FX

US Interest Rates Rise, Major Foreign Currencies Weaken

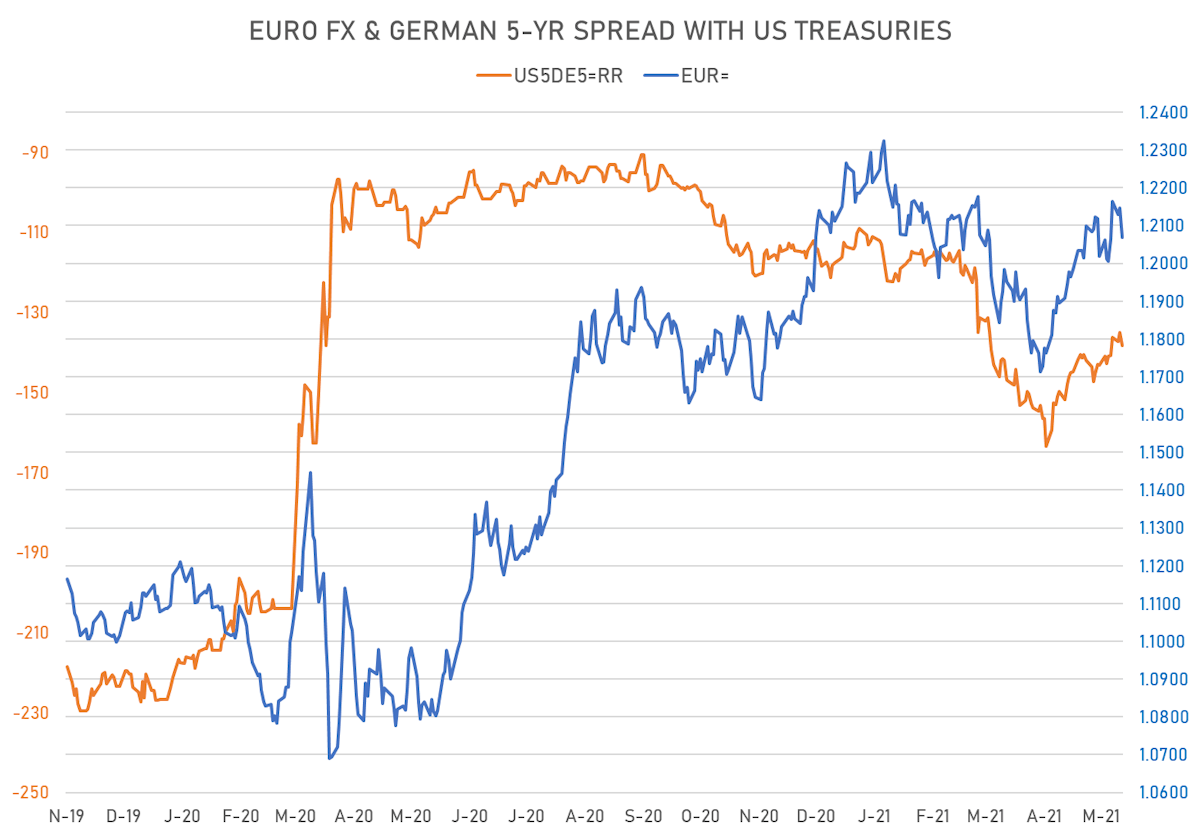

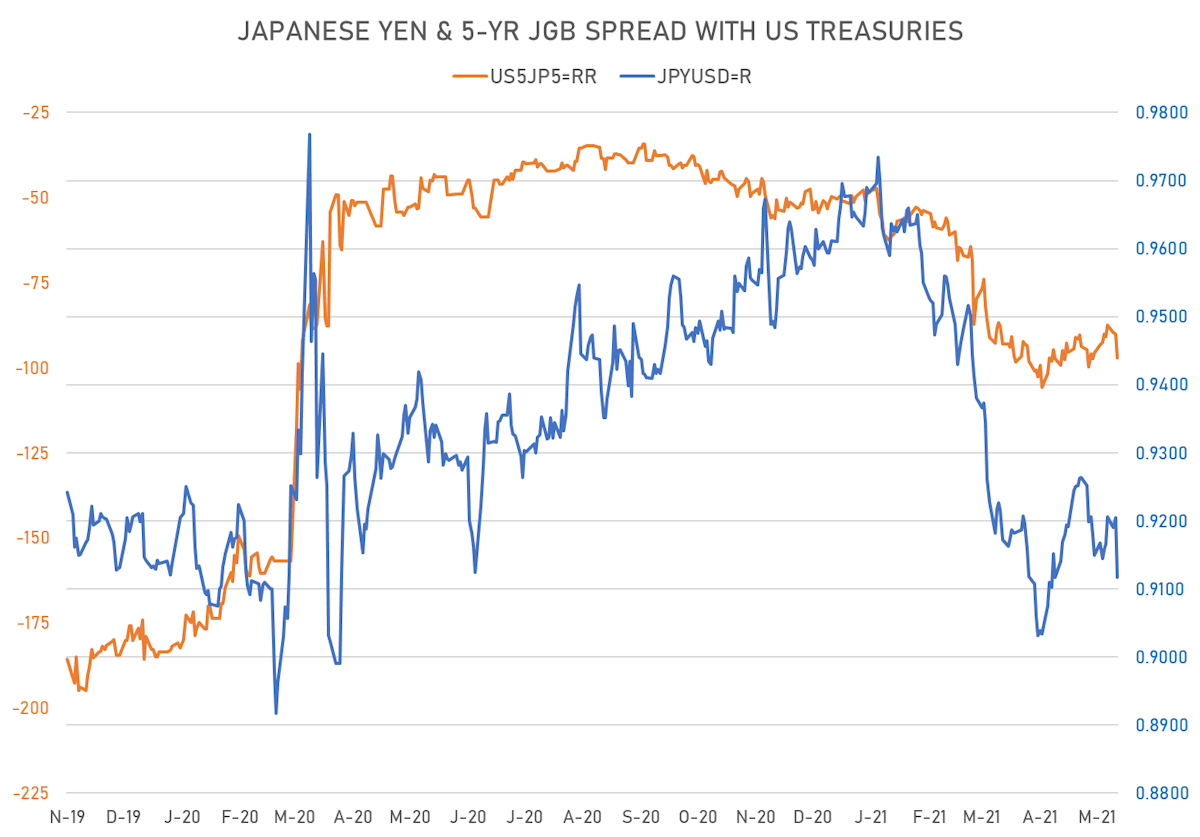

US rate hikes expectations are unmatched in other countries, widening sovereign spreads and making the USD relatively stronger

