Equities

Another Losing Week For Global Equity Indices, Though Friday Saw A Good Rebound, With 93% Of S&P 500 Stocks Up

The high level of uncertainty right now makes it hard for equities to have a sustainable rally, and despite recession fears over the past weeks the market still hasn't marked down earnings estimates: Goldman strategists think that a recession would cut earnings by 15% and bring the S&P 500 down to 3,150

Published ET

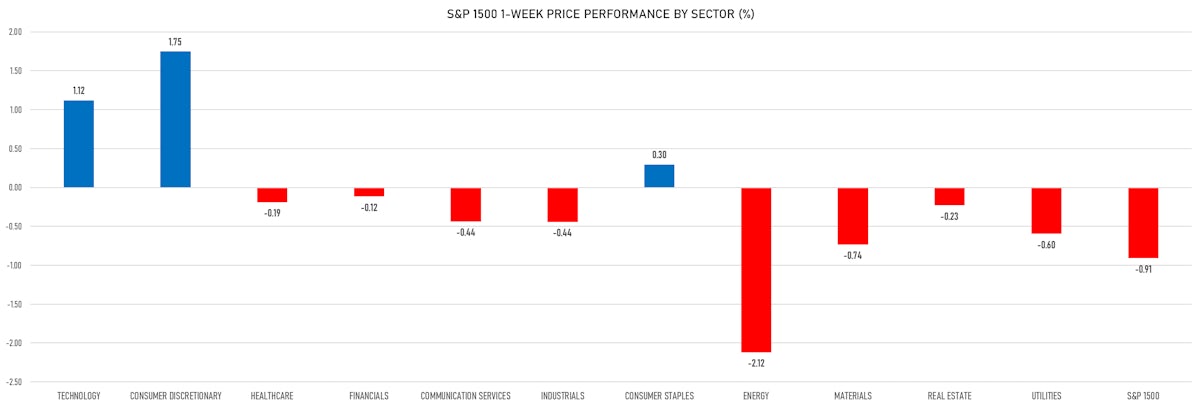

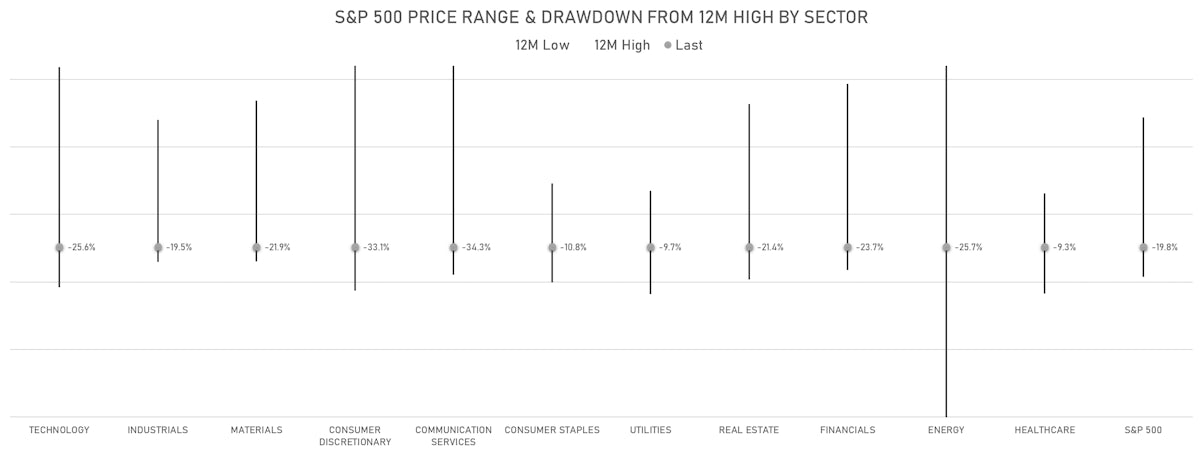

S&P 500 Drawdowns By Sector | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 1.92%; Nasdaq Composite up 1.79%; Wilshire 5000 up 1.96%

