Weekly Macro Summary: Seismic Shift In ECB Policy, Market Repricing Brought Considerable Realized Volatility In Euros Over The Past Days

Very strong US employment report today raised the likelihood of a 50bp Fed hike in March (now 35 bp priced into Fed Funds futures), showed the Fed is likely well behind the curve

Published ET

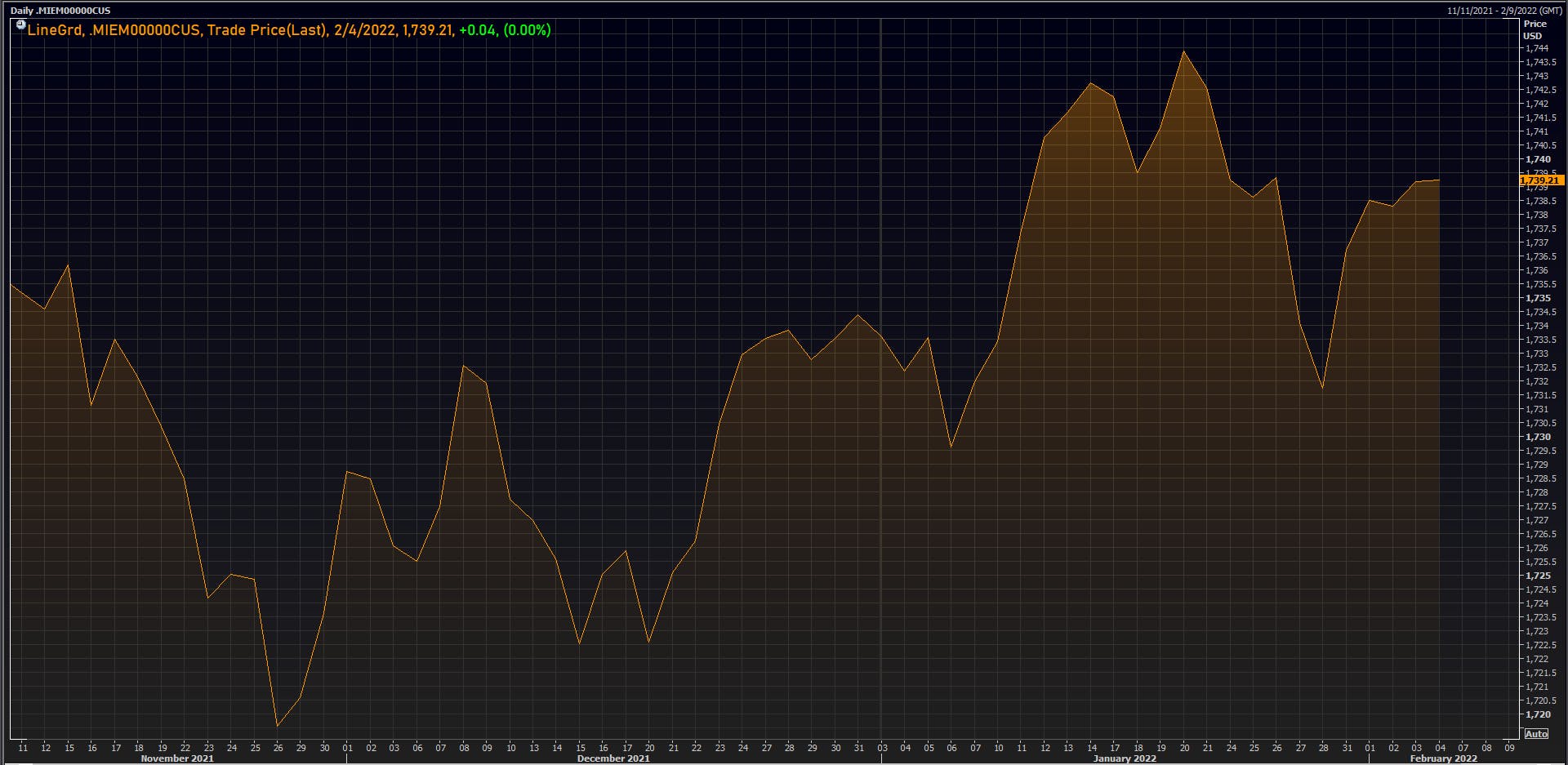

US TIPS 5s30s SPREAD GOING SIDEWAYS, REFLECTING UNCLEAR LONGER-TERM GROWTH EXPECTATIONS | Sources: ϕpost, Refinitiv data

TLDR VERSION

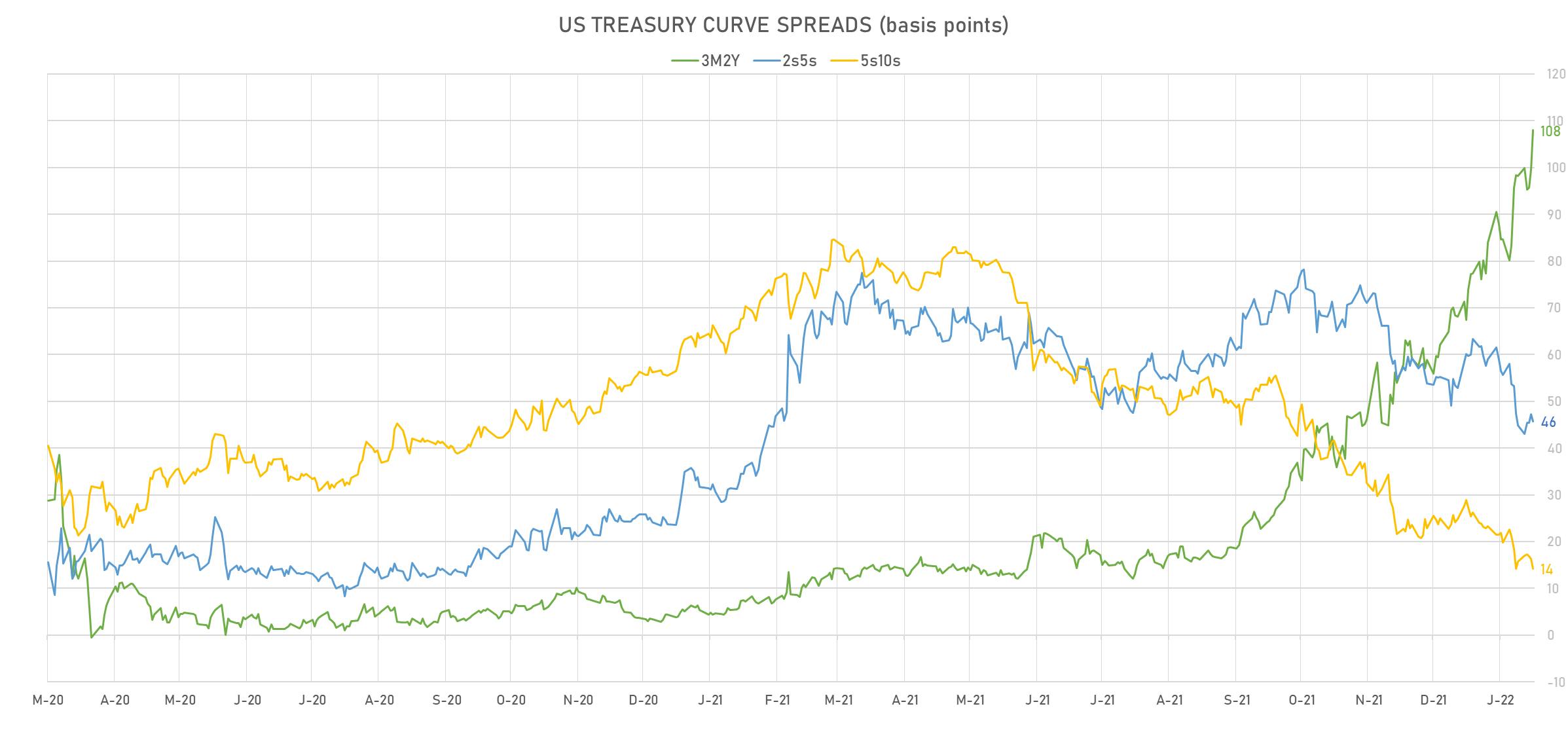

- Rates up at the front end, curves flatter

- Specs and leveraged funds pare short duration trade

- ECB turning hawkish, EUR-USD rates differentials tighten, drive huge jump in euro realized volatility

- Brent and WTI now trading well above $90/bbl at the front end of the curve, with backwardation at or close to historical highs (depending on forward period). With little relief in sight on the supply side (except for a possible Iranian deal), it's hard to short the front end outright. But calendar spreads should mean revert materially lower over the next year

