Equities

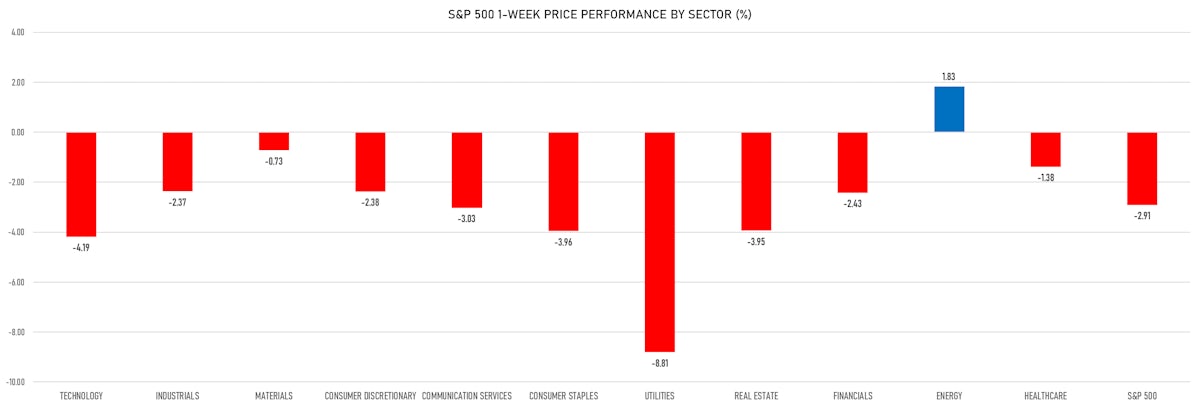

Choppy Trade For US Equities This Week; S&P 500 Price Index Ends September Down 9.4% For The Month, Down 5.3% For The Quarter

