FX

US Dollar Strengthens Despite Real Yields Headwinds

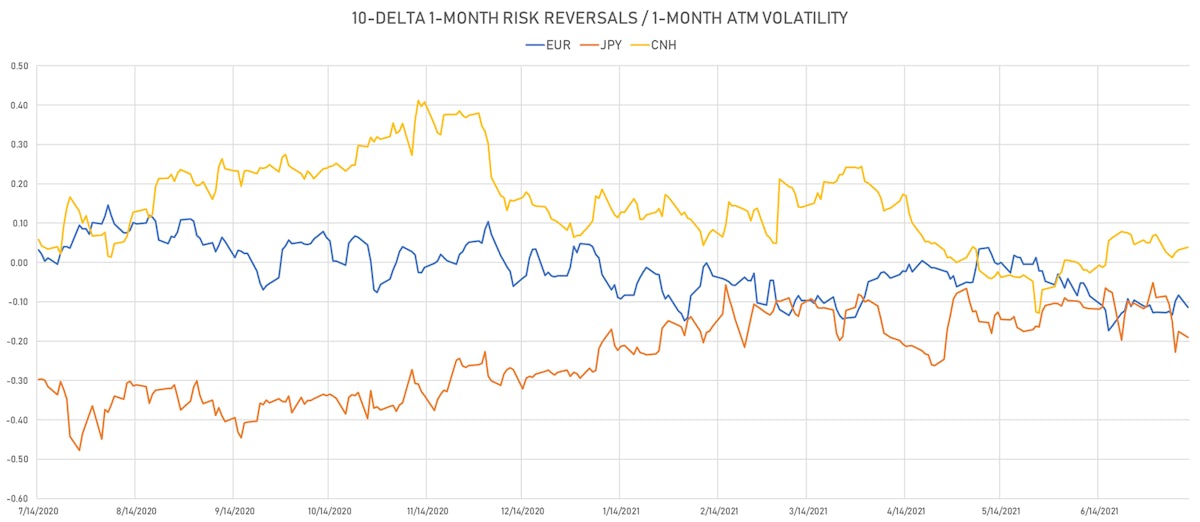

Risk reversals are showing a very slight pickup in downside speculative bias for the euro and Japanese yen

Published ET

Negative Euro Speculative Interest Waned Over The Past Week | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

