Equities

US Equities Continue To Trade Sideways, Caught Between Solid Economic Data And Regional Banking Crisis

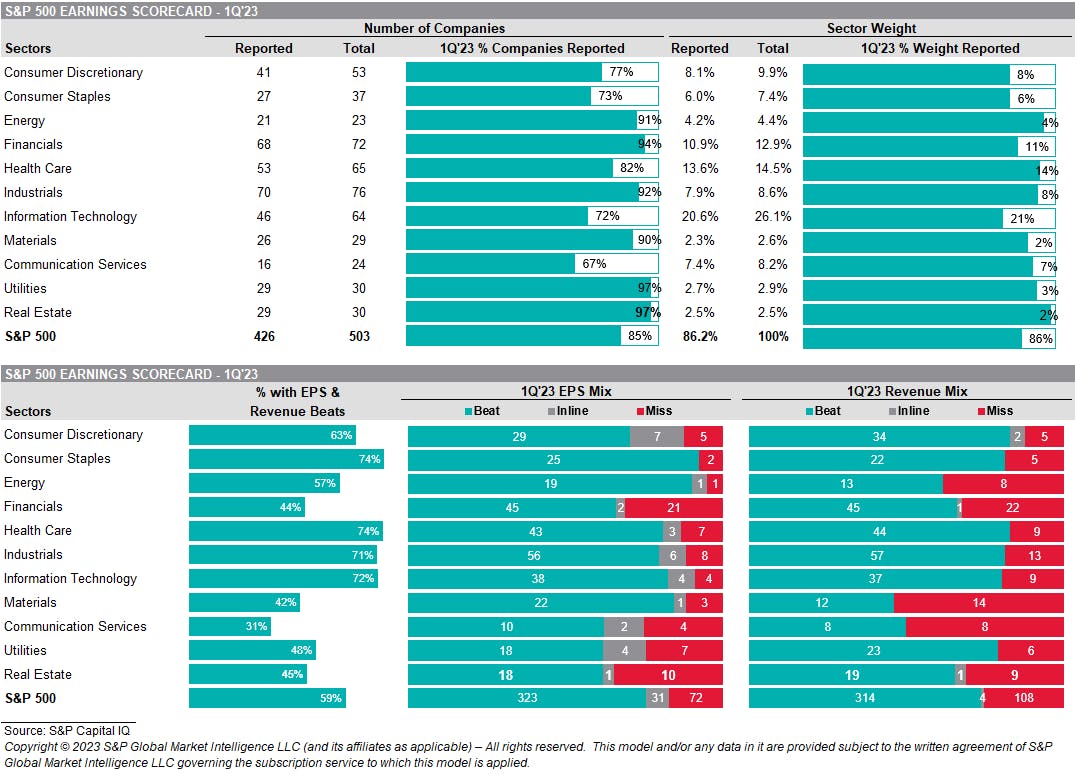

85% of the S&P 500 market cap has now reported 1Q23: the blended revenue growth rate stands at 3.9% and EPS growth rate at -2.2% (vs -6.7% expected) according to FactSet's latest Earnings Insight report

Published ET

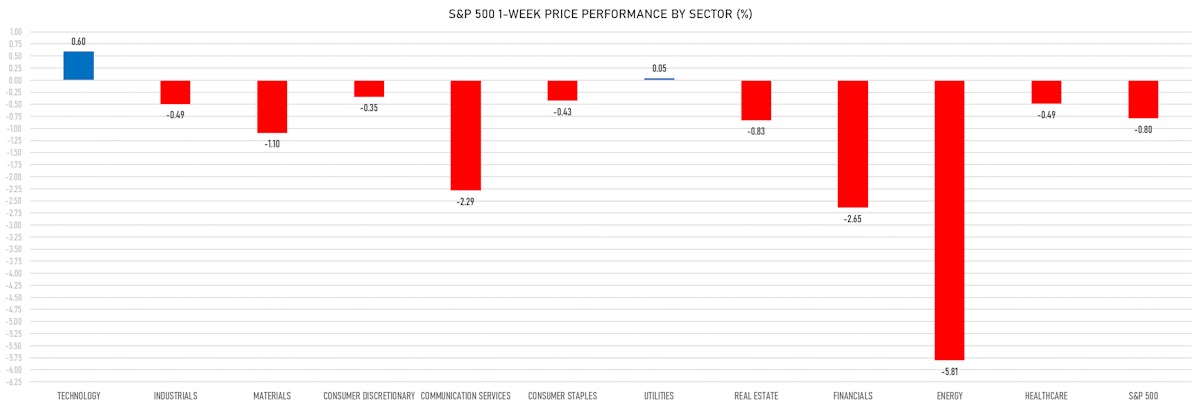

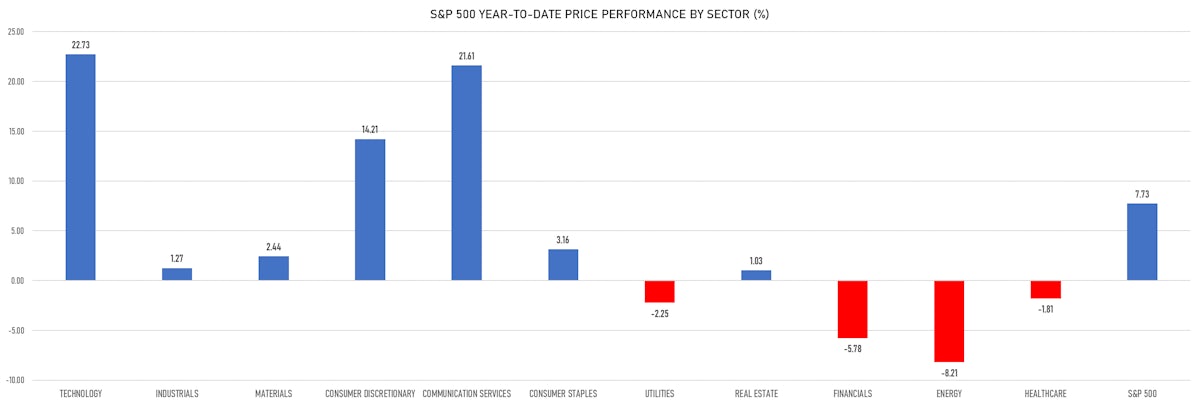

S&P 500 YTD Price performance by sector | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 1.85%; Nasdaq Composite up 2.25%; Wilshire 5000 up 1.45%

