Equities

Winning Week For US Equities, With Large Banks Like Citi And JPM Beating EPS Estimates On Strong NII

Rerisking is definitely here, with Europe and EM seeing healthy inflows this week, but net length in US equity portfolios remains muted (hedge funds long/short ratios at multi-year lows)

Published ET

JP Morgan stock price | Source: Refinitiv

DAILY SUMMARY

- Daily performance of US indices: S&P 500 down -0.21%; Nasdaq Composite down -0.35%; Wilshire 5000 down -0.06%

- 33.4% of S&P 500 stocks were up today, with 56.7% of stocks above their 200-day moving average (DMA) and 53.1% above their 50-DMA

- Top performing sectors in the S&P 500: financials up 1.05% and communication services up 0.31%

- Bottom performing sectors in the S&P 500: real estate down -1.68% and utilities down -1.11%

- The number of shares in the S&P 500 traded today was 566m for a total turnover of US$ 54 bn

- The S&P 500 Value Index Index was down -0.1%, while the S&P 500 Growth Index Index was down -0.3%; the S&P small caps index was down -0.8% and mid caps were down -0.6%

- The volume on CME's INX (S&P 500 Index) was 2077.0m (3-month z-score: -0.8); the 3-month average volume is 2549.0m and the 12-month range is 903.0 - 5761.3m

- Daily performance of international indices: Europe Stoxx 600 up 0.58%; UK FTSE 100 up 0.36%; Hang Seng SH-SZ-HK 300 Index up 0.34%; Japan's TOPIX 500 up 0.54%

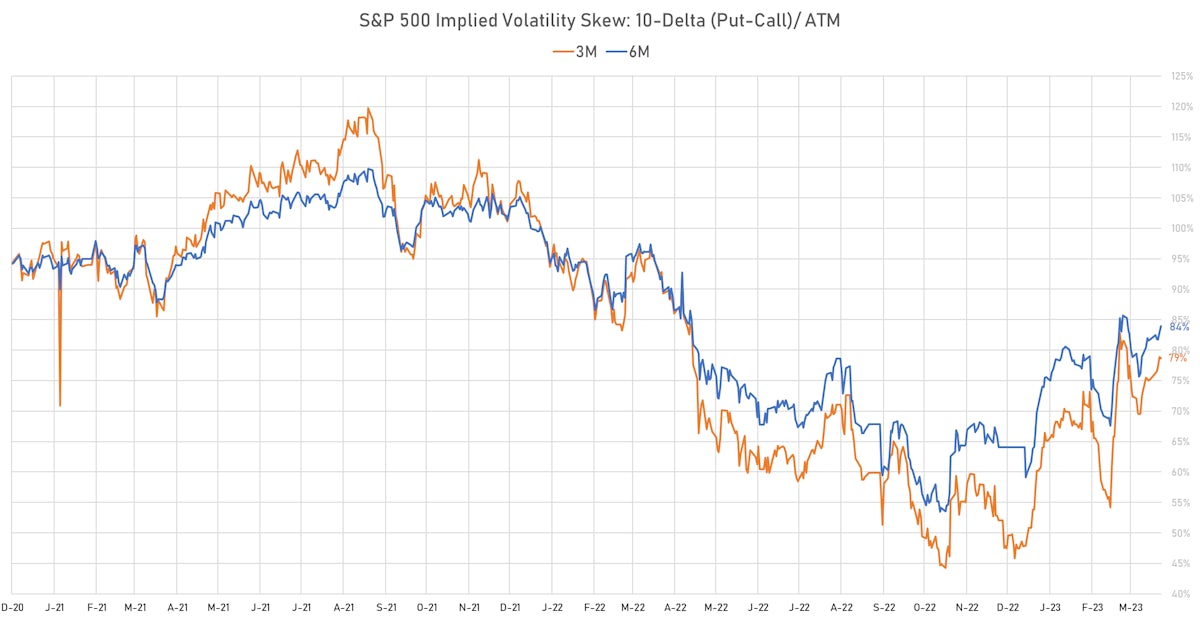

VOLATILITY TODAY

- 3-month at-the-money implied volatility on the S&P 500 at 13.5%, down from 14.4%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 11.0%, down from 11.2%

TOP WINNERS TODAY

- Near Intelligence Inc (NIR), up 100.0% to $5.97 / YTD price return: -41.7% / 12-Month Price Range: $ 2.18-18.65

