Equities

Sharp Rebound For US Equities On Friday Takes The S&P 500 Up 0.8% For The Week, Brings Nasdaq Comp Back To Unchanged

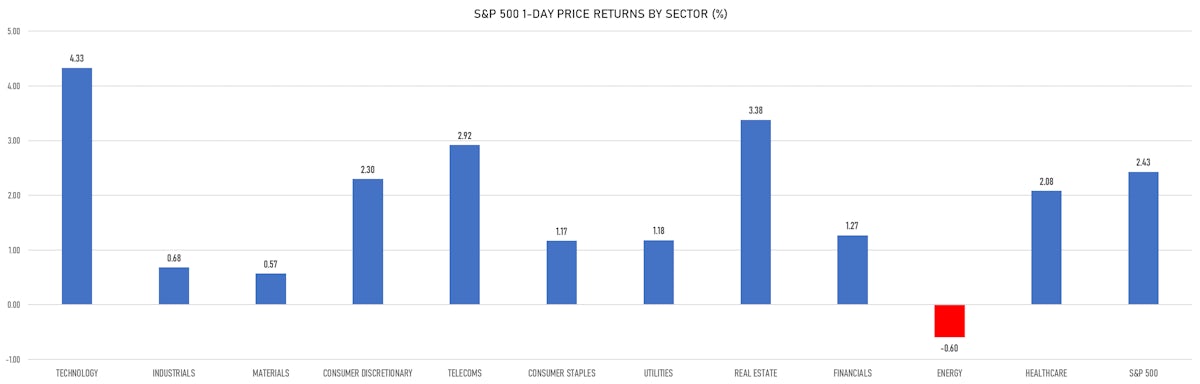

The rise today was broad, with almost 90% of S&P 500 stocks closing up, and was led by Technology (up 4.3%), Real Estate (up 3.4%), and Telecoms (up 2.9%)

