FX

The Dollar Follows Rates Differentials Down

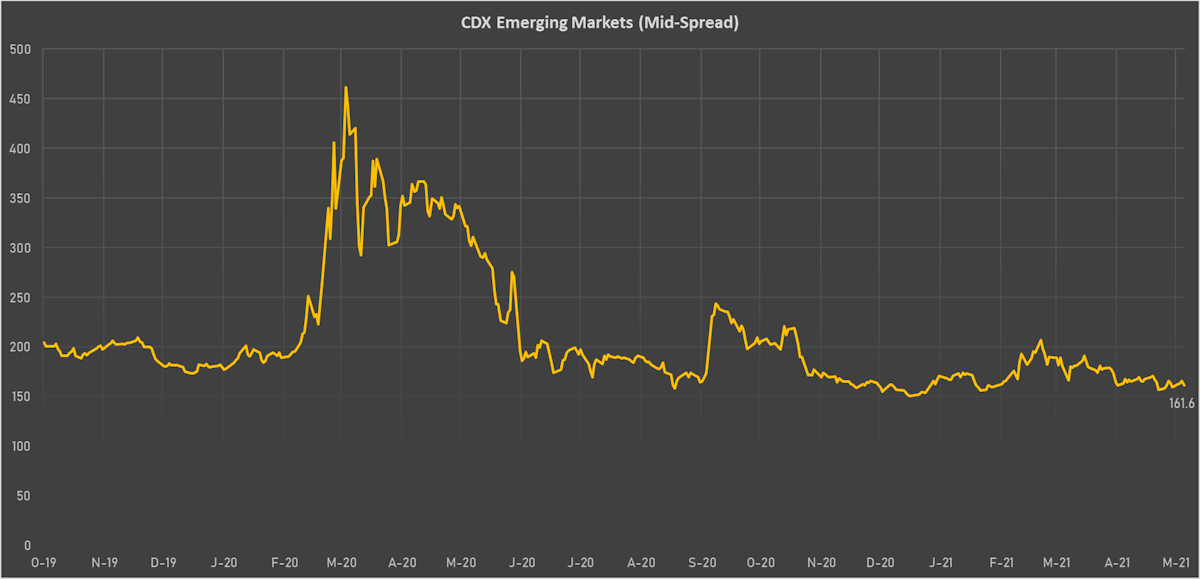

Emerging markets currencies doing mostly well today, with EM CDX spreads down, though still 12bp wider YTD