- 93.2% of S&P 500 stocks were up today, with 17.9% of stocks above their 200-day moving average (DMA) and 27.2% above their 50-DMA

- Top performing sectors in the S&P 500: financials up 3.51% and healthcare up 2.45%

- Bottom performing sectors in the S&P 500: utilities up 0.20% and consumer staples up 0.40%

- The number of shares in the S&P 500 traded today was 723m for a total turnover of US$ 73 bn

- The S&P 500 Value Index was up 1.9%, while the S&P 500 Growth Index was up 1.9%; the S&P small caps index was up 2.1% and mid-caps were up 1.9%

- The volume on CME's INX (S&P 500 Index) was 2,328.2m (3-month z-score: -0.4); the 3-month average volume is 2,522.1m and the 12-month range is 1,340.2 - 4,692.3m

- Daily performance of international indices: Europe Stoxx 600 up 1.79%; UK FTSE 100 up 1.69%; Hang Seng SH-SZ-HK 300 Index down -2.01%; Japan's TOPIX 500 down -0.01%

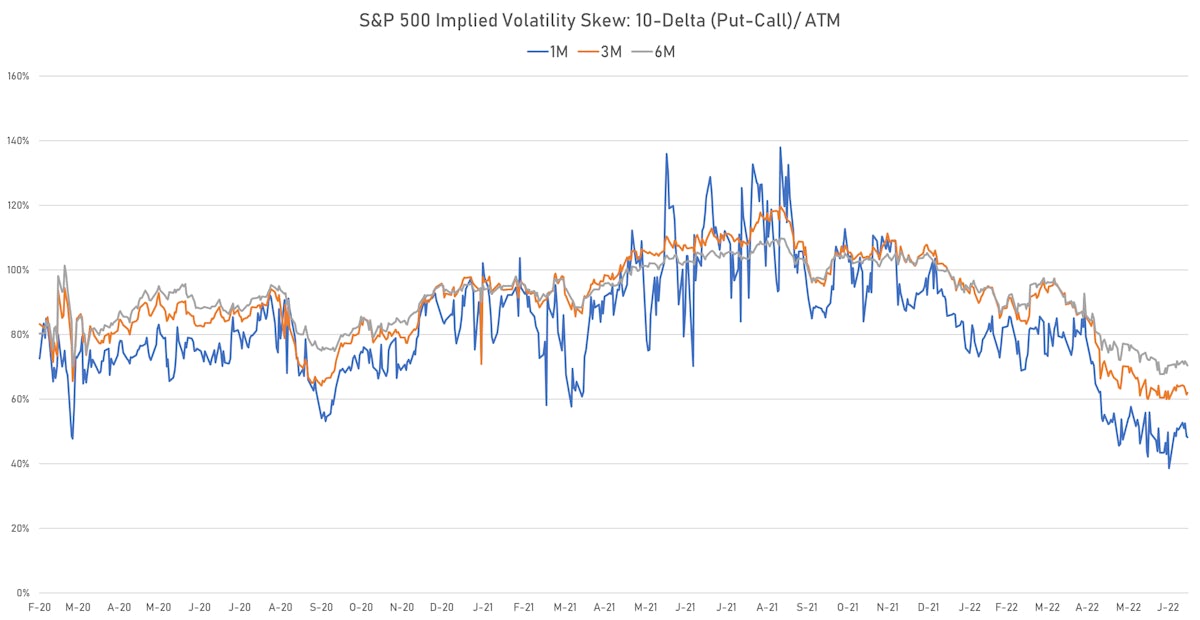

VOLATILITY TODAY

- 1-month at-the-money implied volatility on the S&P 500 at 21.0%, down from 22.7%

- 1-month at-the-money implied volatility on the Euro Stoxx 50 at 24.3%, down from 27.1%

