Cross Asset

FOMC Wrap-Up: Hawkish Fed Focused On Inflation, Spooks Market Into Pricing In More Than 4 Hikes This Year

The major risk outlined by Powell in his Q&A was that inflationary pressures might prove more long-lasting than the FOMC previously expected, notably wage growth in a very tight labor market

Published ET

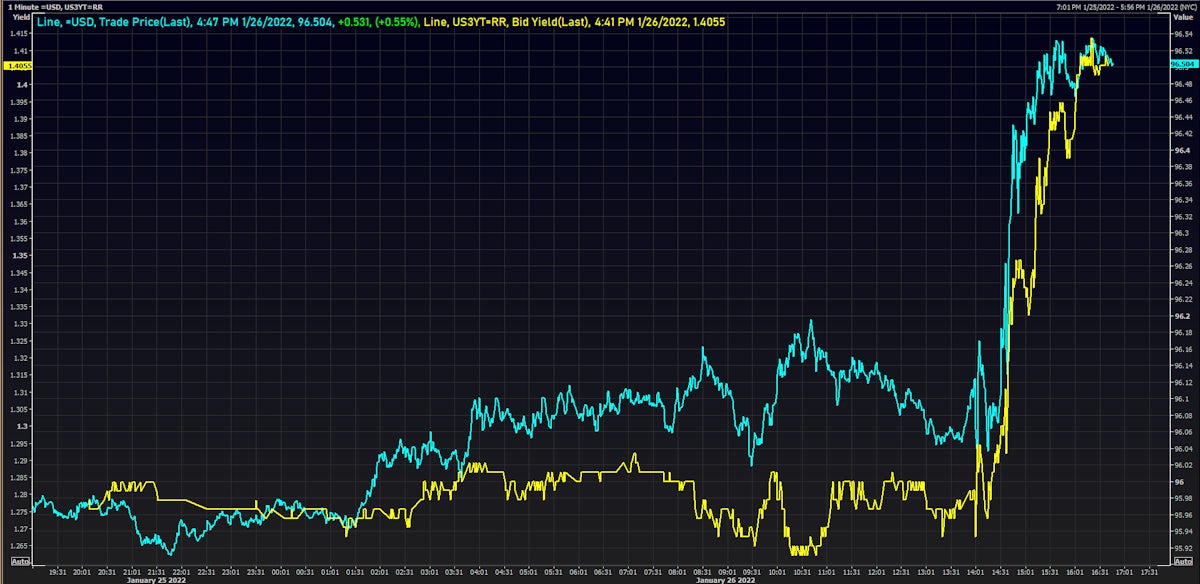

US Dollar Index & 3Y US Treasury Yield Intraday | Source: Refinitiv

WHAT THE FED ANNOUNCED

- QE will end before the next FOMC: "the Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March"

- No rate action this time but they cocked their gun and are ready to hike in March: "the Committee expects it will soon be appropriate to raise the target range for the federal funds rate"

- Powell indicated that inflation may not go down quickly, repeatedly stressing how tight the labor market currently is and noting that supply chain issues aren't going away

- He also continues to be pessimistic on a recovery in labor force participation, estimating that around 1% of the decline in participation was due to retirements

- The Fed wants to appear aggressive and nimble, and we can assume that from now on every meeting will be "live": Powell did not reply negatively when asked whether the Fed would be ready to hike at every meeting (keeping maximal flexibility at this point)

- This implies potentially 7 hikes this year, if necessary, as Powell seemed relaxed about inverting the yield curve.

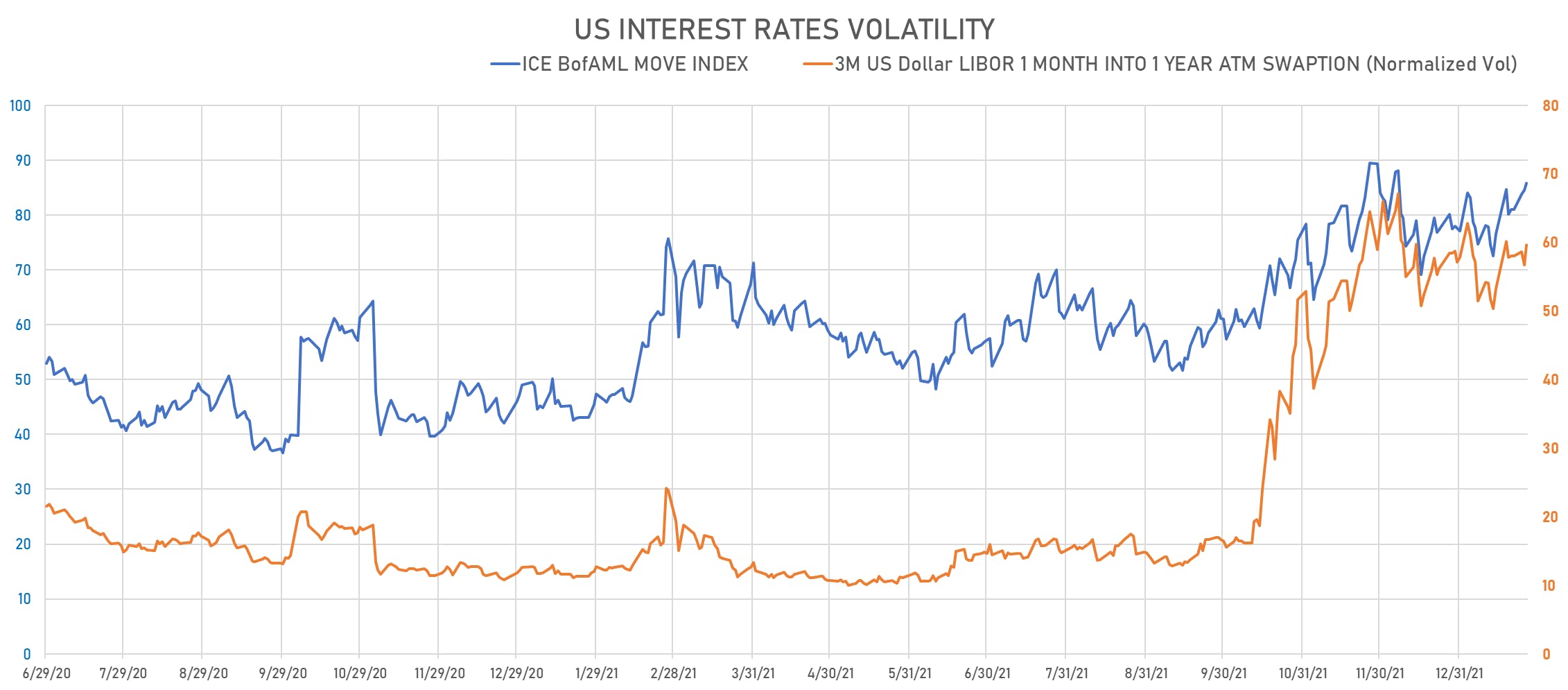

- The Fed is not concerned about the selloff in risky assets, and was not trying to minimize market volatility (rates vol ended higher today)

- The Fed started discussing its balance sheet run-off and issued new guidance regarding QT: "Principles for Reducing the Size of the Federal Reserve's Balance Sheet"

- QT is firmly positioned as a secondary policy tool, with rate hikes taking the lead in their fight against inflation: "the Committee views changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy"

- We see QT starting as early as June, after liftoff and a couple more meetings (March & May).