- Nurix Therapeutics Inc (NRIX), up 20.6% to $12.22 / YTD price return: +11.3% / 12-Month Price Range: $ 7.52-19.91 / Short interest (% of float): 10.7%; days to cover: 13.1

- Fiscalnote Holdings Inc (NOTE), up 20.5% to $2.70 / YTD price return: -57.3% / 12-Month Price Range: $ 1.31-12.30 / Short interest (% of float): 4.8%; days to cover: 1.8

BIGGEST LOSERS TODAY

- Apollomics Inc (MMAT), down 14.1% to $.23 / YTD price return: -42.8% / 12-Month Price Range: $ .23-2.34 / Short interest (% of float): 11.5%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Hillevax Inc (VCSA), down 6.9% to $.81 / YTD price return: -21.0% / 12-Month Price Range: $ .81-7.85 / Short interest (% of float): 7.5%; days to cover: 6.2

- SIGNA Sports United NV (LNZA), down 2.9% to $3.43 / YTD price return: -30.8% / 12-Month Price Range: $ 2.92-10.80 / Short days to cover: 0.4

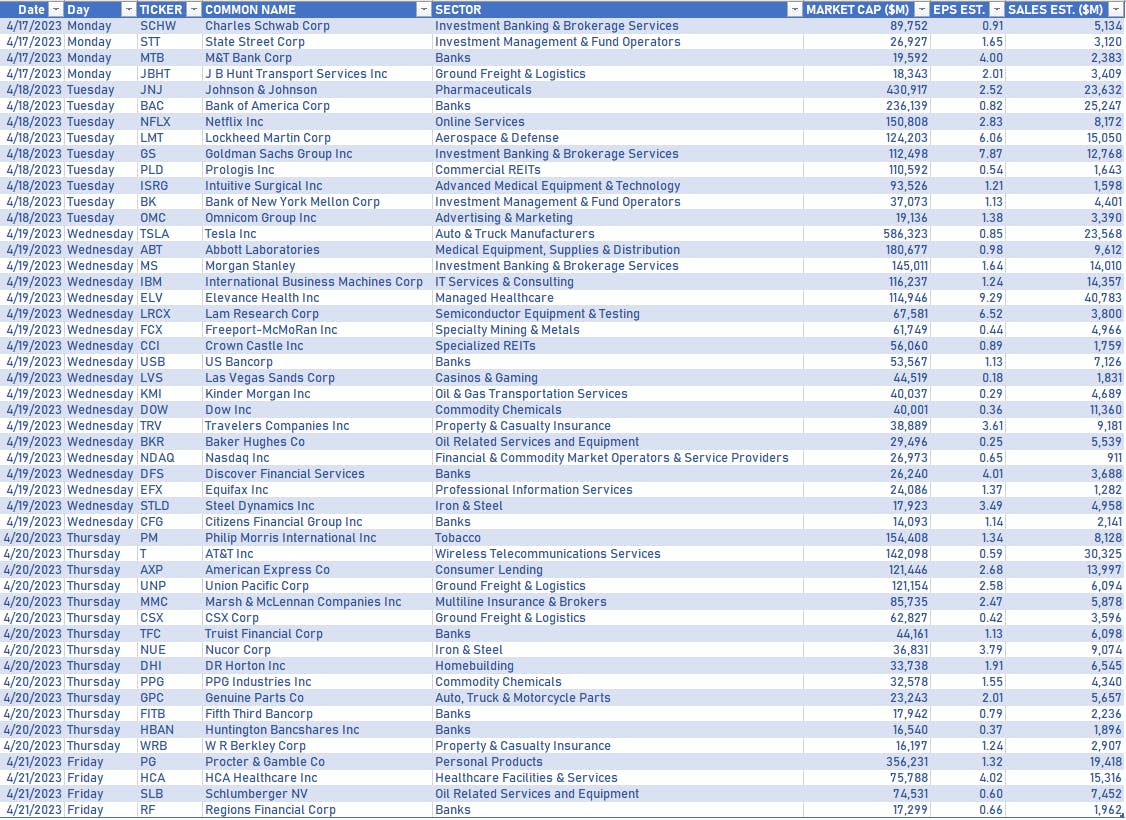

NOTABLE EARNINGS IN THE WEEK AHEAD

TOP S&P 500 PERFORMERS THIS WEEK

- Bio-Techne Corp (TECH), up 12.7% to $85.24 / YTD price return: +2.8% / 12-Month Price Range: $ 68.30-106.91 / Short interest (% of float): 1.5%; days to cover: 2.8