Published ET

us dollar index intraday | Source: Refinitiv

QUICK SUMMARY

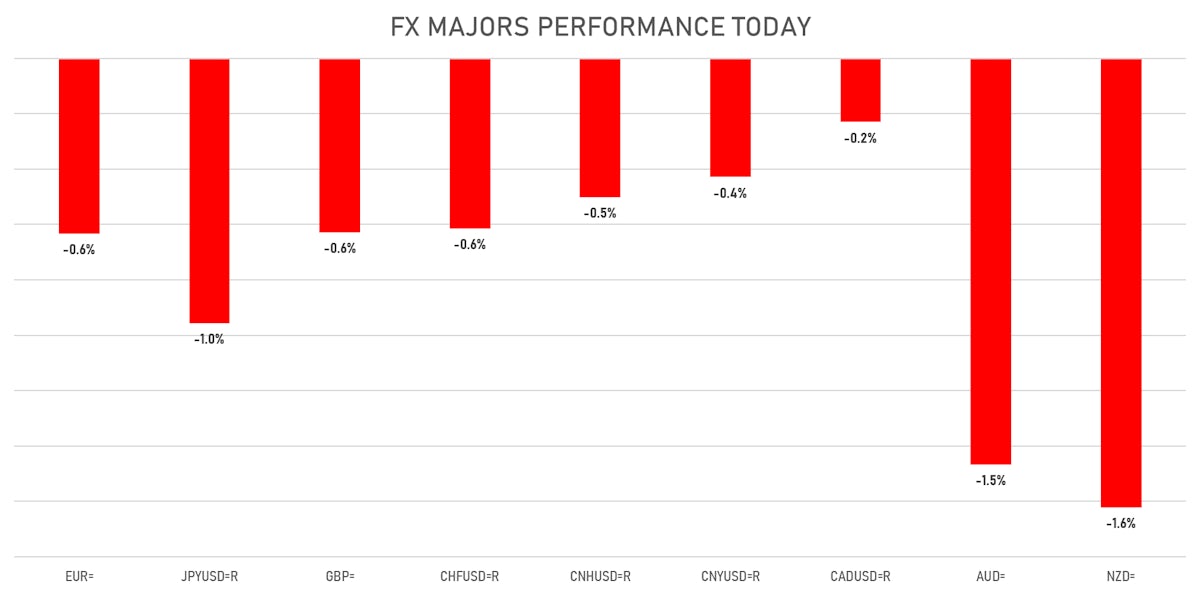

- The US Dollar Index up 0.6% at 90.7

- Euro down 0.6% at 1.2069 (YTD: -1.2%)

- Yen down 1.0% at 109.65 (YTD: -5.8%)

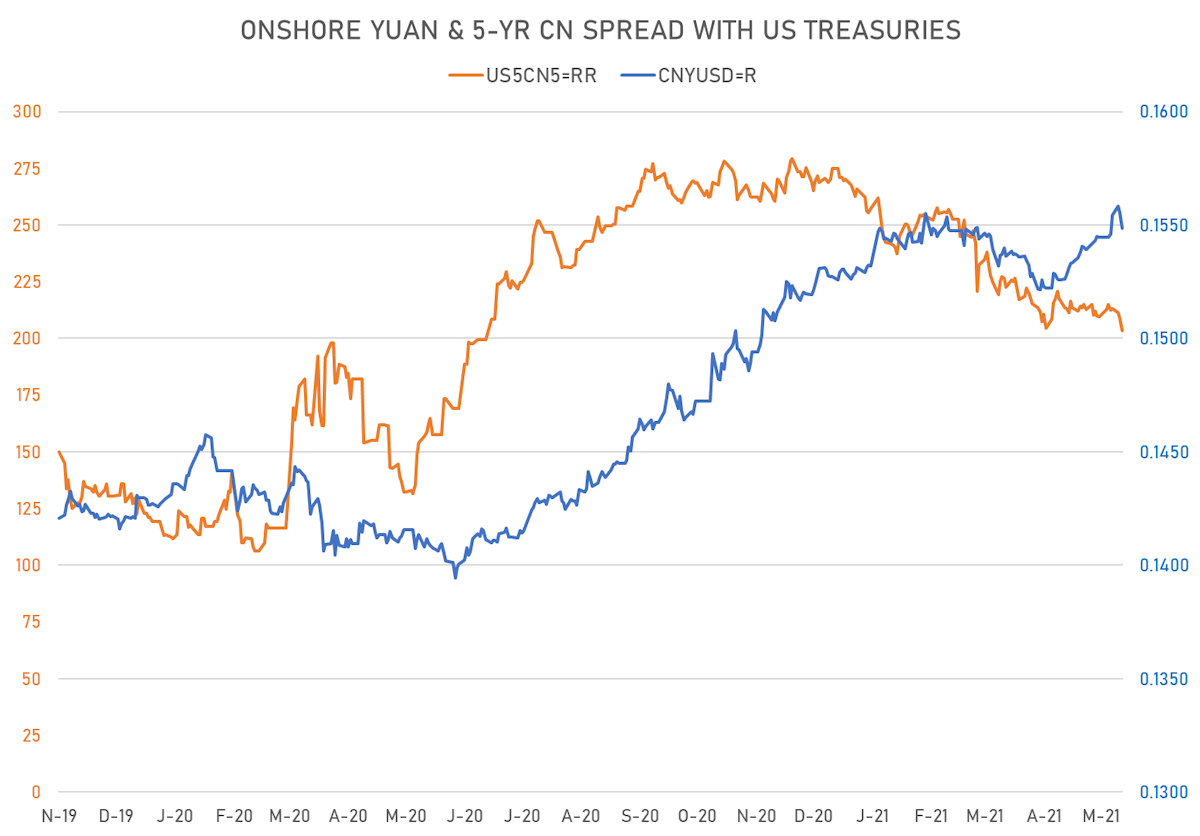

- Onshore Yuan down 0.4% at 6.4566 (YTD: +1.1%)

- Swiss franc down 0.6% at 0.9091 (YTD: -2.6%)

- Sterling down 0.6% at 1.4052 (YTD: +2.8%)

- Canadian dollar down 0.2% at 1.2131 (YTD: +5.0%)

