FX

Dollar Edges Down, FX 1-Week Realized Volatility Up

A slew of mixed data releases today, with rates differentials between currencies moving mostly in the US$ favor

Published ET

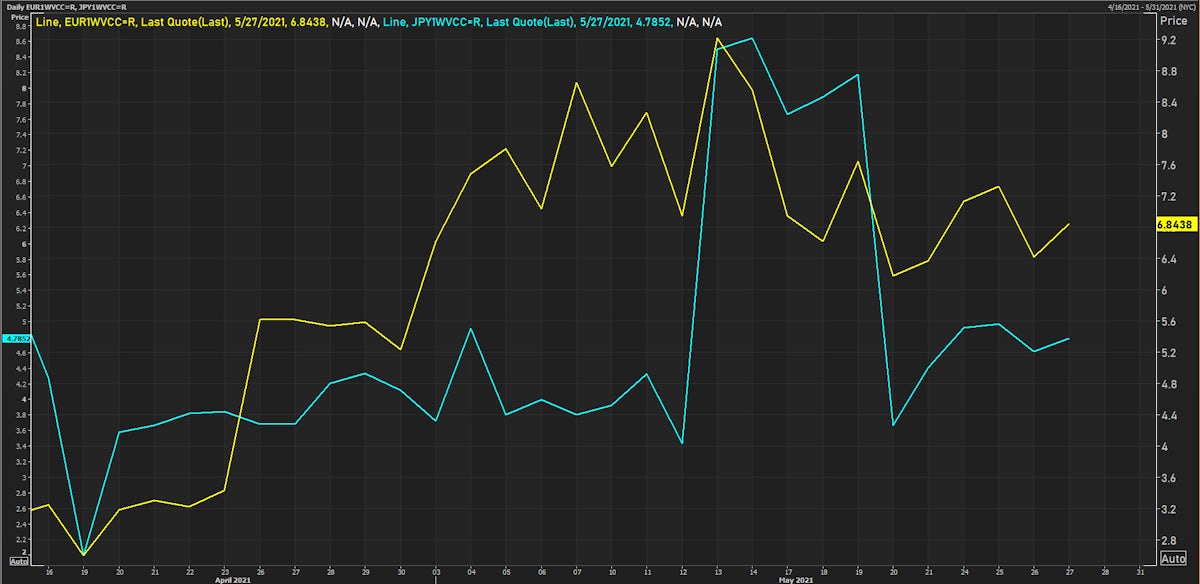

EUR, JPY 1-Week Realized Volatility | Source: Refinitiv