NOTABLE US EARNINGS RELEASES TODAY

- UnitedHealth Group Inc (UNH | Healthcare): beat EPS median estimate (5.57 act. vs. 5.23 est.) and beat revenue median estimate (80,332m act. vs. 79,830m est.), up 5.44% today, closed at $ 529.75 / share and traded at $ 505.00 (-4.67%) after hours

- Wells Fargo & Co (WFC | Financials): missed EPS median estimate (0.74 act. vs. 0.81 est.) and missed revenue median estimate (17,028m act. vs. 17,432m est.), up 6.17% today, closed at $ 41.13 / share and traded at $ 38.80 (-5.66%) after hours

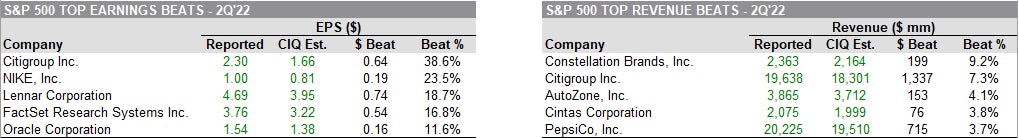

- Citigroup Inc (C | Financials): beat EPS median estimate (2.19 act. vs. 1.68 est.) and beat revenue median estimate (19,638m act. vs. 18,359m est.), up 13.23% today, closed at $ 49.98 / share and traded at $ 44.10 (-11.76%) after hours

- BlackRock Inc (BLK | Financials): missed EPS median estimate (7.36 act. vs. 7.94 est.) and missed revenue median estimate (4,526m act. vs. 4,560m est.), up 1.99% today, closed at $ 600.37 / share and traded at $ 589.49 (-1.81%) after hours

- US Bancorp (USB | Financials): missed EPS median estimate (0.99 act. vs. 1.06 est.) and beat revenue median estimate (6,012m act. vs. 5,903m est.), up 5.24% today, closed at $ 46.57 / share and traded at $ 44.25 (-4.98%) after hours

- Progressive Corp (PGR | Financials): beat EPS median estimate (0.93 act. vs. 0.91 est.) and missed revenue median estimate (12,422m act. vs. 12,496m est.), up 3.34% today, closed at $ 116.08 / share and traded at $ 111.01 (-4.37%) after hours

- PNC Financial Services Group Inc (PNC | Financials): beat EPS median estimate (3.39 act. vs. 3.14 est.) and missed revenue median estimate (5,116m act. vs. 5,138m est.), up 1.63% today, closed at $ 153.42 / share and traded at $ 150.96 (-1.60%) after hours

- Bank of New York Mellon Corp (BK | Financials): missed EPS median estimate (1.03 act. vs. 1.12 est.) and beat revenue median estimate (4,254m act. vs. 4,173m est.), up 7.34% today, closed at $ 43.41 / share and traded at $ 40.99 (-5.57%) after hours

- State Street Corp (STT | Financials): beat EPS median estimate (1.94 act. vs. 1.73 est.) and missed revenue median estimate (2,953m act. vs. 2,977m est.), up 9.74% today, closed at $ 65.67 / share and traded at $ 59.84 (-8.88%) after hours

