FX

Very Little Movement In The Spot Market For Major Currencies

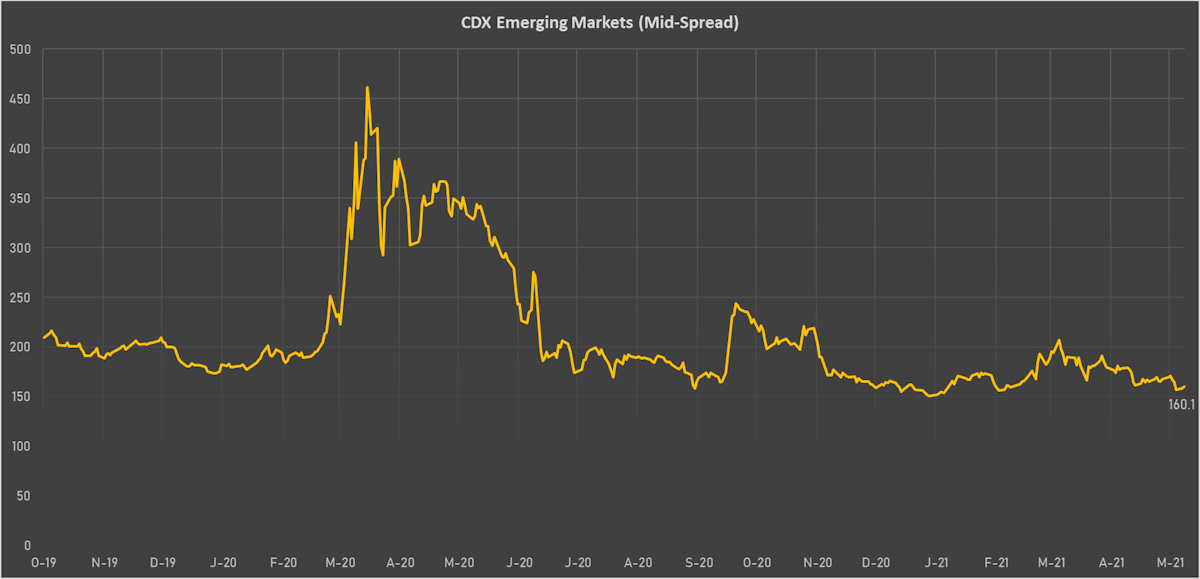

Emerging markets sovereign credit spreads widened slightly (close to their 2-year lows), with the largest moves in the Middle East and Africa

