sale restriction list)

- Sports Entertainment Acquisition Corp. (SEAH), down 15.1% to $8.24 / YTD price return: -16.9% / 12-Month Price Range: $ 9.27-12.48 / Short interest (% of float): 2.4%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Dingdong (Cayman) Ltd (DDL), down 14.5% to $4.95 / YTD price return: -69.4% / 12-Month Price Range: $ 5.72-46.00 / Short interest (% of float): 0.3%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- CureVac NV (CVAC), down 14.3% to $18.73 / YTD price return: -45.4% / 12-Month Price Range: $ 21.76-133.00 / Short interest (% of float): 5.0%; days to cover: 5.6 (the stock is currently on the short sale restriction list)

- Riot Blockchain Inc (RIOT), down 14.2% to $15.00 / YTD price return: -32.8% / 12-Month Price Range: $ 16.75-79.50 (the stock is currently on the short sale restriction list)

- Carvana Co (CVNA), down 14.1% to $135.65 / YTD price return: -41.5% / 12-Month Price Range: $ 147.67-376.83 / Short interest (% of float): 13.1%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Shopify Inc (SHOP), down 13.9% to $882.12 / YTD price return: -36.0% / 12-Month Price Range: $ 1,005.14-1,762.92 (the stock is currently on the short sale restriction list)

- Hut 8 Mining Corp (HUT), down 13.8% to $5.37 / YTD price return: -31.6% / 12-Month Price Range: $ 3.15-16.57 / Short interest (% of float): 6.3%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

