Equities

July Performance Unfazed Despite Mediocre Earnings So Far, Bolstered by Increase In Net Length From Fast Money Community

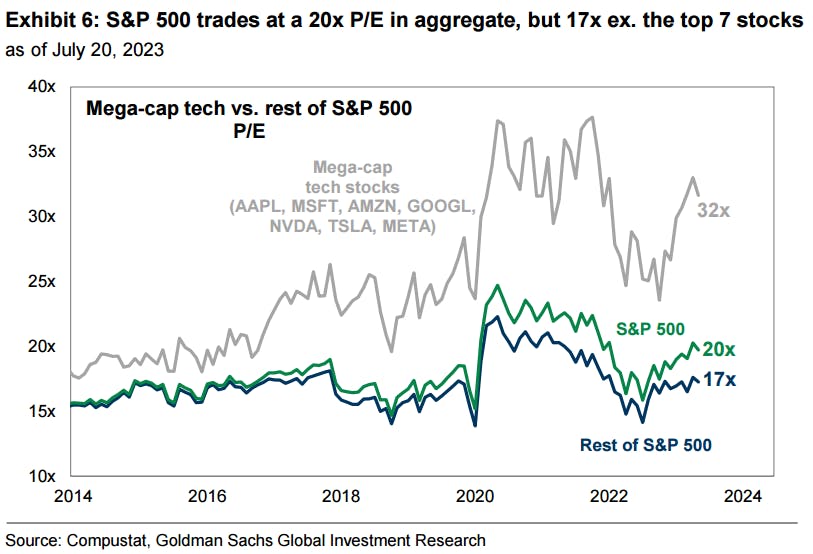

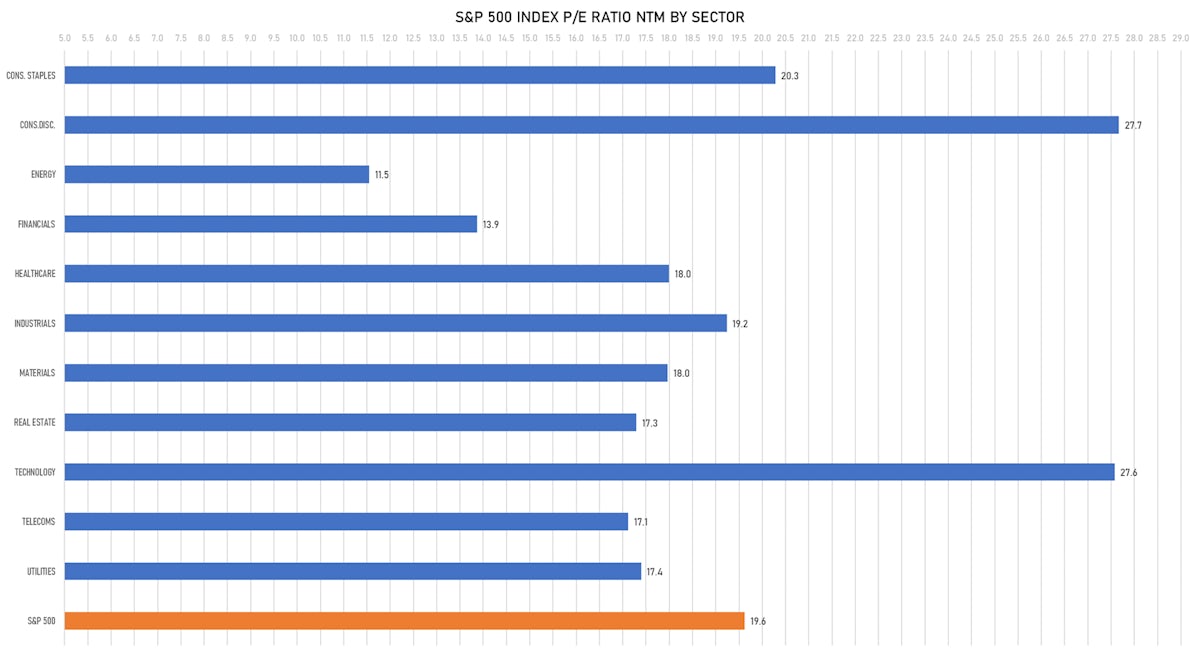

Though current levels of valuation for US equities look high, with the forward P/E on the S&P 500 close to 20, they are actually at a more reasonable 17 when you exclude the "magnificent seven" stocks (collectively trading at 32x)

