Equities

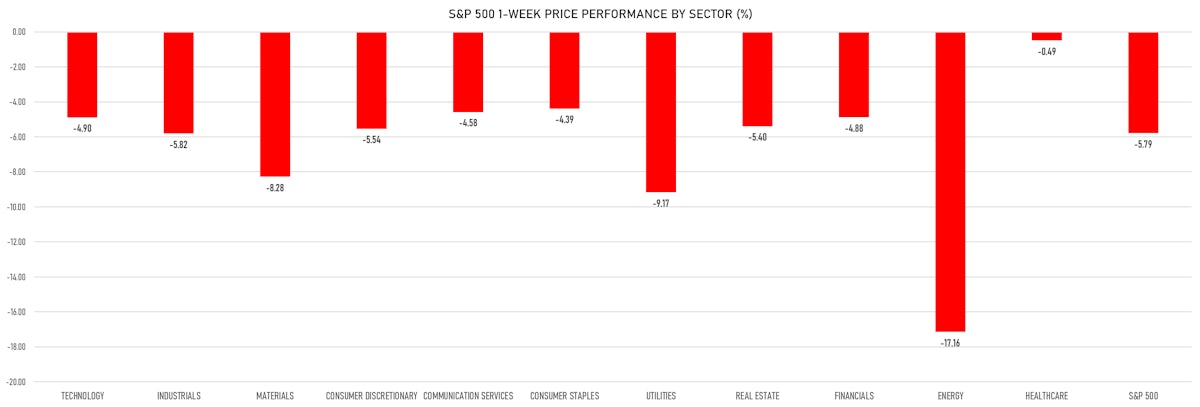

US Equities Dropped Again This Week, Led By Energy, As Talk Of 2023 Recession Hits Industrial Commodities

The initial reaction to the Fed across equities was a compression of multiples, driven by higher real yields, which hit long duration tech stocks the hardest, but the focus is now shifting to earnings growth and possible downgrades with a marked deterioration in the economic outlook