LONGER VERSION, IN CHARTS

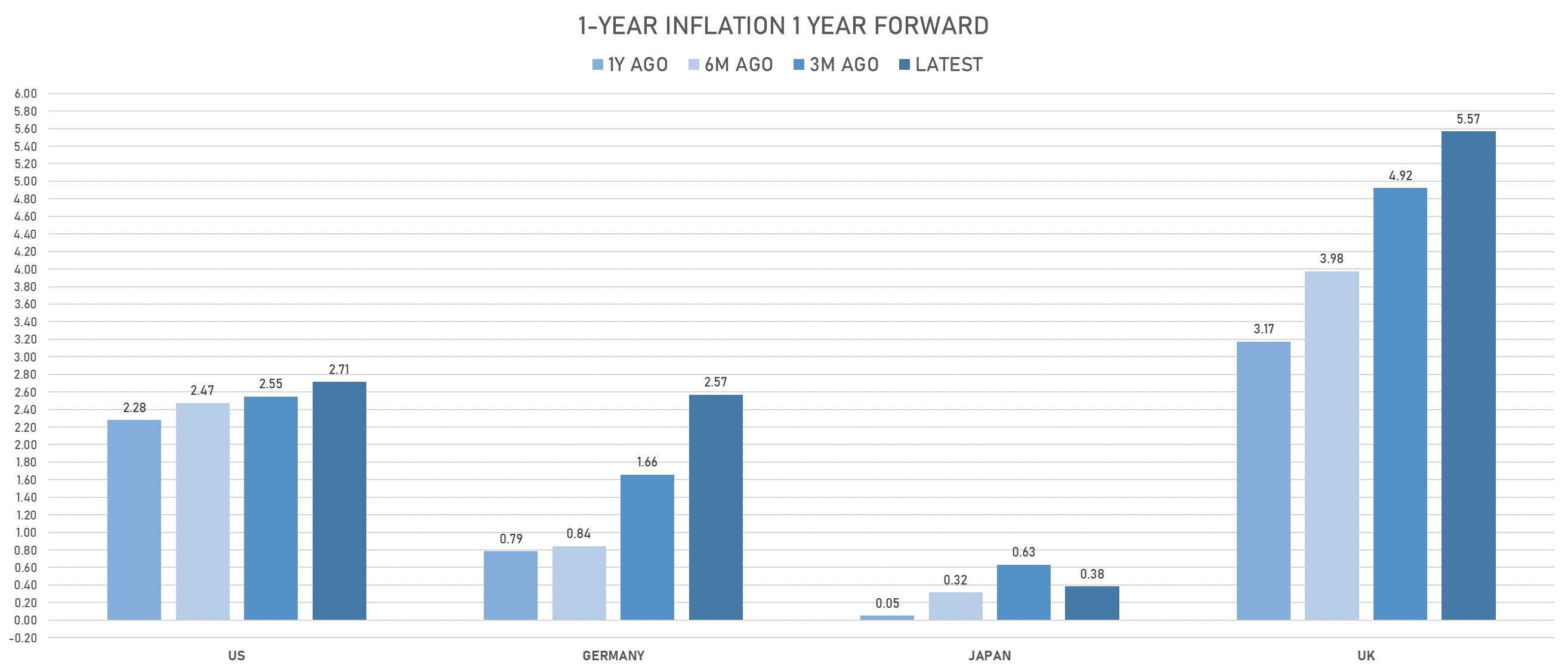

1 YEAR FORWARD INFLATION EXPECTATIONS STILL RISING IN THE US, EUROPE

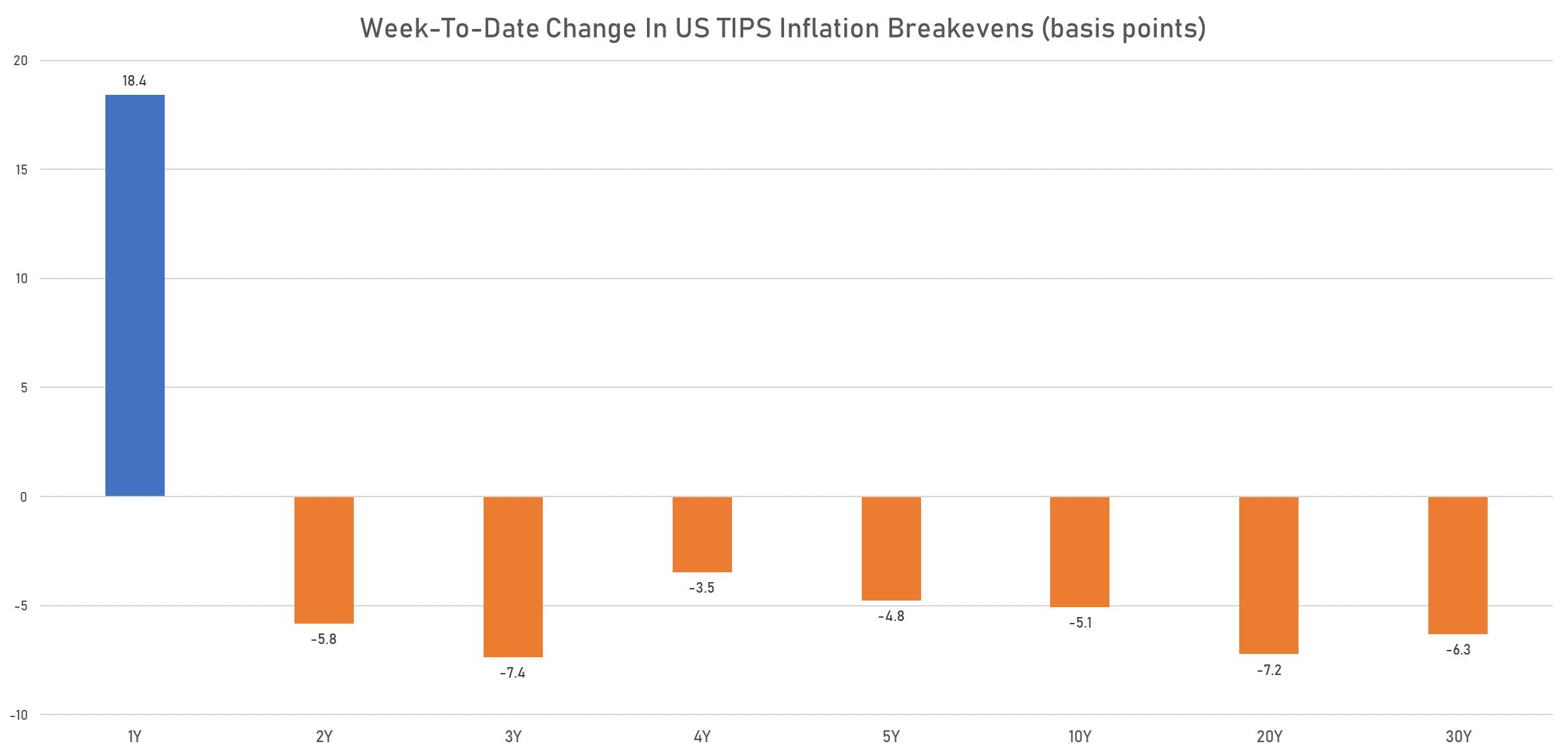

US TIPS INFLATION BREAKEVENS RISE AT THE FRONT END, FALL FURTHER DOWN THE CURVE

THE STEEP RISE AT THE FRONT END OF THE US YIELD CURVE IS DRIVEN BY FED'S INFLATION FEARS

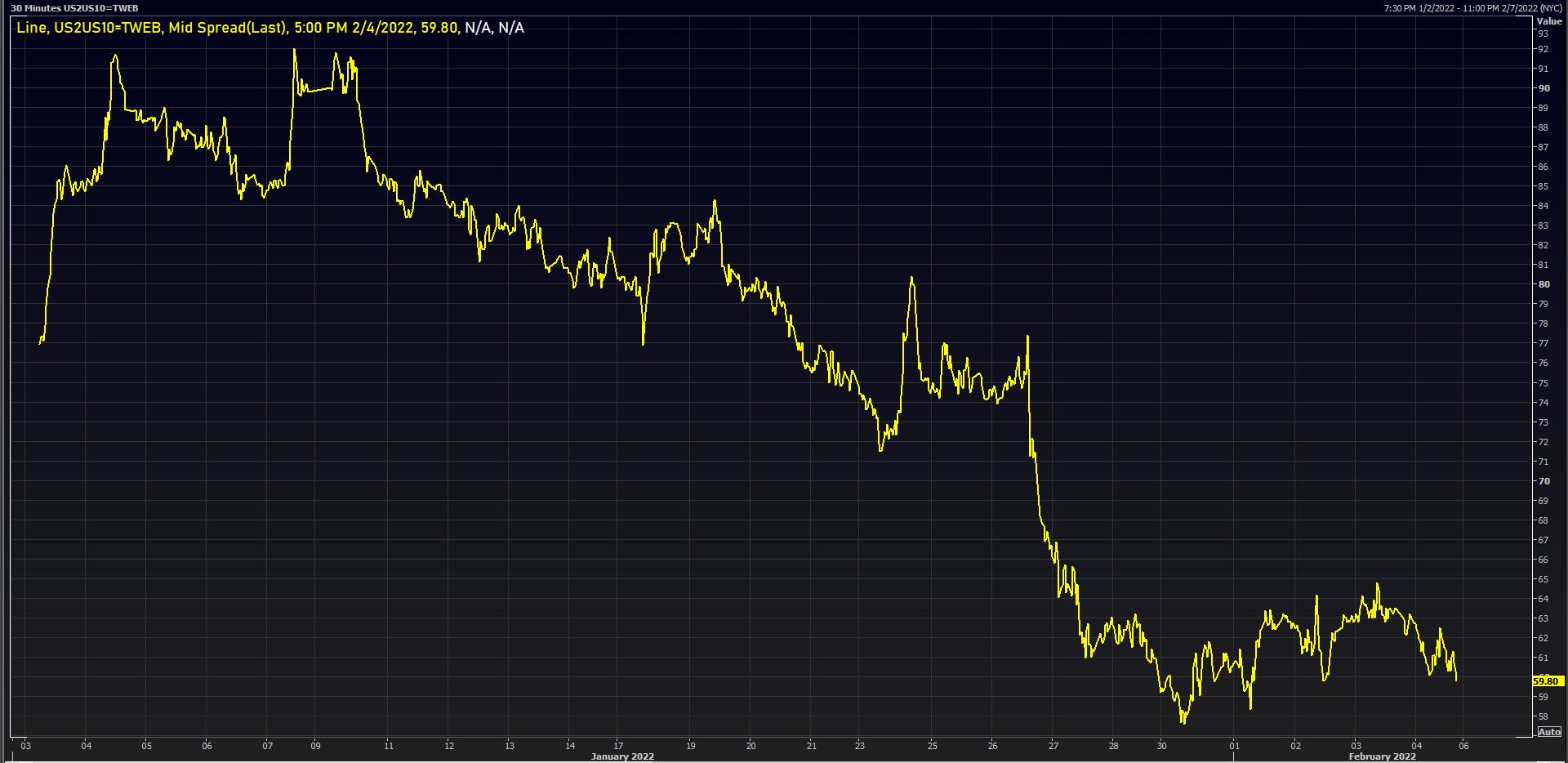