QUICK SUMMARY

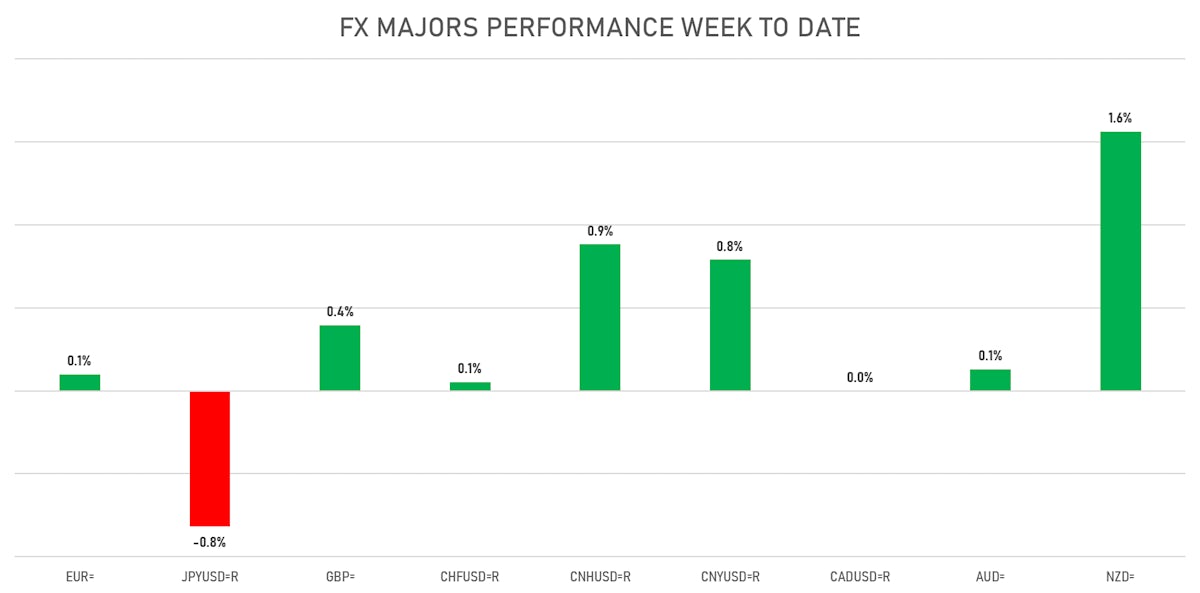

- The US Dollar Index is down -0.1% at 90.0

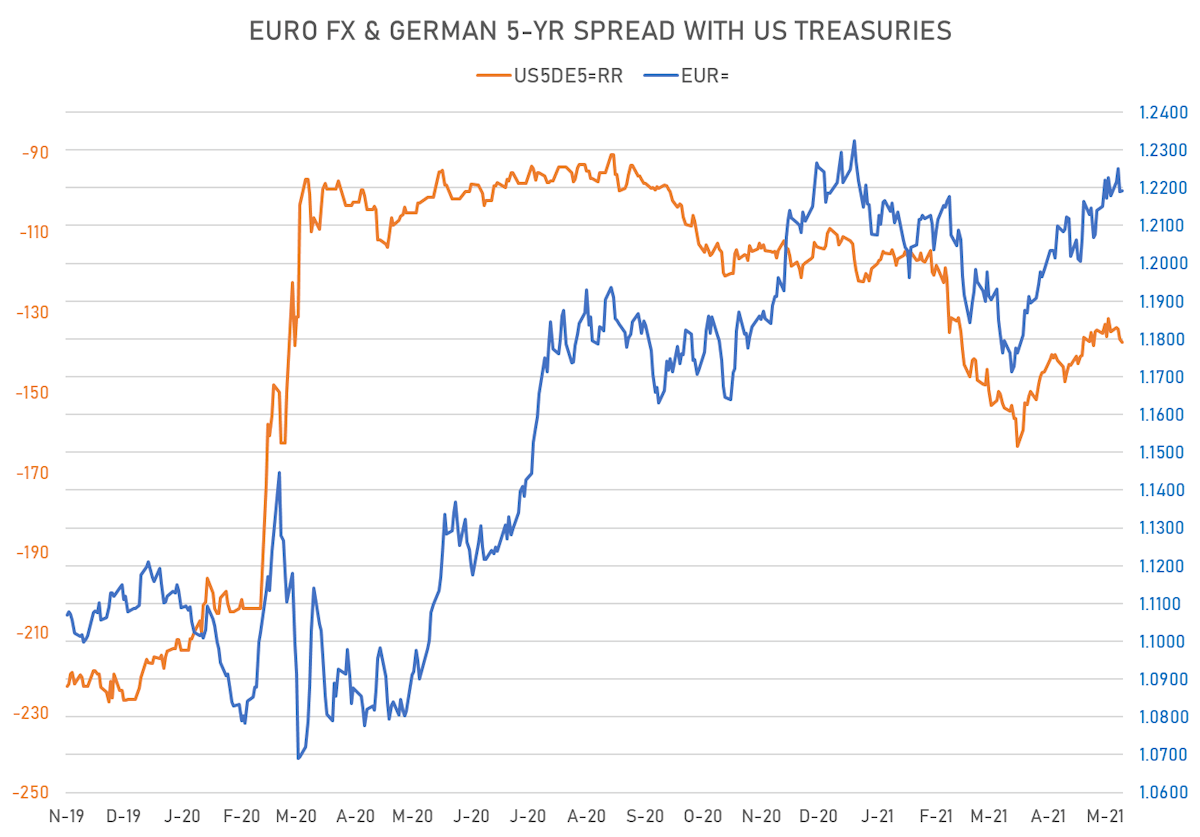

- Euro unchanged at 1.2191 (YTD: -0.2%)

- Yen down 0.6% at 109.84 (YTD: -6.0%)

- Onshore Yuan up 0.1% at 6.3824 (YTD: +2.3%)