- Balance sheet runoff will be done predictably, primarily through reducing reinvestments, not active sales

- No indication about the size of the monthly runoff, but we would expect it to be around $100bn/mth

- FOMC wants to eventually hold a Treasuries-only portfolio in order to stop propping up specific economic sectors (no more MBS)

RATES REACTION AND OUTLOOK

- The Fed wants to normalize financial conditions and bring them to a neutral state (at the very least), though perhaps not in a straight line.

- If we assume that in a couple of years inflation could be running at 2.5%, the neutral rate for financial conditions would be somewhere around 2.5% (real Fed Funds rate = 0).

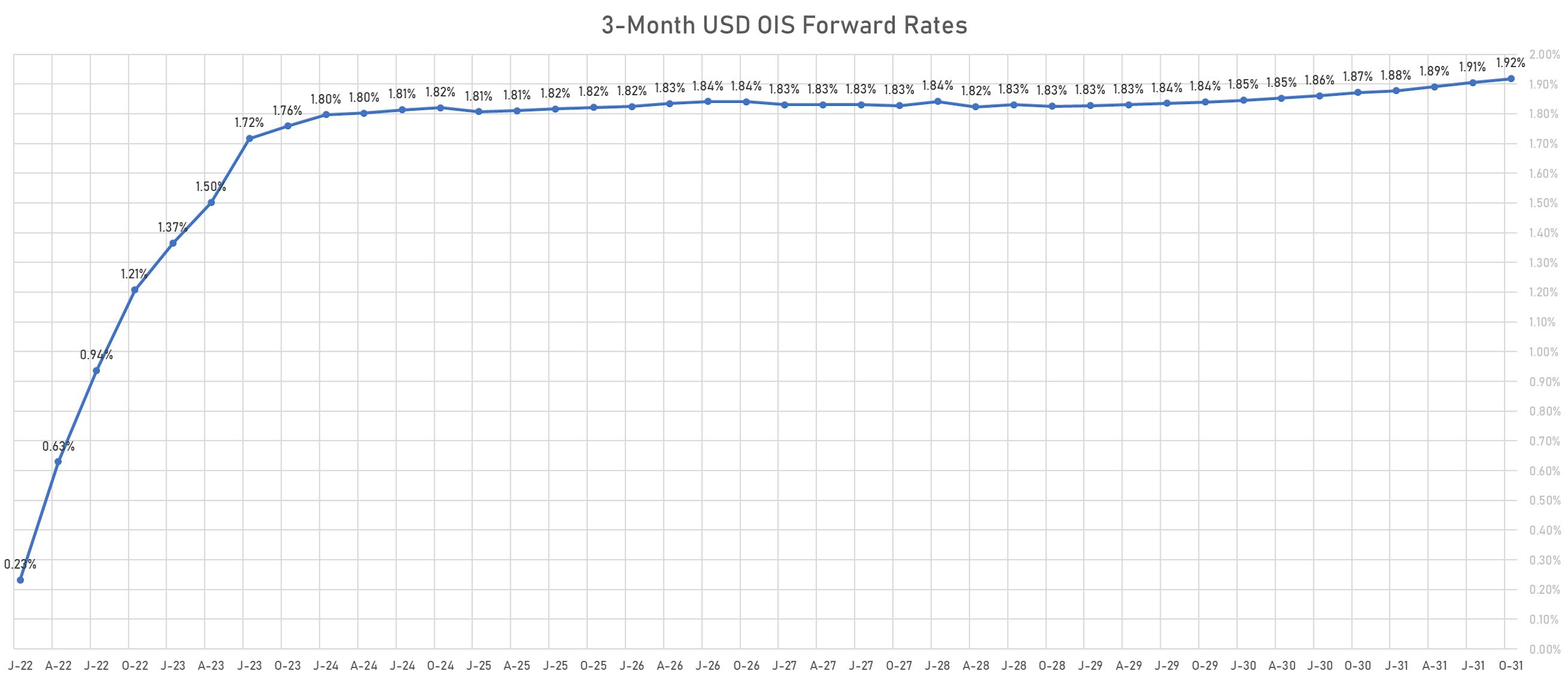

- But forward rates continue to show that the market doesn't believe the FOMC will be able to follow through on its plan: the 3M USD OIS Forward curve shows a terminal rate around 1.85% after 5 years