US TREASURIES 2S10S SPREAD ENDS WEAKER AFTER SLIGHT BOUNCE

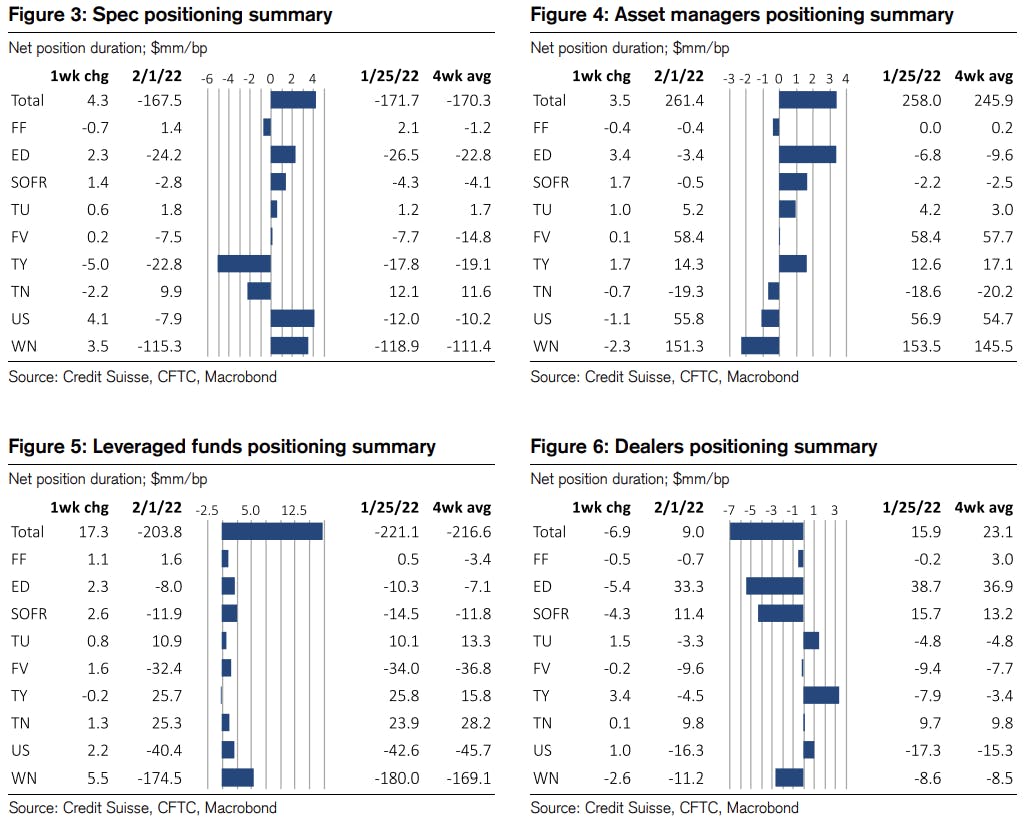

SPECS, LEVERAGED FUNDS REDUCE NET SHORT DURATION POSITIONING

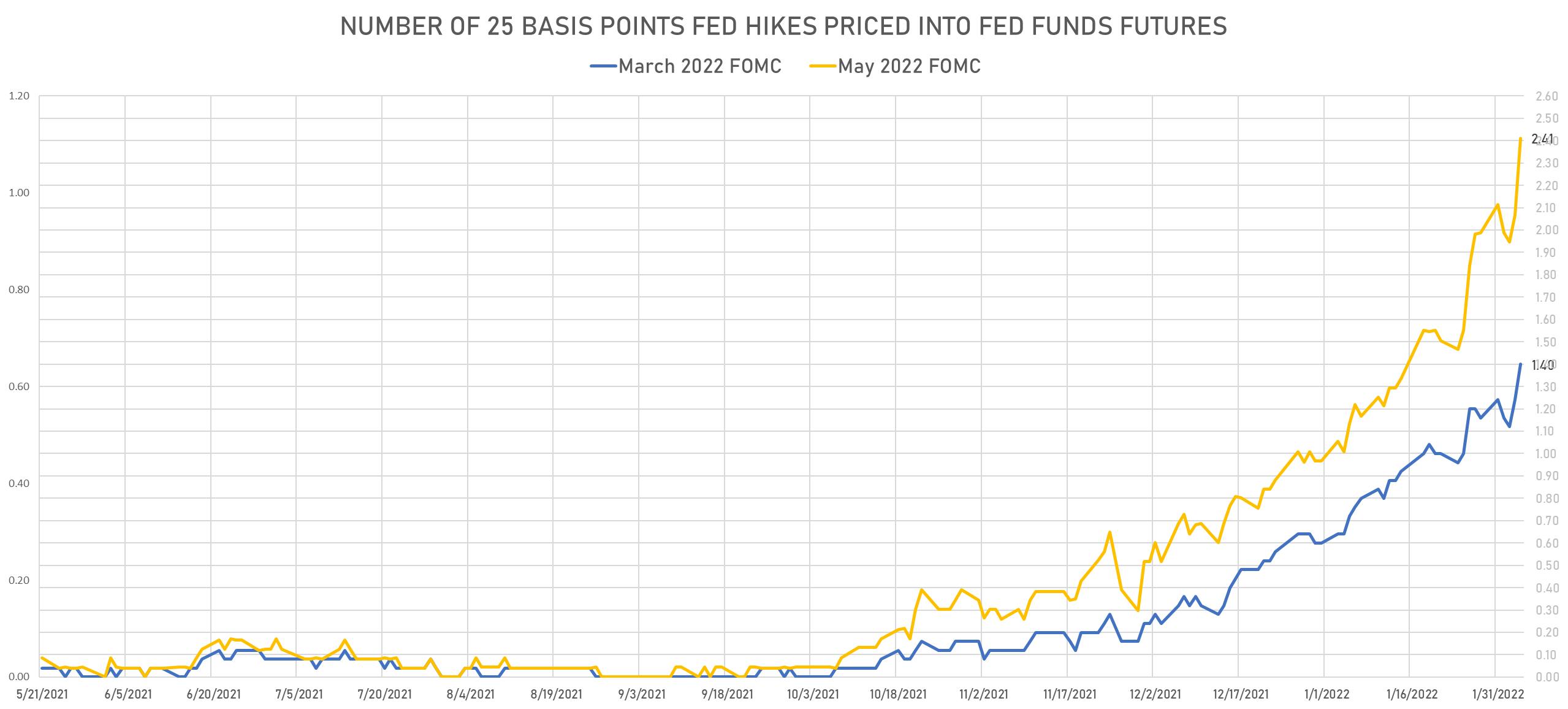

MARKET PRICING GETTING CLOSER TO 50 BP FOR MARCH FOMC

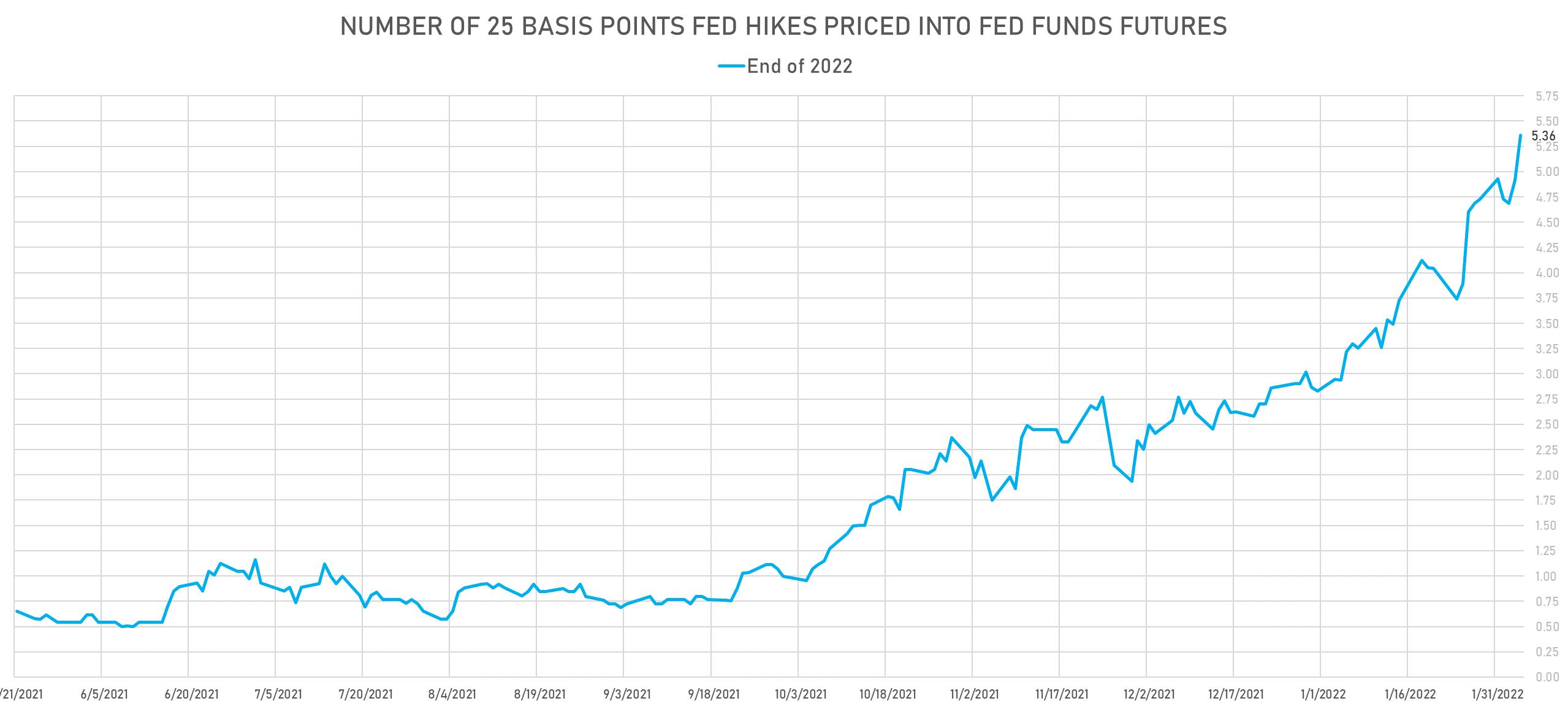

MARKET REALIZES 6 HIKES BY THE END OF THE YEAR QUITE POSSIBLE IF QT NOT USED OFFENSIVELY

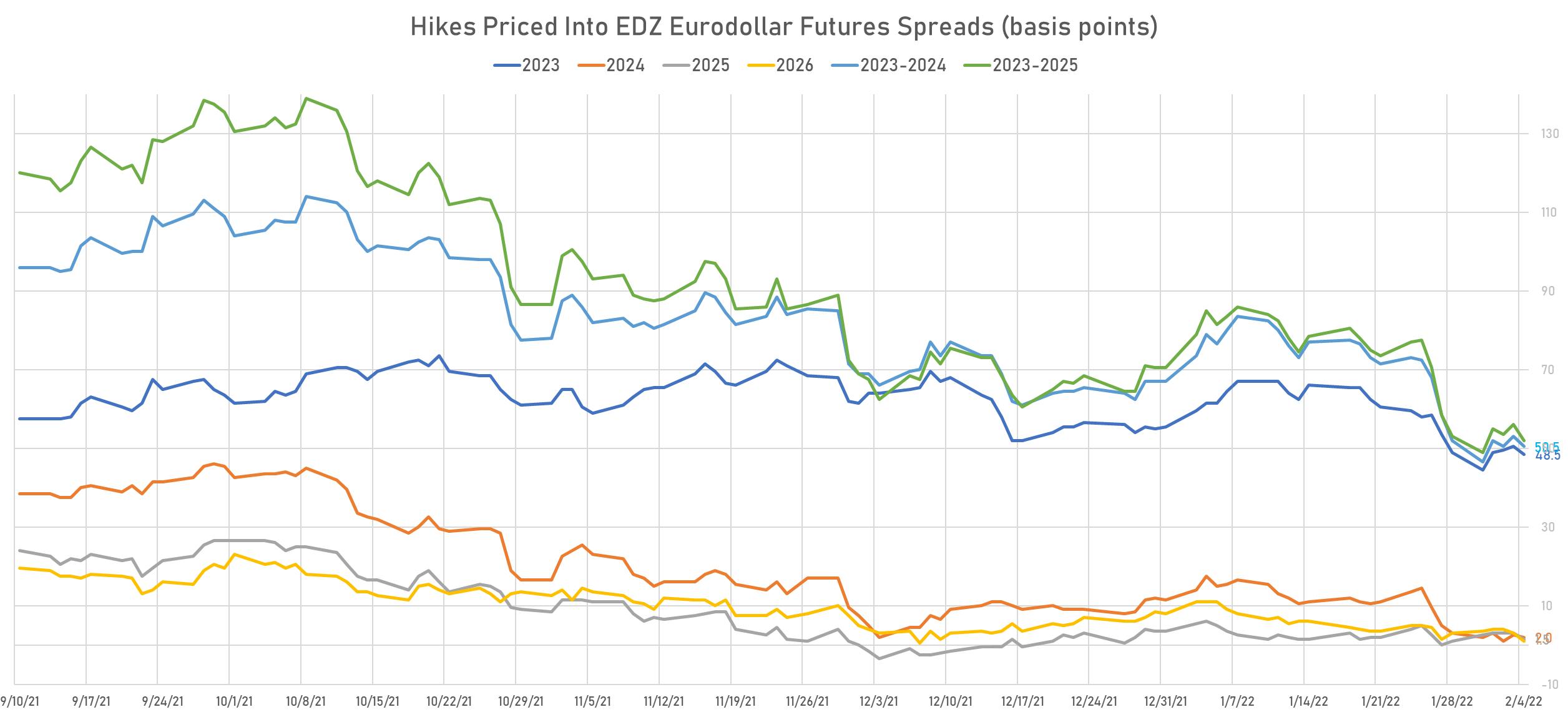