Published ET

Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

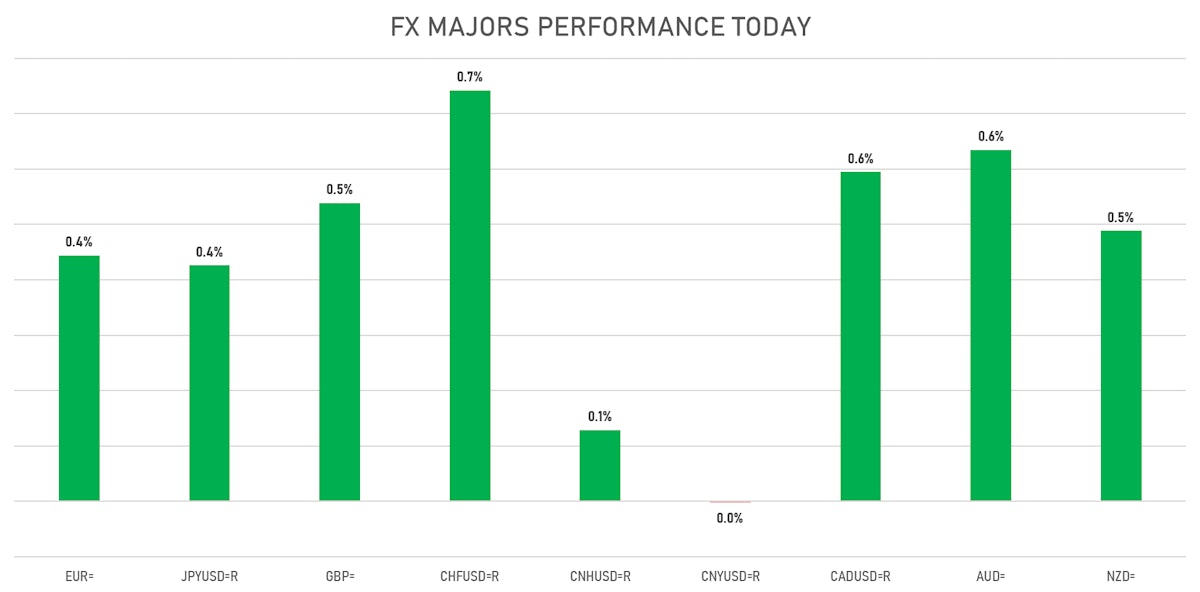

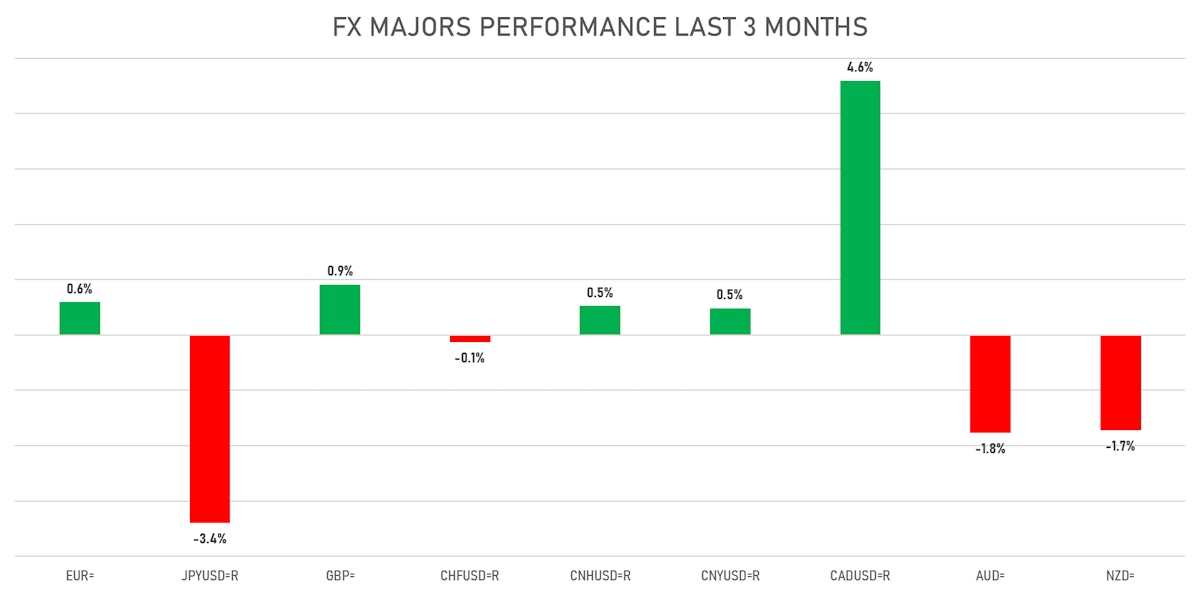

- The US Dollar Index is down -0.4% at 89.8

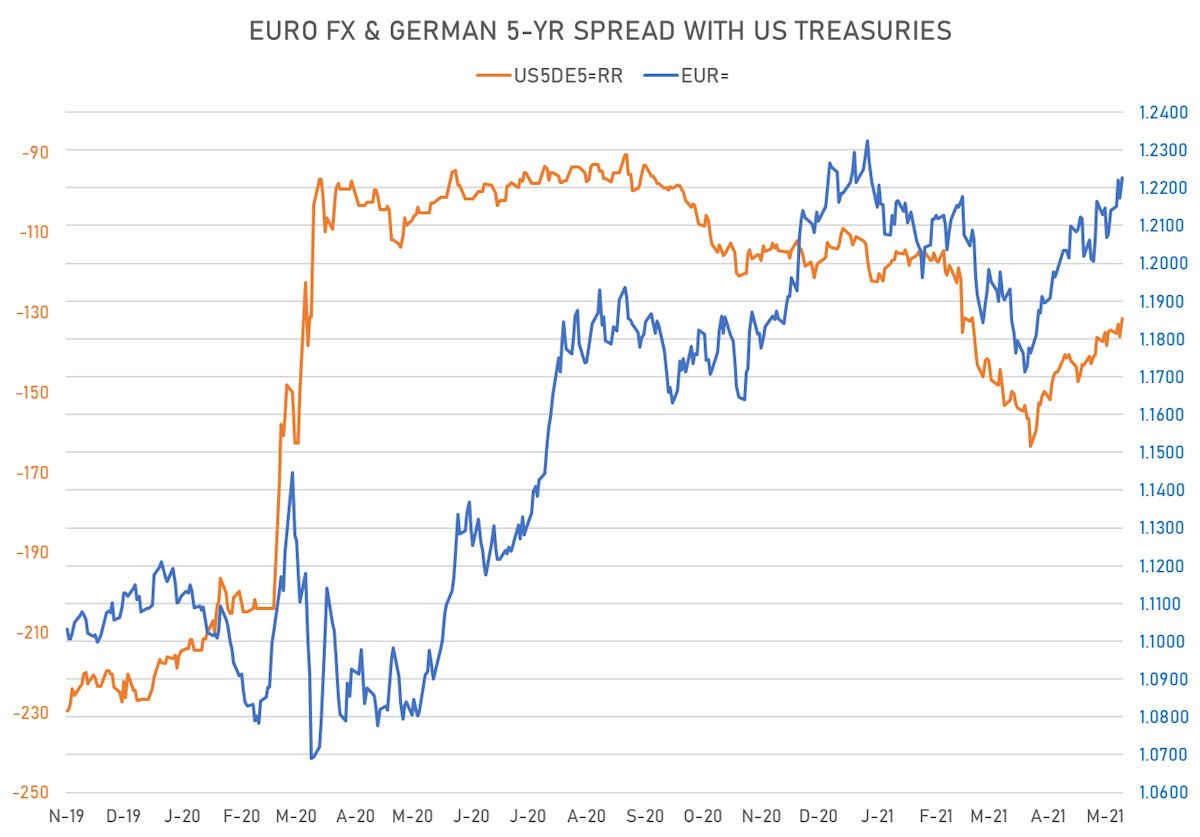

- Euro up 0.4% at 1.2226 (YTD: +0.1%)

- Yen up 0.4% at 108.75 (YTD: -5.1%)

- Onshore Yuan unchanged at 6.4339 (YTD: +1.4%)

- Swiss franc up 0.7% at 0.8971 (YTD: -1.3%)

- Sterling up 0.5% at 1.4189 (YTD: +3.8%)

- Canadian dollar up 0.6% at 1.2058 (YTD: +5.6%)

- Australian dollar up 0.6% at 0.7775 (YTD: +1.1%)

- NZ dollar up 0.5% at 0.7202 (YTD: +0.2%)

MACRO DATA RELEASES

- Australia, Employment, Absolute change for Apr 2021 (AU Bureau of Stat) at -30.60, below consensus estimate of 15.0

- Australia, Markit PMI, Composite for May 2021 (Markit Economics) at 58.10

- Australia, Markit PMI, Manufacturing for May 2021 (Markit Economics) at 59.90

- Australia, Markit PMI, Services for May 2021 (Markit Economics) at 58.20

- Australia, Unemployment, Rate for Apr 2021 (AU Bureau of Stat) at 5.50, below consensus estimate of 5.6

- Indonesia, Trade Balance, Current Prices for Apr 2021 (Statistics Indonesia) at 2.19, above consensus estimate of 1.0

- Japan, CPI, Nationwide, All Items, Change Y/Y for Apr 2021 (MIC, Japan) at -0.40

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Apr 2021 (MIC, Japan) at -0.10, above consensus estimate of -0.20

- South Africa, Policy Rates, Prime Overdraft Rate for May 2021 (SA Reserve Bank) at 7.00

- South Africa, Policy Rates, Repo Rate for May 2021 (SA Reserve Bank) at 3.50, in line with the consensus estimate

- United States, Jobless Claims, National, Initial for W 15 May (U.S. Dept. of Labor) at 444.0, below consensus estimate of 450.0

- United States, Philadelphia Fed, General business activity for May 2021 (FED, Philadelphia) at 31.50, below consensus estimate of 43.0