Published ET

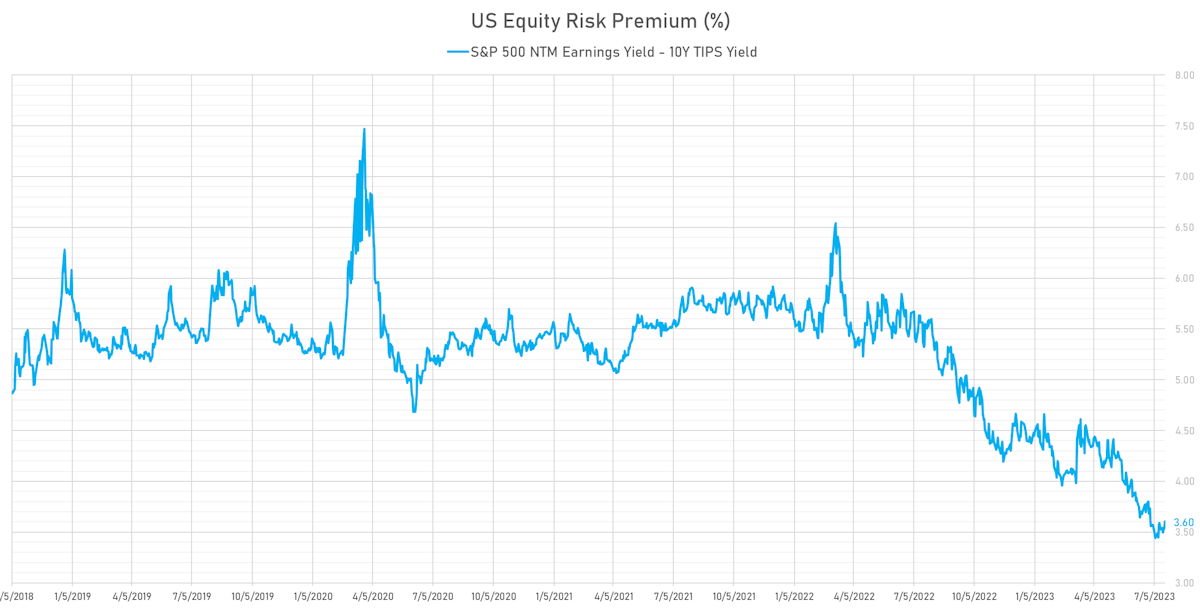

US Equity Risk Premium | Sources: phipost.com, Refinitiv, FactSet data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 0.03%; Nasdaq Composite down -0.22%; Wilshire 5000 down -0.06%

- 59.6% of S&P 500 stocks were up today, with 73.8% of stocks above their 200-day moving average (DMA) and 86.7% above their 50-DMA

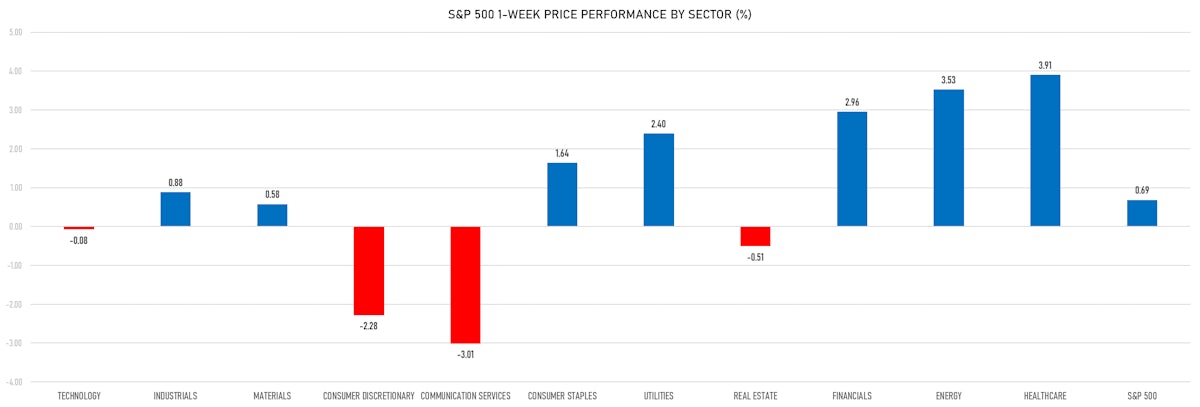

- Top performing sectors in the S&P 500: utilities up 1.50% and healthcare up 1.01%

- Bottom performing sectors in the S&P 500: communication services down -0.50% and industrials down -0.46%

- The number of shares in the S&P 500 traded today was 1153m for a total turnover of US$ 152 bn

