Equities

Good Week For US Equities, Capped By Stellar Performances Into The Weekend, With 96% Of S&P 500 Stocks Up On Friday

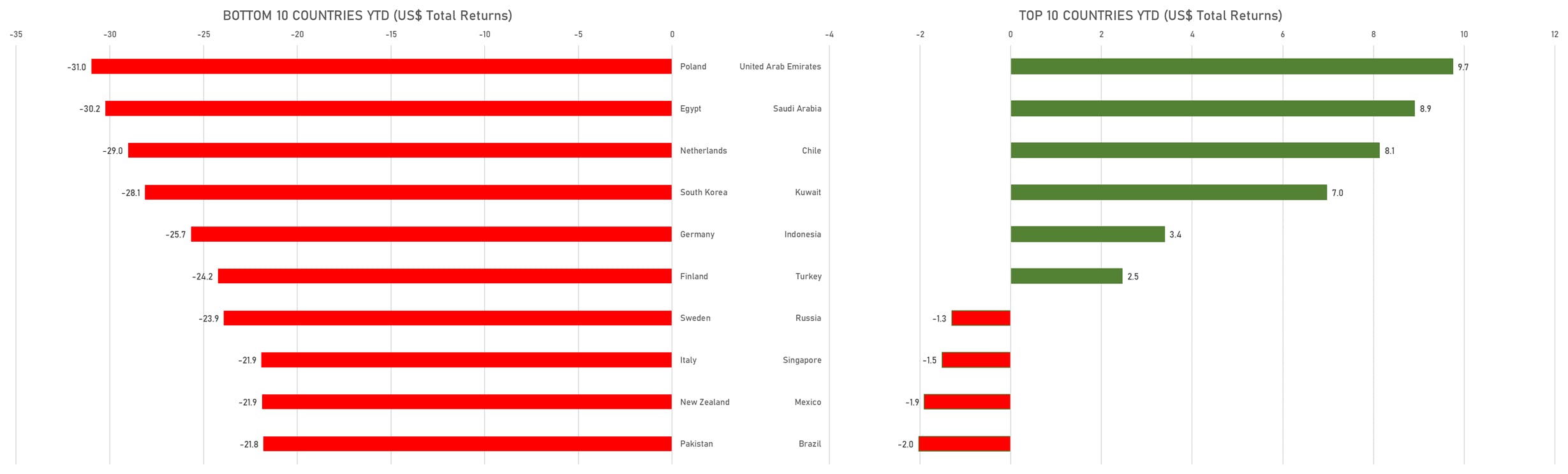

With the rise in energy prices, Middle-Eastern oil-producing countries are among the top performing markets year-to-date (US$ total returns): Saudi Arabia up 8.9% and the UAE up 9.7%

Published ET

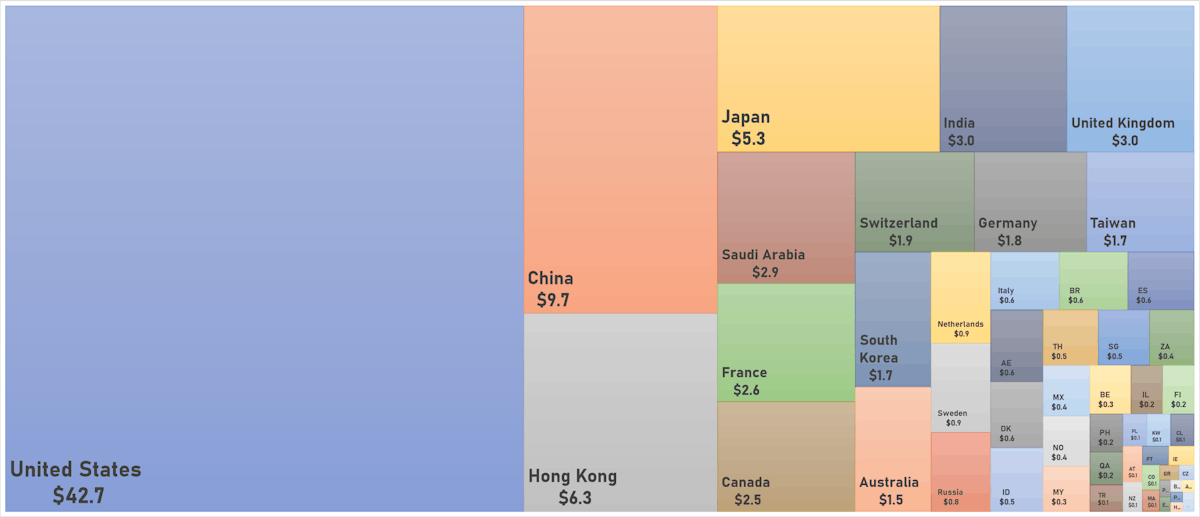

WORLD MARKET CAPITALIZATION (US$ Trillion) | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 3.06%; Nasdaq Composite up 3.34%; Wilshire 5000 up 3.12%

