FX

The Dollar Ends The Week Weaker As US Rates Drop Back

The weekly CFTC Commitment of Traders report confirms that speculators have increased their net short US$ positioning

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

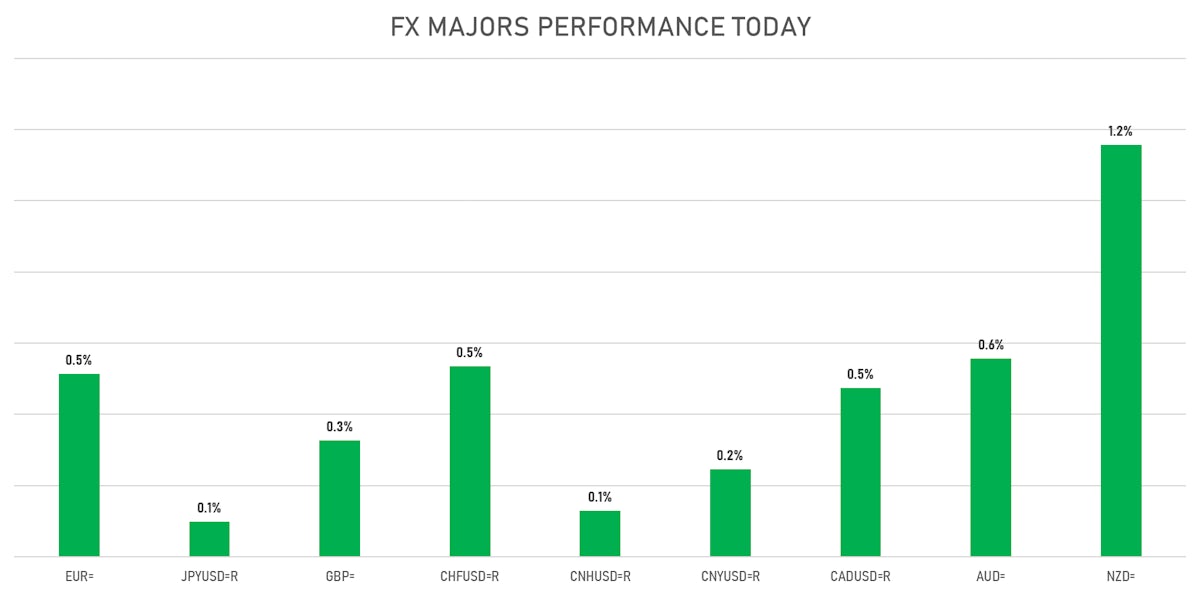

- The US Dollar Index is down -0.5% at 90.3

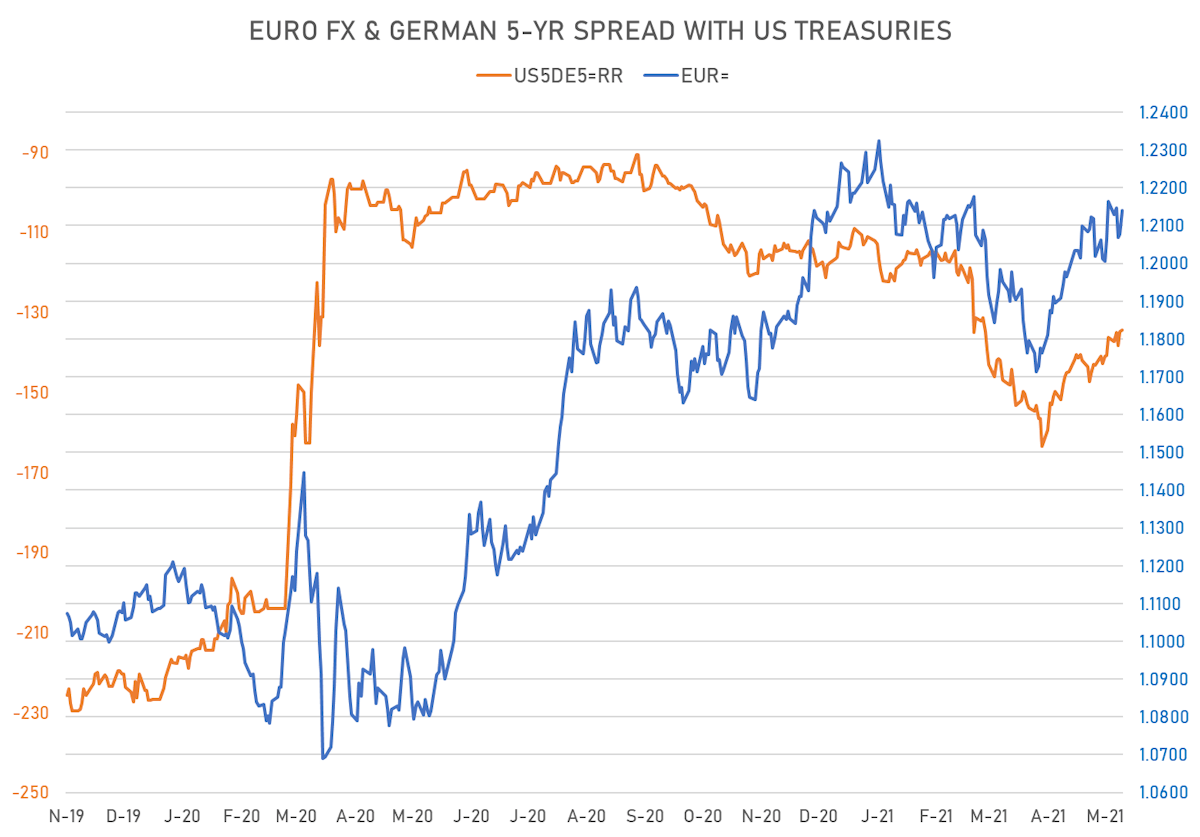

- Euro up 0.5% at 1.2140 (YTD: -0.6%)

