Equities

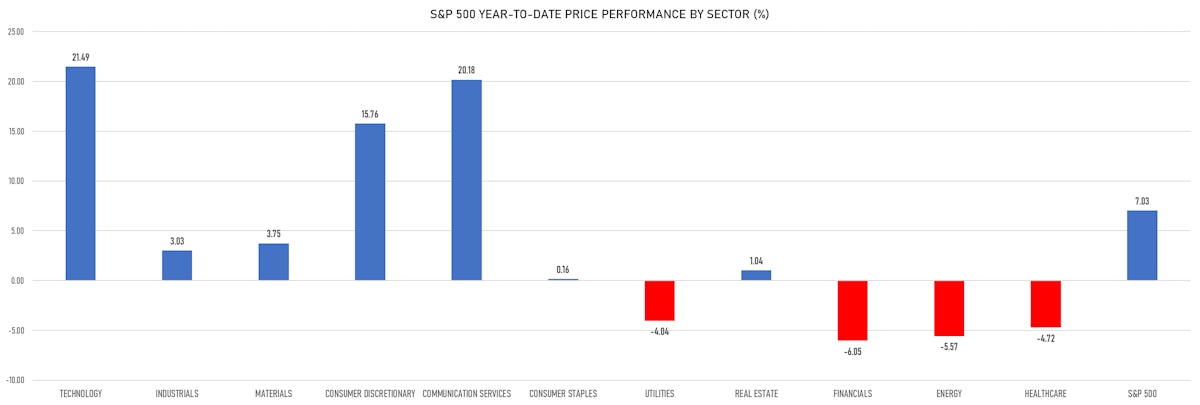

US Equities End Week Broadly Higher After A Good Squeeze; NDX Now Up 20.5% YTD, Best Quarter Since 2Q20

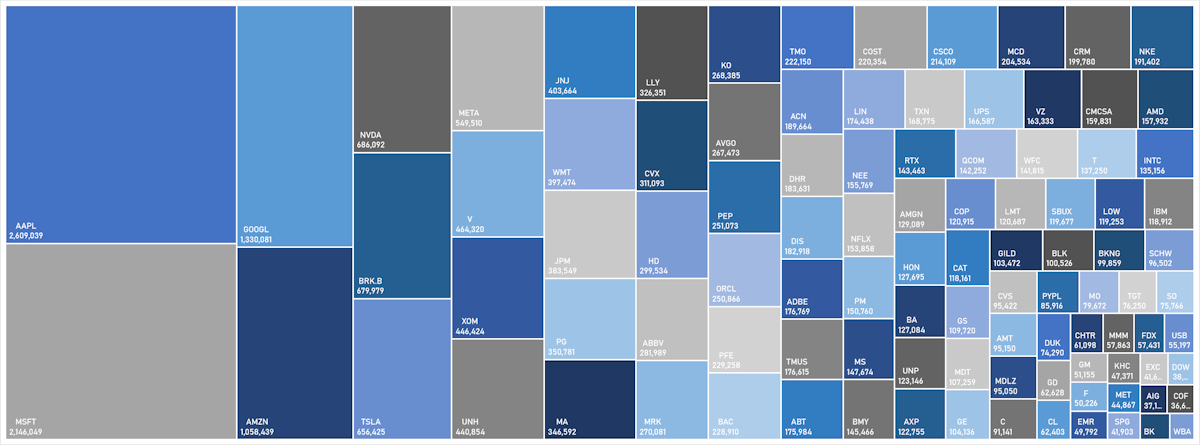

Despite the dispersion of returns across sectors recently, only 6 names (Microsoft, Apple, Nvidia, Google, Amazon, Meta) added up to 84% of the S&P 500's net market cap change this month ($1.1tn)

Published ET

S&P 100 Constituents Market Caps (US$ bn) | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 1.44%; Nasdaq Composite up 1.74%; Wilshire 5000 up 1.08%

- 93.8% of S&P 500 stocks were up today, with 55.3% of stocks above their 200-day moving average (DMA) and 48.7% above their 50-DMA

- Top performing sectors in the S&P 500: consumer discretionary up 2.62% and real estate up 2.18%

- Bottom performing sectors in the S&P 500: energy up 0.63% and utilities up 0.76%

- The number of shares in the S&P 500 traded today was 805m for a total turnover of US$ 81 bn

- The S&P 500 Value Index Index was up 1.4%, while the S&P 500 Growth Index Index was up 1.5%; the S&P small caps index was up 2.0% and mid caps were up 1.8%

- The volume on CME's INX (S&P 500 Index) was 2516.7m (3-month z-score: -0.1); the 3-month average volume is 2557.9m and the 12-month range is 903.0 - 5761.3m