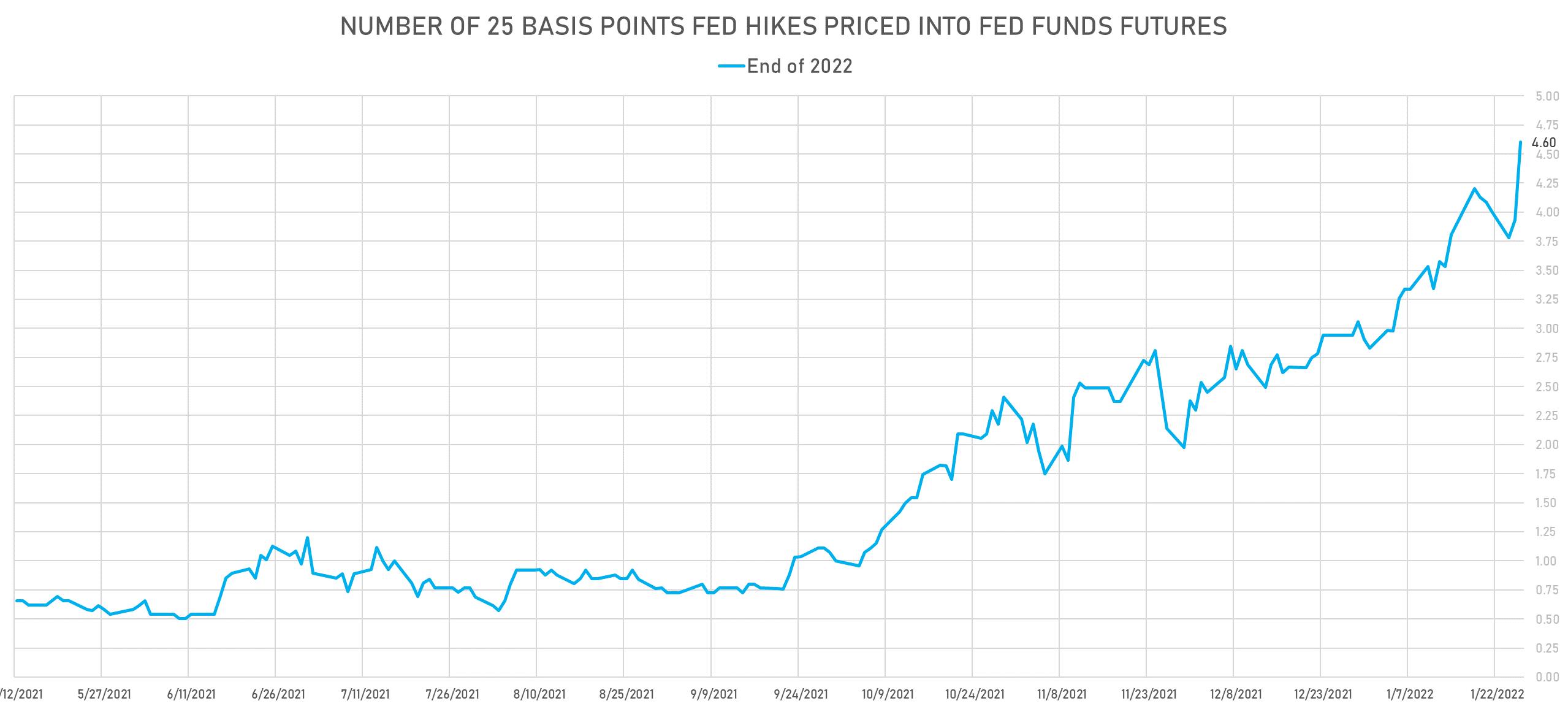

- The market is getting closer to pricing in 5 hikes in 2022: Fed Funds futures reacted to the hawkish Fed tone today by increasing the number of hikes priced until the end of the year to 4.60 (from 3.93 yesterday)

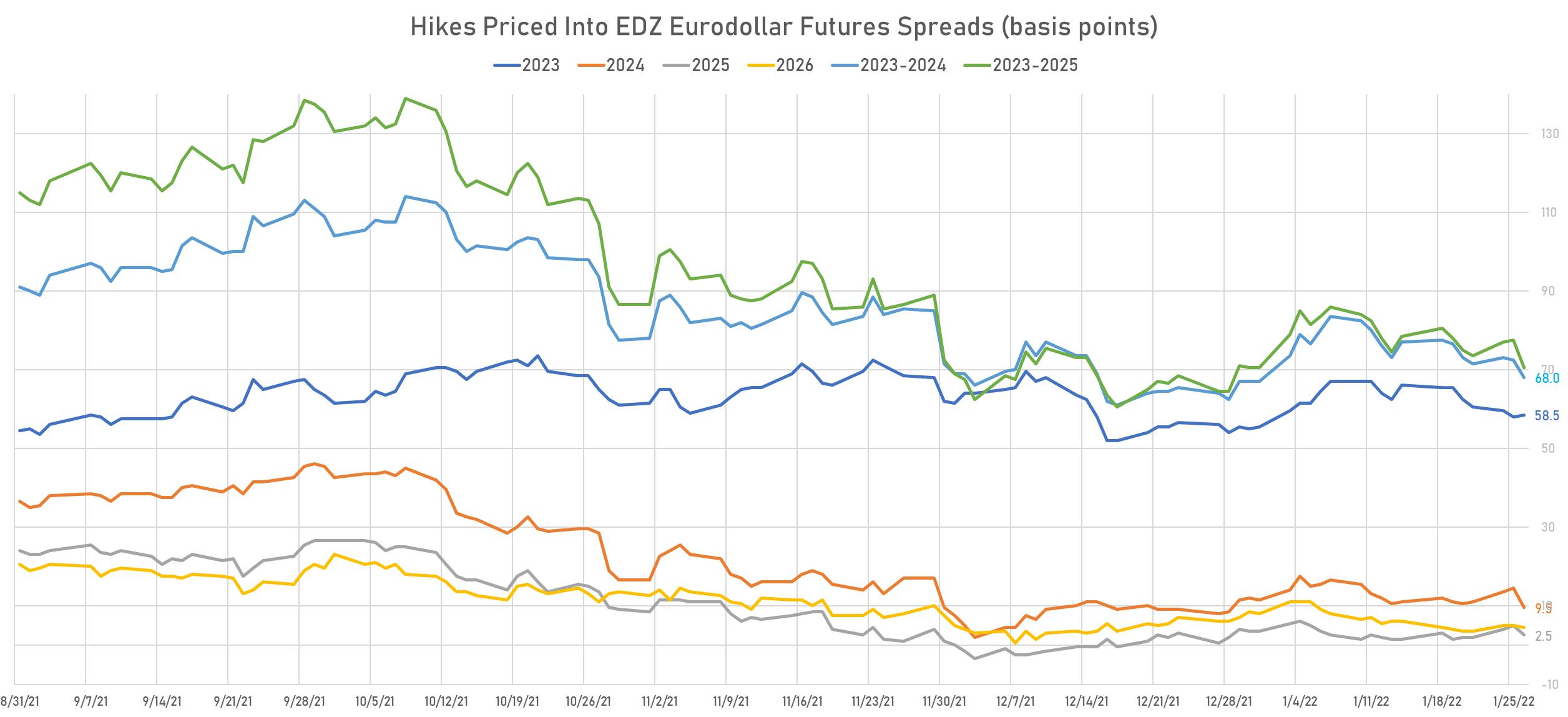

- But the Eurodollar curve flattened: the spread between EDZ25 and EDZ22 implied yields is now at 70bp, down from 77bp yesterday.

