FX

Is The US Dollar Set Up For A Weakening Later This Year?

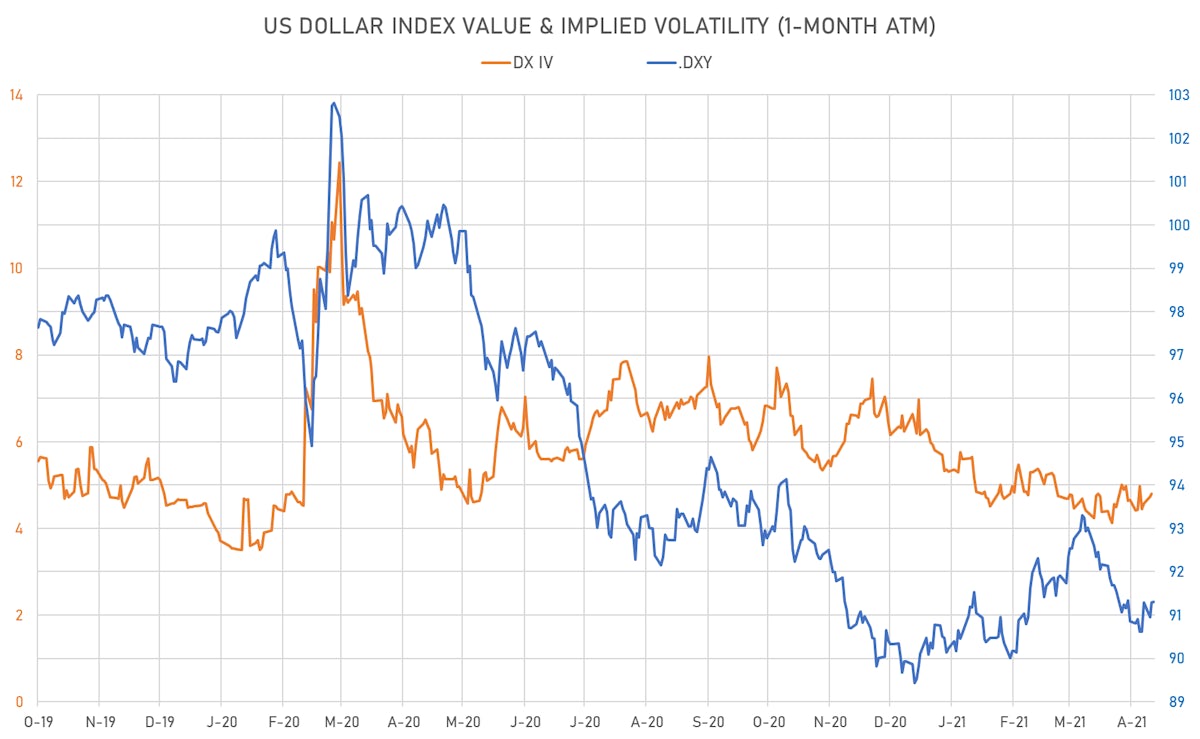

With EU macro data starting to catch up to the US, volatility at very low levels and the Dollar Index stalling, it feels like a reversal of fortune might be in the cards for the greenback