- Daily performance of international indices: Europe Stoxx 600 up 0.66%; UK FTSE 100 up 0.15%; Hang Seng SH-SZ-HK 300 Index up 0.43%; Japan's TOPIX 500 up 1.05%

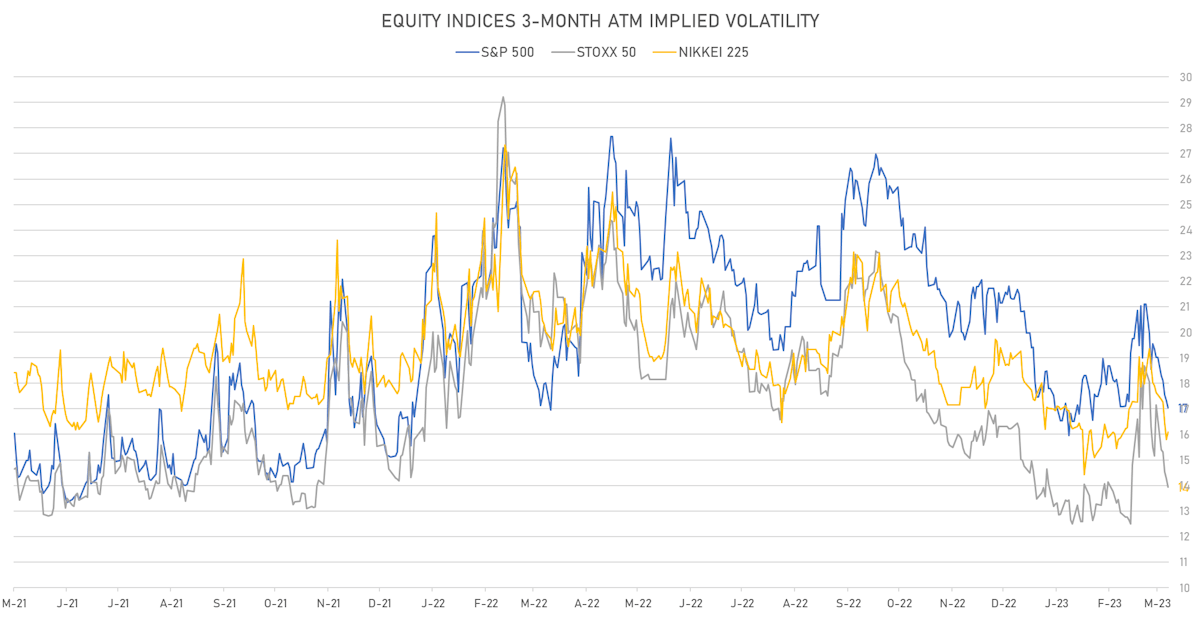

VOLATILITY TODAY

- 3-month at-the-money implied volatility on the S&P 500 at 17.1%, down from 17.3%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 14.2%, down from 14.5%

TOP WINNERS TODAY

- United Homes Group Inc (UHG), up 64.0% to $20.80 / YTD price return: +107.0% / 12-Month Price Range: $ 9.78-28.50

- Burford Capital Ltd (BUR), up 53.2% to $11.06 / YTD price return: +35.7% / 12-Month Price Range: $ 6.09-11.20 / Short interest (% of float): 0.4%; days to cover: 1.9

- SoundHound AI Inc (SOUN), up 40.1% to $2.76 / YTD price return: +55.9% / 12-Month Price Range: $ 0.93-18.14 / Short interest (% of float): 6.7%; days to cover: 0.4

- Metropolitan Bank Holding Corp (MCB), up 33.6% to $33.89 / YTD price return: -42.2% / 12-Month Price Range: $ 13.98-104.84 / Short interest (% of float): 5.7%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Orchestra Biomed Holdings Inc (OBIO), up 26.4% to $19.57 / YTD price return: +96.1% / 12-Month Price Range: $ 7.49-19.57 / Short interest (% of float): 0.4%; days to cover: 2.0

- BigBear.ai Holdings Inc (BBAI), up 23.2% to $2.44 / YTD price return: +262.2% / 12-Month Price Range: $ 0.58-16.12 / Short interest (% of float): 19.6%; days to cover: 0.4

- Inozyme Pharma Inc (INZY), up 22.2% to $5.73 / YTD price return: +445.7% / 12-Month Price Range: $ 0.99-6.25 / Short interest (% of float): 4.1%; days to cover: 0.7

- C3.ai Inc (AI), up 21.5% to $33.57 / YTD price return: +200.0% / 12-Month Price Range: $ 10.16-33.57 / Short interest (% of float): 25.5%; days to cover: 0.8

- IONQ Inc (IONQ), up 21.1% to $6.15 / YTD price return: +78.3% / 12-Month Price Range: $ 3.04-13.76 / Short interest (% of float): 10.7%; days to cover: 5.4