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

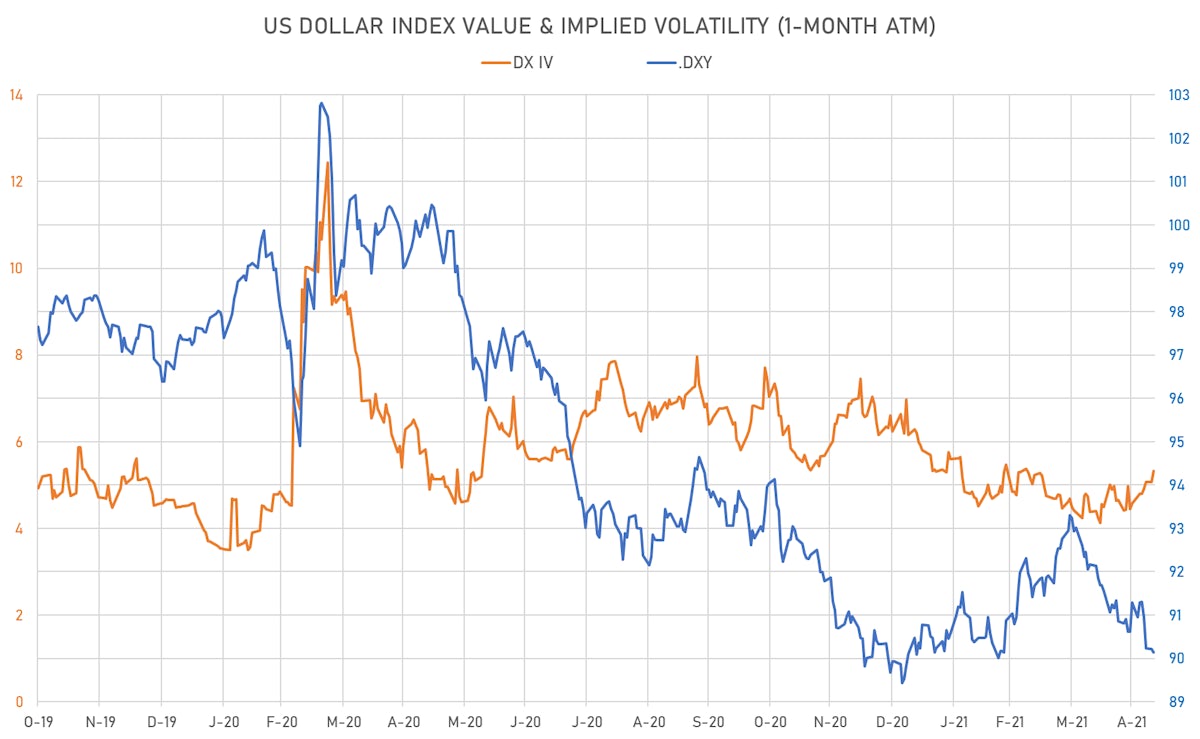

- The US Dollar Index is down -0.1% at 90.1

