Equities

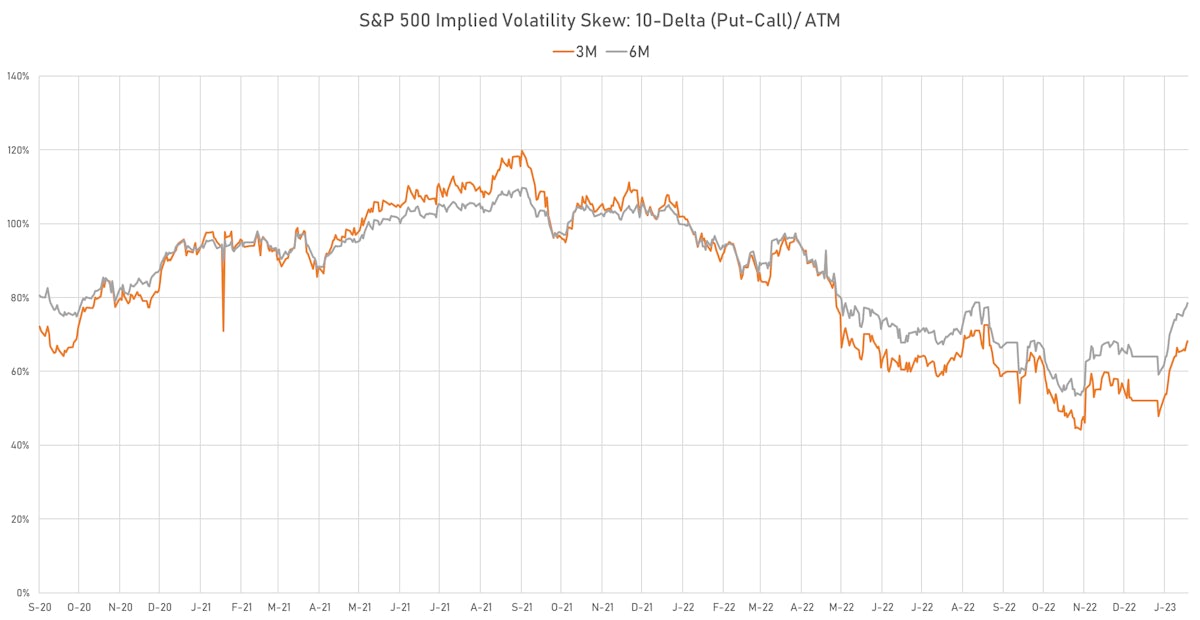

Market Participants Are Taking Advantage Of The Current Equities Rally, Lower Volatility To Buy Downside Protection