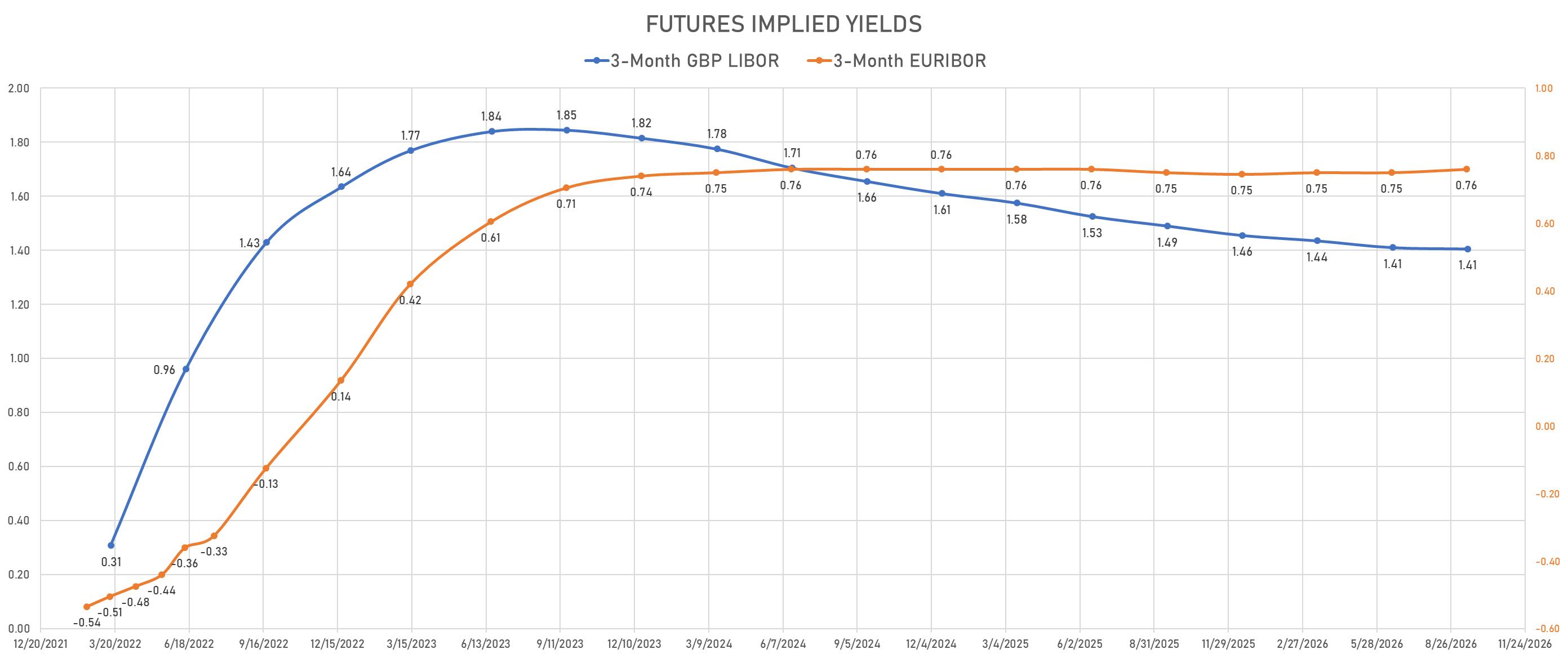

EURODOLLAR FUTURES STILL SEE VERY FRONT-LOADED, SHALLOW HIKING CYCLE, WITH JUST 2 HIKES PRICED FOR 2023, NONE IN 2024

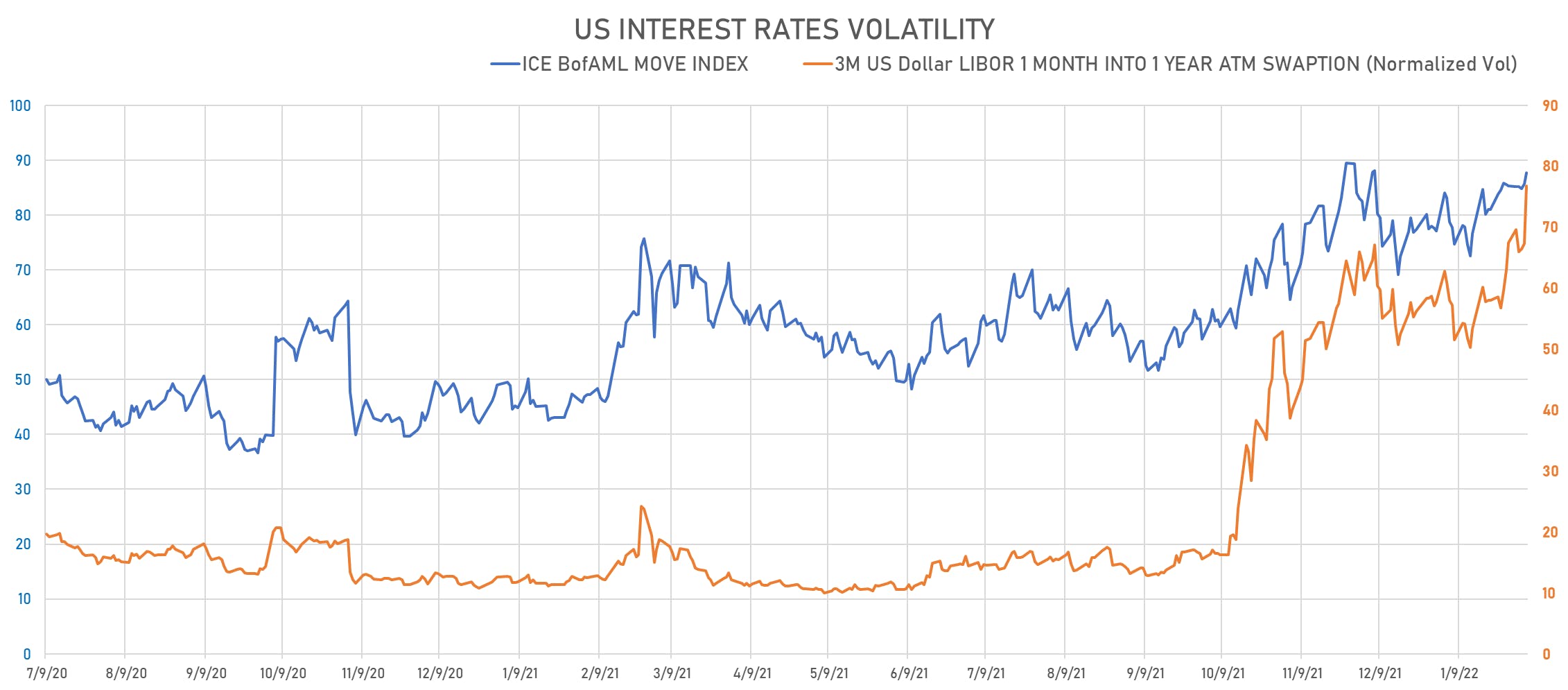

US RATES IMPLIED VOLATILITY STAYS EXTREMELY HIGH, REFLECTS UNCERTAIN ("NIMBLE") POLICY PATH CHOSEN BY THE FED

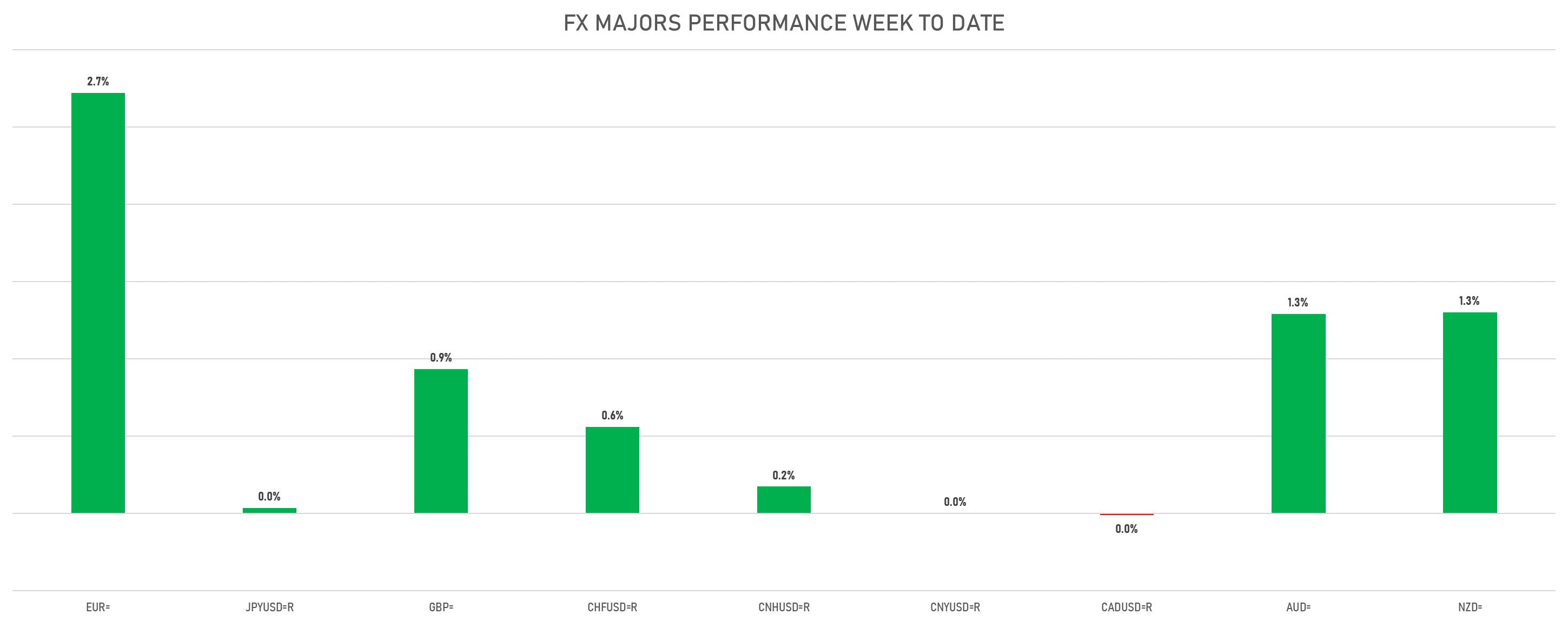

EURO FX GAINS OVER 2% THIS WEEK..