- 96.0% of S&P 500 stocks were up today, with 22.2% of stocks above their 200-day moving average (DMA) and 21.8% above their 50-DMA

- Top performing sectors in the S&P 500: materials up 3.98% and communication services up 3.94%

- Bottom performing sectors in the S&P 500: energy up 1.53% and healthcare up 1.63%

- The number of shares in the S&P 500 traded today was 1,206m for a total turnover of US$ 123 bn

- The S&P 500 Value Index was up 2.7%, while the S&P 500 Growth Index was up 3.4%; the S&P small caps index was up 3.1% and mid-caps were up 3.6%

- The volume on CME's INX (S&P 500 Index) was 3,463.8m (3-month z-score: 1.9); the 3-month average volume is 2,554.0m and the 12-month range is 1,340.2 - 4,692.3m

- Daily performance of international indices: Europe Stoxx 600 up 2.62%; UK FTSE 100 up 2.68%; Hang Seng SH-SZ-HK 300 Index up 1.82%; Japan's TOPIX 500 up 0.75%

VOLATILITY TODAY

- 1-month at-the-money implied volatility on the S&P 500 at 23.4%, down from 24.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 18.1%, down from 18.1%

TOP WINNERS TODAY

- USA Truck Inc (USAK), up 112.6% to $31.00 / YTD price return: +55.9% / 12-Month Price Range: $ 13.01-29.09 / Short interest (% of float): 1.9%; days to cover: 1.0

- Zendesk Inc (ZEN), up 28.0% to $74.17 / YTD price return: -28.9% / 12-Month Price Range: $ 54.16-153.43 / Short interest (% of float): 6.4%; days to cover: 3.2

- Aerovate Therapeutics Inc (AVTE), up 21.8% to $16.55 / YTD price return: +40.4% / 12-Month Price Range: $ 7.74-29.43

- Bausch Health Companies Inc (BHC), up 20.4% to $8.75 / YTD price return: -68.3% / 12-Month Price Range: $ 6.88-30.30 / Short interest (% of float): 5.1%; days to cover: 1.8

- Novonix Ltd (NVX), up 20.3% to $7.28 / 12-Month Price Range: $ 6.00-24.00 / Short interest (% of float): 0.0%; days to cover: 0.8

- Hillevax Inc (HLVX), up 18.0% to $14.04 / 12-Month Price Range: $ 7.90-20.95

- Lytus Technologies Holdings Ptv Ltd (LYT), up 15.9% to $40.00 / 12-Month Price Range: $ 17.01-36.20

- Royal Caribbean Cruises Ltd (RCL), up 15.8% to $41.76 / YTD price return: -45.7% / 12-Month Price Range: $ 34.10-98.27 / Short interest (% of float): 6.1%; days to cover: 3.5

- Gores Guggenheim Inc (PSNY), up 15.8% to $13.00 / YTD price return: +11.1% / 12-Month Price Range: $ 8.53-16.41 / Short interest (% of float): 8.1%; days to cover: 3.2

- RealReal Inc (REAL), up 15.6% to $3.63 / YTD price return: -68.7% / 12-Month Price Range: $ 2.23-22.83

BIGGEST LOSERS TODAY

- Meta Materials Inc (MMAT), down 38.7% to $1.17 / YTD price return: -52.4% / 12-Month Price Range: $ 1.03-11.54 / Short interest (% of float): 20.9%; days to cover: 9.7 (the stock is currently on the short sale restriction list)

- Priority Technology Holdings Inc (PRTH), down 23.7% to $3.50 / YTD price return: -50.6% / 12-Month Price Range: $ 4.32-8.04 / Short interest (% of float): 1.6%; days to cover: 5.4 (the stock is currently on the short sale restriction list)