- Pioneer Natural Resources Co (PXD), up 10.5% to $230.00 / YTD price return: +.7% / 12-Month Price Range: $ 177.37-288.32 / Short interest (% of float): 2.0%; days to cover: 1.4

- Enphase Energy Inc (ENPH), up 9.4% to $208.90 / YTD price return: -21.2% / 12-Month Price Range: $ 128.68-339.88 / Short interest (% of float): 4.5%; days to cover: 1.7

- JPMorgan Chase & Co (JPM), up 8.8% to $138.73 / YTD price return: +3.5% / 12-Month Price Range: $ 101.32-144.32 / Short interest (% of float): 0.6%; days to cover: 0.9

- Citigroup Inc (C), up 8.1% to $49.56 / YTD price return: +9.6% / 12-Month Price Range: $ 40.01-54.56 / Short interest (% of float): 1.9%; days to cover: 1.6

- Carmax Inc (KMX), up 8.0% to $69.46 / YTD price return: +14.1% / 12-Month Price Range: $ 52.87-106.23 / Short interest (% of float): 14.7%; days to cover: 10.3

- CF Industries Holdings Inc (CF), up 7.9% to $77.08 / YTD price return: -9.5% / 12-Month Price Range: $ 67.99-119.57 / Short interest (% of float): 2.5%; days to cover: 1.6

- Mosaic Co (MOS), up 7.6% to $46.99 / YTD price return: +7.7% / 12-Month Price Range: $ 41.17-78.83 / Short interest (% of float): 3.1%; days to cover: 2.2

- Molson Coors Beverage Co (TAP), up 7.5% to $56.06 / YTD price return: +8.8% / 12-Month Price Range: $ 46.69-60.11 / Short interest (% of float): 3.9%; days to cover: 3.8

- Solaredge Technologies Inc (SEDG), up 7.2% to $300.46 / YTD price return: +6.1% / 12-Month Price Range: $ 190.15-375.14 / Short interest (% of float): 5.1%; days to cover: 2.6

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Catalent Inc (CTLT), down 28.7% to $46.32 / YTD price return: +2.9% / 12-Month Price Range: $ 40.70-115.26 / Short interest (% of float): 3.7%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- DISH Network Corp (DISH), down 10.6% to $7.84 / YTD price return: -44.2% / 12-Month Price Range: $ 7.84-33.72 / Short interest (% of float): 19.4%; days to cover: 5.5

- Warner Bros Discovery Inc (WBD), down 8.8% to $13.78 / YTD price return: +45.4% / 12-Month Price Range: $ 8.83-26.57 / Short interest (% of float): 3.2%; days to cover: 4.0

- American Airlines Group Inc (AAL), down 8.7% to $12.79 / YTD price return: +.6% / 12-Month Price Range: $ 11.66-21.42 / Short interest (% of float): 9.2%; days to cover: 2.9

- Progressive Corp (PGR), down 7.8% to $135.85 / YTD price return: +4.7% / 12-Month Price Range: $ 106.43-149.86 / Short interest (% of float): 0.6%; days to cover: 1.3

- Public Storage (PSA), down 6.6% to $290.35 / YTD price return: +3.6% / 12-Month Price Range: $ 270.15-405.30 / Short interest (% of float): 3.0%; days to cover: 4.1

- First Republic Bank (FRC), down 6.5% to $13.12 / YTD price return: -89.2% / 12-Month Price Range: $ 11.52-171.02 / Short interest (% of float): 30.1%; days to cover: 0.9

- Ball Corp (BALL), down 4.9% to $50.03 / YTD price return: -2.2% / 12-Month Price Range: $ 46.01-89.87 / Short interest (% of float): 5.7%; days to cover: 10.5

- Sysco Corp (SYY), down 4.9% to $73.48 / YTD price return: -3.9% / 12-Month Price Range: $ 70.61-91.51 / Short interest (% of float): 2.3%; days to cover: 5.4

