Macro

FOMC Preview: Fed Will Publish More Front-Loaded Dot Plot Than In September

When the Fed releases its updated economic projections and dot plot on 15 December '21, we expect it to show 2 hikes in 2022, which is lower than current market expectations of 2.7 hikes

Published ET

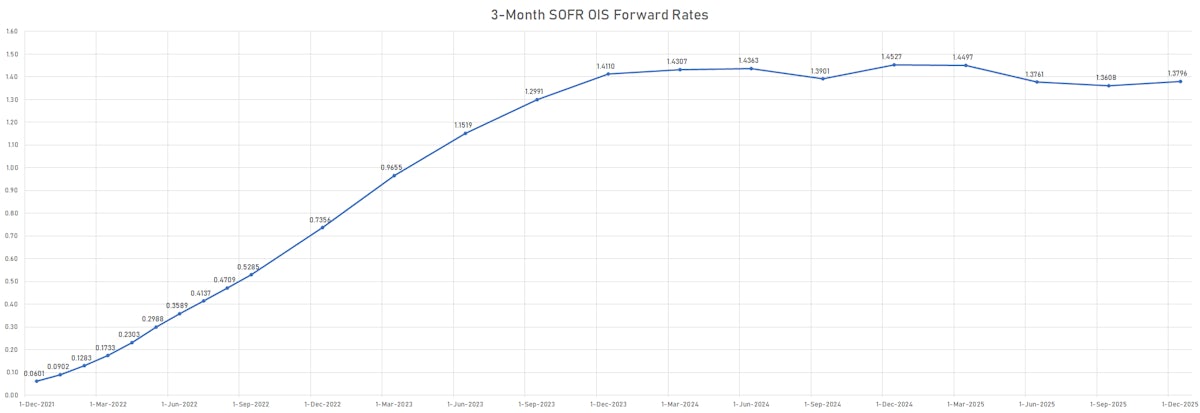

Current 3-Month USD SOFR OIS Forward Rates Curve | Sources: ϕpost, Refinitiv data

WHERE THE FED STANDS

- The dot plot at the September FOMC showed half a hike in 2022, 3 hikes in 2023, 3 hikes in 2024 (a total of 6.5 hikes through 2024)

- The Fed has repeatedly signaled its intention to accelerate the pace of taper in order to get optionality on raising rates. So, we're certain that the Fed will announce $30bn per month of taper, with an end of QE in March 2022.

- The Fed has also mentioned its desire to separate taper from rate hikes, meaning that (unless the inflation situation gets completely out of control) it is very unlikely to raise rates immediately after the end of taper.