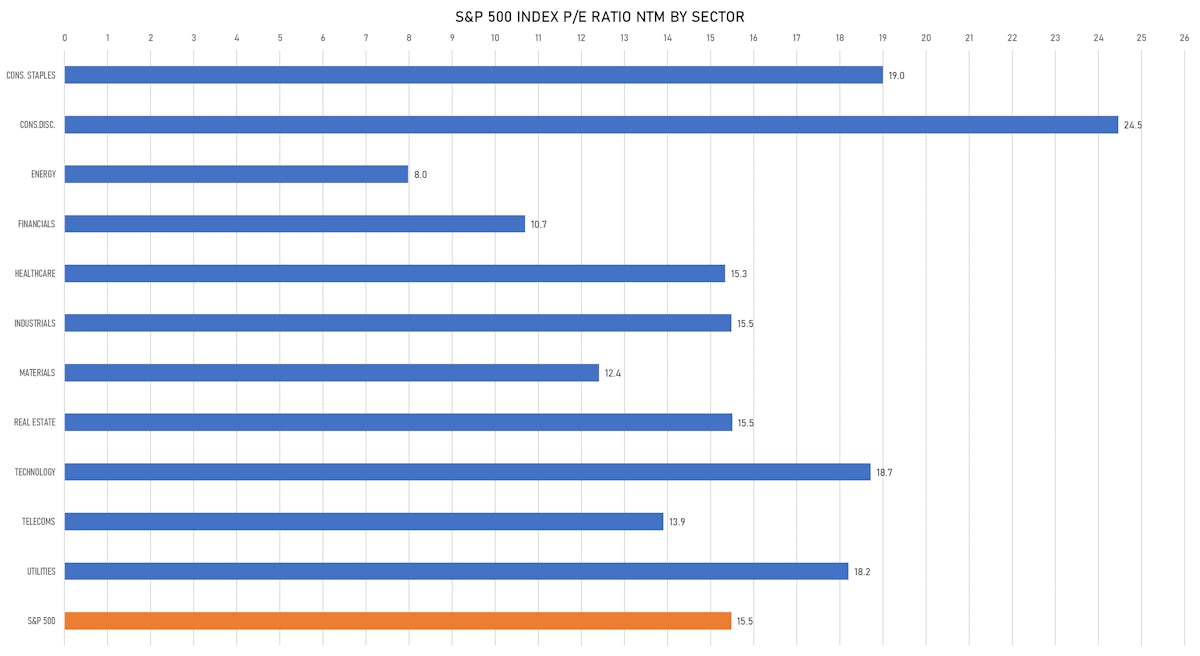

We still expect to see lower cycle lows: valuation multiples are too high relative to real yields and corporate margins expectations will need to compress further

Published ET

S&P 100 Price Performance In September | Source: S&P Capital IQ Pro

DAILY SUMMARY

- Daily performance of US indices: S&P 500 down -1.51%; Nasdaq Composite down -1.51%; Wilshire 5000 down -1.34%

- 16.1% of S&P 500 stocks were up today, with 10.9% of stocks above their 200-day moving average (DMA) and 2.8% above their 50-DMA

- Top performing sectors in the S&P 500: real estate up 0.99% and materials down -0.35%

- Bottom performing sectors in the S&P 500: utilities down -1.97% and technology down -1.94%

- The number of shares in the S&P 500 traded today was 983m for a total turnover of US$ 84 bn

- The S&P 500 Value Index was down -1.3%, while the S&P 500 Growth Index was down -1.7%; the S&P small caps index was down -0.7% and mid caps were down -0.7%

- The volume on CME's INX (S&P 500 Index) was 3146.1m (3-month z-score: 2.2); the 3-month average volume is 2265.4m and the 12-month range is 1340.2 - 4692.3m

- Daily performance of international indices: Europe Stoxx 600 up 1.30%; UK FTSE 100 up 0.18%; Hang Seng SH-SZ-HK 300 Index down -1.04%; Japan's TOPIX 500 down -1.80%

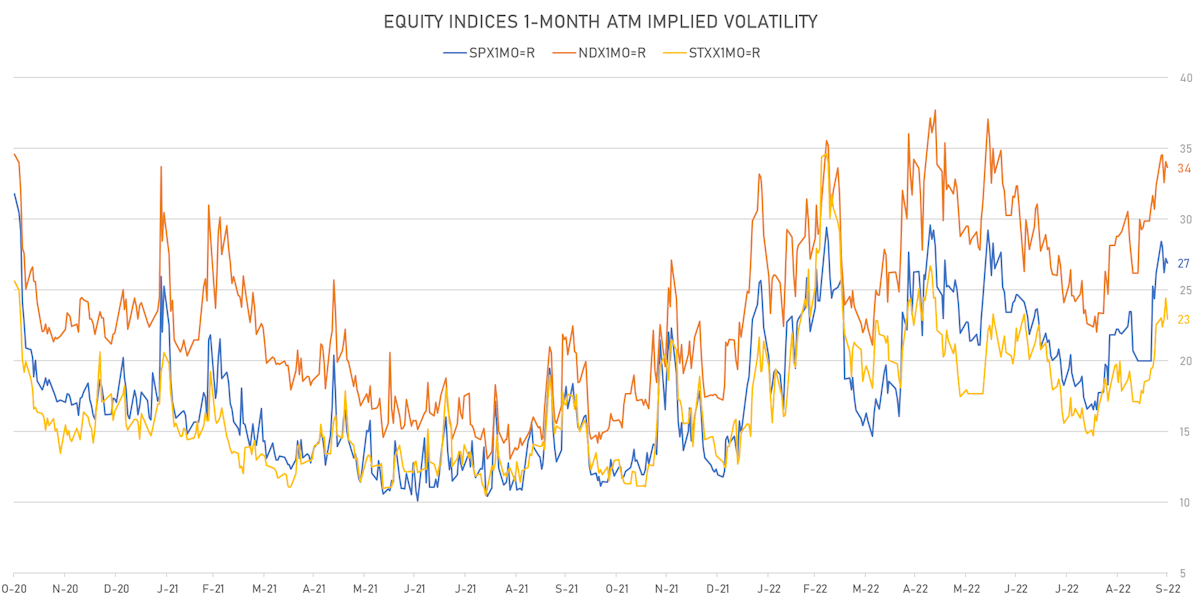

VOLATILITY TODAY

- 1-month at-the-money implied volatility on the S&P 500 at 26.9%, down from 27.2%

