FX

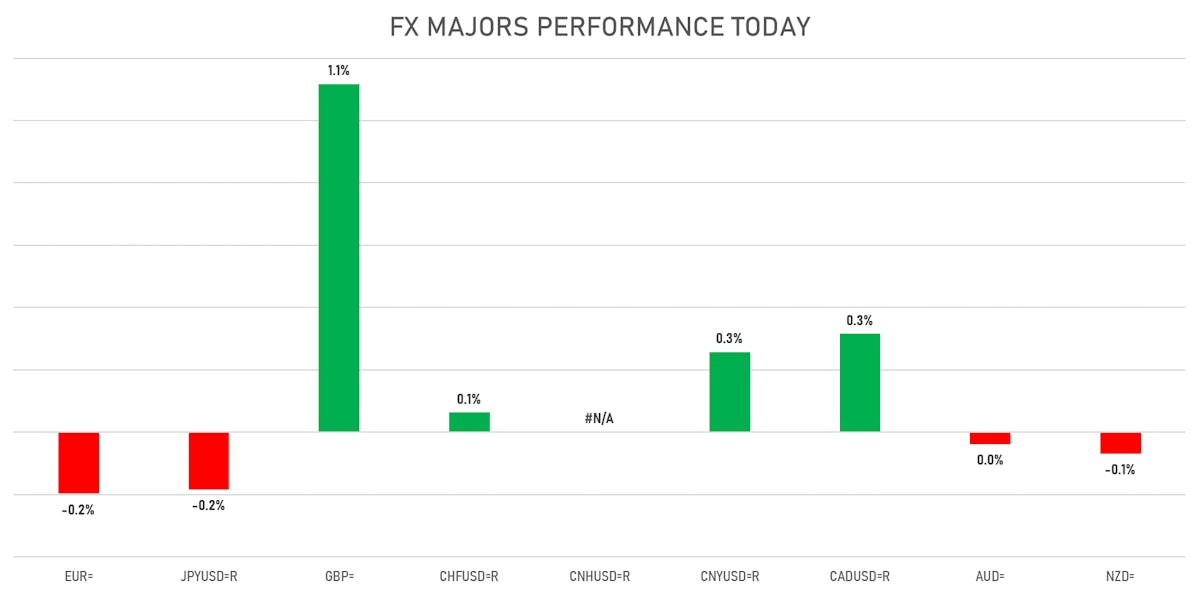

British Pound Up 1%, Other Majors Almost Unchanged Today

The UK was excited by the wider reopening of its economy, just in time to plan a wild summer, though hot spots like Mykonos and Ibiza are not on the green travel list and still require a quarantine

