FX

Broad Weakening Of The US Dollar Following Significant NFP Miss

Some short covering in emerging market currencies that were battered earlier in the week, like the Colombian peso

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

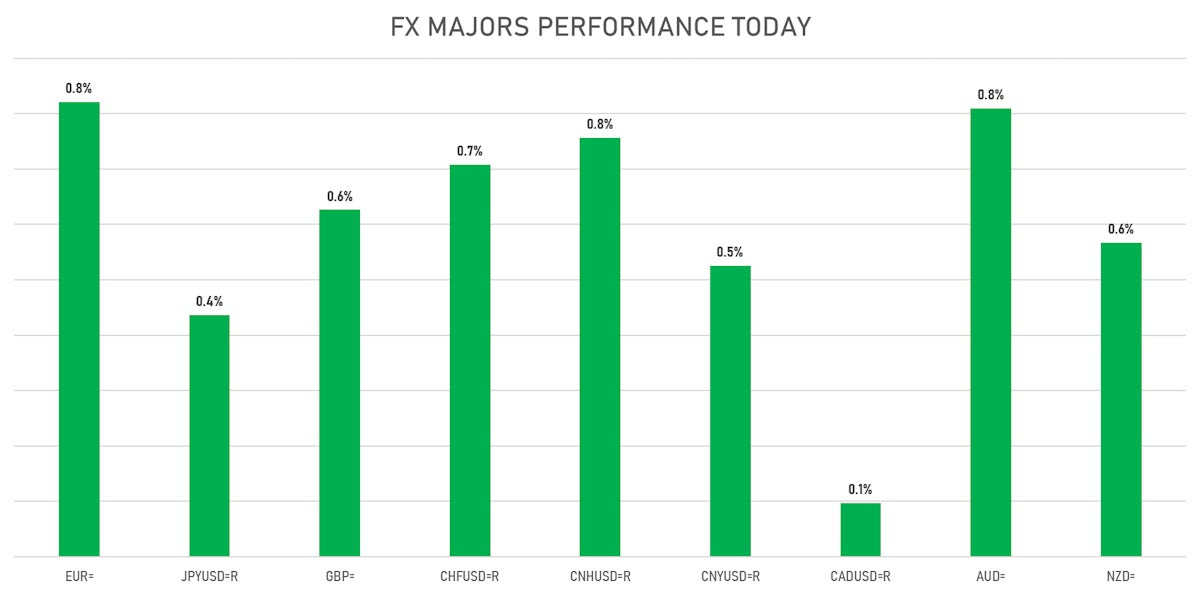

- The US Dollar Index is down -0.8% at 90.2

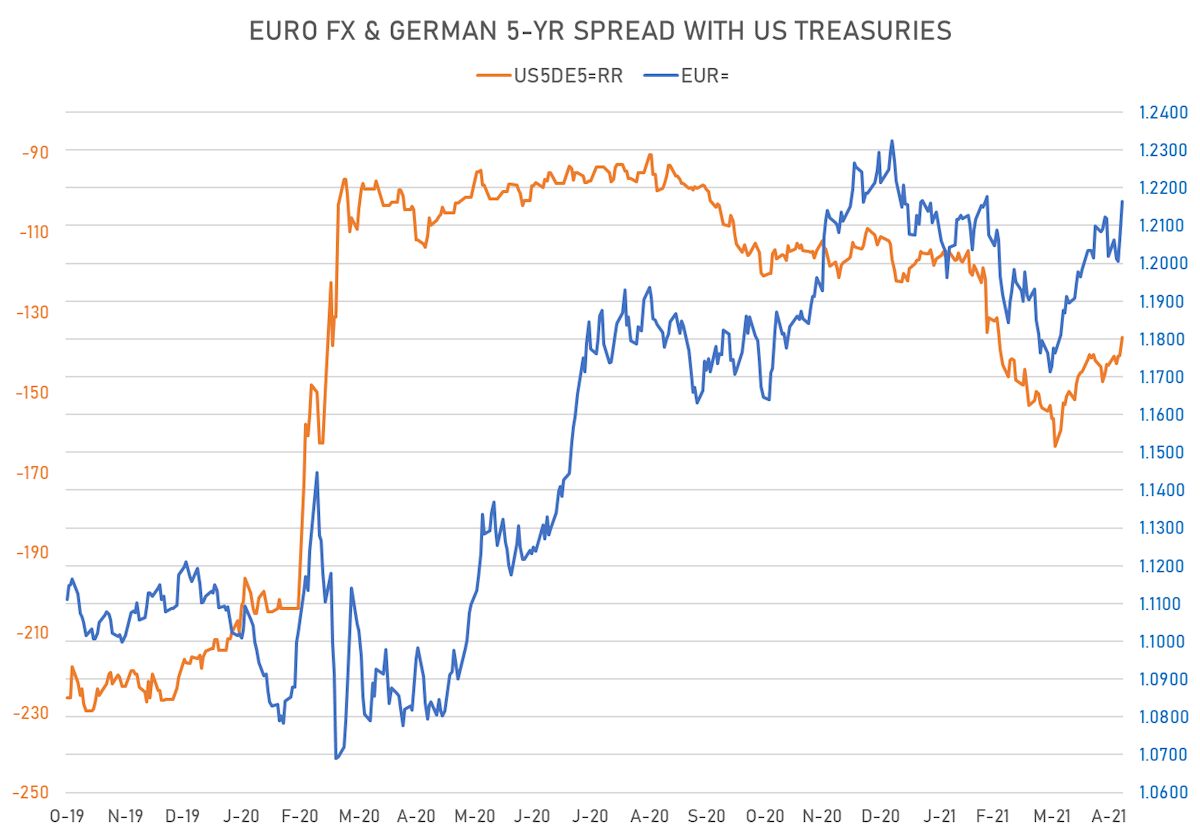

- Euro up 0.8% at 1.2163 (YTD: -0.4%)