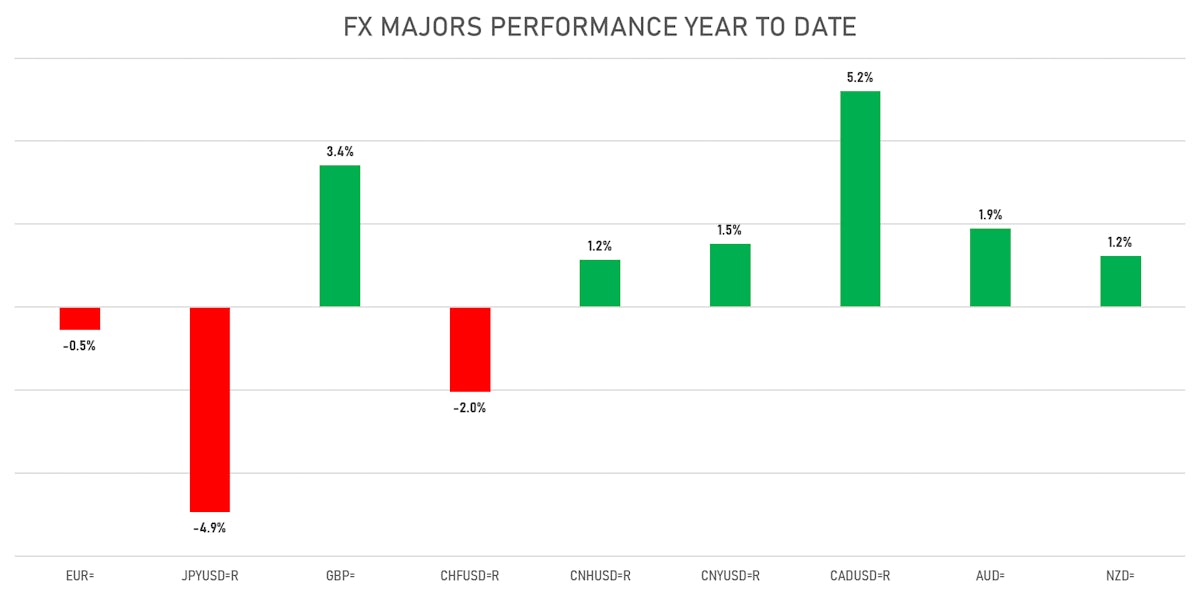

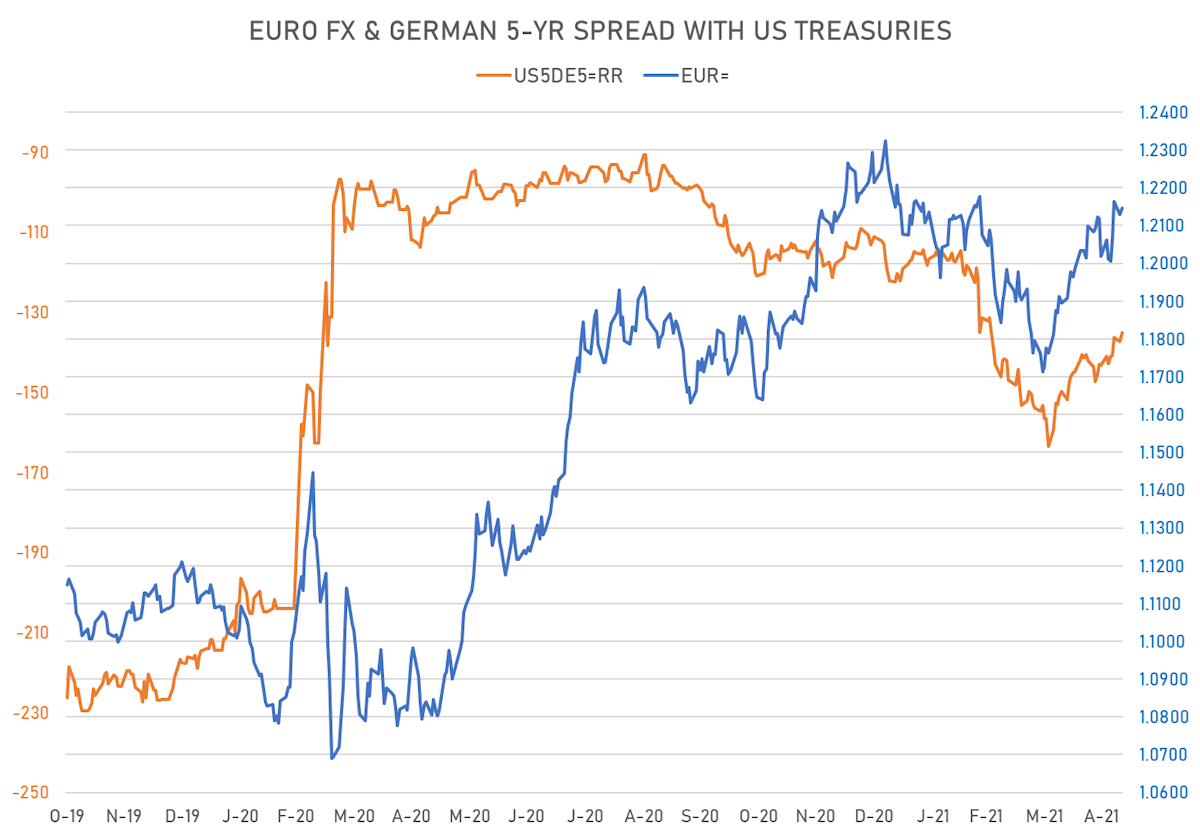

- Euro up 0.1% at 1.2146 (YTD: -0.5%)