Published ET

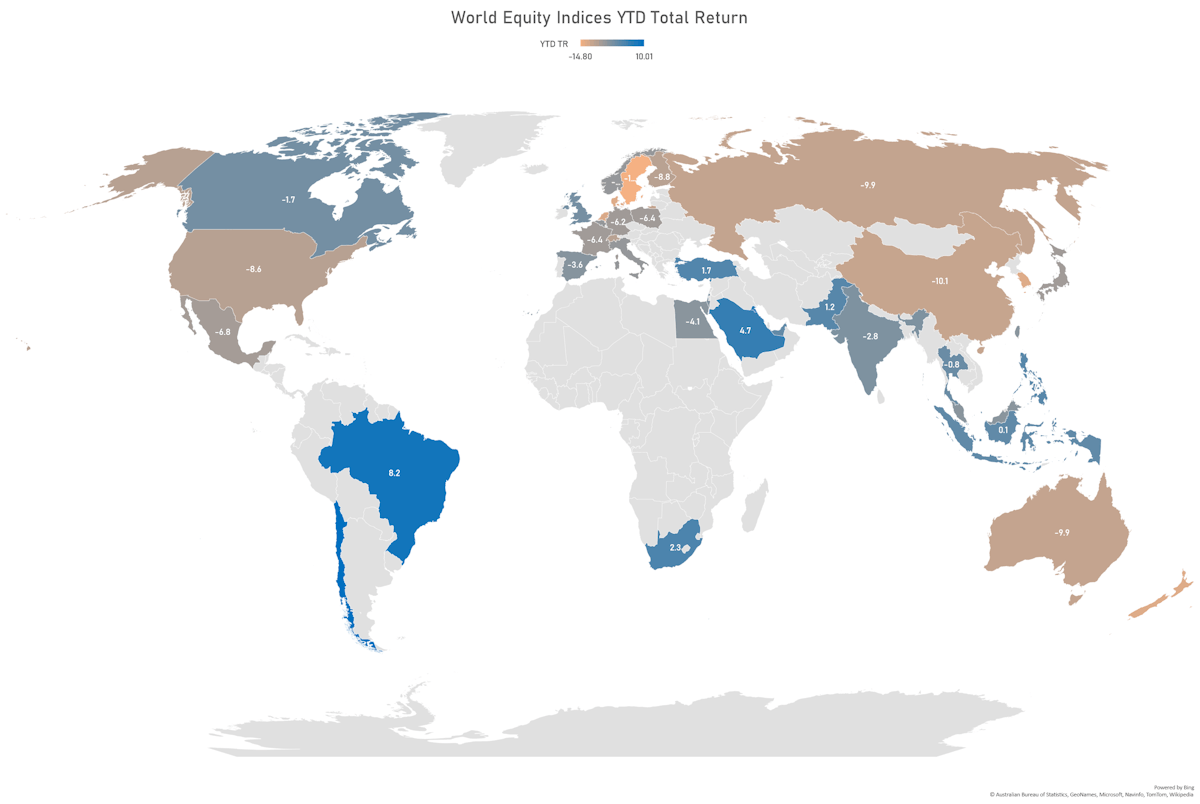

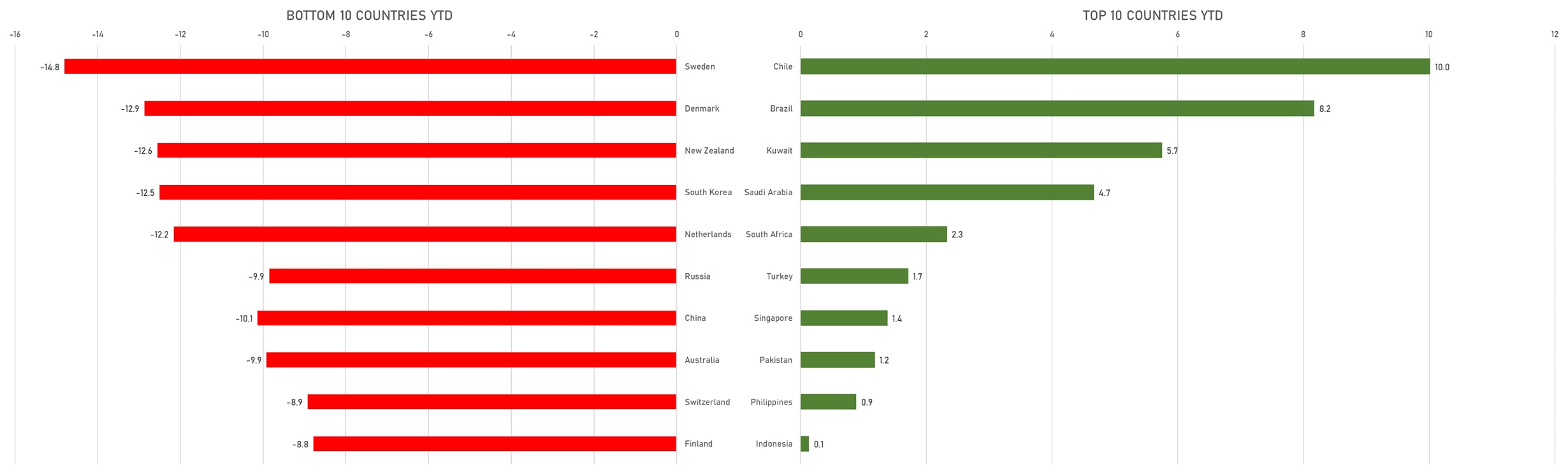

Year To Date Total Returns By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 2.43%; Nasdaq Composite up 3.13%; Wilshire 5000 up 2.45%

- 87.3% of S&P 500 stocks were up today, with 45.7% of stocks above their 200-day moving average (DMA) and 35.6% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 4.33% and real estate up 3.38%

- Bottom performing sectors in the S&P 500: energy down -0.60% and materials up 0.57%

- The number of shares in the S&P 500 traded today was 742m for a total turnover of US$ 95 bn

- The S&P 500 Value Index was up 1.5%, while the S&P 500 Growth Index was up 3.4%; the S&P small caps index was up 1.6% and mid-caps were up 1.9%

- The volume on CME's INX (S&P 500 Index) was 2.9m (3-month z-score: 0.9); the 3-month average volume is 2.4m and the 12-month range is 1.3 - 4.6m