- Swiss franc up 0.1% at 0.8971 (YTD: -1.3%)

- Sterling up 0.6% at 1.4203 (YTD: +3.9%)

- Canadian dollar up 0.4% at 1.2069 (YTD: +5.5%)

- Australian dollar unchanged at 0.7741 (YTD: +0.6%)

- NZ dollar up 0.0% unchanged (YTD: +1.4%)

MACRO DATA RELEASES

- Australia, Private New Capital Expenditure, All industries, Change P/P for Q1 2021 (AU Bureau of Stat) at 6.30, above consensus estimate of 2.00

- Japan, CPI, Tokyo, All Items, General, Change Y/Y for May 2021 (MIC, Japan) at -0.40

- Japan, CPI, Tokyo, All Items, Less fresh food, Change Y/Y for May 2021 (MIC, Japan) at -0.20, in line with consensus

- Japan, Labor Market, Active opening rate for Apr 2021 (JILPT, Japan) at 1.09, below consensus estimate of 1.10

- Japan, Unemployment, Rate for Apr 2021 (MIC, Japan) at 2.80, above consensus estimate of 2.70

- South Korea, Policy Rates, Base Rate for May 2021 (The Bank of Korea) at 0.50, in line with consensus

- United States, GDP, Total-2nd Estimate, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 6.40, below consensus estimate of 6.50

- United States, Jobless Claims, National, Initial for W 22 May (U.S. Dept. of Labor) at 406.00, below consensus estimate of 425.00

- United States, Manufacturers New Orders, Durable goods total, Change P/P for Apr 2021 (U.S. Census Bureau) at -1.30, below consensus estimate of 0.70

