Equities

Mixed Performance In US Equities Today, With Less Than Half Of S&P 500 Stocks Ending Up

Technology stocks rebounded, led by Amazon's blowout earnings, with the market now favoring highly profitable, long visibility stocks (like Apple, Microsoft, Google) rather than expensive and unprofitable growth companies

Published ET

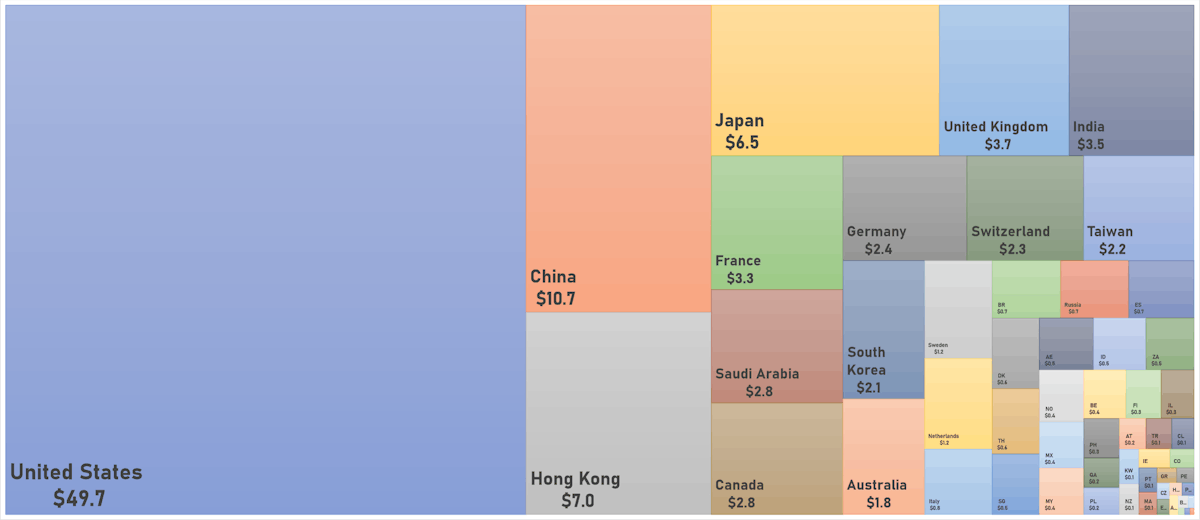

The total world market capitalization is down to US$ 113.5 trillion | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.52%; Nasdaq Composite up 1.58%; Wilshire 5000 up 0.80%

- 43.0% of S&P 500 stocks were up today, with 49.3% of stocks above their 200-day moving average (DMA) and 41.2% above their 50-DMA

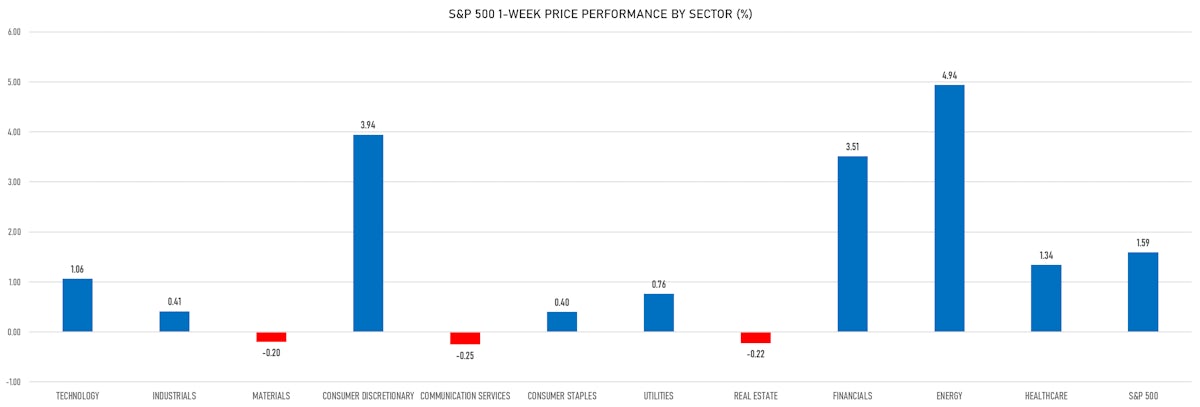

- Top performing sectors in the S&P 500: consumer discretionary up 3.74% and financials up 1.66%