RATES SPREADS

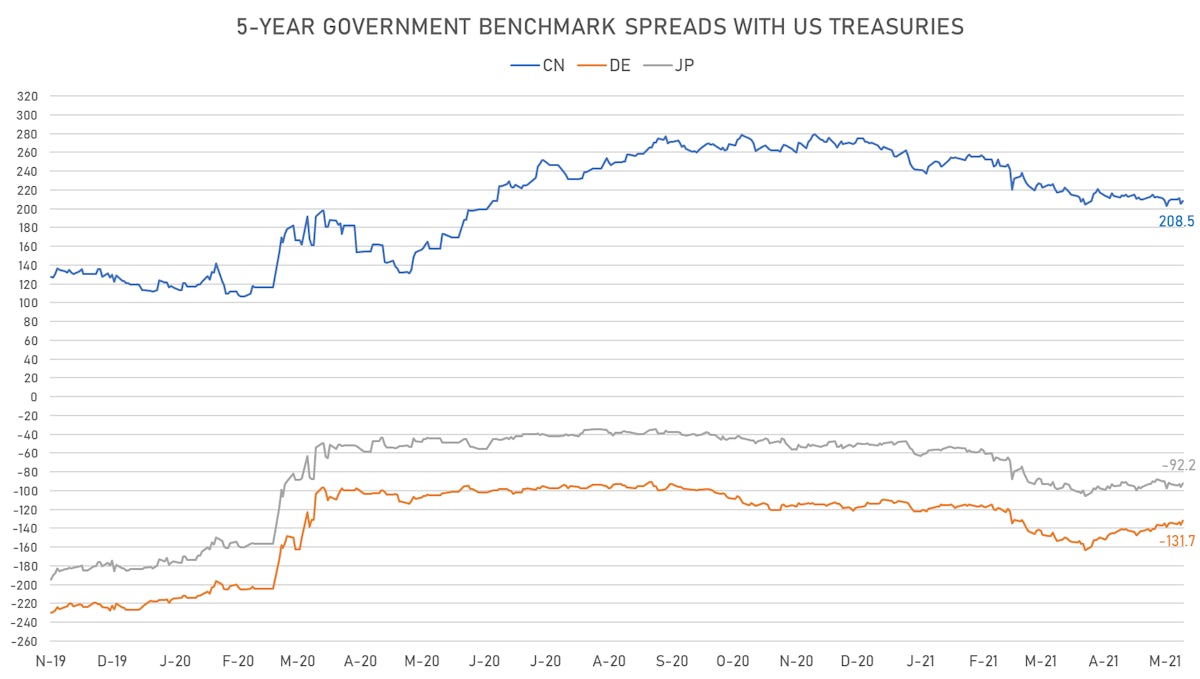

- 5Y German-US interest rates spread 4.3 bp tighter, positive for the euro

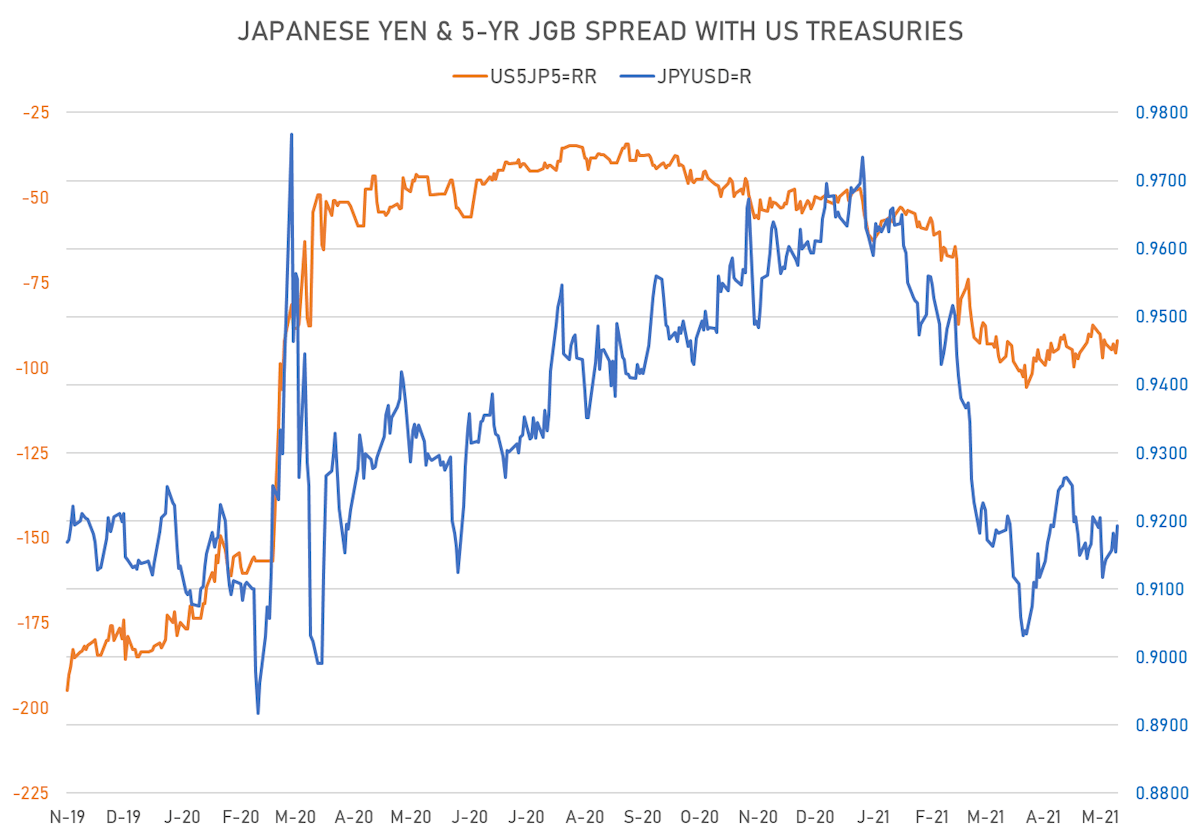