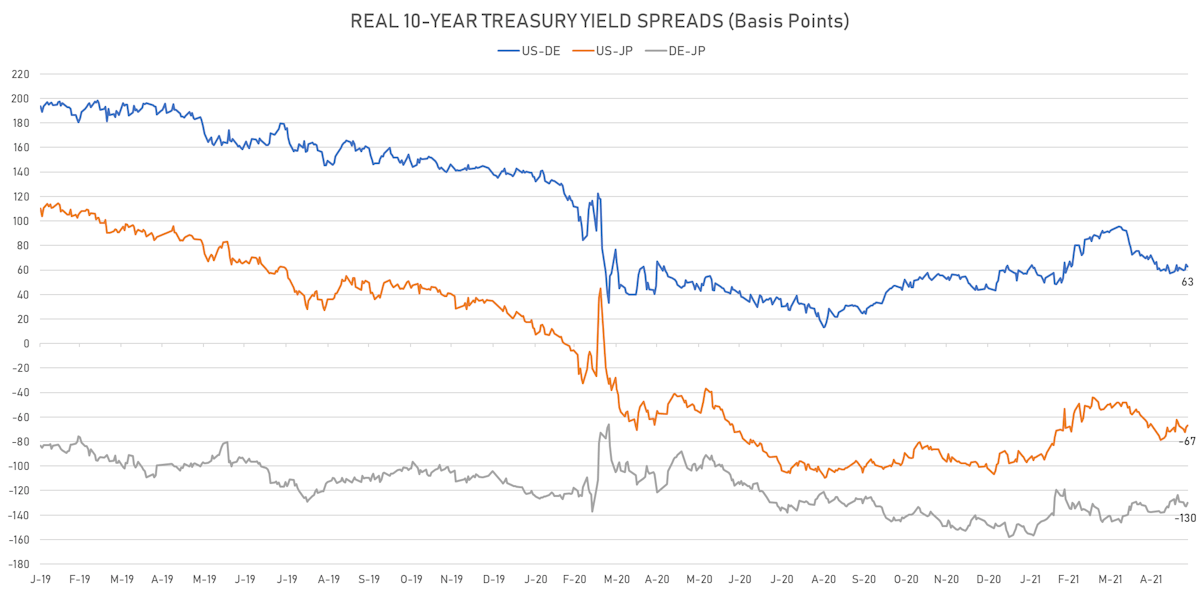

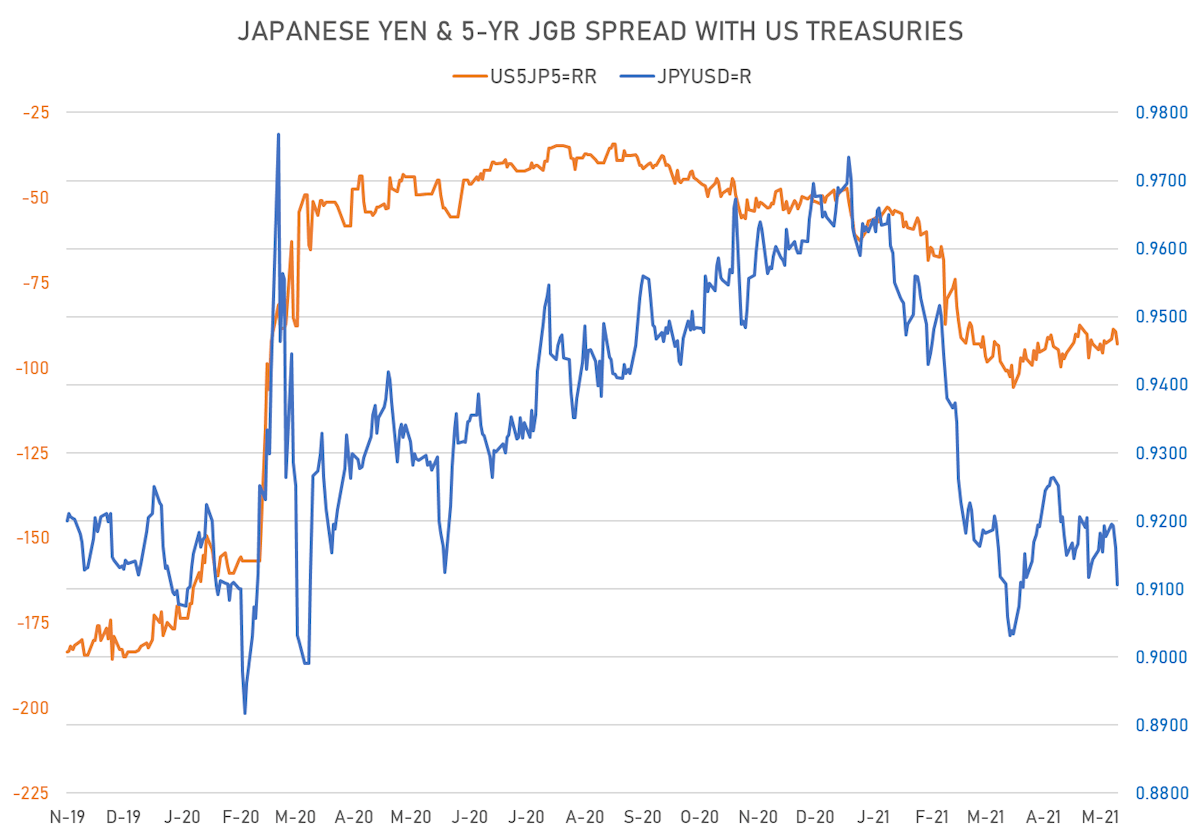

RATES SPREADS

- 5Y German-US interest rates spread 0.9 bp wider, negative for the Euro

- 5Y Japan-US rates spread 3.7 bp wider, negative for the Yen