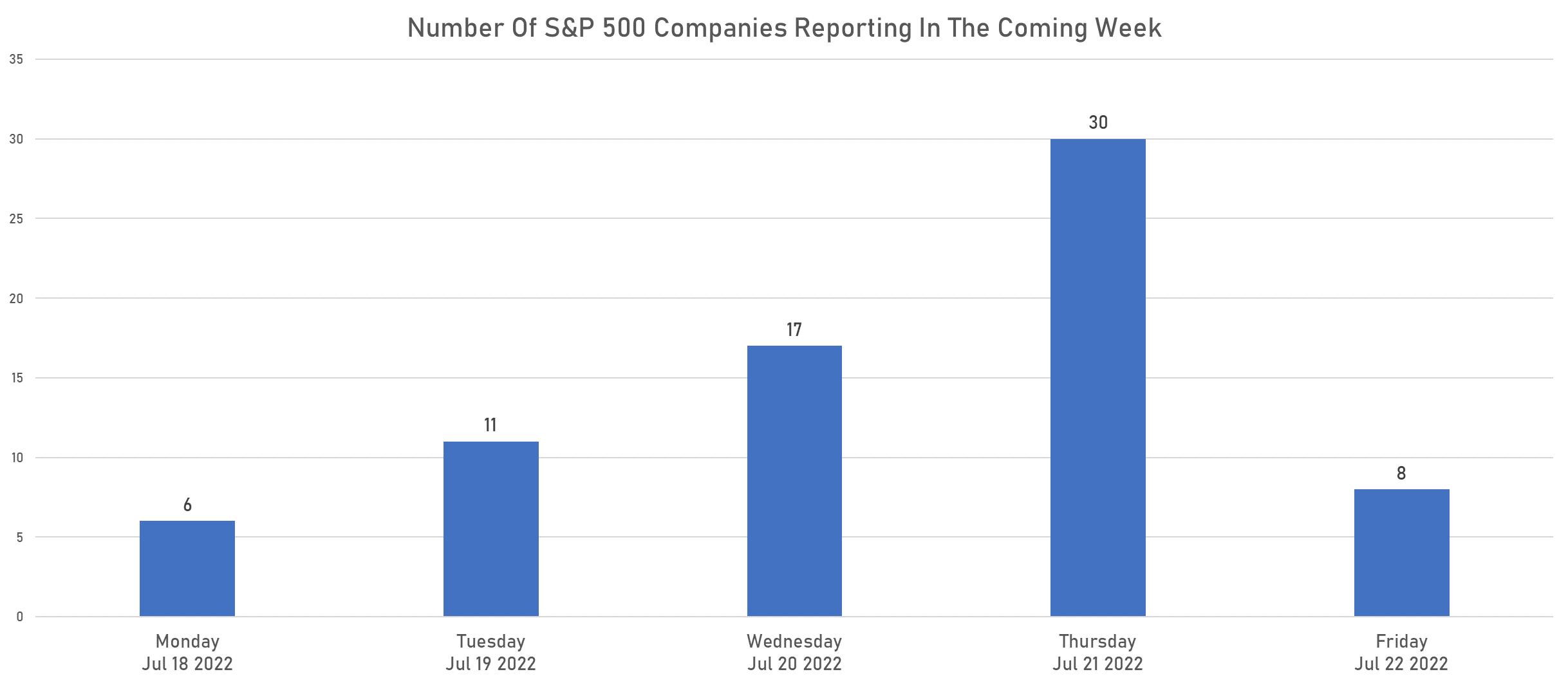

US EARNINGS RELEASES NEXT WEEK

S&P 500 EARNINGS TRACKER

![]()

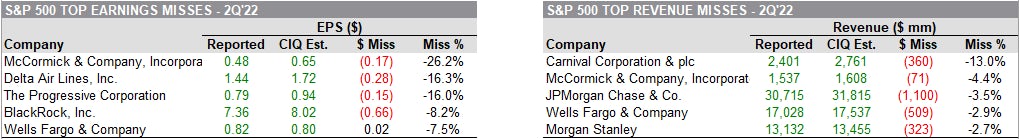

2Q 2022 EARNINGS SURPRISES (BEATS & MISSES)