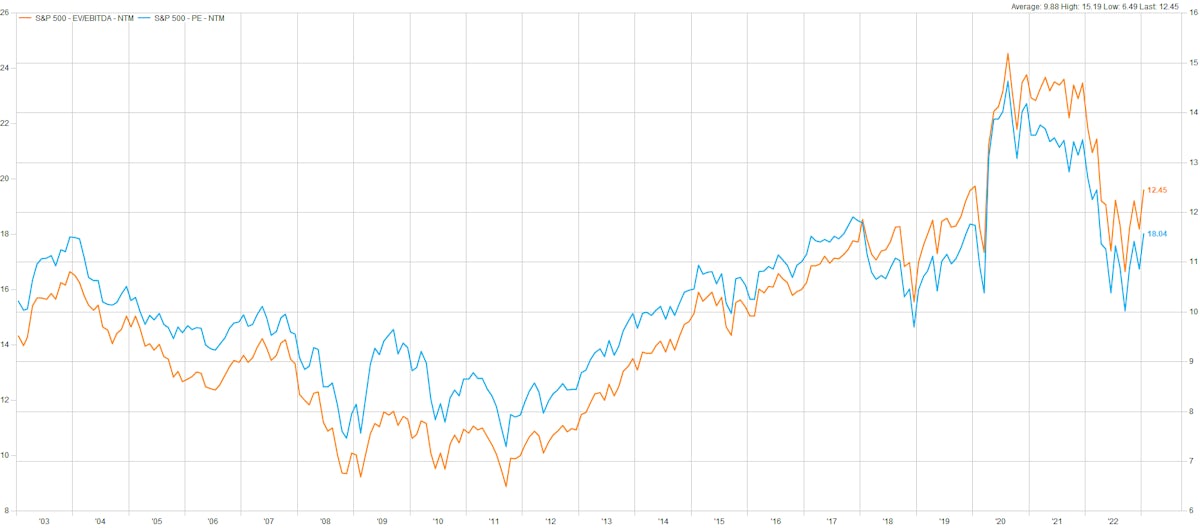

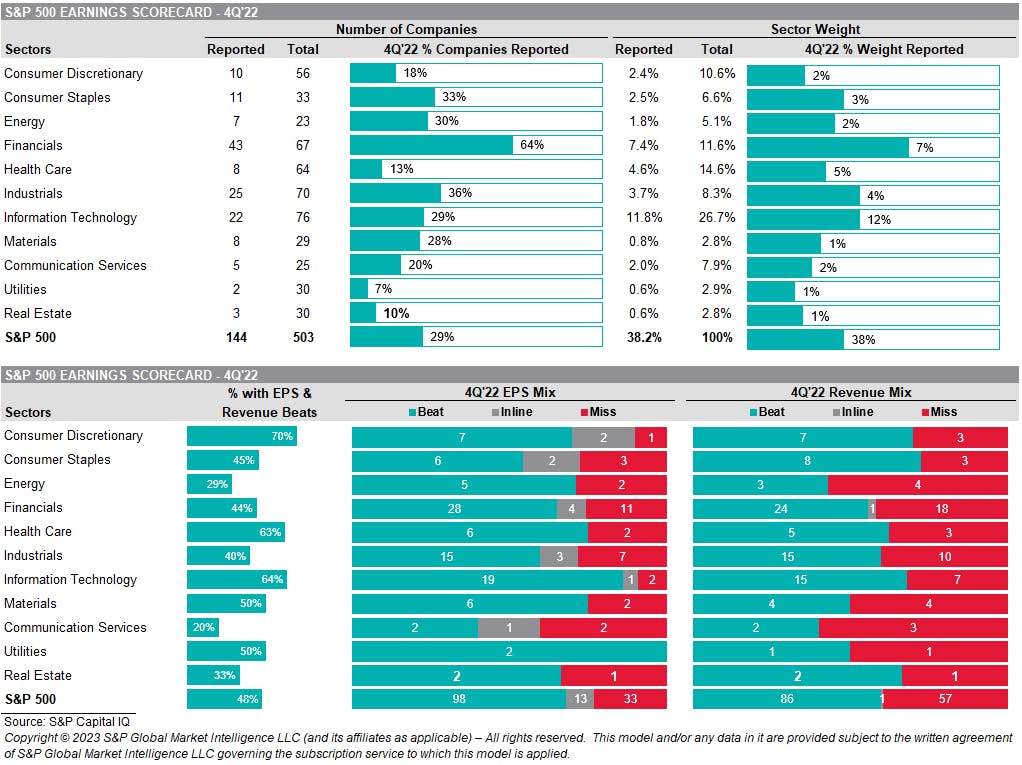

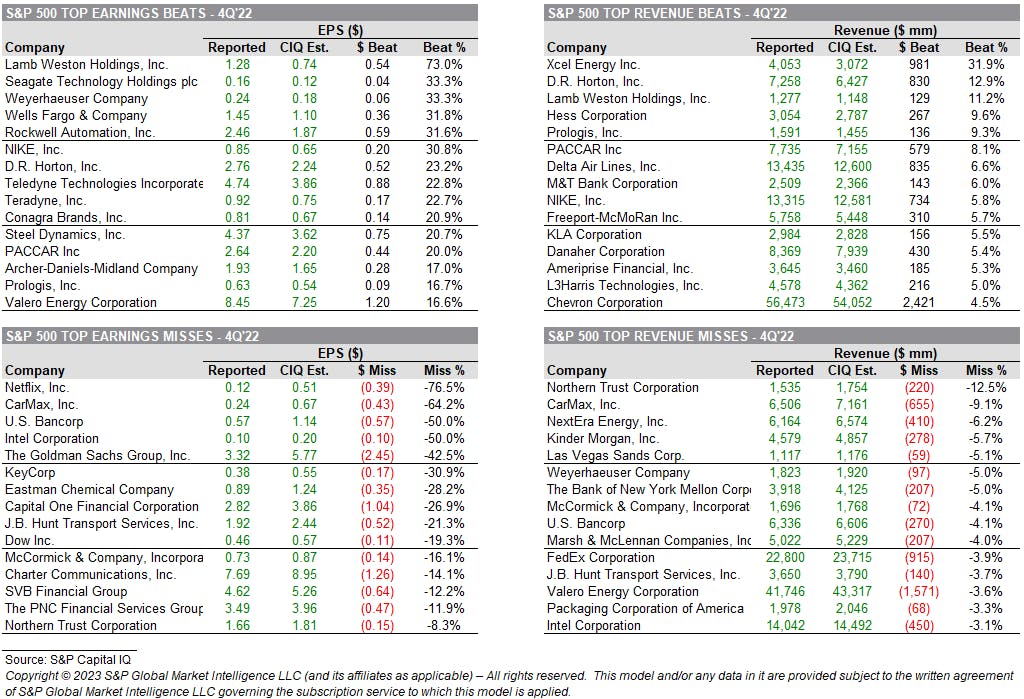

Earnings have been unspectacular so far, essentially in line with lowered market expectations; excluding energy, results are down about 5% YoY, with a focus on margin compression

Published ET

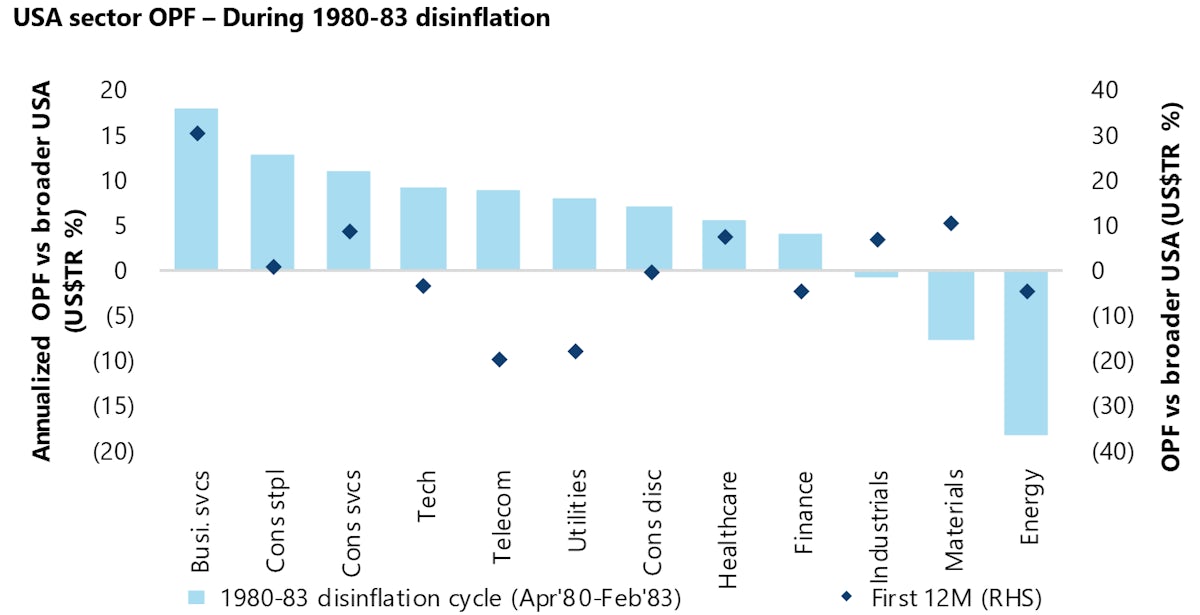

US Sectors Outperformance During 1980's Period Of Disinflation | Source: Jefferies

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 0.25%; Nasdaq Composite up 0.95%; Wilshire 5000 up 0.25%