Published ET

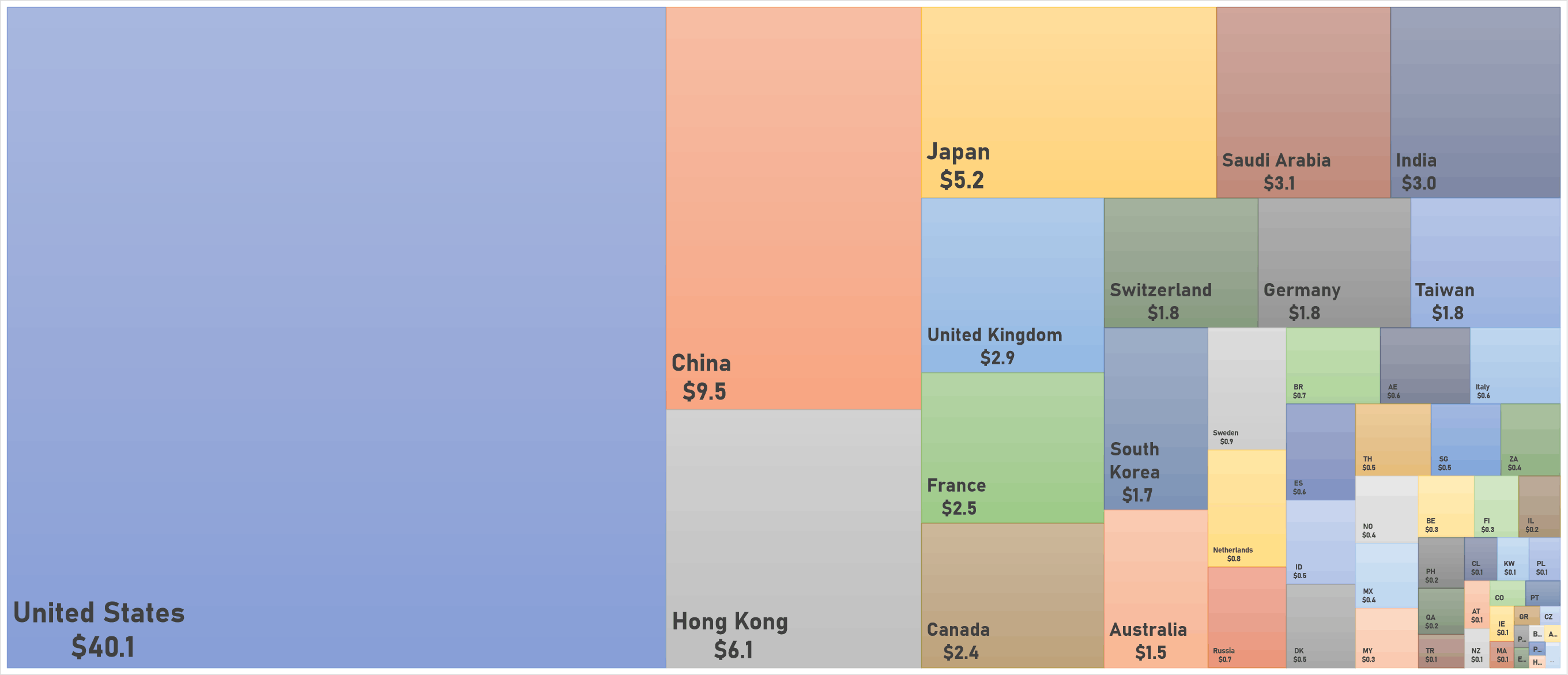

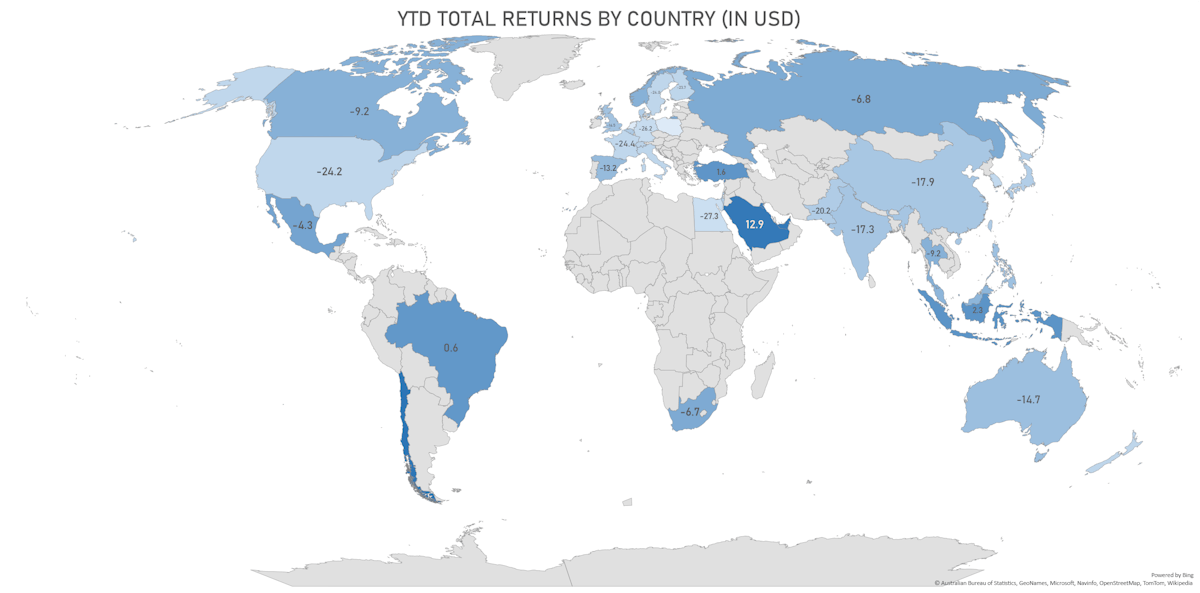

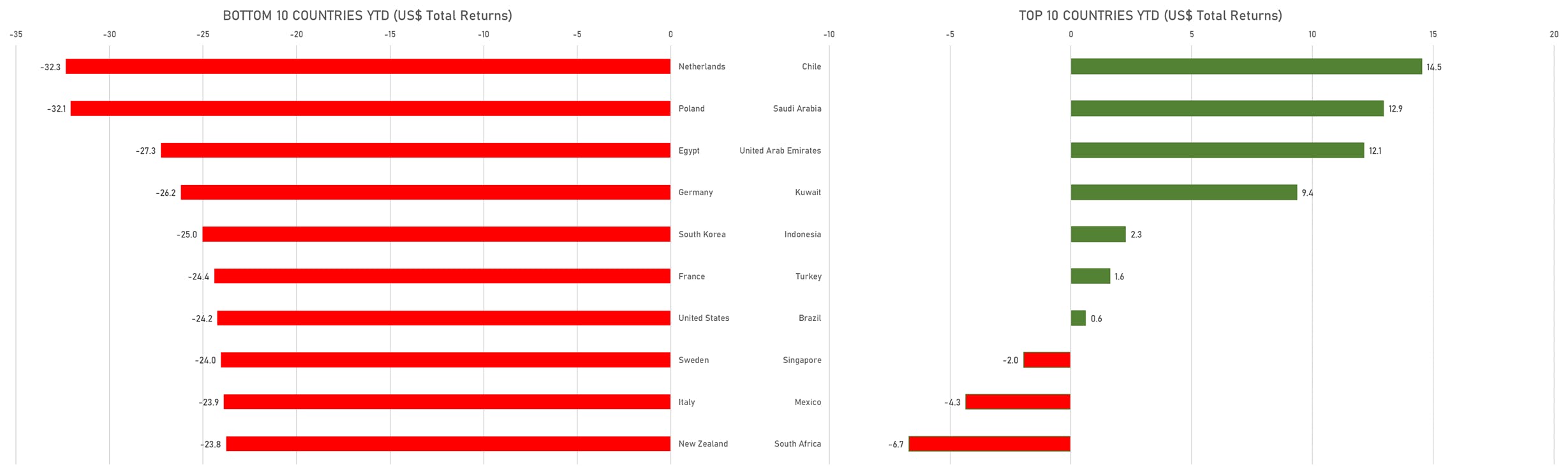

Year-To-Date US$ Total Returns By Country | Sources: ϕpost, FactSet data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 0.22%; Nasdaq Composite up 1.43%; Wilshire 5000 up 0.47%

- 59.0% of S&P 500 stocks were up today, with 11.1% of stocks above their 200-day moving average (DMA) and 2.0% above their 50-DMA

- Top performing sectors in the S&P 500: communication services up 1.31% and consumer discretionary up 1.22%

- Bottom performing sectors in the S&P 500: energy down -5.57% and utilities down -0.95%

- The number of shares in the S&P 500 traded today was 2163m for a total turnover of US$ 188 bn

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was up 0.8%; the S&P small caps index was up 0.7% and mid-caps were up 0.9%

- The volume on CME's INX (S&P 500 Index) was 4.7m (3-month z-score: 4.7); the 3-month average volume is 2.6m and the 12-month range is 1.3 - 4.7m

- Daily performance of international indices: Europe Stoxx 600 up 0.09%; UK FTSE 100 down -0.41%; Hang Seng SH-SZ-HK 300 Index up 1.40%; Japan's TOPIX 500 down -1.74%