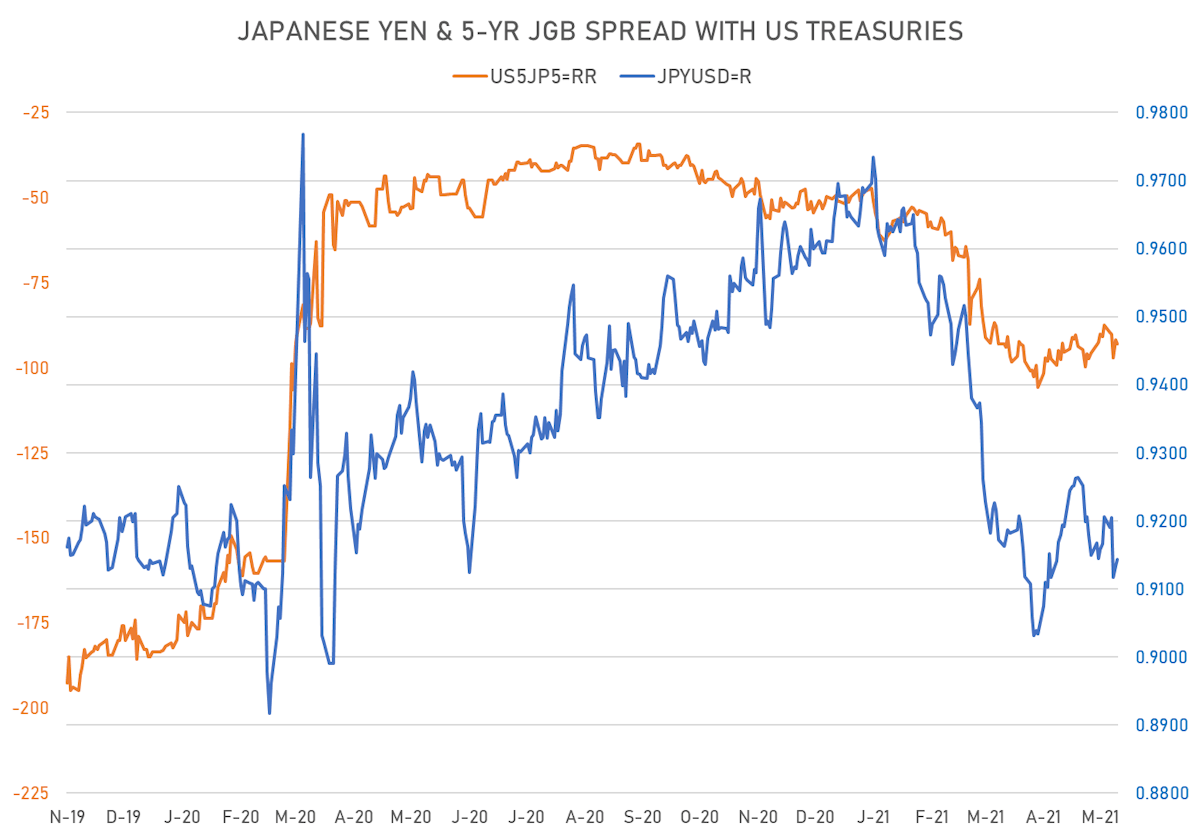

- Yen up 0.1% at 109.34 (YTD: -5.6%)