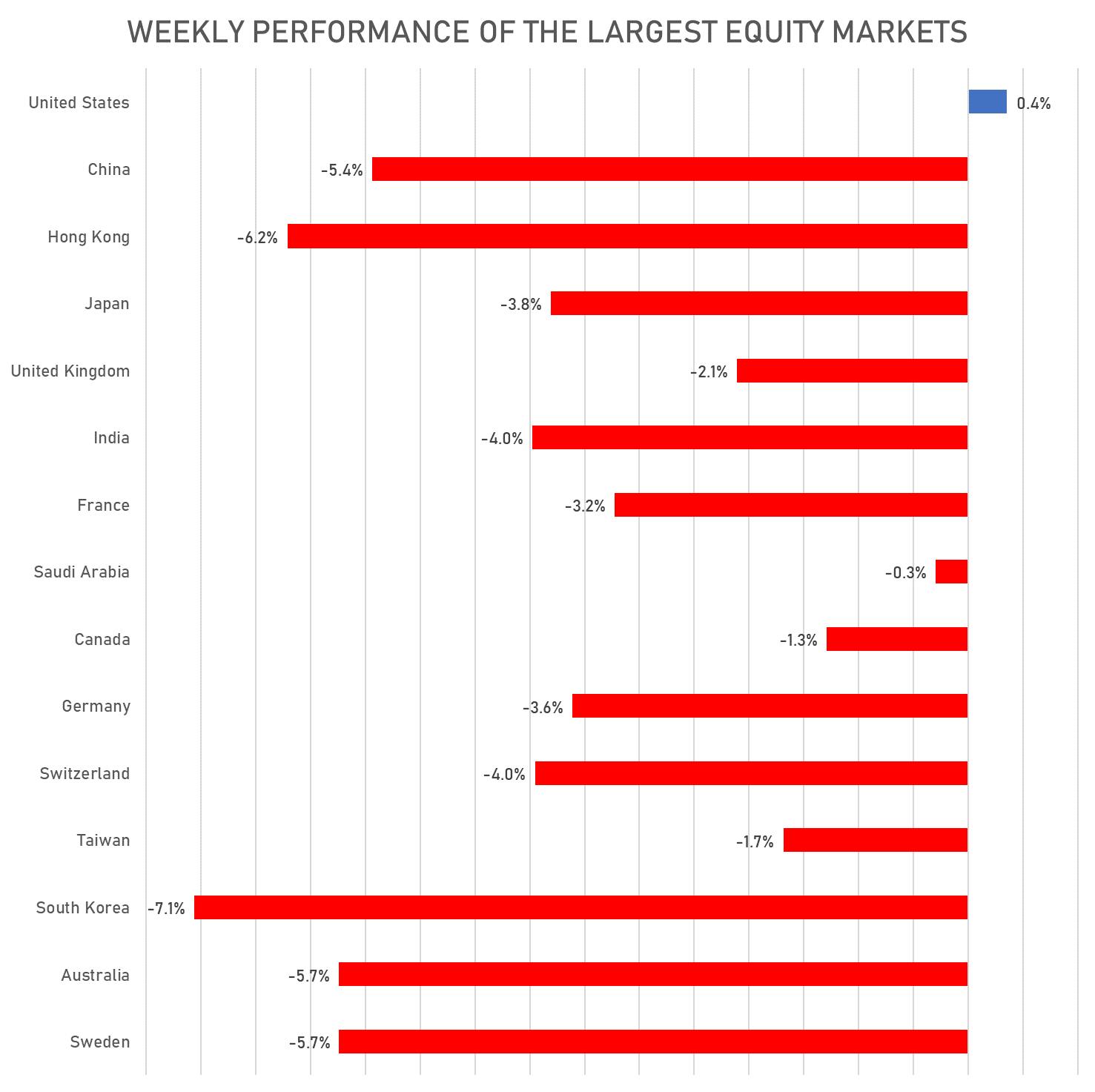

- Daily performance of international indices: Europe Stoxx 600 down -1.02%; UK FTSE 100 down -1.17%; Hang Seng SH-SZ-HK 300 Index down -1.20%; Japan's TOPIX 500 up 1.87%