- The S&P 500 Value Index Index was down 0.0%, while the S&P 500 Growth Index Index was up 0.1%; the S&P small caps index was down -0.6% and mid caps were down -0.5%

- The volume on CME's INX (S&P 500 Index) was 3,275.4m (3-month z-score: 1.8); the 3-month average volume is 2,454.6m and the 12-month range is 903.0 - 5,761.3m

- Daily performance of international indices: Europe Stoxx 600 up 0.32%; UK FTSE 100 up 0.23%; Hang Seng SH-SZ-HK 300 Index up 0.26%; Japan's TOPIX 500 up 0.09%

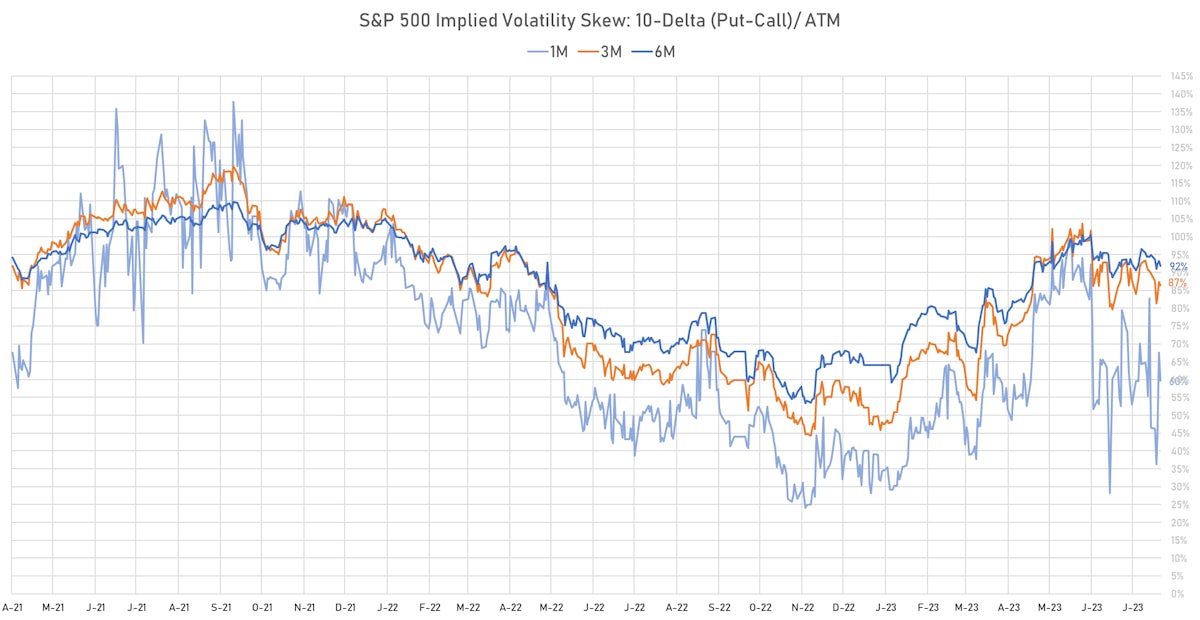

VOLATILITY TODAY

- 3-month at-the-money implied volatility on the S&P 500 at 10.3%, down from 10.4%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 10.3%, down from 10.5%

TOP WINNERS TODAY

- Digital World Acquisition Corp (DWAC), up 50.3% to $20.08 / YTD price return: +33.9% / 12-Month Price Range: $ 12.34-33.63 / Short interest (% of float): 7.5%; days to cover: 14.5

- ServisFirst Bancshares Inc (SFBS), up 20.0% to $58.12 / YTD price return: -15.7% / 12-Month Price Range: $ 39.27-93.83 / Short interest (% of float): 9.7%; days to cover: 15.3

- Nanobiotix SA (NBTX), up 17.5% to $9.19 / YTD price return: +150.4% / 12-Month Price Range: $ 1.75-9.19 / Short interest (% of float): 0.1%; days to cover: 0.7

- Sight Sciences Inc (SGHT), up 16.1% to $8.60 / YTD price return: -29.6% / 12-Month Price Range: $ 5.35-15.30 / Short interest (% of float): 1.0%; days to cover: 2.6

- bluebird bio Inc (BLUE), up 15.4% to $4.05 / YTD price return: -41.5% / 12-Month Price Range: $ 2.78-8.58 / Short interest (% of float): 30.6%; days to cover: 9.1