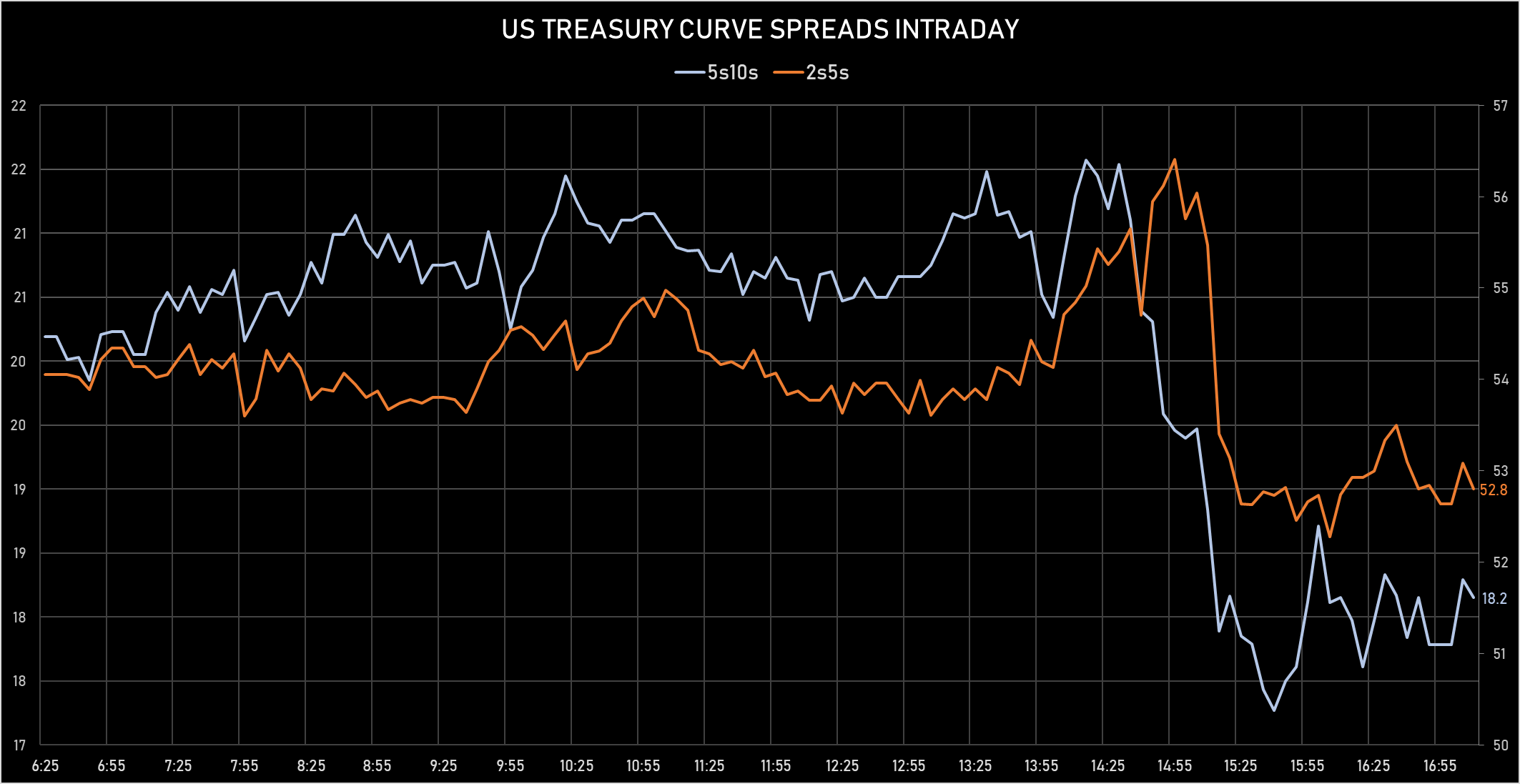

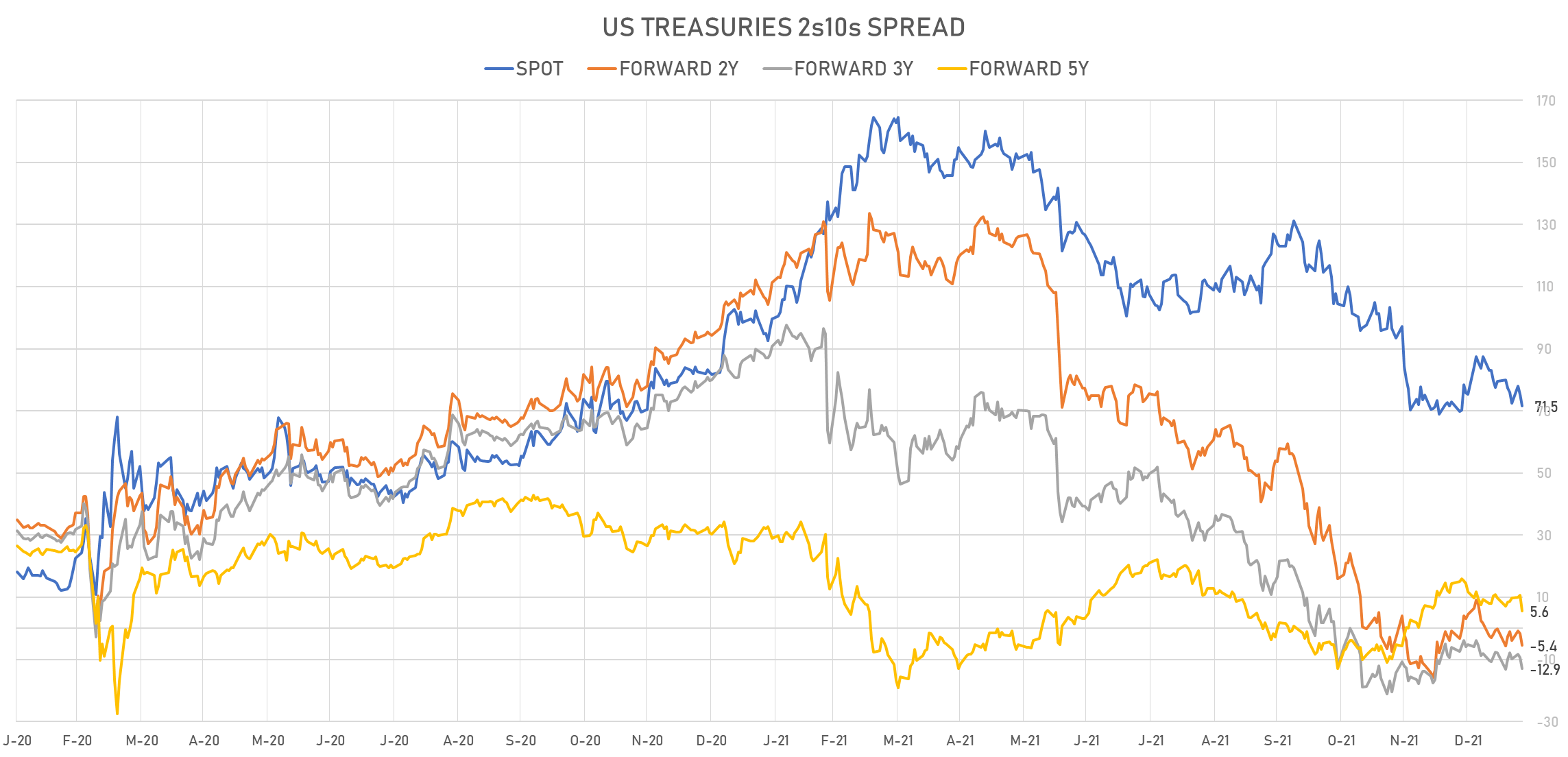

- In other words, any increase in yields at the front end of the curve leads to a forward flattening, which was also true in Treasuries, with the 1s10s spread tightening -1.1 bp, now at 126.7 bp (YTD change: +13.9bp)