- Bottom performing sectors in the S&P 500: materials down -1.72% and real estate down -1.26%

- The number of shares in the S&P 500 traded today was 667m for a total turnover of US$ 90 bn

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was up 1.3%; the S&P small caps index was up 0.0% and mid-caps were up 0.2%

- The volume on CME's INX (S&P 500 Index) was 2.6m (3-month z-score: 0.3); the 3-month average volume is 2.4m and the 12-month range is 1.3 - 4.6m

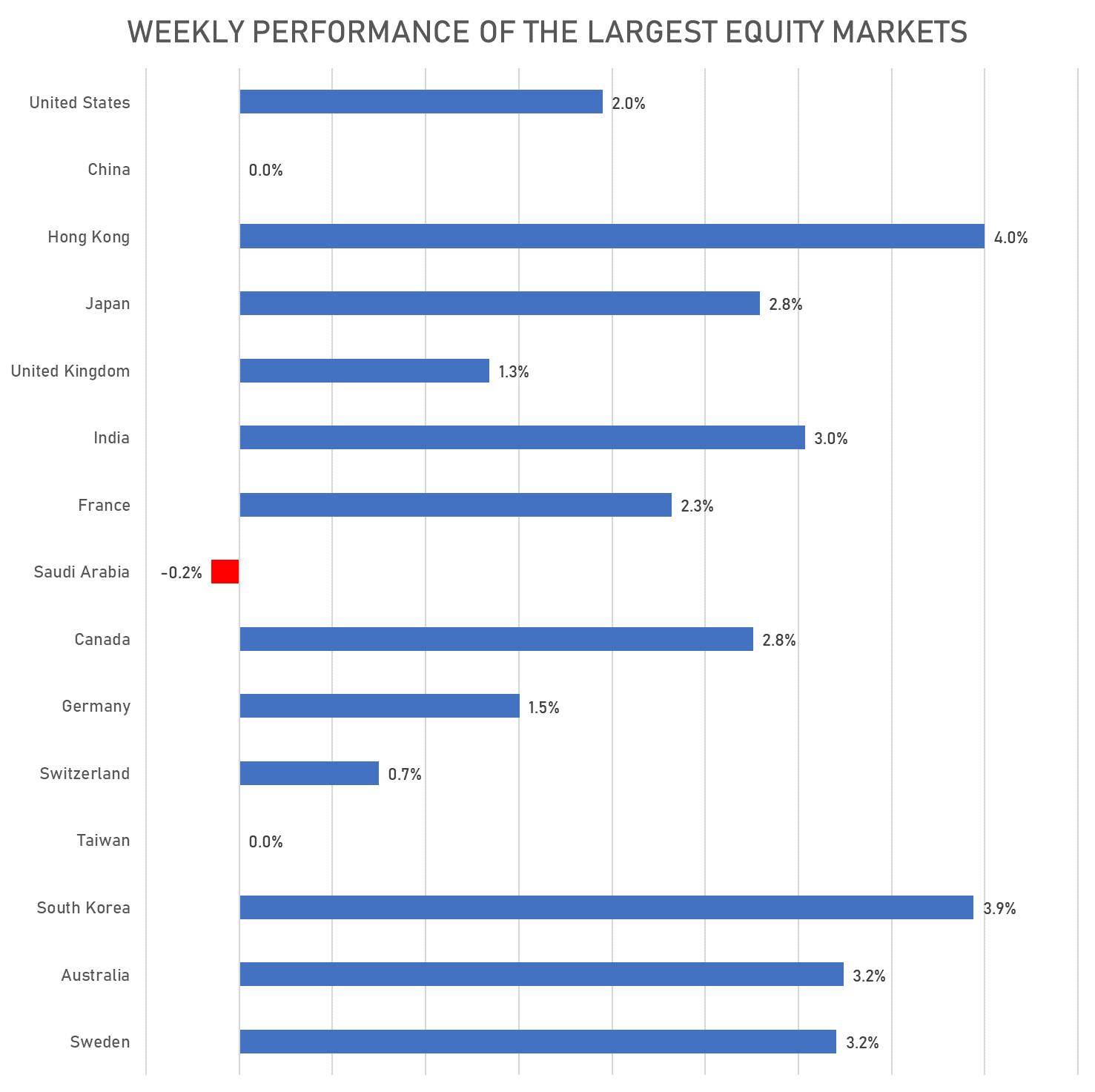

- Daily performance of international indices: Europe Stoxx 600 down -1.38%; UK FTSE 100 down -0.17%; Hang Seng SH-SZ-HK 300 Index up 1.18%; Japan's TOPIX 500 up 0.54%