- 5Y Japan-US rates spread 3.4 bp tighter, positive for the yen

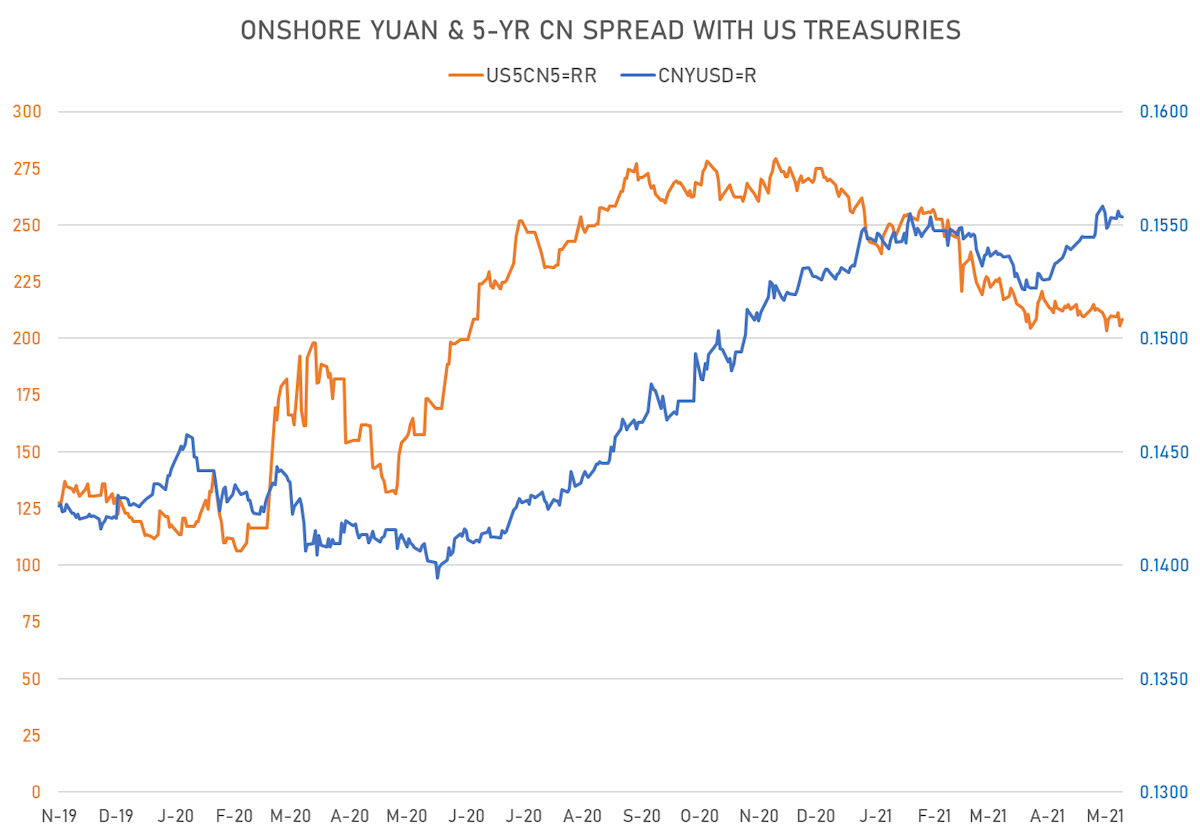

- 5Y Chinese-US rates spread 2.9 bp wider, positive for the yuan