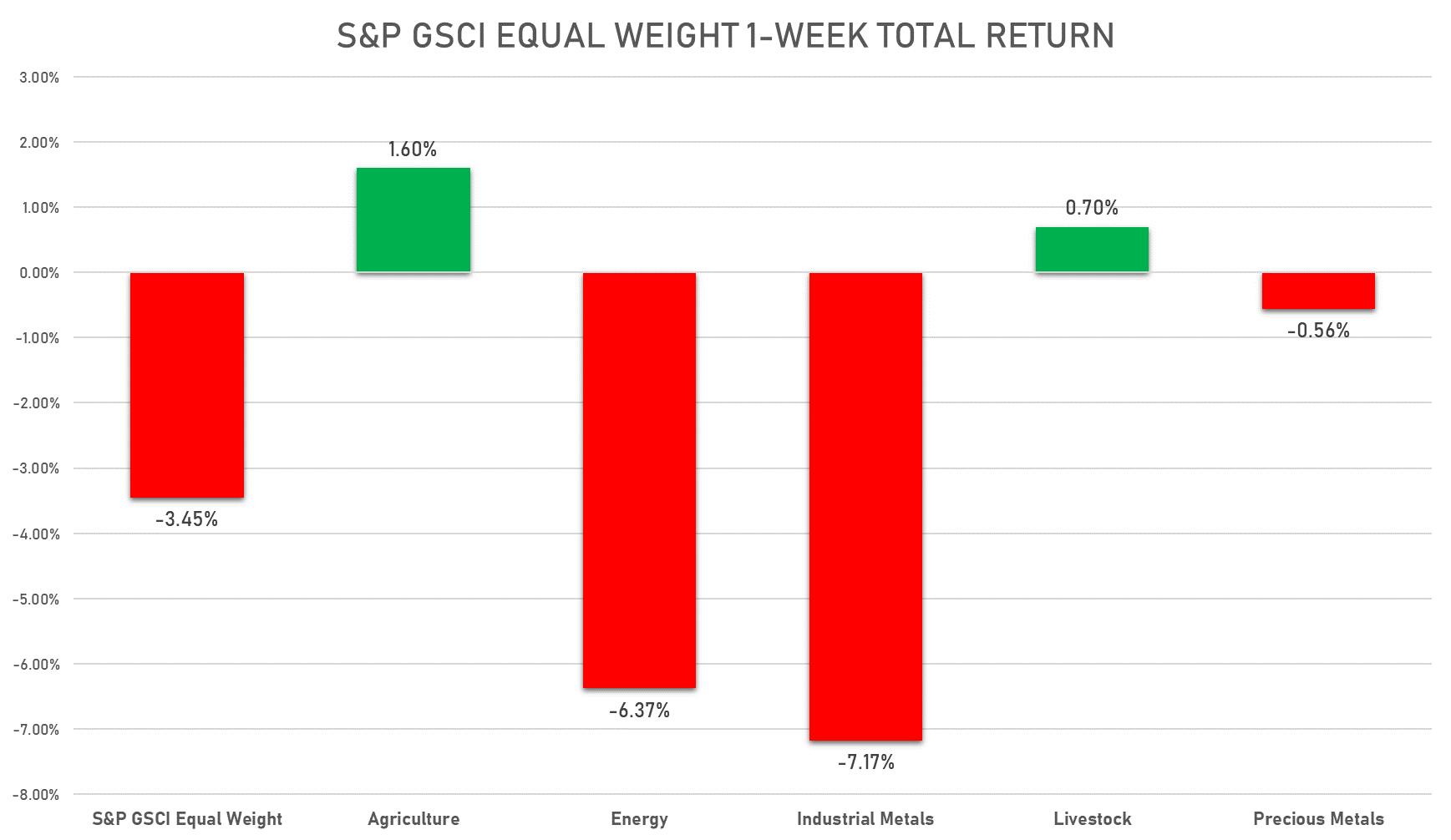

S&P GSCI COMMODITIES INDEX THIS WEEK

VOLATILITY TODAY

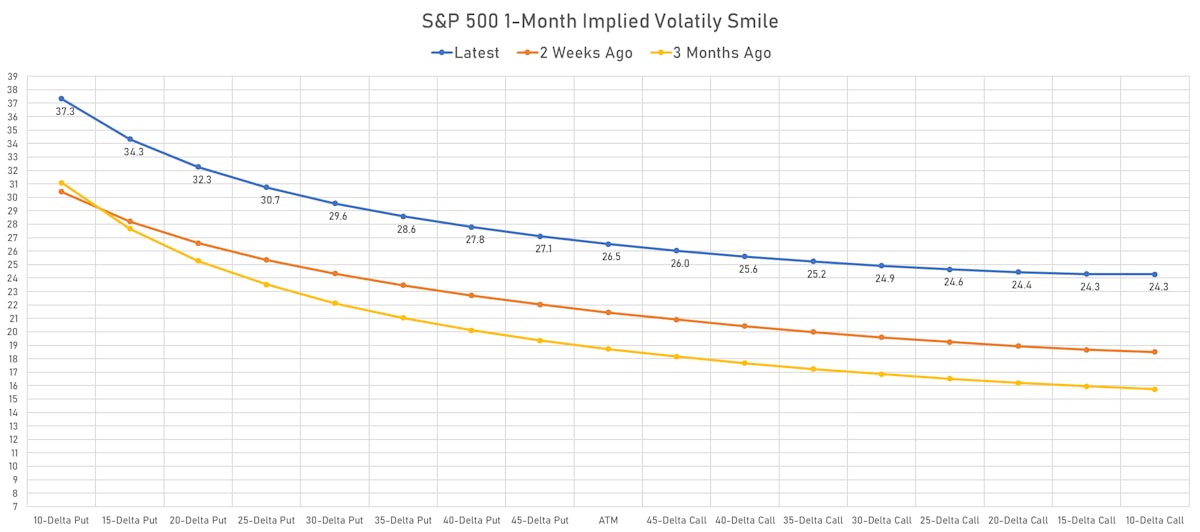

- 1-month at-the-money implied volatility on the S&P 500 at 26.5%, down from 28.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 18.1%, down from 18.1%