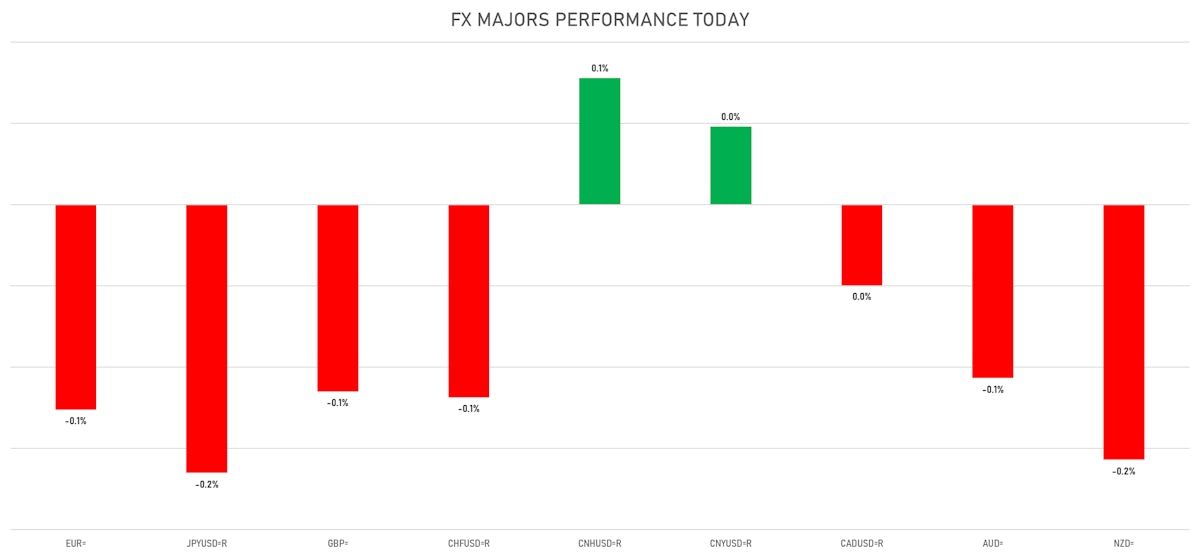

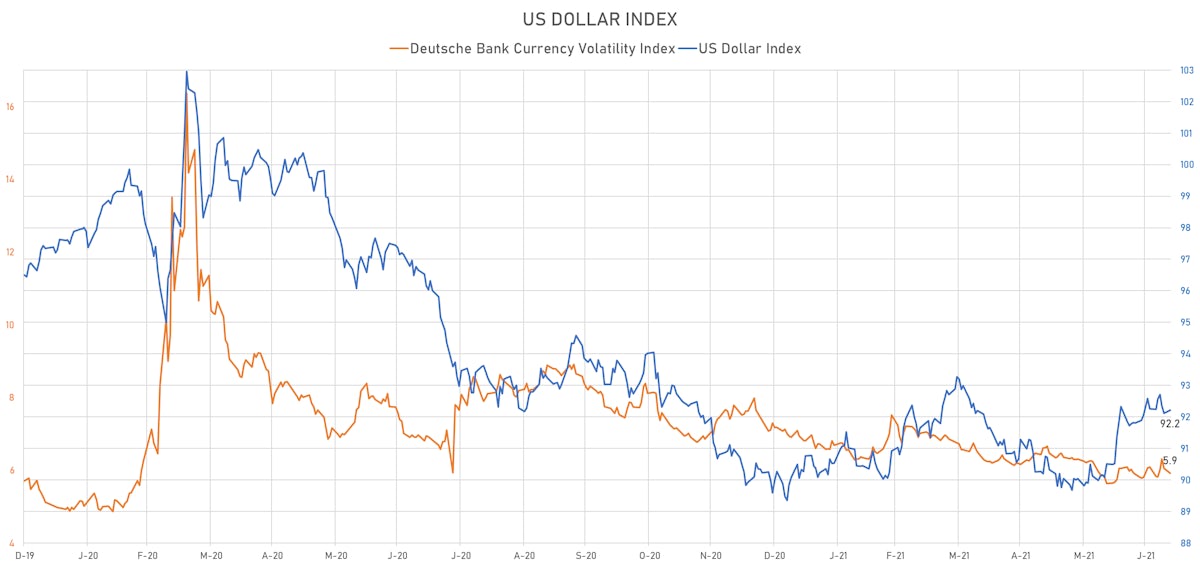

- The US Dollar Index is up 0.11% at 92.22 (YTD: +2.48%)

- Euro down 0.13% at 1.1858 (YTD: -2.9%)