- 1-month at-the-money implied volatility on the STOXX Europe 600 at 23.7%, down from 25.4%

TOP S&P 500 PERFORMERS THIS WEEK

- Biogen Inc (BIIB), up 35.0% to $267.00 / YTD price return: +11.3% / 12-Month Price Range: $ 187.22-290.70 / Short interest (% of float): 1.4%; days to cover: 2.6

- Marathon Petroleum Corp (MPC), up 8.6% to $99.33 / YTD price return: +55.2% / 12-Month Price Range: $ 59.55-114.35 / Short interest (% of float): 3.4%; days to cover: 3.8

- Valero Energy Corp (VLO), up 6.2% to $106.85 / YTD price return: +42.3% / 12-Month Price Range: $ 65.16-146.80 / Short interest (% of float): 2.7%; days to cover: 2.9

- Phillips 66 (PSX), up 6.2% to $80.72 / YTD price return: +11.4% / 12-Month Price Range: $ 67.08-111.27 / Short interest (% of float): 2.2%; days to cover: 3.5

- Las Vegas Sands Corp (LVS), up 5.8% to $37.52 / YTD price return: -.3% / 12-Month Price Range: $ 28.88-48.26 / Short interest (% of float): 4.7%; days to cover: 3.8

- Wynn Resorts Ltd (WYNN), up 5.7% to $63.03 / YTD price return: -25.9% / 12-Month Price Range: $ 50.22-98.99 / Short interest (% of float): 5.6%; days to cover: 2.6

- Twitter Inc (TWTR), up 5.4% to $43.84 / YTD price return: +1.4% / 12-Month Price Range: $ 31.95-68.40 / Short interest (% of float): 4.6%; days to cover: 2.9

- Charles River Laboratories International Inc (CRL), up 5.0% to $196.80 / YTD price return: -47.8% / 12-Month Price Range: $ 181.37-449.29 / Short interest (% of float): 2.6%; days to cover: 2.3

- Occidental Petroleum Corp (OXY), up 4.6% to $61.45 / YTD price return: +112.0% / 12-Month Price Range: $ 26.06-77.11 / Short interest (% of float): 6.8%; days to cover: 2.4

- Diamondback Energy Inc (FANG), up 4.6% to $120.46 / YTD price return: +15.8% / 12-Month Price Range: $ 91.18-159.41 / Short interest (% of float): 4.4%; days to cover: 3.2