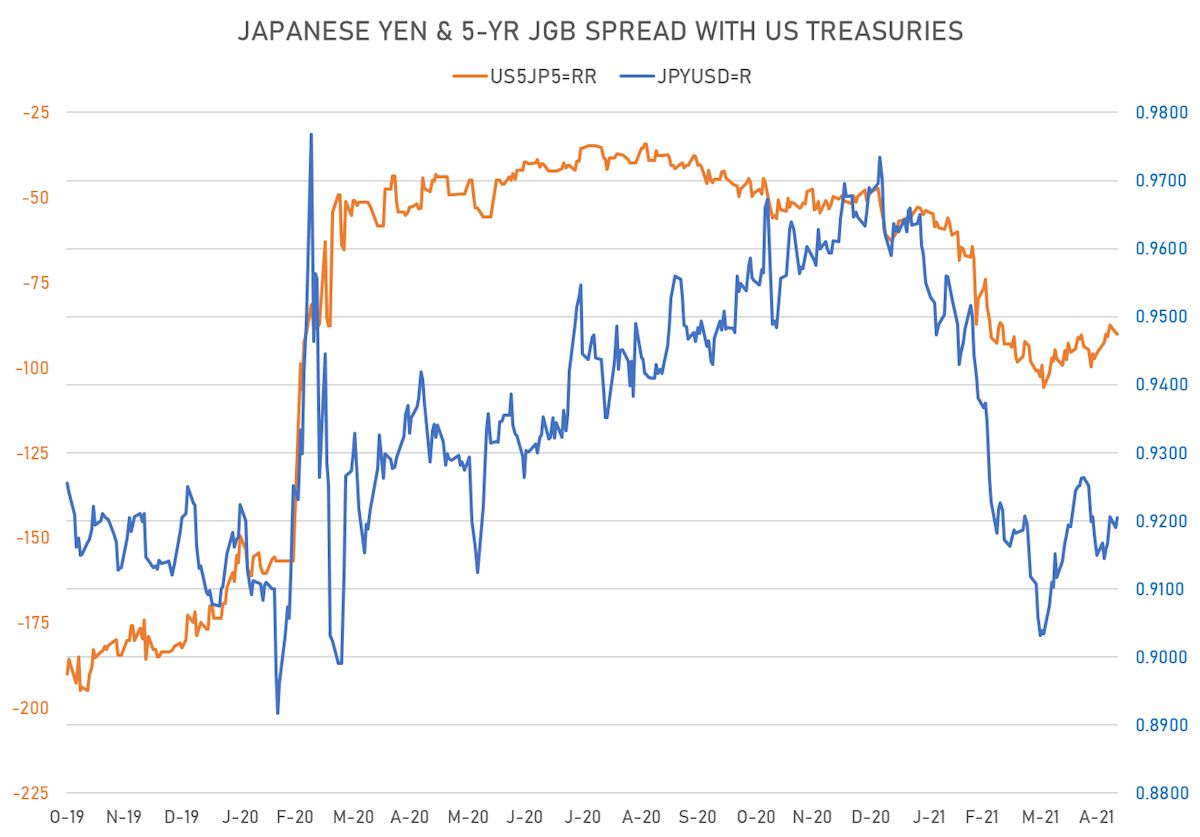

- Yen up 0.2% at 108.61 (YTD: -4.9%)