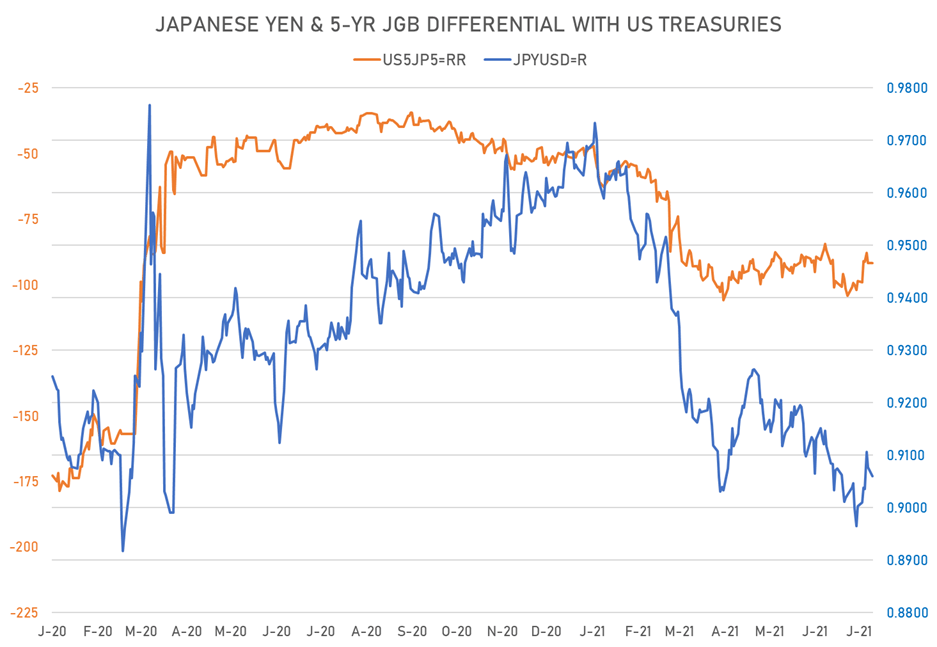

- Yen down 0.17% at 110.34 (YTD: -6.4%)

- Onshore Yuan up 0.05% at 6.4751 (YTD: +0.8%)

- Swiss franc down 0.12% at 0.9151 (YTD: -3.2%)

- Sterling down 0.12% at 1.3883 (YTD: +1.5%)

- Canadian dollar down 0.05% at 1.2452 (YTD: +2.3%)

- Australian dollar down 0.11% at 0.7477 (YTD: -2.8%)

- NZ dollar down 0.16% at 0.6984 (YTD: -2.8%)

MACRO DATA RELEASES

- Denmark, CPI, All Items, Change Y/Y, Price Index for Jun 2021 (statbank.dk) at 1.70 %

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for Jun 2021 (MOSPI, India) at 6.26 %, below consensus estimate of 6.58 %

- India, Production, Change Y/Y, Volume Index for May 2021 (MOSPI, India) at 29.30 %, below consensus estimate of 32.00 %

- Malaysia, Production, Total industry, Change Y/Y for May 2021 (Statistics, Malaysia) at 26.00 %, above consensus estimate of 24.60 %

- Mexico, Production, Total industry, Change P/P for May 2021 (INEGI, Mexico) at 0.10 %, below consensus estimate of 0.30 %

- Mexico, Production, Total industry, Change Y/Y for May 2021 (INEGI, Mexico) at 36.40 %, below consensus estimate of 36.90 %

- Portugal, CPI, All items, national, Change P/P, Price Index for Jun 2021 (INE, Portugal) at 0.20 %

- Portugal, CPI, All items, national, Change Y/Y, Price Index for Jun 2021 (INE, Portugal) at 0.50 %

- Russia, Trade Balance, Total, Free On Board, Current Prices for May 2021 (Central Bank, Russia) at 10.21 Bln USD

- South Africa, Manuf Production MM, Change P/P for May 2021 (Statistics, SA) at -2.60 %, below consensus estimate of 1.40 %