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

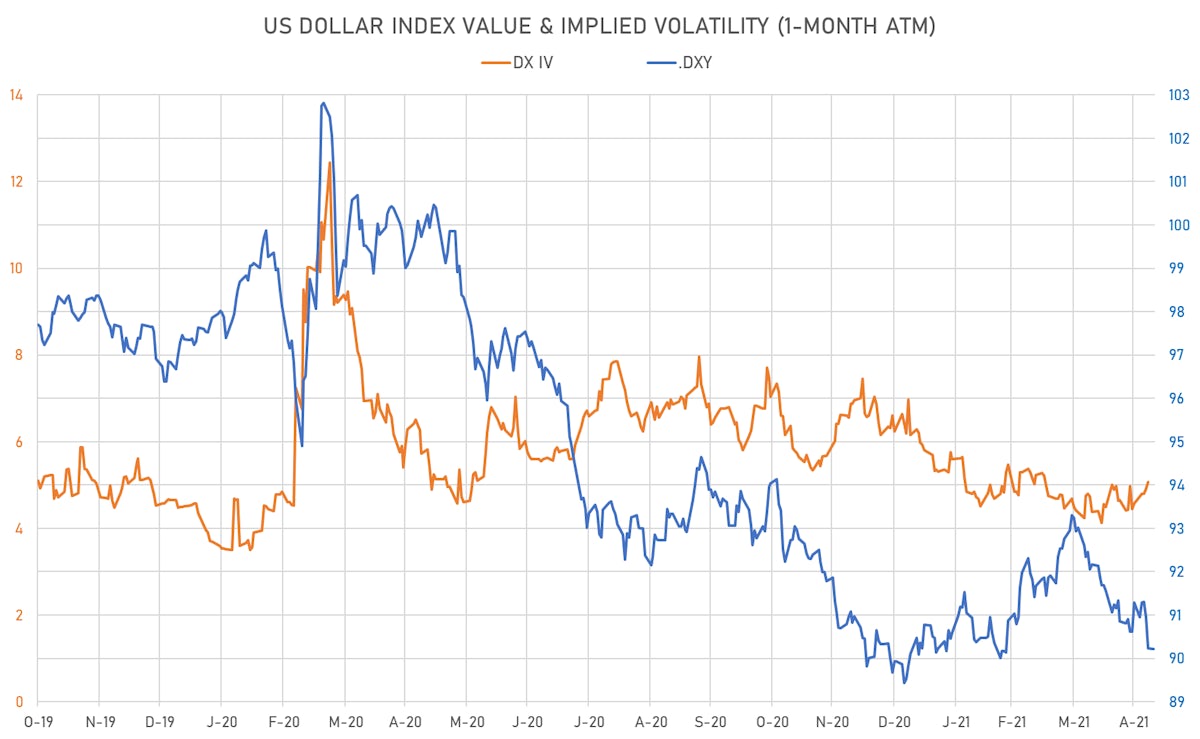

- The US Dollar Index is unchanged at 90.2