- Australian dollar down 1.5% at 0.7725 (YTD: +0.4%)

- NZ dollar down 1.6% at 0.7156 (YTD: -0.4%)

MACRO DATA RELEASES

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Apr 2021 (PBC) at 1,850.0, below consensus estimate of 2,250.0

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Apr 2021 (PBC) at 1,470.0, below consensus estimate of 1,600.0

- China (Mainland), Money supply M2, Change Y/Y for Apr 2021 (PBC) at 8.1, below consensus estimate of 9.3

- France, HICP, Change Y/Y, Price Index for Apr 2021 (INSEE, France) at 1.6, below consensus estimate of 1.7

- France, HICP, Final, Change P/P, Price Index for Apr 2021 (INSEE, France) at 0.2, below consensus estimate of 0.3

- Germany, HICP, Final, Change Y/Y, Price Index for Apr 2021 (Destatis) at 2.1, in line with estimates

- India, Production, Change Y/Y, Volume Index for Mar 2021 (MOSPI, India) at 22.4, above consensus estimate of 17.6

- Japan, Current Account, Balance, Current Prices for Mar 2021 (BOJ/MOF Japan) at 0.0, below consensus estimate of 2,796.2

- Norway, GDP, Mainland Norway, Change P/P for Q1 2021 (Statistics Norway) at -1.0, below consensus estimate of -0.7

- Philippines, Policy Rates, Reverse Repo, O/N (Borrowing) Key Rate for 12 May (Bangko Sentral ng) at 2.0

- Romania, Policy Rates, Policy Rate for 13 May (Cent. Bank, Romania) at 1.3, below consensus estimate of 1.3

- Sweden, CPI, All Items, Change P/P, Price Index for Apr 2021 (SCB, Sweden) at 0.2, in line with estimates

- Sweden, CPI, All Items, Change Y/Y, Price Index for Apr 2021 (SCB, Sweden) at 2.2, in line with estimates

- United Kingdom, GDP Estimated YY, Change Y/Y for Mar 2021 (ONS, United Kingdom) at 1.4, above consensus estimate of 1.0

- United Kingdom, GDP Estimated, Change M/M for Mar 2021 (ONS, United Kingdom) at 2.1, above consensus estimate of 1.3

- United Kingdom, GDP estimate 3m/3m for Mar 2021 (ONS, United Kingdom) at -1.5, above consensus estimate of -1.7

- United Kingdom, GDP, Total, at market prices, Change P/P for Q1 2021 (ONS, United Kingdom) at -1.5, above consensus estimate of -1.6

- United Kingdom, GDP, Total, at market prices, Change Y/Y for Q1 2021 (ONS, United Kingdom) at -6.1, in line with estimates

- United Kingdom, Production, Manufacturing, Change P/P for Mar 2021 (ONS, United Kingdom) at 2.1, above consensus estimate of 1.0

- United States, CPI, All items, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.8, above consensus estimate of 0.2

