FX

Small Gain For The US Dollar To End The Week

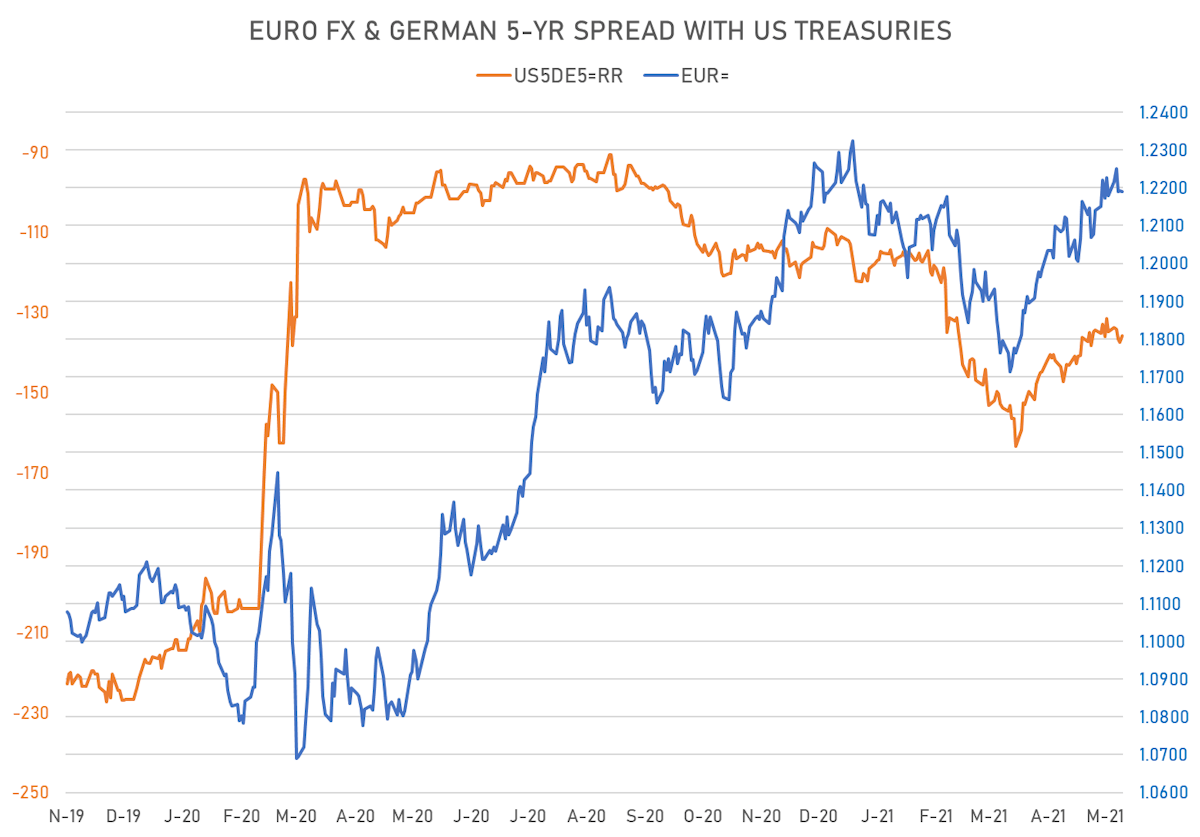

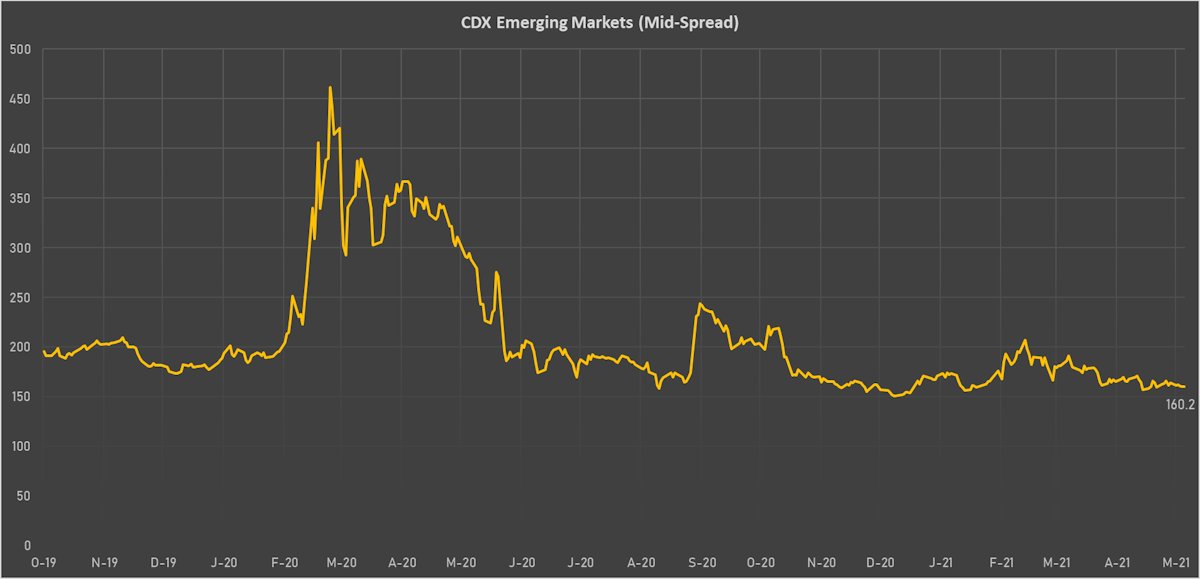

Speculative interest in the Euro may be fizzling with rates stall: the implied volatility smile has become less skewed to the upside this week, though the CFTC Report today pointed to an increase in net long positions

Published ET

EUR/USD 1-Month Implied Volatily Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

