Equities

Broad Rally For US Stocks, Led By Small Caps; S&P 500 Up 0.84%, Russell 2000 Up 1.63%, NASDAQ Comp Up 1.28%

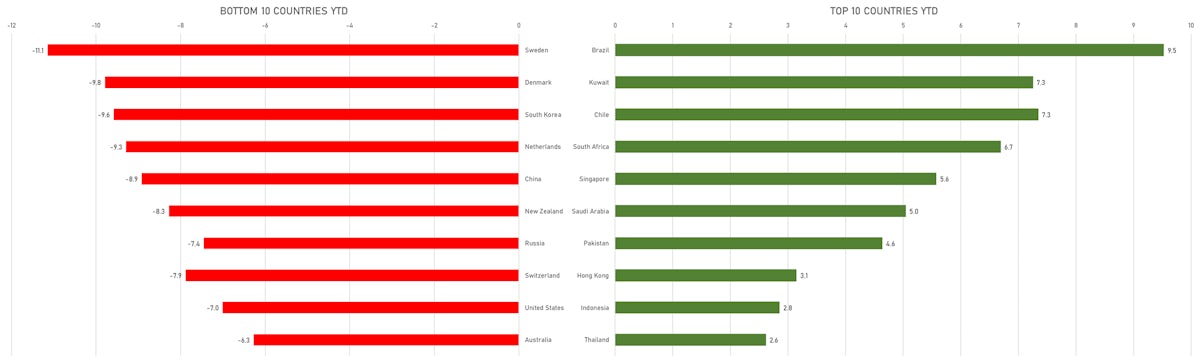

Looking at the performance of global equities year-to-date, the top countries are Brazil, Kuwait and Chile, the worst are Sweden, Denmark and South Korea

Published ET

YTD Top And Bottom Performing Countries | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.84%; Nasdaq Composite up 1.28%; Wilshire 5000 up 0.97%

- 75.4% of S&P 500 stocks were up today, with 53.5% of stocks above their 200-day moving average (DMA) and 44.8% above their 50-DMA

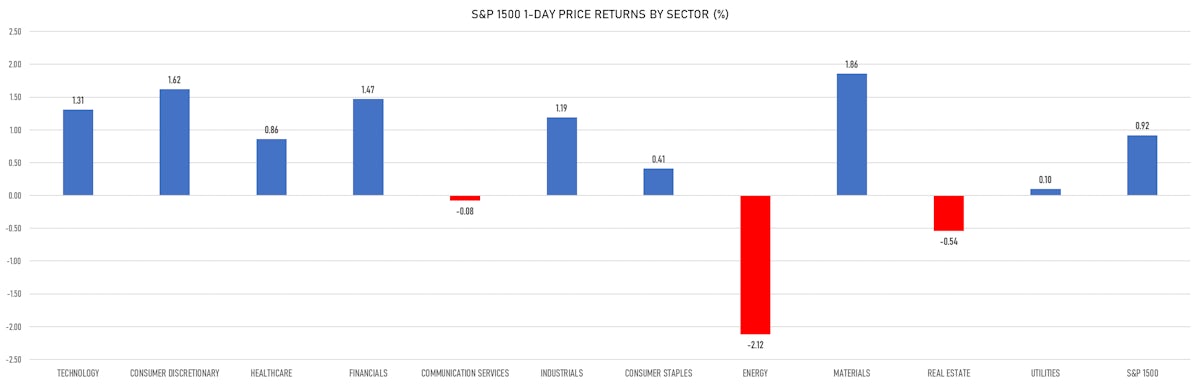

- Top performing sectors in the S&P 500: materials up 1.57% and consumer discretionary up 1.50%

- Bottom performing sectors in the S&P 500: energy down -2.12% and real estate down -0.80%

- The number of shares in the S&P 500 traded today was 604m for a total turnover of US$ 74 bn