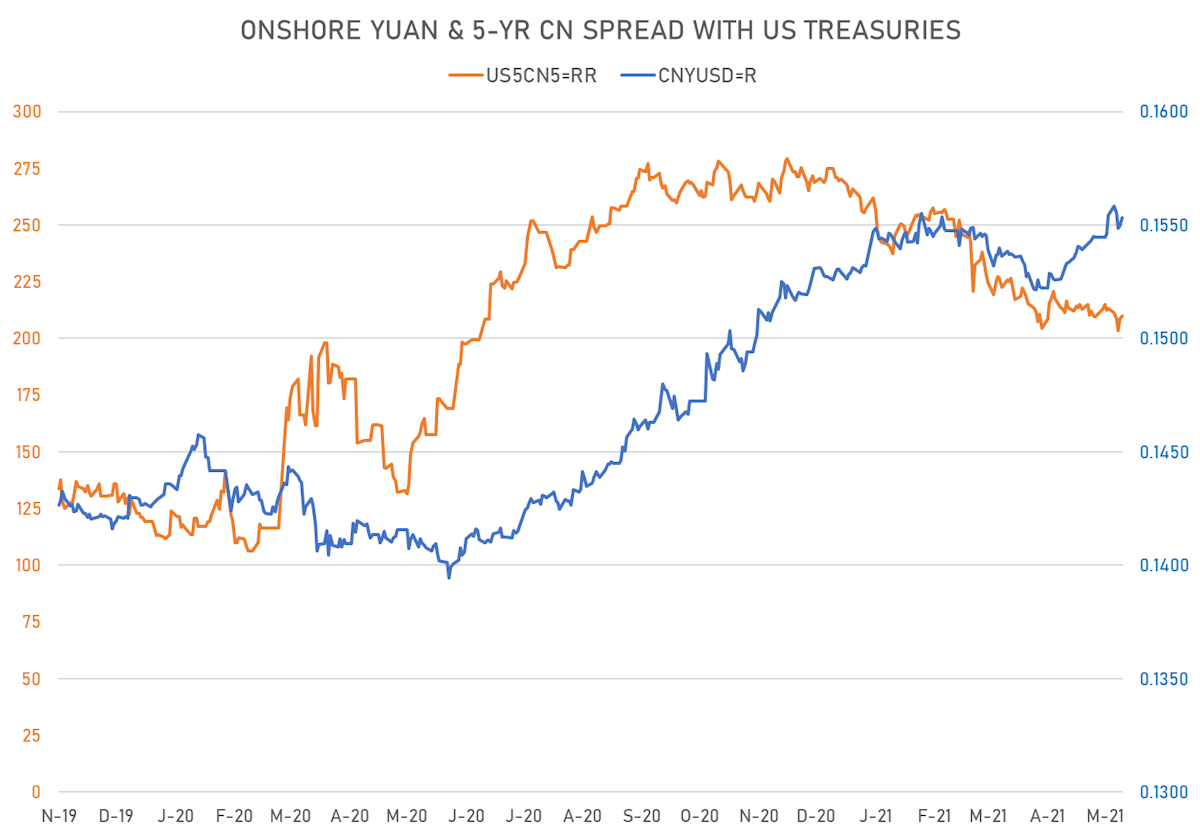

- Onshore Yuan up 0.2% at 6.4367 (YTD: +1.4%)