- 90.9% of S&P 500 stocks were up today, with 48.3% of stocks above their 200-day moving average (DMA) and 51.5% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 2.75% and technology up 2.71%

- Bottom performing sectors in the S&P 500: utilities up 0.66% and consumer staples up 0.89%

- The number of shares in the S&P 500 traded today was 662m for a total turnover of US$ 62 bn

- The S&P 500 Value Index Index was up 1.6%, while the S&P 500 Growth Index Index was up 2.1%; the S&P small caps index was up 2.4% and mid caps were up 2.4%

- The volume on CME's INX (S&P 500 Index) was 2470.2m (3-month z-score: -0.1); the 3-month average volume is 2527.2m and the 12-month range is 903.0 - 5761.3m

- Daily performance of international indices: Europe Stoxx 600 up 1.08%; UK FTSE 100 up 0.98%; Hang Seng SH-SZ-HK 300 Index up 0.11%; Japan's TOPIX 500 down -0.12%

VOLATILITY TODAY

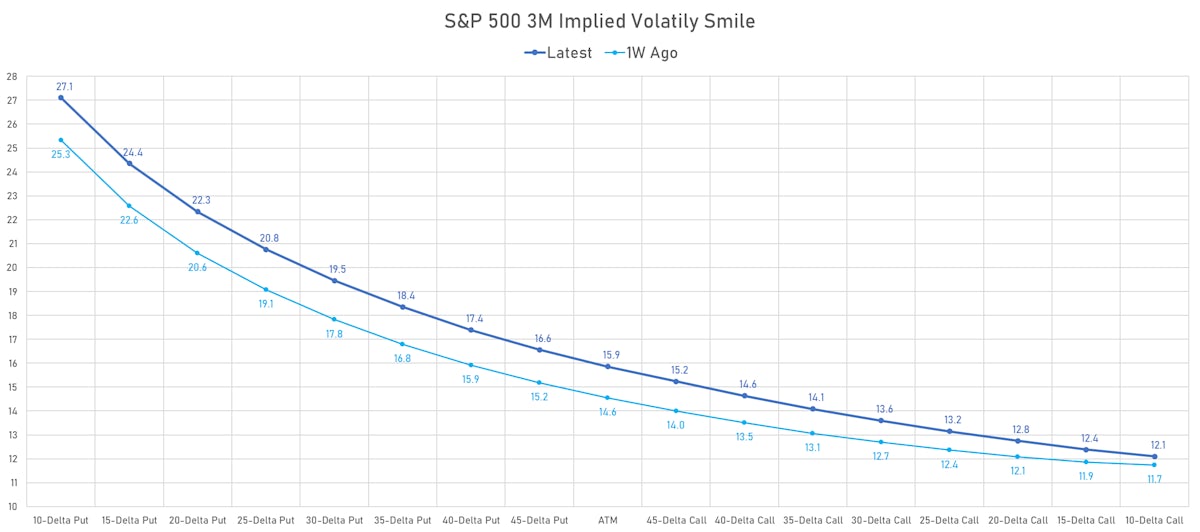

- 3-month at-the-money implied volatility on the S&P 500 at 14.4%, down from 16.8%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 12.0%, down from 14.0%

TOP WINNERS TODAY

- PacWest Bancorp (PACW), up 81.7% to $5.76 / YTD price return: -74.9% / 12-Month Price Range: $ 2.48-34.21 / Short interest (% of float): 17.8%; days to cover: 0.9

- Western Alliance Bancorp (WAL), up 49.2% to $27.16 / YTD price return: -54.4% / 12-Month Price Range: $ 7.46-86.87 / Short interest (% of float): 7.3%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Immunitybio Inc (IBRX), up 43.2% to $5.54 / YTD price return: +9.3% / 12-Month Price Range: $ 1.21-7.80 / Short interest (% of float): 24.5%; days to cover: 5.2

- nLIGHT Inc (LASR), up 38.1% to $12.75 / YTD price return: +25.7% / 12-Month Price Range: $ 8.22-14.40 / Short interest (% of float): 2.4%; days to cover: 3.0

- Owens & Minor Inc (OMI), up 37.5% to $18.63 / YTD price return: -4.6% / 12-Month Price Range: $ 11.79-39.92 / Short interest (% of float): 7.7%; days to cover: 5.4

- Redfin Corp (RDFN), up 33.2% to $9.43 / YTD price return: +122.4% / 12-Month Price Range: $ 3.08-13.03

- Opendoor Technologies Inc (OPEN), up 32.6% to $1.79 / YTD price return: +54.3% / 12-Month Price Range: $ 0.92-8.08 / Short interest (% of float): 11.0%; days to cover: 2.6

- Fubotv Inc (FUBO), up 31.3% to $1.47 / YTD price return: -15.5% / 12-Month Price Range: $ 0.96-8.14 / Short interest (% of float): 15.3%; days to cover: 3.1

- B Riley Financial Inc (RILY), up 30.6% to $36.69 / YTD price return: +7.3% / 12-Month Price Range: $ 24.95-59.09

- Lilium NV (LILM), up 30.1% to $0.82 / YTD price return: -28.3% / 12-Month Price Range: $ 0.37-3.41 / Short interest (% of float): 7.1%; days to cover: 4.3

