Equities

Friday Meltdown For US Equities As Fed Not Amused By Recent Loosening In Financial Conditions

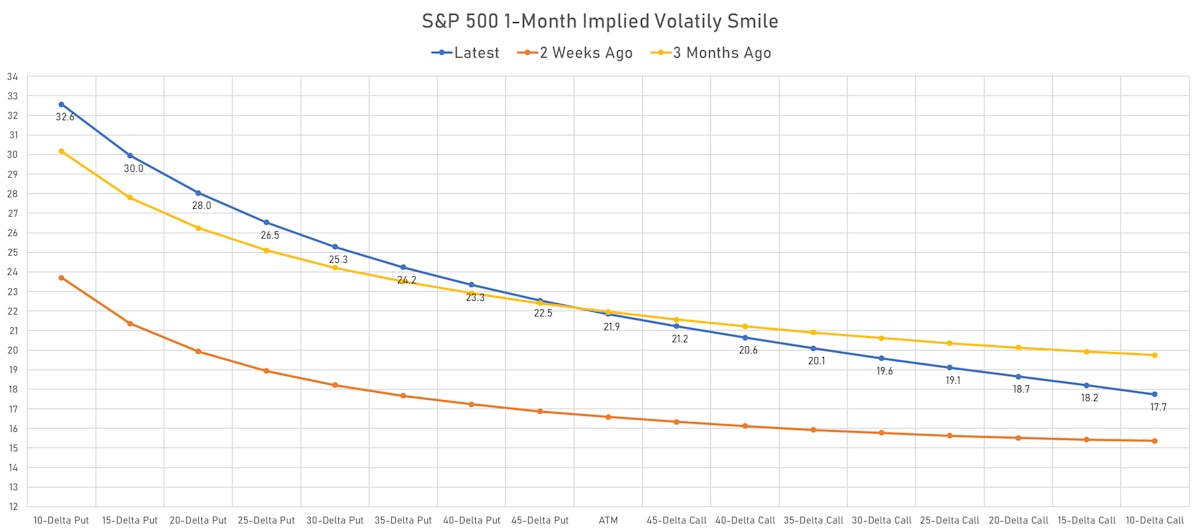

Despite a little jolt today, volatility remains low considering the difficult background for the remainder of the year: if the labor market and the economy stay strong, the flight path will need to be higher rates, wider credit spreads, lower equity valuations

Published ET

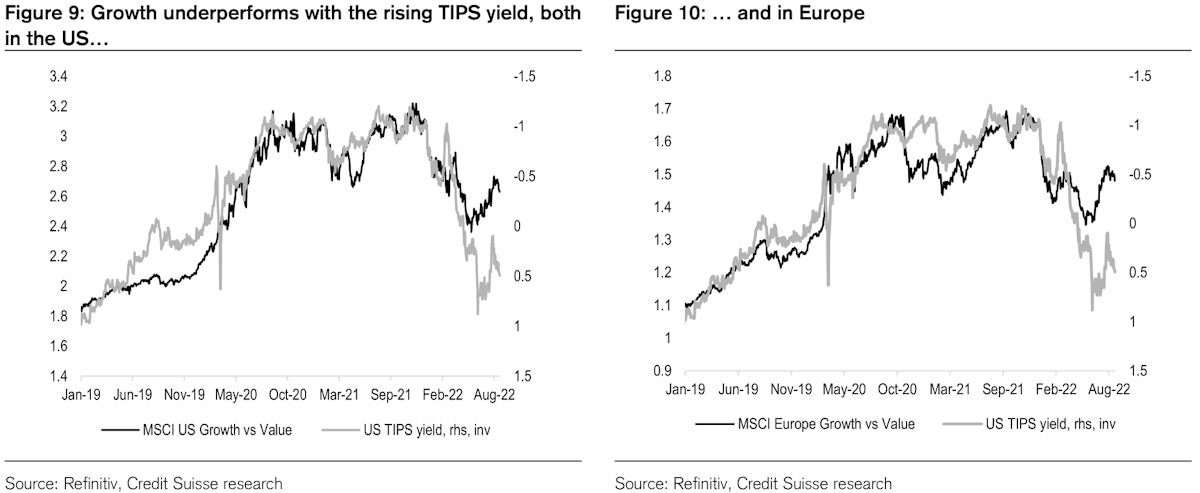

Growth Stocks Underperform Value When Real Yields Rise | Source: Credit Suisse

DAILY SUMMARY

- Daily performance of US indices: S&P 500 down -3.37%; Nasdaq Composite down -3.94%; Wilshire 5000 down -3.35%

