Equities

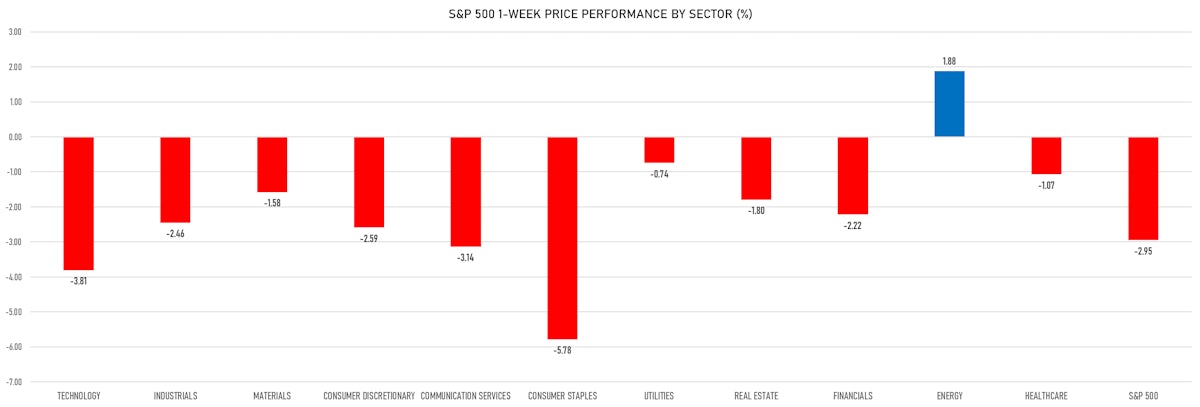

The S&P 500 Ends The Week Down Nearly 3%, With Consumer Staples Falling 5.8% And Technology 3.8%