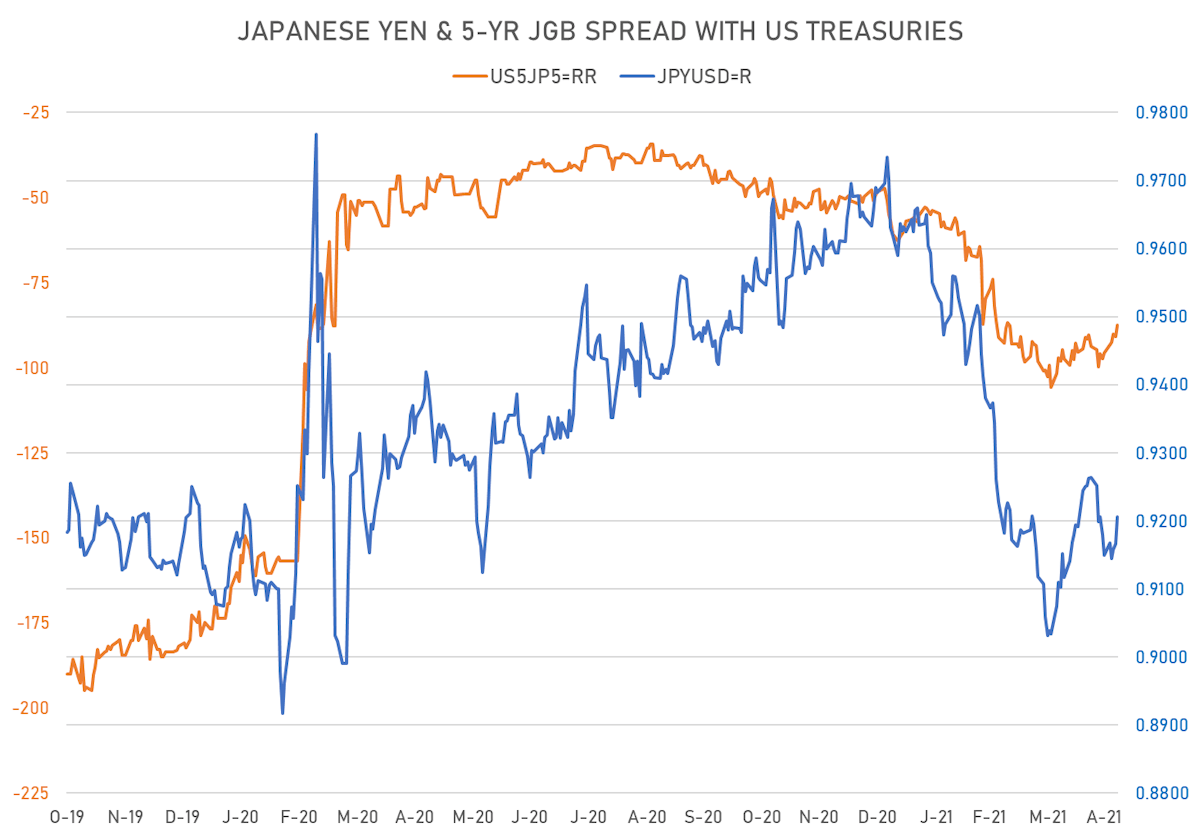

- Yen up 0.4% at 108.60 (YTD: -4.9%)

- Onshore Yuan up 0.5% at 6.4310 (YTD: +1.5%)

- Swiss franc up 0.7% at 0.9010 (YTD: -1.8%)

- Sterling up 0.6% at 1.3972 (YTD: +2.2%)

- Canadian dollar up 0.1% at 1.2137 (YTD: +4.9%)

- Australian dollar up 0.8% at 0.7842 (YTD: +1.9%)

- NZ dollar up 0.6% at 0.7273 (YTD: +1.2%)

TOP GLOBAL MACRO DATA RELEASES

- Brazil, Retail Sales, Chg Y/Y for Mar 2021 (IBGE, Brazil) at 2.4, above consensus estimate of -1.7

- Canada, Employment, Absolute change for Apr 2021 (CANSIM, Canada) at -207.1, below consensus estimate of -175.0

- Canada, Unemployment, Rate for Apr 2021 (CANSIM, Canada) at 8.1, above consensus estimate of 7.8

- China (Mainland), Exports, Chg Y/Y for Apr 2021 (China Customs) at 32.3, above consensus estimate of 24.1

- China (Mainland), Imports, Chg Y/Y for Apr 2021 (China Customs) at 43.1, above consensus estimate of 42.5

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for Apr 2021 (Markit Economics) at 56.3

- China (Mainland), Trade Balance, Current Prices for Apr 2021 (China Customs) at 42.9, above consensus estimate of 28.1

- France, Reserve Assets, Current Prices for Apr 2021 (MINEFI, France) at 183,428.0

- Germany, Production, Total industry including construction, Chg P/P for Mar 2021 (Destatis) at 2.5, above consensus estimate of 2.3

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Apr 2021 (Markit Economics) at 49.5

- New Zealand, Reserve Assets, Current Prices for Apr 2021 (RBNZ) at 20,153.0

- Russia, CPI, Chg P/P for Apr 2021 (RosStat, Russia) at 0.6, in line with estimate

- Russia, CPI, Chg Y/Y for Apr 2021 (RosStat, Russia) at 5.5, in line with estimate

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Apr 2021 (SA Reserve Bank) at 53.7

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Apr 2021 (SA Reserve Bank) at 51.5

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Apr 2021 (Swiss National Bank) at 914,080.0

- United States, Employment, Nonfarm payroll, total, Absolute change for Apr 2021 (BLS, U.S Dep. Of Lab) at 266.0, below consensus estimate of 978.0

- United States, Unemployment, Rate for Apr 2021 (BLS, U.S Dep. Of Lab) at 6.1, above consensus estimate of 5.8

