FX

Dollar Up On Higher Rates, Though Currencies Volatility Still Low

Total crypto market cap was down over $1T from its highs at one point this morning before a strong bounce off the lows

Published ET

Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

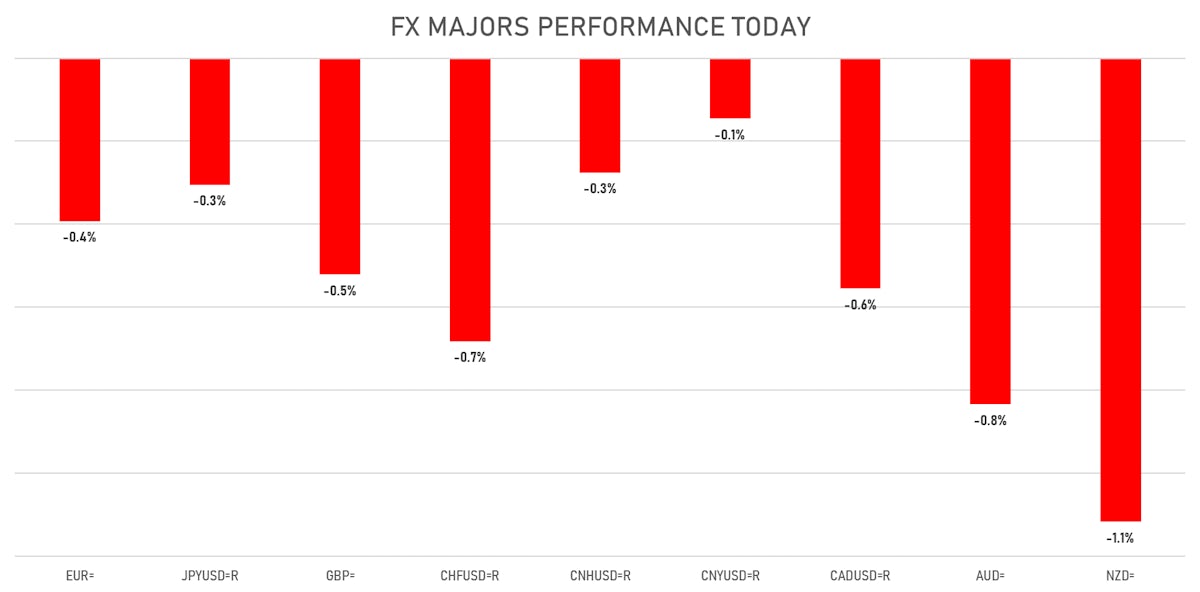

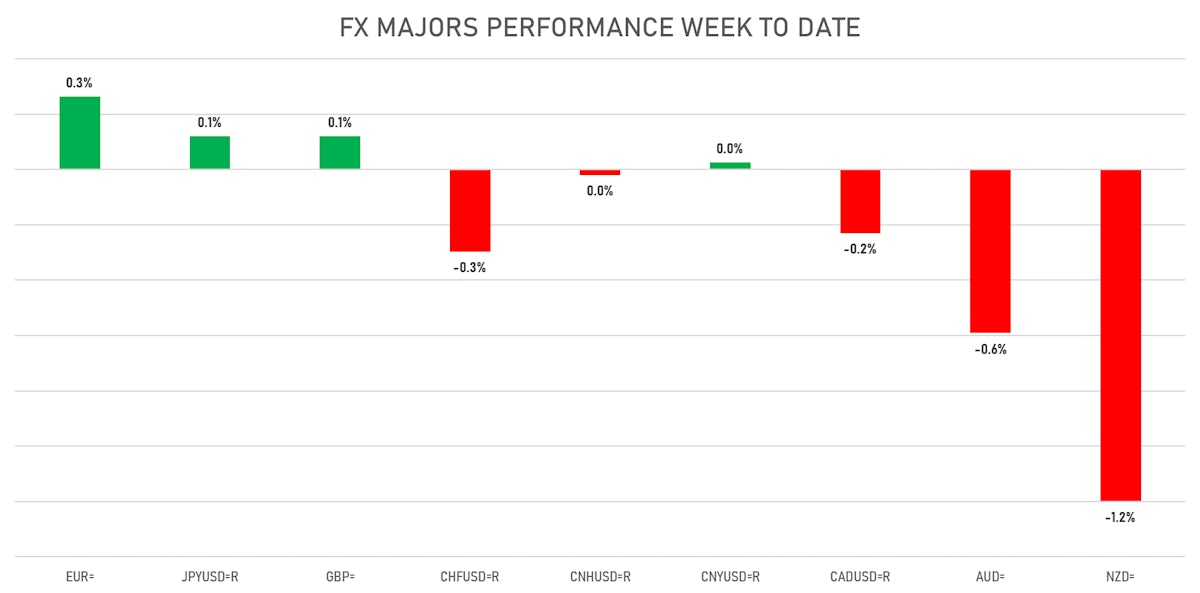

- The US Dollar Index is up 0.5% at 90.2