- Just 1.0% of S&P 500 stocks were up today, with 34.0% of stocks above their 200-day moving average (DMA) and 63.4% above their 50-DMA

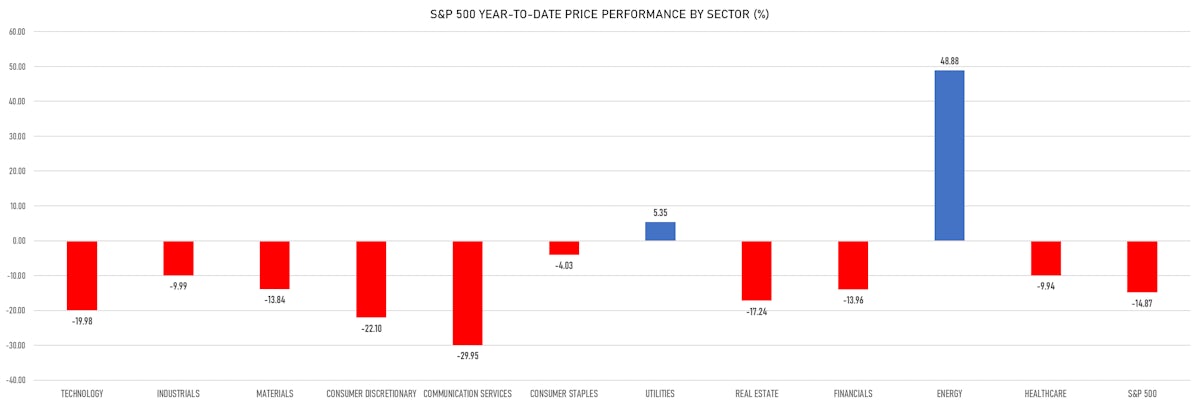

- Top performing sectors in the S&P 500: energy down -1.07% and utilities down -1.54%

- Bottom performing sectors in the S&P 500: technology down -4.28% and consumer discretionary down -3.88%

- The number of shares in the S&P 500 traded today was 633m for a total turnover of US$ 66 bn

- The S&P 500 Value Index was down -2.7%, while the S&P 500 Growth Index was down -4.0%; the S&P small caps index was down -3.2% and mid caps were down -3.0%

- The volume on CME's INX (S&P 500 Index) was 2,113.4m (3-month z-score: -0.4); the 3-month average volume is 2,293.8m and the 12-month range is 1,340.2 - 4,692.3m

- Daily performance of international indices: Europe Stoxx 600 down -1.68%; UK FTSE 100 down -0.70%; Hang Seng SH-SZ-HK 300 Index up 0.33%; Japan's TOPIX 500 up 0.15%

VOLATILITY TODAY

- 1-month at-the-money implied volatility on the S&P 500 at 21.9%, up from 18.3%

- 1-month at-the-money implied volatility on the Euro Stoxx 50 at 22.4%, up from 20.4%

TOP S&P 500 PERFORMERS THIS WEEK

- Mosaic Co (MOS), up 15.4% to $61.77 / YTD price return: +57.2% / 12-Month Price Range: $ 30.58-79.25 / Short interest (% of float): 2.5%; days to cover: 1.7

- CF Industries Holdings Inc (CF), up 14.3% to $118.35 / YTD price return: +67.2% / 12-Month Price Range: $ 44.06-118.35 / Short interest (% of float): 2.8%; days to cover: 2.4

- APA Corp (US) (APA), up 11.1% to $40.18 / YTD price return: +49.4% / 12-Month Price Range: $ 17.55-51.95 / Short interest (% of float): 2.6%; days to cover: 1.1