- 5Y Chinese-US rates spread 2.6 bp tighter, negative for the Yuan

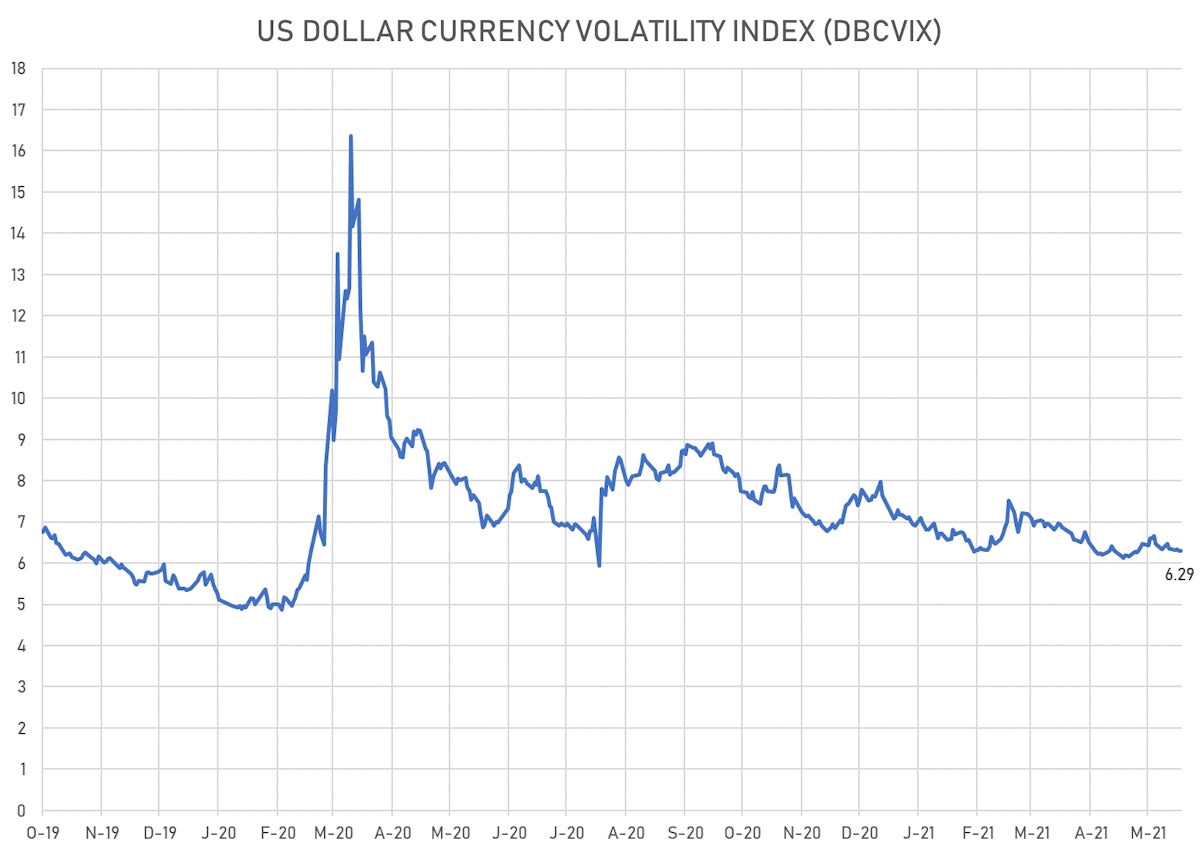

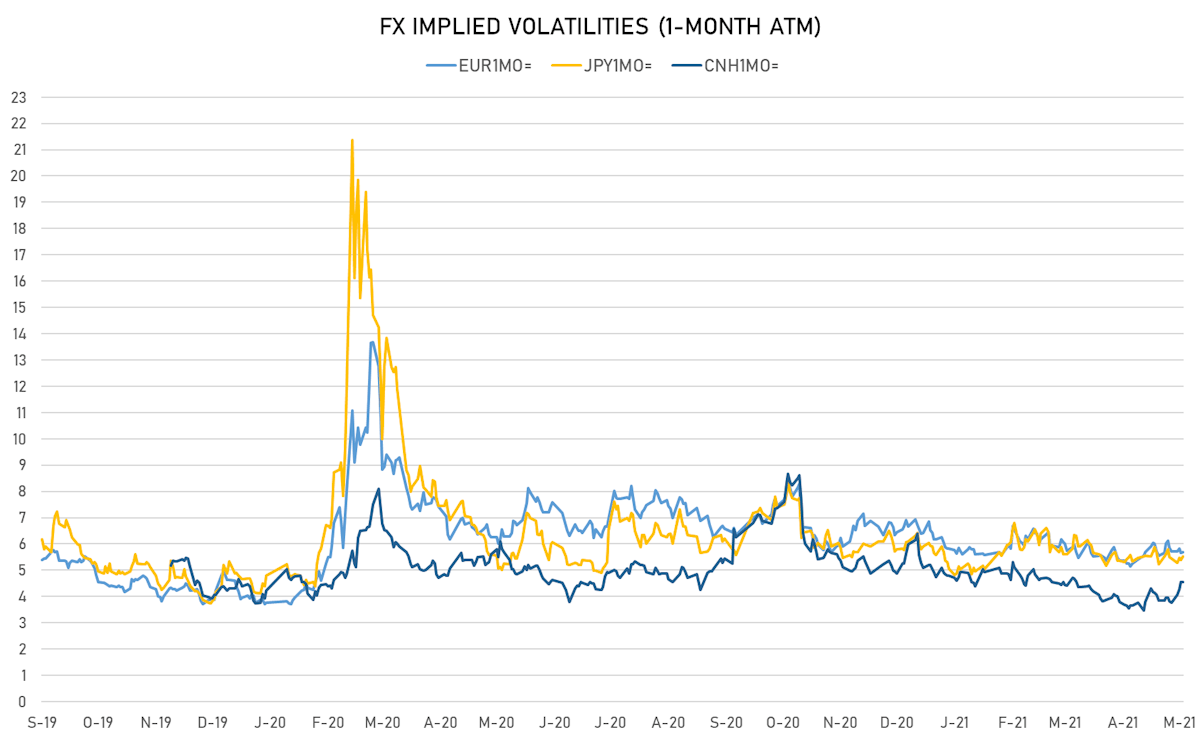

OPTIONS IMPLIED VOLATILITIES