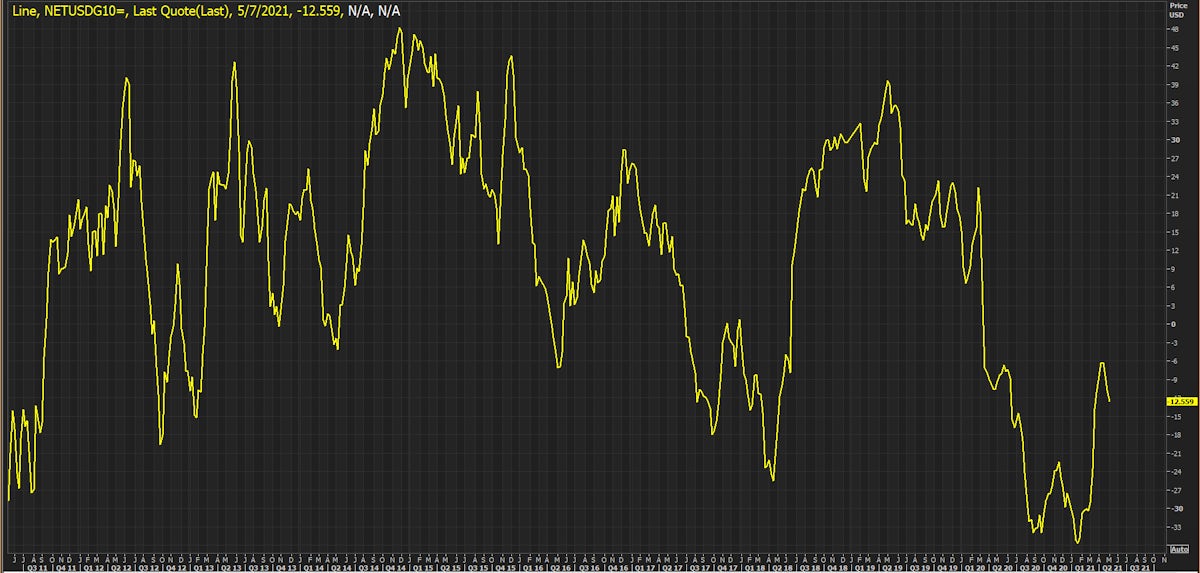

WEEKLY IMM CHANGES IN SPECULATIVE POSITIONS

- G10 currencies: increase in net short US$ positioning

- Emerging currencies: reduction in net long US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduction in net long US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: reduced their net short US$ positioning