- The S&P 500 Value Index was up 0.7%, while the S&P 500 Growth Index was up 1.0%; the S&P small caps index was up 1.8% and mid caps were up 1.9%

- The volume on CME's INX (S&P 500 Index) was 2.5m (3-month z-score: 0.2); the 3-month average volume is 2.4m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.01%; UK FTSE 100 down -0.08%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 1.12%, Japan's TOPIX 500 up 1.19%

VOLATILITY

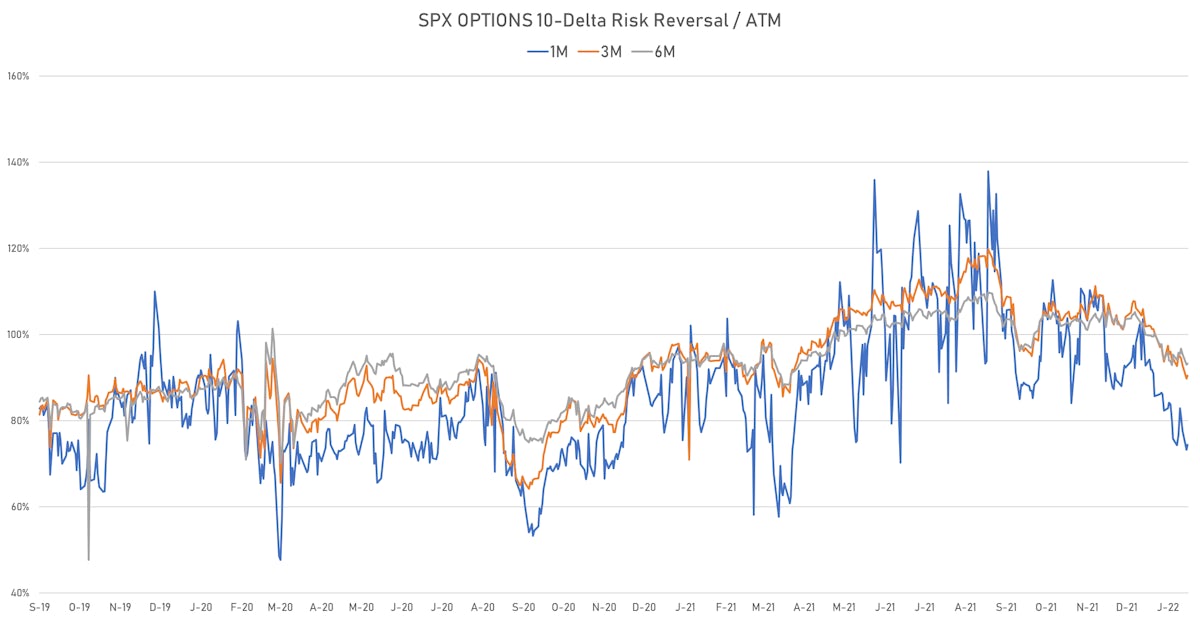

- 1-month at-the-money implied volatility on the S&P 500 at 17.8%, down from 19.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.6%, down from 17.1%

NOTABLE US EARNINGS RELEASES

- UWM Holdings Corp (UWMC | Financials): beat EPS median estimate (0.16 act. vs. 0.11 est.) and beat revenue median estimate (690m act. vs. 583m est.), up 5.61% today, closed at $ 4.52 / share and traded at $ 4.31 (-4.65%) after hours

TOP WINNERS

- Tritium Dcfc Ltd (DCFC), up 39.5% to $9.54 / YTD price return: -4.3% / 12-Month Price Range: $ 6.42-11.00 / Short interest (% of float): 0.6%; days to cover: 1.0

- Teradata Corp (TDC), up 26.3% to $50.89 / YTD price return: +19.8% / 12-Month Price Range: $ 37.05-59.58

- Peloton Interactive Inc (PTON), up 25.3% to $37.27 / YTD price return: +4.2% / 12-Month Price Range: $ 22.81-155.52 / Short interest (% of float): 11.8%; days to cover: 2.0