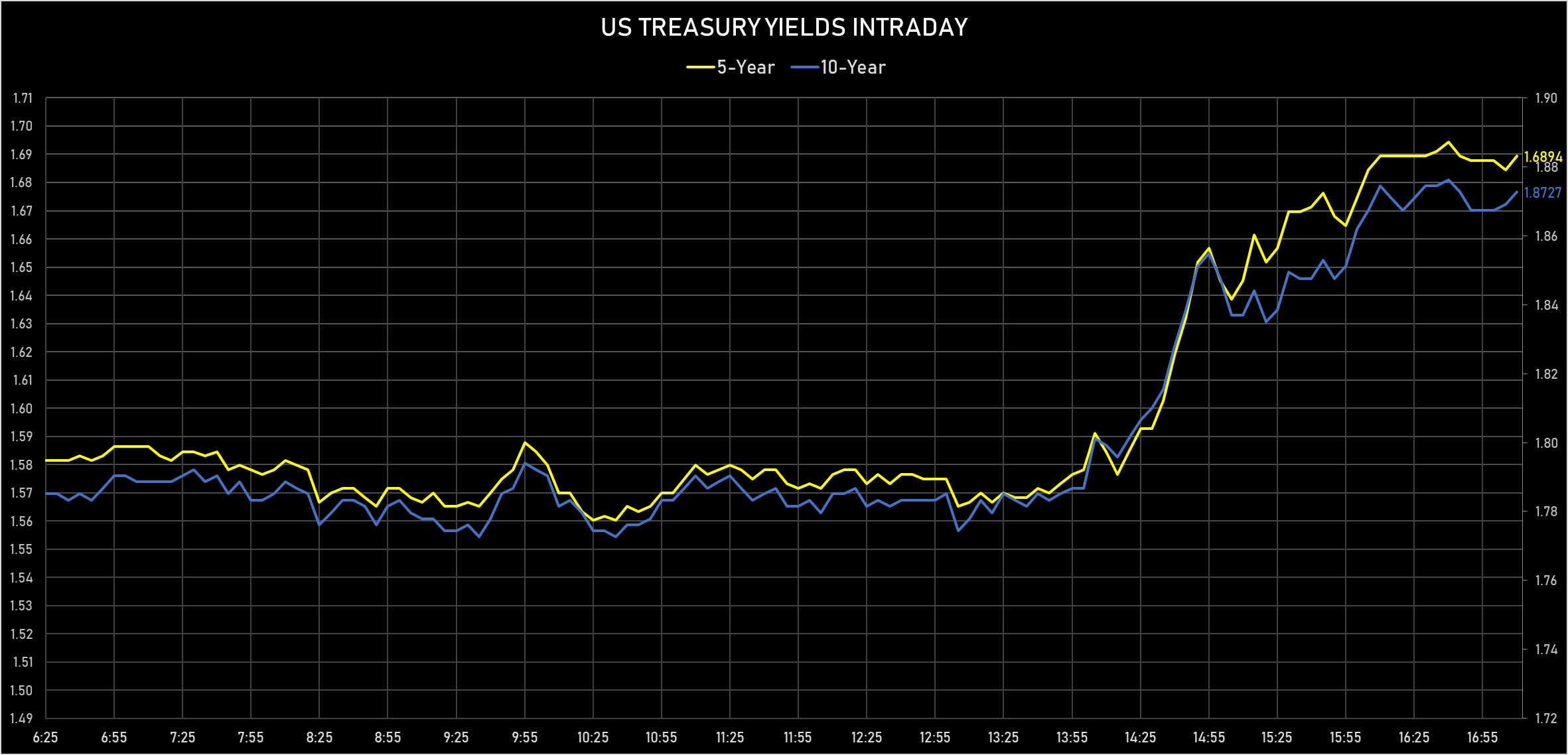

- Treasury curve: 1Y at 0.6060% (up 10.8 bp), 2Y at 1.1564% (up 12.9 bp), 5Y at 1.6894% (up 12.5 bp), 7Y at 1.8358% (up 11.3 bp), 10Y at 1.8727% (up 9.7 bp), 30Y at 2.1746% (up 5.5 bp)