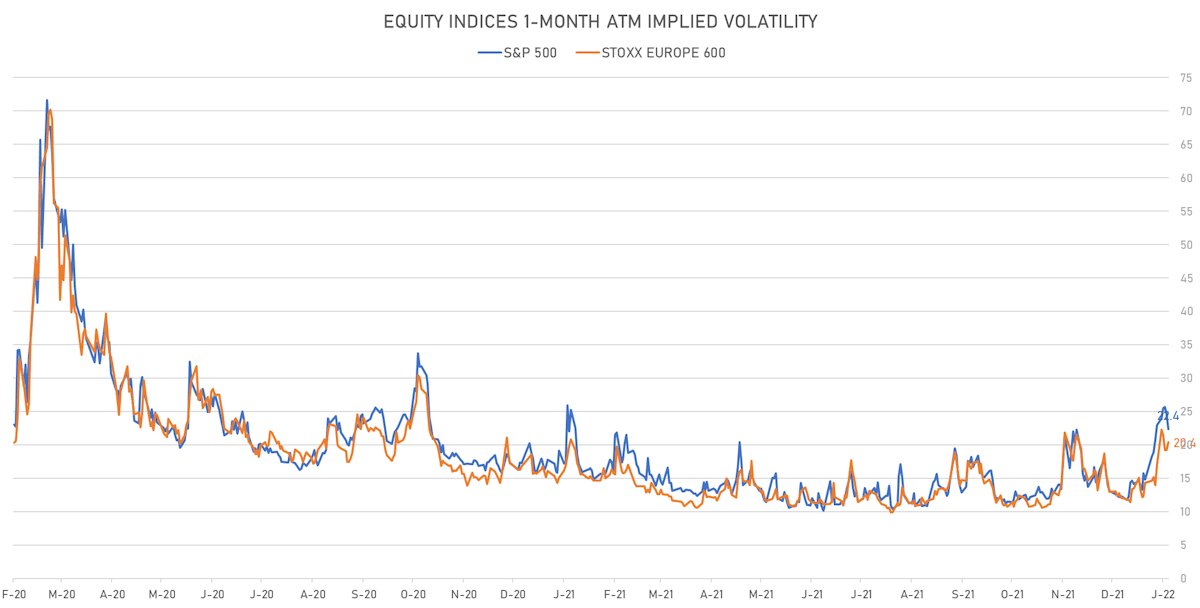

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 22.4%, down from 24.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 20.4%, up from 19.2%