- 52.3% of S&P 500 stocks were up today, with 66.4% of stocks above their 200-day moving average (DMA) and 72.8% above their 50-DMA

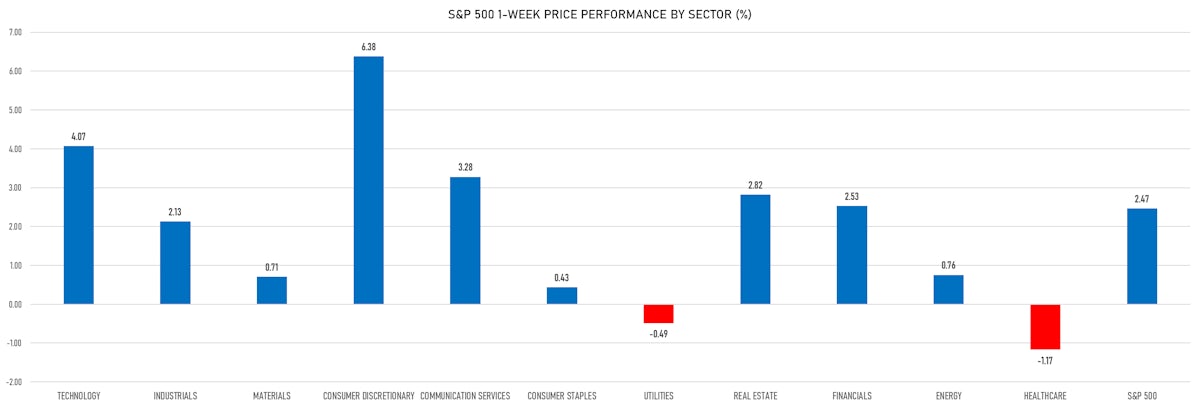

- Top performing sectors in the S&P 500: consumer discretionary up 2.27% and real estate up 0.94%

- Bottom performing sectors in the S&P 500: energy down -1.99% and healthcare down -0.69%

- The number of shares in the S&P 500 traded today was 627m for a total turnover of US$ 64 bn

- The S&P 500 Value Index was up 0.2%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was up 0.7% and mid caps were up 0.6%

- The volume on CME's INX (S&P 500 Index) was 2572.7m (3-month z-score: 0.2); the 3-month average volume is 2445.6m and the 12-month range is 903.0 - 5089.5m

- Daily performance of international indices: Europe Stoxx 600 up 0.26%; UK FTSE 100 up 0.05%; Hang Seng SH-SZ-HK 300 Index up 0.30%; Japan's TOPIX 500 up 0.23%

VOLATILITY TODAY

- 3-month at-the-money implied volatility on the S&P 500 at 16.5%, down from 16.8%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 13.2%, down from 13.3%