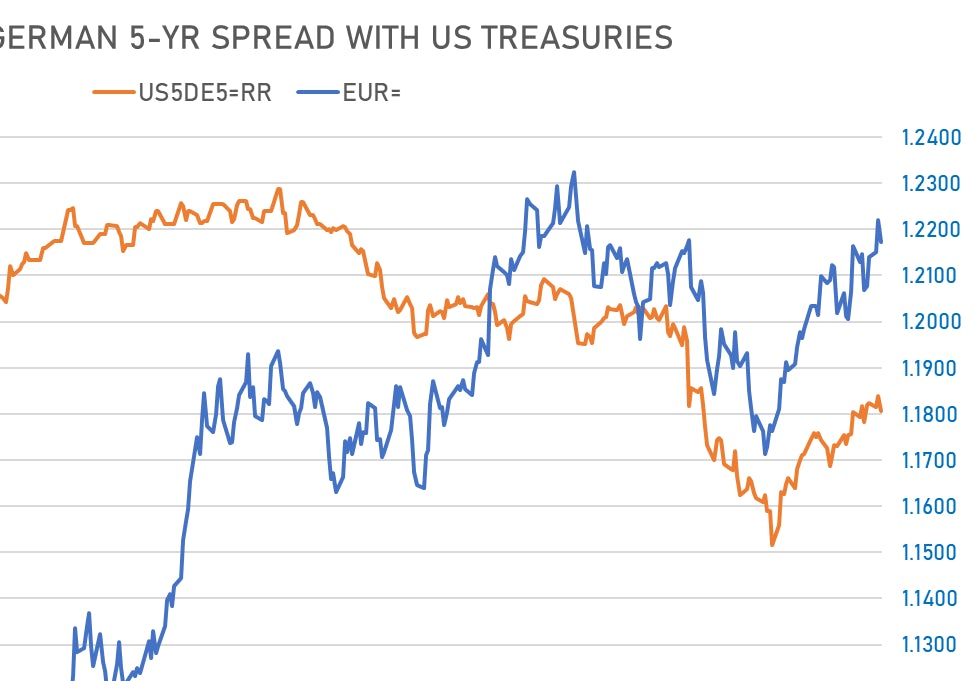

- Euro down 0.4% at 1.2172 (YTD: -0.3%)

- Yen down 0.3% at 109.21 (YTD: -5.5%)

- Onshore Yuan down 0.1% at 6.4342 (YTD: +1.4%)

- Swiss franc down 0.7% at 0.9038 (YTD: -2.1%)

- Sterling down 0.5% at 1.4113 (YTD: +3.2%)

- Canadian dollar down 0.6% at 1.2131 (YTD: +5.0%)

- Australian dollar down 0.8% at 0.7726 (YTD: +0.4%)

- NZ dollar down 1.1% at 0.7167 (YTD: -0.3%)

