FX

Eurozone Macro Data Almost Matched Expectations, US Missed Consensus

The US dollar was down on Monday against major currencies, as macro data expectations proved too high

Published ET

Note that Chinese markets are closed until Wednesday | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.4% at 90.9

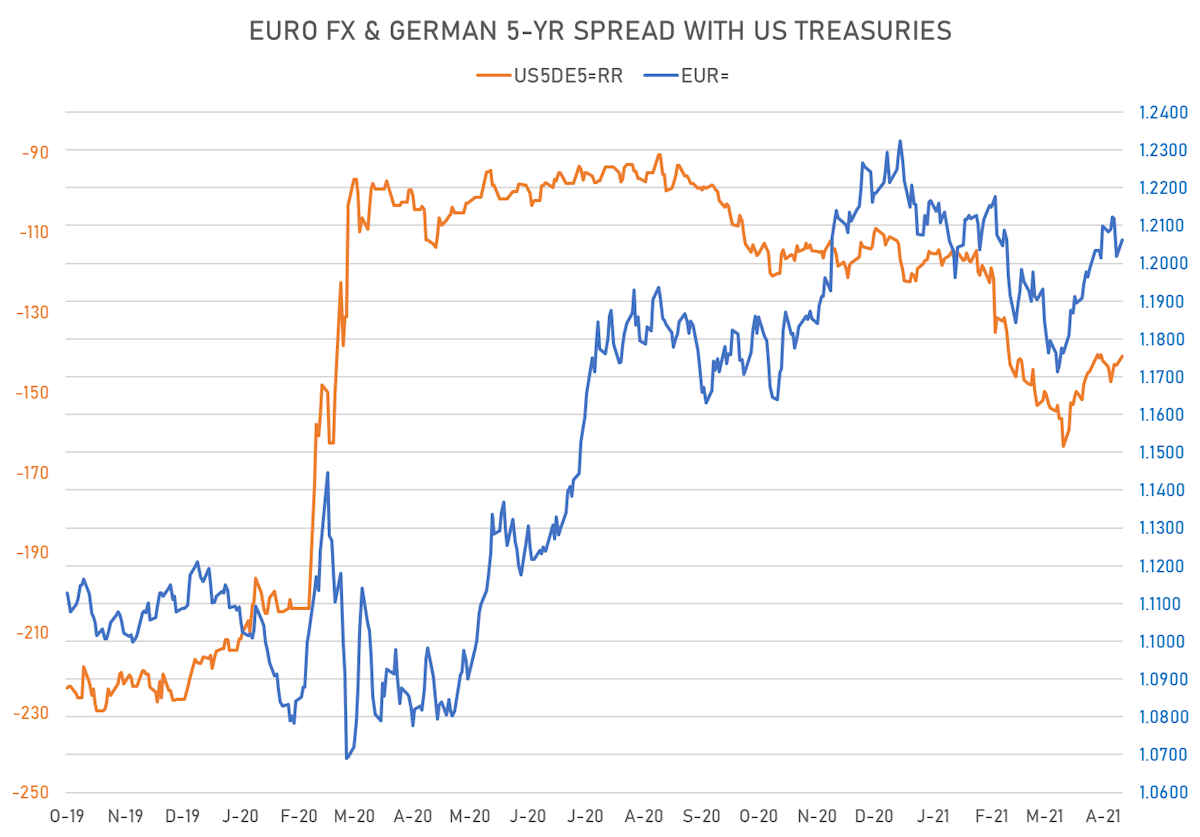

- Euro up 0.3% at 1.2057 (YTD: -1.3%)