- Swiss franc up 0.5% at 0.9011 (YTD: -1.8%)

- Sterling up 0.3% at 1.4096 (YTD: +3.1%)

- Canadian dollar up 0.5% at 1.2102 (YTD: +5.2%)

- Australian dollar up 0.6% at 0.7772 (YTD: +1.0%)

- NZ dollar up 1.2% at 0.7254 (YTD: +1.0%)

MACRO DATA RELEASES

- Chile, Policy Rates, Monetary Policy Interest Rate for May 2021 (Central Bank, Chile) at 0.50%, in line with consensus (prior 0.50%)

- Colombia, GDP, Change Y/Y for Q1 2021 (DANE, Colombia) at 1.10%, above consensus estimate of -1.0%

- Poland, CPI, Change P/P, Price Index for Apr 2021 (CSO, Poland) at 0.80%, above consensus of 0.70%

- Poland, CPI, Change Y/Y, Price Index for Apr 2021 (CSO, Poland) at 4.30%, in line with consensus

- United States, Production, Change P/P for Apr 2021 (FED, U.S.) at 0.70%, below consensus estimate of 1.0%

- United States, Retail Sales, Total including food services, Change P/P for Apr 2021 (U.S. Census Bureau) at 0.00%, below consensus estimate of 1.0%

- United States, University of Michigan, Total-prelim, Volume Index for May 2021 (UMICH, Survey) at 82.80, below consensus estimate of 90.4

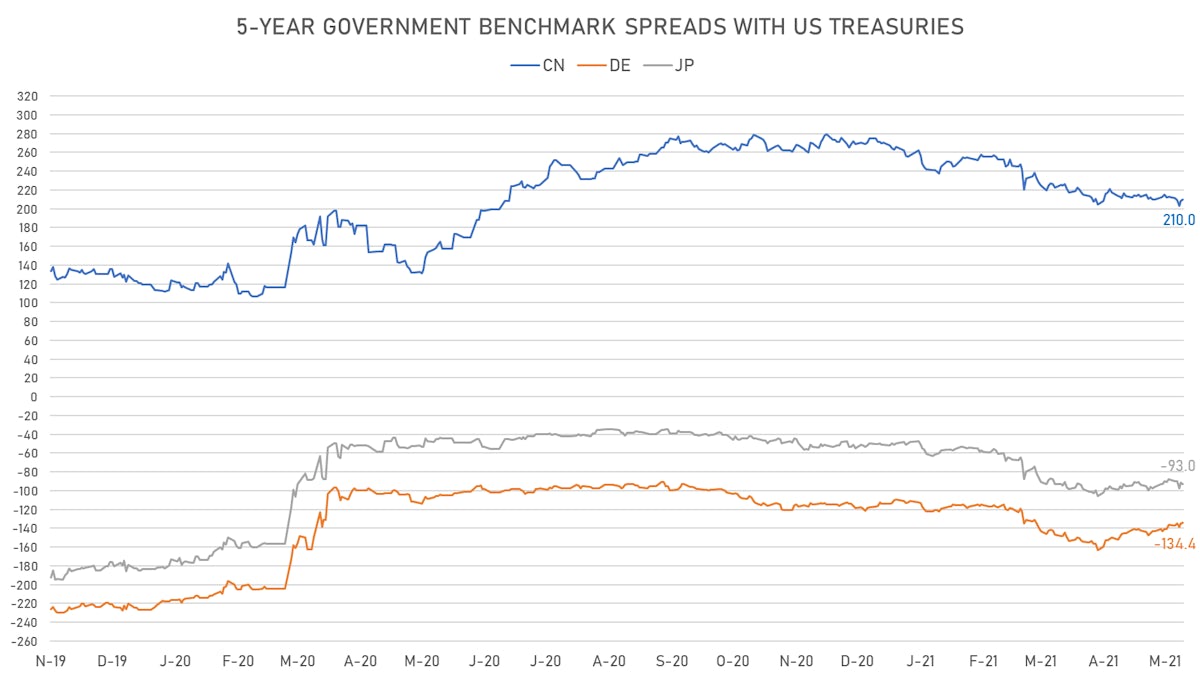

RATES SPREADS

- 5Y German-US interest rates spread 0.4 bp tighter (positive for the Euro)