PERFORMANCE OF TOP EQUITY MARKETS THIS WEEK

TOP & BOTTOM PERFORMING COUNTRIES YEAR TO DATE

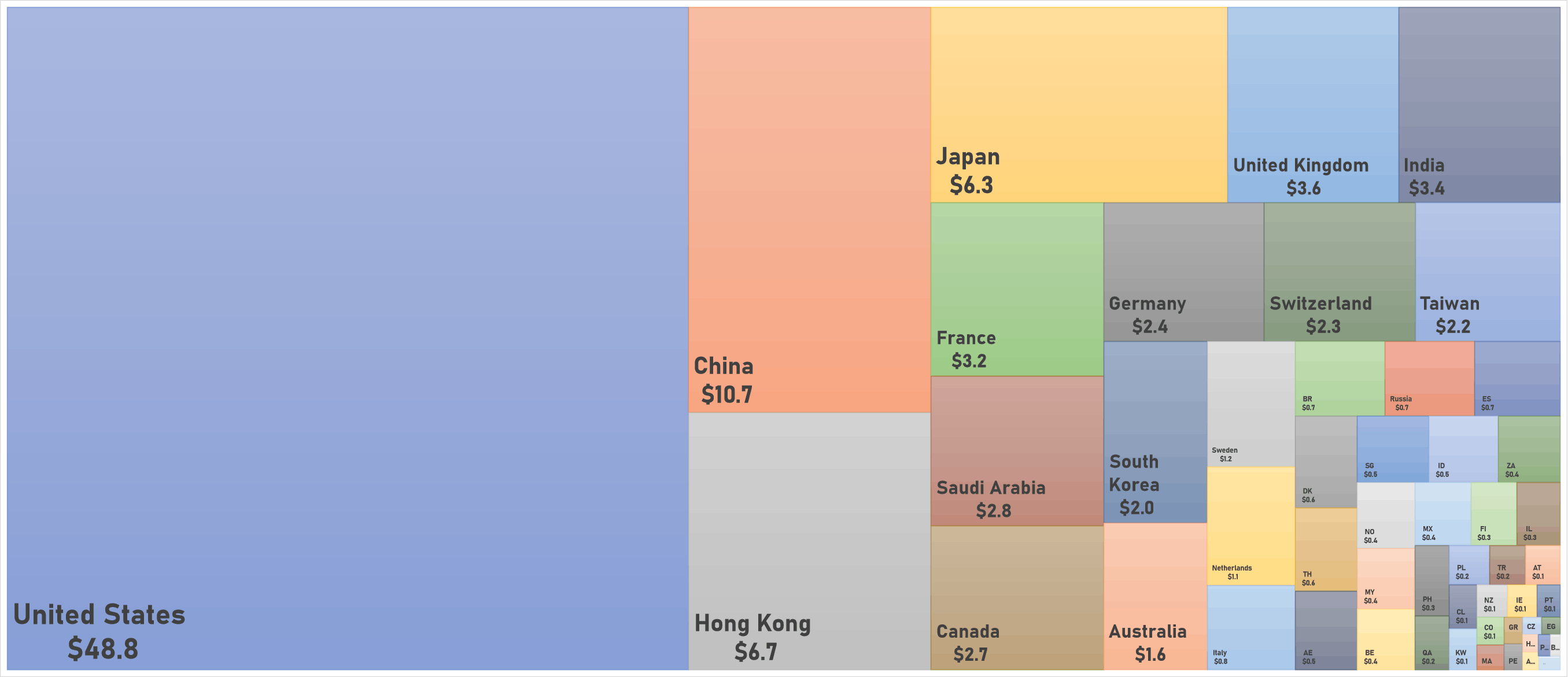

TOTAL WORLD MARKET CAPITALIZATION (US$ TRILLION)

NOTABLE US EARNINGS RELEASES TODAY

- Chevron Corp (CVX | Energy): missed EPS median estimate (2.56 act. vs. 3.09 est.) and beat revenue median estimate (48,129m act. vs. 44,284m est.), down -3.52% today, closed at $ 130.61 / share and traded at $ 130.61 (unchanged) after hours

- Caterpillar Inc (CAT | Industrials): beat EPS median estimate (2.69 act. vs. 2.27 est.) and beat revenue median estimate (13,798m act. vs. 13,172m est.), down -5.19% today, closed at $ 201.16 / share and traded at $ 201.50 (+0.17%) after hours

- Charter Communications Inc (CHTR | Technology): beat EPS median estimate (8.93 act. vs. 7.02 est.) and missed revenue median estimate (13,212m act. vs. 13,245m est.), up 5.25% today, closed at $ 590.47 / share and traded at $ 590.00 (-0.08%) after hours

- Colgate-Palmolive Co (CL | Consumer Non-Cyclicals): matched EPS median estimate (0.79 act. vs. 0.79 est.) and missed revenue median estimate (4,403m act. vs. 4,419m est.), up 0.42% today, closed at $ 83.05 / share and traded at $ 83.04 (-0.01%) after hours

- Phillips 66 (PSX | Energy): beat EPS median estimate (2.94 act. vs. 1.95 est.) and beat revenue median estimate (33,568m act. vs. 26,875m est.), down -1.83% today, closed at $ 84.25 / share and traded at $ 84.90 (+0.77%) after hours

- Weyerhaeuser Co (WY | Real Estate): matched EPS median estimate (0.49 act. vs. 0.49 est.) and beat revenue median estimate (2,206m act. vs. 2,178m est.), up 4.65% today, closed at $ 39.65 / share and traded at $ 39.58 (-0.18%) after hours

- Church & Dwight Co Inc (CHD | Consumer Non-Cyclicals): beat EPS median estimate (0.64 act. vs. 0.59 est.) and beat revenue median estimate (1,369m act. vs. 1,346m est.), up 4.40% today, closed at $ 103.00 / share and traded at $ 103.50 (+0.49%) after hours

- VF Corp (VFC | Consumer Cyclicals): beat EPS median estimate (1.35 act. vs. 1.21 est.) and beat revenue median estimate (3,624m act. vs. 3,607m est.), down -6.52% today, closed at $ 62.96 / share and traded at $ 62.96 (unchanged) after hours