- Vir Biotechnology Inc (VIR), up 13.0% to $14.35 / YTD price return: -43.3% / 12-Month Price Range: $ 12.56-31.55

- Thorne Healthtech Inc (THRN), up 12.9% to $5.95 / YTD price return: +63.9% / 12-Month Price Range: $ 3.41-6.45 / Short interest (% of float): 1.4%; days to cover: 4.4

- SIGNA Sports United NV (SSU), up 12.7% to $2.76 / YTD price return: -43.8% / 12-Month Price Range: $ 2.34-6.70 / Short interest (% of float): 0.1%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Scholastic Corp (SCHL), up 11.5% to $44.35 / YTD price return: +12.4% / 12-Month Price Range: $ 28.22-48.28

- Repligen Corp (RGEN), up 11.3% to $175.34 / YTD price return: +3.6% / 12-Month Price Range: $ 134.64-262.26 / Short interest (% of float): 10.3%; days to cover: 8.4

BIGGEST LOSERS TODAY

- PSQ Holdings Inc (PSQH), down 29.2% to $21.11 / YTD price return: +112.4% / 12-Month Price Range: $ 8.94-35.57 / Short interest (% of float): 0.1%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- Genelux Corp (GNLX), down 15.8% to $20.35 / 12-Month Price Range: $ 5.35-40.98 / Short interest (% of float): 0.9%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Interpublic Group of Companies Inc (IPG), down 13.3% to $32.87 / YTD price return: -1.3% / 12-Month Price Range: $ 25.14-40.95 / Short interest (% of float): 3.3%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- D-Wave Quantum Inc (QBTS), down 12.4% to $2.41 / YTD price return: +67.4% / 12-Month Price Range: $ .40-13.23 / Short interest (% of float): 2.2%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- AutoNation Inc (AN), down 12.3% to $155.11 / YTD price return: +44.6% / 12-Month Price Range: $ 94.92-182.08 / Short interest (% of float): 11.8%; days to cover: 7.3 (the stock is currently on the short sale restriction list)

- Sharecare Inc (SHCR), down 11.4% to $1.47 / YTD price return: -8.1% / 12-Month Price Range: $ 1.31-2.71 / Short interest (% of float): 2.3%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- SHENGFENG DEVELOPMENT Ltd (SFWL), down 10.5% to $5.04 / 12-Month Price Range: $ 2.94-12.45 / Short interest (% of float): 3.0%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Puyi Inc (PUYI), down 10.4% to $6.00 / 12-Month Price Range: $ 4.44-9.63 / Short interest (% of float): 0.0%; days to cover: 0.9

- Fiscalnote Holdings Inc (NOTE), down 10.0% to $3.52 / YTD price return: -44.4% / 12-Month Price Range: $ 1.31-12.30 / Short interest (% of float): 5.7%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Cano Health Inc (CANO), down 9.7% to $1.39 / YTD price return: +1.5% / 12-Month Price Range: $ .76-9.75 (the stock is currently on the short sale restriction list)