- 5Y Japan-US rates spread 1.2 bp wider (negative for the Yen)

- 5Y Chinese-US rates spread 1.4 bp wider (positive for the Yuan)

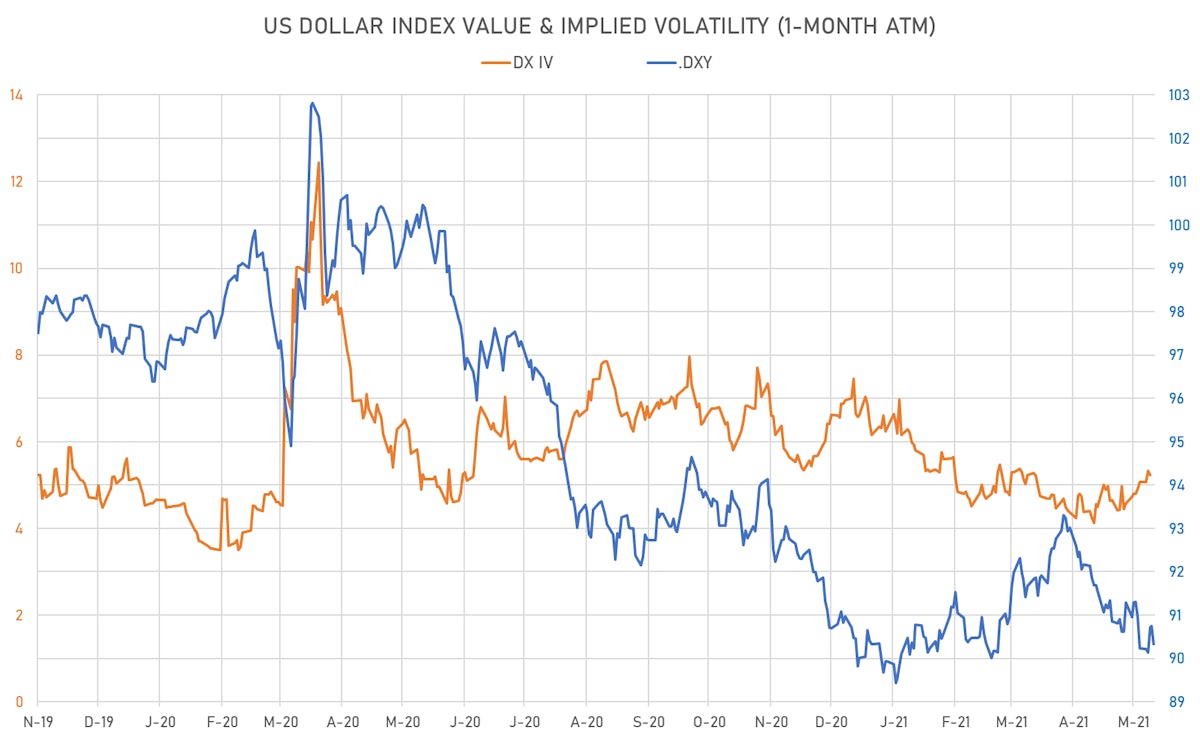