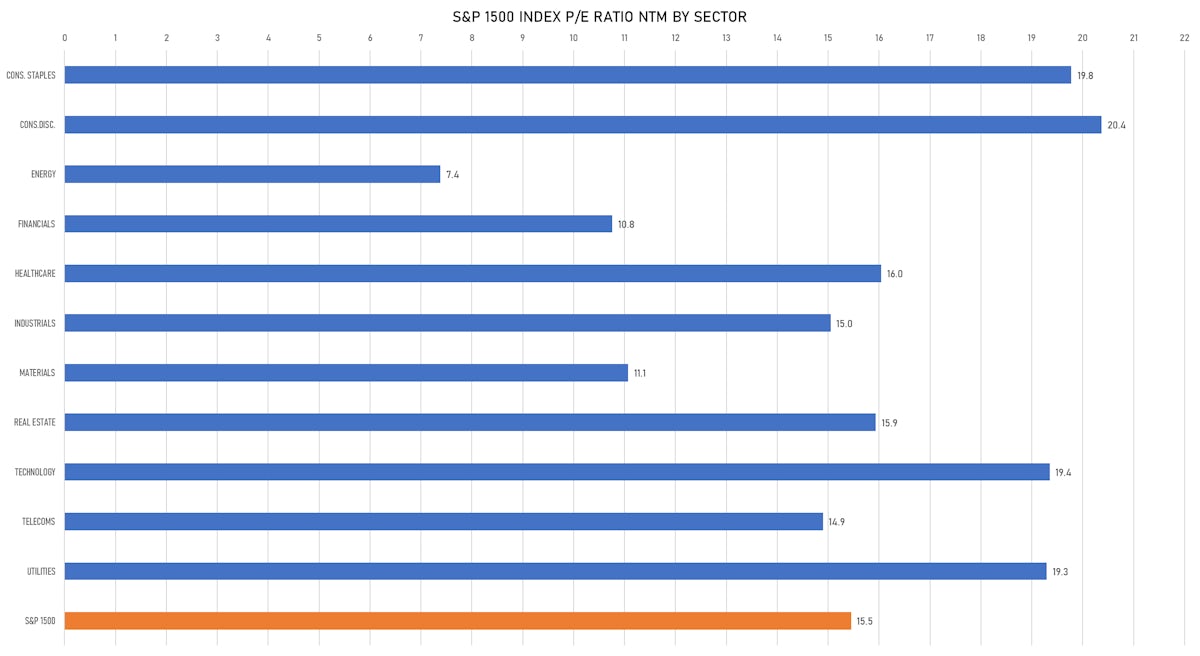

VALUATION MULTIPLES

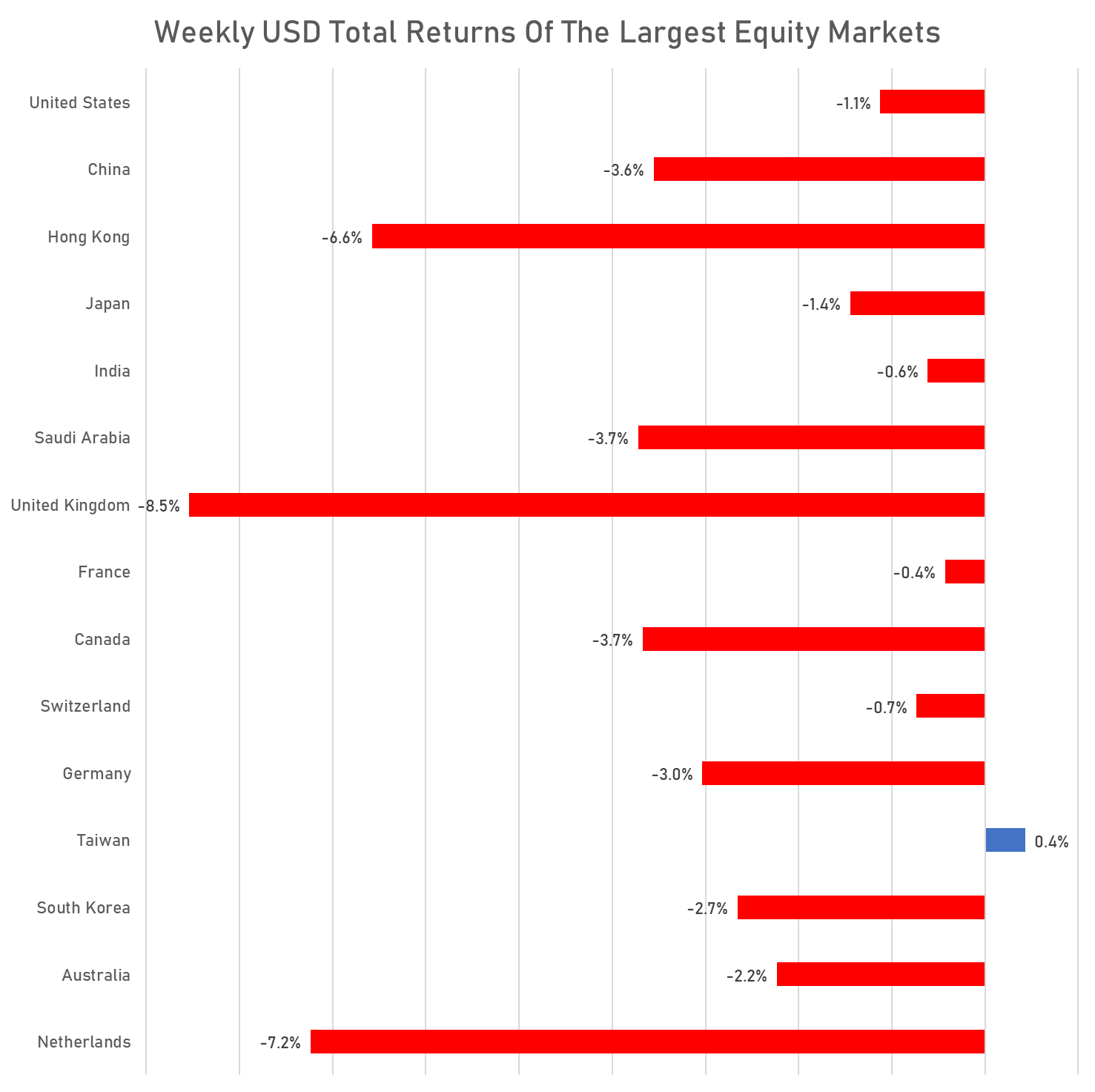