VOLATILITIES

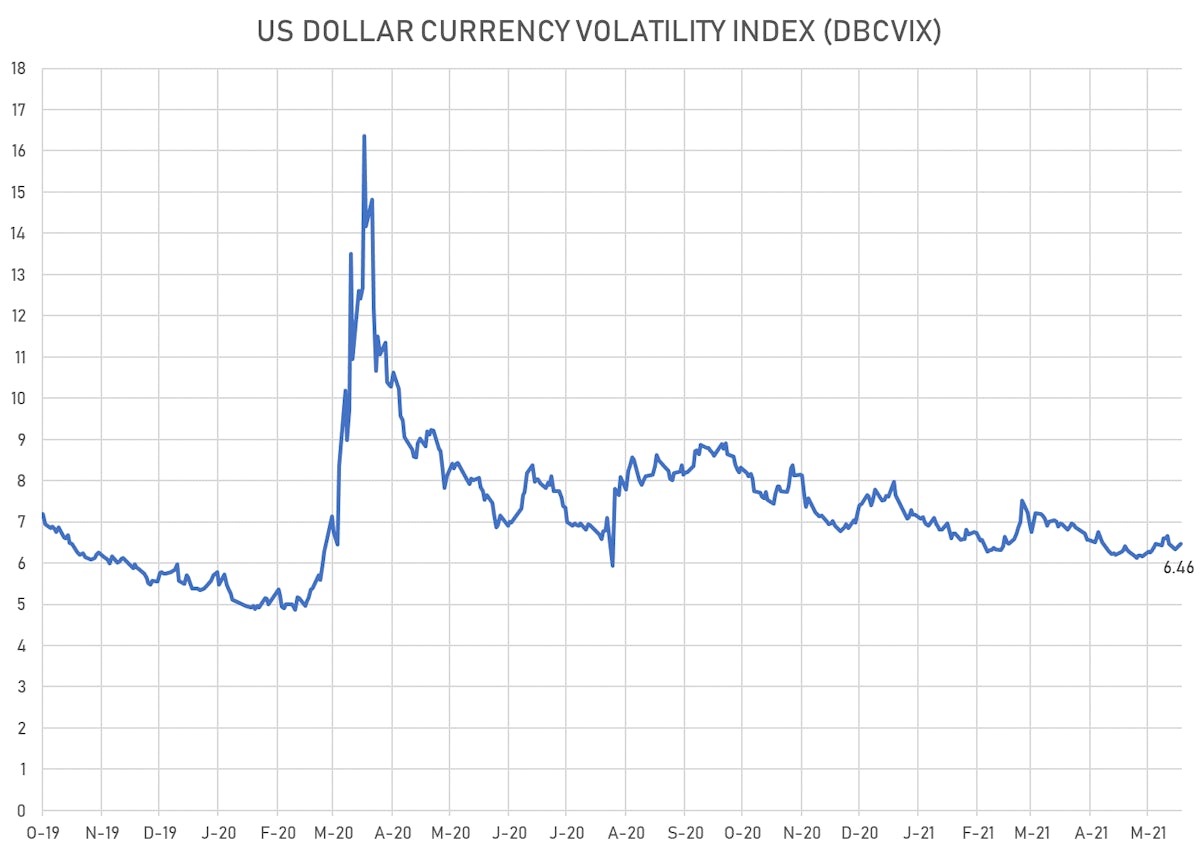

- Deutsche Bank USD Currency Volatility Index currently at 6.46, up 0.02 on the day (YTD: -0.83)