RATES SPREADS

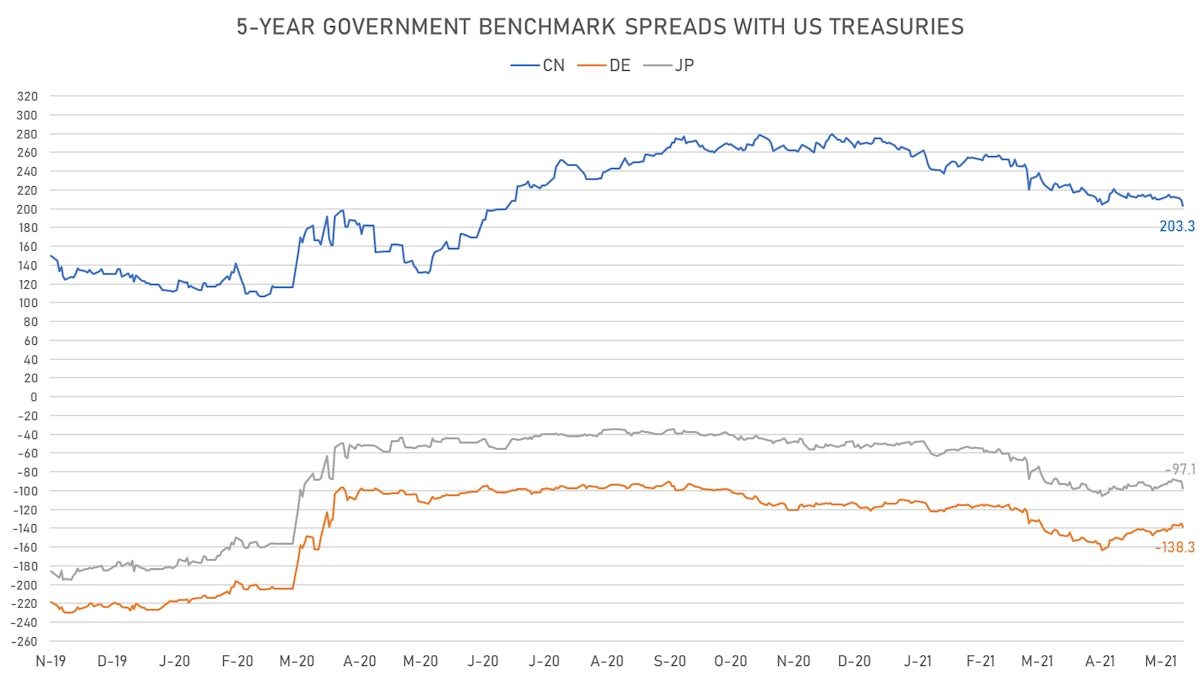

- 5Y German-US interest rates spread 3.2 bp wider

- 5Y Japan-US rates spread 6.9 bp wider

- 5Y Chinese-US rates spread 5.6 bp tighter

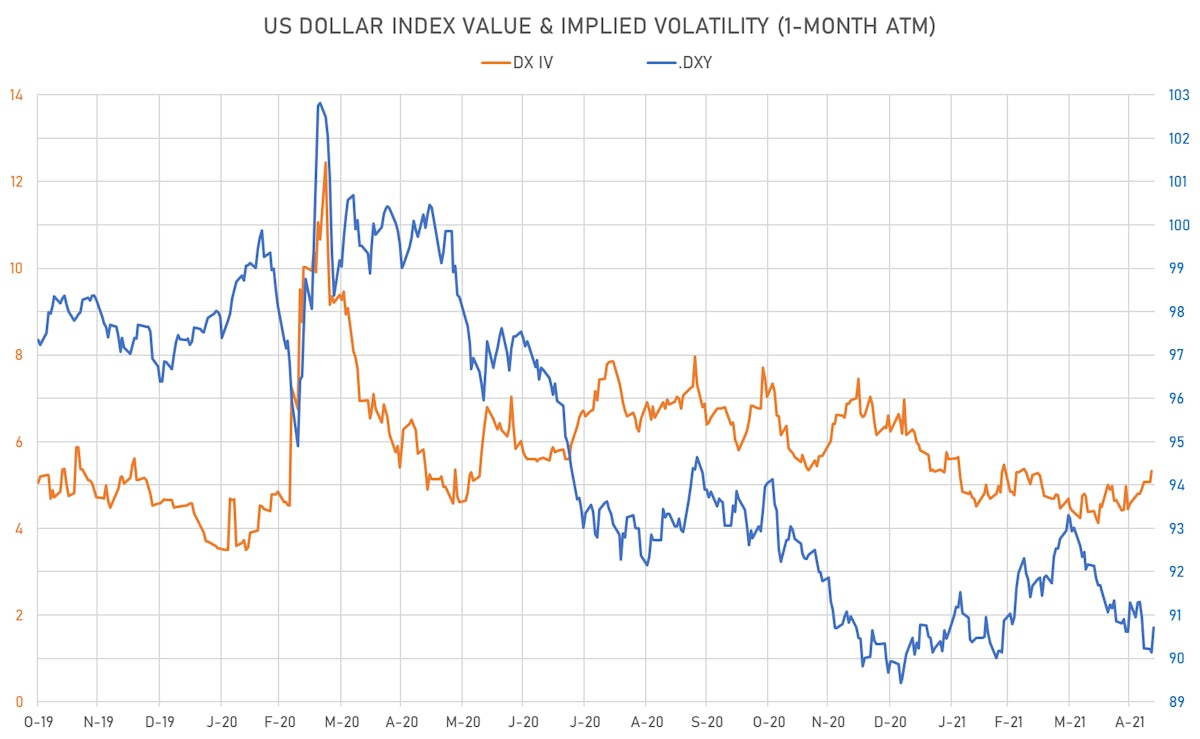

VOLATILITIES

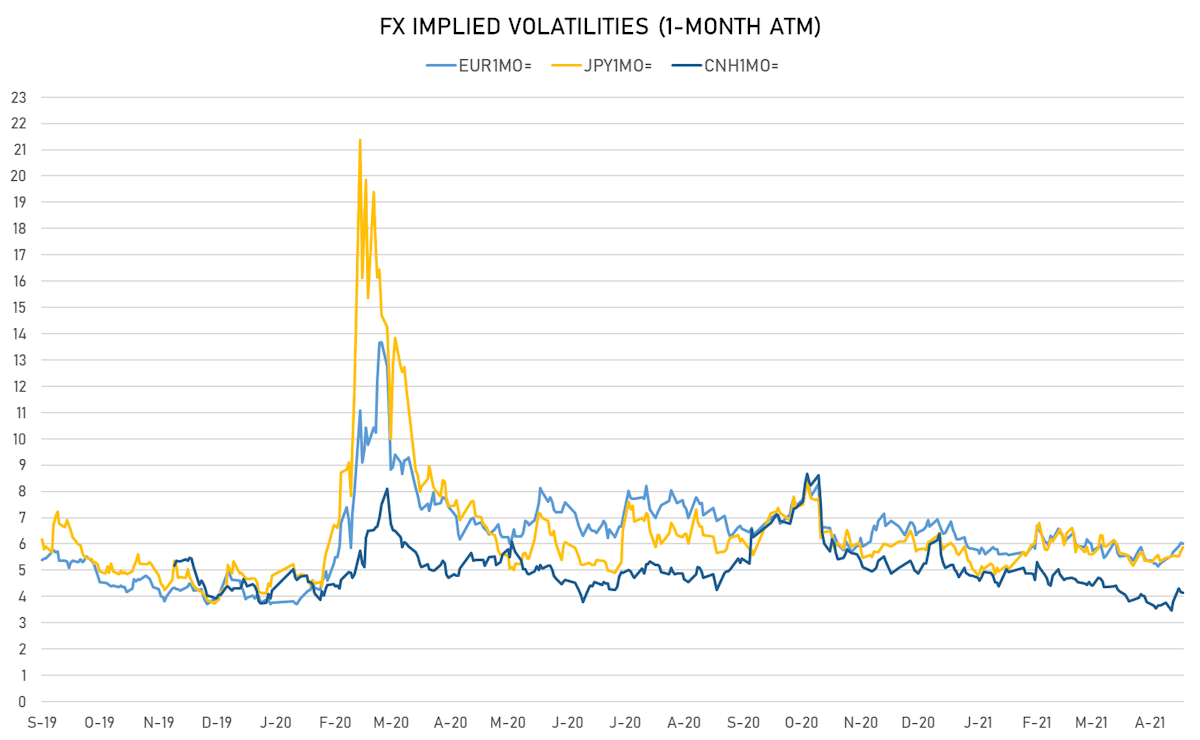

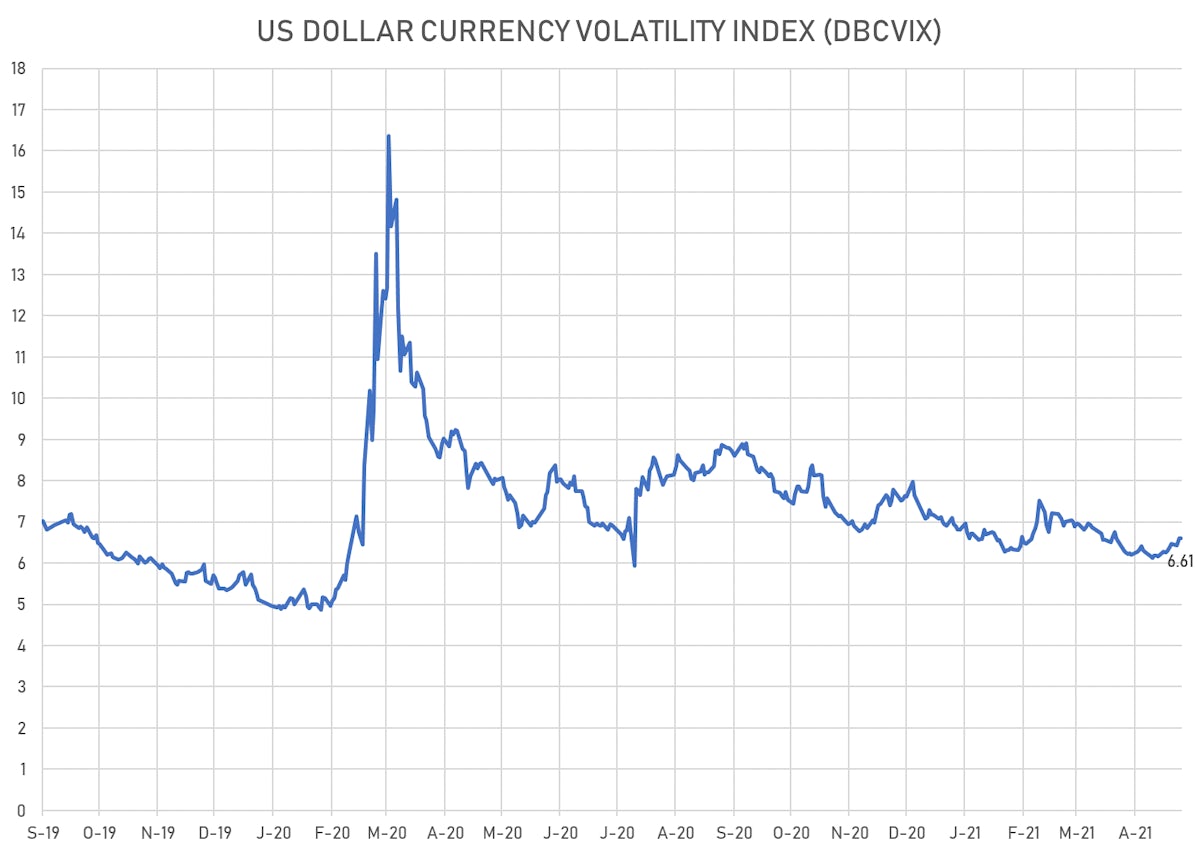

- Deutsche Bank USD Currency Volatility Index currently at 6.61, unchanged (YTD: -0.68)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.01, unchanged (YTD: -0.9)

- Japanese Yen 1M ATM IV currently at 5.88, up 0.2 on the day (YTD: -0.2)

- Offshore Yuan 1M ATM IV currently at 4.15, unchanged (YTD: -1.5)