- Newmont Corporation (NEM), down 4.9% to $49.52 / YTD price return: +4.9% / 12-Month Price Range: $ 37.45-86.37 / Short interest (% of float): 2.3%; days to cover: 2.1

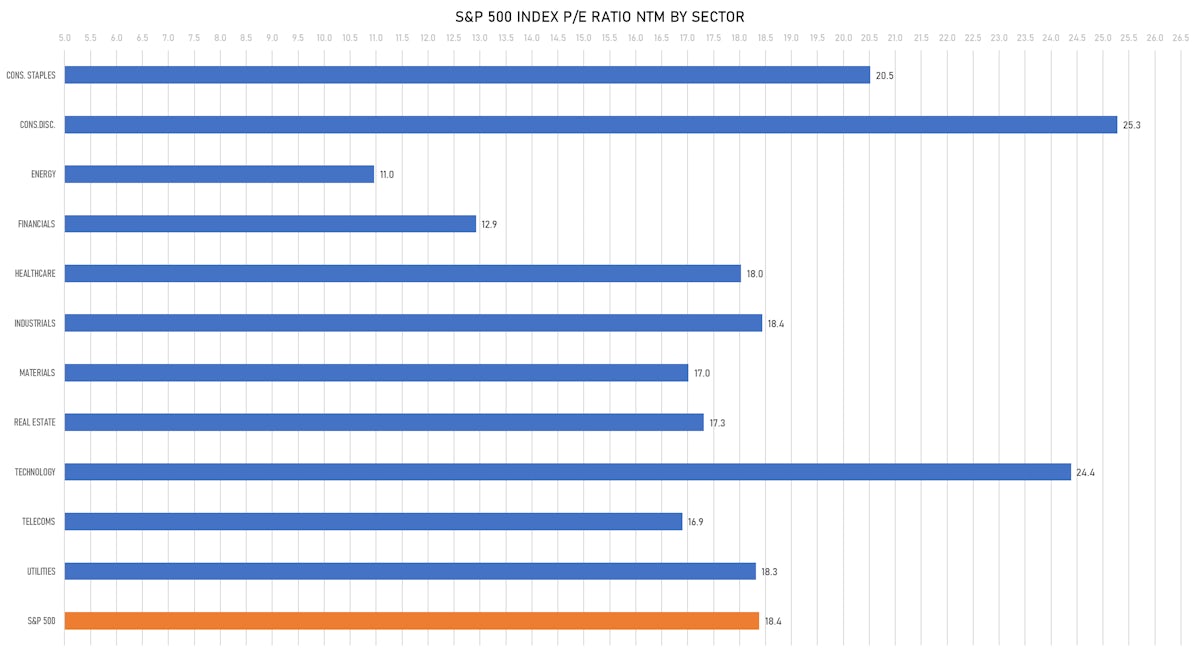

VALUATION MULTIPLES BY SECTORS

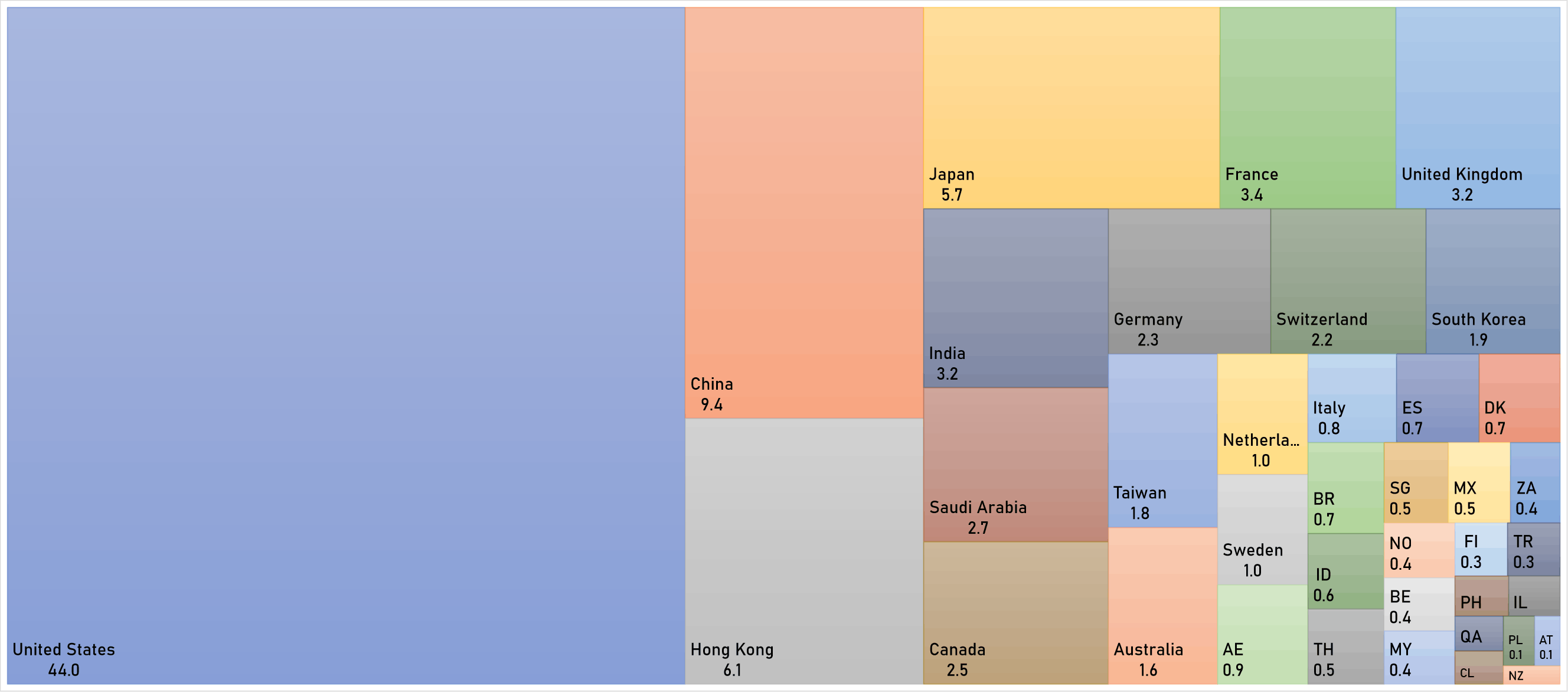

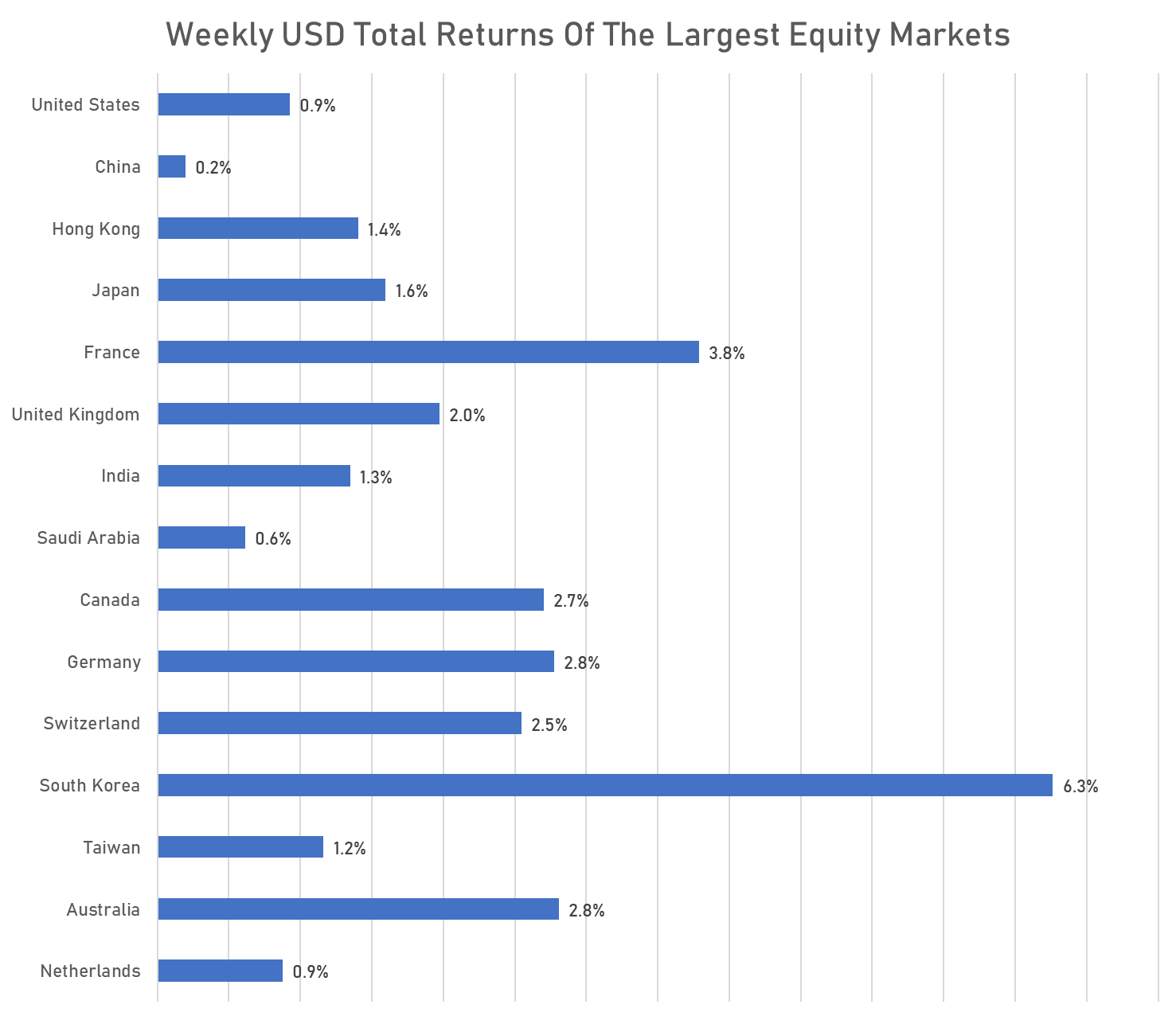