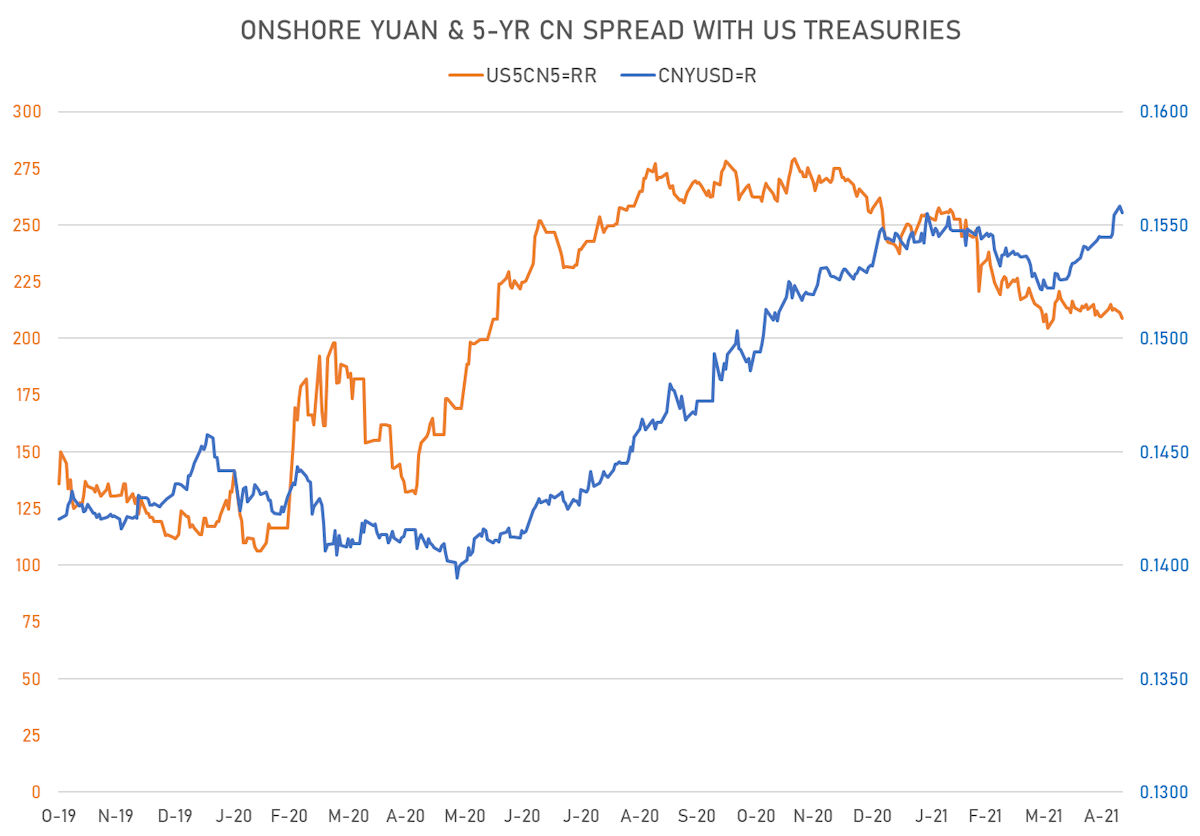

- Onshore Yuan down 0.2% at 6.4285 (YTD: +1.5%)

- Swiss franc down 0.3% at 0.9037 (YTD: -2.0%)

- Sterling up 0.1% at 1.4141 (YTD: +3.4%)

- Canadian dollar unchanged at 1.2099 (YTD: +5.2%)

- Australian dollar up 0.1% at 0.7840 (YTD: +1.9%)

- NZ dollar unchanged at 0.7274 (YTD: +1.2%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Apr 2021 (IBGE, Brazil) at 0.3, in line with consensus

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Apr 2021 (NBS, China) at 0.9, below consensus estimate of 1.0

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Apr 2021 (NBS, China) at 6.8, above consensus estimate of 6.5

- Czech Republic, CPI, Change Y/Y, Price Index for Apr 2021 (CSU, Czech Rep) at 3.1, above consensus estimate of 2.7

- Germany, ZEW, Current Economic Situation, Germany, balance for May 2021 (ZEW, Germany) at -40.1, above consensus estimate of -41.3

- Germany, ZEW, Economic Expectations, Germany, balance for May 2021 (ZEW, Germany) at 84.4, above consensus estimate of 72.0

- Turkey, Current Account, Balance, Current Prices for Mar 2021 (Central Bank, Turkey) at -3.3, above consensus estimate of -3.8