S&P 500 EARNINGS DASHBOARD

EARNINGS BEATS & MISSES

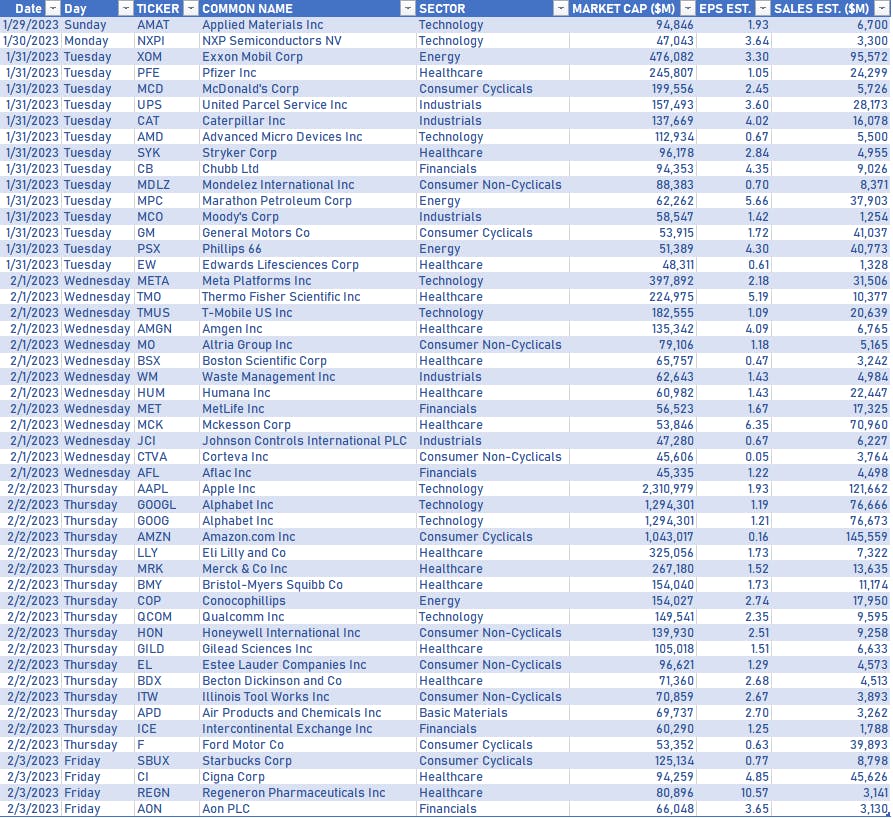

TOP COMPANIES REPORTING IN THE WEEK AHEAD

TOP WINNERS TODAY

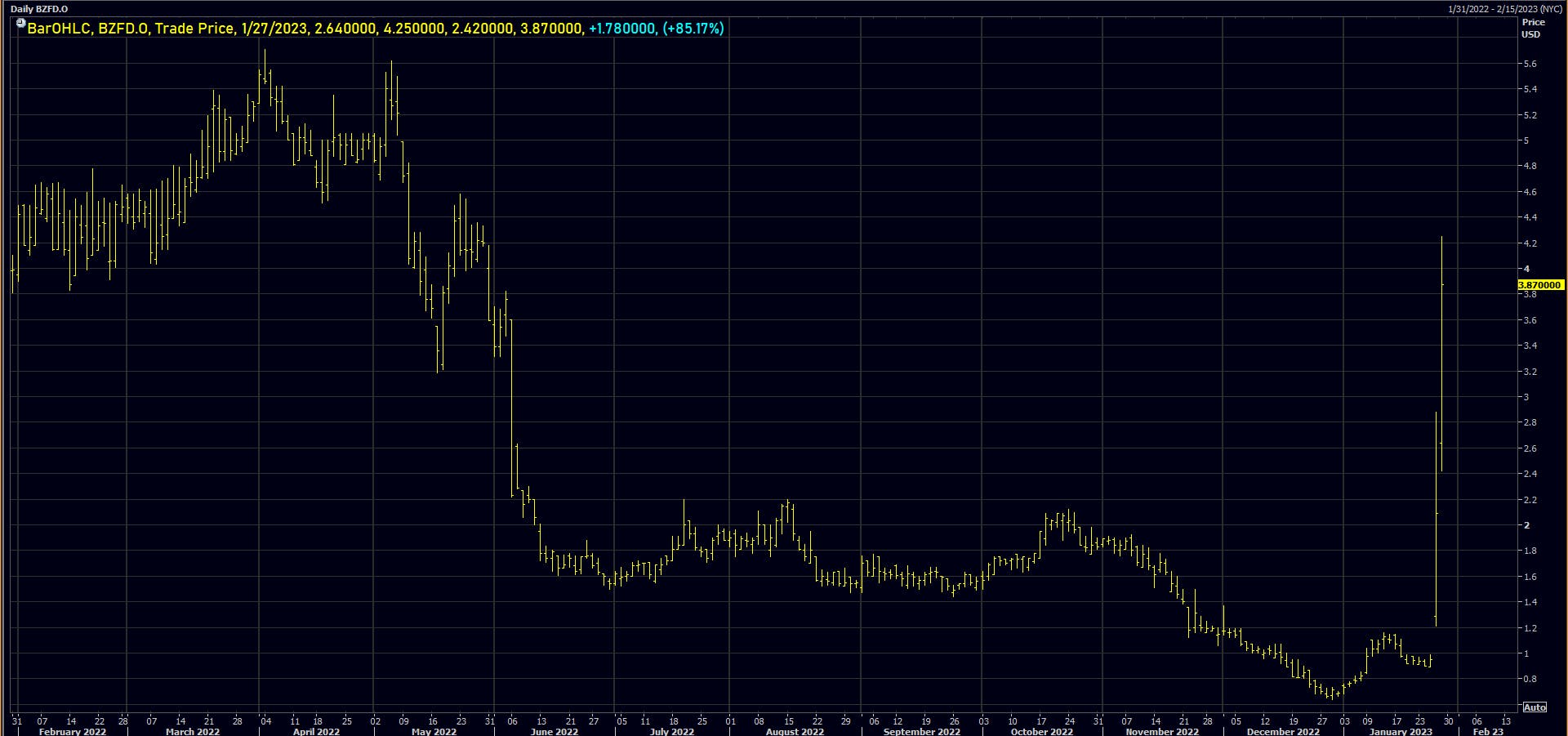

- BuzzFeed Inc (BZFD), up 85.2% to $3.87 / YTD price return: +461.2% / 12-Month Price Range: $ 0.64-5.71 / Short interest (% of float): 0.8%; days to cover: 2.3

- Lucid Group Inc (LCID), up 43.0% to $12.87 / YTD price return: +88.4% / 12-Month Price Range: $ 6.09-33.91 / Short interest (% of float): 10.2%; days to cover: 5.4

- Applied Digital Corp (APLD), up 21.7% to $3.20 / YTD price return: +73.9% / 12-Month Price Range: $ 0.85-27.12 / Short interest (% of float): 4.4%; days to cover: 3.2

- NewAmsterdam Pharma Company NV (NAMS), up 20.1% to $16.28 / YTD price return: +49.4% / 12-Month Price Range: $ 7.52-32.88 / Short interest (% of float): 0.1%; days to cover: 2.8

- Cyxtera Technologies Inc (CYXT), up 19.9% to $3.25 / YTD price return: +69.3% / 12-Month Price Range: $ 1.53-15.42 / Short interest (% of float): 2.8%; days to cover: 7.6

- Redfin Corp (RDFN), up 19.7% to $7.28 / YTD price return: +71.7% / 12-Month Price Range: $ 3.08-32.30

- Carvana Co (CVNA), up 19.5% to $7.77 / YTD price return: +63.9% / 12-Month Price Range: $ 3.55-167.00 / Short interest (% of float): 58.2%; days to cover: 2.1

- C3.ai Inc (AI), up 17.8% to $17.77 / YTD price return: +58.8% / 12-Month Price Range: $ 10.16-27.62 / Short interest (% of float): 9.1%; days to cover: 3.9

- Vaxxinity Inc (VAXX), up 17.4% to $3.58 / YTD price return: +155.7% / 12-Month Price Range: $ 1.24-8.35 / Short interest (% of float): 1.9%; days to cover: 1.8

- SoundHound AI Inc (SOUN), up 16.8% to $1.81 / YTD price return: +2.3% / 12-Month Price Range: $ 0.93-18.14 / Short interest (% of float): 4.2%; days to cover: 4.3

BIGGEST LOSERS TODAY

- Alvarium Tiedemann Holdings Inc (ALTI), down 26.4% to $9.55 / YTD price return: -12.5% / 12-Month Price Range: $ 5.54-28.49 / Short interest (% of float): 1.2%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- FLJ Group Ltd (FLJ), down 15.9% to $1.64 / YTD price return: -33.3% / 12-Month Price Range: $ .60-4.06 / Short interest (% of float): 0.1%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Tuniu Corp (TOUR), down 11.9% to $2.52 / YTD price return: +66.9% / 12-Month Price Range: $ .46-2.88 / Short interest (% of float): 0.8%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Netscout Systems Inc (NTCT), down 11.6% to $31.87 / YTD price return: -2.0% / 12-Month Price Range: $ 28.69-38.02 / Short interest (% of float): 3.5%; days to cover: 5.0 (the stock is currently on the short sale restriction list)

- EVI Industries Inc (EVI), down 10.9% to $20.27 / YTD price return: -15.1% / 12-Month Price Range: $ 7.25-26.92 / Short interest (% of float): 4.2%; days to cover: 9.2 (the stock is currently on the short sale restriction list)