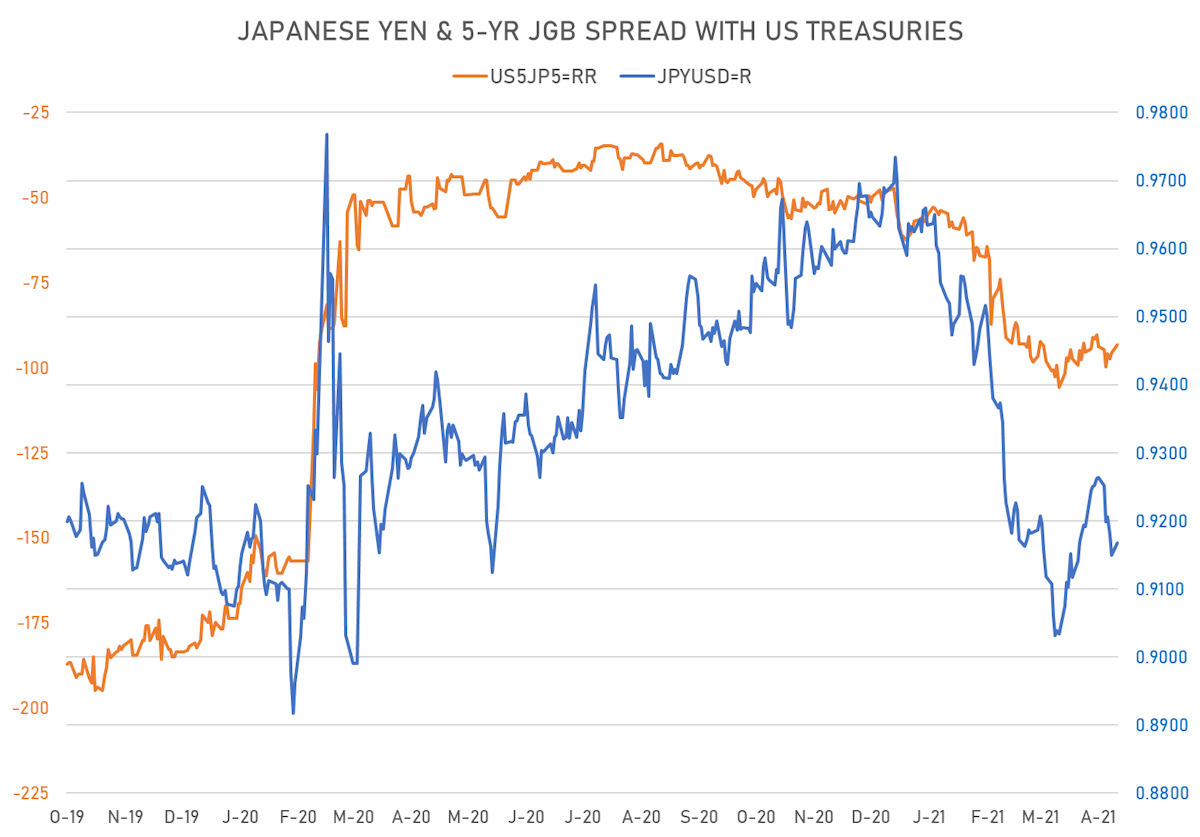

- Yen up 0.2% at 109.08 (YTD: -5.3%)

- Onshore Yuan unchanged at 6.4730 (YTD: +0.8%)

- Swiss franc up 0.2% at 0.9115 (YTD: -2.9%)

- Sterling up 0.6% at 1.3901 (YTD: +1.7%)

- Canadian dollar up 0.1% at 1.2280 (YTD: +3.7%)

- Australian dollar up 0.5% at 0.7758 (YTD: +0.8%)

- NZ dollar up 0.5% at 0.7196 (YTD: +0.2%)

MACRO DATA

- Brazil, PMI, Manufacturing Sector for Apr 2021 (Markit Economics) at 52.3

- Canada, PMI, Manufacturing Sector for Apr 2021 (Markit Economics) at 57.2

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Apr 2021 (Markit Economics) at 62.9, missed consensus estimate of 63.3

- France, PMI, Manufacturing Sector, Total, Final for Apr 2021 (Markit Economics) at 58.9, missed consensus estimate of 59.2

- Germany, PMI, Manufacturing Sector, Total, Final for Apr 2021 (Markit Economics) at 66.2, missed consensus estimate of 66.4

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Apr 2021 (Markit Economics) at 55.5, beat consensus estimate of 51.6

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Apr 2021 (Markit Economics) at 54.6

- Indonesia, CPI, Chg Y/Y for Apr 2021 (Statistics Indonesia) at 1.4, missed consensus estimate of 1.5

- Italy, PMI, Manufacturing Sector for Apr 2021 (Markit Economics) at 60.7, missed consensus estimate of 61.0

- Mexico, PMI, Manufacturing Sector for Apr 2021 (Markit Economics) at 48.4

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Apr 2021 (Markit Economics) at 54.6

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Apr 2021 (Markit Economics) at 50.4

- Turkey, CPI, Chg P/P, Price Index for Apr 2021 (TURKSTAT) at 1.7

- United States, ISM Manufacturing, PMI total for Apr 2021 (ISM, United States) at 60.7, missed consensus estimate of 65.0