- Nexters Inc (GDEV), up 19.0% to $6.79 / YTD price return: +6.3% / 12-Month Price Range: $ 3.10-6.79 / Short interest (% of float): 1.1%

BIGGEST LOSERS TODAY

- Gorilla Technology Group Inc (GRRR), down 59.3% to $4.80 / YTD price return: -40.8% / 12-Month Price Range: $ 2.62-51.00 / Short interest (% of float): 0.3%; days to cover: 5.4 (the stock is currently on the short sale restriction list)

- AST SpaceMobile Inc (ASTS), down 20.9% to $5.08 / YTD price return: +5.4% / 12-Month Price Range: $ 3.55-14.27 / Short interest (% of float): 24.0%; days to cover: 8.2 (the stock is currently on the short sale restriction list)

- Cano Health Inc (CANO), down 19.5% to $.91 / YTD price return: -33.6% / 12-Month Price Range: $ .91-9.75 / Short interest (% of float): 16.1%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- IGM Biosciences Inc (IGMS), down 19.3% to $13.74 / YTD price return: -19.2% / 12-Month Price Range: $ 12.67-28.41 / Short interest (% of float): 20.6%; days to cover: 23.8 (the stock is currently on the short sale restriction list)

- Target Hospitality Corp (TH), down 14.7% to $13.14 / YTD price return: -13.2% / 12-Month Price Range: $ 4.85-18.48 / Short interest (% of float): 20.4%; days to cover: 11.0 (the stock is currently on the short sale restriction list)

- Nikola Corp (NKLA), down 13.6% to $1.21 / YTD price return: -44.0% / 12-Month Price Range: $ 1.21-11.14 / Short interest (% of float): 28.2%; days to cover: 8.3 (the stock is currently on the short sale restriction list)

- Arco Platform Ltd (ARCE), down 11.5% to $10.96 / YTD price return: -18.8% / 12-Month Price Range: $ 7.85-22.74 / Short interest (% of float): 5.8%; days to cover: 29.8 (the stock is currently on the short sale restriction list)

- Genelux Corp (GNLX), down 9.8% to $27.74 / 12-Month Price Range: $ 5.35-39.27 / Short interest (% of float): 0.4%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Home Point Capital Inc (HMPT), down 9.4% to $1.93 / YTD price return: +40.9% / 12-Month Price Range: $ .99-4.65 / Short interest (% of float): 1.9%; days to cover: 8.5 (the stock is currently on the short sale restriction list)

- Lanzatech Global Inc (LNZA), down 8.9% to $3.88 / YTD price return: -61.1% / 12-Month Price Range: $ 2.92-10.80 / Short interest (% of float): 0.0%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

TOP S&P 500 PERFORMERS THIS WEEK

- Caesars Entertainment Inc (CZR), up 15.1% to $48.81 / YTD price return: +17.3% / 12-Month Price Range: $ 31.31-80.87 / Short interest (% of float): 3.2%; days to cover: 2.1

- McCormick & Company Inc (MKC), up 14.2% to $83.21 / YTD price return: +.4% / 12-Month Price Range: $ 70.62-105.15 / Short interest (% of float): 2.8%; days to cover: 5.2

- First Republic Bank (FRC), up 13.2% to $13.99 / YTD price return: -88.5% / 12-Month Price Range: $ 11.52-171.02 / Short interest (% of float): 5.0%; days to cover: 0.6

- VF Corp (VFC), up 12.9% to $22.91 / YTD price return: -17.0% / 12-Month Price Range: $ 20.03-58.82 / Short interest (% of float): 4.0%; days to cover: 1.3

- Paycom Software Inc (PAYC), up 11.9% to $304.01 / YTD price return: -2.0% / 12-Month Price Range: $ 256.04-402.63 / Short interest (% of float): 2.3%; days to cover: 2.1

- Hewlett Packard Enterprise Co (HPE), up 11.9% to $15.93 / YTD price return: -.2% / 12-Month Price Range: $ 11.91-17.25 / Short interest (% of float): 2.2%; days to cover: 2.1

- Intel Corp (INTC), up 11.3% to $32.67 / YTD price return: +23.6% / 12-Month Price Range: $ 24.59-51.25 / Short interest (% of float): 2.0%; days to cover: 1.7

- Carmax Inc (KMX), up 11.2% to $64.28 / YTD price return: +5.6% / 12-Month Price Range: $ 52.87-106.23 / Short interest (% of float): 14.7%; days to cover: 11.6

- Delta Air Lines Inc (DAL), up 10.5% to $34.92 / YTD price return: +6.3% / 12-Month Price Range: $ 27.21-46.27 / Short interest (% of float): 3.1%; days to cover: 2.3