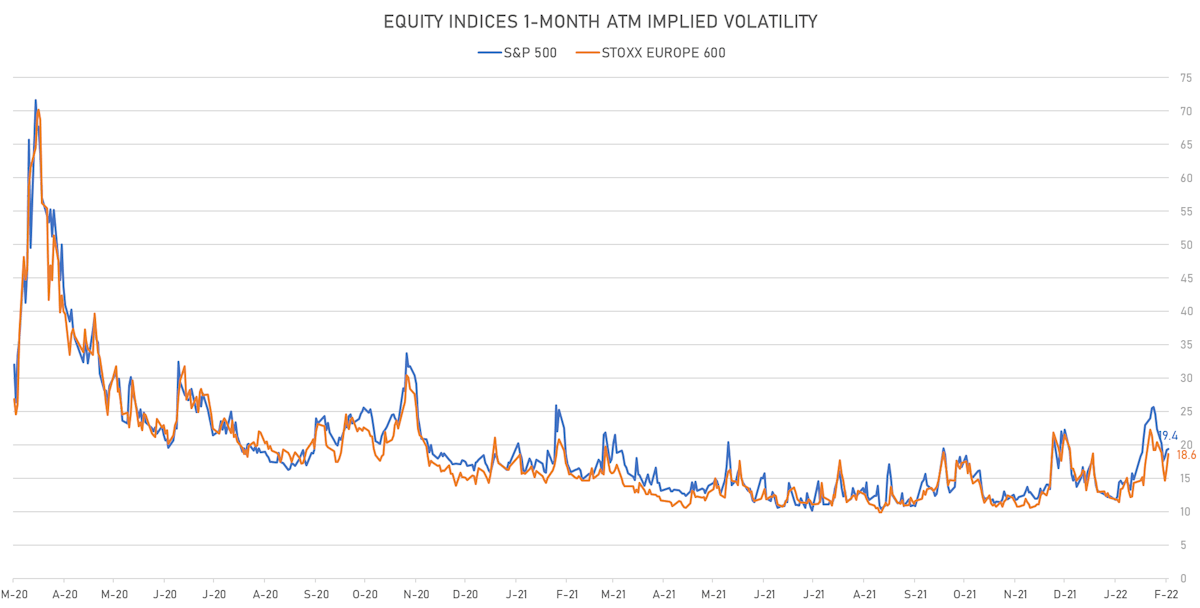

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 19.4%, up from 19.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 18.6%, up from 16.5%

TOP WINNERS

- Snap Inc (SNAP), up 58.8% to $38.91 / YTD price return: -17.6% / 12-Month Price Range: $ 24.32-83.34 / Short interest (% of float): 4.2%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Bill.com Holdings Inc (BILL), up 36.1% to $231.67 / YTD price return: -7.0% / 12-Month Price Range: $ 128.00-348.50 / Short interest (% of float): 8.5%; days to cover: 4.3