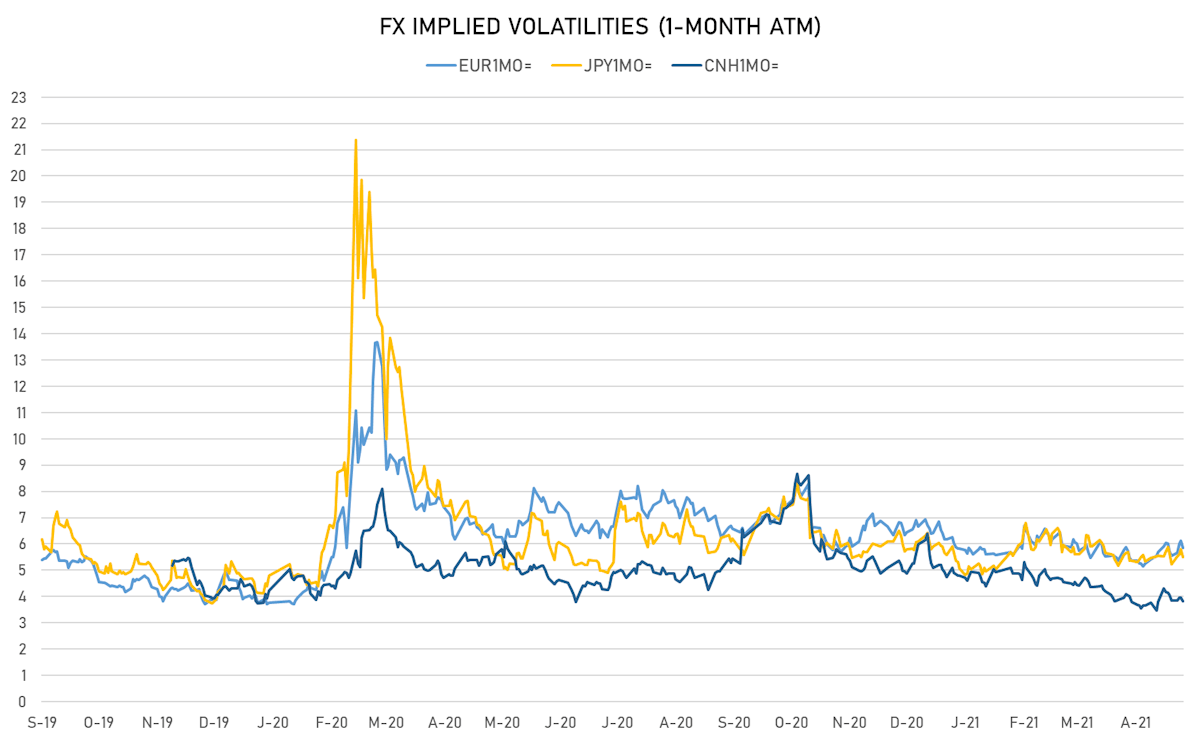

- Euro 1-Month At-The-Money Implied Volatility currently at 5.84, down -0.3 on the day (YTD: -1.1)

- Japanese Yen 1M ATM IV currently at 5.50, down -0.3 on the day (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.83, down -0.1 on the day (YTD: -1.8)

NOTABLE MOVES IN SOVEREIGN CDS

- Thailand (rated BBB+): up 1.8 basis points to 41 bp (1Y range: 33-54bp)

- Colombia (rated BBB-): up 3.2 basis points to 138 bp (1Y range: 83-200bp)

- Brazil (rated BB-): down 3.6 basis points to 176 bp (1Y range: 141-310bp)

- Peru (rated BBB+): down 1.7 basis points to 82 bp (1Y range: 52-97bp)

- Portugal (rated BBB): down 0.7 basis points to 31 bp (1Y range: 26-92bp)

- Czech Republic (rated AA-): down 1.0 basis points to 38 bp (1Y range: 31-39bp)

- Spain (rated A-): down 1.0 basis points to 36 bp (1Y range: 29-95bp)

- Hong Kong Special Administrative Region Government (rated AA-): down 1.0 basis points to 35 bp (1Y range: 28-42bp)

- South Africa (rated BB-): down 5.8 basis points to 194 bp, lowest in a year (1Y range: 195-355bp)

- State of Qatar (rated AA-): down 1.4 basis points to 42 bp (1Y range: 33-92bp)

NOTABLE OTHER FX MOVERS TODAY

- Afghani up 2.2% (YTD: -0.7%)

- Qatari Riyal up 1.3% (YTD: 0.0%)

- Jamaican Dollar up 1.2% (YTD: -4.4%)

- Polish Zloty up 1.2% (YTD: +1.8%)

- Iceland Krona up 1.0% (YTD: +4.7%)

- South Africa Rand up 0.9% (YTD: +5.1%)

- Lesotho Loti up 0.9% (YTD: +5.1%)

- Haiti Gourde down 0.9% (YTD: -16.7%)

- Colombian Peso down 1.0% (YTD: -7.9%)

- Venezuela Bolivar down 3.0% (YTD: -64.4%)