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index unchanged at 91.3

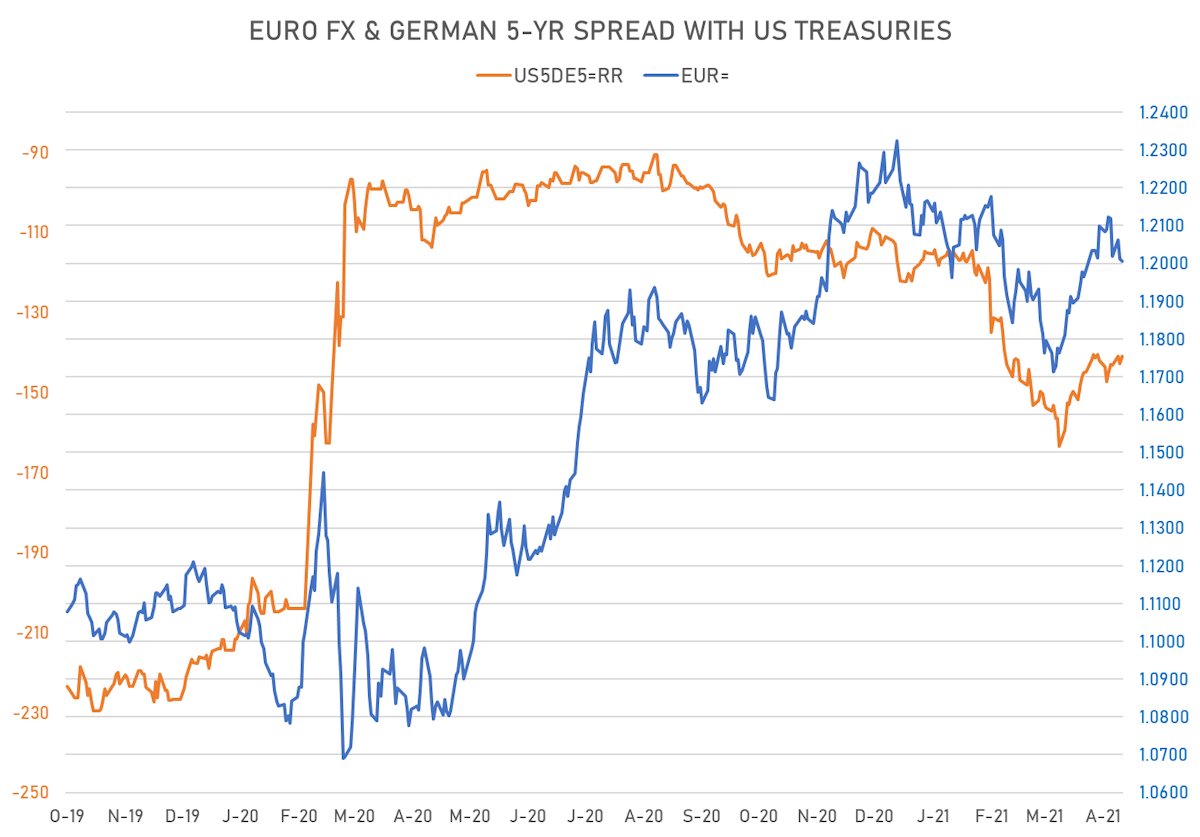

- Euro down 0.1% at 1.2003 (YTD: -1.7%)

- Yen up 0.1% at 109.23 (YTD: -5.5%)

- Onshore Yuan unchanged at 6.4730 (YTD: +0.8%)

- Swiss franc unchanged at 0.9135 (YTD: -3.1%)

- Sterling up 0.2% at 1.3910 (YTD: +1.7%)

- Canadian dollar up 0.3% at 1.2269 (YTD: +3.8%)

- Australian dollar up 0.5% at 0.7745 (YTD: +0.7%)

- NZ dollar up 1.0% at 0.7216 (YTD: +0.4%)

MACRO DATA RELEASES

- Australia, Dwellings Approved, Total building, Australia, Chg P/P for Mar 2021 (AU Bureau of Stat) at 17.4, above consensus estimate of 3.0

- Brazil, PMI, Composite, Output, Total for Apr 2021 (Markit Economics) at 44.5

- Brazil, PMI, Services Sector, Business Activity for Apr 2021 (Markit Economics) at 42.9

- Brazil, Policy Rates, SELIC Target Rate for 06 May (Central Bank, Brazil) at 3.5, below consensus estimate of 3.5

- Brazil, Production, General industry, Chg P/P for Mar 2021 (IBGE, Brazil) at -2.4, above consensus estimate of -3.5

- Brazil, Production, General industry, Chg Y/Y for Mar 2021 (IBGE, Brazil) at 10.5, above consensus estimate of 7.6

- Euro Zone, PMI, Composite, Output, Final for Apr 2021 (Markit Economics) at 53.8, above consensus estimate of 53.7