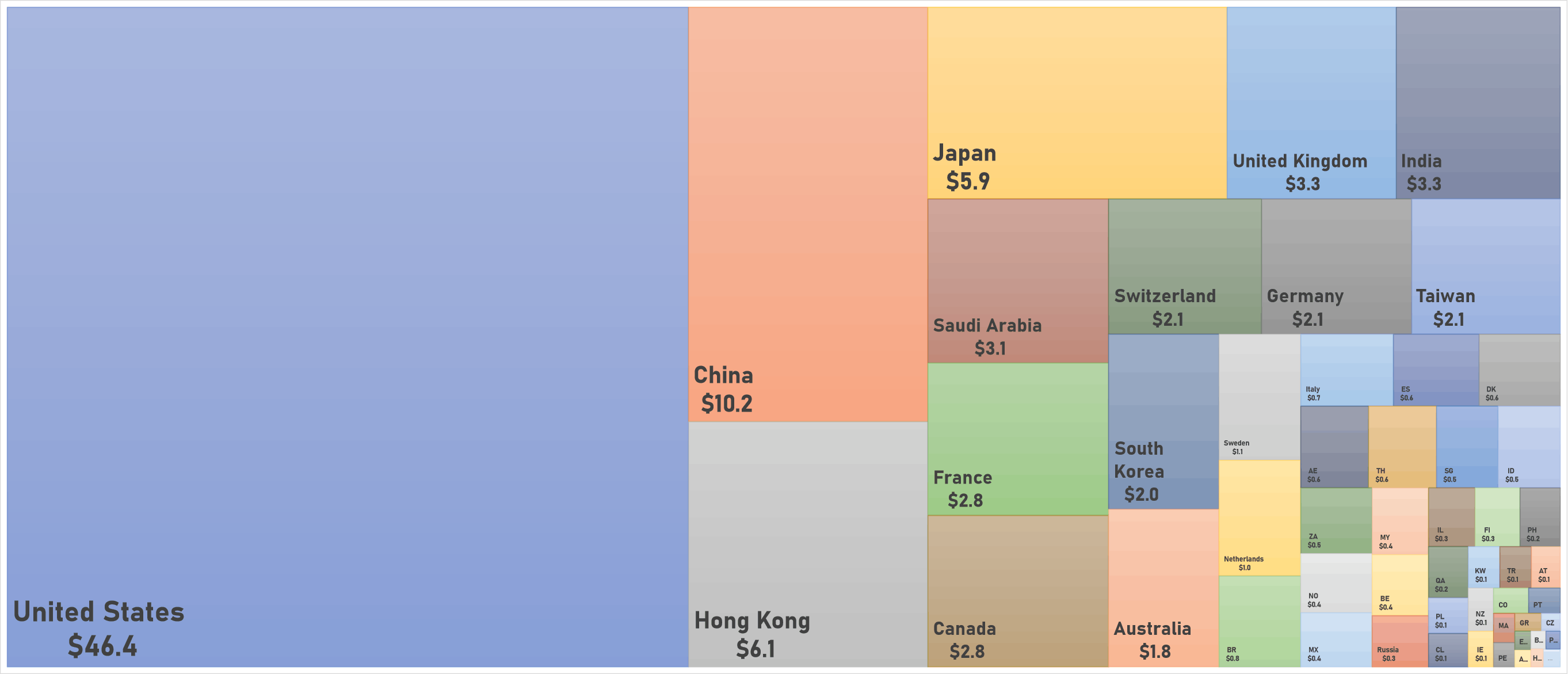

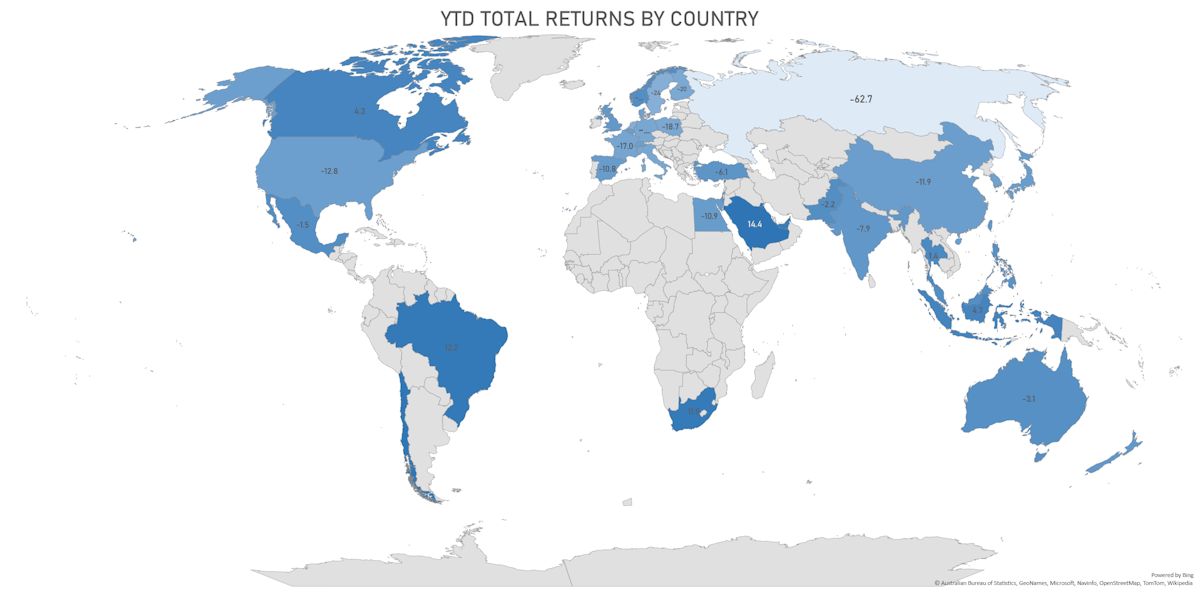

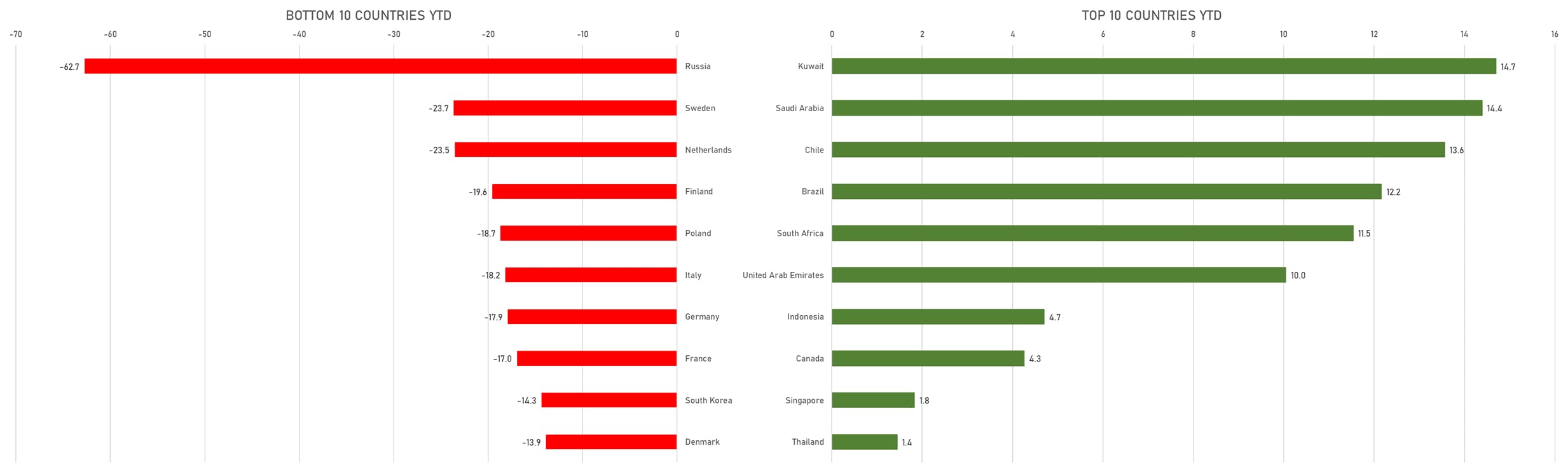

The worst-performing country this year (US$ total returns) is obviously Russia, now down more than 62%, followed by Sweden and the Netherlands, both down close to 24% year-to-date after a good rebound this week

Published ET

Year-To-Date Total Returns By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.30%; Nasdaq Composite down -2.18%; Wilshire 5000 down -1.49%

- 18.2% of S&P 500 stocks were up today, with 35.0% of stocks above their 200-day moving average (DMA) and 25.0% above their 50-DMA

- Top performing sectors in the S&P 500: utilities down -0.37% and financials down -0.72%

- Bottom performing sectors in the S&P 500: communication services down -1.88% and technology down -1.80%

- The number of shares in the S&P 500 traded today was 630m for a total turnover of US$ 72 bn

- The S&P 500 Value Index was down -0.8%, while the S&P 500 Growth Index was down -1.8%; the S&P small caps index was down -1.2% and mid-caps were down -1.0%

- The volume on CME's INX (S&P 500 Index) was 2.3m (3-month z-score: -0.4); the 3-month average volume is 2.6m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 0.95%; UK FTSE 100 up 0.80%; Hang Seng SH-SZ-HK 300 Index down -0.94%; Japan's TOPIX 500 down -1.69%