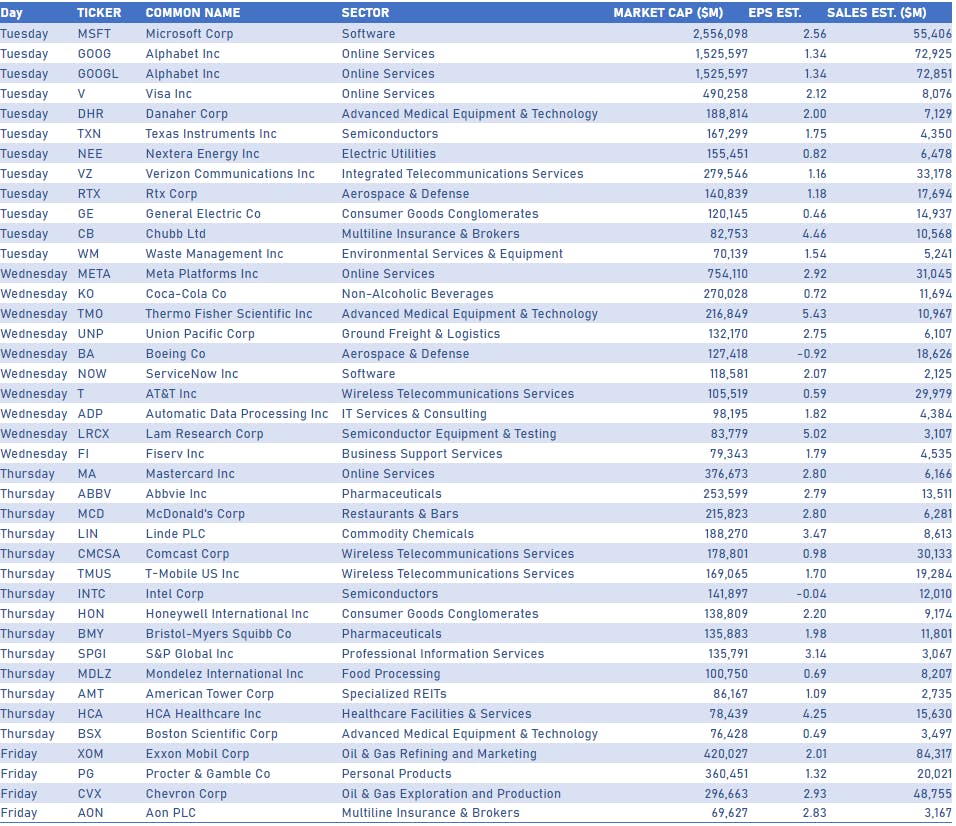

NOTABLE US EARNINGS RELEASES IN THE WEEK AHEAD

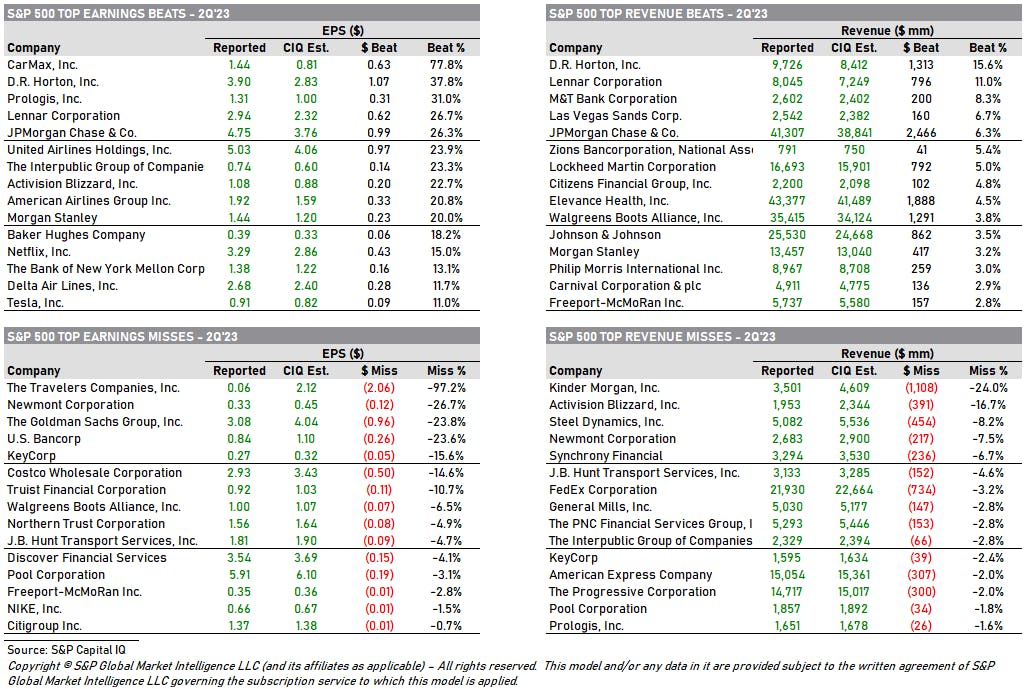

2Q23 EARNINGS: TOP BEATS AND MISSES

TOP S&P 500 PERFORMERS THIS WEEK

- Zions Bancorporation NA (ZION), up 17.6% to $36.11 / YTD price return: -26.5% / 12-Month Price Range: $ 18.26-59.74 / Short interest (% of float): 15.0%; days to cover: 4.5

- Charles Schwab Corp (SCHW), up 13.6% to $66.48 / YTD price return: -20.2% / 12-Month Price Range: $ 45.00-86.62 / Short interest (% of float): 1.5%; days to cover: 1.9

- KeyCorp (KEY), up 12.5% to $11.43 / YTD price return: -34.4% / 12-Month Price Range: $ 8.54-20.30 / Short interest (% of float): 4.9%; days to cover: 2.4

- Citizens Financial Group Inc (CFG), up 11.8% to $31.05 / YTD price return: -21.1% / 12-Month Price Range: $ 23.38-44.82 / Short interest (% of float): 5.9%; days to cover: 4.0