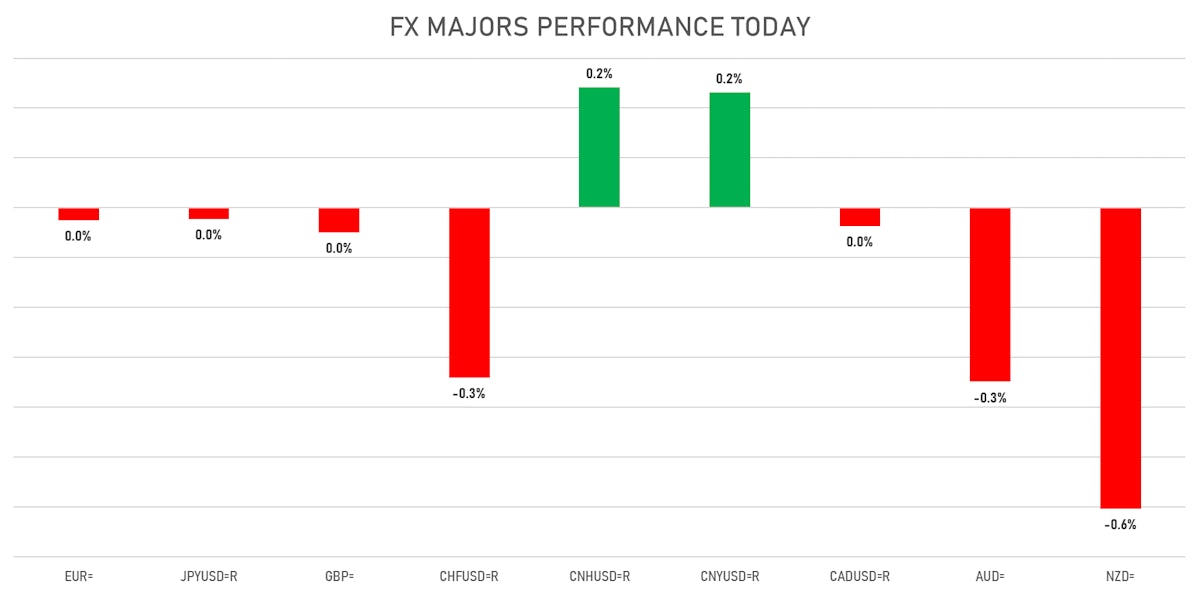

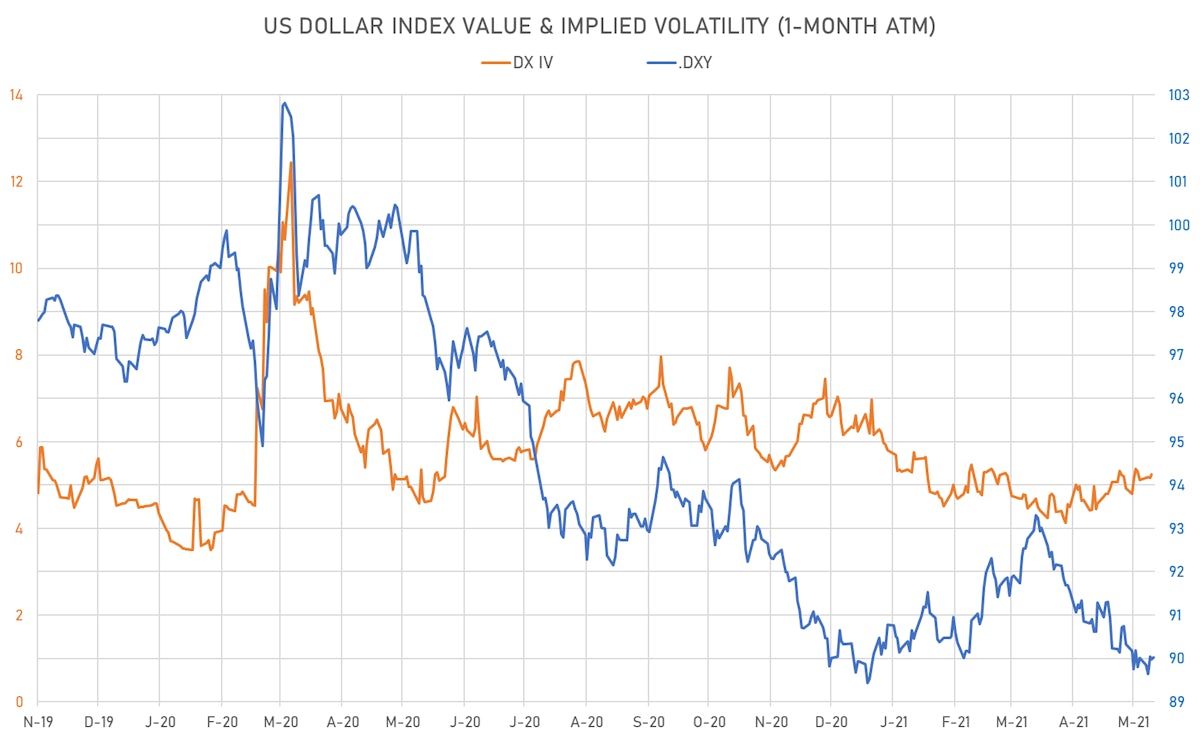

- The US Dollar Index is up 0.1% at 90.03

- Yen unchanged at 109.81 (YTD: -6.0%)

- Onshore Yuan up 0.2% at 6.3674 (YTD: +2.5%)

- Swiss franc down 0.3% at 0.8997 (YTD: -1.6%)

- Sterling unchanged at 1.4198 (YTD: +3.8%)

- Canadian dollar unchanged at 1.2066 (YTD: +5.5%)

- Australian dollar down 0.3% at 0.7713 (YTD: +0.2%)

- NZ dollar down 0.6% at 0.7247 (YTD: +0.9%)

MACRO DATA RELEASES

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for May 2021 (FGV, Brazil) at 4.10, above consensus estimate of 4.00

- Colombia, Policy Rates, Intervention Rate for May 2021 (Cent Bank, Colombia) at 1.75

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for May 2021 (DG ECFIN, France) at -5.10, in line with consensus