TOP WINNERS TODAY

- Virgin Orbit Holdings Inc (VORB), up 28.1% to $3.51 / YTD price return: -56.3% / 12-Month Price Range: $ 2.59-11.28 / Short interest (% of float): 1.0%; days to cover: 2.4

- MINISO Group Holding Ltd (MNSO), up 21.7% to $7.67 / YTD price return: -25.8% / 12-Month Price Range: $ 5.07-24.68 / Short interest (% of float): 1.7%; days to cover: 6.4

- Lyell Immunopharma Inc (LYEL), up 20.0% to $5.46 / YTD price return: -29.5% / 12-Month Price Range: $ 3.57-19.84 / Short interest (% of float): 8.3%; days to cover: 21.7

- Zai Lab Ltd (ZLAB), up 19.8% to $27.73 / YTD price return: -55.9% / 12-Month Price Range: $ 22.51-178.91 / Short interest (% of float): 4.3%; days to cover: 5.4

- BridgeBio Pharma Inc (BBIO), up 17.5% to $7.65 / YTD price return: -54.1% / 12-Month Price Range: $ 4.98-65.33 / Short interest (% of float): 19.5%; days to cover: 9.1

- Stem Inc (STEM), up 16.4% to $7.30 / YTD price return: -61.5% / 12-Month Price Range: $ 5.72-37.79 / Short interest (% of float): 10.5%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Allogene Therapeutics Inc (ALLO), up 16.3% to $10.96 / YTD price return: -26.5% / 12-Month Price Range: $ 6.43-27.86 / Short interest (% of float): 25.1%; days to cover: 9.9

- Recursion Pharmaceuticals Inc (RXRX), up 15.3% to $7.62 / YTD price return: -55.5% / 12-Month Price Range: $ 4.92-42.81 / Short interest (% of float): 9.3%; days to cover: 14.3

- American Well Corp (AMWL), up 14.8% to $4.74 / YTD price return: -21.5% / 12-Month Price Range: $ 2.52-14.05 / Short interest (% of float): 4.0%; days to cover: 3.0

- Roivant Sciences Ltd (ROIV), up 14.7% to $4.38 / YTD price return: -56.5% / 12-Month Price Range: $ 2.52-16.76 / Short interest (% of float): 0.9%; days to cover: 4.7

BIGGEST LOSERS TODAY

- Northern Oil and Gas Inc (NOG), down 14.4% to $27.52 / YTD price return: +33.7% / 12-Month Price Range: $ 14.03-39.10 / Short interest (% of float): 12.1%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

- Bio Rad Laboratories Inc (BIOb), down 13.2% to $465.00 / 12-Month Price Range: $ 504.50-818.60 / Short interest (% of float): 0.0%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- PDC Energy Inc (PDCE), down 10.8% to $64.78 / YTD price return: +32.8% / 12-Month Price Range: $ 34.16-89.22 / Short interest (% of float): 7.8%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

- Whiting Petroleum Corp (WLL), down 10.5% to $75.71 / YTD price return: +17.1% / 12-Month Price Range: $ 38.41-101.74 / Short interest (% of float): 5.6%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Oasis Petroleum Inc (OAS), down 10.5% to $135.76 / YTD price return: +7.8% / 12-Month Price Range: $ 79.31-181.34 / Short interest (% of float): 7.7%; days to cover: 4.6 (the stock is currently on the short sale restriction list)

- Watsco Inc (WSOb), down 9.9% to $234.50 / 12-Month Price Range: $ 259.16-314.00 / Short interest (% of float): 0.0%; days to cover: 0.6

- Range Resources Corp (RRC), down 9.9% to $26.29 / YTD price return: +47.4% / 12-Month Price Range: $ 12.37-37.44 / Short interest (% of float): 6.5%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Centennial Resource Development Inc (CDEV), down 9.7% to $7.25 / YTD price return: +21.2% / 12-Month Price Range: $ 3.90-9.70 / Short interest (% of float): 16.8%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Callon Petroleum Co (CPE), down 9.6% to $46.03 / YTD price return: -2.6% / 12-Month Price Range: $ 25.32-66.48 / Short interest (% of float): 9.1%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Civitas Resources Inc (CIVI), down 9.5% to $60.08 / YTD price return: +22.7% / 12-Month Price Range: $ 31.74-84.76 / Short interest (% of float): 5.4%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