WHAT THE MARKET IS CURRENTLY PRICING IN

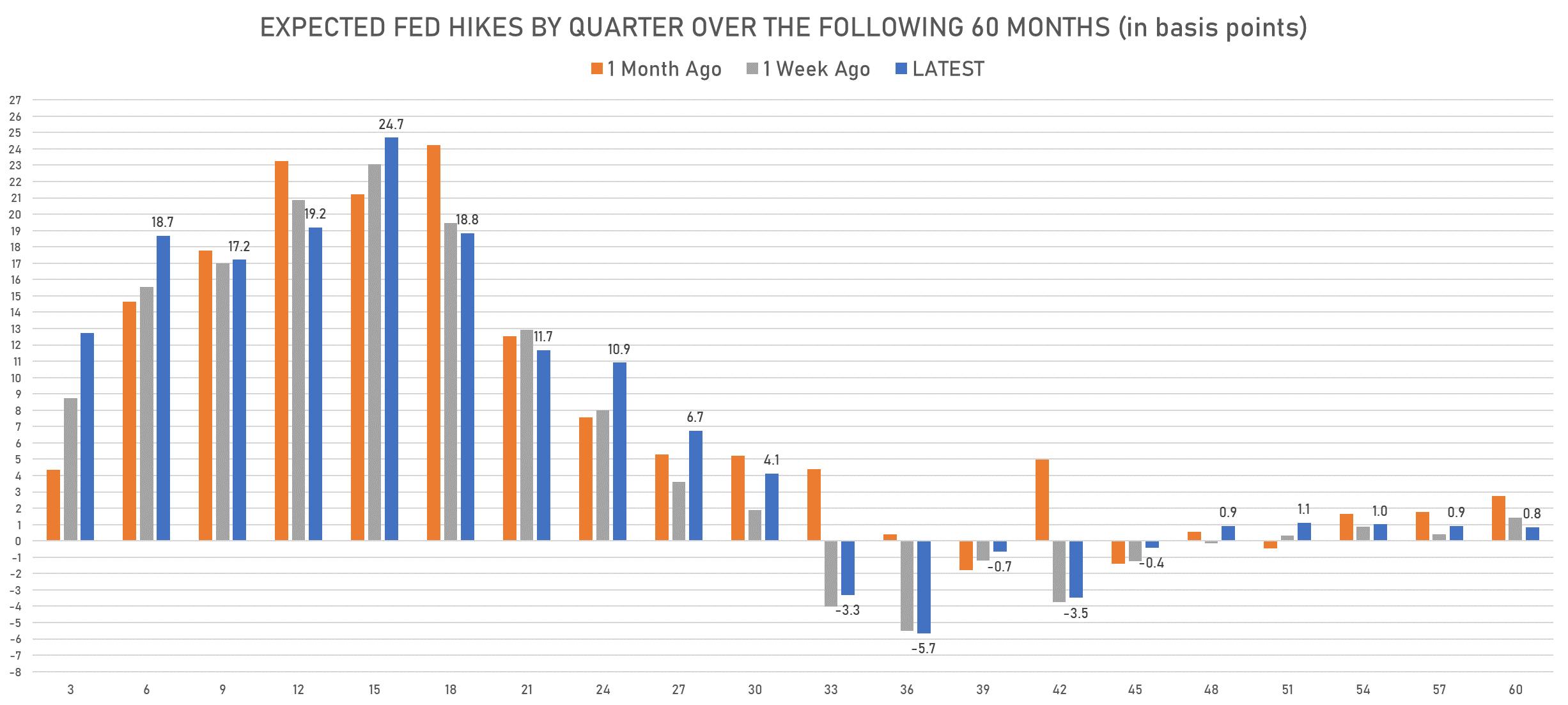

- The market currently prices a very short burst of hikes in 2022-23 and nothing much thereafter

- Looking at USD OIS forward rates, 67bp of hikes are priced in 2022 (2.7 hikes), 62bp in 2023 (2.5 hikes), and just 8bp in 2024 for a total of 5.5 hikes through 2024

- The volatility in rates this year has clearly shown that lower expectations of rate hikes over the next couple of years result in a higher terminal rate.

- Conversely, as you can see in the chart below (derived from 3M USD OIS Forward rates), the sharp rise in rates at the front end of the curve creates a reversal of policy 3 years on (a policy mistake)

SELL-SIDE DOT PLOT FORECASTS

- Goldman Sachs: David Mericle sees 3 hikes in 2022, with liftoff in June, a second hike in September, and a third hike in December. Then he expects 2 hikes in 2023, 2 hikes in 2024, for a total of 7 hikes through 2024

- Deutsche Bank expects 3 hikes in 2022, 3 in 2023, and 2 in 2024 (8 hikes through 2024).

- Credit Suisse: James Sweeney expects the Fed's dot plot to show 2 hikes in 2022, 4 hikes in 2023, 4 hikes in 2023 (10 hikes through 2024)

OUR VIEWS

- The Fed is very mindful of not spooking the market in any way, taking great care to signal its intentions well ahead of time

- Another way to say that is that it is very much leading from behind, waiting for the market to signal the necessary level of rates to contain inflation, then meeting those expectations

- In this context, we see the Fed's dot plot showing 2 hikes in 2022 for the moment (knowing that they can adjust it higher next year if needed), 2 in 2023, and 2 in 2024 2024 (6 hikes through 2024).

- In terms of timing, we expect the first hike in June 2022, followed by a second hike in September or October 2022

- Our views are just slightly more hawkish than market expectations through 2024, but a half a hike lower than the September FOMC's dot plot

POTENTIAL RISKS IF THE FED OUTLOOK ALIGNS WITH OUR VIEWS

- The market still prices in a 40% chance of a rate hike through March 2022, which we think would require extraordinary changes in the inflation data to be realized. The risk of this probability going lower can be hedged by going long April Fed Funds futures (FFJ2)

- With 67 bp of hikes priced for 2022 (2.7 hikes), there is very limited upside for being outright short December 2022 eurodollar: the risk is for a run back towards 2 hikes, which means long EDZ22

- With our view of fewer hikes early on, we have a bias for higher terminal rates, with a steepening at the front end of the eurodollar curve: being short longer-dated eurodollar futures makes sense to us, especially as a spread (EDZ22/EDZ25 or Reds/Blues)