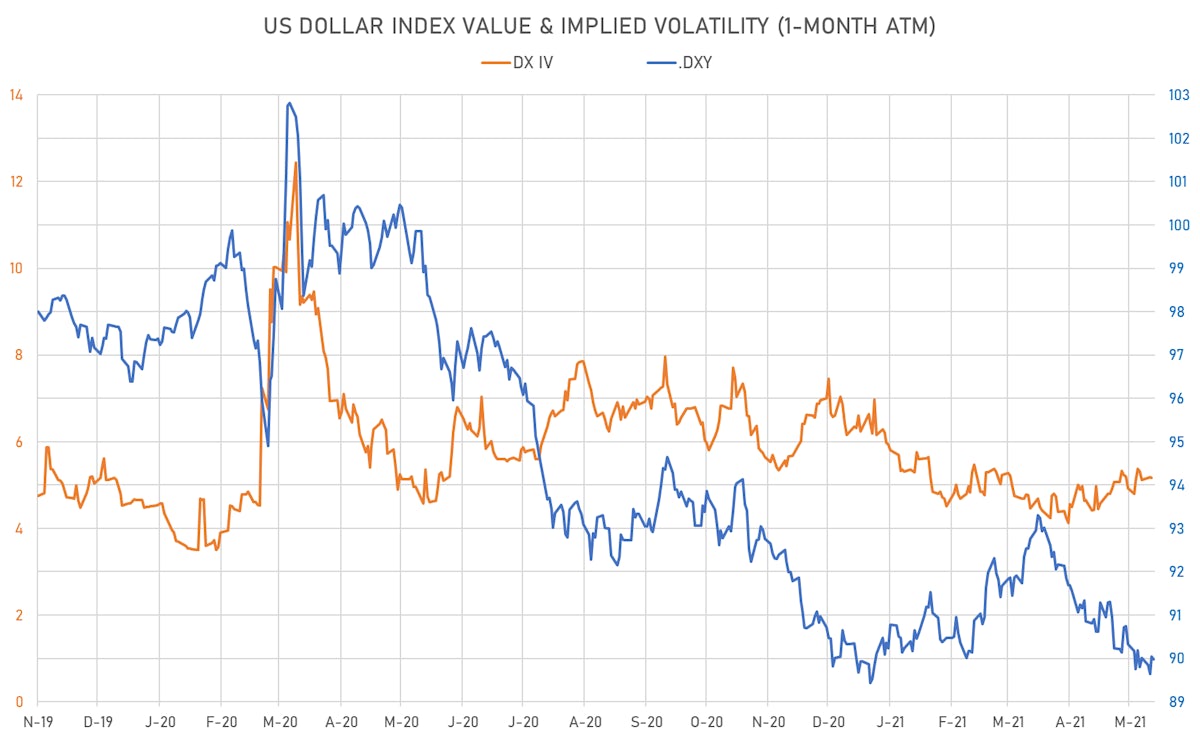

- Deutsche Bank USD Currency Volatility Index currently at 6.29, unchanged on the day (YTD: -1.00)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.68, unchanged (YTD: -1.2)