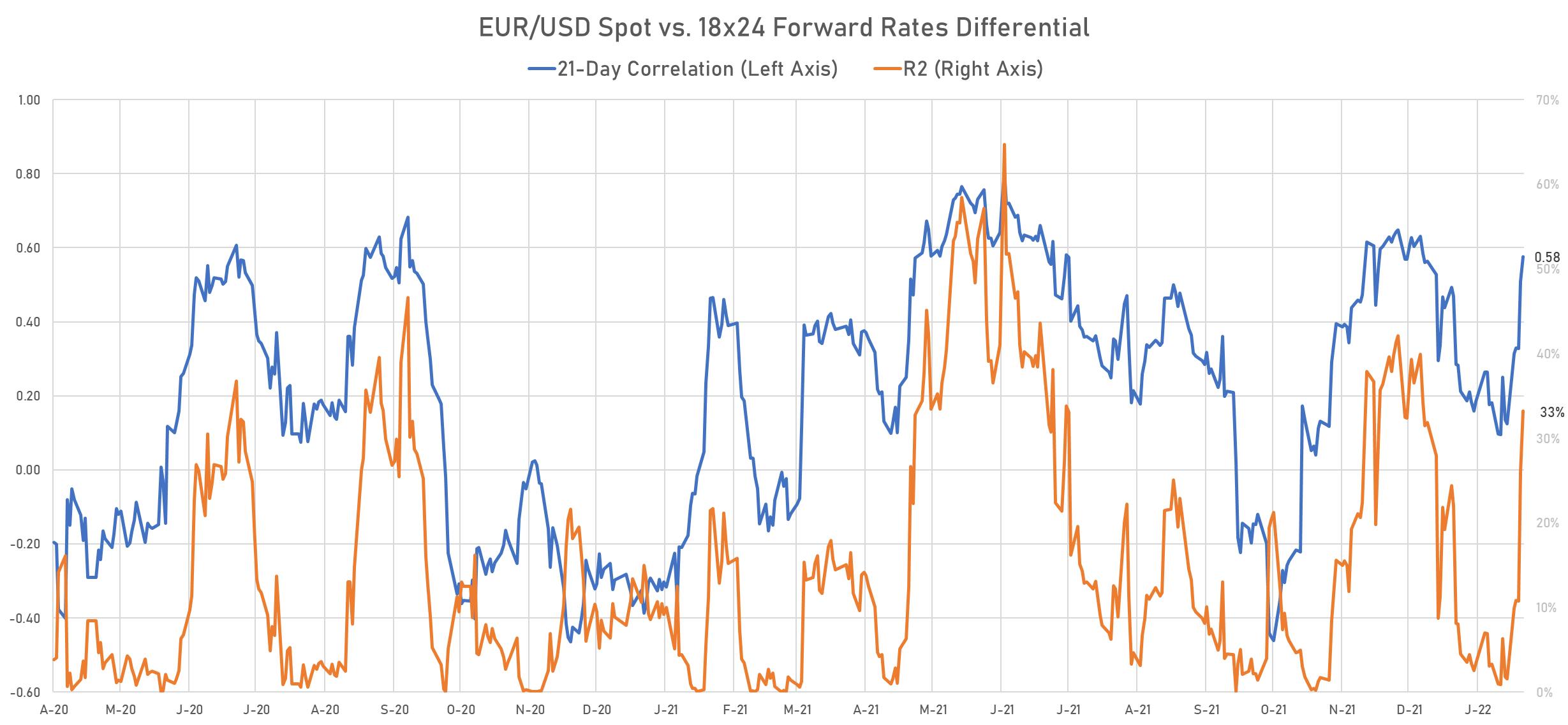

..ON THE BACK OF TIGHTER FORWARD RATES DIFFERENTIAL

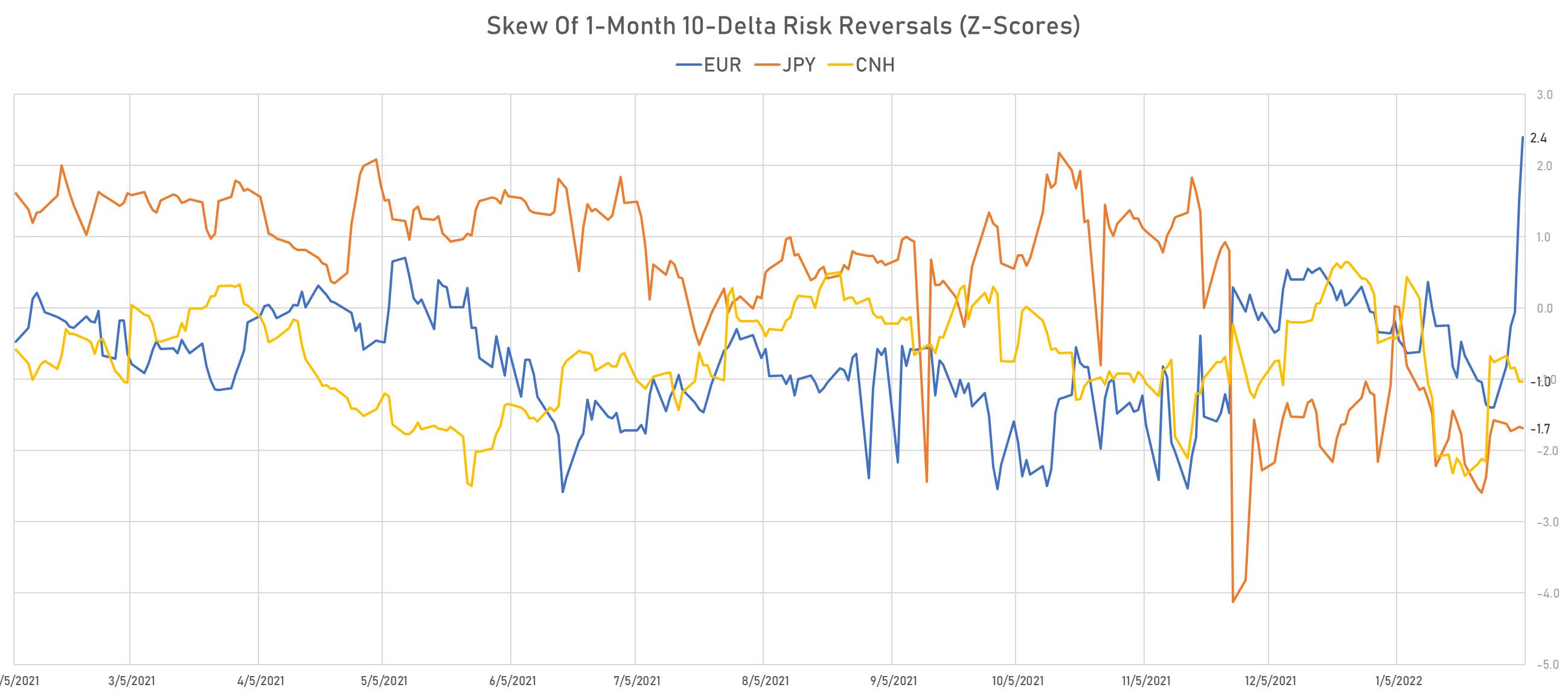

THE SIZE OF THE MOVE IS BEST SEEN IN THE SKEW OF EURO 1-MONTH 10-DELTA RISK REVERSALS