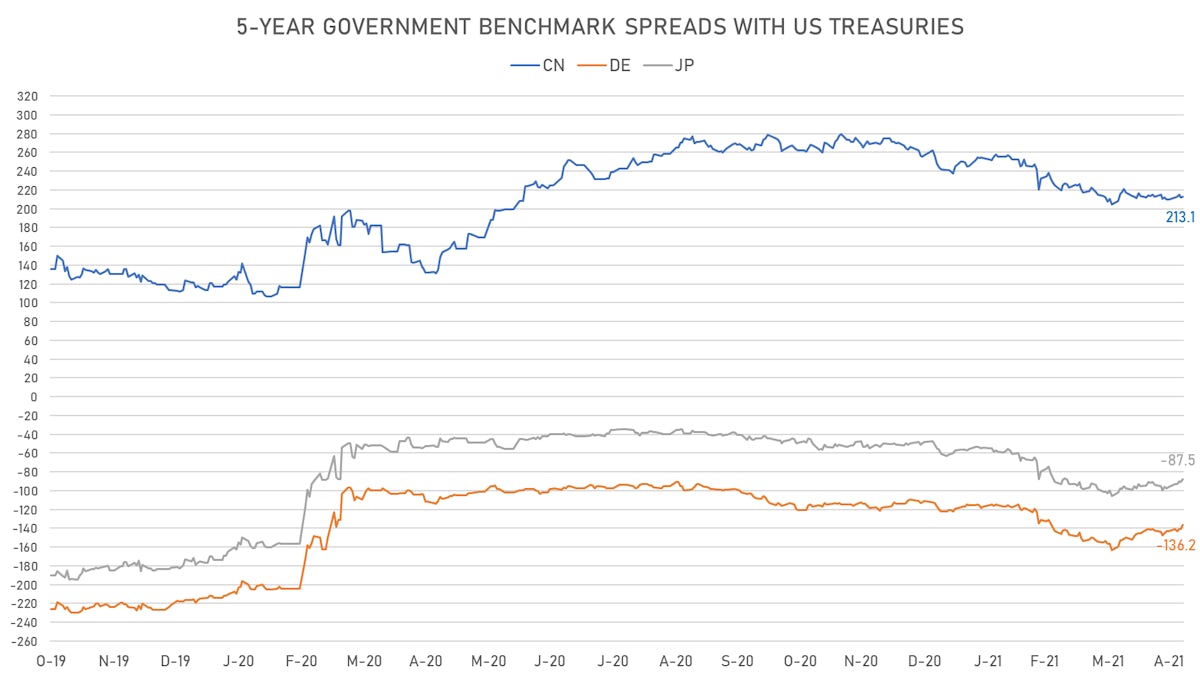

RATES SPREADS

- 5Y German-US interest rates spread 4.5 bp tighter

- 5Y Japan-US rates spread 3.5 bp tighter

- 5Y Chinese-US rates spread 0.7 bp wider

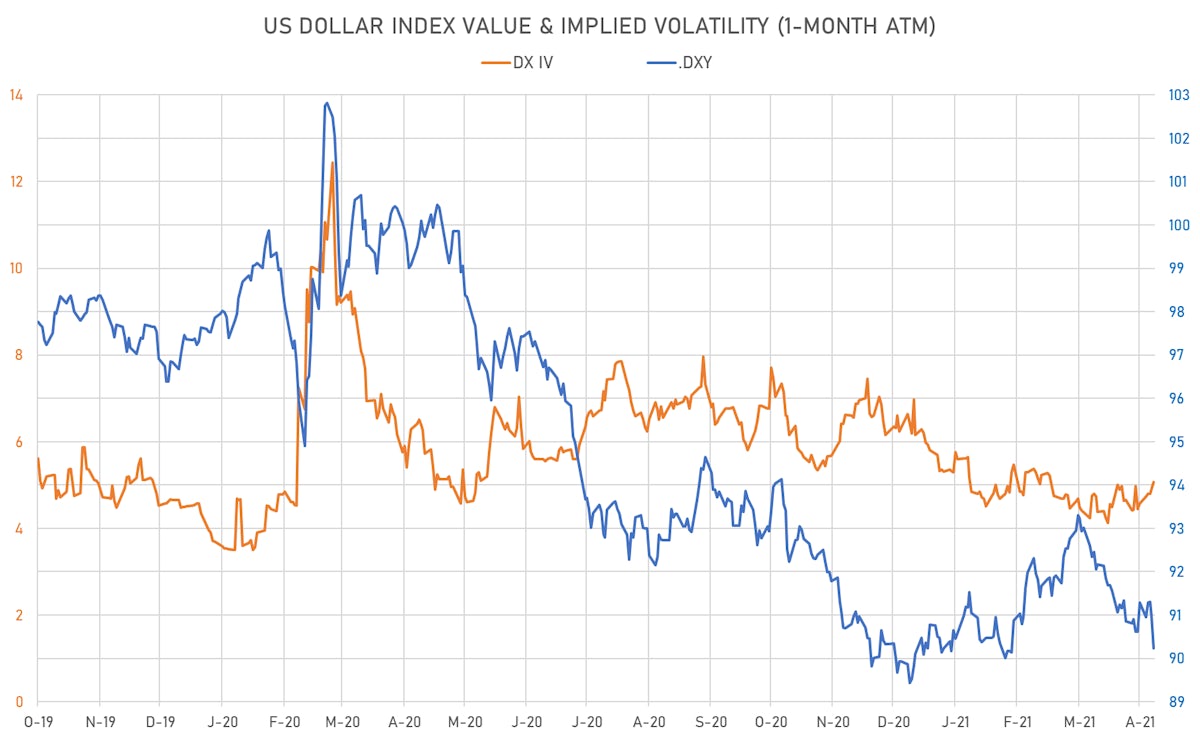

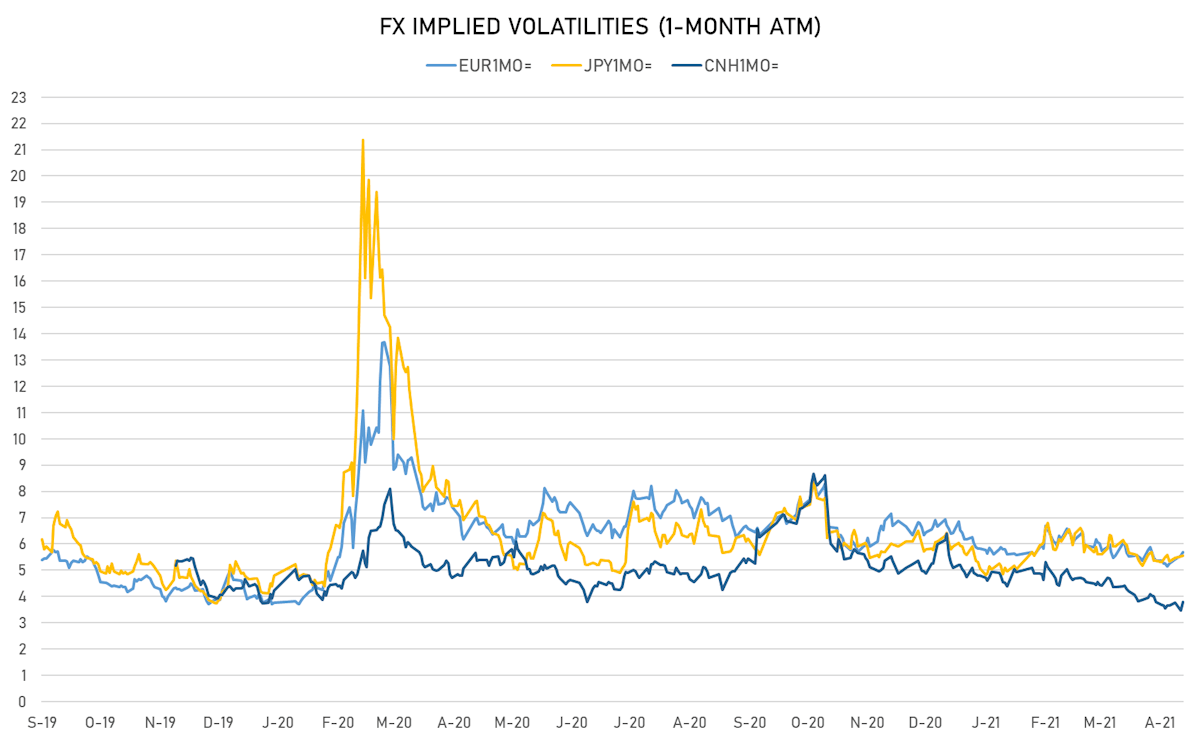

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.46, up 0.07 on the day (YTD: -0.83)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.70, up 0.2 on the day (YTD: -1.2)

- Japanese Yen 1M ATM IV currently at 5.55, unchanged (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 3.80, up 0.3 on the day (YTD: -1.8)