- Japanese Yen 1M ATM IV currently at 5.54, up 0.1 on the day (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 4.54, unchanged (YTD: -1.1)

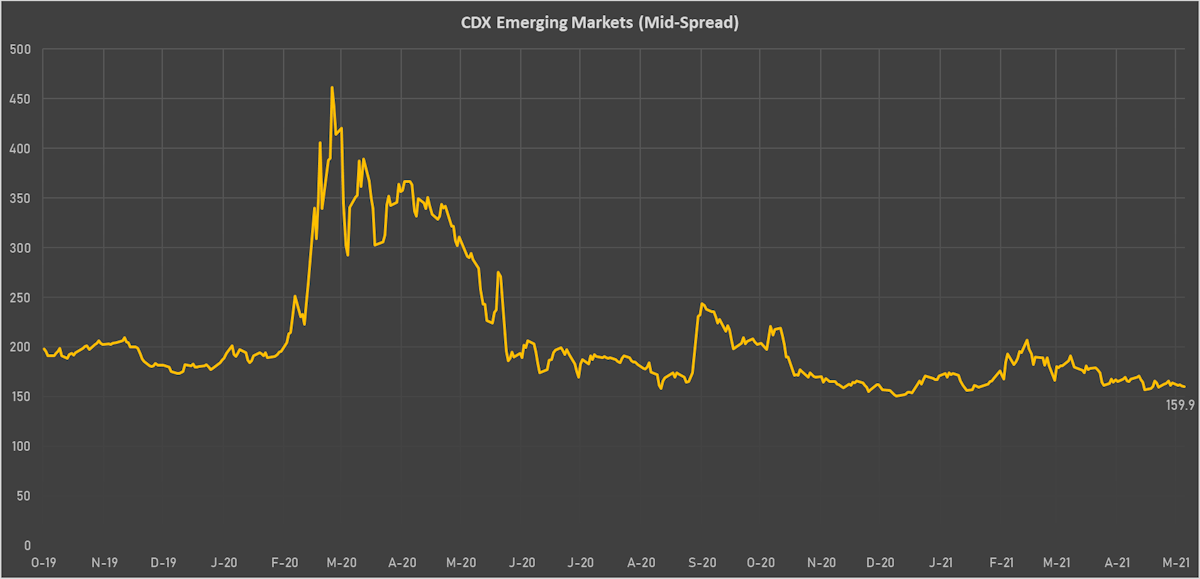

NOTABLE MOVES IN SOVEREIGN CDS

- Nigeria (rated B): down 4.0 basis points to 356 bp (1Y range: 333-383bp)

- Mexico (rated BBB-): down 1.1 basis points to 93 bp (1Y range: 79-172bp)

- Pakistan (rated B-): down 4.5 basis points to 392 bp (1Y range: 362-512bp)

- Ecuador (rated WD): down 2.0 basis points to 168 bp (1Y range: 157-181bp)

- Government of Chile (rated A-): down 1.0 basis points to 68 bp (1Y range: 43-87bp)

- Argentina (rated CCC): down 27.0 basis points to 1,849 bp (1Y range: 1,049-6,788bp)

- Panama (rated BBB-): down 1.1 basis points to 70 bp (1Y range: 44-115bp)

- Russia (rated BBB): down 1.6 basis points to 95 bp (1Y range: 72-129bp)

- Brazil (rated BB-): down 3.0 basis points to 172 bp (1Y range: 141-275bp)

- Slovenia (rated A): down 1.0 basis points to 51 bp (1Y range: 47-55bp)

NOTABLE OTHER MOVERS TODAY

- Haiti Gourde up 2.1% (YTD: -19.1%)

- Georgian Lari up 1.5% (YTD: +0.8%)

- Brazilian Real up 1.4% (YTD: -0.9%)

- Jamaican Dollar up 1.2% (YTD: -3.9%)

- Chilean Peso up 0.7% (YTD: -1.9%)

- Turkish Lira down 0.7% (YTD: -12.6%)

- North Macedonian denar down 1.0% (YTD: -0.5%)

- Qatari Riyal down 1.6% (YTD: -1.6%)

- Mauritania ouguiya down 1.9% (YTD: 0.0%)

- Ethiopian Birr down 2.3% (YTD: -10.2%)