- United States, PMI, Manufacturing Sector, Total, Final for Apr 2021 (Markit Economics) at 60.5

RATES SPREADS

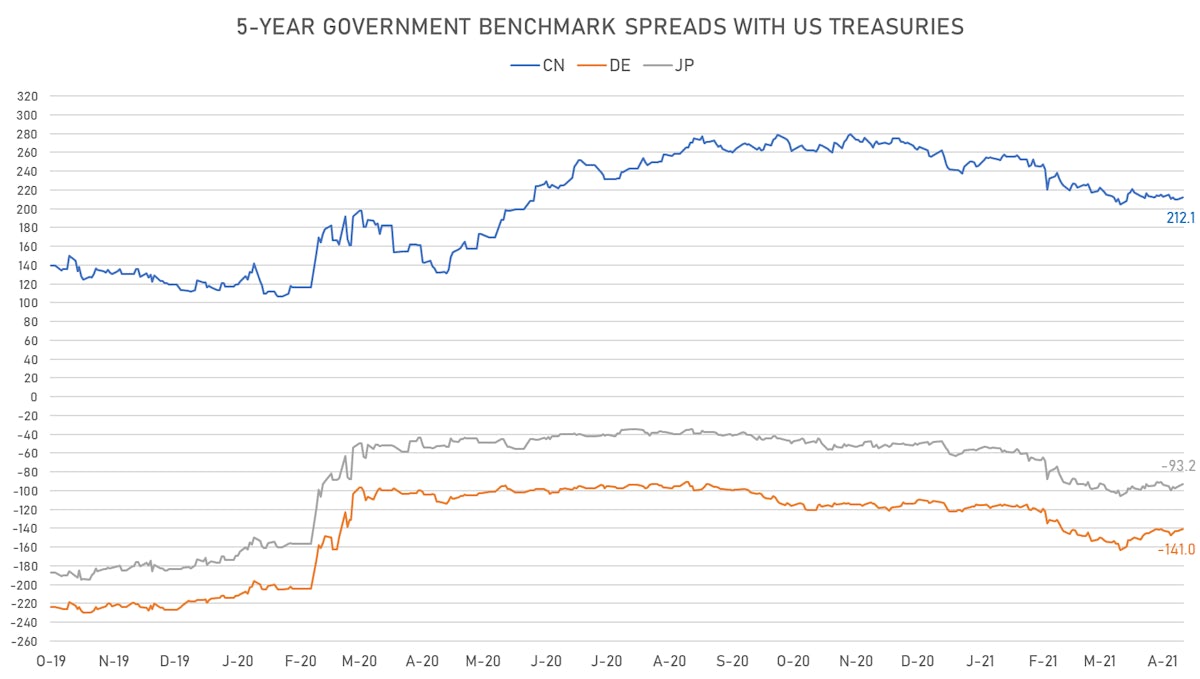

- 5Y German-US interest rates spread 2.1 bp tighter

- 5Y Japan-US rates spread 2.4 bp tighter

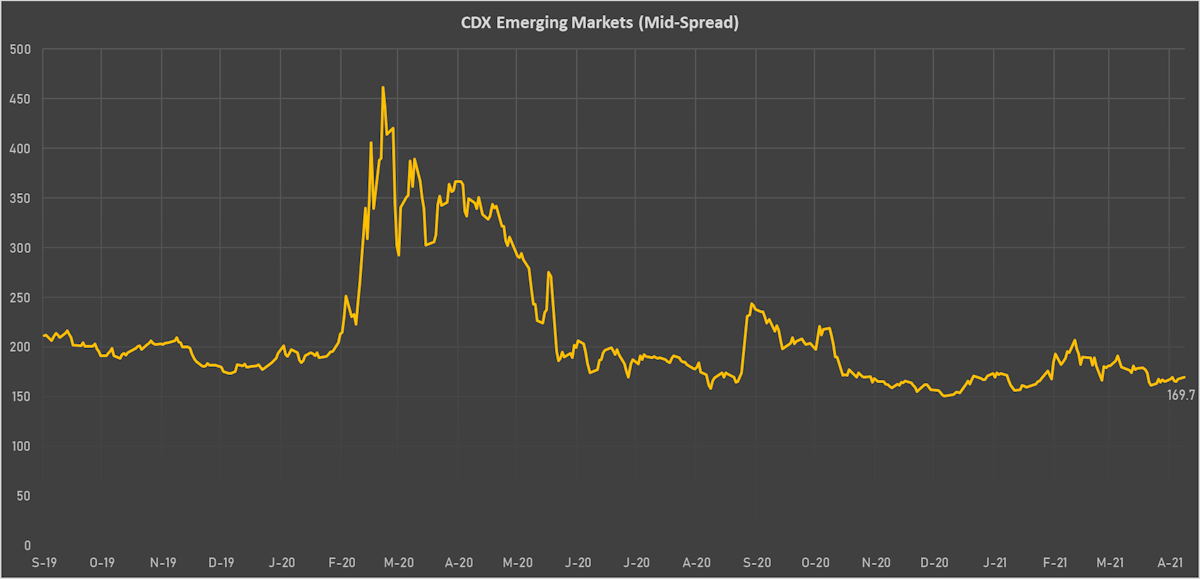

NOTABLE MOVES IN SOVEREIGN CDS

- Colombia (rated BBB-): up 10.8 basis points to 136 bp (1Y range: 83-239bp)

- Mexico (rated BBB-): up 3.7 basis points to 97 bp (1Y range: 79-254bp)

- Brazil (rated BB-): up 2.1 basis points to 192 bp (1Y range: 141-343bp)

- Peru (rated BBB+): up 1.2 basis points to 91 bp (1Y range: 52-106bp)

- Government of Chile (rated A-): up 0.7 basis points to 52 bp (1Y range: 43-110bp)

- Czech Republic (rated AA-): down 0.5 basis points to 35 bp (1Y range: 31-38bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 57 bp (1Y range: 50-62bp)

- Thailand (rated BBB+): down 1.2 basis points to 39 bp (1Y range: 33-64bp)