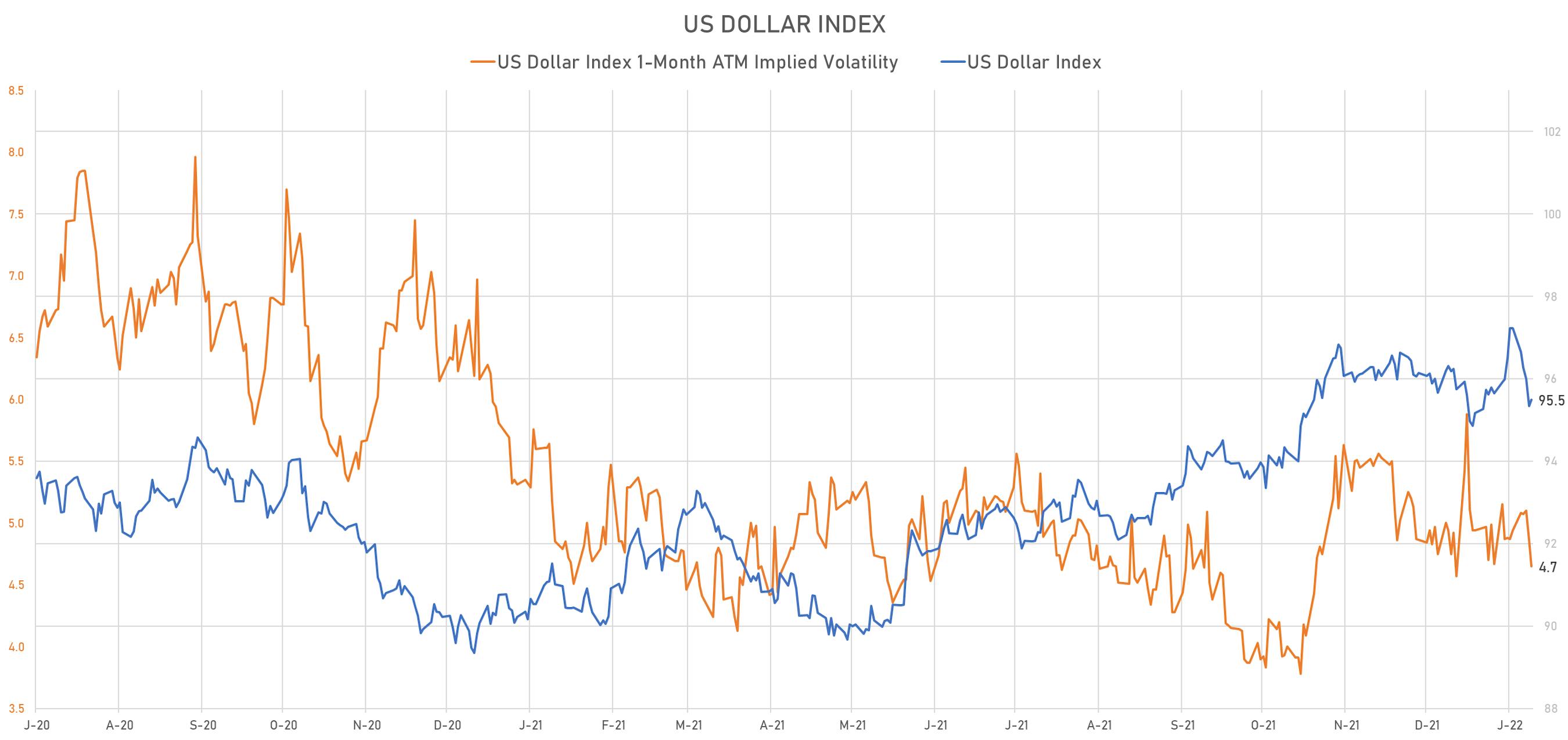

US DOLLAR INDEX, DX IMPLIED VOLATILITY FALL

GBP FORWARD RATES CURVE DEEPLY INVERTED, MARKET KEEPS PRICING POLICY ERROR

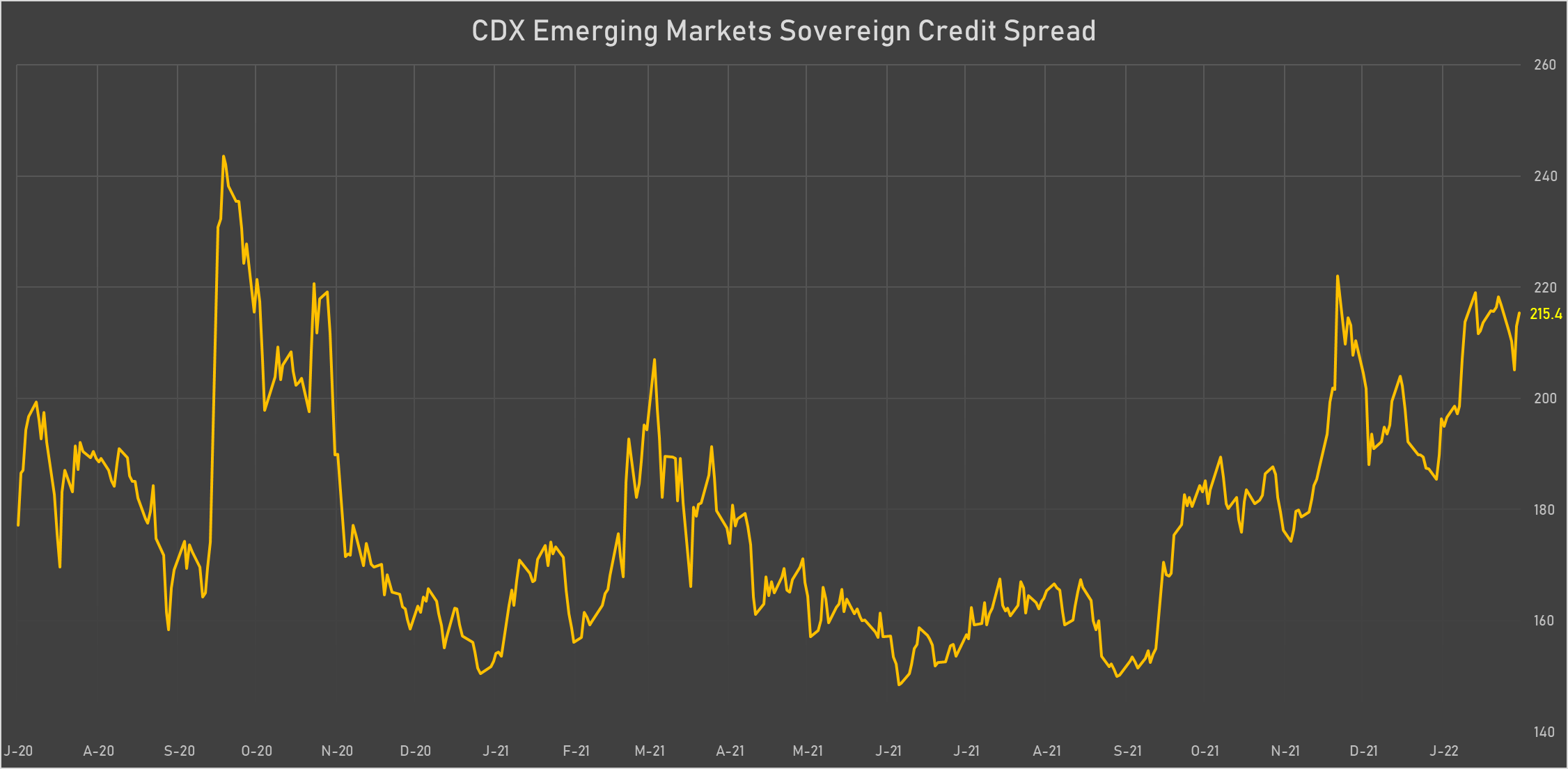

CDX EM SOVEREIGN CREDIT SPREAD WIDENS..