- Synchrony Financial (SYF | Financials): missed EPS median estimate (1.48 act. vs. 1.49 est.) and beat revenue median estimate (2,730m act. vs. 2,609m est.), down -6.75% today, closed at $ 41.42 / share and traded at $ 41.50 (+0.19%) after hours

- Booz Allen Hamilton Holding Corp (BAH | Technology): beat EPS median estimate (1.02 act. vs. 0.97 est.) and missed revenue median estimate (2,031m act. vs. 2,137m est.), down -8.28% today, closed at $ 75.25 / share and traded at $ 76.00 (+1.00%) after hours

- Autoliv Inc (ALV | Consumer Cyclicals): beat EPS median estimate (1.30 act. vs. 1.21 est.) and missed revenue median estimate (2,119m act. vs. 2,179m est.), up 0.91% today, closed at $ 96.79 / share and traded at $ 96.79 (unchanged) after hours

- Gentex Corp (GNTX | Consumer Cyclicals): beat EPS median estimate (0.36 act. vs. 0.35 est.) and beat revenue median estimate (420m act. vs. 417m est.), down -1.57% today, closed at $ 30.79 / share and traded at $ 31.28 (+1.59%) after hours

TOP WINNERS TODAY

- Dave Inc (DAVE), up 23.7% to $11.39 / YTD price return: +11.1% / 12-Month Price Range: $ 4.62-11.93 / Short interest (% of float): 0.7%; days to cover: 1.6

- Insulet Corp (PODD), up 18.4% to $230.59 / YTD price return: -13.3% / 12-Month Price Range: $ 193.70-324.81 / Short interest (% of float): 3.9%; days to cover: 5.1

- TG Therapeutics Inc (TGTX), up 17.7% to $9.73 / YTD price return: -48.8% / 12-Month Price Range: $ 8.05-56.50 / Short interest (% of float): 12.3%; days to cover: 9.3

- Affirm Holdings Inc (AFRM), up 17.1% to $59.71 / YTD price return: -40.6% / 12-Month Price Range: $ 46.50-176.65 / Short interest (% of float): 5.8%; days to cover: 1.2

- Fair Isaac Corp (FICO), up 16.6% to $493.12 / YTD price return: +13.7% / 12-Month Price Range: $ 342.89-553.97 / Short interest (% of float): 3.0%; days to cover: 2.5

- Calix Inc (CALX), up 15.8% to $46.80 / YTD price return: -41.5% / 12-Month Price Range: $ 29.12-80.95 / Short interest (% of float): 4.8%; days to cover: 2.1

- Novavax Inc (NVAX), up 13.7% to $82.92 / YTD price return: -42.0% / 12-Month Price Range: $ 66.38-331.68 / Short interest (% of float): 12.8%; days to cover: 1.5

- Bed Bath & Beyond Inc (BBBY), up 12.3% to $15.53 / YTD price return: +6.5% / 12-Month Price Range: $ 12.39-49.48 / Short interest (% of float): 28.5%; days to cover: 3.8

- 1-800-Flowers.Com Inc (FLWS), up 12.0% to $16.90 / YTD price return: -27.7% / 12-Month Price Range: $ 13.70-39.61 / Short interest (% of float): 19.4%; days to cover: 5.3

BIGGEST LOSERS TODAY

- Qurate Retail Inc (QRTEB), down 15.5% to $6.65 / YTD price return: -12.5% / 12-Month Price Range: $ 7.07-15.37 / Short interest (% of float): 0.3%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Western Alliance Bancorp (WAL), down 11.1% to $95.20 / YTD price return: -11.6% / 12-Month Price Range: $ 67.59-124.93 / Short interest (% of float): 1.6%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Boot Barn Holdings Inc (BOOT), down 9.7% to $85.69 / YTD price return: -30.4% / 12-Month Price Range: $ 53.73-134.50 / Short interest (% of float): 6.0%; days to cover: 3.3 (the stock is currently on the short sale restriction list)

- LumiraDx Ltd (LMDX), down 8.6% to $8.83 / YTD price return: -.9% / 12-Month Price Range: $ 7.15-11.09 / Short interest (% of float): 0.2%; days to cover: 9.2 (the stock is currently on the short sale restriction list)