MACRO DATA RELEASES

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change P/P for Q1 2021 (AU Bureau of Stat) at 0.60, above consensus estimate of 0.5

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change Y/Y for Q1 2021 (AU Bureau of Stat) at 1.50, above consensus estimate of 1.4

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Apr 2021 (CANSIM, Canada) at 0.50

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Apr 2021 (CANSIM, Canada) at 2.30

- Euro Zone, CPI, Change P/P, Price Index for Apr 2021 (Eurostat) at 0.60, in line with consensus

- Euro Zone, CPI, Change Y/Y for Apr 2021 (Eurostat) at 1.60, in line with consensus

- Japan, Exports, Change Y/Y for Apr 2021 (MoF, Japan) at 0.00, below consensus estimate of 30.9

- Japan, Imports, Change Y/Y for Apr 2021 (MoF, Japan) at 0.00, below consensus estimate of 8.8

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Mar 2021 (Cabinet Office, JP) at 0.00, below consensus estimate of 6.4

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Mar 2021 (Cabinet Office, JP) at 0.00, above consensus estimate of -2.6

- Japan, Trade Balance, Current Prices for Apr 2021 (MoF, Japan) at 0.00, below consensus estimate of 140.0

- Mozambique, Policy Rates, Standing Lending Facility for May 2021 (Bank of Mozambique) at 16.25

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for Apr 2021 (Statistics, SA) at 4.40, above consensus estimate of 4.30

- United Kingdom, CPI, All items (CPI), Change Y/Y for Apr 2021 (ONS, United Kingdom) at 1.50, above consensus estimate of 1.4