- Northern Trust Corp (NTRS), up 10.6% to $78.75 / YTD price return: -11.0% / 12-Month Price Range: $ 69.54-104.56 / Short interest (% of float): 1.7%; days to cover: 2.7

- Bank of America Corp (BAC), up 9.9% to $31.98 / YTD price return: -3.4% / 12-Month Price Range: $ 26.33-38.59 / Short interest (% of float): 0.9%; days to cover: 1.5

- Morgan Stanley (MS), up 9.6% to $94.01 / YTD price return: +10.6% / 12-Month Price Range: $ 74.67-100.99 / Short interest (% of float): 1.6%; days to cover: 2.8

- Caesars Entertainment Inc (CZR), up 9.6% to $57.73 / YTD price return: +38.8% / 12-Month Price Range: $ 31.31-57.85 / Short interest (% of float): 3.8%; days to cover: 2.8

- Allstate Corp (ALL), up 9.5% to $110.82 / YTD price return: -18.3% / 12-Month Price Range: $ 100.74-142.13 / Short interest (% of float): 1.7%; days to cover: 2.2

- US Bancorp (USB), up 8.7% to $38.42 / YTD price return: -11.9% / 12-Month Price Range: $ 27.27-49.95 / Short interest (% of float): 2.6%; days to cover: 2.7

BOTTOM S&P 500 PERFORMERS THIS WEEK

- Interpublic Group of Companies Inc (IPG), down 16.4% to $32.87 / YTD price return: -1.3% / 12-Month Price Range: $ 25.15-40.95 / Short interest (% of float): 3.3%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Omnicom Group Inc (OMC), down 13.0% to $83.81 / YTD price return: +2.7% / 12-Month Price Range: $ 61.88-99.19 / Short interest (% of float): 5.5%; days to cover: 7.4

- Discover Financial Services (DFS), down 11.3% to $105.11 / YTD price return: +7.4% / 12-Month Price Range: $ 87.73-122.50 / Short interest (% of float): 2.3%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Equifax Inc (EFX), down 10.2% to $212.35 / YTD price return: +9.2% / 12-Month Price Range: $ 146.01-240.29 / Short interest (% of float): 4.1%; days to cover: 6.8 (the stock is currently on the short sale restriction list)

- Albemarle Corp (ALB), down 8.2% to $215.99 / YTD price return: -.4% / 12-Month Price Range: $ 171.93-334.25 / Short interest (% of float): 6.4%; days to cover: 3.9

- Las Vegas Sands Corp (LVS), down 8.2% to $55.97 / YTD price return: +16.4% / 12-Month Price Range: $ 33.39-65.58 / Short interest (% of float): 3.0%; days to cover: 2.4

- Align Technology Inc (ALGN), down 8.0% to $337.37 / YTD price return: +60.0% / 12-Month Price Range: $ 172.29-371.96 / Short interest (% of float): 3.8%; days to cover: 4.0

- Tesla Inc (TSLA), down 7.6% to $260.02 / YTD price return: +111.1% / 12-Month Price Range: $ 101.83-314.67 / Short interest (% of float): 3.5%; days to cover: 0.6

- Crown Castle Inc (CCI), down 7.2% to $107.28 / YTD price return: -20.9% / 12-Month Price Range: $ 103.25-184.74 / Short interest (% of float): 1.1%; days to cover: 1.5

- Estee Lauder Companies Inc (EL), down 7.2% to $179.66 / YTD price return: -27.6% / 12-Month Price Range: $ 175.15-284.27 / Short interest (% of float): 1.1%; days to cover: 1.1