..BUT EM CURRENCIES HAVE HELD UP PRETTY WELL SO FAR

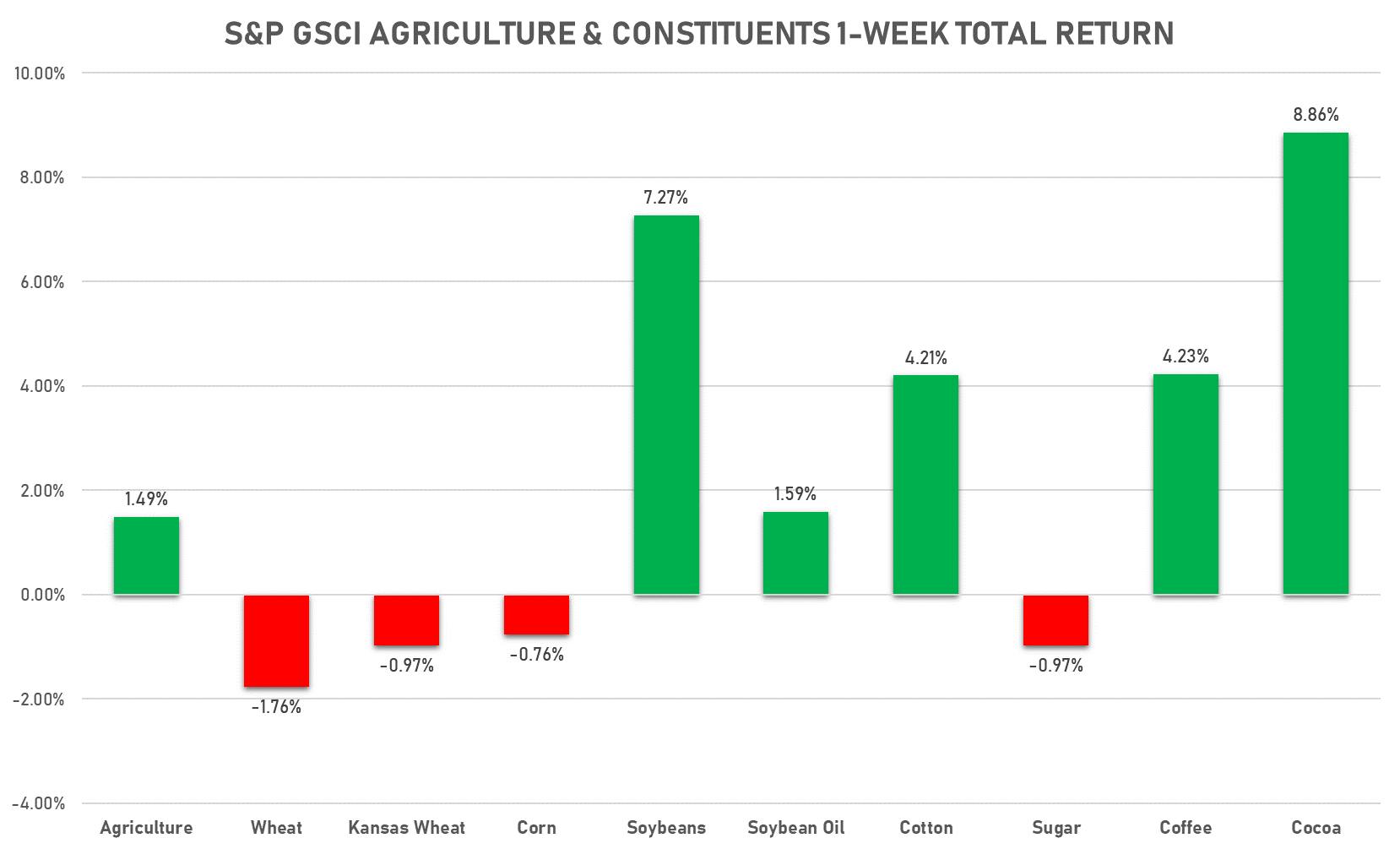

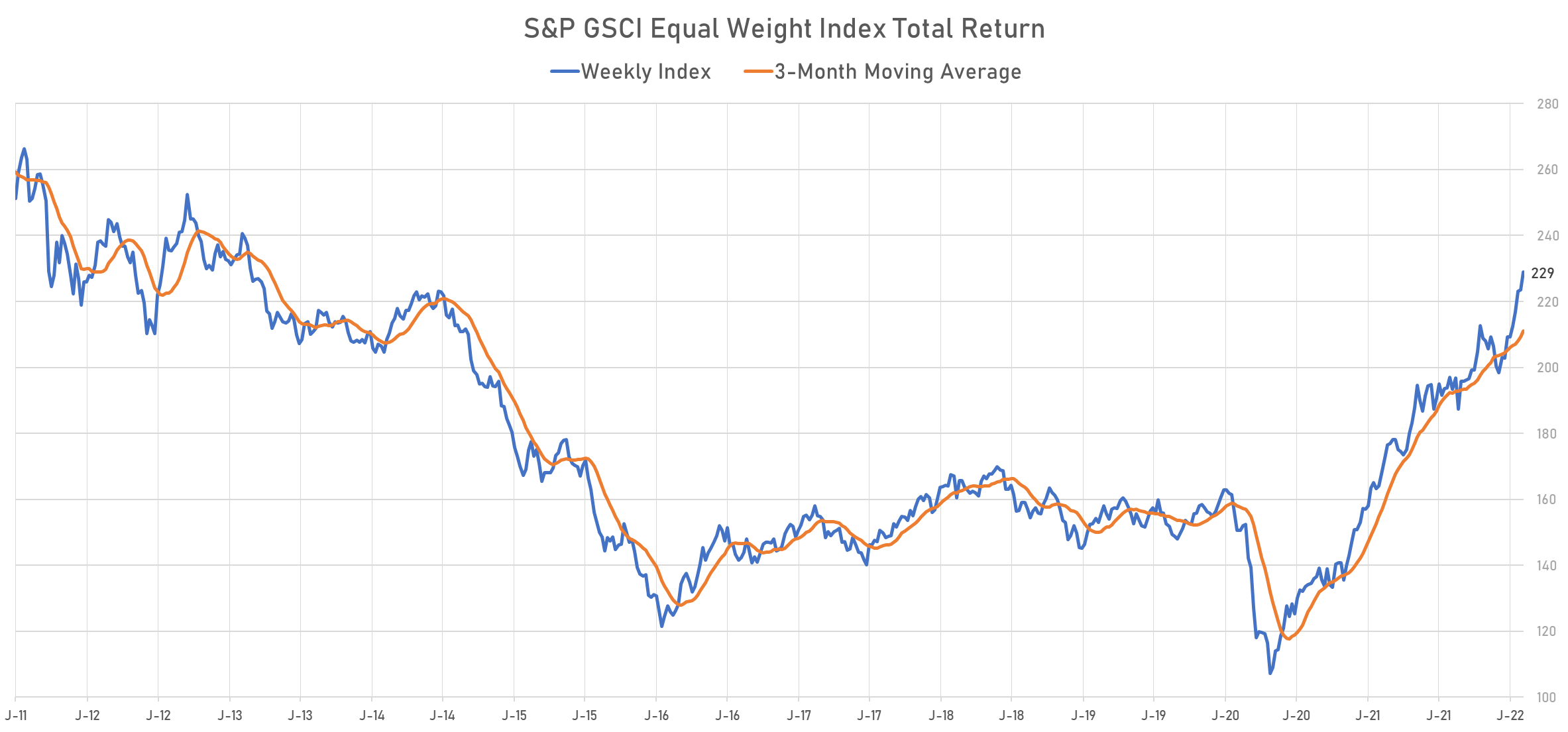

COMMODITY PRICES HELPING EM FX, WITH THE S&P GSCI EQUAL-WEIGHTED INDEX STILL RISING

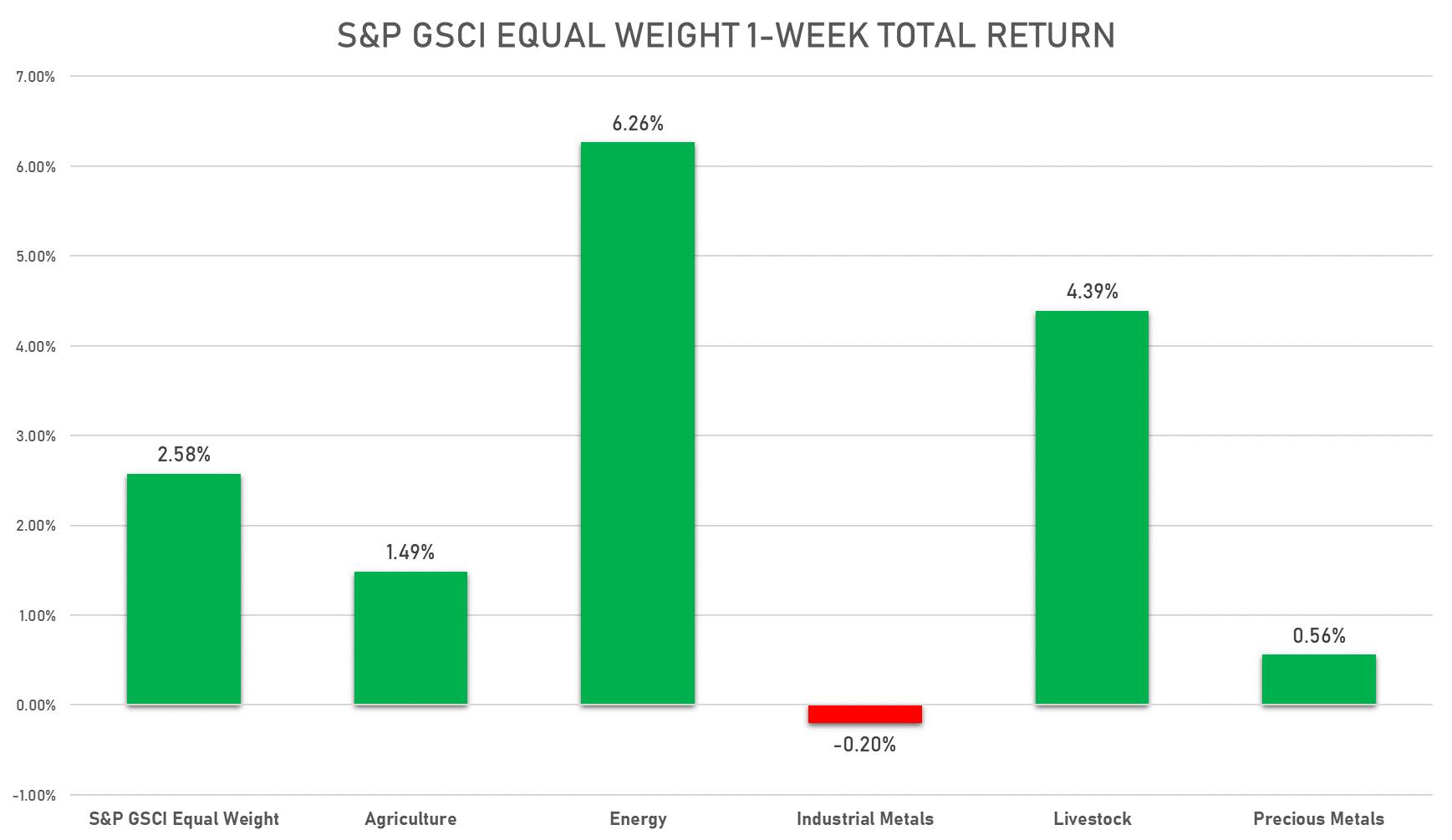

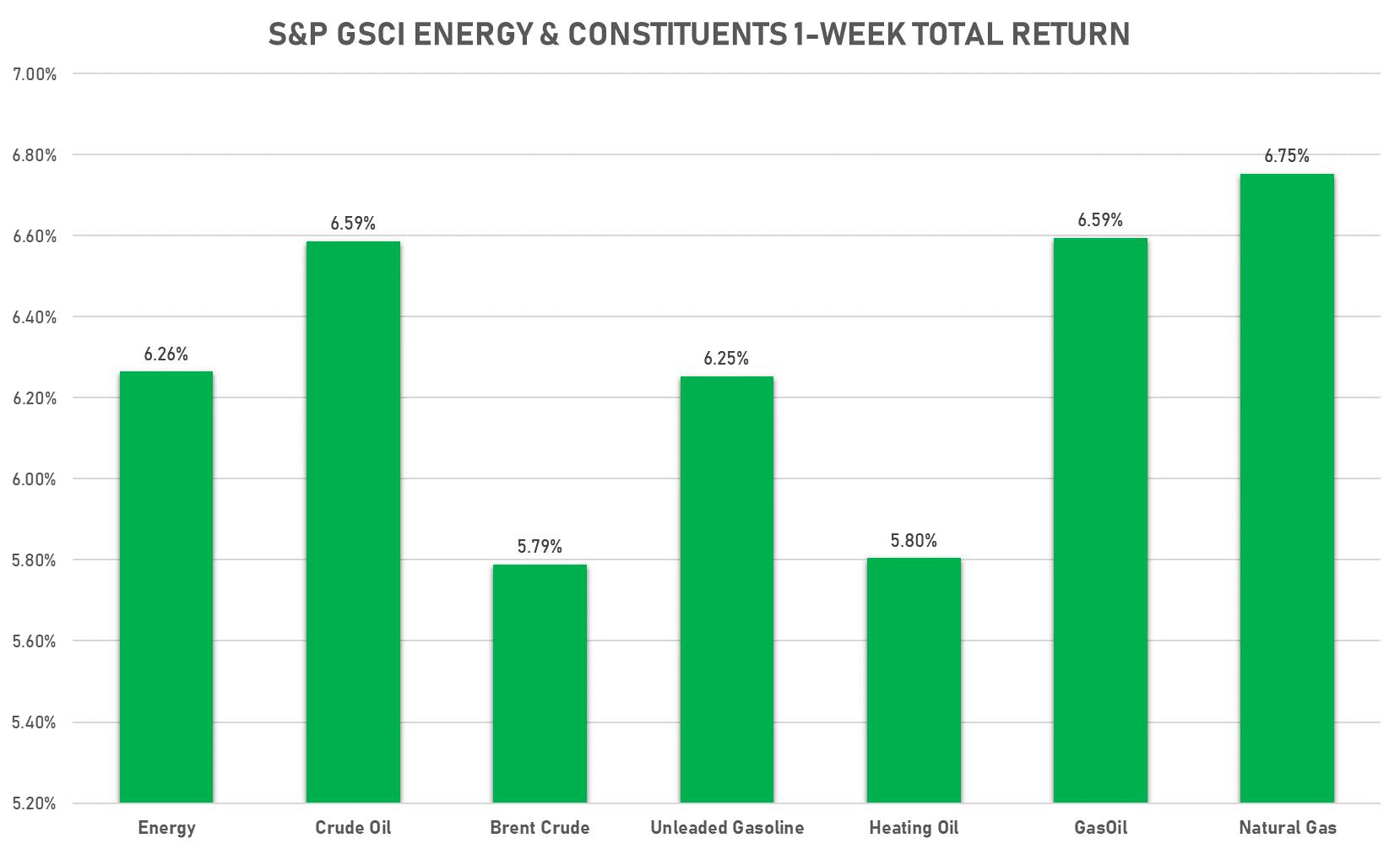