- Euro Zone, PMI, Services Sector, Business Activity, Final for Apr 2021 (Markit Economics) at 50.5, above consensus estimate of 50.3

- France, PMI, Composite, Output, Final for Apr 2021 (Markit/CDAF, France) at 51.6, below consensus estimate of 51.7

- France, PMI, Services Sector, Business Activity, Final for Apr 2021 (Markit Economics) at 50.3, below consensus estimate of 50.4

- Germany, PMI, Composite, Output, Final for Apr 2021 (Markit Economics) at 55.8, below consensus estimate of 56.0

- Germany, PMI, Services Sector, Business Activity, Final for Apr 2021 (Markit Economics) at 49.9, below consensus estimate of 50.1

- India, IHS Markit, PMI, Services Sector, Business Activity for Apr 2021 (Markit Economics) at 54.0, above consensus estimate of 51.1

- Philippines, CPI, Total, inflation rate, Chg Y/Y for Apr 2021 (PSA) at 4.5, below consensus estimate of 4.7

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for May 2021 (Central Bank, Poland) at 0.1, below consensus estimate of 0.1

- South Africa, Standard Bank PMI for Apr 2021 (Markit Economics) at 53.7

- Thailand, Policy Rates, 1-Day Repurchase Rate (Key Policy Rate) for 05 May (Bank of Thailand) at 0.5, below consensus estimate of 0.5

- United States, ISM Non-manufacturing, NMI/PMI for Apr 2021 (ISM, United States) at 62.7, below consensus estimate of 64.3

- United States, PMI, Composite, Output, Final for Apr 2021 (Markit Economics) at 63.5

- United States, PMI, Services Sector, Business Activity, Final for Apr 2021 (Markit Economics) at 64.7