- Paramount Global (PARA), up 10.3% to $22.31 / YTD price return: +32.2% / 12-Month Price Range: $ 15.29-38.19 / Short interest (% of float): 15.6%; days to cover: 7.6

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Match Group Inc (MTCH), down 4.5% to $38.39 / YTD price return: -7.5% / 12-Month Price Range: $ 34.63-114.05 / Short interest (% of float): 4.0%; days to cover: 2.4

- Humana Inc (HUM), down 3.4% to $485.46 / YTD price return: -5.2% / 12-Month Price Range: $ 410.87-571.30 / Short interest (% of float): 1.5%; days to cover: 1.8

- Generac Holdings Inc (GNRC), down 2.9% to $108.01 / YTD price return: +7.3% / 12-Month Price Range: $ 86.33-328.60 / Short interest (% of float): 8.8%; days to cover: 3.8

- Citizens Financial Group Inc (CFG), down 2.3% to $30.37 / YTD price return: -22.9% / 12-Month Price Range: $ 28.82-47.03 / Short interest (% of float): 2.1%; days to cover: 1.9

- Alphabet Inc (GOOG), down 1.9% to $104.00 / YTD price return: +17.2% / 12-Month Price Range: $ 83.46-144.04 / Short interest (% of float): 0.6%; days to cover: 0.9

- Cigna Group (CI), down 1.8% to $255.53 / YTD price return: -22.9% / 12-Month Price Range: $ 239.50-340.11 / Short interest (% of float): 0.9%; days to cover: 1.6

- Charles Schwab Corp (SCHW), down 1.7% to $52.38 / YTD price return: -37.1% / 12-Month Price Range: $ 45.00-88.80 / Short interest (% of float): 0.9%; days to cover: 0.7

- Alphabet Inc (GOOGL), down 1.6% to $103.73 / YTD price return: +17.6% / 12-Month Price Range: $ 83.34-143.71 / Short interest (% of float): 0.7%; days to cover: 1.0

- Micron Technology Inc (MU), down 1.3% to $60.34 / YTD price return: +20.7% / 12-Month Price Range: $ 48.43-79.95 / Short interest (% of float): 1.9%; days to cover: 1.7

- Centene Corp (CNC), down 1.3% to $63.21 / YTD price return: -22.9% / 12-Month Price Range: $ 61.71-98.52 / Short interest (% of float): 1.2%; days to cover: 1.6