BIGGEST LOSERS TODAY

- TOP Financial Group Ltd (TOP), down 37.1% to $10.99 / YTD price return: +125.2% / 12-Month Price Range: $ 3.50-256.44 / Short interest (% of float): 6.3%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Air Transport Services Group Inc (ATSG), down 24.8% to $14.93 / YTD price return: -42.5% / 12-Month Price Range: $ 14.93-34.00 / Short interest (% of float): 2.3%; days to cover: 3.7 (the stock is currently on the short sale restriction list)

- Grid Dynamics Holdings Inc (GDYN), down 20.0% to $9.04 / YTD price return: -19.5% / 12-Month Price Range: $ 9.04-24.27 (the stock is currently on the short sale restriction list)

- Trupanion Inc (TRUP), down 19.7% to $28.88 / YTD price return: -39.2% / 12-Month Price Range: $ 28.88-82.49 / Short interest (% of float): 24.4%; days to cover: 10.9 (the stock is currently on the short sale restriction list)

- Lyft Inc (LYFT), down 19.3% to $8.63 / YTD price return: -21.7% / 12-Month Price Range: $ 8.19-22.82 (the stock is currently on the short sale restriction list)

- AlTi Global, Inc (ALTI), down 18.0% to $5.19 / YTD price return: -52.4% / 12-Month Price Range: $ 5.19-28.49 / Short interest (% of float): 1.5%; days to cover: 2.6 (the stock is currently on the short sale restriction list)

- Qurate Retail Inc (QRTEB), down 17.7% to $5.90 / YTD price return: +16.4% / 12-Month Price Range: $ 3.04-21.93 / Short interest (% of float): 0.9%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Telephone and Data Systems Inc (TDS), down 17.1% to $7.93 / YTD price return: -24.4% / 12-Month Price Range: $ 7.93-19.60 / Short interest (% of float): 4.4%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Bio Rad Laboratories Inc (BIO), down 16.7% to $385.24 / YTD price return: -8.4% / 12-Month Price Range: $ 344.63-572.70 (the stock is currently on the short sale restriction list)

- Clearfield Inc (CLFD), down 16.3% to $35.27 / YTD price return: -62.5% / 12-Month Price Range: $ 35.27-134.90 / Short interest (% of float): 16.5%; days to cover: 5.3 (the stock is currently on the short sale restriction list)