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

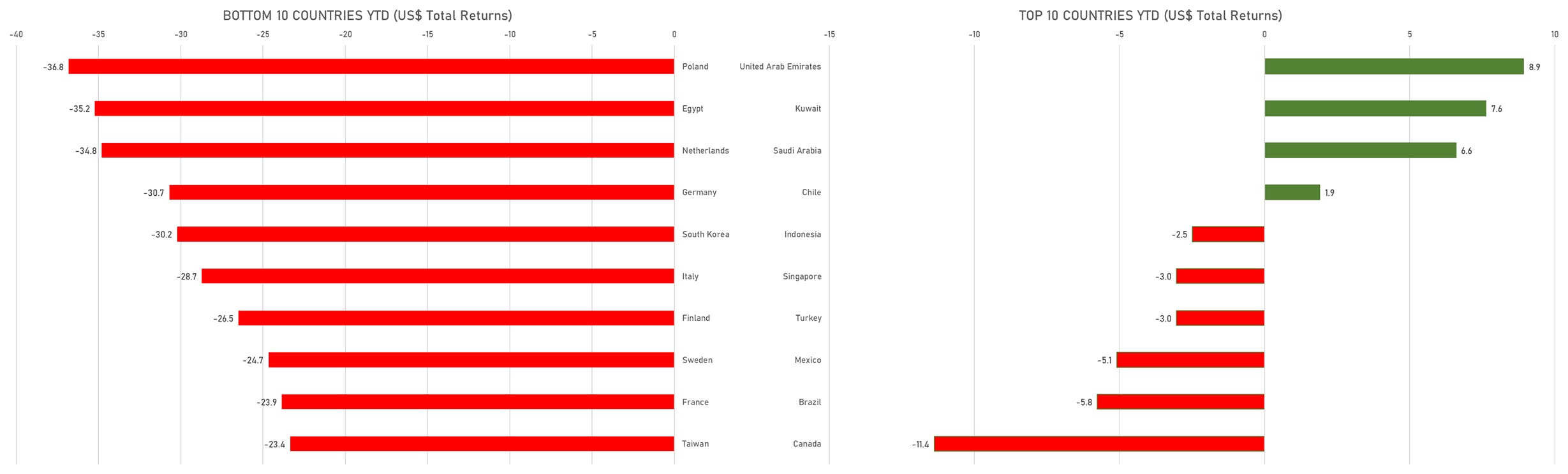