- Zambia, Policy Rates, BOZ Policy Rate for May 2021 (Bank of Zambia) at 8.50

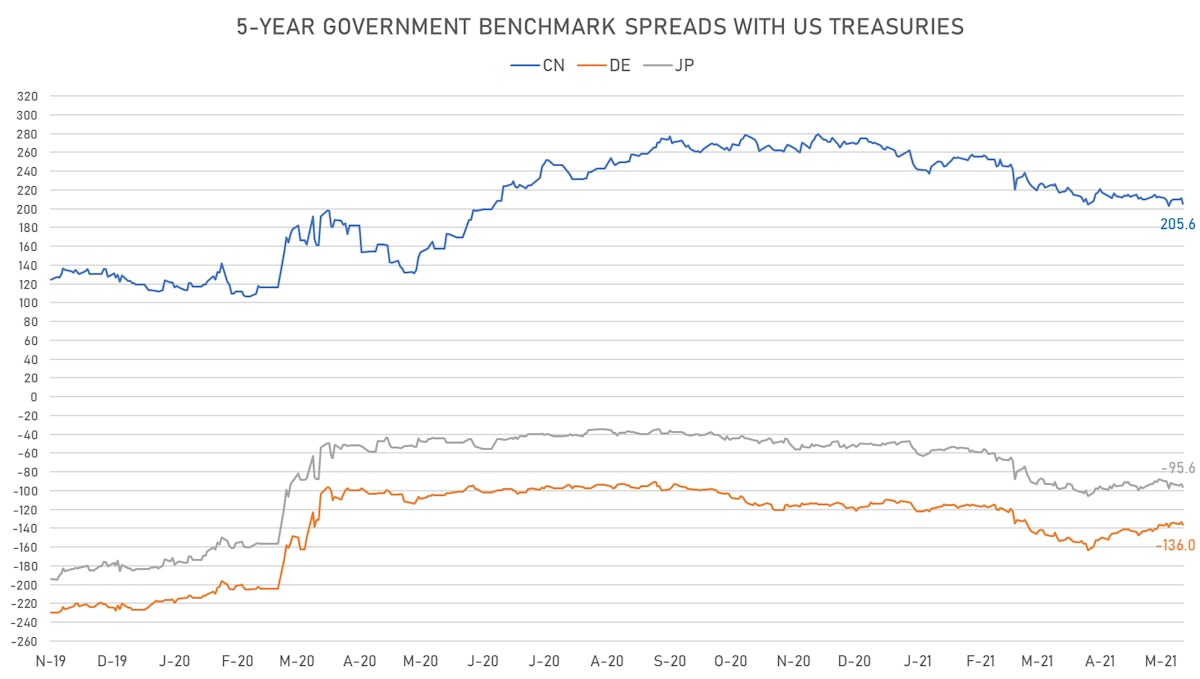

RATES SPREADS

- 5Y German-US interest rates spread 3.0 bp wider