US VALUATION MULTIPLES

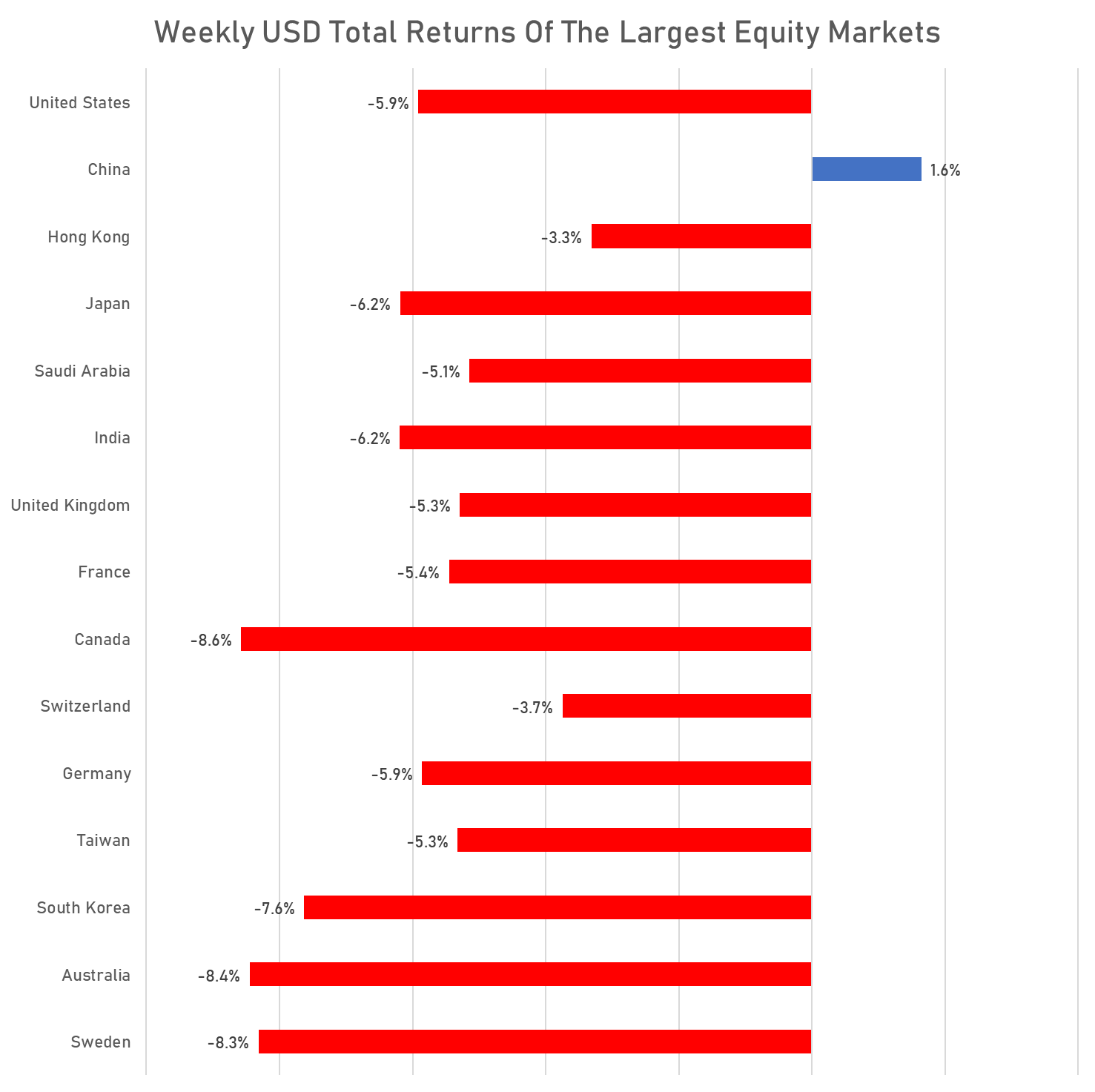

WEEKLY US$ TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING WORLD MARKETS YTD (US$ Total Returns)

WORLD MARKET CAPITALIZATION (US$ Trillion)