S&P 500 1Q23 EARNINGS DASHBOARD

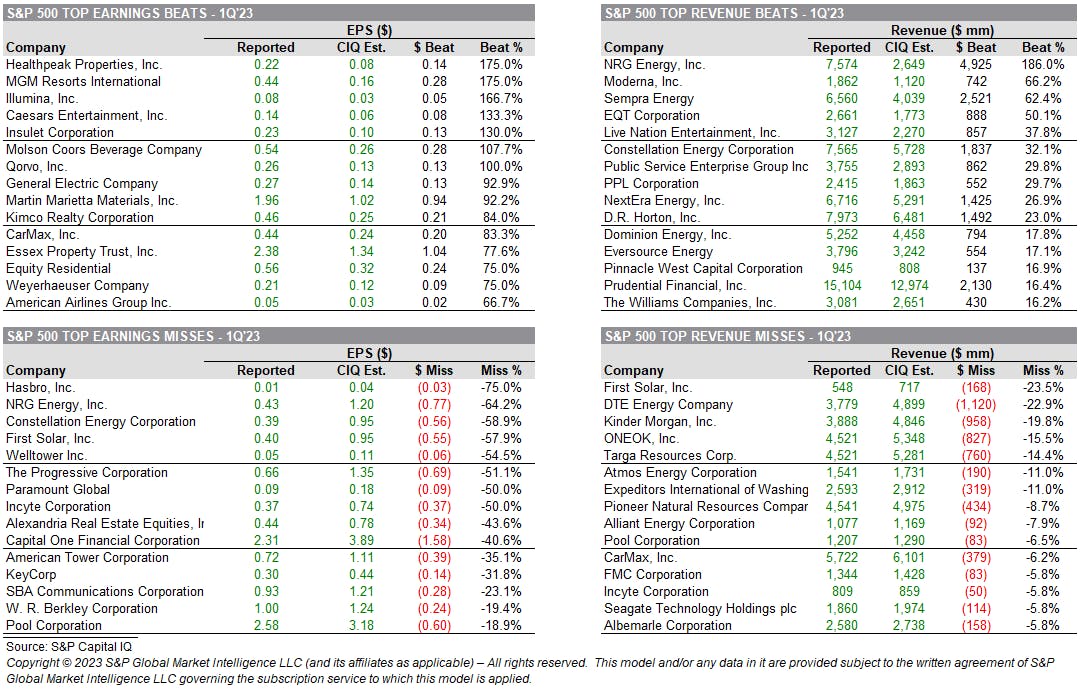

S&P 500 1Q23 EARNINGS: TOP BEATS & MISSES

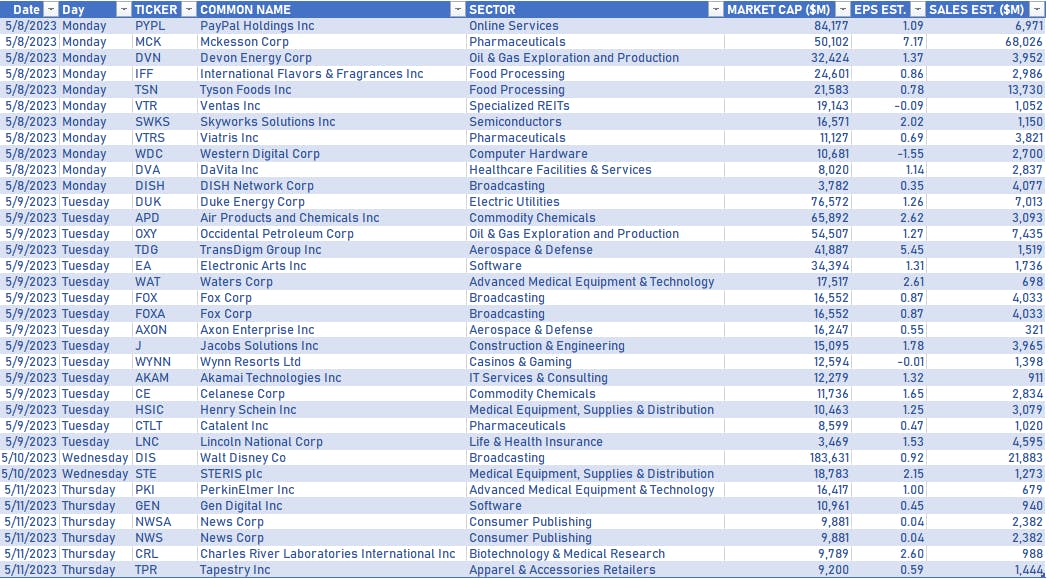

NOTABLE US COMPANIES REPORTING EARNINGS NEXT WEEK

TOP S&P 500 PERFORMERS THIS WEEK

- Royal Caribbean Cruises Ltd (RCL), up 15.6% to $75.61 / YTD price return: +53.0% / 12-Month Price Range: $ 31.09-78.97 / Short interest (% of float): 8.0%; days to cover: 5.0

- Live Nation Entertainment Inc (LYV), up 13.8% to $77.16 / YTD price return: +10.6% / 12-Month Price Range: $ 64.25-99.62 / Short interest (% of float): 7.5%; days to cover: 6.9

- ON Semiconductor Corp (ON), up 12.9% to $81.22 / YTD price return: +30.2% / 12-Month Price Range: $ 44.77-87.52 / Short interest (% of float): 6.0%; days to cover: 4.2

- Generac Holdings Inc (GNRC), up 11.7% to $114.18 / YTD price return: +13.4% / 12-Month Price Range: $ 86.33-299.85 / Short interest (% of float): 7.4%; days to cover: 4.0

- Vulcan Materials Co (VMC), up 10.5% to $193.57 / YTD price return: +10.5% / 12-Month Price Range: $ 137.55-197.72 / Short interest (% of float): 1.1%; days to cover: 1.8

- Ball Corp (BALL), up 10.2% to $58.60 / YTD price return: +14.6% / 12-Month Price Range: $ 46.01-81.79 / Short interest (% of float): 5.8%; days to cover: 11.4

- Host Hotels & Resorts Inc (HST), up 9.8% to $17.76 / YTD price return: +10.7% / 12-Month Price Range: $ 14.51-21.33 / Short interest (% of float): 5.0%; days to cover: 4.9

- Martin Marietta Materials Inc (MLM), up 9.5% to $397.66 / YTD price return: +17.7% / 12-Month Price Range: $ 285.42-397.66 / Short interest (% of float): 1.4%; days to cover: 2.3

- Molson Coors Beverage Co (TAP), up 9.1% to $64.89 / YTD price return: +26.0% / 12-Month Price Range: $ 46.69-66.62 / Short interest (% of float): 3.5%; days to cover: 3.5

- Carnival Corp (CCL), up 8.7% to $10.01 / YTD price return: +24.2% / 12-Month Price Range: $ 6.12-17.54 / Short interest (% of float): 12.9%; days to cover: 3.2

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Paramount Global (PARA), down 27.7% to $16.86 / YTD price return: -.1% / 12-Month Price Range: $ 15.29-34.50 / Short interest (% of float): 16.9%; days to cover: 9.4

- Estee Lauder Companies Inc (EL), down 17.5% to $203.54 / YTD price return: -18.0% / 12-Month Price Range: $ 186.54-284.27 / Short interest (% of float): 1.2%; days to cover: 2.3

- Newell Brands Inc (NWL), down 16.8% to $10.11 / YTD price return: -22.7% / 12-Month Price Range: $ 9.76-24.70 / Short interest (% of float): 6.5%; days to cover: 5.7

- Comerica Inc (CMA), down 16.0% to $36.44 / YTD price return: -45.5% / 12-Month Price Range: $ 28.40-87.01 / Short interest (% of float): 7.5%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Zions Bancorporation NA (ZION), down 14.7% to $23.76 / YTD price return: -51.7% / 12-Month Price Range: $ 18.26-59.74 / Short interest (% of float): 9.5%; days to cover: 2.0

- Citizens Financial Group Inc (CFG), down 14.5% to $26.44 / YTD price return: -32.8% / 12-Month Price Range: $ 23.38-44.82 / Short interest (% of float): 3.8%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Bio Rad Laboratories Inc (BIO), down 14.5% to $385.24 / YTD price return: -8.4% / 12-Month Price Range: $ 344.63-570.54 / Short interest (% of float): 1.3%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Epam Systems Inc (EPAM), down 14.2% to $242.47 / YTD price return: -26.0% / 12-Month Price Range: $ 242.47-462.72 / Short interest (% of float): 1.6%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Arista Networks Inc (ANET), down 13.8% to $137.98 / YTD price return: +13.7% / 12-Month Price Range: $ 89.13-171.43 / Short interest (% of float): 1.4%; days to cover: 1.2

- Leidos Holdings Inc (LDOS), down 13.3% to $80.83 / YTD price return: -23.2% / 12-Month Price Range: $ 78.58-110.86 / Short interest (% of float): 1.4%; days to cover: 2.0