NOTABLE MOVES IN SOVEREIGN CDS

- Turkey (rated BB-): up 11.8 basis points to 407 bp (1Y range: 282-621bp)

- Oman (rated BB-): up 6.6 basis points to 238 bp (1Y range: 228-676bp)

- Brazil (rated BB-): up 5.4 basis points to 179 bp (1Y range: 141-343bp)

- Colombia (rated BBB-): up 4.0 basis points to 132 bp (1Y range: 83-239bp)

- Government of Chile (rated A-): up 3.6 basis points to 54 bp (1Y range: 43-110bp)

- Mexico (rated BBB-): up 3.2 basis points to 96 bp (1Y range: 79-242bp)

- Russia (rated BBB): up 2.7 basis points to 95 bp (1Y range: 72-151bp)

- Peru (rated BBB+): up 2.6 basis points to 85 bp (1Y range: 52-106bp)

- Panama (rated BBB-): up 2.3 basis points to 71 bp (1Y range: 44-147bp)

- Malaysia (rated BBB+): up 1.1 basis points to 46 bp (1Y range: 33-109bp)

NOTABLE OTHER MOVERS TODAY

- Afghani up 2.6% (YTD: -0.4%)

- Haiti Gourde up 2.2% (YTD: -15.7%)

- Norwegian Krone down 1.0% (YTD: +2.8%)

- Korean Won down 1.1% (YTD: -4.1%)

- Swedish Krona down 1.3% (YTD: -2.2%)

- Australian Dollar down 1.4% (YTD: +0.5%)

- New Zealand $ down 1.5% (YTD: -0.3%)

- Brazilian Real down 1.6% (YTD: -2.1%)

- Turkish Lira down 1.7% (YTD: -11.8%)

- Fiji Dollar down 2.6% (YTD: -0.3%)