- Terran Orbital Corp (LLAP), down 22.1% to $5.05 / YTD price return: -48.9% / 12-Month Price Range: $ 3.64-12.69 / Short interest (% of float): 0.9%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- View Inc (VIEW), down 15.6% to $1.89 / YTD price return: -51.7% / 12-Month Price Range: $ .37-8.79 / Short interest (% of float): 9.7%; days to cover: 8.0 (the stock is currently on the short sale restriction list)

- Zhong Yang Financial Group Ltd (TOP), down 14.5% to $34.85 / 12-Month Price Range: $ 12.60-50.97 (the stock is currently on the short sale restriction list)

- Valneva SE (VALN), down 13.3% to $27.27 / YTD price return: -50.9% / 12-Month Price Range: $ 13.71-67.84 / Short interest (% of float): 0.1%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Energy Vault Holdings Inc (NRGV), down 12.1% to $9.42 / YTD price return: -4.8% / 12-Month Price Range: $ 8.34-22.10 / Short interest (% of float): 4.0%; days to cover: 7.0 (the stock is currently on the short sale restriction list)

- System1 Inc (SST), down 11.5% to $8.68 / YTD price return: -12.9% / 12-Month Price Range: $ 7.45-37.10 / Short interest (% of float): 7.1%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Symbotic Inc (SYM), down 10.3% to $13.91 / YTD price return: +39.1% / 12-Month Price Range: $ 9.01-28.48 / Short interest (% of float): 137.4%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Karat Packaging Inc (KRT), down 10.1% to $17.12 / YTD price return: -15.3% / 12-Month Price Range: $ 14.70-25.91 / Short interest (% of float): 1.2%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