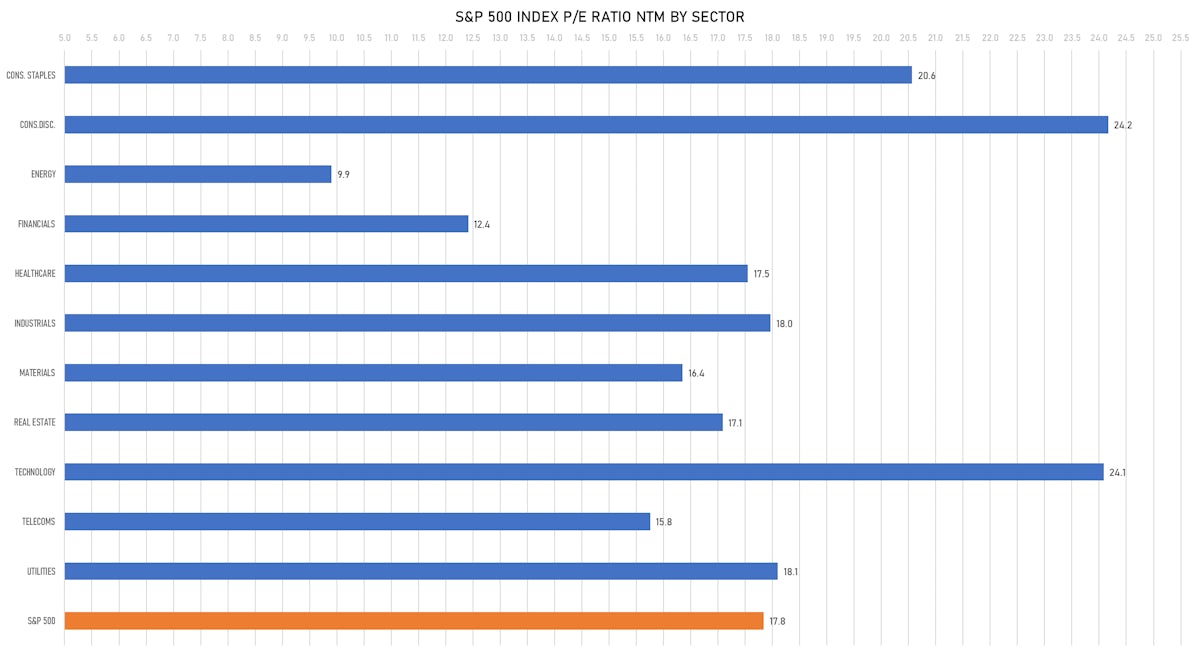

VALUATION MULTIPLES BY SECTORS

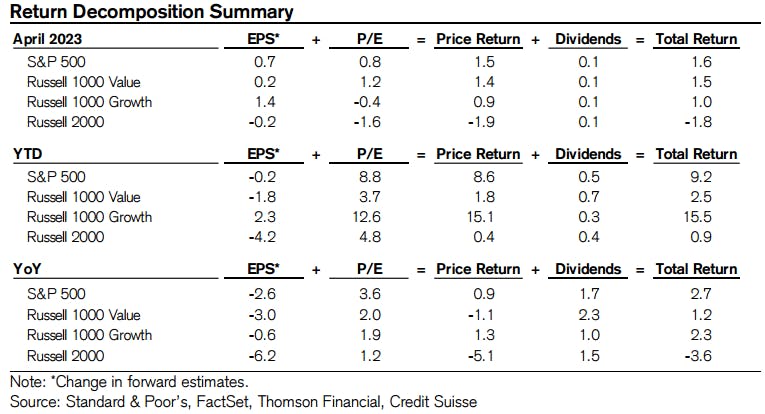

US EQUITIES YTD PERFORMANCE DRIVEN BY P/E EXPANSION

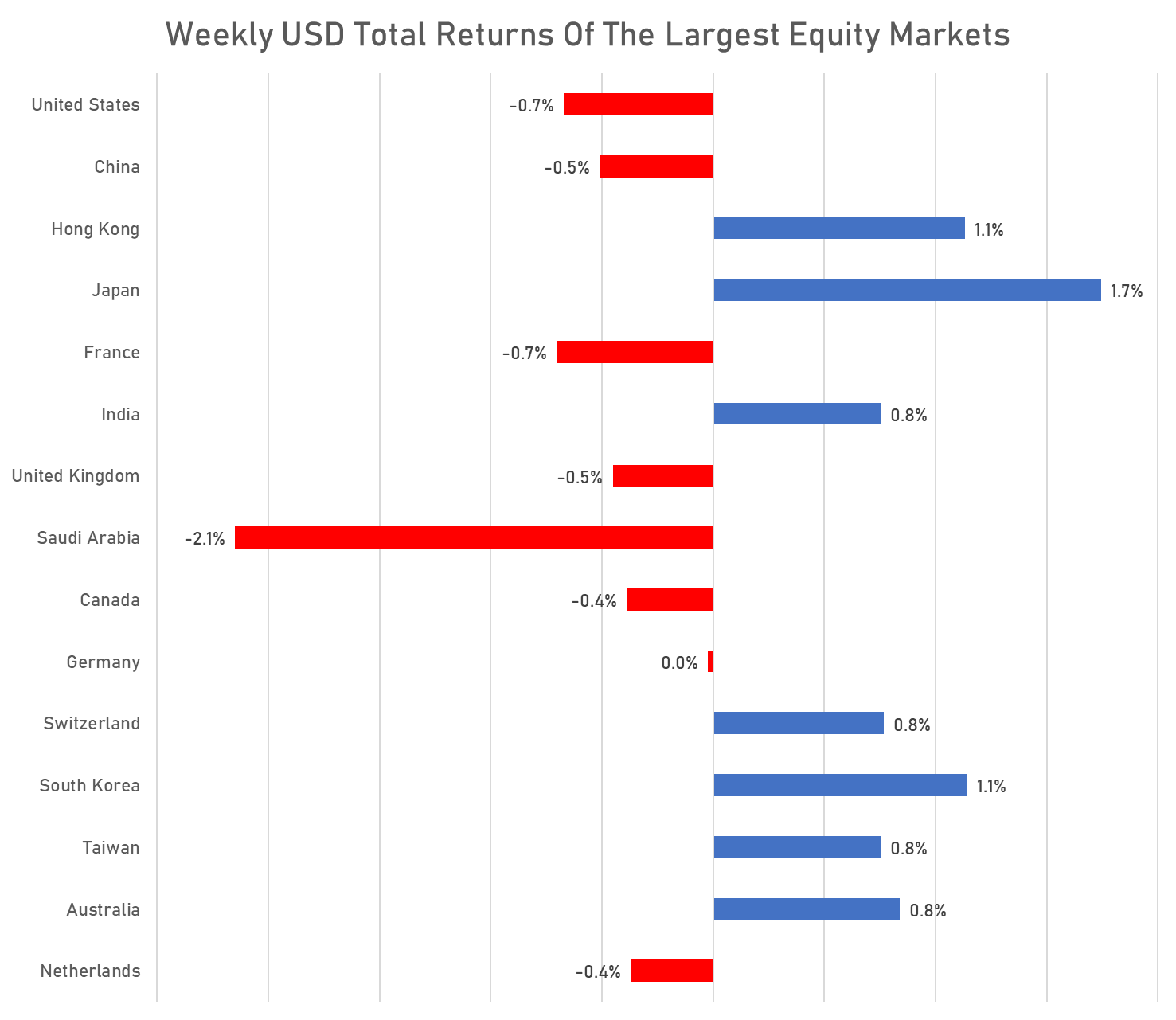

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

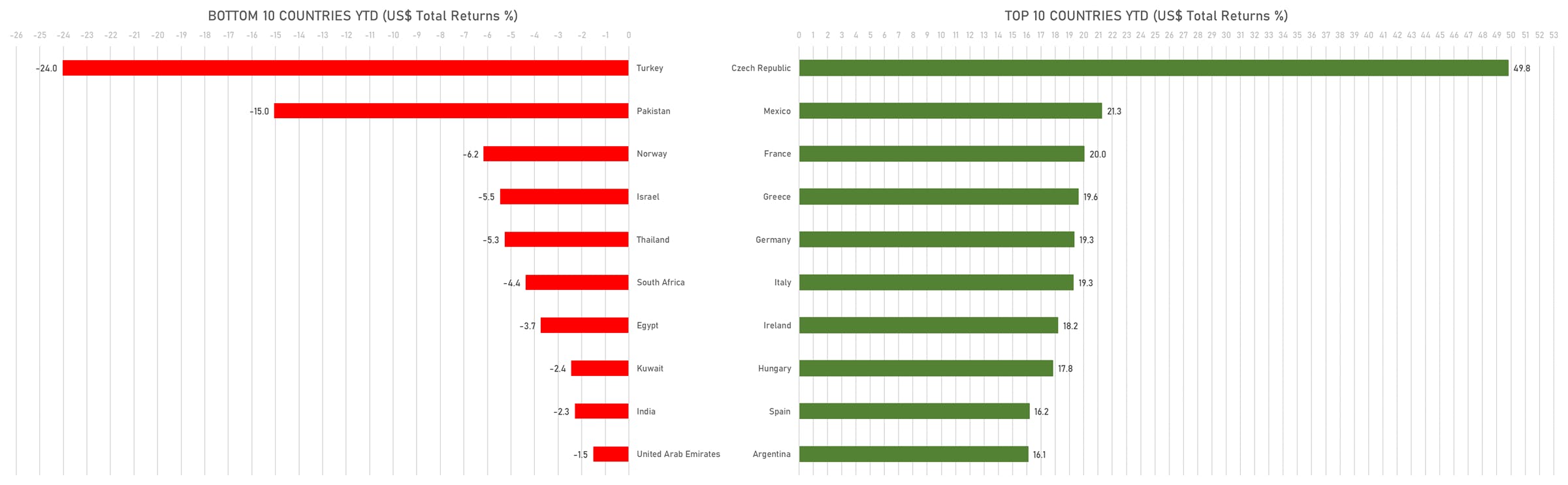

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

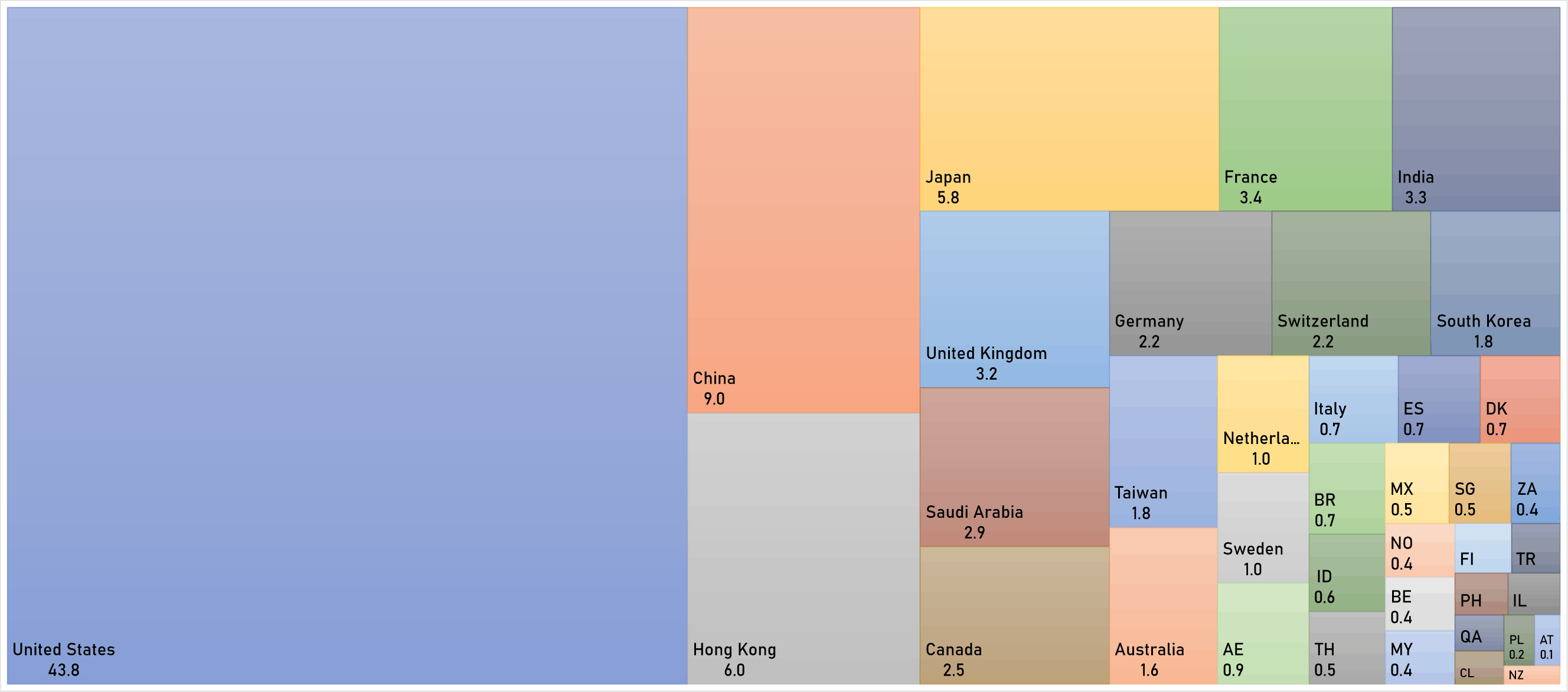

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Kenvue Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: KVUE / Gross proceeds (including overallotment): US$ 3,801.88m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, UBS Investment Bank, RBC Capital Markets LLC, HSBC Securities (USA) Inc, BNP Paribas Securities Corp, JP Morgan Securities LLC, BofA Securities Inc

- ACELYRIN Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SLRN / Gross proceeds (including overallotment): US$ 540.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Jefferies LLC, Morgan Stanley & Co LLC, Piper Sandler & Co

- Ares Acquisition Corp II / United States of America - Financials / Listing Exchange: NYSE MKT / Ticker: AACT.U / Gross proceeds (including overallotment): US$ 450.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, CastleOak Securities LP, UBS Securities LLC

- Prospect Energy Holdings Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: AMGSU / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: EF Hutton

- Inflection Point Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: IPXXU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

IPOs RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- SM Prime-REIT Business / Philippines - Real Estate / Listing Exchange: Philippine / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar)

- Nexchip Semiconductor Corp / China - High Technology / Listing Exchange: SSES / Ticker: 688249 / Gross proceeds (including overallotment): US$ 773.48m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