- France, GDP, Total growth, Change P/P for Q1 2021 (INSEE, France) at -0.10, below consensus estimate of 0.40

- France, HICP, Flash, Change Y/Y, Price Index for May 2021 (INSEE, France) at 1.80, in line with consensus

- Switzerland, KOF composite leading indicator for May 2021 (KOF, Switzerland) at 143.20, above consensus estimate of 136.00

- United States, Personal Consumption Expenditure, Change P/P for Apr 2021 (BEA, US Dept. Of Com) at 0.50, in line with consensus

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for May 2021 (UMICH, Survey) at 82.90, in line with consensus

WEEKLY CFTC DATA

- ALL: increase in net short US$ positioning

- G10: increase in net short US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net short US$ positioning

- Australian Dollar: reduced their net short US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

RATES SPREADS

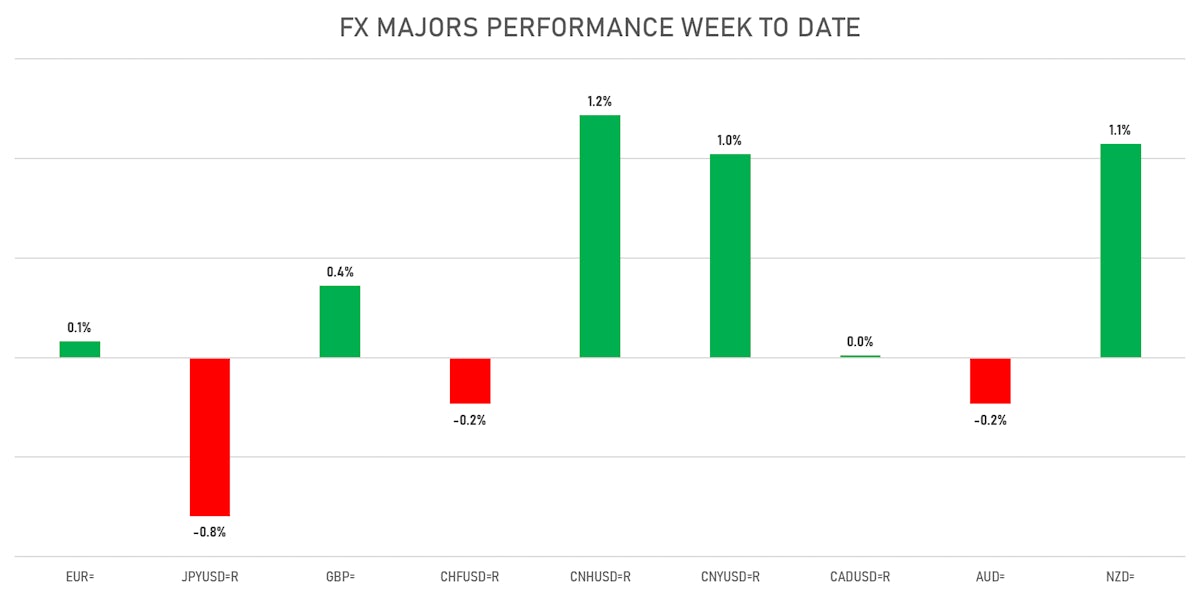

- 5Y German-US interest rates spread 1.6 bp tighter, positive for the Euro