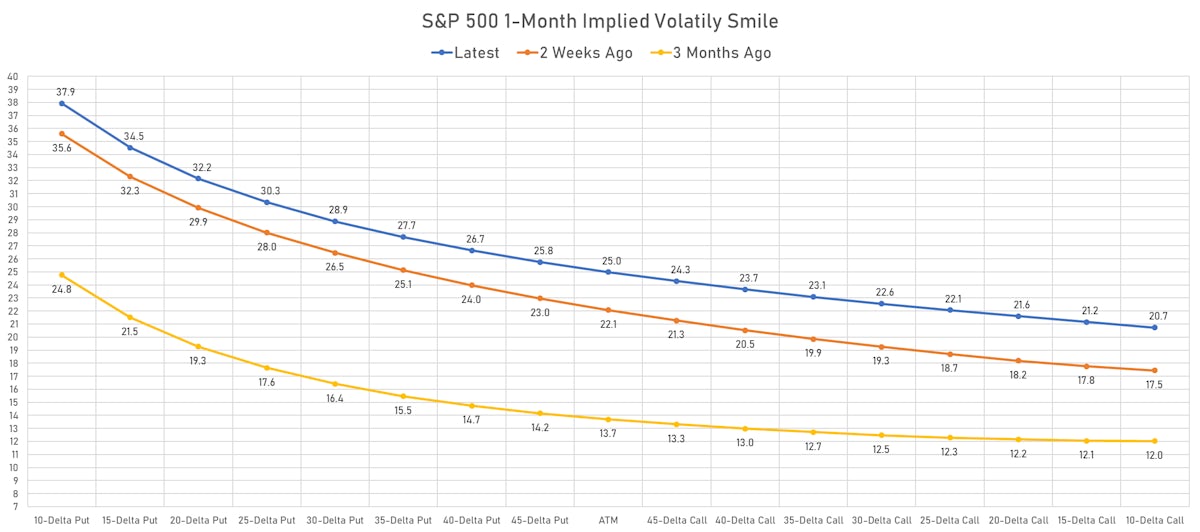

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 25.0%, up from 24.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 29.5%, down from 32.1%

NOTABLE WINNERS

- Pearson PLC (PSO), up 17.7% to $10.23 / YTD price return: +21.8% / 12-Month Price Range: $ 7.68-12.39 / Short interest (% of float): 0.3%; days to cover: 3.8

- Shoals Technologies Group Inc (SHLS), up 14.6% to $17.92 / YTD price return: -26.3% / 12-Month Price Range: $ 11.19-39.98 / Short interest (% of float): 5.7%

- Amphastar Pharmaceuticals Inc (AMPH), up 12.6% to $34.30 / YTD price return: +47.3% / 12-Month Price Range: $ 16.91-30.92 / Short interest (% of float): 5.4%; days to cover: 5.5

- Just Eat Takeaway.com NV (GRUB), up 10.7% to $6.72 / YTD price return: -37.5% / 12-Month Price Range: $ 5.57-36.00

NOTABLE LOSERS

- DiDi Global Inc (DIDI), down 44.1% to $1.89 / YTD price return: -62.0% / 12-Month Price Range: $ 3.33-18.01 / Short interest (% of float): 0.7%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- RLX Technology Inc (RLX), down 36.3% to $1.49 / YTD price return: -61.8% / 12-Month Price Range: $ 2.11-20.65 / Short interest (% of float): 6.4%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Tuya Inc (TUYA), down 32.0% to $2.46 / YTD price return: -60.6% / 12-Month Price Range: $ 3.37-27.65 / Short interest (% of float): 2.4%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Full Truck Alliance Co Ltd (YMM), down 26.0% to $5.18 / YTD price return: -38.1% / 12-Month Price Range: $ 6.92-22.80 / Short interest (% of float): 2.2%; days to cover: 5.0 (the stock is currently on the short sale restriction list)

- Inspirato Inc (ISPO), down 24.7% to $10.71 / YTD price return: +6.0% / 12-Month Price Range: $ 9.00-108.00 / Short interest (% of float): 0.3%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- TDCX Inc (TDCX), down 23.9% to $9.89 / YTD price return: -48.4% / 12-Month Price Range: $ 12.00-30.00 / Short interest (% of float): 6.2%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

- MINISO Group Holding Ltd (MNSO), down 21.2% to $7.33 / YTD price return: -29.1% / 12-Month Price Range: $ 7.60-28.55 (the stock is currently on the short sale restriction list)