VOLATILITIES

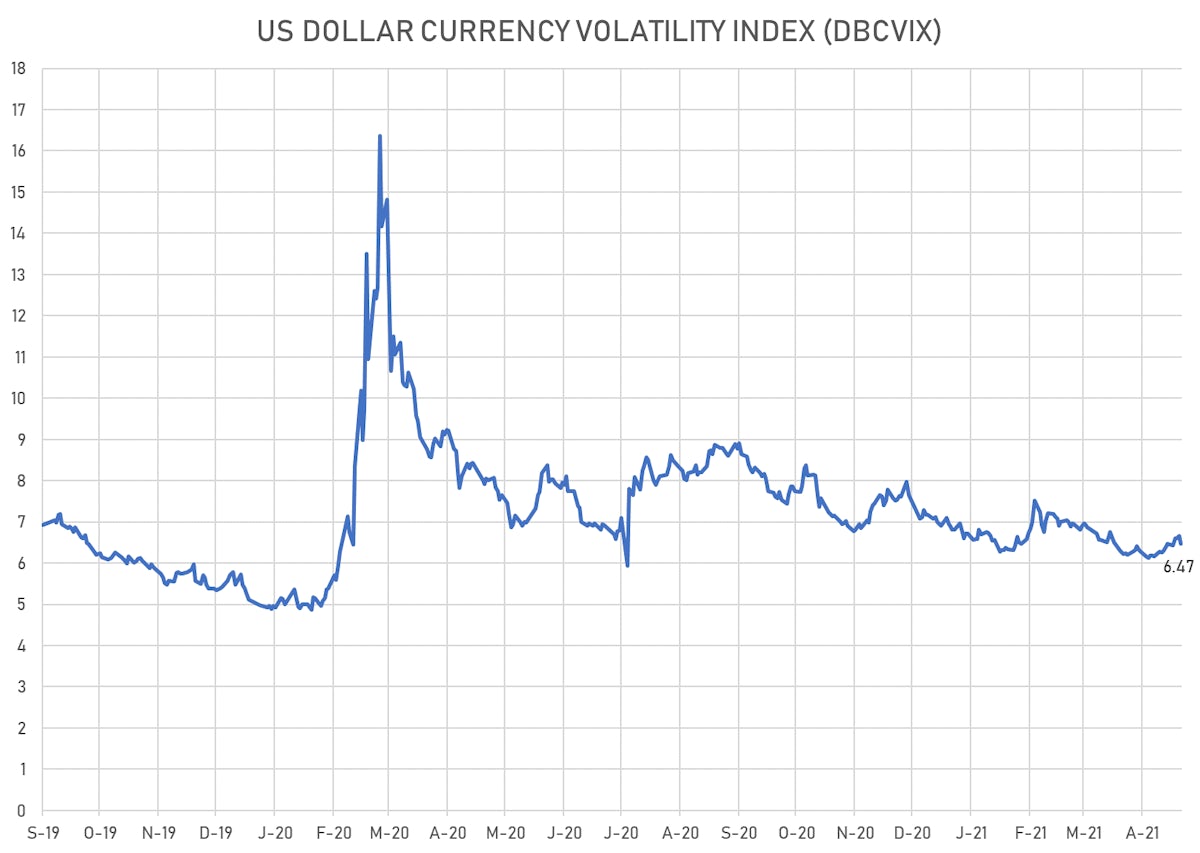

- Deutsche Bank USD Currency Volatility Index currently at 6.47, down -0.19 on the day (YTD: -0.82)