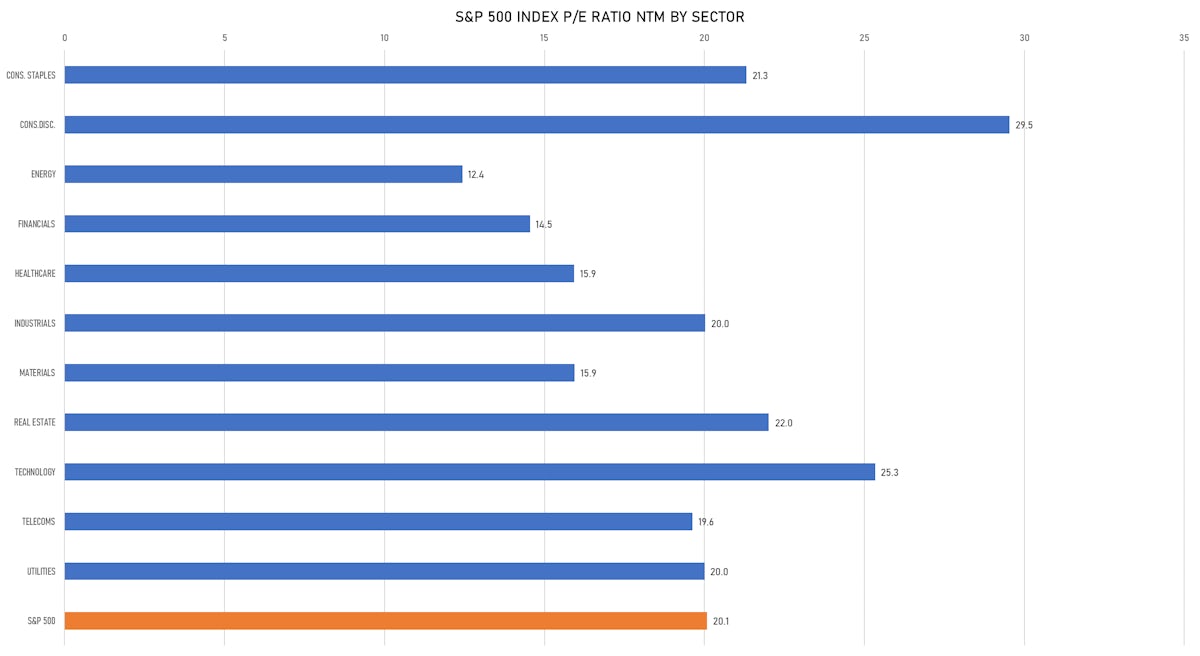

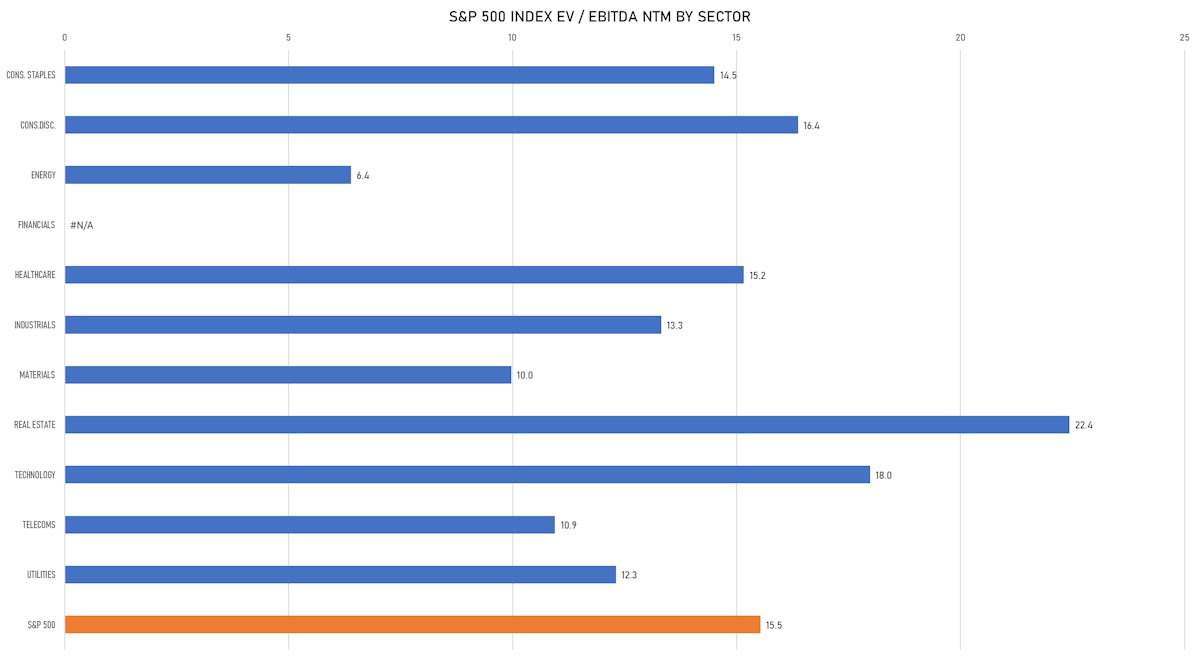

VALUATION MULTIPLES BY SECTORS

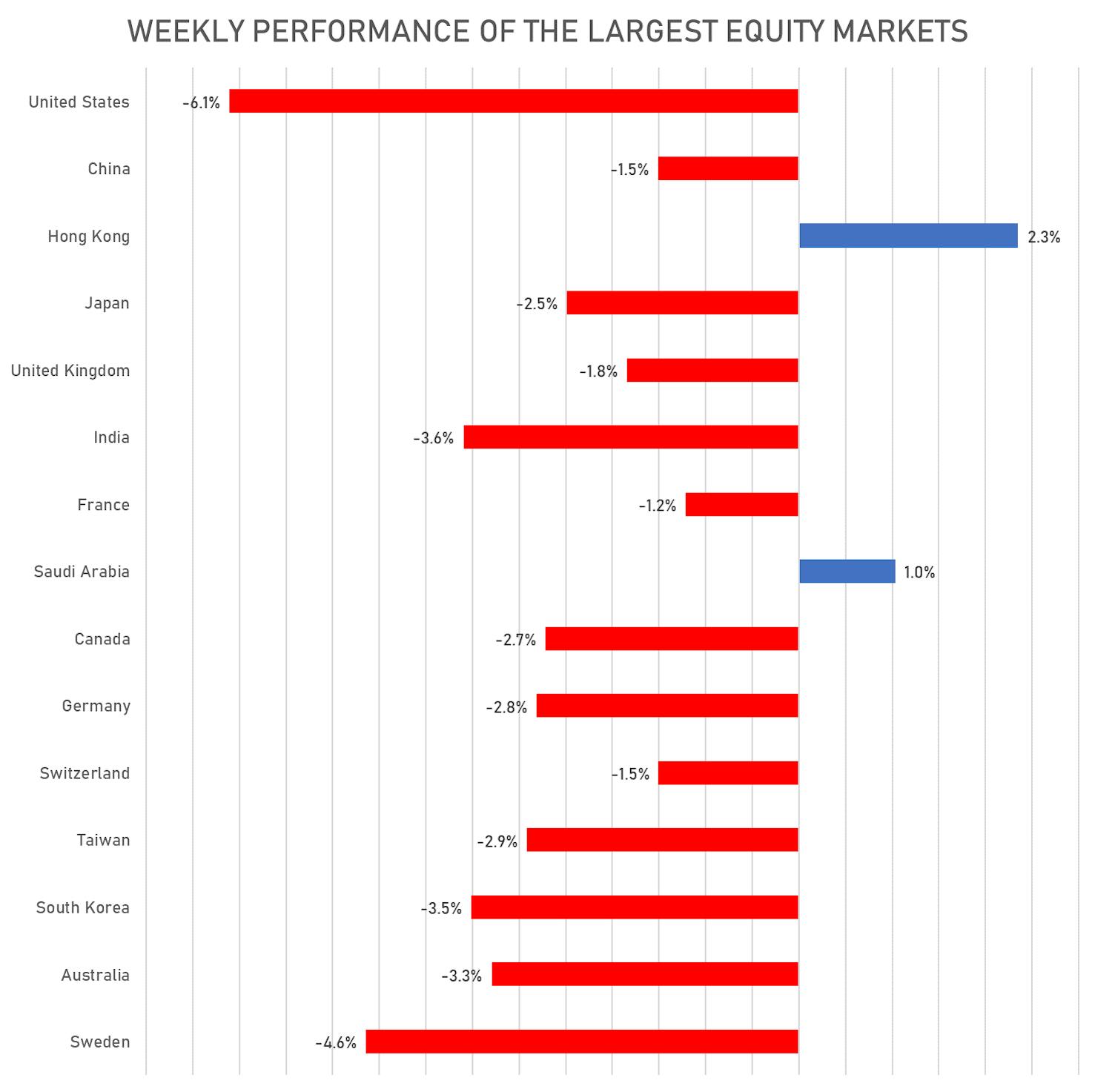

WEEKLY PERFORMANCE OF THE LARGEST GLOBAL EQUITY MARKETS

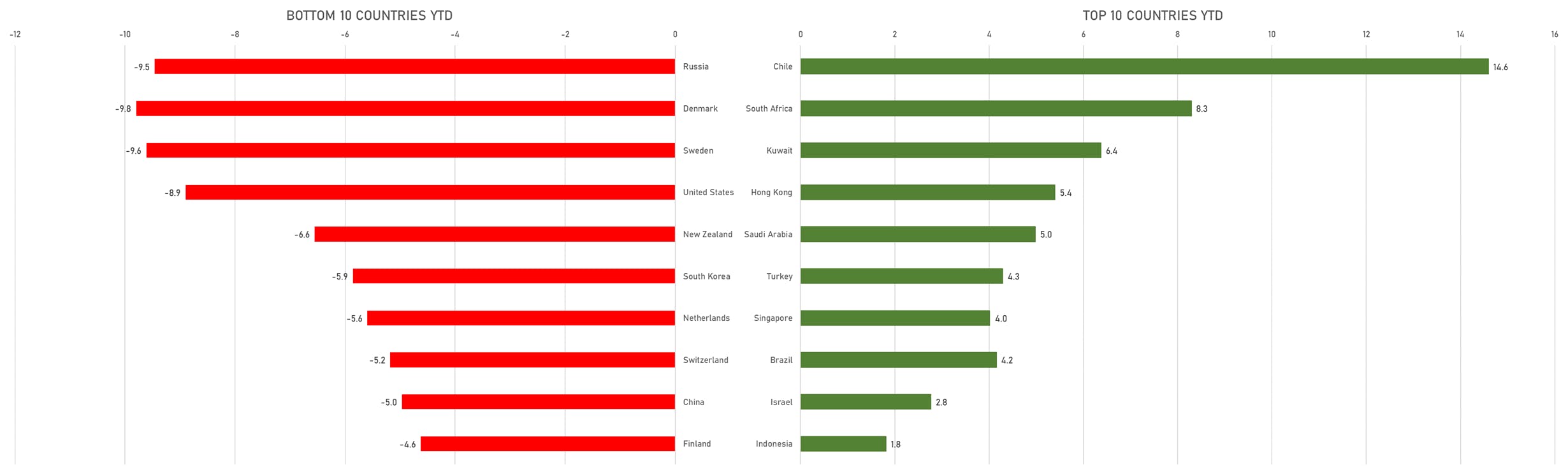

TOP / BOTTOM YTD PERFORMANCE BY COUNTRY

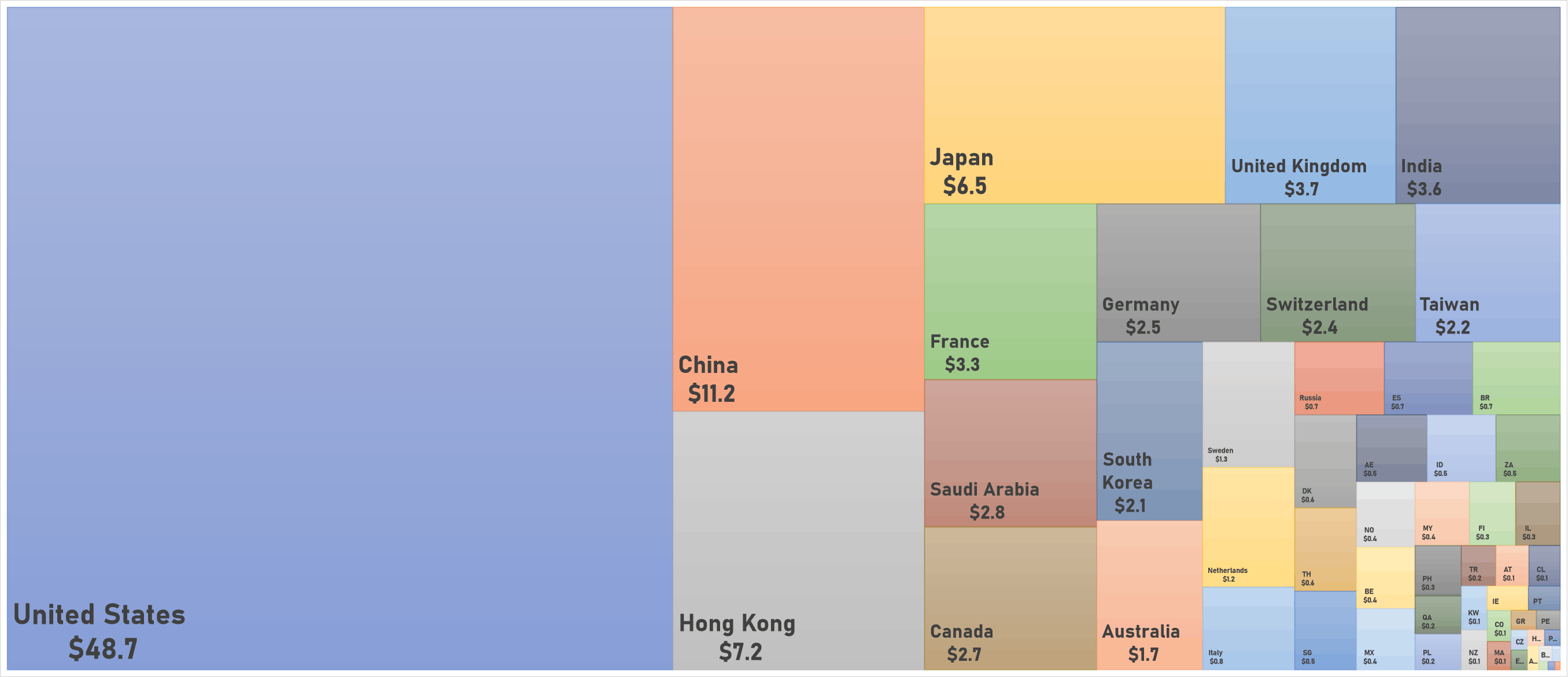

WORLD MARKET CAPITALIZATION BY COUNTRY

NEW IPOs ANNOUNCED OR PRICED

- HCM Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: HCMAU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Kensington Capital Acquisition Corp IV / United States of America - Financials / Listing Exchange: New York / Ticker: KCAC.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, UBS Securities LLC

- Heartland Media Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: HMA.U / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Moelis & Co, Bofa Securities Inc

- Shandong Sanyuan Biotechnology Co Ltd / China - Consumer Staples / Listing Exchange: ShenzChNxt / Ticker: 301206 / Gross proceeds (including overallotment): US$ 581.3m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Asiainfo Security Technologies Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688225 / Gross proceeds (including overallotment): US$ 132.84m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

SECONDARIES / FOLLOW-ONS

- AP Memory Technology Corp / Taiwan - High Technology / Listing Exchange: Luxembourg / Ticker: 6531 / Gross proceeds (including overallotment): US$ 189.76m (offering in U.S. Dollar) / Bookrunners: Credit Suisse

- Baltic Classifieds Group PLC / Lithuania - Media and Entertainment / Listing Exchange: London / Ticker: BCG / Gross proceeds (including overallotment): US$ 105.21m (offering in British Pound) / Bookrunners: Merrill Lynch International Ltd