RATES SPREADS

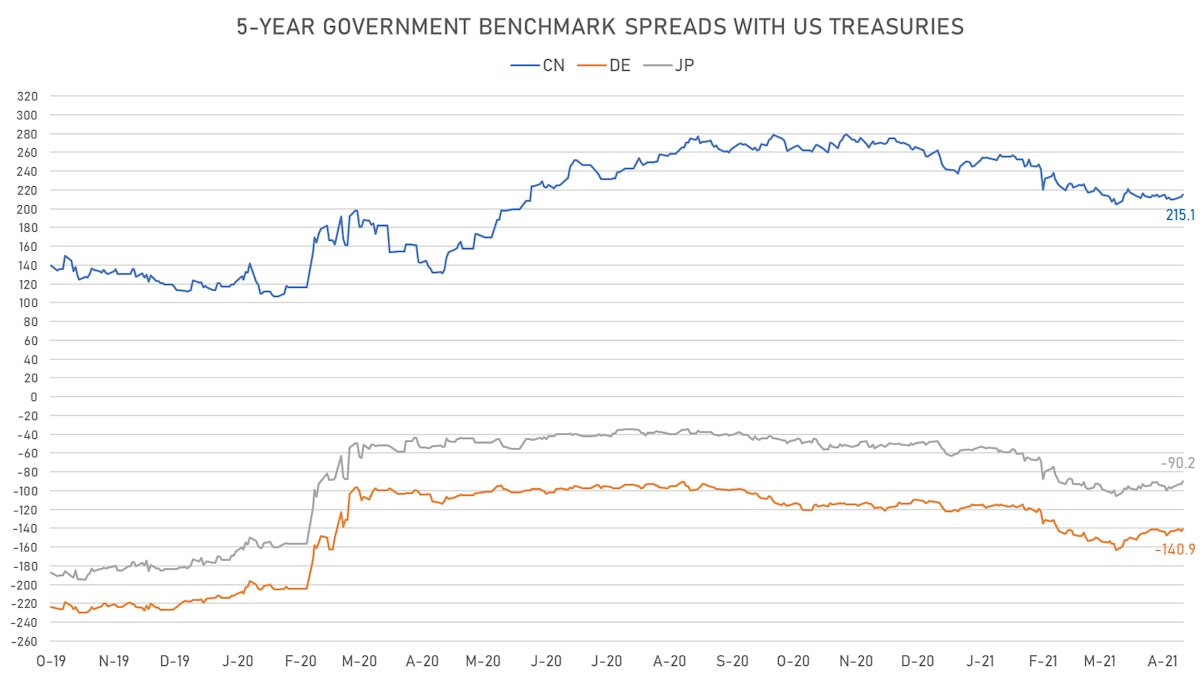

- 5Y German-US interest rates spread 1.9 bp tighter

- 5Y Japan-US rates spread 2.4 bp tighter

- 5Y Chinese-US rates spread 2.4 bp wider

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.30, up 0.04 on the day (YTD: -0.99)

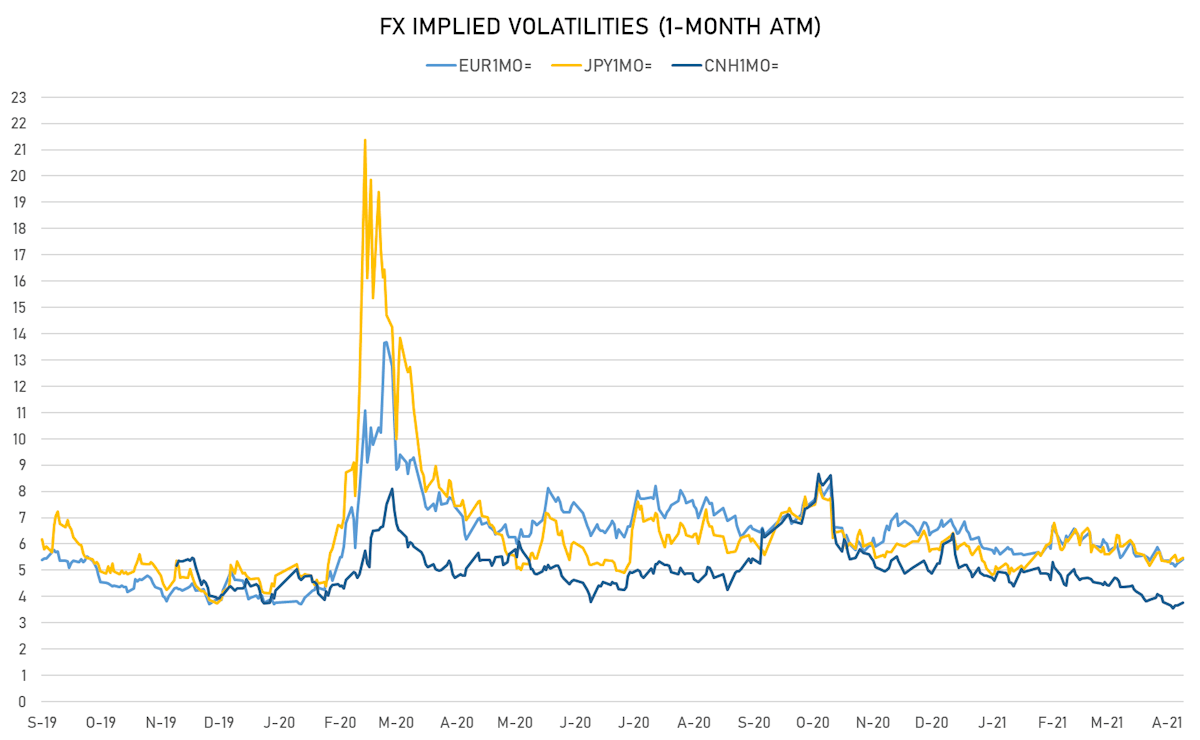

- Euro 1-Month At-The-Money Implied Volatility currently at 5.43, up 0.2 on the day (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.48, up 0.1 on the day (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.78, up 0.1 on the day (YTD: -1.9)