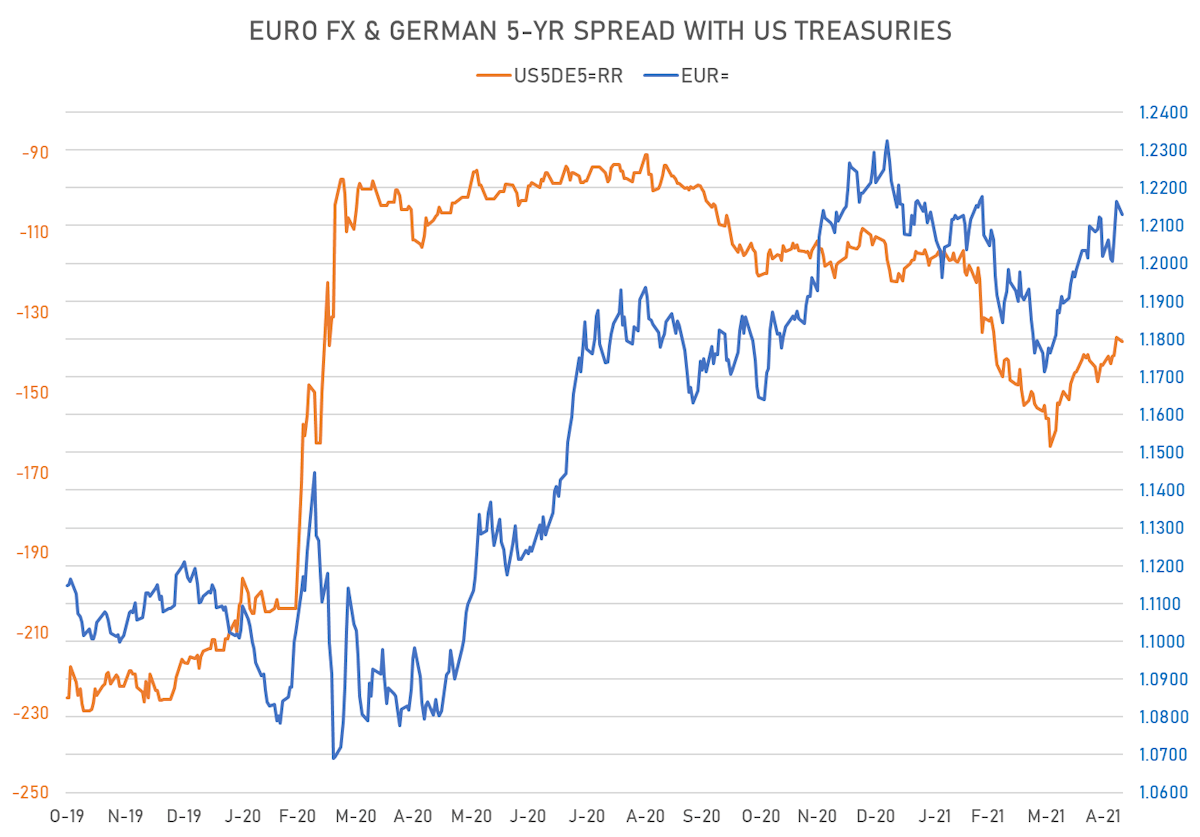

- Euro down 0.2% at 1.2139 (YTD: -0.6%)

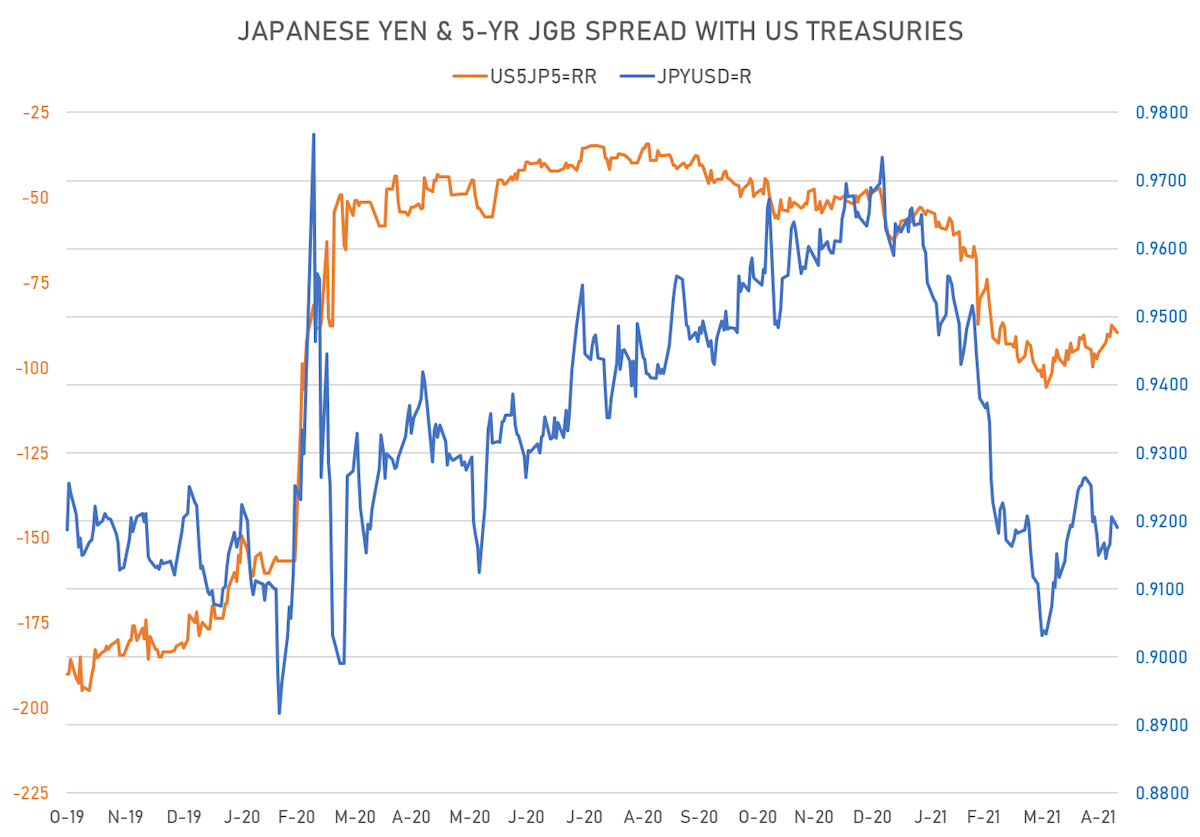

- Yen down 0.2% at 108.78 (YTD: -5.1%)