- Semiconductor Manufacturing Electronics (Shaoxing) Corp / China - High Technology / Listing Exchange: SSES / Ticker: 688469 / Gross proceeds (including overallotment): US$ 698.07m (offering in Chinese Yuan) / Bookrunners: Huatai United Securities Co Ltd, Haitong Securities Co Ltd

- PT Trimegah Bangun Persada Tbk / Indonesia - Materials / Listing Exchange: Indonesia / Ticker: NCKL / Gross proceeds (including overallotment): US$ 668.02m (offering in U.S. Dollar) / Bookrunners: Citicorp Securities Indonesia, PT Mandiri Sekuritas, DBS Vickers Sec Indonesia PT, Credit Suisse Sec Indonesia, UOB Kay Hian Securities PT, PT OCBC Sekuritas Indonesia, BNP Paribas Indonesia

- Lottomatica Group SpA / Italy - Media and Entertainment / Listing Exchange: Milan / Ticker: N/A / Gross proceeds (including overallotment): US$ 661.20m (offering in EURO) / Bookrunners: Mediobanca-Banca di Credito Finanziario SpA, UniCredit, Barclays Bank PLC, Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank, Banca Akros SpA/Oaklins Italy, BNP Paribas SA, Apollo Global Management Inc

- ZJLD Group Inc / China - Consumer Staples / Listing Exchange: Hong Kong / Ticker: 6979 / Gross proceeds (including overallotment): US$ 608.75m (offering in Hong Kong Dollar) / Bookrunners: Goldman Sachs (Asia), China International Capital Corp HK Securities Ltd, China Securities (International) Corporate Finance Co, KKR Capital Markets Asia Ltd

- Nexchip Semiconductor Corp / China - High Technology / Listing Exchange: SSES / Ticker: 688249 / Gross proceeds (including overallotment): US$ 528.60m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

- CPF Global Food Solution PCL / Thailand - Consumer Staples / Listing Exchange: Thailand / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar)