KEY GLOBAL RATES DIFFERENTIALS

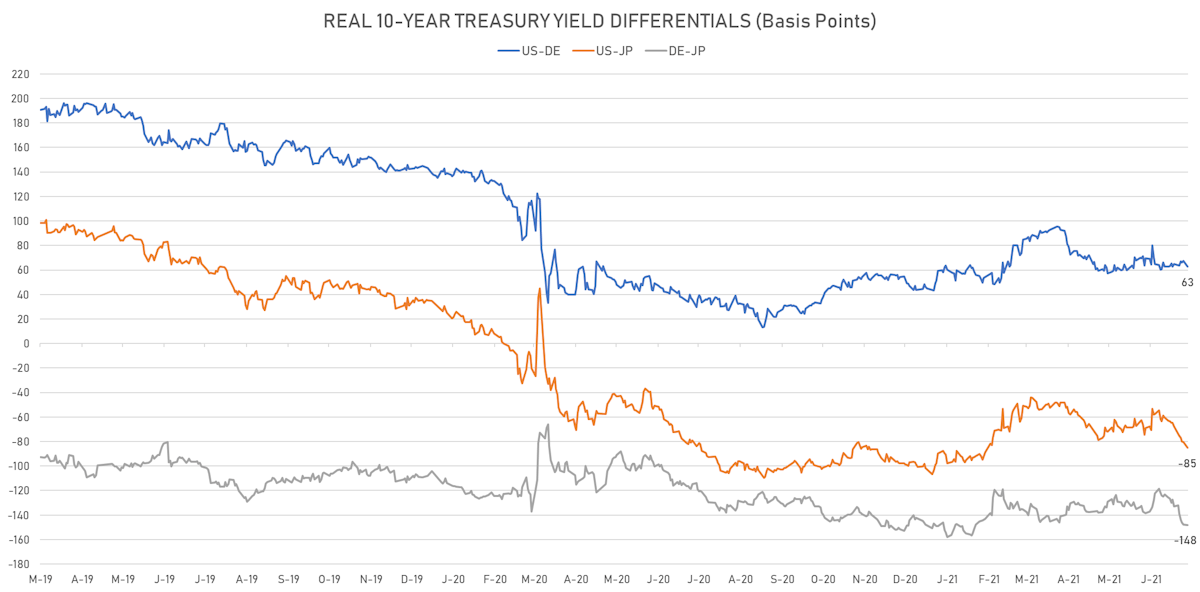

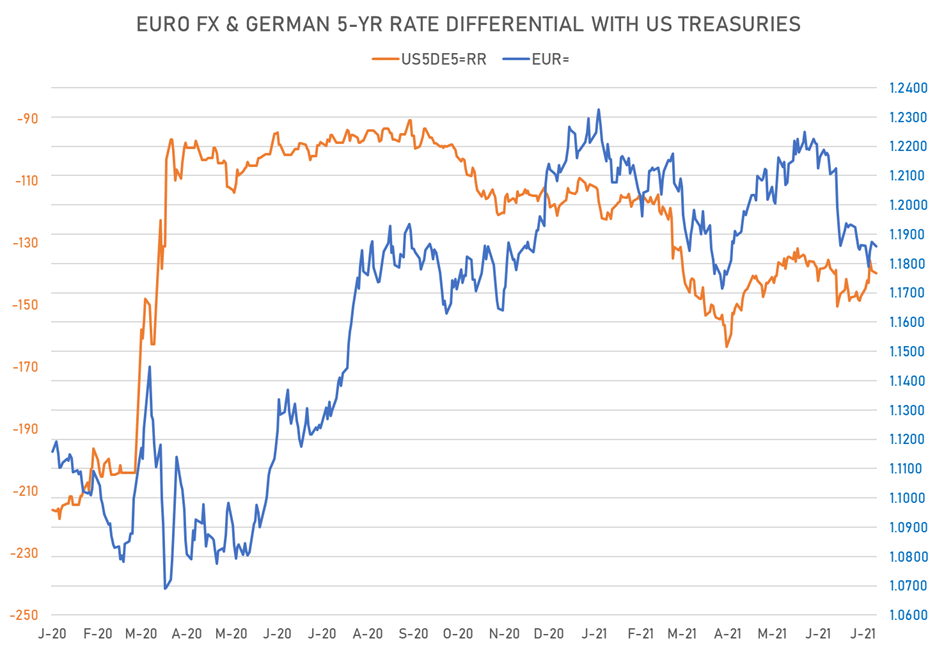

- 5Y German-US interest rates differential 0.8 bp wider at -139.8 bp (YTD change: -28.7 bp), negative for the euro

- 5Y Japan-US interest rates differential 0.1 bp tighter at -91.8 bp (YTD change: -43.5 bp), positive for the yen