- First Interstate BancSystem Inc (FIBK), down 10.8% to $33.62 / YTD price return: -13.0% / 12-Month Price Range: $ 32.40-46.34 / Short interest (% of float): 1.8%; days to cover: 3.7 (the stock is currently on the short sale restriction list)

- Meihua International Medical Technologies Co Ltd (MHUA), down 10.1% to $12.13 / YTD price return: +46.5% / 12-Month Price Range: $ 2.60-14.94 / Short interest (% of float): 0.3%; days to cover: 1.0 (the stock is currently on the short sale restriction list)

- Midland States Bancorp Inc (MSBI), down 10.1% to $24.00 / YTD price return: -9.8% / 12-Month Price Range: $ 23.48-30.60 / Short interest (% of float): 1.7%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- Qurate Retail Inc (QRTEB), down 9.9% to $5.93 / YTD price return: +17.0% / 12-Month Price Range: $ 3.04-21.93 / Short interest (% of float): 2.2%; days to cover: 1.2

- California Resources Corp (CRC), down 9.8% to $43.16 / YTD price return: -.8% / 12-Month Price Range: $ 35.95-51.46 / Short interest (% of float): 4.8%; days to cover: 5.7 (the stock is currently on the short sale restriction list)

TOP S&P 500 PERFORMERS THIS WEEK

- Tesla Inc (TSLA), up 33.3% to $177.90 / YTD price return: +44.4% / 12-Month Price Range: $ 101.83-384.15 / Short interest (% of float): 3.4%; days to cover: 0.6

- Western Digital Corp (WDC), up 16.9% to $44.97 / YTD price return: +42.5% / 12-Month Price Range: $ 29.74-63.26 / Short interest (% of float): 2.4%; days to cover: 1.4

- Seagate Technology Holdings PLC (STX), up 16.3% to $68.99 / YTD price return: +31.1% / 12-Month Price Range: $ 47.47-116.89 / Short interest (% of float): 4.9%; days to cover: 4.3

- Warner Bros Discovery Inc (WBD), up 14.6% to $14.91 / YTD price return: +57.3% / 12-Month Price Range: $ 8.83-31.11 / Short interest (% of float): 4.3%; days to cover: 2.9

- NVIDIA Corp (NVDA), up 14.2% to $203.65 / YTD price return: +39.4% / 12-Month Price Range: $ 108.14-289.34 / Short interest (% of float): 1.6%; days to cover: 0.9

- American Express Co (AXP), up 13.7% to $172.31 / YTD price return: +16.6% / 12-Month Price Range: $ 130.75-199.51 / Short interest (% of float): 0.8%; days to cover: 2.1

- Paramount Global (PARA), up 13.6% to $23.07 / YTD price return: +36.7% / 12-Month Price Range: $ 15.29-39.21 / Short interest (% of float): 15.4%; days to cover: 7.6

- Albemarle Corp (ALB), up 13.4% to $281.72 / YTD price return: +29.9% / 12-Month Price Range: $ 169.95-334.25 / Short interest (% of float): 3.1%; days to cover: 2.5

- United Rentals Inc (URI), up 13.1% to $434.09 / YTD price return: +22.1% / 12-Month Price Range: $ 230.73-434.09 / Short interest (% of float): 5.7%; days to cover: 6.3

- Capital One Financial Corp (COF), up 12.9% to $117.58 / YTD price return: +26.5% / 12-Month Price Range: $ 86.98-160.50 / Short interest (% of float): 1.6%; days to cover: 1.9

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Nextera Energy Inc (NEE), down 7.6% to $75.58 / YTD price return: -9.6% / 12-Month Price Range: $ 67.22-91.34 / Short interest (% of float): 0.9%; days to cover: 3.3

- Hasbro Inc (HAS), down 7.4% to $58.61 / YTD price return: -3.9% / 12-Month Price Range: $ 54.66-105.11 / Short interest (% of float): 4.0%; days to cover: 3.1

- Xylem Inc (XYL), down 7.0% to $102.42 / YTD price return: -7.4% / 12-Month Price Range: $ 72.14-118.41 / Short interest (% of float): 2.1%; days to cover: 4.7

- Automatic Data Processing Inc (ADP), down 6.9% to $220.80 / YTD price return: -7.6% / 12-Month Price Range: $ 192.26-273.89 / Short interest (% of float): 1.3%; days to cover: 3.4

- Sherwin-Williams Co (SHW), down 6.8% to $228.54 / YTD price return: -3.7% / 12-Month Price Range: $ 195.57-295.74 / Short interest (% of float): 0.8%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Brown & Brown Inc (BRO), down 6.7% to $57.60 / YTD price return: +1.1% / 12-Month Price Range: $ 52.91-74.00 / Short interest (% of float): 1.3%; days to cover: 3.0

- CSX Corp (CSX), down 6.0% to $30.08 / YTD price return: -2.9% / 12-Month Price Range: $ 25.81-38.63 / Short interest (% of float): 0.8%; days to cover: 1.4

- Norfolk Southern Corp (NSC), down 5.9% to $238.81 / YTD price return: -3.1% / 12-Month Price Range: $ 203.85-291.36 / Short interest (% of float): 1.1%; days to cover: 2.4

- Enphase Energy Inc (ENPH), down 5.6% to $210.09 / YTD price return: -20.7% / 12-Month Price Range: $ 113.98-339.88 / Short interest (% of float): 4.4%; days to cover: 1.7

- Colgate-Palmolive Co (CL), down 5.1% to $71.59 / YTD price return: -9.1% / 12-Month Price Range: $ 67.85-83.80 / Short interest (% of float): 0.8%; days to cover: 1.9