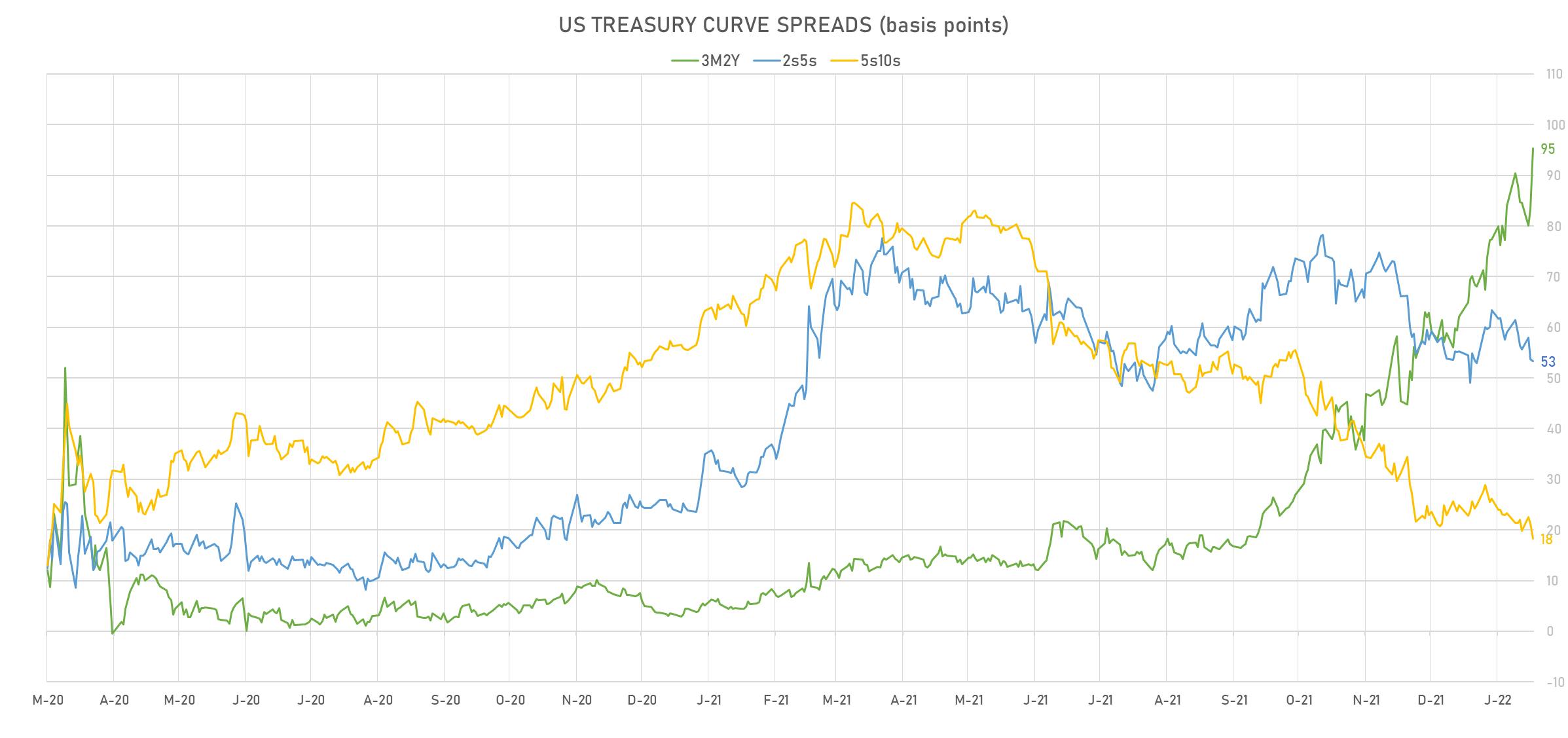

- US treasury curve spreads: 3m2Y at 95.4bp (up 11.9bp today), 2s5s at 53.2bp (down -0.7bp), 5s10s at 18.5bp (down -2.7bp), 10s30s at 30.2bp (down -4.1bp)

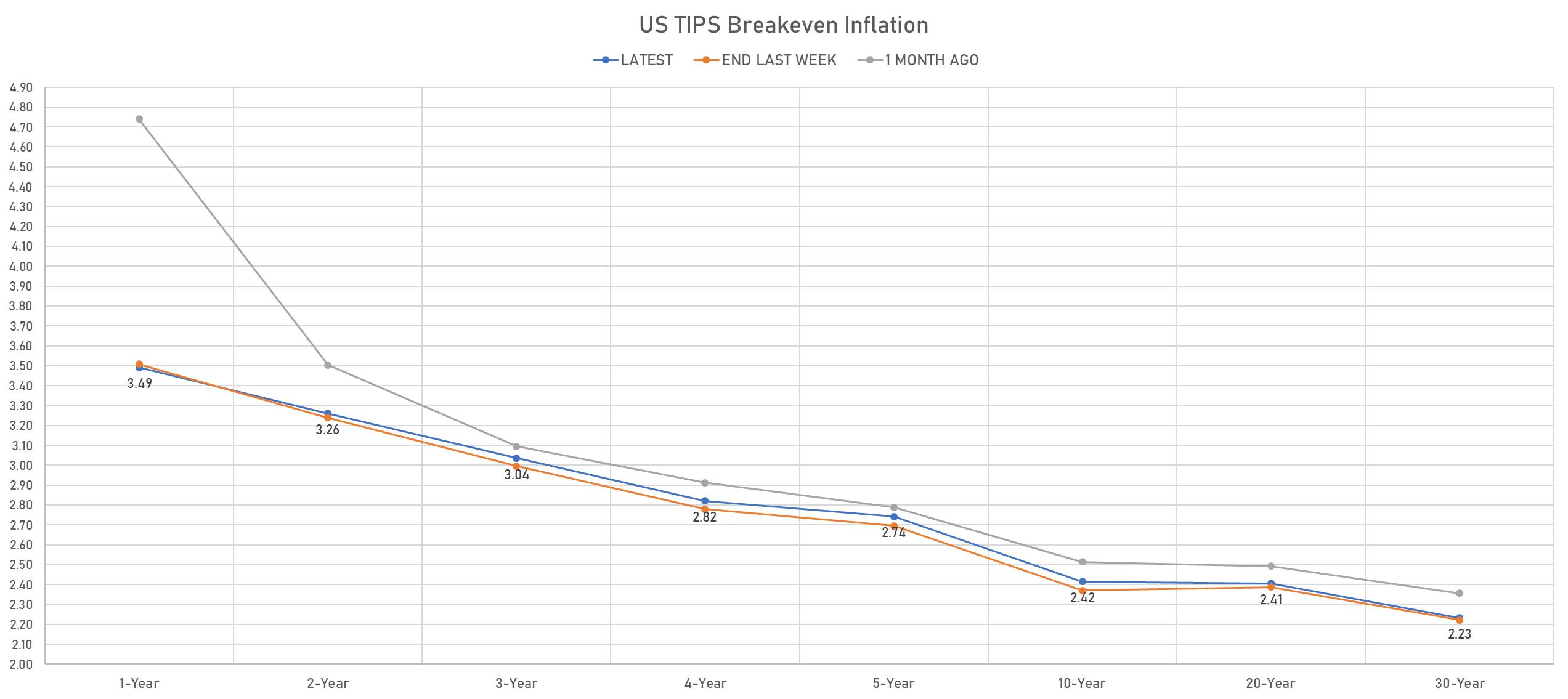

- TIPS 1Y breakeven inflation at 3.49% (up -5.7bp); 2Y at 3.26% (down -0.8bp); 5Y at 2.74% (down -1.2bp); 10Y at 2.42% (up 0.1bp); 30Y at 2.23% (up 0.4bp)