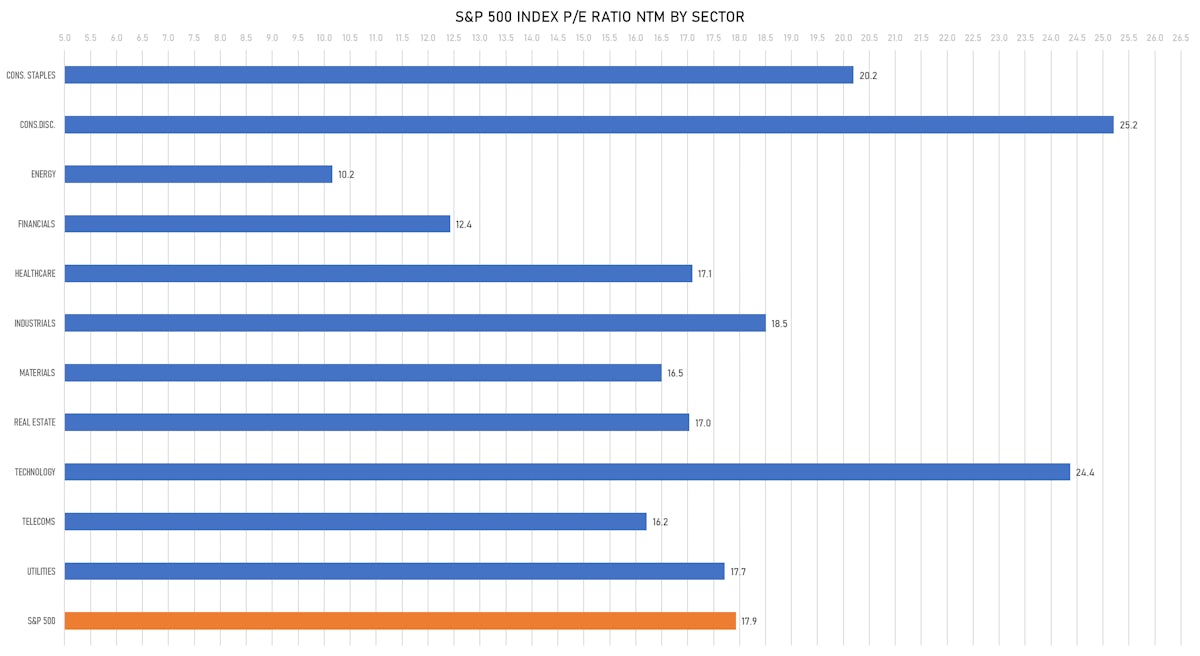

VALUATION MULTIPLES BY SECTORS

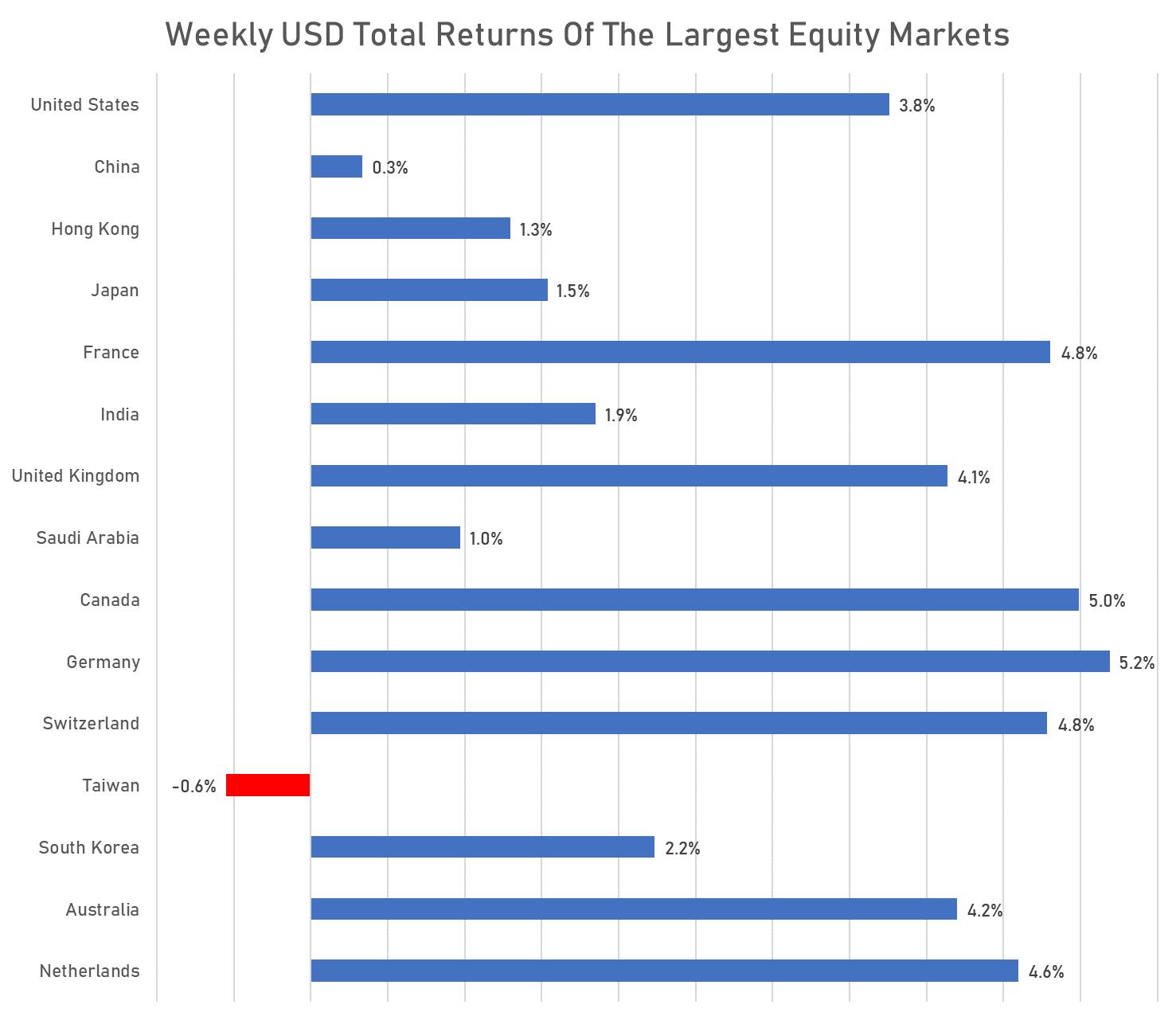

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

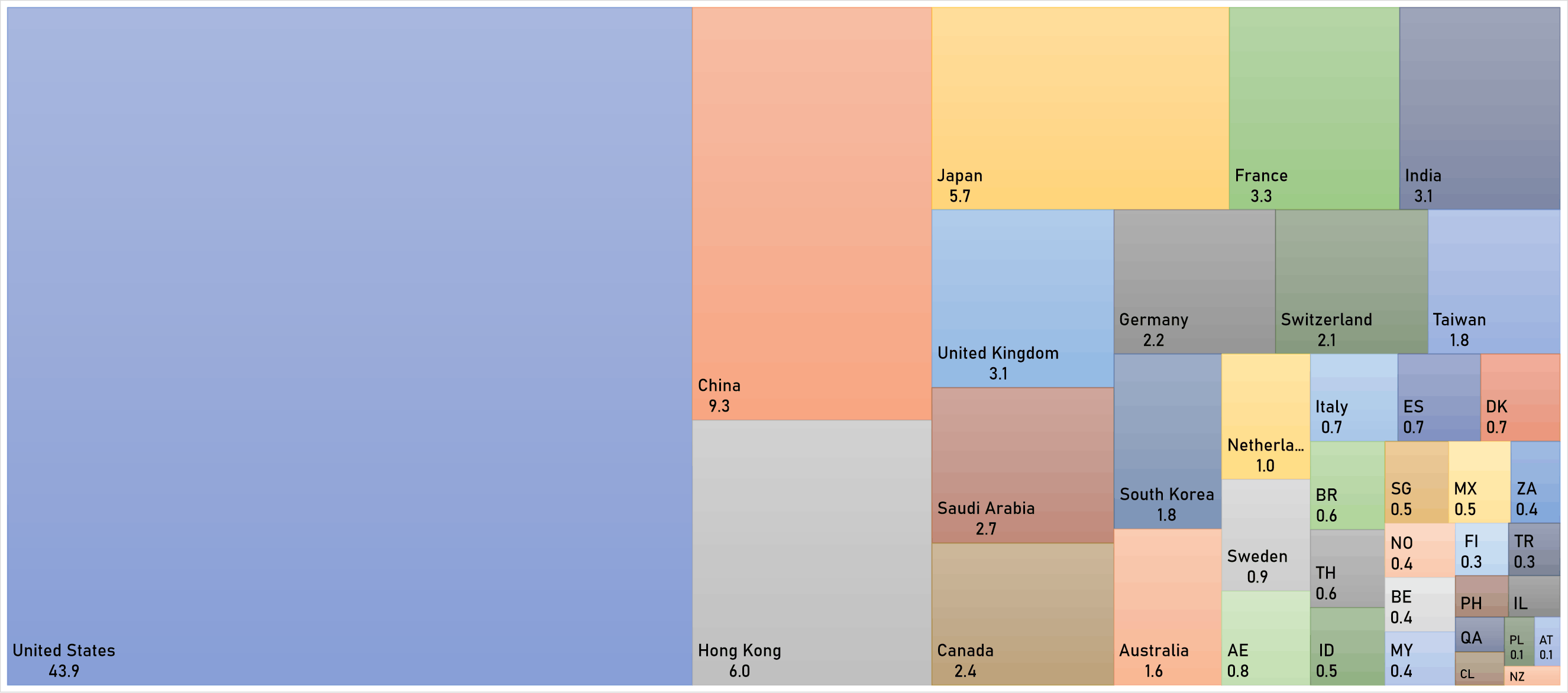

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Atlas Energy Solutions Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: AESI / Gross proceeds (including overallotment): US$ 324.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, RBC Capital Markets LLC, BofA Securities Inc, Barclays Capital Inc, Piper Sandler & Co

- Lithium Royalty Corp / Canada - Financials / Listing Exchange: Toronto / Ticker: LIRC / Gross proceeds (including overallotment): US$ 108.67m (offering in Canadian Dollar) / Bookrunners: Canaccord Genuity Corp, Citigroup Global Markets Canada Inc

IPOs RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- ADNOC Gas PLC / United Arab Emirates - Energy and Power / Listing Exchange: Abu Dhabi / Ticker: ADNOC / Gross proceeds (including overallotment): US$ 2,080.17m (offering in Utd. Arab Em. Dirham) / Bookrunners: Deutsche Bank AG (London), Abu Dhabi Commercial Bank PJSC, BNP Paribas SA, Arqaam Capital Ltd, EFG-Hermes UAE Ltd, HSBC Bank Middle East Ltd, First Abu Dhabi Bank PJSC, International Securities LLC

- JINGDONG Industrials Inc / China - Retail / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs (Asia), Merrill Lynch (Asia Pacific) Ltd, Haitong International Securities Co Ltd, UBS AG-Hong Kong Branch

- Beijing Chusudu Technology Co Ltd / China - High Technology / Listing Exchange: - / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Beijing Ziroom Information Technology Co Ltd / China - High Technology / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Lalatech Holdings Ltd / Hong Kong - Industrials / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities (Asia) Ltd (Hong Kong), Goldman Sachs (Asia), Merrill Lynch (Asia Pacific) Ltd

- PT Trimegah Bangun Persada / Indonesia - Materials / Listing Exchange: Indonesia / Ticker: N/A / Gross proceeds (including overallotment): US$ 972.52m (offering in U.S. Dollar) / Bookrunners: Credit Suisse, Citibank AG, DBS Securities Indonesia, OCBC Capital Markets, BNP Paribas SA, PT Mandiri Sekuritas, UOB Kay Hian Securities PT