- Aurora Innovation Inc (AUR), up 22.2% to $5.79 / 12-Month Price Range: $ 3.94-17.77 / Short interest (% of float): 2.6%; days to cover: 5.4

- Standard Lithium Ltd (SLI), up 18.5% to $6.27 / 12-Month Price Range: $ 2.25-12.92 / Short interest (% of float): 2.7%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- GitLab Inc (GTLB), up 17.5% to $72.40 / 12-Month Price Range: $ 53.14-137.00 / Short interest (% of float): 42.1%; days to cover: 3.4

- Unity Software Inc (U), up 17.4% to $108.66 / YTD price return: -24.0% / 12-Month Price Range: $ 76.00-210.00

- Magnite Inc (MGNI), up 16.2% to $13.89 / YTD price return: -20.6% / 12-Month Price Range: $ 11.41-64.39 / Short interest (% of float): 8.5%; days to cover: 5.0

- Microstrategy Inc (MSTR), up 15.2% to $391.64 / YTD price return: -28.1% / 12-Month Price Range: $ 307.19-1,315.00

- Amazon.com Inc (AMZN), up 13.5% to $3,152.79 / YTD price return: -5.4% / 12-Month Price Range: $ 2,707.04-3,773.08

- Embark Technology Inc (EMBK), up 13.5% to $4.30 / 12-Month Price Range: $ 3.01-10.49 / Short interest (% of float): 1.3%; days to cover: 3.2

BIGGEST LOSERS

- SkyWest Inc (SKYW), down 22.4% to $29.47 / YTD price return: -25.0% / 12-Month Price Range: $ 35.32-61.16 / Short interest (% of float): 2.1%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Evotec SE (EVO), down 15.1% to $17.47 / 12-Month Price Range: $ 17.07-26.57 / Short interest (% of float): 0.0%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Clorox Co (CLX), down 14.5% to $141.41 / YTD price return: -18.9% / 12-Month Price Range: $ 156.23-200.05 / Short interest (% of float): 5.1%; days to cover: 5.1 (the stock is currently on the short sale restriction list)

- GrafTech International Ltd (EAF), down 11.9% to $9.92 / YTD price return: -16.1% / 12-Month Price Range: $ 9.58-14.17 / Short interest (% of float): 1.6%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Dolby Laboratories Inc (DLB), down 11.1% to $75.86 / YTD price return: -20.3% / 12-Month Price Range: $ 83.10-104.74 (the stock is currently on the short sale restriction list)

- Ubiquiti Inc (UI), down 10.7% to $236.22 / YTD price return: -23.0% / 12-Month Price Range: $ 261.49-401.81 / Short interest (% of float): 5.0%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Ford Motor Co (F), down 9.7% to $17.96 / YTD price return: -13.5% / 12-Month Price Range: $ 11.13-25.87 / Short interest (% of float): 2.1% (the stock is currently on the short sale restriction list)

- Exponent Inc (EXPO), down 8.7% to $84.33 / 12-Month Price Range: $ 85.99-127.61

- Newell Brands Inc (NWL), down 8.5% to $21.33 / YTD price return: -2.3% / 12-Month Price Range: $ 20.36-30.10 / Short interest (% of float): 3.2%; days to cover: 4.6

- Nov Inc (NOV), down 8.2% to $16.21 / YTD price return: +19.6% / 12-Month Price Range: $ 11.46-18.02 / Short interest (% of float): 3.4%; days to cover: 3.9