- Onshore Yuan up 0.3% at 6.4156 (YTD: +1.7%)

- Swiss franc up 0.1% at 0.9002 (YTD: -1.7%)

- Sterling up 1.1% at 1.4128 (YTD: +3.3%)

- Canadian dollar up 0.3% at 1.2093 (YTD: +5.3%)

- Australian dollar down 0.0% at 0.7839 (YTD: +1.9%)

- NZ dollar down 0.1% at 0.7268 (YTD: +1.2%)

MACRO DATA RELEASES

- Australia, Retail Sales, Change P/P for Q1 2021 (AU Bureau of Stat) at -0.5, below consensus estimate of -0.4

- Australia, Retail Sales, Total, Final, Change P/P for Mar 2021 (AU Bureau of Stat) at 1.3, below consensus estimate of 1.4

- Denmark, CPI, All Items, Change Y/Y, Price Index for Apr 2021 (statbank.dk) at 1.5

- Norway, CPI, All Items, Change P/P, Price Index for Apr 2021 (Statistics Norway) at 0.3, below consensus estimate of 0.5

- Norway, CPI, All Items, Change Y/Y for Apr 2021 (Statistics Norway) at 3.0, in line with consensus

- United Kingdom, House Prices, Halifax, UK, Change P/P for Apr 2021 at 1.4

RATES SPREADS