- GDS Holdings Ltd (GDS), down 20.5% to $27.36 / YTD price return: -42.0% / 12-Month Price Range: $ 33.21-94.64 (the stock is currently on the short sale restriction list)

- Lufax Holding Ltd (LU), down 20.4% to $4.68 / YTD price return: -16.9% / 12-Month Price Range: $ 4.19-15.94 (the stock is currently on the short sale restriction list)

- DocuSign Inc (DOCU), down 20.1% to $75.01 / YTD price return: -50.8% / 12-Month Price Range: $ 90.90-314.76 / Short interest (% of float): 5.0%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

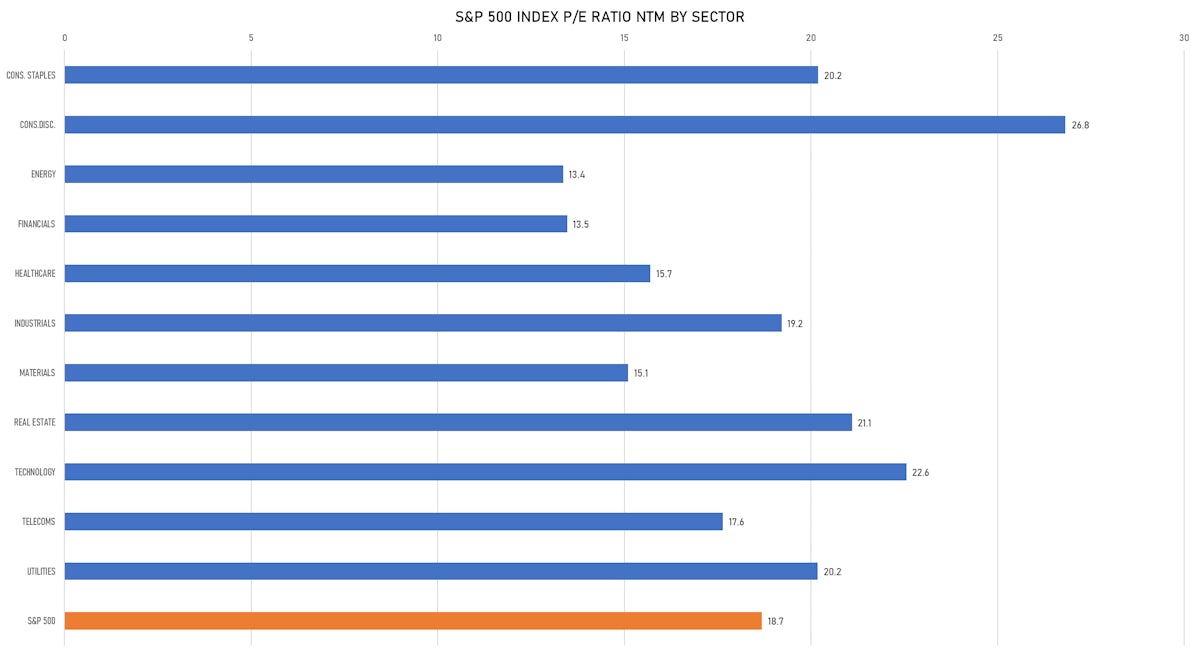

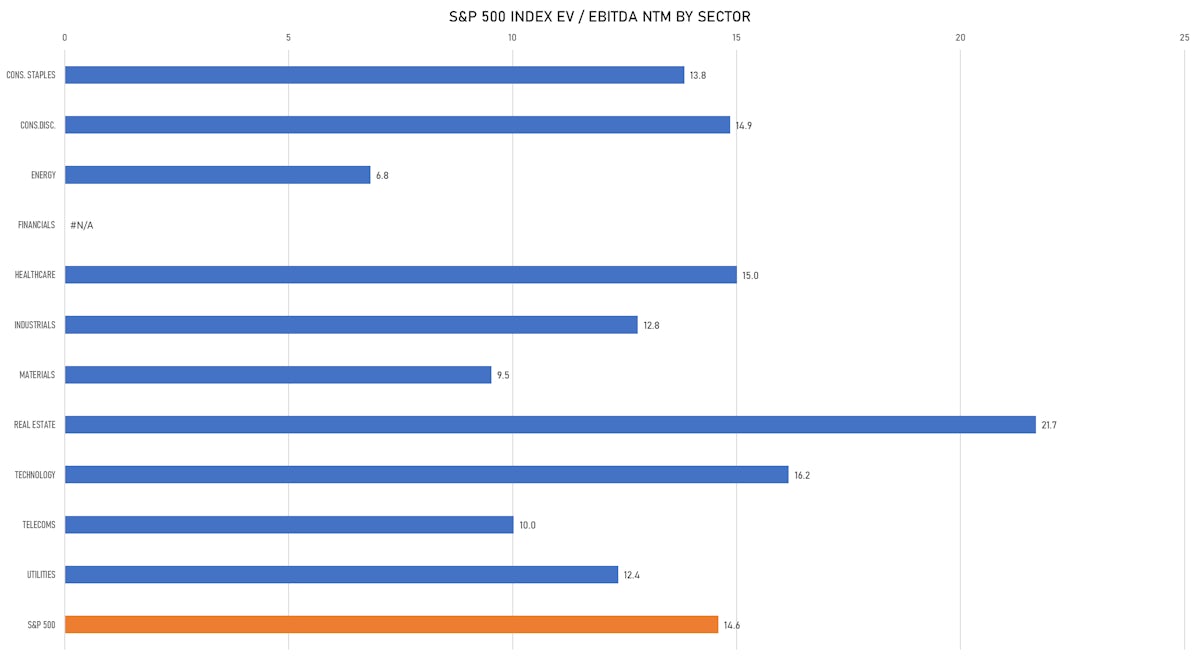

VALUATION MULTIPLES BY SECTORS

IPOs RECENTLY ANNOUNCED OR PRICED

- Nubia Brand International Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: NUBIU / Gross proceeds (including overallotment): US$ 110.00m (offering in U.S. Dollar) / Bookrunners: EF Hutton

- Pimco Multi-Sector Income Fund / Canada - Financials / Listing Exchange: Toronto / Ticker: PIX.UN / Gross proceeds (including overallotment): US$ 107.11m (offering in Canadian Dollar) / Bookrunners: CIBC Capital Markets, National Bank Financial Inc, RBC Dominion Securities Inc

- BBGI PCL / Thailand - Energy and Power / Listing Exchange: Thailand / Ticker: N/A / Gross proceeds (including overallotment): US$ 137.34m (offering in Thai Baht) / Bookrunners: Finansa Securities Ltd, Bualuang Securities Public Co Ltd, Kasikorn Securities Co Ltd

- Nephroplus Healthcare Services Pvt Ltd / India - Healthcare / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 131.08m (offering in Indian Rupee) / Bookrunners: Not Applicable

RECENT SECONDARIES / FOLLOW-ONS

- Inari Medical Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NARI / Gross proceeds (including overallotment): US$ 162.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, Bofa Securities Inc

- Coforge Ltd / India - High Technology / Listing Exchange: Bombay / Ticker: 532541 / Gross proceeds (including overallotment): US$ 335.04m (offering in Indian Rupee) / Bookrunners: JP Morgan Chase & Co, IIFL Securities Ltd

- Argo Investments Ltd / Australia - Financials / Listing Exchange: Australia / Ticker: ARG / Gross proceeds (including overallotment): US$ 202.72m (offering in Australian Dollar) / Bookrunners: Not Applicable