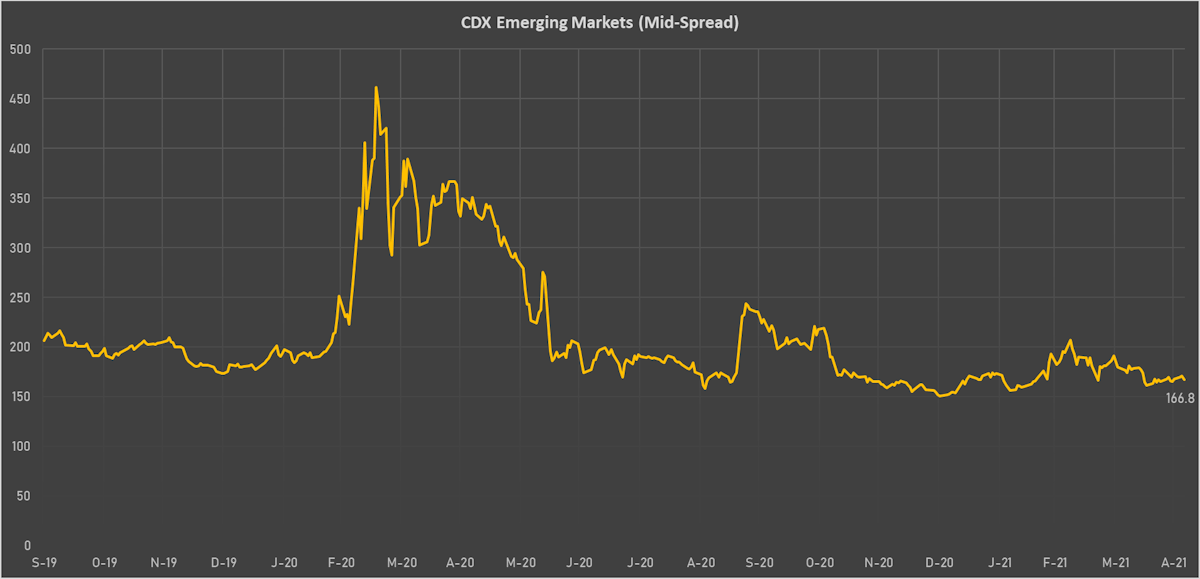

NOTABLE MOVES IN SOVEREIGN CDS

- Malaysia (rated BBB+): up 0.9 basis points to 46 bp (1Y range: 33-109bp)

- State of Qatar (rated AA-): down 0.8 basis points to 45 bp (1Y range: 33-116bp)

- Government of Chile (rated A-): down 1.0 basis points to 53 bp (1Y range: 43-110bp)

- Saudi Arabia (rated A): down 1.2 basis points to 66 bp (1Y range: 53-159bp)

- Panama (rated BBB-): down 1.5 basis points to 72 bp (1Y range: 44-147bp)

- Mexico (rated BBB-): down 1.9 basis points to 96 bp (1Y range: 79-243bp)

- Russia (rated BBB): down 2.0 basis points to 96 bp (1Y range: 72-158bp)

- Brazil (rated BB-): down 4.0 basis points to 189 bp (1Y range: 141-343bp)

- South Africa (rated BB-): down 4.9 basis points to 215 bp (1Y range: 197-410bp)

- Egypt (rated B+): down 5.8 basis points to 308 bp (1Y range: 283-638bp)

NOTABLE OTHER MOVERS TODAY

- Brazilian Real up 1.7% (YTD: -3.0%)

- Malagasy Ariary up 0.8% (YTD: +5.7%)

- Lesotho Loti up 0.7% (YTD: +2.3%)

- Paraguay guarani down 0.8% (YTD: +3.0%)

- Iceland Krona down 0.9% (YTD: +1.5%)

- CFA Franc Beac down 1.0% (YTD: -2.4%)

- Mauritius Rupee down 1.2% (YTD: -2.8%)

- Venezuela Bolivar down 2.9% (YTD: -62.2%)

- Haiti Gourde down 3.0% (YTD: -16.7%)