- 5Y German-US interest rates spread 1.1 bp wider

- 5Y Japan-US rates spread 2.2 bp wider

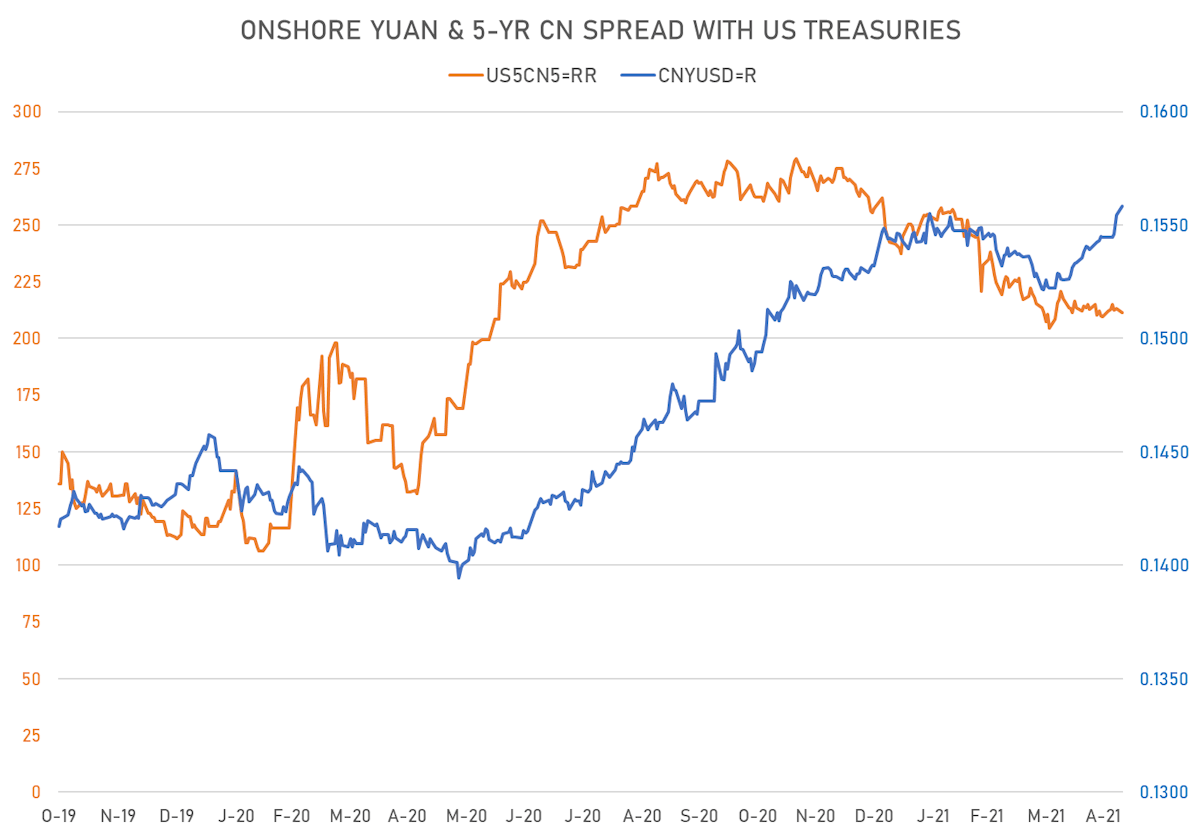

- 5Y Chinese-US rates spread 1.6 bp tighter

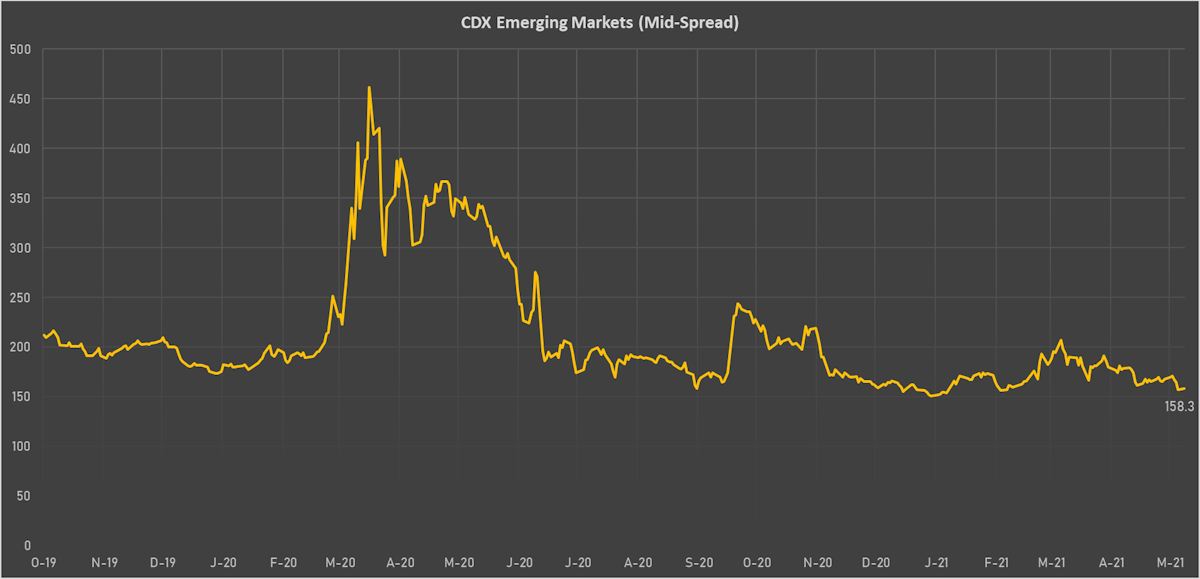

NOTABLE MOVES IN SOVEREIGN CDS

- Morocco (rated BB+): up 2.3 basis points to 90 bp (1Y range: 86-155bp)

- Spain (rated A-): down 0.8 basis points to 34 bp (1Y range: 29-116bp)

- Philippines (rated BBB): down 0.9 basis points to 44 bp (1Y range: 33-86bp)

- Indonesia (rated BBB): down 1.5 basis points to 74 bp (1Y range: 66-203bp)

- Mexico (rated BBB-): down 1.7 basis points to 90 bp (1Y range: 79-242bp)

- Vietnam (rated BB): down 2.3 basis points to 98 bp (1Y range: 90-259bp)

- Peru (rated BBB+): down 2.9 basis points to 84 bp (1Y range: 52-106bp)

- Italy (rated BBB-): down 3.5 basis points to 84 bp (1Y range: 69-233bp)

- South Africa (rated BB-): down 4.3 basis points to 199 bp (1Y range: 197-407bp)