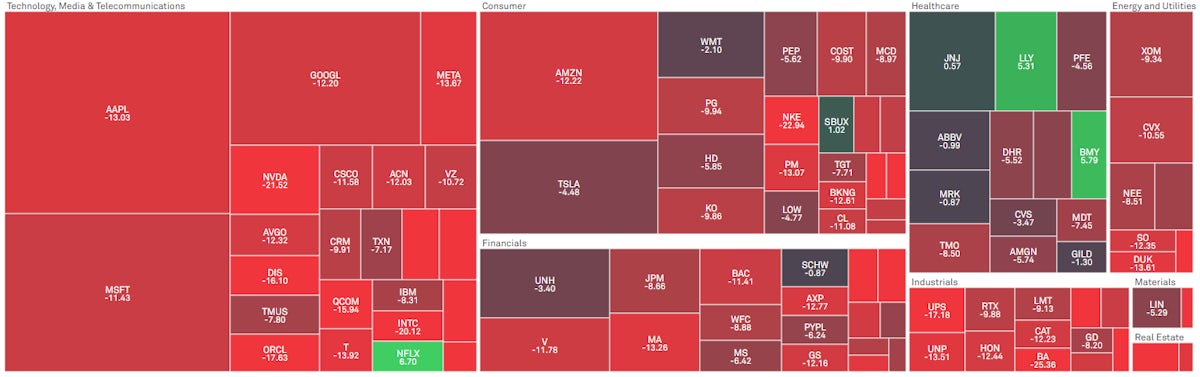

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Carnival Corp (CCL), down 21.5% to $7.03 / YTD price return: -65.1% / 12-Month Price Range: $ 7.03-26.56 / Short interest (% of float): 10.2%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Carmax Inc (KMX), down 16.9% to $66.02 / YTD price return: -49.3% / 12-Month Price Range: $ 64.47-155.97 / Short interest (% of float): 8.4%; days to cover: 12.3 (the stock is currently on the short sale restriction list)

- VF Corp (VFC), down 16.4% to $29.91 / YTD price return: -59.2% / 12-Month Price Range: $ 29.91-78.88 / Short interest (% of float): 4.0%; days to cover: 6.1

- Norwegian Cruise Line Holdings Ltd (NCLH), down 16.2% to $11.36 / YTD price return: -45.2% / 12-Month Price Range: $ 10.31-29.44 / Short interest (% of float): 9.3%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Royal Caribbean Cruises Ltd (RCL), down 14.7% to $37.90 / YTD price return: -50.7% / 12-Month Price Range: $ 31.09-98.21 / Short interest (% of float): 10.2%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Nike Inc (NKE), down 14.3% to $83.12 / YTD price return: -50.1% / 12-Month Price Range: $ 83.12-179.10 / Short interest (% of float): 1.4%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Edison International (EIX), down 12.8% to $56.58 / YTD price return: -17.1% / 12-Month Price Range: $ 54.98-73.31 / Short interest (% of float): 1.4%; days to cover: 3.3

- American Electric Power Company Inc (AEP), down 11.6% to $86.45 / YTD price return: -2.8% / 12-Month Price Range: $ 80.22-105.58 / Short interest (% of float): 1.6%; days to cover: 3.6

- Dominion Energy Inc (D), down 11.1% to $69.11 / YTD price return: -12.0% / 12-Month Price Range: $ 69.11-88.78 / Short interest (% of float): 0.9%; days to cover: 2.6

- Alliant Energy Corp (LNT), down 11.0% to $52.99 / YTD price return: -13.8% / 12-Month Price Range: $ 52.99-65.36 / Short interest (% of float): 1.5%; days to cover: 3.1

VALUATION MULTIPLES BY SECTORS

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Corebridge Financial Inc / United States of America - Financials / Listing Exchange: New York / Ticker: CRBG / Gross proceeds (including overallotment): US$ 1,680.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, JP Morgan Securities LLC, Piper Sandler & Co

- Green Energy Global Inc / United States of America - Energy and Power / Listing Exchange: Nasdaq / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Third Harmonic Bio Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: THRD / Gross proceeds (including overallotment): US$ 213.10m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Morgan Stanley & Co, Jefferies LLC

- EF Hutton Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: EFHTU / Gross proceeds (including overallotment): US$ 115.00m (offering in U.S. Dollar) / Bookrunners: EF Hutton

IPOs RECENTLY ANNOUNCED OR PRICED GLOBALLY

- Porsche AG / Germany - Industrials / Listing Exchange: Frankfurt / Ticker: P911 / Gross proceeds (including overallotment): US$ 7,951.99m (offering in EURO) / Bookrunners: Societe Generale SA, Barclays Bank (Ireland), Deutsche Bank, BNP Paribas SA, Banco Santander SA, UniCredit Bank AG, BofA Securities Europe SA, Citigroup Global Markets Europe AG, Goldman Sachs Bank Europe SE, Morgan Stanley Europe SE, JP Morgan SE