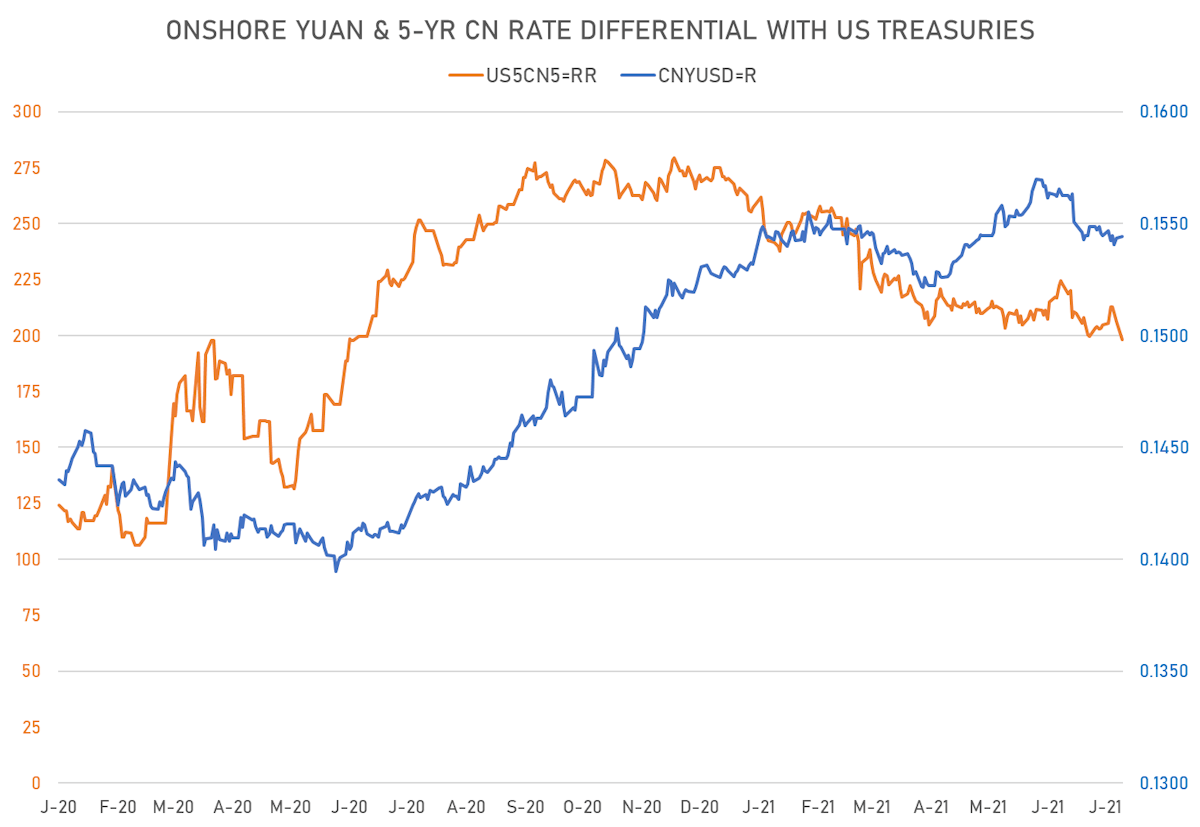

- 5Y China-US interest rates differential 8.3 bp tighter at 197.9 bp (YTD change: -59.2 bp), negative for the yuan