- Booz Allen Hamilton Holding Corp (BAH), down 8.3% to $75.25 / YTD price return: -11.3% / 12-Month Price Range: $ 75.15-98.18 / Short interest (% of float): 1.3%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Faraday Future Intelligent Electric Inc (FFIE), down 8.2% to $3.85 / YTD price return: -27.6% / 12-Month Price Range: $ 3.87-20.75 / Short interest (% of float): 10.3%; days to cover: 12.9

- Oxford Industries Inc (OXM), down 7.9% to $80.95 / YTD price return: -20.3% / 12-Month Price Range: $ 63.77-114.47 / Short interest (% of float): 3.8%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Western Digital Corp (WDC), down 7.3% to $49.90 / YTD price return: -23.5% / 12-Month Price Range: $ 49.50-78.19 / Short interest (% of float): 2.2%; days to cover: 2.0

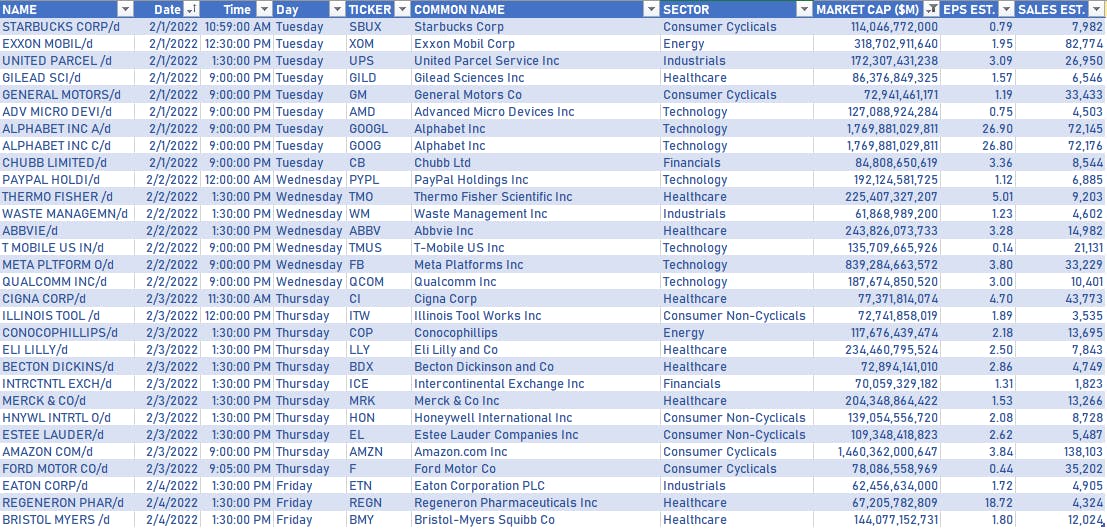

MAJOR US EARNINGS RELEASES IN THE WEEK AHEAD

NEW IPOs ANNOUNCED OR PRICED

- PingPong Global Solutions Inc / United States of America - Financials / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- SCG Chemicals Co Ltd / Thailand - Energy and Power / Listing Exchange: Thailand / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,163.14m (offering in Thai Baht) / Bookrunners: Not Applicable

- Credo Technology Group Holding Ltd / Cayman Islands - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: CRDO / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, BofA Securities Inc

SECONDARIES / FOLLOW-ONS

- Sierra Oncology Inc / Canada - Healthcare / Listing Exchange: Nasdaq / Ticker: SRRA / Gross proceeds (including overallotment): US$ 110.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Cantor Fitzgerald & Co

- Samsung Biologics Co Ltd / South Korea - Healthcare / Listing Exchange: Korea / Ticker: 207940 / Gross proceeds (including overallotment): US$ 2,492m (offering in U.S. Dollar) / Bookrunners: Korea Investment & Securities Co Ltd, NH Investment & Securities Co Ltd, KBI Securities Co Ltd

- Phoenix Group Holdings PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: PHNX / Gross proceeds (including overallotment): US$ 353.20m (offering in British Pound) / Bookrunners: Goldman Sachs International

- IG Group Holdings PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: IGG / Gross proceeds (including overallotment): US$ 161.83m (offering in British Pound) / Bookrunners: Barclays Bank PLC, Jefferies International Ltd