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

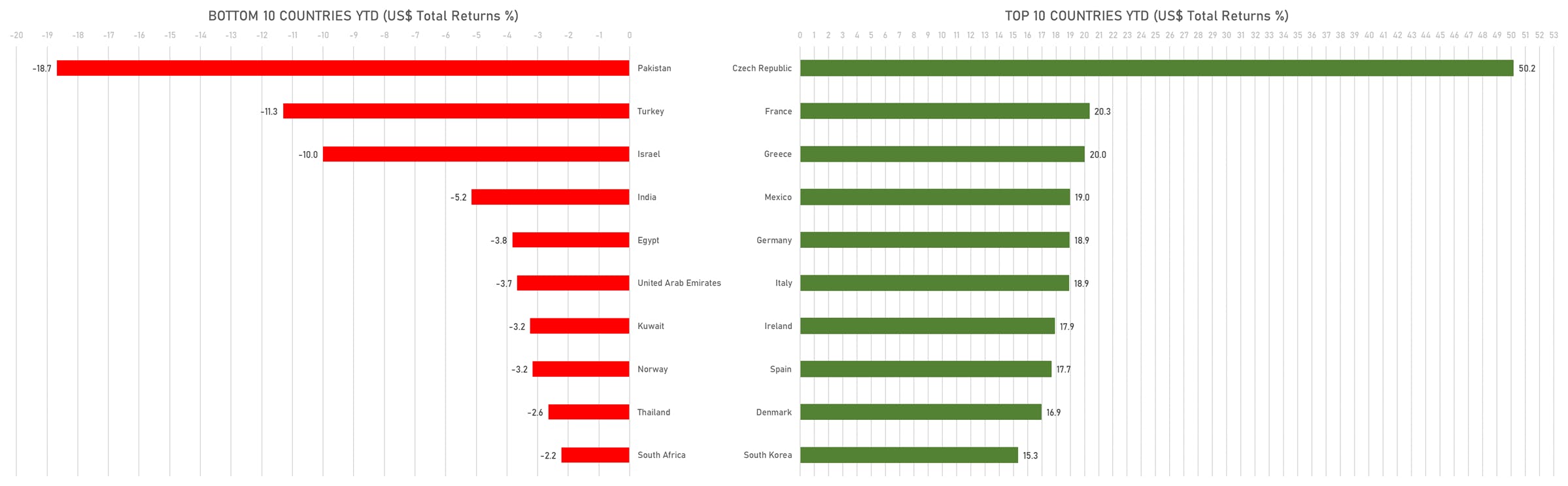

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

WORLD MARKET CAPITALIZATION (US$ Trillion)