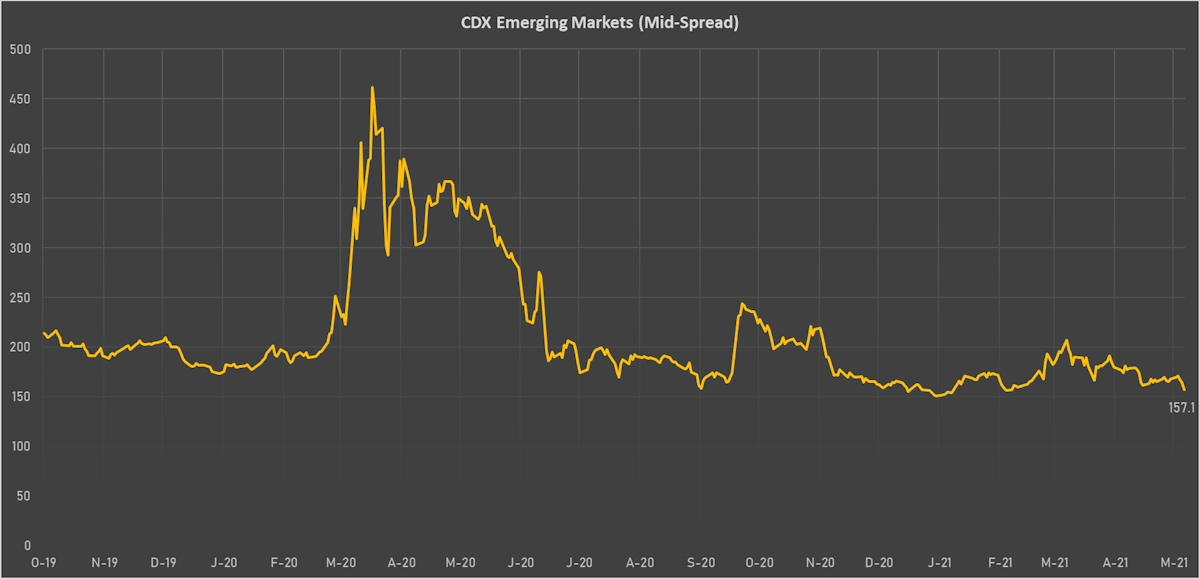

NOTABLE MOVES IN SOVEREIGN CDS

- China (rated A+): down 1.3 basis points to 35 bp (1Y range: 27-54bp)

- State of Qatar (rated AA-): down 2.1 basis points to 44 bp (1Y range: 33-110bp)

- Government of Chile (rated A-): down 3.2 basis points to 50 bp (1Y range: 43-110bp)

- Panama (rated BBB-): down 3.4 basis points to 68 bp (1Y range: 44-147bp)

- Mexico (rated BBB-): down 5.2 basis points to 91 bp (1Y range: 79-242bp)

- Peru (rated BBB+): down 5.7 basis points to 87 bp (1Y range: 52-106bp)

- Colombia (rated BBB-): down 7.0 basis points to 127 bp (1Y range: 83-239bp)

- South Africa (rated BB-): down 8.6 basis points to 204 bp (1Y range: 197-407bp)

- Brazil (rated BB-): down 11.4 basis points to 173 bp (1Y range: 141-343bp)

- Turkey (rated BB-): down 15.3 basis points to 391 bp (1Y range: 282-645bp)

NOTABLE OTHER FX MOVERS TODAY

- CFA Franc Beac up 3.3% (YTD: +1.2%)

- Venezuela Bolivar up 2.9% (YTD: -61.1%)

- Barbados Dollar up 1.5% (YTD: +1.5%)

- Colombian Peso up 1.4% (YTD: -8.6%)

- Swedish Krona up 1.4% (YTD: -0.8%)

- Czech Koruna up 1.2% (YTD: +1.9%)

- Jamaican Dollar up 1.2% (YTD: -5.7%)

- Polish Zloty up 1.2% (YTD: -0.2%)

- Eritrean Nakfa down 1.5% (YTD: -1.5%)

- Qatari Riyal down 1.8% (YTD: -1.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 37.5%

- Mozambique metical up 27.8%

- Colombian Peso down 8.6%

- Turkish Lira down 9.8%

- Argentine Peso down 10.4%

- Haiti Gourde down 17.1%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 61.1%

- Libyan Dinar down 70.2%

- Sudanese Pound down 86.2%