RATES SPREADS

- 5Y German-US interest rates spread 2.2 bp tighter

- 5Y Japan-US rates spread 0.5 bp wider

- 5Y Chinese-US rates spread 2.6 bp tighter

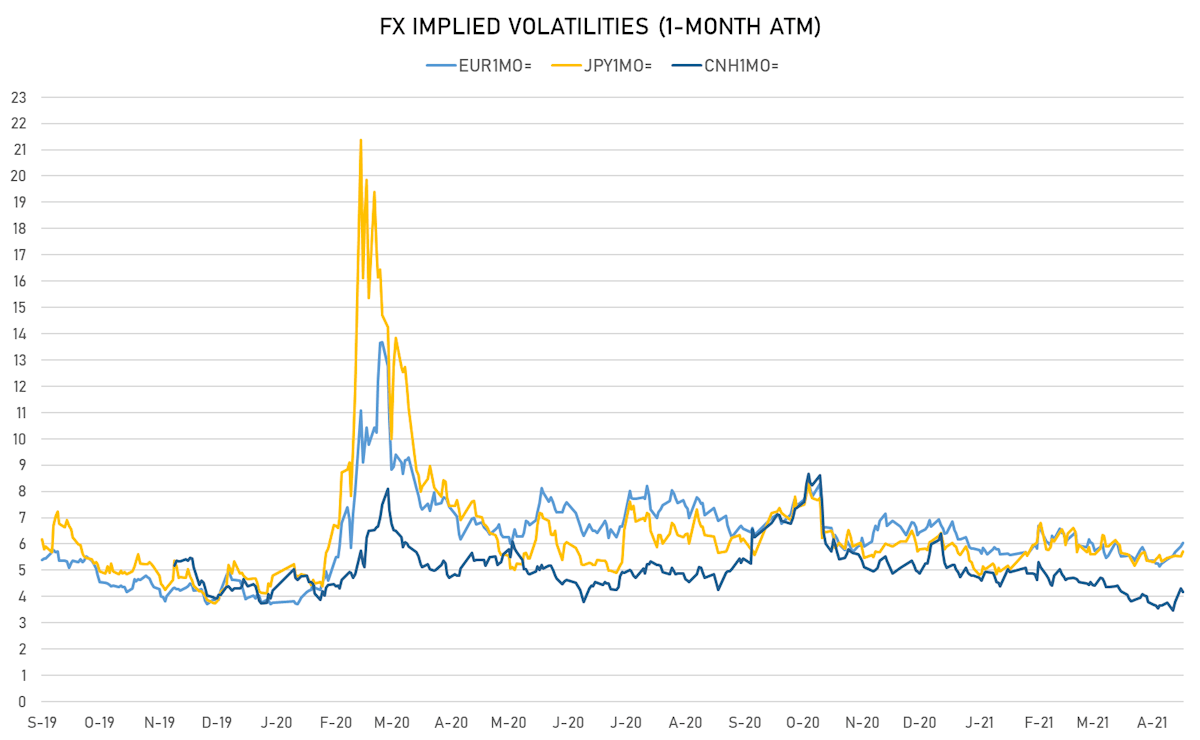

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.61, up 0.18 on the day (YTD: -0.68)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.05, up 0.1 on the day (YTD: -0.9)

- Japanese Yen 1M ATM IV currently at 5.73, up 0.2 on the day (YTD: -0.4)

- Offshore Yuan 1M ATM IV currently at 4.16, down -0.1 on the day (YTD: -1.5)

NOTABLE MOVES IN SOVEREIGN CDS

- Lebanon (rated CC): up 109.0 basis points to 3,334 bp (1Y range: 3,196-3,683bp)

- Kenya (rated B+): up 13.5 basis points to 411 bp (1Y range: 394-454bp)

- Ethiopia (rated CCC): up 13.0 basis points to 400 bp (1Y range: 383-442bp)

- Pakistan (rated B-): up 12.5 basis points to 382 bp (1Y range: 362-512bp)

- Senegal (rated ): up 12.0 basis points to 370 bp (1Y range: 355-409bp)

- Nigeria (rated B): up 11.0 basis points to 347 bp (1Y range: 333-383bp)

- Ecuador (rated WD): up 5.5 basis points to 163 bp (1Y range: 157-181bp)

- Latvia (rated A-): up 1.5 basis points to 42 bp (1Y range: 39-46bp)

- Lithuania (rated A): up 1.5 basis points to 43 bp (1Y range: 40-47bp)

- Poland (rated A-): up 1.5 basis points to 43 bp (1Y range: 40-47bp)

LARGEST MOVERS TODAY

- Seychelles rupee up 2.0% (YTD: +38.7%)

- Jamaican Dollar up 1.1% (YTD: -5.3%)

- Bangladesh Taka up 0.5% (YTD: +0.2%)

- Kazakhstan Tenge down 0.3% (YTD: -1.5%)

- Taiwan Dollar down 0.3% (YTD: +0.9%)

- Swaziland Lilageni down 0.3% (YTD: +4.4%)

- Cayman Is. Dollar down 0.6% (YTD: 0.0%)

- Fiji Dollar down 0.6% (YTD: +1.7%)

- Tunisian Dinar down 0.7% (YTD: -1.9%)

- Mauritius Rupee down 0.8% (YTD: -2.4%)