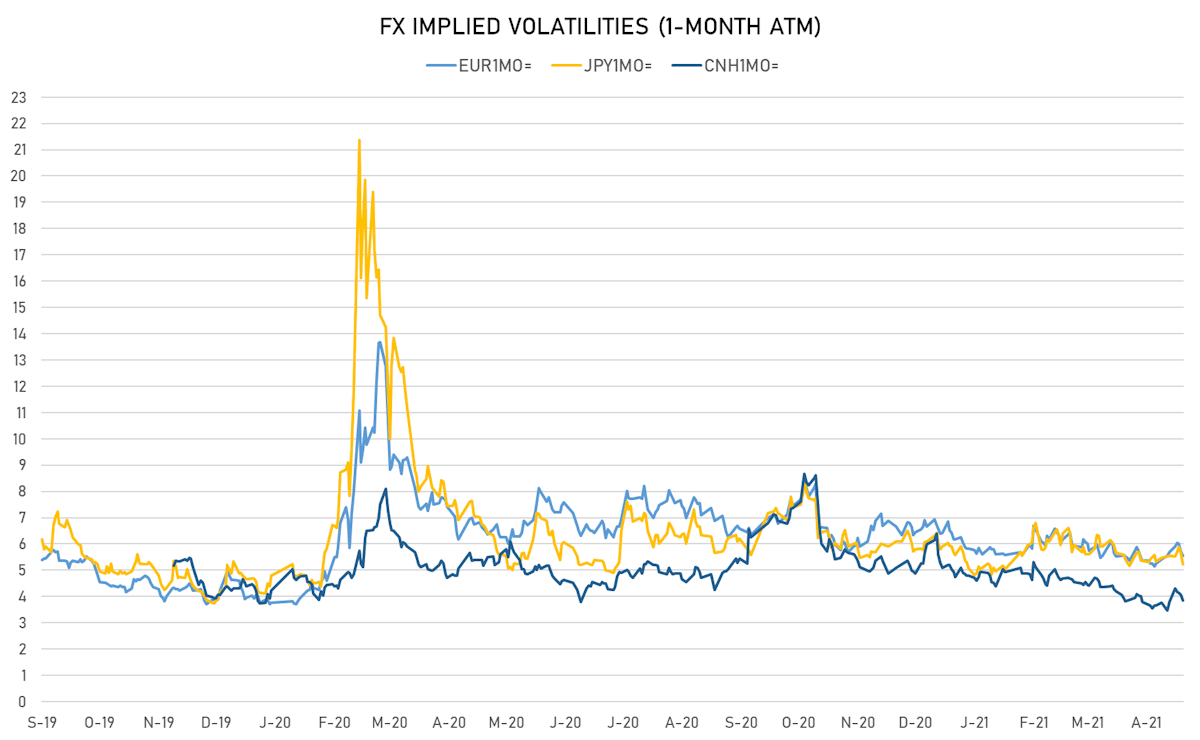

- Euro 1-Month At-The-Money Implied Volatility currently at 5.55, down -0.2 on the day (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.23, down -0.4 on the day (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.85, down -0.2 on the day (YTD: -1.8)

NOTABLE MOVES IN SOVEREIGN CDS

- Spain (rated A-): up 1.1 basis points to 36 bp (1Y range: 29-112bp)

- Malaysia (rated BBB+): down 1.1 basis points to 46 bp (1Y range: 33-109bp)

- State of Qatar (rated AA-): down 1.5 basis points to 43 bp (1Y range: 33-108bp)

- Indonesia (rated BBB): down 2.0 basis points to 77 bp (1Y range: 66-200bp)

- Mexico (rated BBB-): down 3.0 basis points to 92 bp (1Y range: 79-242bp)

- Saudi Arabia (rated A): down 3.3 basis points to 62 bp (1Y range: 53-156bp)

- Peru (rated BBB+): down 4.0 basis points to 79 bp (1Y range: 52-106bp)

- South Africa (rated BB-): down 6.2 basis points to 202 bp (1Y range: 197-407bp)

- Turkey (rated BB-): down 9.4 basis points to 402 bp (1Y range: 282-621bp)

- Argentina (rated CCC): down 44.8 basis points to 1,923 bp (1Y range: 1,049-14,175bp)

WEEKLY COT REPORT

- G10: increase in net short US$ positioning

- Emerging: reduction in net long US$ positioning

- ALL: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: increase in net short US$ positioning

- Australian Dollar: increase in net short US$ positioning

- Swiss Franc: reduced their net short US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduction in net long US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

NOTABLE OTHER MOVERS TODAY

- CFA Franc BEAC up 3.5% (YTD: +2.0%)

- Cape Verde Escudo up 2.8% (YTD: +2.8%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Colombian Peso up 1.8% (YTD: -7.0%)

- Seychelles rupee down 2.1% (YTD: +35.8%)

- Nicaragua Cordoba down 2.3% (YTD: -2.3%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

- Haiti Gourde down 3.6% (YTD: -18.8%)

- Venezuela Bolivar down 5.7% (YTD: -63.3%)

- Nigerian Naira down 8.1% (YTD: -8.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 35.8%

- Mozambique metical up 26.3%

- Ethiopian Birr down 8.1%

- Argentine Peso down 10.6%

- Turkish Lira down 12.1%

- Haiti Gourde down 18.8%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 63.3%

- Libyan Dinar down 70.1%

- Sudanese Pound down 86.2%