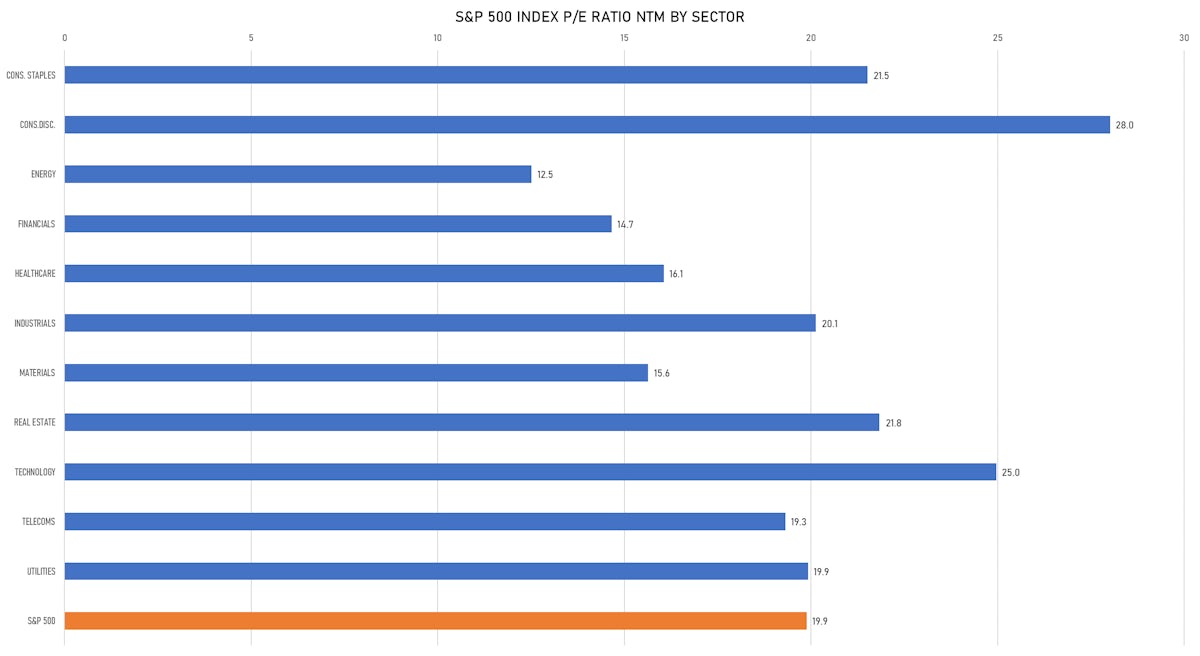

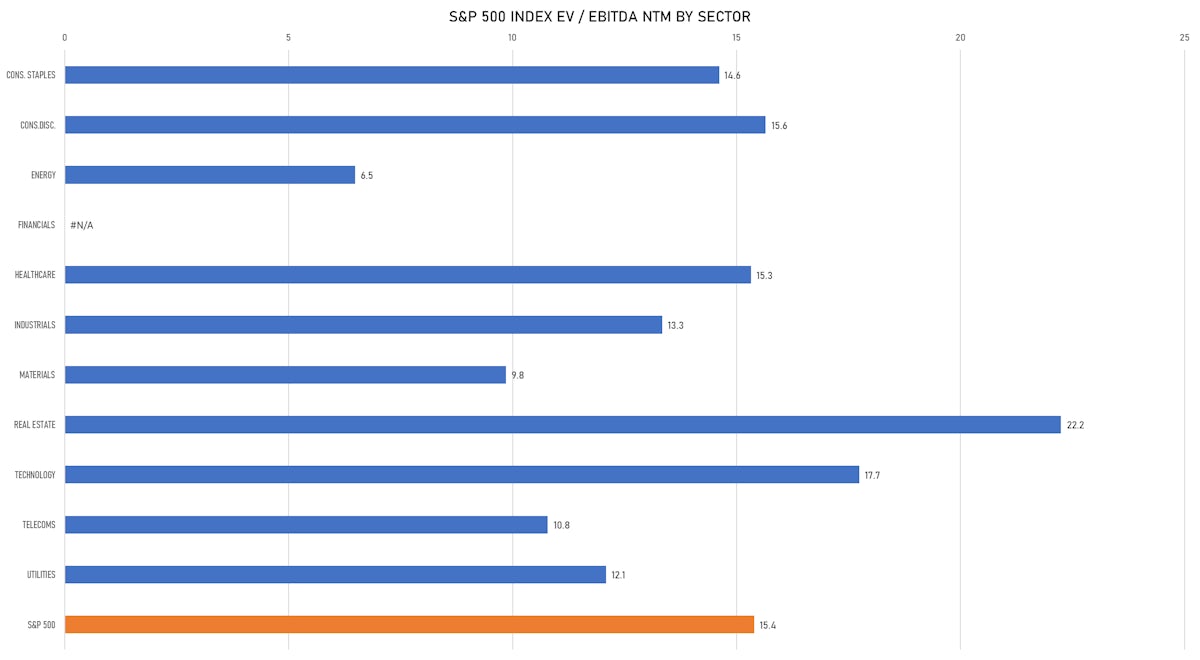

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Kimbell Tiger Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: TGR.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: UBS Securities LLC

- Arcellx Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ACLX / Gross proceeds (including overallotment): US$ 123.75m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, SVB Leerink LLC, BofA Securities Inc, Barclays Capital Inc

- GCP Co-Living REIT PLC / United Kingdom - Real Estate / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 407.31m (offering in British Pound) / Bookrunners: Stifel Nicolaus Europe Ltd

- Fred. Olsen Windcarrier Asa / Norway - Consumer Products and Services / Listing Exchange: Oslo / Ticker: N/A / Gross proceeds (including overallotment): US$ 169.55m (offering in EURO) / Bookrunners: DnB Markets AS, Arctic Securities ASA, SpareBank 1 Markets AS

- Harsha Engineers International Ltd / India - Industrials / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 100.94m (offering in Indian Rupee) / Bookrunners: JM Financial Group, Equirus Capital Pvt Ltd, Axis Capital Ltd

SECONDARIES / FOLLOW-ONS

- Innergex Renewable Energy Inc / Canada - Energy and Power / Listing Exchange: Toronto / Ticker: INE / Gross proceeds (including overallotment): US$ 118.34m (offering in Canadian Dollar) / Bookrunners: CIBC Capital Markets, TD Securities Inc, National Bank Financial Inc, BMO Capital Markets