VALUATION MULTIPLES BY SECTORS

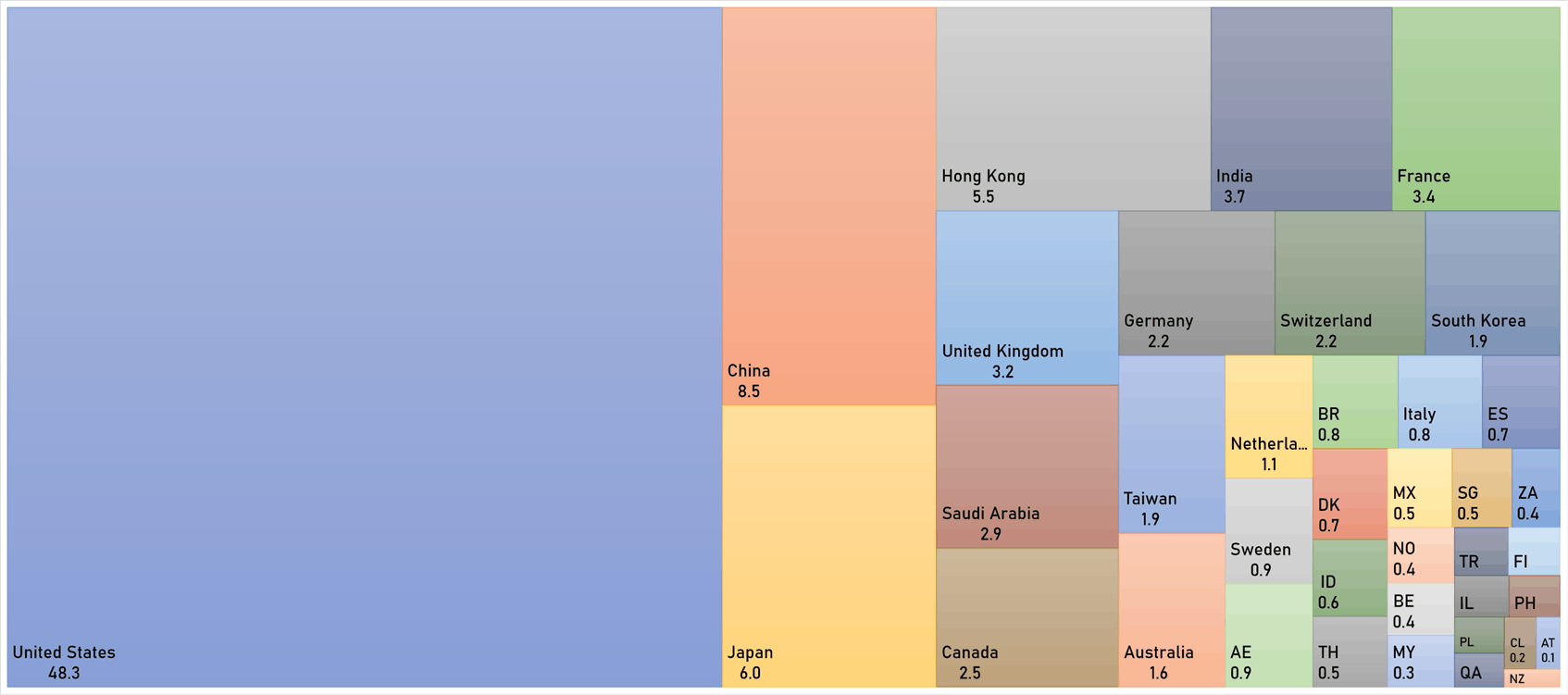

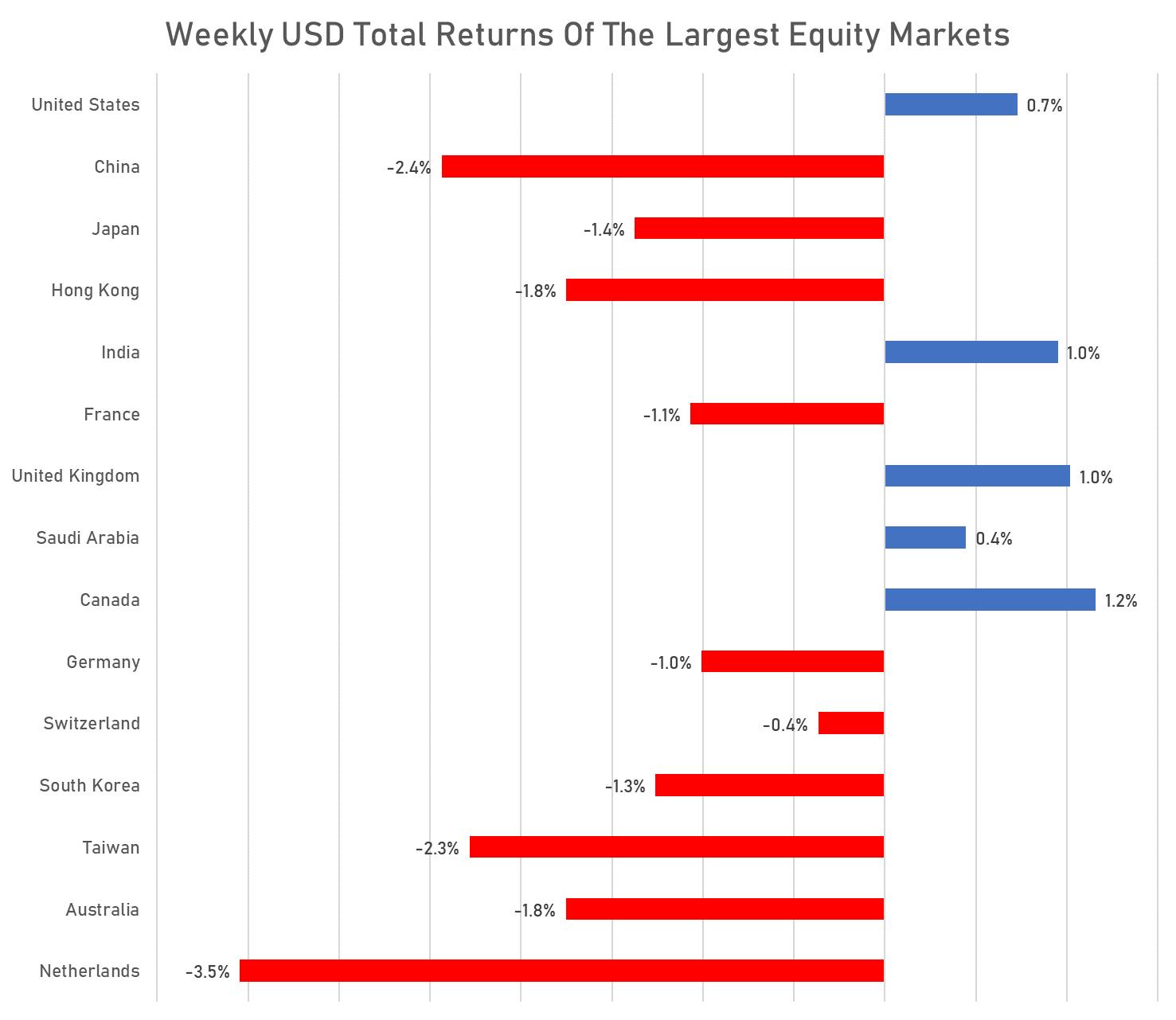

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