VOLATILITIES TODAY

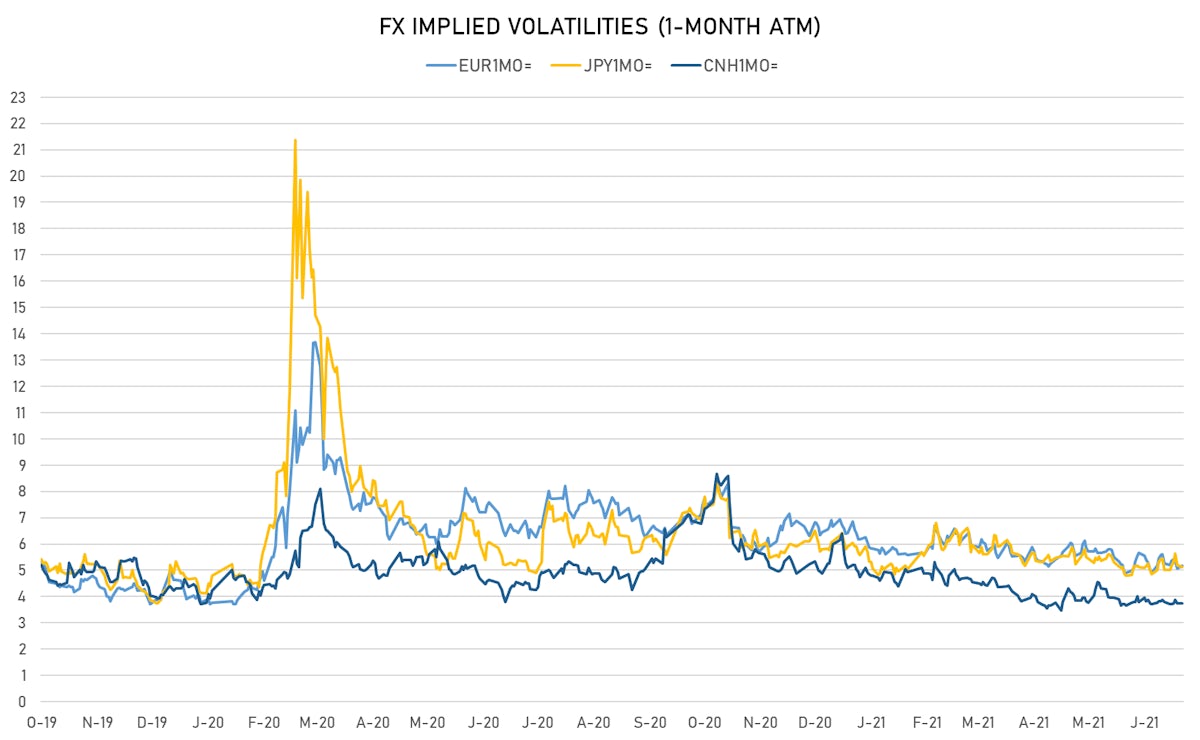

- Deutsche Bank USD Currency Volatility Index currently at 5.92, down -0.13 (YTD: -1.25)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.18, up 0.1 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.13, down -0.1 (YTD: -1.0)

- Offshore Yuan 1M ATM IV unchanged at 3.75 (YTD: -2.2)