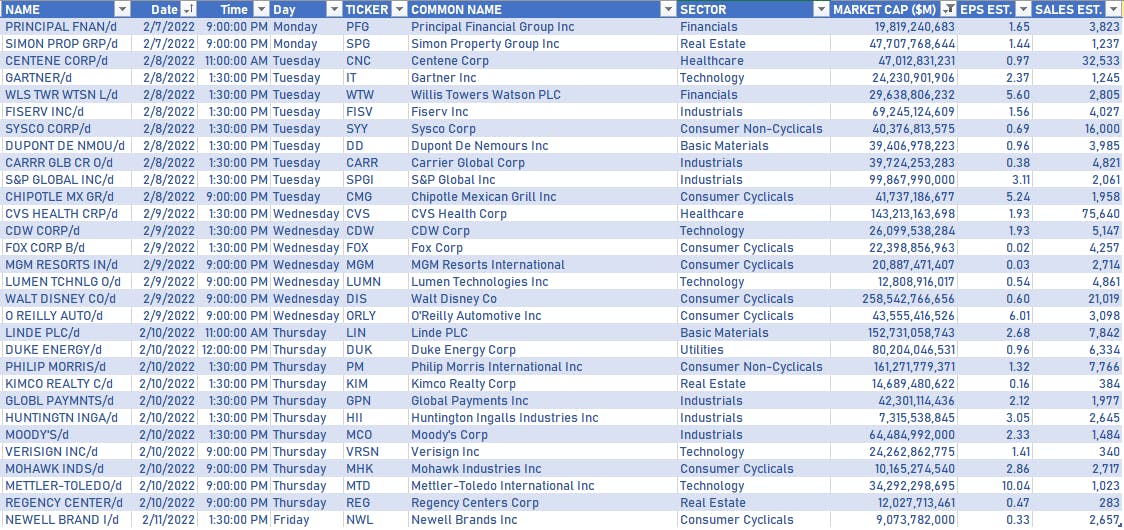

US EARNINGS IN THE WEEK AHEAD

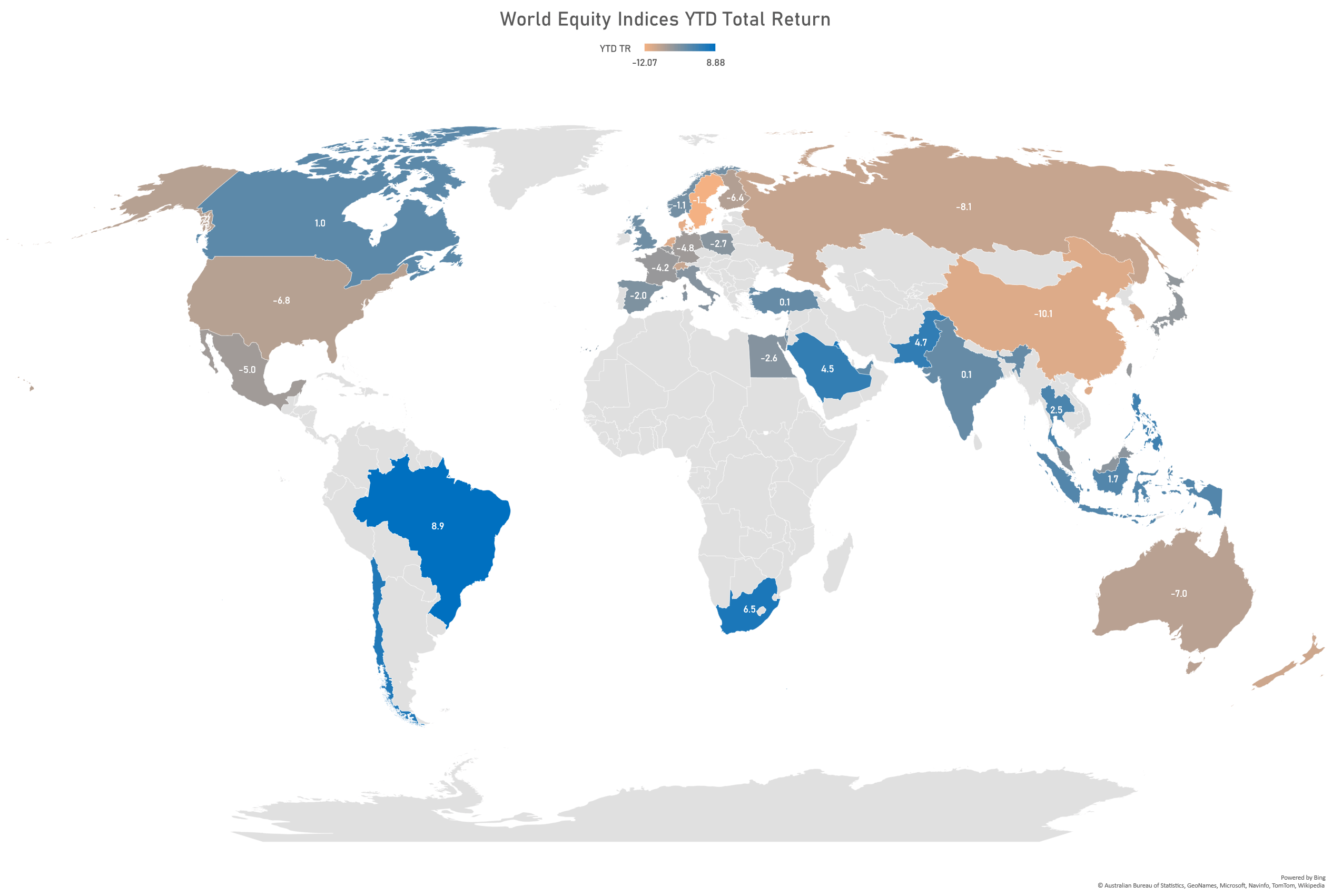

PERFORMANCE OF TOP EQUITY MARKETS WORLDWIDE (CHINA CLOSED FOR THE SPRING FESTIVAL HOLIDAY)

MAP OF EQUITY MARKET TOTAL RETURNS YTD