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

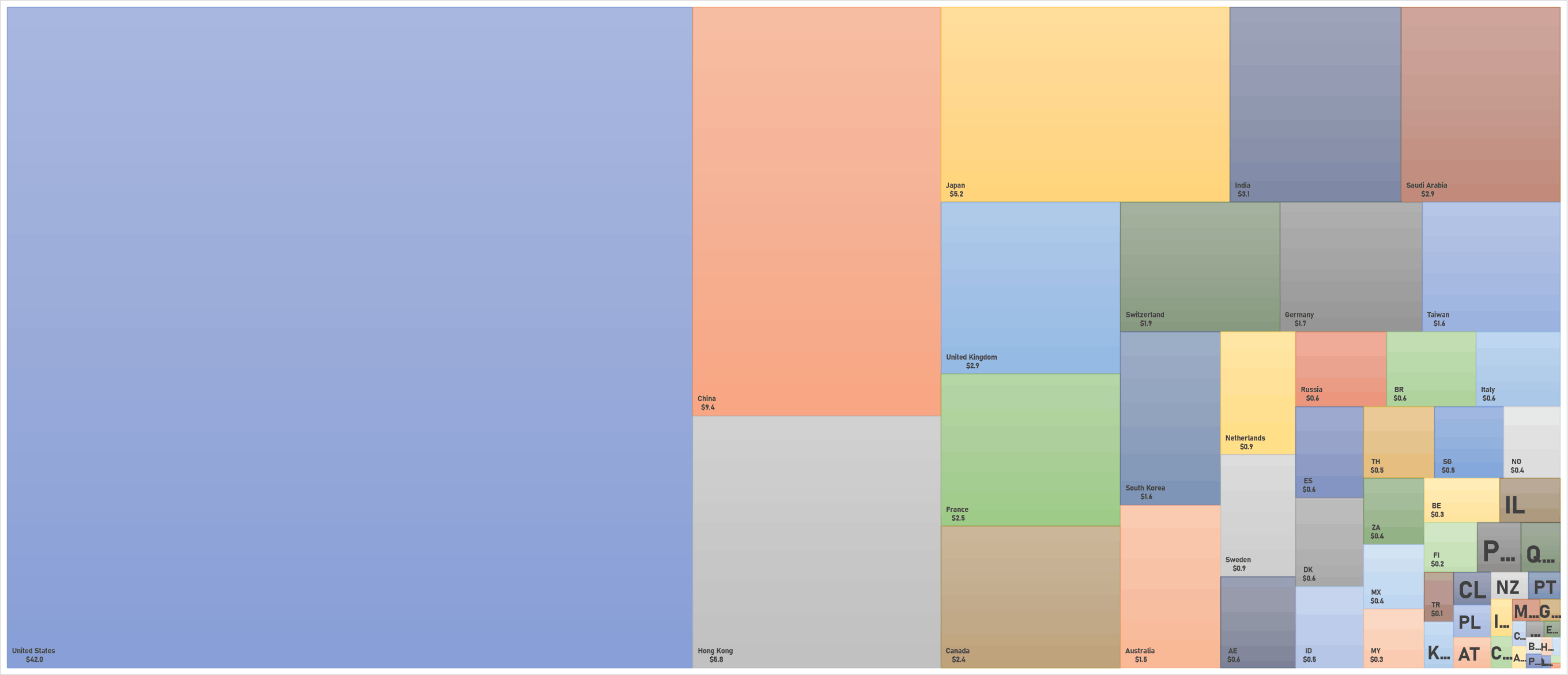

WORLD MARKET CAPITALIZATION (US$ Trillion)