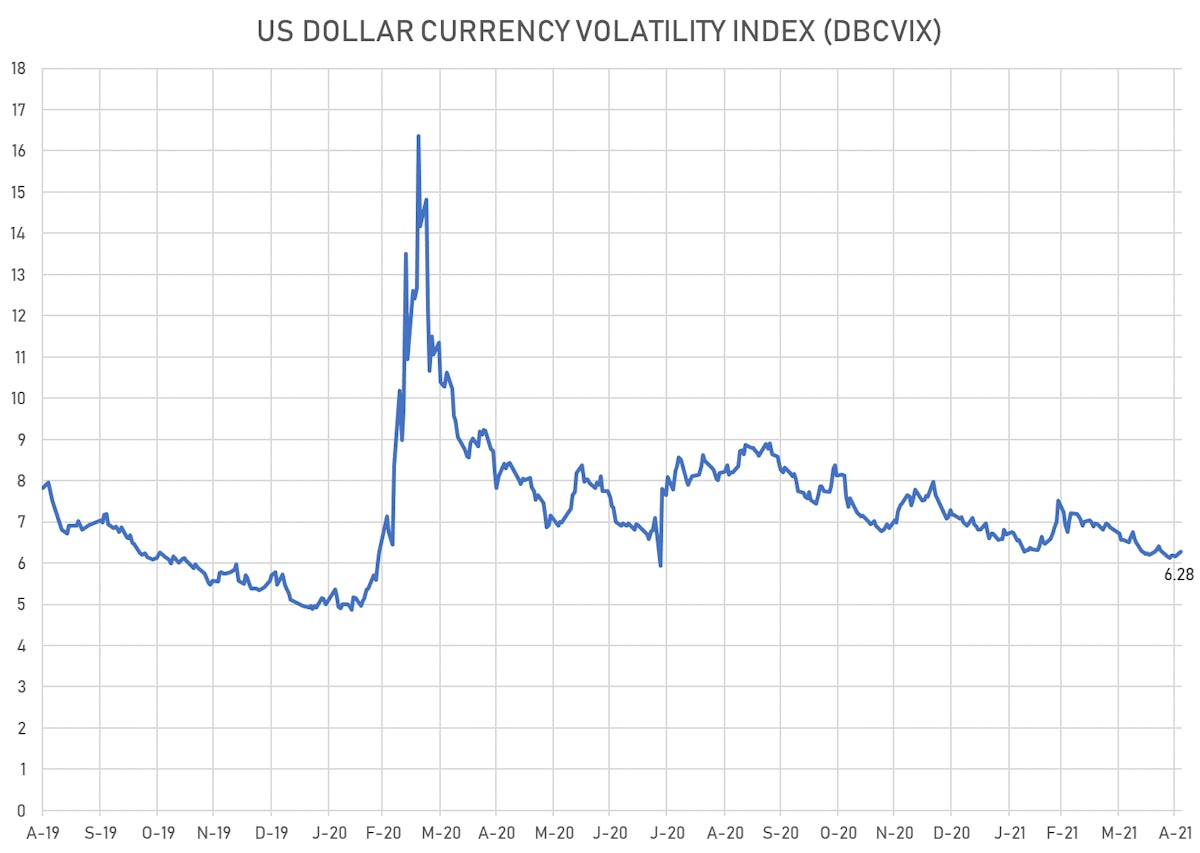

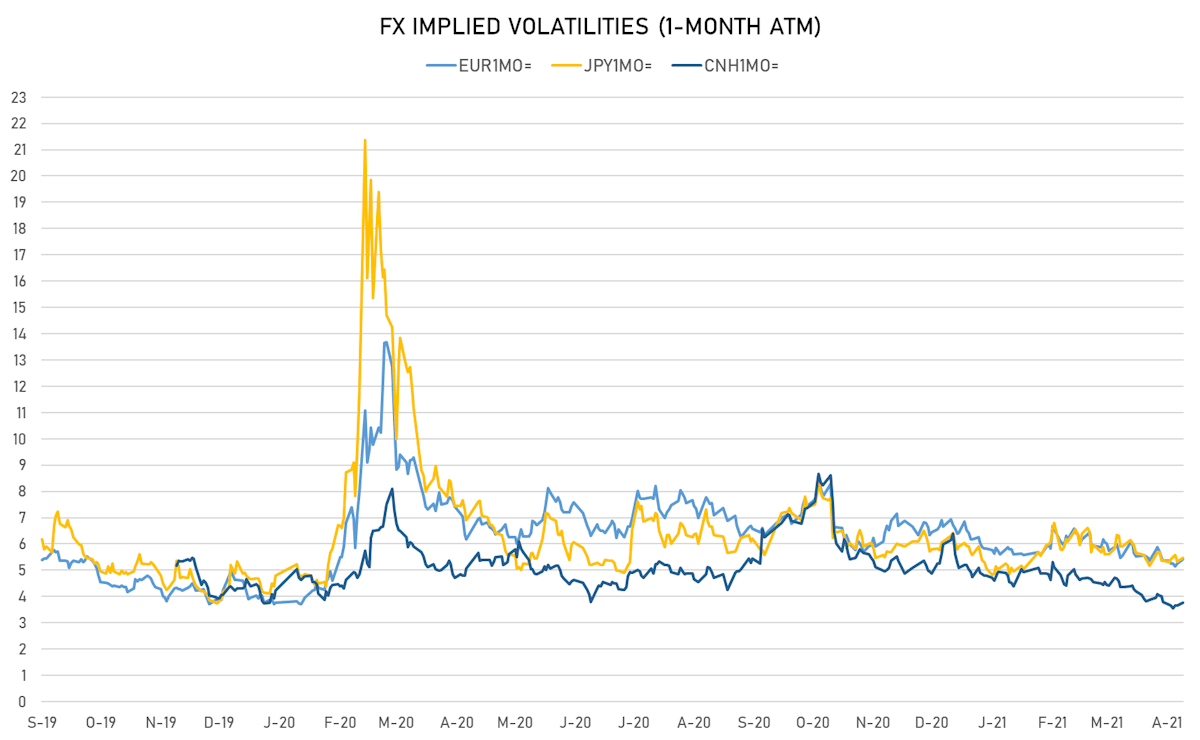

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.28, up 0.12 on the day (YTD: -1.01)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.43, up 0.2 on the day (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.48, up 0.1 on the day (YTD: -0.6)

NOTABLE OTHER MOVERS TODAY

- Bosnian Mark up 2.7% (YTD: -1.6%)

- Solomon Is Dollar up 2.7% (YTD: -0.1%)

- Chilean Peso up 0.9% (YTD: +0.9%)

- Polish Zloty up 0.7% (YTD: -0.8%)

- Gibraltar Pound down 0.8% (YTD: +1.5%)

- Falklands Pound down 0.8% (YTD: +1.5%)

- Samoa Tala down 1.1% (YTD: -0.2%)

- Colombian Peso down 1.4% (YTD: -9.9%)

- Ethiopian Birr down 1.7% (YTD: -8.1%)

- Afghani down 2.4% (YTD: -2.9%)