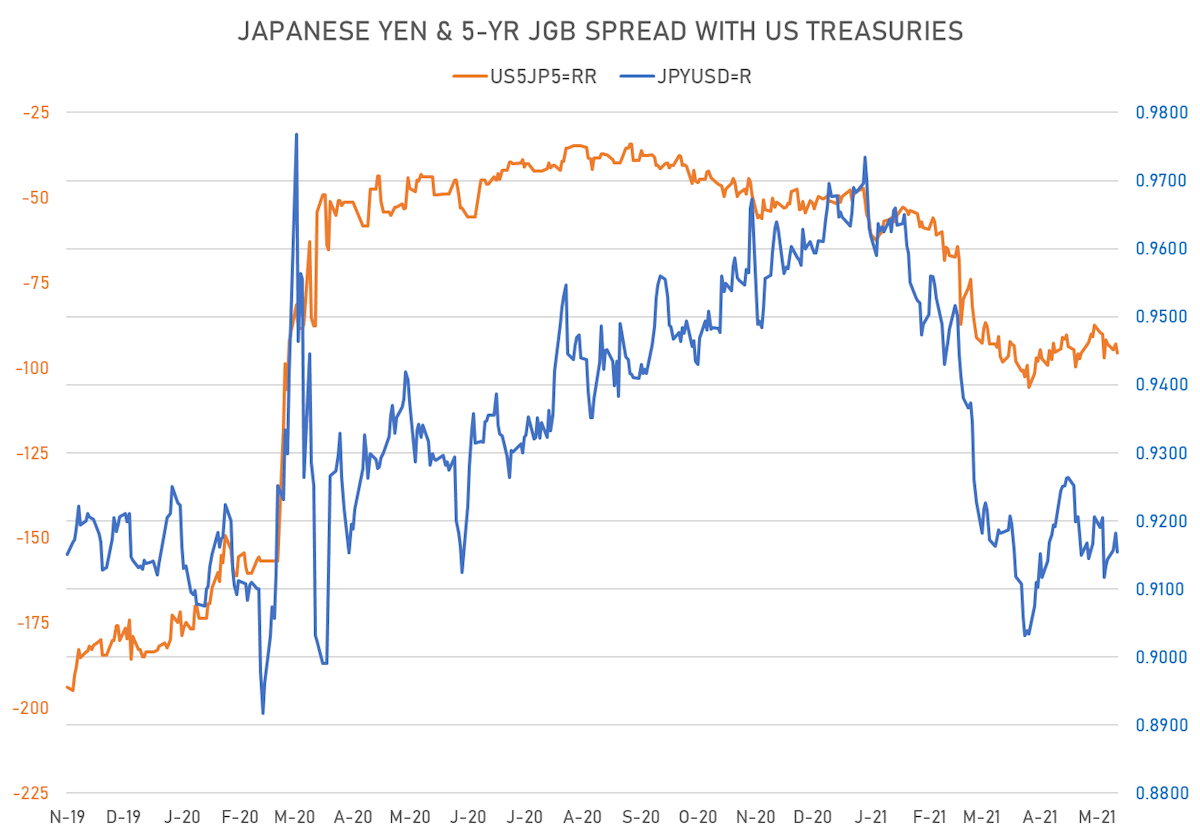

- 5Y Japan-US rates spread 2.5 bp wider

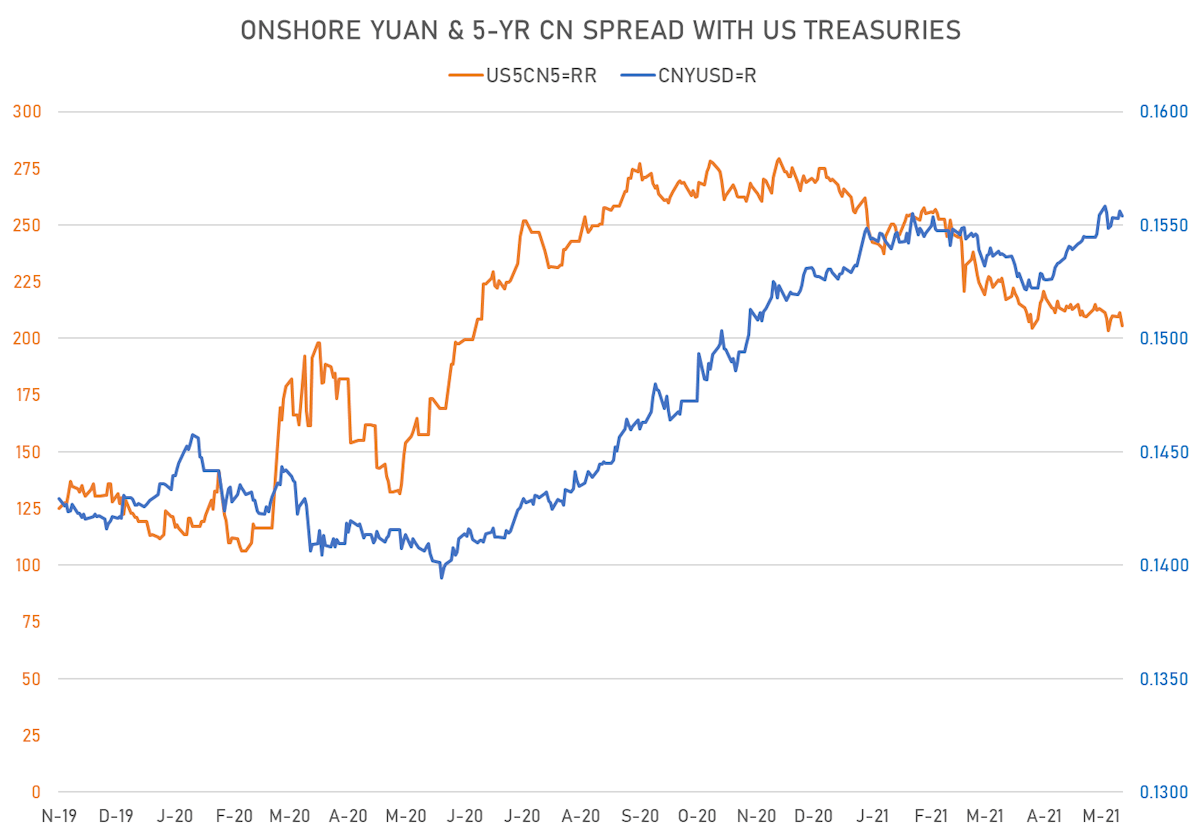

- 5Y Chinese-US rates spread 5.8 bp tighter