- Salik Co PJSC / United Arab Emirates - Government and Agencies / Listing Exchange: Dubai PJSC / Ticker: SALIK / Gross proceeds (including overallotment): US$ 781.34m (offering in Utd. Arab Em. Dirham) / Bookrunners: Goldman Sachs International, Merrill Lynch International Ltd, Citigroup Global Markets Ltd, EFG-Hermes UAE Ltd, HSBC Bank Middle East Ltd

- Hubei Wanrun New Energy Technology Co Ltd / China - Energy and Power / Listing Exchange: SSES / Ticker: 688275 / Gross proceeds (including overallotment): US$ 533.27m (offering in Chinese Yuan) / Bookrunners: Donghai Securities Co Ltd

- Zhejiang Leapmotor Technology Co Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: 9863 / Gross proceeds (including overallotment): US$ 485.39m (offering in Hong Kong Dollar) / Bookrunners: Citigroup Global Markets Ltd, CLSA Asia-Pacific Markets Ltd, CCB International Capital Ltd, China International Capital Corp HK Securities Ltd, Huatai Financial holdings (Hong Kong) Ltd, JP Morgan Securities Plc, China Securities (International) Corporate Finance Co, ABCI Capital Ltd, Futu Securities International (Hong Kong) Ltd, Tiger Brokers (HK) Global Ltd

- Onewo Inc / China - Real Estate / Listing Exchange: Hong Kong / Ticker: 2602 / Gross proceeds (including overallotment): US$ 384.69m (offering in Hong Kong Dollar) / Bookrunners: Goldman Sachs (Asia), BOCI Asia Ltd, Citigroup Global Markets Ltd, CLSA Asia-Pacific Markets Ltd, CCB International Capital Ltd, CMB International Capital Corp, ABCI Securities Co Ltd, ICBC International Securities, Guosen Securities (HK) Capital Co Ltd, ICBC International Capital Ltd, ABCI Capital Ltd

- Hubei Wanrun New Energy Technology Co Ltd / China - Energy and Power / Listing Exchange: SSES / Ticker: 688275 / Gross proceeds (including overallotment): US$ 318.07m (offering in Chinese Yuan) / Bookrunners: Donghai Securities Co Ltd

- CICT Mobile Communication Technology Co Ltd / China - Telecommunications / Listing Exchange: SSES / Ticker: 688387 / Gross proceeds (including overallotment): US$ 305.10m (offering in Chinese Yuan) / Bookrunners: Shenwan Hongyuan Securities Un

- Zhejiang Leapmotor Technology Co Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: 9863 / Gross proceeds (including overallotment): US$ 301.49m (offering in Hong Kong Dollar) / Bookrunners: Citigroup Global Markets Ltd, CLSA Asia-Pacific Markets Ltd, CCB International Capital Ltd, China International Capital Corp HK Securities Ltd, Huatai Financial holdings (Hong Kong) Ltd, JP Morgan Securities Plc, China Securities (International) Corporate Finance Co, ABCI Capital Ltd, Futu Securities International (Hong Kong) Ltd, Tiger Brokers (HK) Global Ltd

- Welkin China Private Equity Ltd / Guernsey - Financials / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Deutsche Bank AG (London), finnCap Ltd, Huatai Financial holdings (Hong Kong) Ltd, CLSA (UK)

- Socionext Inc / Japan - High Technology / Listing Exchange: TOKPR / Ticker: 6526 / Gross proceeds (including overallotment): US$ 296.94m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, SMBC Nikko Securities Inc

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- NextEra Energy Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: NEE / Gross proceeds (including overallotment): US$ 1,950.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Mizuho Securities USA LLC