- Marathon Oil Corp (MRO), up 7.0% to $26.16 / YTD price return: +59.3% / 12-Month Price Range: $ 11.02-33.23 / Short interest (% of float): 2.8%; days to cover: 1.3

- Hess Corp (HES), up 6.8% to $124.60 / YTD price return: +68.3% / 12-Month Price Range: $ 66.20-131.42 / Short interest (% of float): 2.5%; days to cover: 3.8

- Albemarle Corp (ALB), up 6.7% to $288.16 / YTD price return: +23.3% / 12-Month Price Range: $ 169.95-297.90 / Short interest (% of float): 2.2%; days to cover: 2.2

- Royal Caribbean Cruises Ltd (RCL), up 6.7% to $42.30 / YTD price return: -45.0% / 12-Month Price Range: $ 31.09-98.21 / Short interest (% of float): 9.4%; days to cover: 2.6

- Conocophillips (COP), up 6.6% to $112.12 / YTD price return: +55.3% / 12-Month Price Range: $ 54.43-124.07 / Short interest (% of float): 1.2%; days to cover: 2.3

- Pioneer Natural Resources Co (PXD), up 6.4% to $257.38 / YTD price return: +41.5% / 12-Month Price Range: $ 143.63-288.32 / Short interest (% of float): 2.4%; days to cover: 2.5

- Devon Energy Corp (DVN), up 6.2% to $72.77 / YTD price return: +65.2% / 12-Month Price Range: $ 27.41-79.40 / Short interest (% of float): 2.6%; days to cover: 1.5

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Dollar Tree Inc (DLTR), down 17.3% to $138.70 / YTD price return: -1.3% / 12-Month Price Range: $ 84.26-177.14 / Short interest (% of float): 2.6%; days to cover: 3.2

- Advance Auto Parts Inc (AAP), down 16.1% to $173.59 / YTD price return: -27.6% / 12-Month Price Range: $ 164.27-244.51 / Short interest (% of float): 6.8%; days to cover: 6.7

- 3M Co (MMM), down 11.1% to $129.14 / YTD price return: -27.3% / 12-Month Price Range: $ 125.60-197.27 / Short interest (% of float): 1.8%; days to cover: 3.1

- Adobe Inc (ADBE), down 10.4% to $381.02 / YTD price return: -32.8% / 12-Month Price Range: $ 346.28-699.50 / Short interest (% of float): 1.2%; days to cover: 2.4

- Salesforce Inc (CRM), down 10.1% to $165.23 / YTD price return: -35.0% / 12-Month Price Range: $ 154.55-311.75 / Short interest (% of float): 1.3%; days to cover: 2.8

- VF Corp (VFC), down 9.6% to $41.16 / YTD price return: -43.8% / 12-Month Price Range: $ 41.16-78.88 / Short interest (% of float): 4.0%; days to cover: 4.6

- Stanley Black & Decker Inc (SWK), down 9.0% to $90.07 / YTD price return: -52.2% / 12-Month Price Range: $ 90.07-199.19 / Short interest (% of float): 3.1%; days to cover: 2.2

- NVIDIA Corp (NVDA), down 8.9% to $162.60 / YTD price return: -44.7% / 12-Month Price Range: $ 140.55-346.10 / Short interest (% of float): 1.3%; days to cover: 0.6

- Aptiv PLC (APTV), down 8.9% to $94.55 / YTD price return: -42.7% / 12-Month Price Range: $ 84.15-180.70 / Short interest (% of float): 2.0%; days to cover: 2.7

- Booking Holdings Inc (BKNG), down 8.4% to $1,910.96 / YTD price return: -20.4% / 12-Month Price Range: $ 1,670.01-2,713.86 / Short interest (% of float): 1.6%; days to cover: 1.6