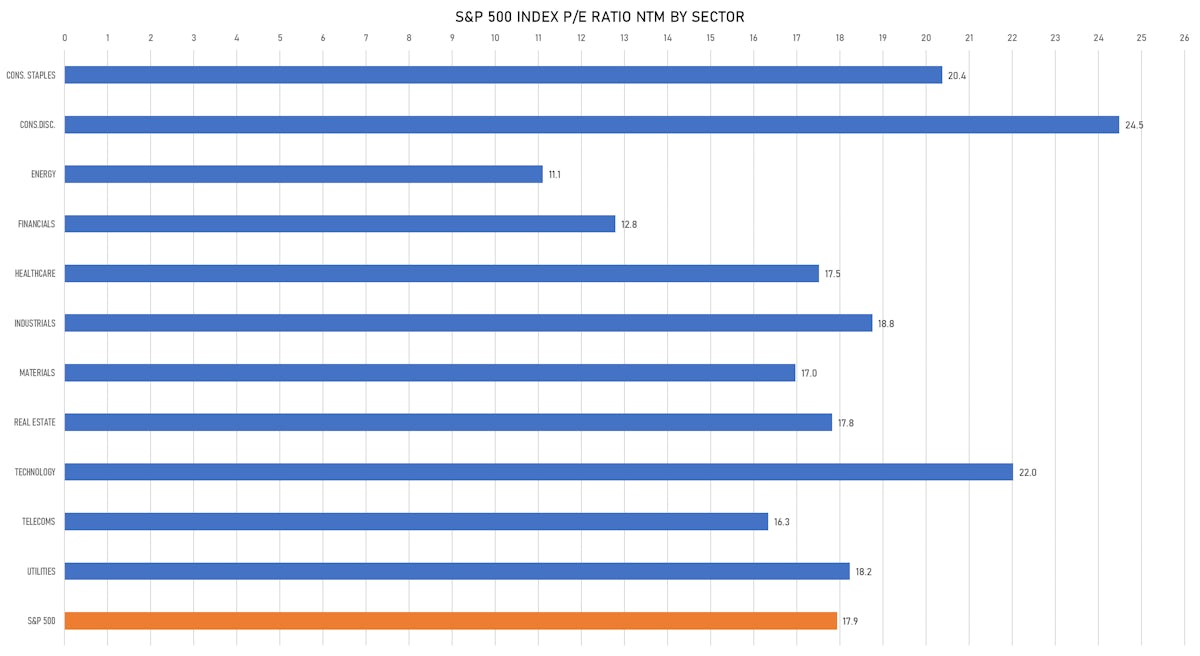

VALUATION MULTIPLES BY SECTORS

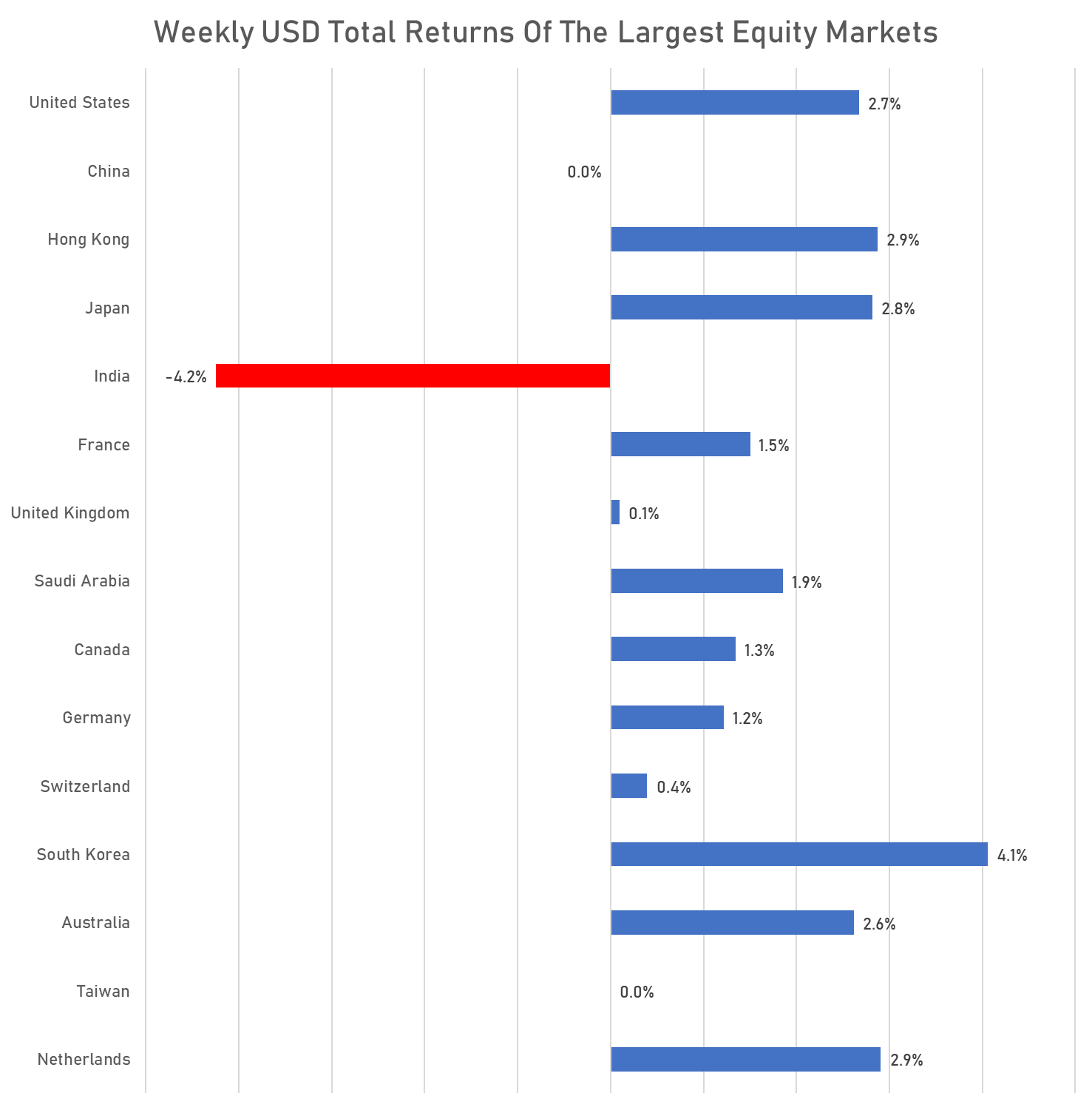

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

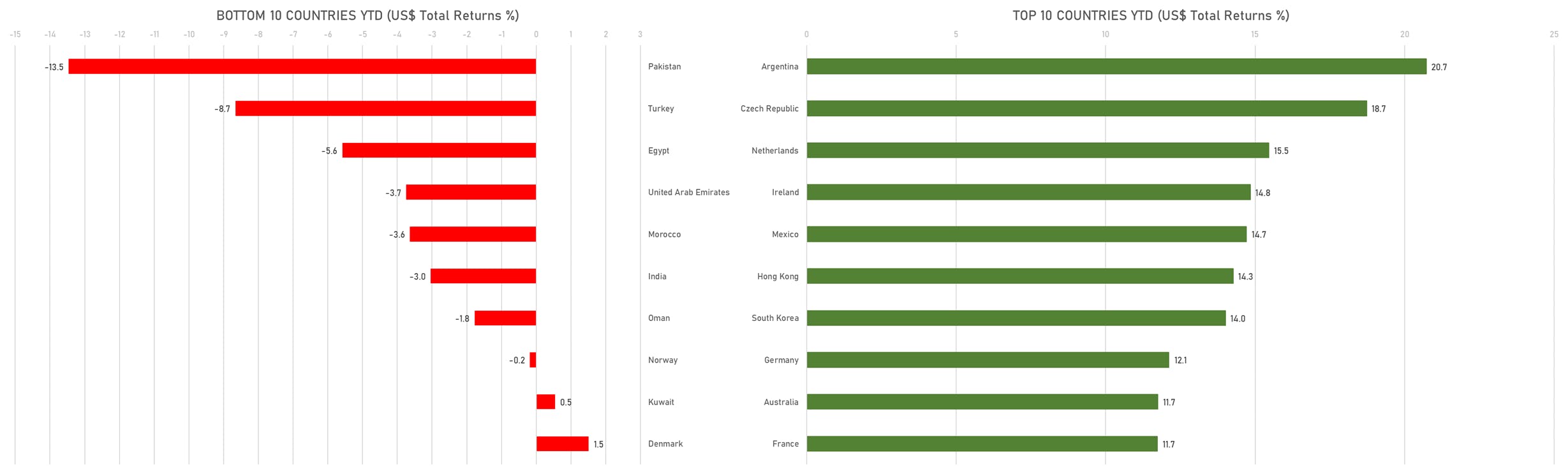

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

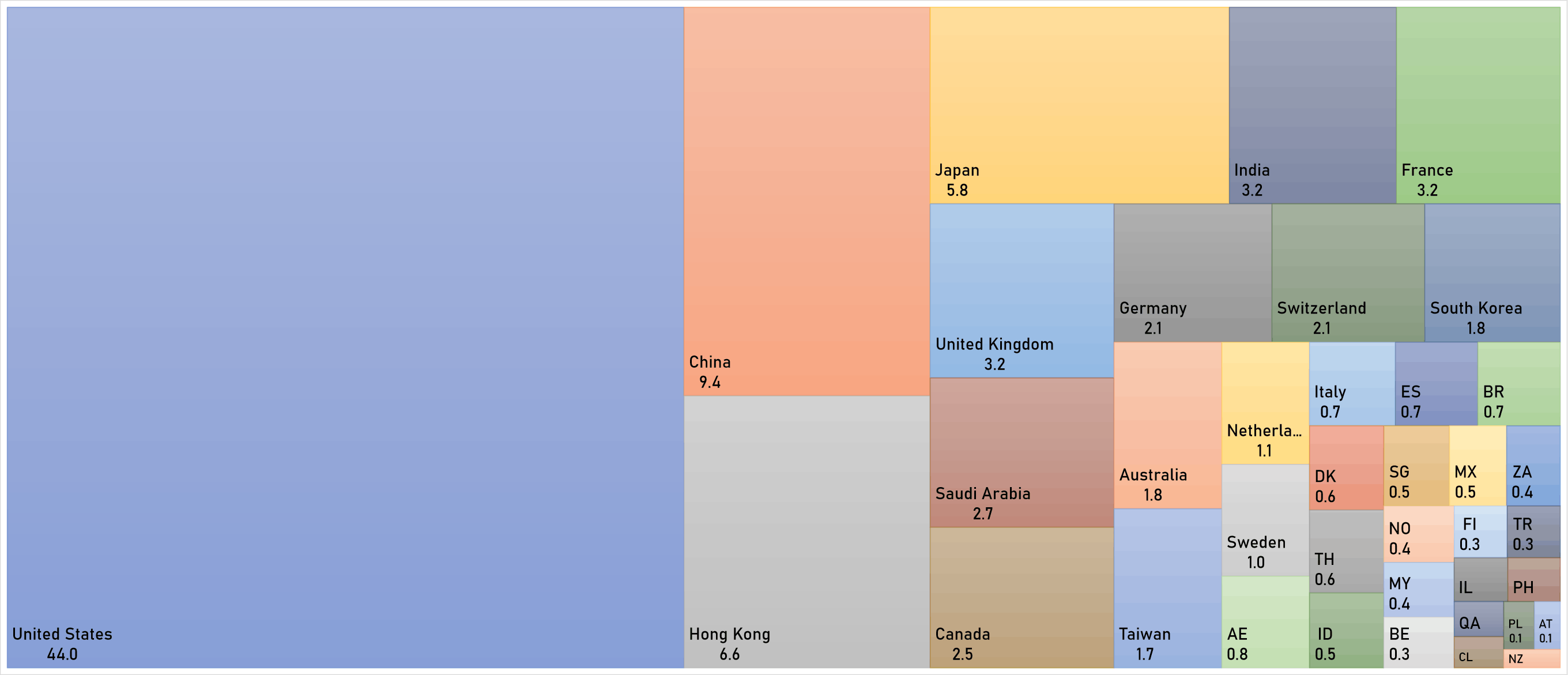

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Skyward Specialty Insurance Group Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SKWD / Gross proceeds (including overallotment): US$ 154.43m (offering in U.S. Dollar) / Bookrunners: Keefe Bruyette & Woods Inc, Barclays Capital Inc

- Israel Acquisitions Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ISRLU / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC

IPOs RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- ST Telemedia Global Data Centres / Singapore - Telecommunications / Listing Exchange: Singapore / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- JD Property Group Corp / China - Real Estate / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Abraj Energy Services SAOC / Oman - Energy and Power / Listing Exchange: Muscat / Ticker: - / Gross proceeds (including overallotment): US$ 500.00m (offering in Omani Riyal) / Bookrunners: National Bank of Oman Ltd, Ahli Bank SAOG, EFG Hermes Brokerage UAE LLC

- Lu DaoPei Medical Group Holding Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: CLSA Asia-Pacific Markets Ltd, CMB International Capital Corp, Macquarie Capital Ltd

- Hunan Yuneng New Energy Battery Material Co Ltd / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: 301358 / Gross proceeds (including overallotment): US$ 372.02m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Greenworks (Jiangsu) Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 301260 / Gross proceeds (including overallotment): US$ 339.74m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Hubei Jianghan New Materials Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 603281 / Gross proceeds (including overallotment): US$ 315.43m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Meeza Qstp LLC / Qatar - High Technology / Listing Exchange: Qatar Exch / Ticker: N/A / Gross proceeds (including overallotment): US$ 240.40m (offering in Qatari Riyal) / Bookrunners: QInvest LLC

- Seacrest Petroleo BV / Bermuda - Energy and Power / Listing Exchange: Oslo / Ticker: N/A / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: ABG Sundal Collier, Pareto Securities, SpareBank 1 Markets AS

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- VICI Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: VICI / Gross proceeds (including overallotment): US$ 999.98m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co, JP Morgan & Co Inc, Citigroup, BofA Securities Inc

- AvalonBay Communities Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: AVB / Gross proceeds (including overallotment): US$ 705.96m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Xponential Fitness Inc / United States of America - Media and Entertainment / Listing Exchange: New York / Ticker: XPOF / Gross proceeds (including overallotment): US$ 514.88m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- TD SYNNEX Corp / United States of America - High Technology / Listing Exchange: New York / Ticker: SNX / Gross proceeds (including overallotment): US$ 501.98m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Inc, RBC Capital Markets, Wells Fargo Securities LLC, HSBC Securities (USA) Inc, BNP Paribas Securities Corp, MUFG Securities Americas Inc, Mizuho Securities USA LLC, BofA Securities Inc, Barclays Capital Inc, Apollo Global Securities LLC

- Tellurian Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: TELL / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Pliant Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PLRX / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets LLC, JP Morgan Securities LLC, Piper Sandler & Co

- Ares Capital Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ARCC / Gross proceeds (including overallotment): US$ 227.37m (offering in U.S. Dollar) / Bookrunners: Raymond James & Associates Inc, Keefe Bruyette & Woods Inc, Wells Fargo Securities LLC, RBC Capital Markets LLC, Morgan Stanley & Co LLC, BofA Securities Inc, UBS Securities LLC

- Ellington Financial Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: EFC / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- NexGen Energy Ltd / Canada - Materials / Listing Exchange: Toronto / Ticker: NXE / Gross proceeds (including overallotment): US$ 185.98m (offering in Canadian Dollar) / Bookrunners: Not Applicable

- Pacific Biosciences of California Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PACB / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Cowen & Co, Goldman Sachs & Co, Morgan Stanley & Co

- Geron Corp / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: GERN / Gross proceeds (including overallotment): US$ 166.62m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Stifel Nicolaus & Co Inc

- Cactus Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: WHD / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, JP Morgan Securities LLC, Tudor Pickering Holt & Co LLC, BofA Securities Inc, Barclays Capital Inc, Piper Sandler & Co

- Pear Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PEAR / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Expro Group Holdings Nv / United States of America - Energy and Power / Listing Exchange: New York / Ticker: EXPRO / Gross proceeds (including overallotment): US$ 132.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Fulcrum Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: FULC / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Piper Sandler & Co, SVB Securities LLC

- Deciphera Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: DCPH / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Cowen & Co, Jefferies LLC, JP Morgan Securities LLC

- bluebird bio Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: BLUE / Gross proceeds (including overallotment): US$ 120.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

SECONDARIES RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- Huatai Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601688 / Gross proceeds (including overallotment): US$ 3,290.67m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Power Construction Corp Of China Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601669 / Gross proceeds (including overallotment): US$ 1,942.24m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Huatai United Securities Co Ltd

- Poly Developments & Holdings Group Co Ltd / China - Real Estate / Listing Exchange: Shanghai / Ticker: 600048 / Gross proceeds (including overallotment): US$ 1,667.34m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China Eastern Airlines Corp Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 600115 / Gross proceeds (including overallotment): US$ 1,436.27m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Haitong Securities Co Ltd, Shenwan Hongyuan Securities Un, J.P. Morgan Securities (China) Co Ltd

- Air China Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 753 / Gross proceeds (including overallotment): US$ 1,374.12m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd

- Zheshang Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601878 / Gross proceeds (including overallotment): US$ 944.82m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Air China Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 753 / Gross proceeds (including overallotment): US$ 795.55m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd

- Lotte Chemical Corp / South Korea - Energy and Power / Listing Exchange: Korea / Ticker: 011170 / Gross proceeds (including overallotment): US$ 791.30m (offering in Korean Won) / Bookrunners: Samsung Securities Co Ltd, Yuanta Securities Korea Co Ltd, NH Investment & Securities Co, KBI Securities Co Ltd, Mirae Asset Securities Co Ltd, Hana Securities Co Ltd, Shinhan Securities Co Ltd

- Huatai Securities Co Ltd / China - Financials / Listing Exchange: Hong Kong / Ticker: 601688 / Gross proceeds (including overallotment): US$ 768.95m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Sichuan Road & Bridge Co Ltd / China - Industrials / Listing Exchange: Swiss Exch / Ticker: 600039 / Gross proceeds (including overallotment): US$ 741.29m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China Eastern Airlines Corp Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 600115 / Gross proceeds (including overallotment): US$ 718.13m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Haitong Securities Co Ltd, Shenwan Hongyuan Securities Un, J.P. Morgan Securities (China) Co Ltd

- Qingdao Sentury Tire Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 002984 / Gross proceeds (including overallotment): US$ 579.95m (offering in Chinese Yuan) / Bookrunners: Not Applicable