- AMC Entertainment Holdings Inc / United States of America - Media and Entertainment / Listing Exchange: New York / Ticker: AMC / Gross proceeds (including overallotment): US$ 1,521.50m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- CoStar Group Inc / United States of America - Media and Entertainment / Listing Exchange: Nasdaq / Ticker: CSGP / Gross proceeds (including overallotment): US$ 750.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Agree Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: ADC / Gross proceeds (including overallotment): US$ 750.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- MicroStrategy Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MSTR / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Agree Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: ADC / Gross proceeds (including overallotment): US$ 336.75m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co, Citigroup

- Crestwood Equity Partners LP / United States of America - Energy and Power / Listing Exchange: New York / Ticker: NRGY / Gross proceeds (including overallotment): US$ 306.66m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- Relay Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RLAY / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, JP Morgan Securities LLC

- Core & Main Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: CNM / Gross proceeds (including overallotment): US$ 261.25m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Blink Charging Co / United States of America - Energy and Power / Listing Exchange: Nasdaq / Ticker: BLNK / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Akero Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: AKRO / Gross proceeds (including overallotment): US$ 230.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Driven Brands Holdings Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: DRVN / Gross proceeds (including overallotment): US$ 227.15m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, BofA Securities Inc

- Revance Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RVNC / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, Guggenheim Securities LLC

- Ventyx Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: VTYX / Gross proceeds (including overallotment): US$ 176.55m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Allakos Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ALLK / Gross proceeds (including overallotment): US$ 150.01m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Jefferies LLC

- Celularity Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CELU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- AST SpaceMobile Inc / United States of America - Telecommunications / Listing Exchange: Nasdaq / Ticker: ASTS / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Volta Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: VLTA / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- POINT Biopharma Global Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PNT / Gross proceeds (including overallotment): US$ 142.75m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Piper Sandler & Co

- Paycor HCM Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: PYCR / Gross proceeds (including overallotment): US$ 136.75m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

SECONDARIES RECENTLY ANNOUNCED OR PRICED GLOBALLY

- Uniper SE / Germany - Energy and Power / Listing Exchange: Frankfurt / Ticker: UN01 / Gross proceeds (including overallotment): US$ 7,966.03m (offering in EURO) / Bookrunners: Not Applicable

- Ningbo Zhoushan Port Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601018 / Gross proceeds (including overallotment): US$ 2,022.06m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

- Atlas Arteria / Australia - Financials / Listing Exchange: Australia / Ticker: ALX / Gross proceeds (including overallotment): US$ 1,702.37m (offering in Australian Dollar) / Bookrunners: Royal Bank of Canada, UBS Securities Australia Ltd

- China International Capital Corp Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 3908 / Gross proceeds (including overallotment): US$ 1,563.92m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China International Capital Corp Ltd / China - Financials / Listing Exchange: Hong Kong / Ticker: 3908 / Gross proceeds (including overallotment): US$ 1,537.72m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China Merchants Port Group Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 001872 / Gross proceeds (including overallotment): US$ 1,525.60m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, China Merchants Securities Co Ltd, CITIC Securities Co Ltd, Zheshang Securities Co Ltd

- Tianma Microelectronics Co Ltd / China - High Technology / Listing Exchange: Shenzhen / Ticker: 000050 / Gross proceeds (including overallotment): US$ 977.09m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Guolian Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 1456 / Gross proceeds (including overallotment): US$ 972.36m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Bharti Airtel Ltd / India - Telecommunications / Listing Exchange: National / Ticker: BHARTI / Gross proceeds (including overallotment): US$ 895.96m (offering in Indian Rupee) / Bookrunners: Not Applicable

- China International Capital Corp Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 3908 / Gross proceeds (including overallotment): US$ 797.56m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Shanghai International Airport Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 600009 / Gross proceeds (including overallotment): US$ 713.78m (offering in Chinese Yuan) / Bookrunners: Guotai Junan Securities

- Tianjin China Green Power Investment Co Ltd / China - Real Estate / Listing Exchange: Shenzhen / Ticker: 000537 / Gross proceeds (including overallotment): US$ 702.29m (offering in Chinese Yuan) / Bookrunners: Not Applicable