- Joby Aviation Inc (JOBY), up 21.1% to $4.65 / 12-Month Price Range: $ 3.61-17.00 / Short interest (% of float): 4.6%; days to cover: 4.8

- Mandiant Inc (MNDT), up 17.9% to $17.75 / YTD price return: +1.2% / 12-Month Price Range: $ 13.76-22.80

- Haemonetics Corp (HAE), up 16.2% to $54.56 / YTD price return: +2.9% / 12-Month Price Range: $ 43.50-142.11

- Chegg Inc (CHGG), up 16.0% to $31.63 / YTD price return: +3.0% / 12-Month Price Range: $ 23.23-115.21 / Short interest (% of float): 6.1%; days to cover: 2.2

- Loandepot Inc (LDI), up 16.0% to $4.14 / YTD price return: -13.7% / 12-Month Price Range: $ 3.55-38.68 / Short interest (% of float): 3.9%; days to cover: 0.7

- PC Connection Inc (CNXN), up 15.9% to $49.90 / 12-Month Price Range: $ 40.08-54.10

- Bright Health Group Inc (BHG), up 15.6% to $3.55 / YTD price return: +3.2% / 12-Month Price Range: $ 2.44-17.93 / Short interest (% of float): 1.9%; days to cover: 2.2

BIGGEST LOSERS

- Edgewell Personal Care Co (EPC), down 13.2% to $37.19 / 12-Month Price Range: $ 29.87-51.86 (the stock is currently on the short sale restriction list)

- Novavax Inc (NVAX), down 12.0% to $83.45 / YTD price return: -41.7% / 12-Month Price Range: $ 66.38-331.68 (the stock is currently on the short sale restriction list)

- Mirati Therapeutics Inc (MRTX), down 11.8% to $106.42 / 12-Month Price Range: $ 106.14-214.43 (the stock is currently on the short sale restriction list)

- Ginkgo Bioworks Holdings Inc (DNA), down 11.5% to $5.40 / YTD price return: -35.0% / 12-Month Price Range: $ 4.34-15.86 / Short interest (% of float): 6.6%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

- Micro Focus International PLC (MFGP), down 10.3% to $5.47 / 12-Month Price Range: $ 4.32-8.19 / Short interest (% of float): 0.6%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Whiting Petroleum Corp (WLL), down 10.2% to $68.91 / YTD price return: +6.5% / 12-Month Price Range: $ 26.10-79.97 (the stock is currently on the short sale restriction list)

- EQRx Inc (EQRX), down 10.1% to $3.84 / YTD price return: -43.7% / 12-Month Price Range: $ 3.92-11.10 / Short interest (% of float): 0.9%; days to cover: 5.6 (the stock is currently on the short sale restriction list)

- Editas Medicine Inc (EDIT), down 9.7% to $17.44 / YTD price return: -34.3% / 12-Month Price Range: $ 16.37-73.03 (the stock is currently on the short sale restriction list)

- California Resources Corp (CRC), down 7.9% to $39.63 / 12-Month Price Range: $ 21.79-47.18

- Northern Oil and Gas Inc (NOG), down 7.8% to $22.27 / YTD price return: +8.2% / 12-Month Price Range: $ 10.90-27.87

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Endeavor Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ENACU / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Mizuho Securities USA Inc, Cantor Fitzgerald & Co

- Aurora Technology Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ATAKU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Maxim Group LLC

- Jiangyin PIVOT Automotive Products Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 301181 / Gross proceeds (including overallotment): US$ 101.84m (offering in Chinese Yuan) / Bookrunners: GF Securities, China Securities Co Ltd

SECONDARIES / FOLLOW-ONS

- Airtel Africa PLC / United Kingdom - Telecommunications / Listing Exchange: London / Ticker: AAF / Gross proceeds (including overallotment): US$ 109.90m (offering in British Pound) / Bookrunners: Citigroup Global Markets Ltd