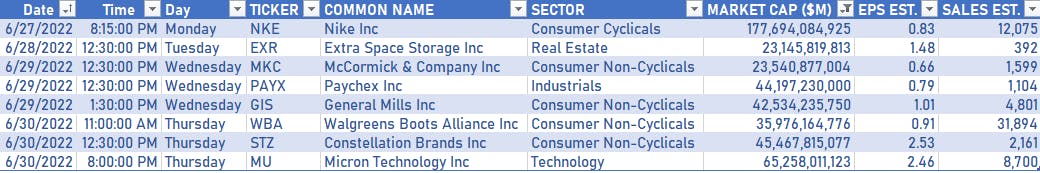

NOTABLE US EARNINGS NEXT WEEK

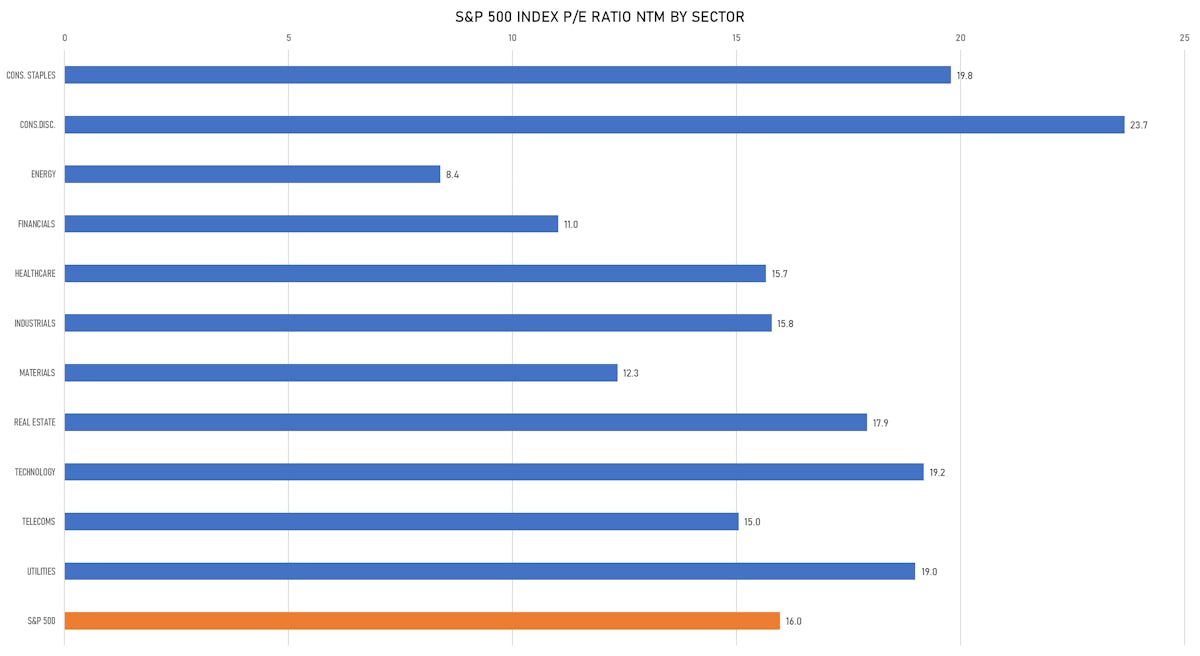

VALUATION MULTIPLES BY SECTORS

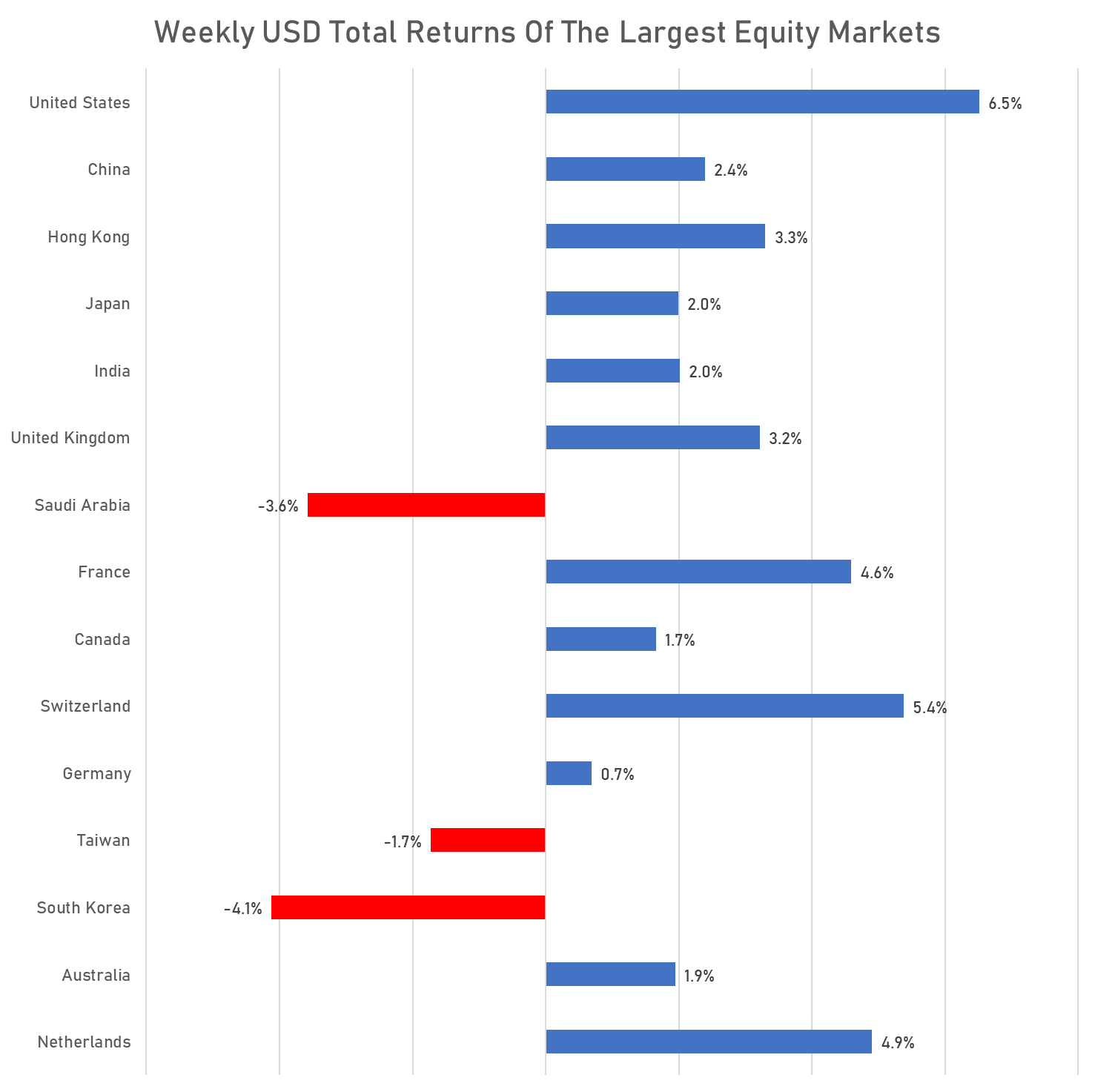

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING WORLD MARKETS YTD