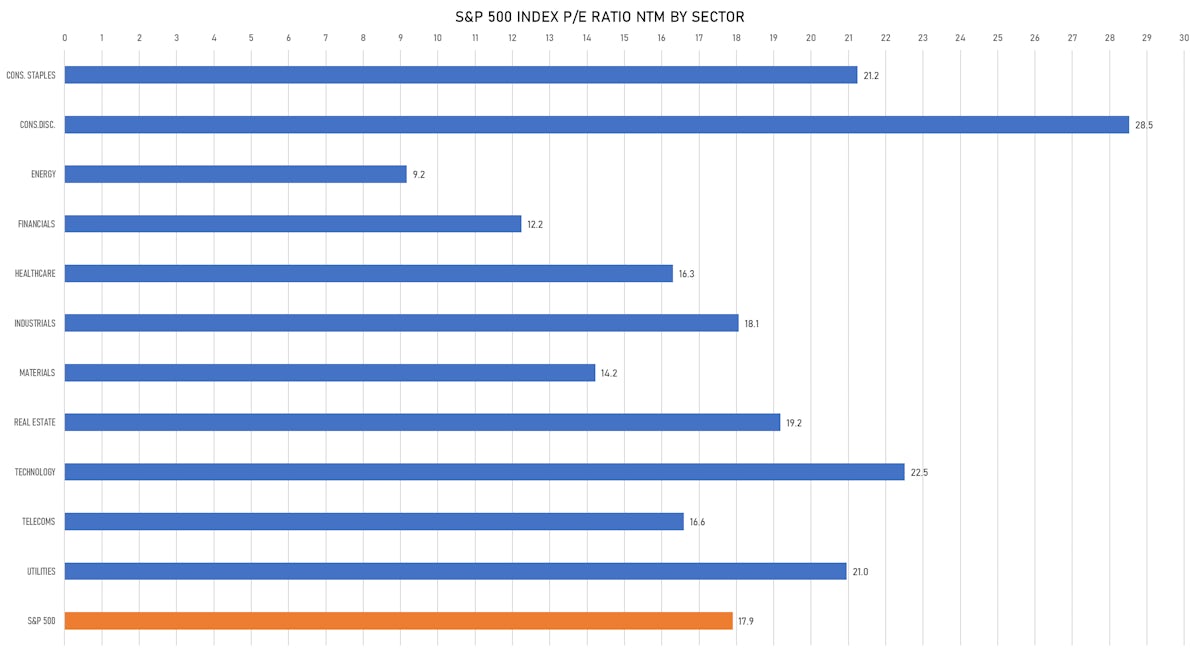

VALUATION MULTIPLES BY SECTORS

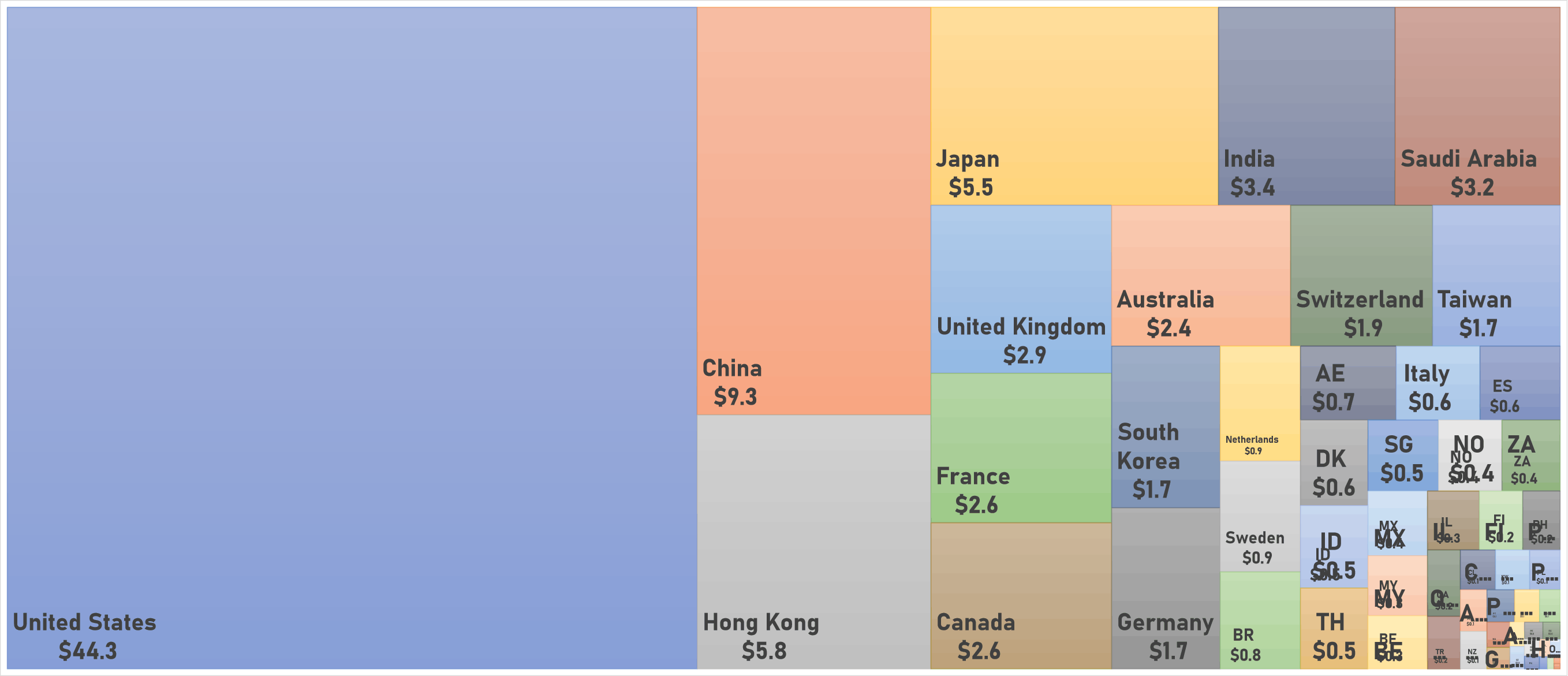