- Shaanxi Energy Investment Co Ltd / China - Energy and Power / Listing Exchange: Shenzhen / Ticker: 001286 / Gross proceeds (including overallotment): US$ 732.20m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd, Western Securities

- Rakuten Bank Ltd / Japan - Financials / Listing Exchange: TOKPR / Ticker: 5838 / Gross proceeds (including overallotment): US$ 463.21m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd, SMBC Nikko Securities Inc

- Presight AI Holding PLC / United Arab Emirates - High Technology / Listing Exchange: Abu Dhabi / Ticker: PRESI / Gross proceeds (including overallotment): US$ 434.68m (offering in Utd. Arab Em. Dirham) / Bookrunners: Dubai Islamic Bank PJSC

- Deepblue Technology (Shanghai) Co Ltd / China - Consumer Products and Services / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar)

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Digital Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: DLR / Gross proceeds (including overallotment): US$ 1,500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- SVB Financial Group / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SIVB / Gross proceeds (including overallotment): US$ 1,250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Americold Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: COLD / Gross proceeds (including overallotment): US$ 900.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Shoals Technologies Group Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: SHLS / Gross proceeds (including overallotment): US$ 605.19m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- National Health Investors Inc / United States of America - Real Estate / Listing Exchange: NYSE MKT / Ticker: NHI / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Summit Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SUMM / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- NextEra Energy Partners LP / United States of America - Energy and Power / Listing Exchange: NYSE MKT / Ticker: NEP / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Alight Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: ALIT / Gross proceeds (including overallotment): US$ 414.00m (offering in U.S. Dollar) / Bookrunners: DA Davidson & Co Inc, Needham & Co LLC, Wedbush Securities, Inc., Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC, KeyBanc Capital Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, BofA Securities Inc

- Ares Acquisition Corp II / United States of America - Financials / Listing Exchange: NYSE MKT / Ticker: - / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, CastleOak Securities LP, UBS Securities LLC

- Karuna Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: KRTX / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Stifel Nicolaus & Co Inc, Guggenheim Securities LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Option Care Health Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: BIOS / Gross proceeds (including overallotment): US$ 399.75m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- DoubleVerify Holdings Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: DV / Gross proceeds (including overallotment): US$ 331.25m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, Barclays Capital Inc

- Guggenheim Strategic Opportunities Fund / United States of America - Financials / Listing Exchange: New York / Ticker: GOF / Gross proceeds (including overallotment): US$ 330.03m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- 89bio Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ETNB / Gross proceeds (including overallotment): US$ 316.25m (offering in U.S. Dollar) / Bookrunners: Raymond James & Associates Inc, Evercore Group, RBC Capital Markets, BofA Securities Inc, SVB Securities LLC

- Bumble Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: BMBL / Gross proceeds (including overallotment): US$ 313.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- Ormat Technologies Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: ORA / Gross proceeds (including overallotment): US$ 304.20m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Permian Resources Corp / United States of America - Energy and Power / Listing Exchange: New York / Ticker: PR / Gross proceeds (including overallotment): US$ 302.50m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Wells Fargo Securities LLC, JP Morgan Securities LLC, Truist Securities Inc

- Bed Bath & Beyond Inc / United States of America - Retail / Listing Exchange: Nasdaq / Ticker: BBBY / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Sunstone Hotel Investors Inc / United States of America - Real Estate / Listing Exchange: NYSE MKT / Ticker: SHO / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Revolution Medicines Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RVMD / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Guggenheim Securities LLC, JP Morgan Securities LLC, UBS Securities LLC, SVB Securities LLC

SECONDARIES RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- Japan Post Bank Co Ltd / Japan - Financials / Listing Exchange: TOKPR / Ticker: 7182 / Gross proceeds (including overallotment): US$ 7,398.46m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Postal Savings Bank of China Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 1658 / Gross proceeds (including overallotment): US$ 6,540.51m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, China Securities Co Ltd, China Post Securities

- Link Real Estate Investment Trust / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: 823 / Gross proceeds (including overallotment): US$ 2,397.89m (offering in Hong Kong Dollar) / Bookrunners: DBS Asia Capital Ltd, Hongkong & Shanghai Banking Corp Ltd, JP Morgan Securities Plc

- London Stock Exchange Group PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: LSEG / Gross proceeds (including overallotment): US$ 2,370.77m (offering in British Pound) / Bookrunners: Deutsche Bank AG (London), Barclays Bank PLC, Goldman Sachs International, Jefferies International Ltd, TD Securities Inc, HSBC Bank PLC, BNP Paribas SA, Mizuho International PLC, Citigroup Global Markets Ltd, Credit Suisse International, BMO Capital Markets, Morgan Stanley & Co. International plc, Banco Santander SA, UBS AG London, JP Morgan Securities Plc, RBC Europe Ltd, BofA Securities Inc