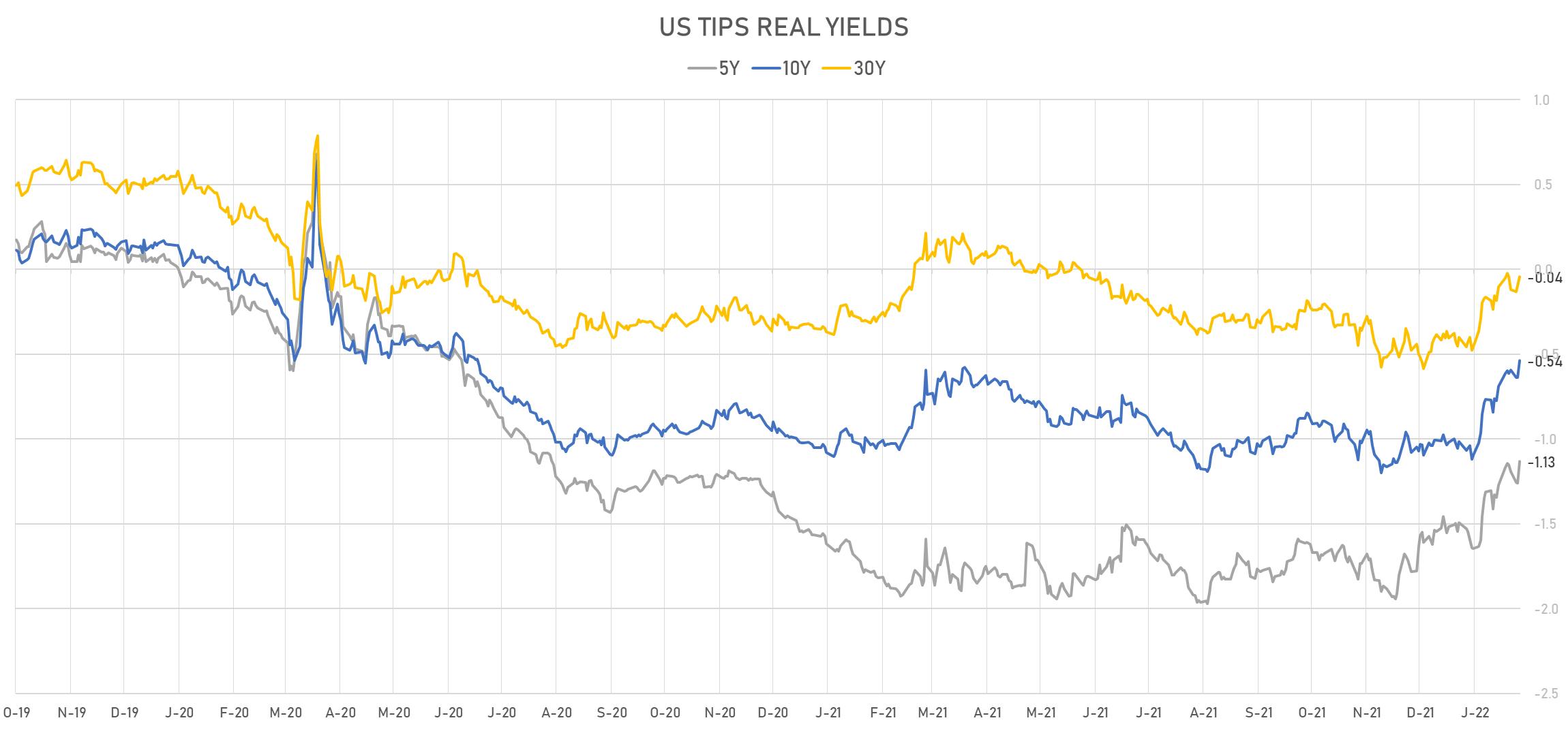

- US 5-Year TIPS Real Yield: +13.0 bp at -1.1310%; 10-Year TIPS Real Yield: +9.7 bp at -0.5390%; 30-Year TIPS Real Yield: +5.2 bp at -0.0440%

- The fact that Powell seems relaxed about the shape of the curve (as mentioned above) means that we could see an inversion in the Treasuries 2s10s spot spread later this year (at 71bp right now), especially if inflation remains stubbornly high in the face of higher rates.

- Inflation expectations remain highly uncertain, which should bring continued rates volatility until there is more clarity on that front

RISKS THAT HAVEN'T BEEN PRICED IN YET

- The Fed dropping a deuce in March: right now only 27bp of hikes priced in by the end of March '22, and 41.9bp (1.68 x 25bp hikes) by the end of May

- Indications that QT will be used aggressively as a primary policy tool: the yield curve is still flattening, but the Fed could easily change that with QT (though they very clearly articulated that they don't care about the shape of the curve)

OUTLOOK FOR FX

- The dollar is driven by two main factors: the outlook for the Fed and the state of the global economy