VOLATILITIES

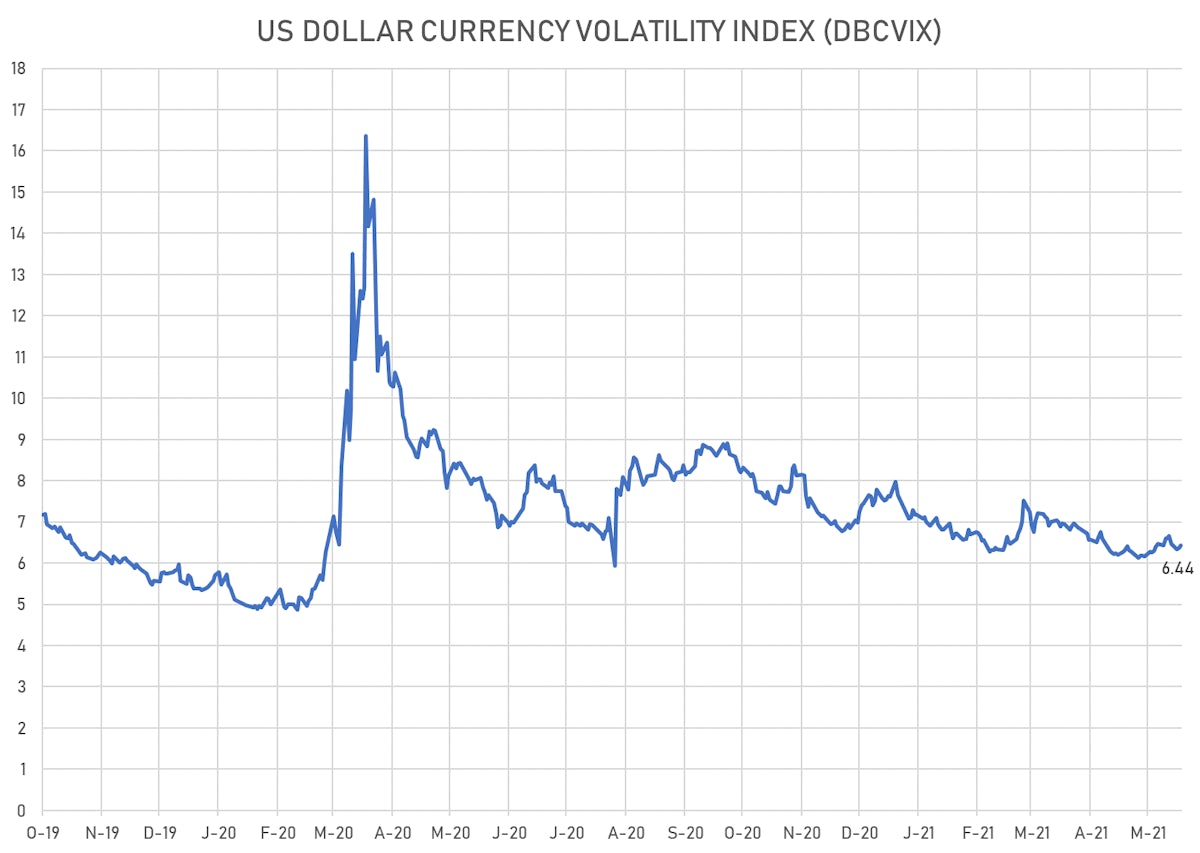

- Deutsche Bank USD Currency Volatility Index currently at 6.44, up 0.07 on the day (YTD: -0.85)