- Semiconductor Manufacturing Electronics (Shaoxing) Corp / China - High Technology / Listing Exchange: SSES / Ticker: 688469 / Gross proceeds (including overallotment): US$ 488.65m (offering in Chinese Yuan) / Bookrunners: Huatai United Securities Co Ltd, Haitong Securities Co Ltd

- Semiconductor Manufacturing Electronics (Shaoxing) Corp / China - High Technology / Listing Exchange: SSES / Ticker: 688469 / Gross proceeds (including overallotment): US$ 418.84m (offering in Chinese Yuan) / Bookrunners: Huatai United Securities Co Ltd, Haitong Securities Co Ltd

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Welltower Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: WELL / Gross proceeds (including overallotment): US$ 2,532.14m (offering in U.S. Dollar)

- Privia Health Group Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PRVA / Gross proceeds (including overallotment): US$ 848.76m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- MicroStrategy Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MSTR / Gross proceeds (including overallotment): US$ 625.00m (offering in U.S. Dollar)

- Gladstone Land Corp / United States of America - Real Estate / Listing Exchange: Nasdaq / Ticker: LAND / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar)

- Vaxcyte Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PCVX / Gross proceeds (including overallotment): US$ 459.20m (offering in U.S. Dollar) / Bookrunners: Evercore Group, Guggenheim Securities LLC, Jefferies LLC, BofA Securities Inc, SVB Securities LLC

- Agree Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: ADC / Gross proceeds (including overallotment): US$ 446.60m (offering in U.S. Dollar)

- ImmunoGen Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: IMGN / Gross proceeds (including overallotment): US$ 325.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, Jefferies LLC