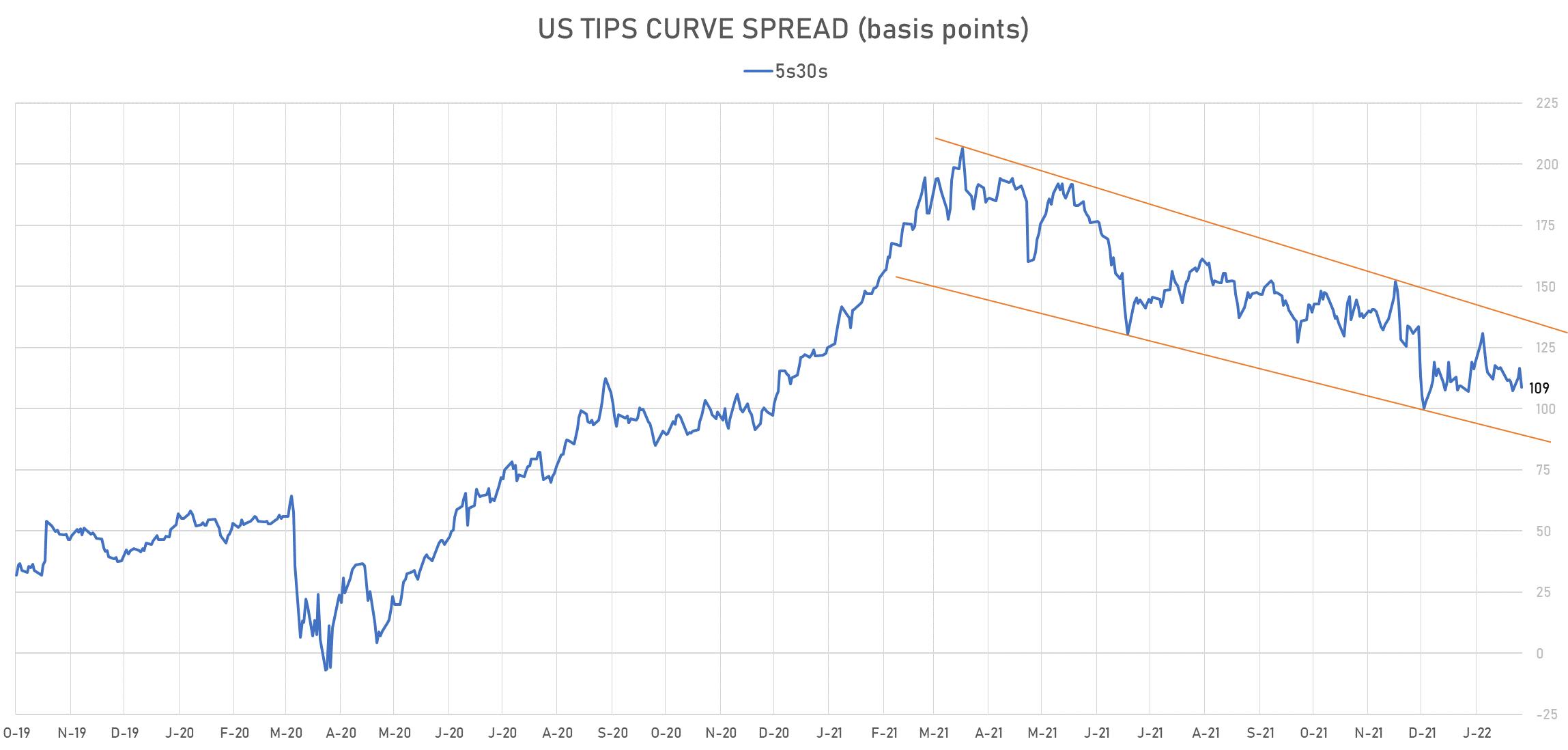

- The first factor is priced in short rates differentials, while the second is priced in riskier assets sensitive to longer-term growth (we like looking at the US TIPS 5s30s spread, but you can also look at growth equities, the CDX EM sovereign credit spread, etc)

- At this time, those factors are going in the same direction, favorable to the USD: short rates differentials are widening, and risky assets are selling off (5s30s TIPS is flattening). The front-end of the US curve is probably not fully priced, with possibly more hikes coming this year than expected. So, in the short term we think it's dangerous to be outright short the USD.

- In the medium term we could see an environment where risky assets rebound and other major central banks start closing the gap with the Fed, both of which would be negative for the dollar

- That is particularly true for high yielding EM currencies, where inflation and hikes started earlier: the real carry (real yields differential) could turn positive for some of those countries when inflationary pressures start receding (probably too early now)

OUTLOOK FOR CREDIT MARKETS

- Credit derivatives widened today, with the Markit CDX.NA.IG 5Y up 1.5 bp, now at 100bp (YTD change: +10.9bp), and Markit CDX.NA.HY 5Y up 6.4 bp, now at 338bp (YTD change: +45.7bp)

- In the medium term, it's hard to be extremely positive on credit, as higher yields should raise historically low default rates

- Having said that, on a tactical basis, spreads have widened very significantly lately, and we could see a rebound, especially in US$ HY: we prefer shorter durations in this environment, though the curve is flattening, and it shouldn't be too bad for IG until BS runoff starts

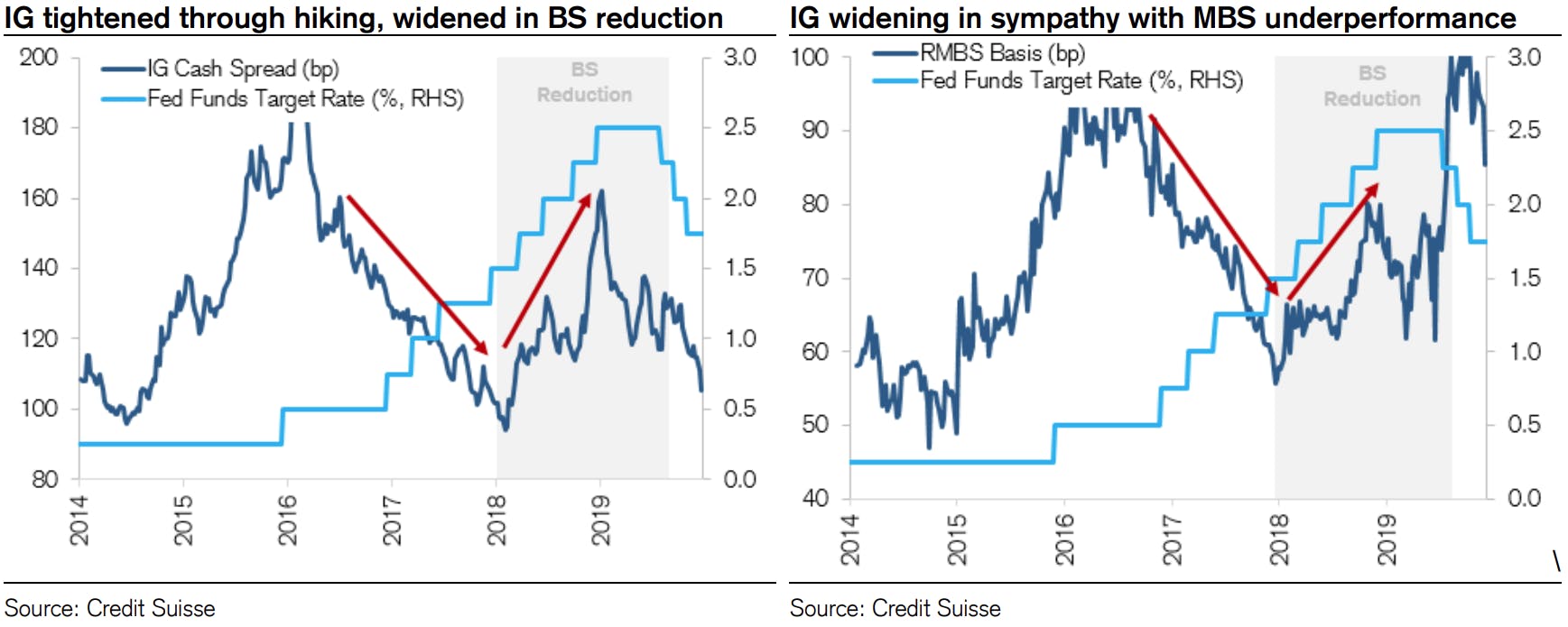

- Generally, QT proves worse for longer-duration investment grade bonds (rather than HY or loans), with the MBS basis expected to widen significantly

- Here's a Credit Suisse analysis of the historical impact of QT on US$ IG

OUTLOOK FOR EQUITY MARKETS

- The Fed will also determine to a large extent the performance of US equities, with real rates being the main driver of P/E multiples

- Volatility should stay elevated, with the Fed unlikely to help in this respect, with its nimble / tactical bias not conducive to a stabilization of markets expectations

- The flattening of the curve should help technology stocks rebound, with long rates the main driver of terminal values. In particular, an inversion of the curve would favor growth over value.