ENERGY LEADING THE RISE IN COMMODITIES THIS WEEK..

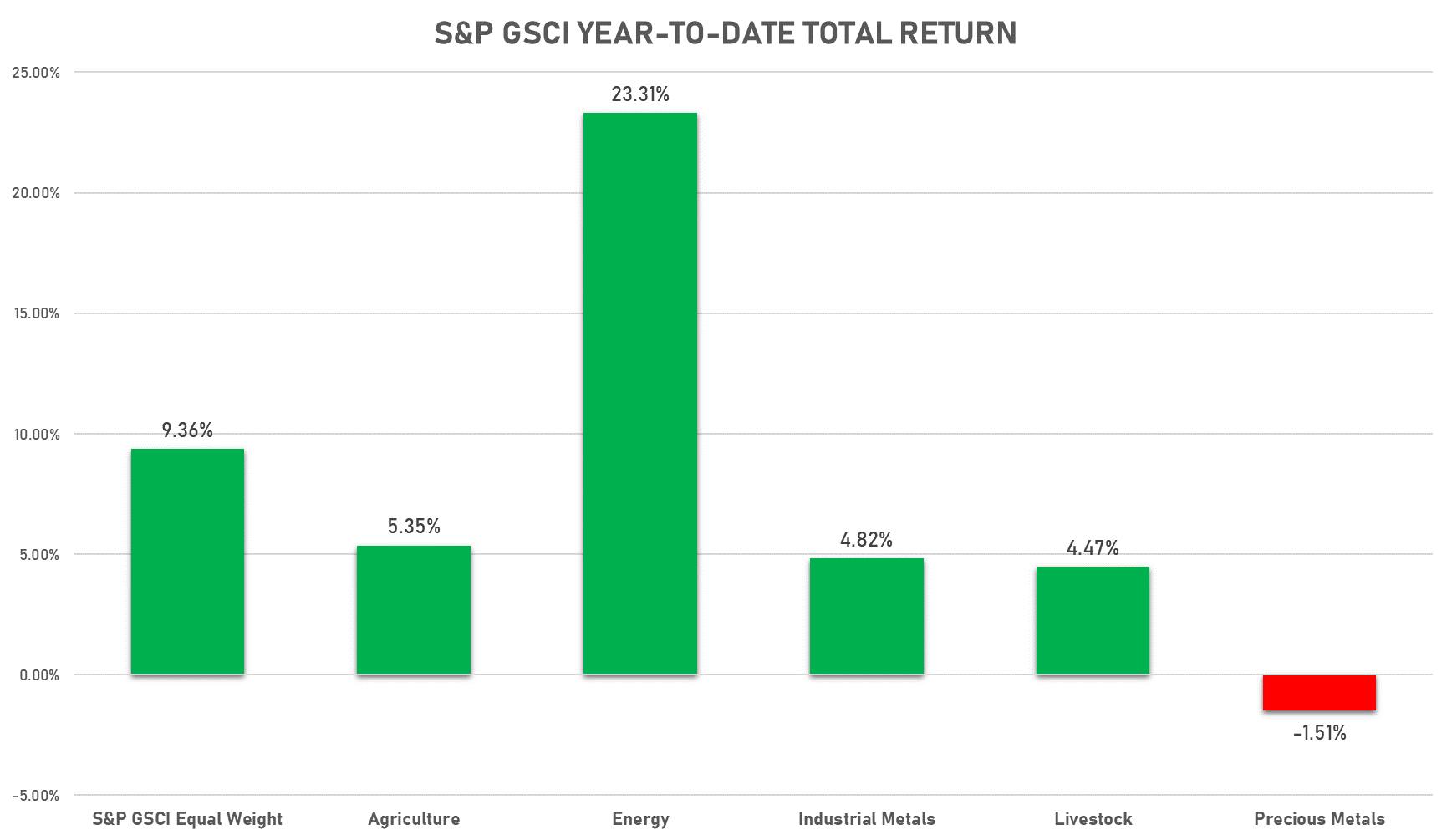

... AND THIS YEAR

ENERGY RISE IS BROAD BASED

BRENT FRONT MONTH PRICES WELL ABOVE $90/BBL, THOUGH BACKWARDATION AT HISTORICALLY HIGH LEVELS

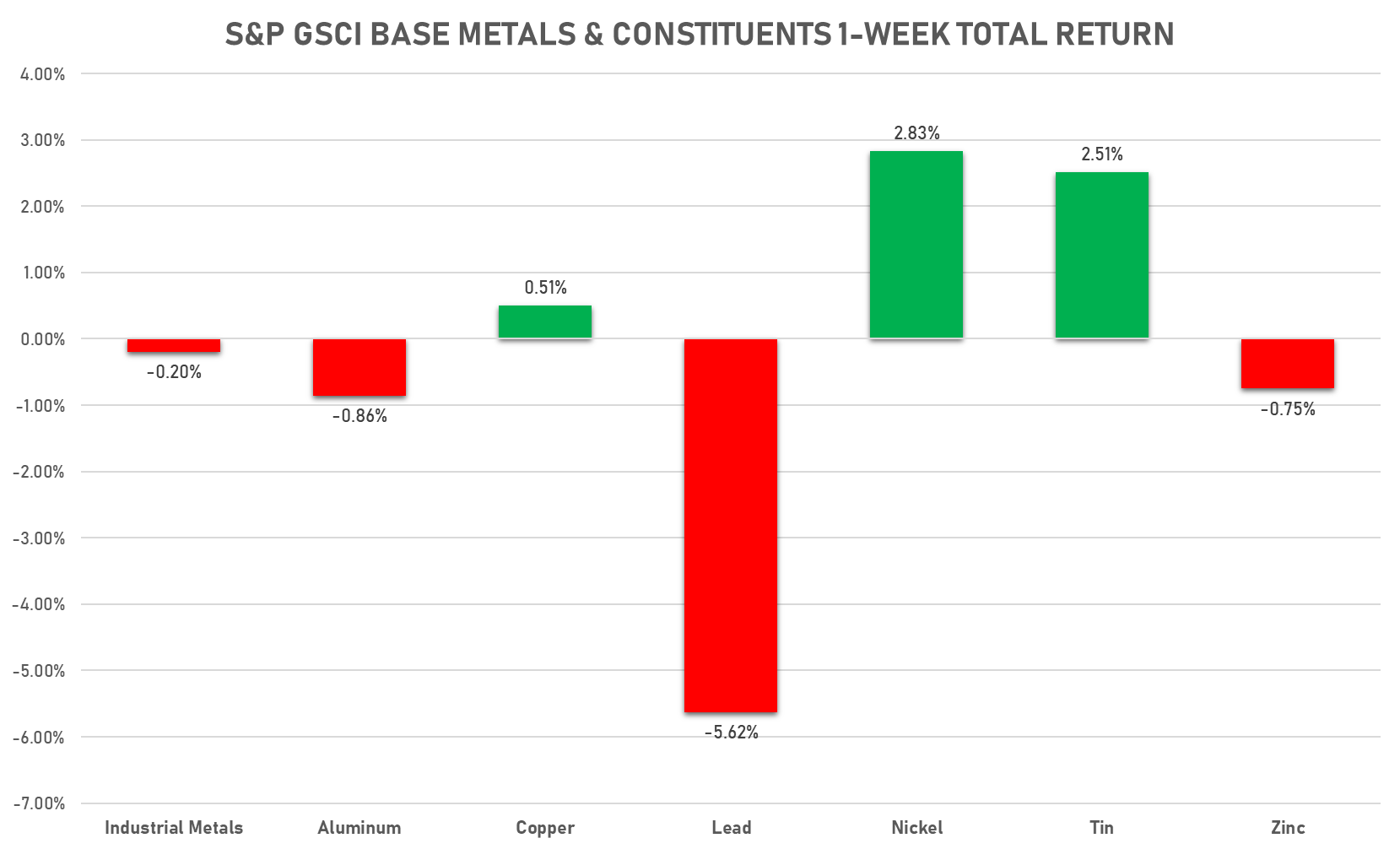

BASE METALS MIXED, LED BY NICKEL

AGS LED BY SOYBEANS AND COCOA