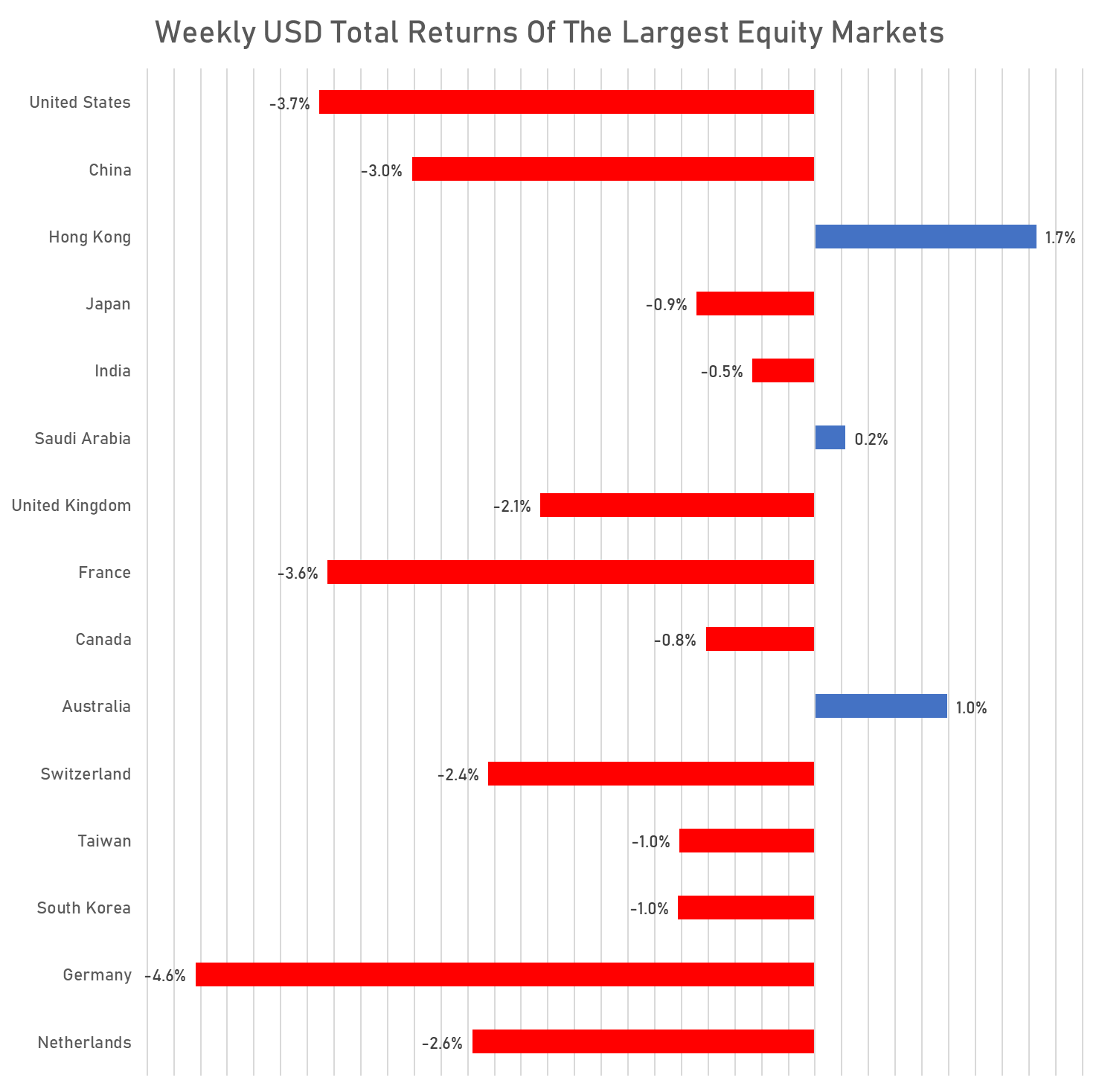

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

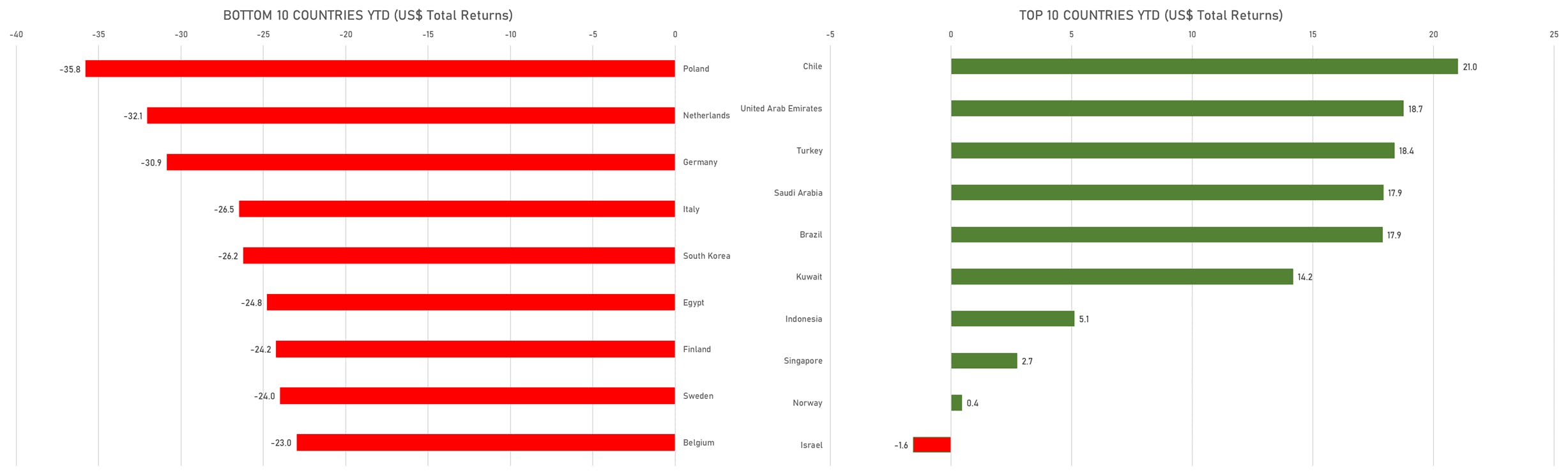

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

WORLD MARKET CAPITALIZATION (US$ Trillion)