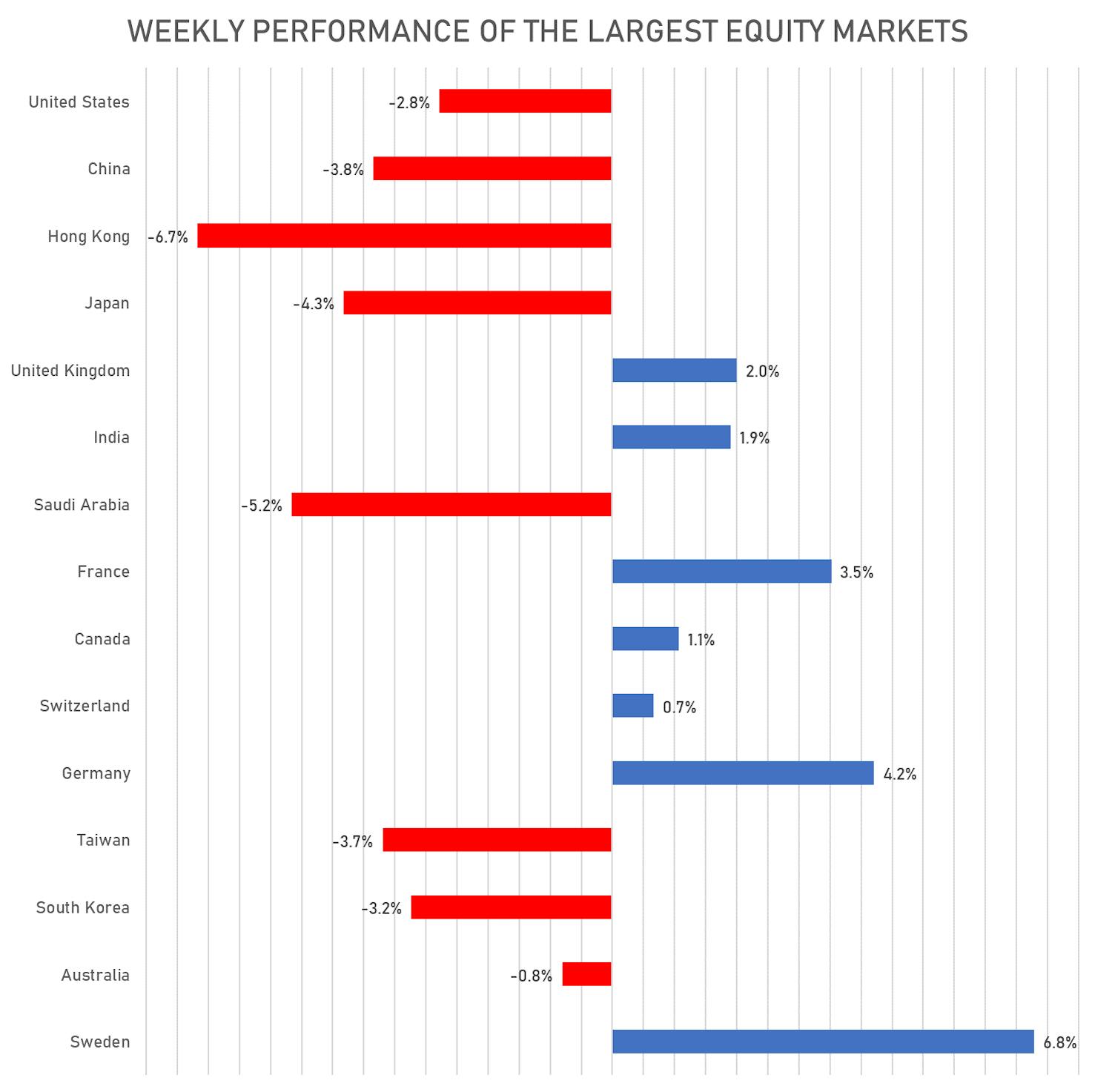

WEEKLY PERFORMANCE OF THE LARGEST GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING COUNTRIES YEAR-TO-DATE

WORLD MARKET CAP BY COUNTRY (US$ Trillions)