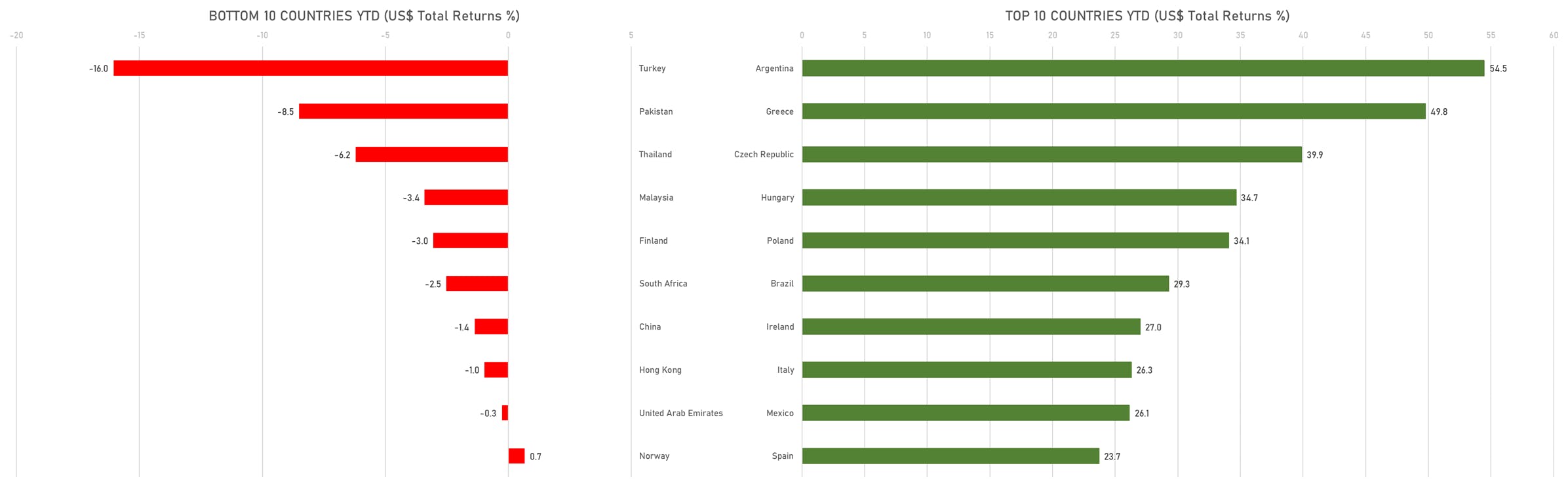

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

WORLD MARKET CAPITALIZATION (US$ Trillion)