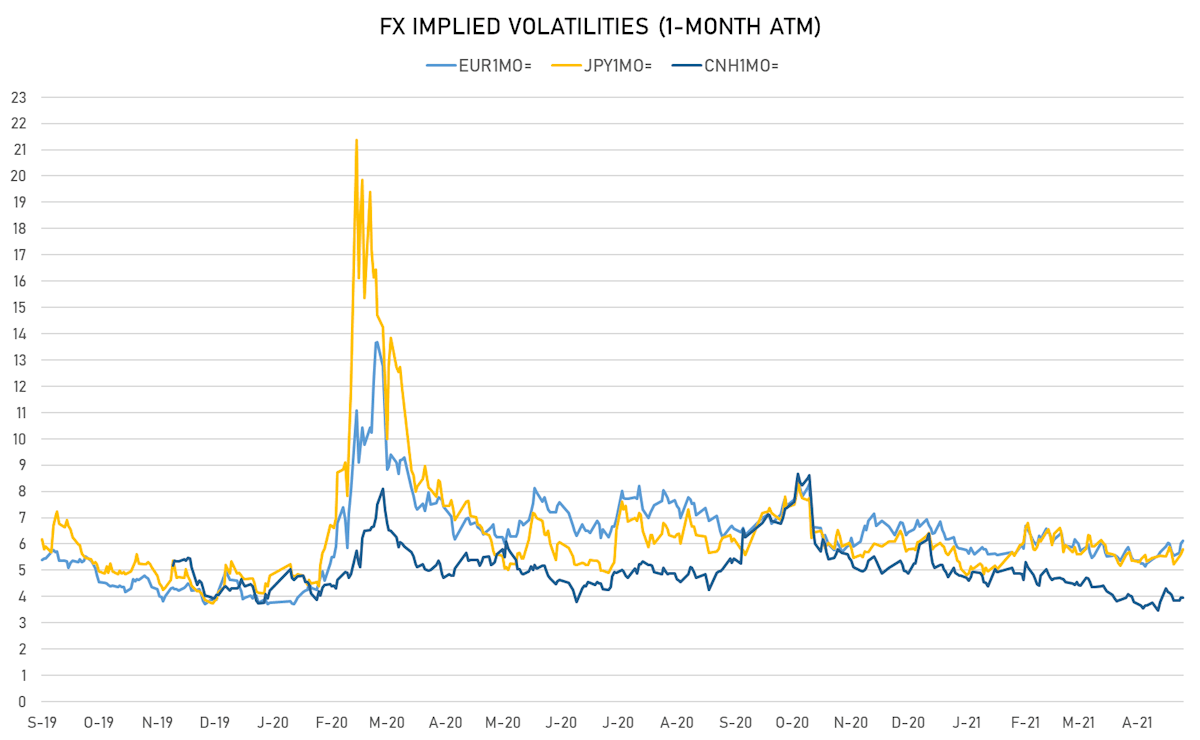

- Euro 1-Month At-The-Money Implied Volatility currently at 6.13, up 0.1 on the day (YTD: -0.8)

- Japanese Yen 1M ATM IV currently at 5.80, up 0.2 on the day (YTD: -0.3)

- Offshore Yuan 1M ATM IV currently at 3.95, unchanged (YTD: -1.7)

NOTABLE MOVES IN SOVEREIGN CDS

- Government of Chile (rated A-): up 4.4 basis points to 66 bp (1Y range: 43-104bp)

- State of Qatar (rated AA-): up 2.0 basis points to 44 bp (1Y range: 33-95bp)

- Saudi Arabia (rated A): up 2.9 basis points to 64 bp (1Y range: 53-136bp)

- Hong Kong Special Administrative Region Government (rated AA-): up 1.5 basis points to 36 bp (1Y range: 28-42bp)

- Philippines (rated BBB): up 1.8 basis points to 48 bp (1Y range: 33-80bp)

- Russia (rated BBB): up 3.4 basis points to 93 bp (1Y range: 72-130bp)

- United Arab Emirates (rated AA-): up 2.0 basis points to 62 bp (1Y range: 50-62bp)

- Israel (rated A+): up 1.5 basis points to 52 bp (1Y range: 46-53bp)

- Malaysia (rated BBB+): up 1.3 basis points to 47 bp (1Y range: 33-101bp)

- Czech Republic (rated AA-): up 1.0 basis points to 39 bp (1Y range: 31-39bp)

NOTABLE OTHER MOVERS TODAY

- Malagasy Ariary up 2.1% (YTD: +8.1%)

- Angolan Kwanza up 1.3% (YTD: +1.2%)

- North Macedonian Denar up 1.0% (YTD: 0.0%)

- Jamaican Dollar up 0.9% (YTD: -4.4%)

- Australian Dollar down 0.9% (YTD: +0.4%)

- Brazilian Real down 0.9% (YTD: -2.2%)

- New Zealand $ down 1.1% (YTD: -0.3%)

- Norwegian Krone down 1.2% (YTD: +3.1%)

- Qatari Riyal down 1.3% (YTD: -1.3%)

- Samoa Tala down 1.5% (YTD: -0.5%)