- Oman (rated BB-): down 11.6 basis points to 228 bp (1Y range: 240-676bp)

VOLATILITIES

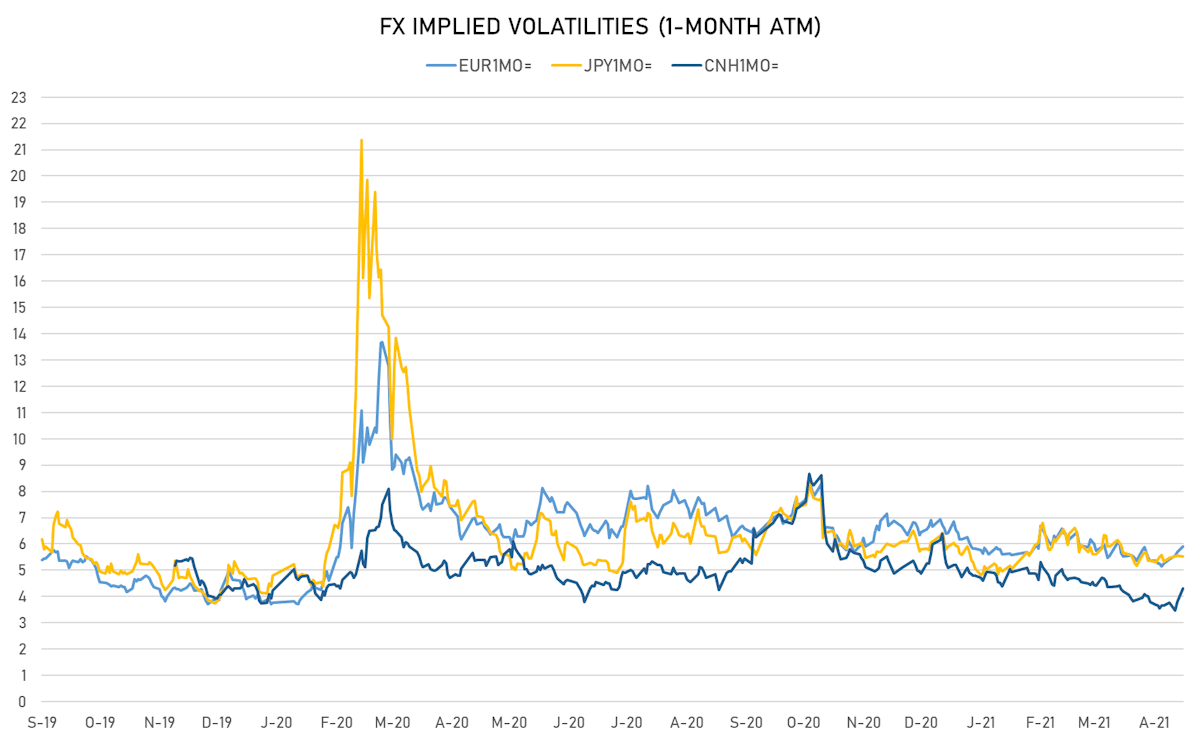

- Deutsche Bank USD Currency Volatility Index currently at 6.43, down -0.03 on the day (YTD: -0.86)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.90, up 0.2 on the day (YTD: -1.0)

- Japanese Yen 1M ATM IV currently at 5.53, down 0.0 on the day (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 4.30, up 0.5 on the day (YTD: -1.3)

NOTABLE OTHER MOVERS TODAY

- Haiti Gourde up 4.1% (YTD: -13.7%)

- Peru Sol up 2.2% (YTD: -2.9%)

- Qatari Riyal up 1.8% (YTD: 0.0%)

- St Helena Pound up 1.8% (YTD: +3.6%)

- Vanuatu Vatu up 1.8% (YTD: +0.9%)

- Pacific Franc up 1.5% (YTD: -0.8%)

- Colombian Peso up 1.2% (YTD: -7.5%)

- Afghani down 2.4% (YTD: -2.9%)

- CFA Franc BEAC down 2.9% (YTD: -1.8%)