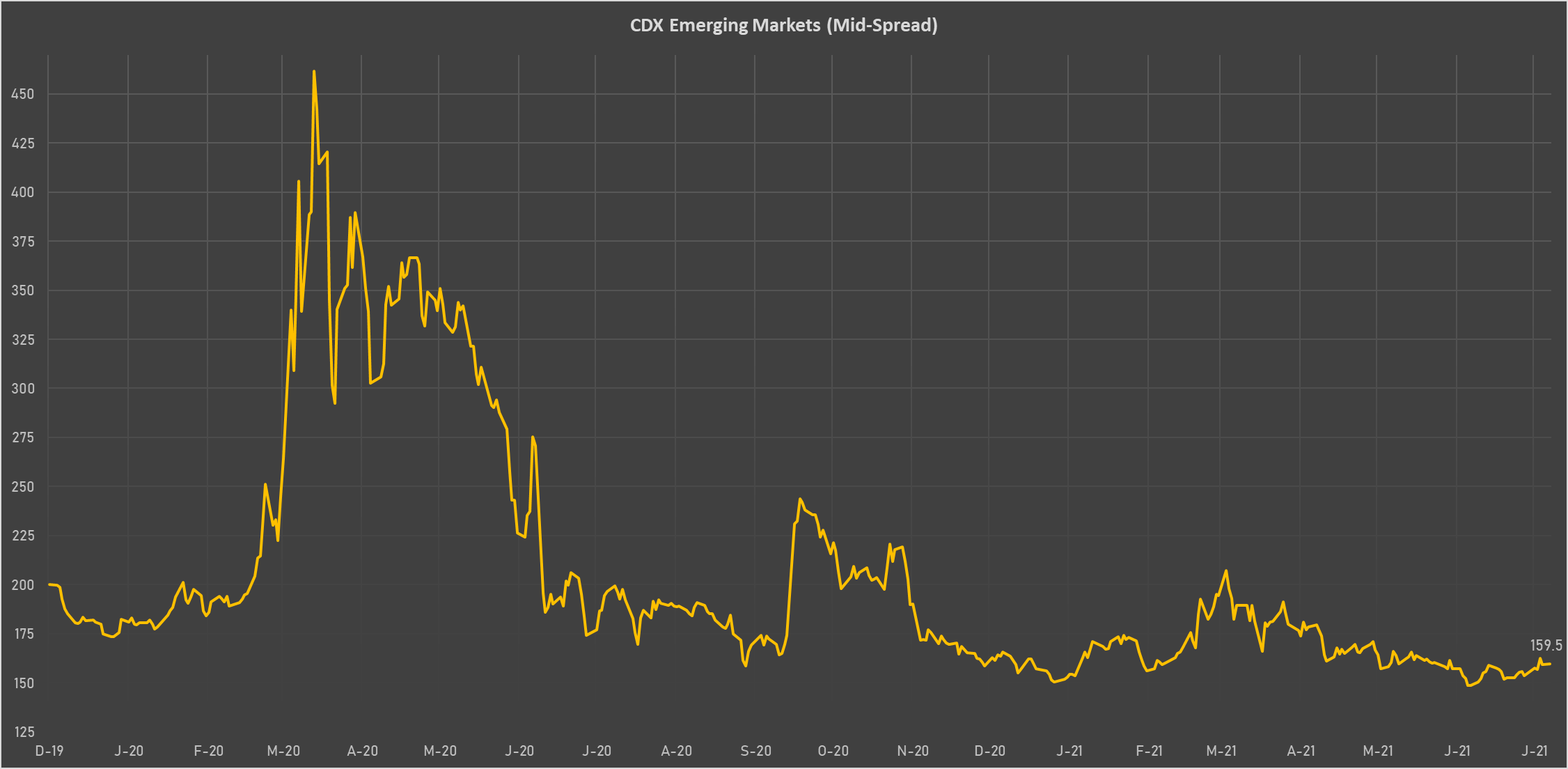

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Bahrain (rated B+): up 13.6 basis points to 226 bp (1Y range: 159-347bp)

- Oman (rated BB-): up 12.2 basis points to 254 bp (1Y range: 223-485bp)

- Government of Chile (rated A-): up 2.2 basis points to 60 bp (1Y range: 43-75bp)

- Egypt (rated B+): up 6.3 basis points to 343 bp (1Y range: 283-437bp)

- Vietnam (rated BB): down 0.8 basis points to 107 bp (1Y range: 90-167bp)

- Peru (rated BBB+): down 0.7 basis points to 80 bp (1Y range: 52-98bp)

- Turkey (rated BB-): down 4.0 basis points to 388 bp (1Y range: 282-597bp)

- Russia (rated BBB): down 1.5 basis points to 86 bp (1Y range: 72-129bp)

- Mexico (rated BBB-): down 1.7 basis points to 92 bp (1Y range: 79-164bp)

- Saudi Arabia (rated A): down 1.5 basis points to 56 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 14.3% (YTD: +43.6%)

- Qatari Riyal up 1.7% (YTD: 0.0%)

- Brazilian Real up 1.7% (YTD: +0.4%)

- Botswana Pula down 1.1% (YTD: -1.8%)

- Lesotho Loti down 1.2% (YTD: +2.1%)

- Congo Franc down 1.2% (YTD: -2.0%)

- Swaziland Lilageni down 1.2% (YTD: +2.1%)

- South Africa Rand down 1.5% (YTD: +2.1%)

- Namibian Dollar down 1.6% (YTD: +2.1%)

- Mauritania ouguiya down 1.9% (YTD: 0.0%)