- Japan Post Bank Co Ltd / Japan - Financials / Listing Exchange: TOKPR / Ticker: 7182 / Gross proceeds (including overallotment): US$ 1,849.62m (offering in Japanese Yen) / Bookrunners: Nomura International PLC, Goldman Sachs International, Merrill Lynch International Ltd, Citigroup Global Markets Ltd, Morgan Stanley & Co. International plc, Daiwa Capital Markets Europe Ltd, JP Morgan Securities Plc

- China Petroleum & Chemical Corp / China - Materials / Listing Exchange: ShenzChNxt / Ticker: 0386 / Gross proceeds (including overallotment): US$ 1,743.33m (offering in Chinese Yuan)

- BNP Paribas SA / France - Financials / Listing Exchange: Euro Paris / Ticker: BNP / Gross proceeds (including overallotment): US$ 1,539.26m (offering in EURO) / Bookrunners: Goldman Sachs & Co, Merrill Lynch International Ltd

- AerCap Holdings NV / Republic of Ireland - Industrials / Listing Exchange: New York / Ticker: AER / Gross proceeds (including overallotment): US$ 1,345.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Societe Generale SA, Evercore Group, BNP Paribas SA, Citigroup Global Markets Inc, Credit Agricole Corporate & Investment Bank, SMBC Nikko Securities Inc, HSBC Securities (USA) Inc, Morgan Stanley & Co LLC

- Siemens Energy AG / Germany - Energy and Power / Listing Exchange: Xetra / Ticker: ENR / Gross proceeds (including overallotment): US$ 1,330.92m (offering in EURO) / Bookrunners: Societe Generale SA, HSBC Holdings PLC (United Kingdom), Citi, UniCredit Bank AG

- Taiwan Cement Corp / Taiwan - Materials / Listing Exchange: Taiwan / Ticker: 1101 / Gross proceeds (including overallotment): US$ 1,231.33m (offering in Taiwanese Dollar) / Bookrunners: Not Applicable

- Bank VTB PAO / Russian Federation - Financials / Listing Exchange: MICEX-RTS / Ticker: VTBR / Gross proceeds (including overallotment): US$ 1,203.49m (offering in Russian Rouble) / Bookrunners: Not Applicable

- Seazen Holdings Co Ltd / China - Real Estate / Listing Exchange: Shanghai / Ticker: 601155 / Gross proceeds (including overallotment): US$ 1,168.65m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- EDP Renovaveis SA / Spain - Energy and Power / Listing Exchange: Euronxt L / Ticker: EDPR / Gross proceeds (including overallotment): US$ 903.72m (offering in EURO) / Bookrunners: Citigroup Global Markets Europe AG, Goldman Sachs Bank Europe SE, Morgan Stanley Europe SE, JP Morgan SE

- Beijer Ref AB / Sweden - Industrials / Listing Exchange: OMX Stock / Ticker: BEIJ B / Gross proceeds (including overallotment): US$ 876.20m (offering in Swedish Krona) / Bookrunners: Handelsbanken Capital Markets, Nordea, Citi

- BNP Paribas SA / France - Financials / Listing Exchange: Euro Paris / Ticker: BNP / Gross proceeds (including overallotment): US$ 769.63m (offering in EURO) / Bookrunners: BNP Paribas SA

- Sendas Distribuidora SA / Brazil - Consumer Staples / Listing Exchange: New York / Ticker: ASAI3 / Gross proceeds (including overallotment): US$ 768.60m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC, Bradesco BBI, Itau BBA USA Securities Inc, JP Morgan Securities LLC, BTG Pactual Us Capital LLC, Safra Securities LLC, UBS Securities LLC

- Zhejiang Dahua Technology Co Ltd / China - High Technology / Listing Exchange: Shenzhen / Ticker: 002236 / Gross proceeds (including overallotment): US$ 765.68m (offering in Chinese Yuan) / Bookrunners: Guosen Securities Co Ltd

- Sunwoda Electronic Co Ltd / China - Energy and Power / Listing Exchange: ShenzChNxt / Ticker: 300207 / Gross proceeds (including overallotment): US$ 690.69m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Adani Enterprises Ltd / India - Materials / Listing Exchange: National / Ticker: ADANIE / Gross proceeds (including overallotment): US$ 663.05m (offering in Indian Rupee) / Bookrunners: Jefferies India Pvt Ltd

- Adani Ports & Special Economic Zone Ltd / India - Industrials / Listing Exchange: National / Ticker: ADANIP / Gross proceeds (including overallotment): US$ 641.45m (offering in Indian Rupee) / Bookrunners: Jefferies India Pvt Ltd