- Portland General Electric Co / United States of America - Energy and Power / Listing Exchange: New York / Ticker: POR / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar)

- Safehold Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: SAFE / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar)

- Scilex Holding Co / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SCLX / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar)

- Capstone Copper Corp / Canada - Materials / Listing Exchange: Toronto / Ticker: CS / Gross proceeds (including overallotment): US$ 242.51m (offering in Canadian Dollar) / Bookrunners: National Bank Financial Inc, Scotia Capital Inc

- Legend Biotech Corp / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: LEGN / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar)

- Canoo Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: GOEV / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar)

- Altus Power Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: AMPS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar)

- Polymet Mining Corp / Canada - Materials / Listing Exchange: Toronto / Ticker: POM / Gross proceeds (including overallotment): US$ 195.40m (offering in U.S. Dollar)

- Lilium NV / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: QELL / Gross proceeds (including overallotment): US$ 184.21m (offering in U.S. Dollar)

- UMH Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: UMH / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar)

- IDEAYA Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: IDYA / Gross proceeds (including overallotment): US$ 137.63m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Jefferies LLC, JP Morgan Securities LLC

- Metals Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: MTAL / Gross proceeds (including overallotment): US$ 113.63m (offering in U.S. Dollar)

SECONDARIES RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- China Yangtze Power Co Ltd / China - Energy and Power / Listing Exchange: Shanghai / Ticker: 600900 / Gross proceeds (including overallotment): US$ 2,340.33m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Huatai United Securities Co Ltd, Changjiang Financing Services Co Ltd

- Tongwei Co Ltd / China - Consumer Products and Services / Listing Exchange: Shanghai / Ticker: 600438 / Gross proceeds (including overallotment): US$ 2,308.04m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- TUI AG / Germany - Consumer Products and Services / Listing Exchange: Frankfurt / Ticker: TUI1 / Gross proceeds (including overallotment): US$ 1,812.68m (offering in EURO) / Bookrunners: ING Bank NV, Commerzbank AG, Societe Generale SA, Barclays Bank (Ireland), Deutsche Bank, Natixis, Credit Agricole Corporate & Investment Bank, UniCredit Bank AG, HSBC Trinkaus & Burkhardt AG, BofA Securities Europe SA, Citigroup Global Markets Europe AG

- ANTA Sports Products Ltd / China - Consumer Staples / Listing Exchange: Hong Kong / Ticker: 2020 / Gross proceeds (including overallotment): US$ 1,503.65m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley (Asia) Ltd, Citigroup Global Markets Ltd, UBS AG-Hong Kong Branch

- Ningxia Baofeng Energy Group Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 600989 / Gross proceeds (including overallotment): US$ 1,455.08m (offering in Chinese Yuan)

- Anxin Trust Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 600816 / Gross proceeds (including overallotment): US$ 1,309.10m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Casino Guichard-Perrachon SA / France - Retail / Listing Exchange: Euro Paris / Ticker: CO / Gross proceeds (including overallotment): US$ 993.69m (offering in EURO)

- Cineworld Group PLC / United Kingdom - Media and Entertainment / Listing Exchange: London / Ticker: CINE / Gross proceeds (including overallotment): US$ 800.00m (offering in U.S. Dollar)

- Dongfang Electric Corp Ltd / China - Energy and Power / Listing Exchange: Shanghai / Ticker: 1072 / Gross proceeds (including overallotment): US$ 654.26m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Nanjing Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601990 / Gross proceeds (including overallotment): US$ 650.10m (offering in Chinese Yuan)

- Yuexiu Property Co Ltd / Hong Kong - Industrials / Listing Exchange: Hong Kong / Ticker: 123 / Gross proceeds (including overallotment): US$ 641.35m (offering in Hong Kong Dollar) / Bookrunners: Goldman Sachs (Asia), DBS Asia Capital Ltd, Morgan Stanley Asia Ltd (HK), CLSA Asia-Pacific Markets Ltd, China International Capital Corp HK Securities Ltd

- Tianfeng Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601162 / Gross proceeds (including overallotment): US$ 577.87m (offering in Chinese Yuan)

- Zhejiang Supcon Technology Co Ltd / China - High Technology / Listing Exchange: Swiss Exch / Ticker: 688777 / Gross proceeds (including overallotment): US$ 564.66m (offering in U.S. Dollar) / Bookrunners: Huatai Securities Co Ltd

- National Agricultural Development Co SJSC / Saudi Arabia - Consumer Staples / Listing Exchange: Saudi Exch / Ticker: 6010 / Gross proceeds (including overallotment): US$ 533.26m (offering in Saudi Arabian Riyal)

- PharmaEssentia Corp / Taiwan - Healthcare / Listing Exchange: Luxembourg / Ticker: 6446 / Gross proceeds (including overallotment): US$ 464.61m (offering in U.S. Dollar) / Bookrunners: JP Morgan & Co Inc, Morgan Stanley, UBS, Macquarie Group, Yuanta Securities Co Ltd

- Coles Group Ltd / Australia - Retail / Listing Exchange: Australia / Ticker: COL / Gross proceeds (including overallotment): US$ 460.27m (offering in Australian Dollar) / Bookrunners: Barrenjoey Markets Pty Ltd

- WT Microelectronics Co Ltd / Taiwan - High Technology / Listing Exchange: Taiwan / Ticker: 3036 / Gross proceeds (including overallotment): US$ 443.57m (offering in Taiwanese Dollar)

- Zhejiang Provincial New Energy Investment Group Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 600032 / Gross proceeds (including overallotment): US$ 436.75m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Yuexiu Property Co Ltd / Hong Kong - Industrials / Listing Exchange: Hong Kong / Ticker: 123 / Gross proceeds (including overallotment): US$ 423.73m (offering in Hong Kong Dollar)

- Nano-X Imaging Ltd / Israel - Healthcare / Listing Exchange: Nasdaq / Ticker: NNOX / Gross proceeds (including overallotment): US$ 411.60m (offering in U.S. Dollar)