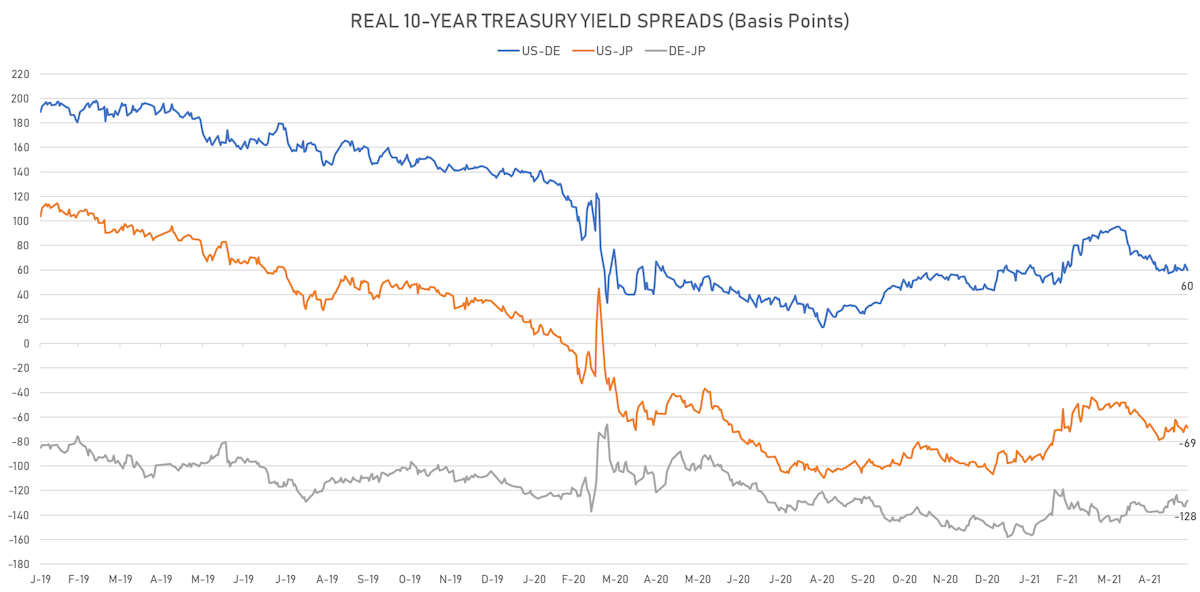

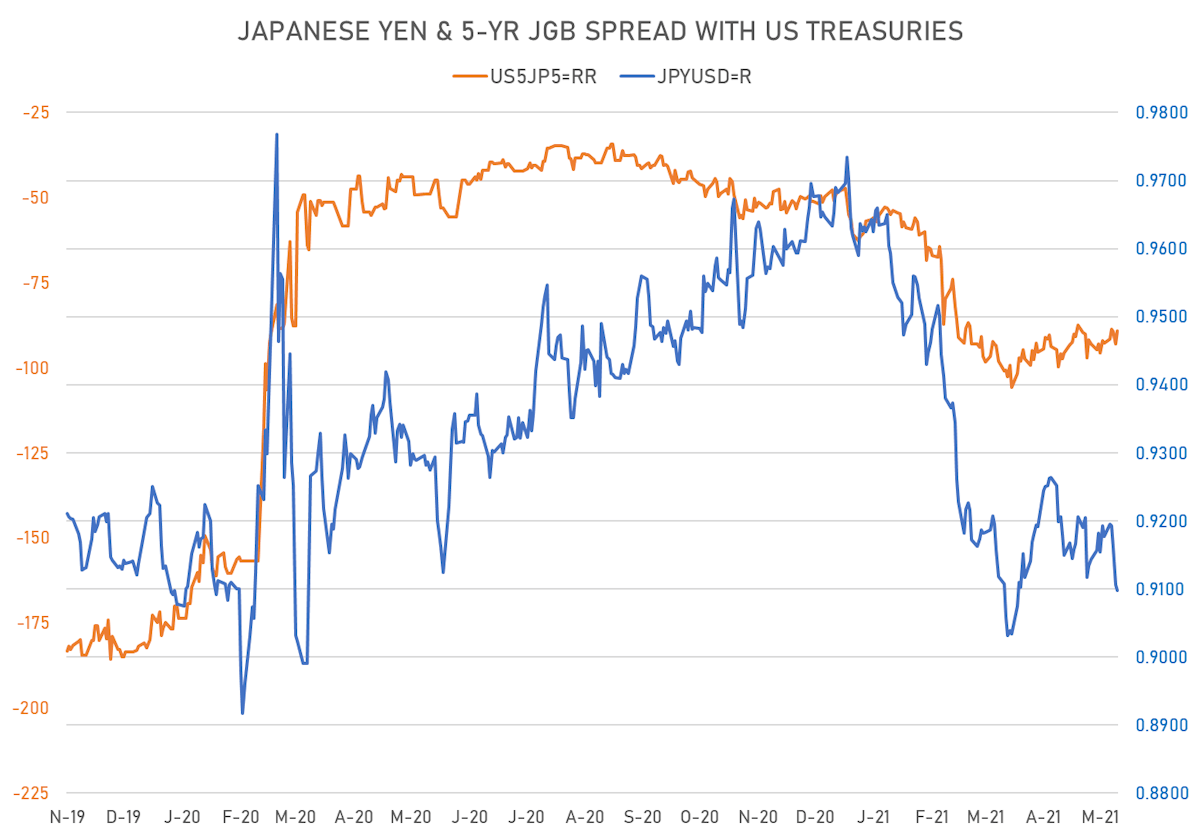

- 5Y Japan-US rates spread 3.9 bp tighter, positive for the Yen

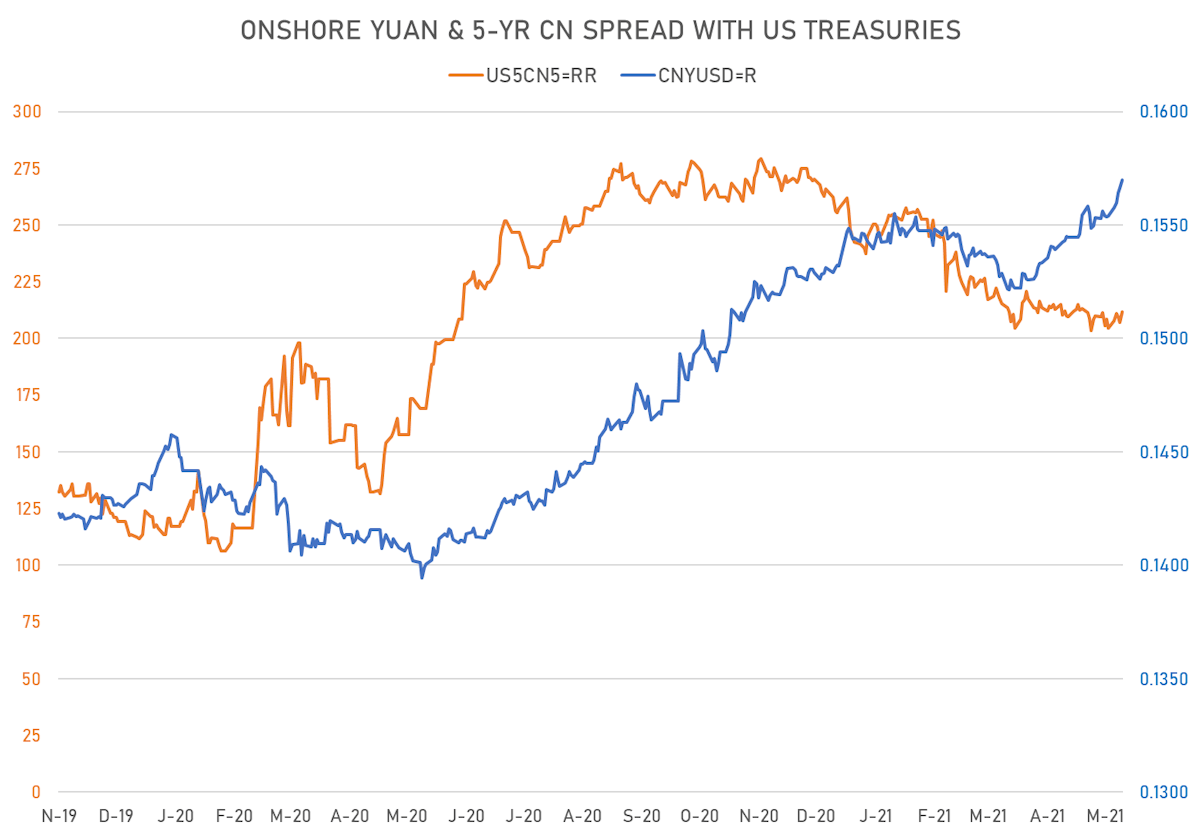

- 5Y Chinese-US rates spread 4.7 bp wider, positive for the Yuan

VOLATILITIES

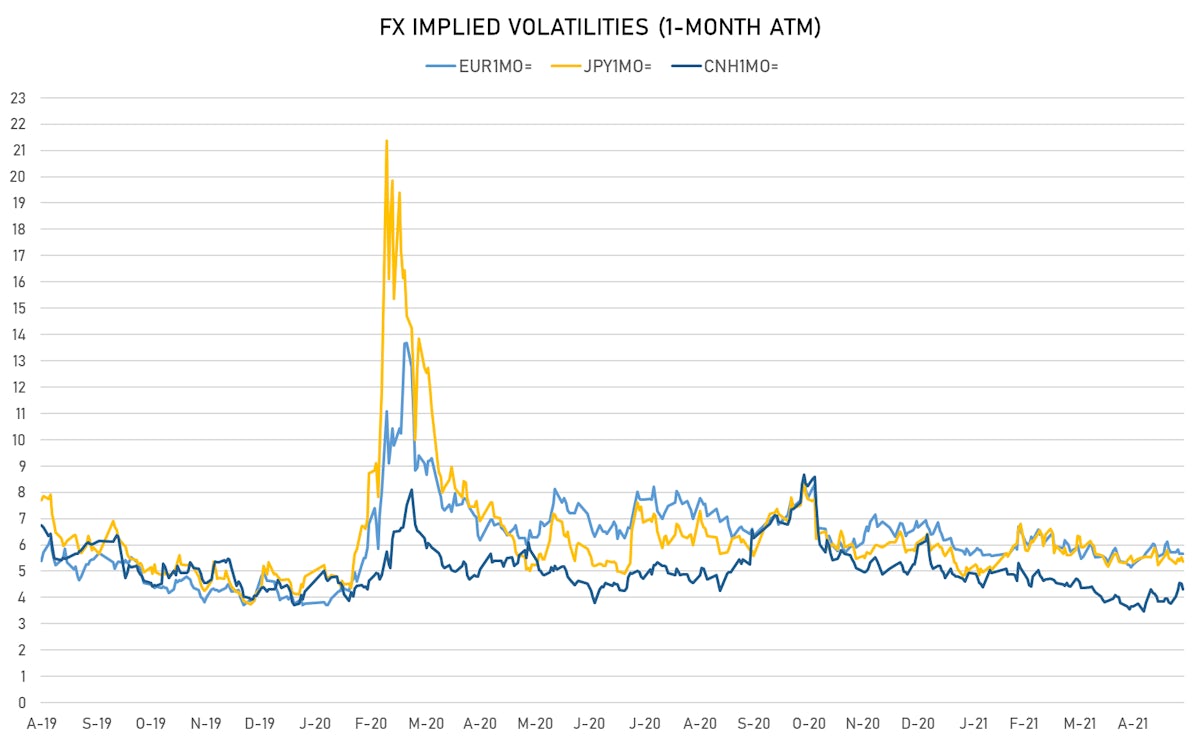

- Deutsche Bank USD Currency Volatility Index currently at 6.30, up 0.01 on the day (YTD: -0.87)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.65, unchanged (YTD: -1.0)

- Japanese Yen 1M ATM IV currently at 5.38, down -0.2 on the day (YTD: -0.7)

- Offshore Yuan 1M ATM IV currently at 4.31, down -0.2 on the day (YTD: -1.7)

NOTABLE MOVES IN SOVEREIGN CDS

- Turkey (rated BB-): up 7.5 basis points to 407 bp (1Y range: 282-597bp)

- Senegal (rated B+): down 4.5 basis points to 376 bp (1Y range: 355-409bp)

- Kenya (rated B+): down 5.0 basis points to 417 bp (1Y range: 394-454bp)

- Ecuador (rated WD): down 2.0 basis points to 166 bp (1Y range: 157-181bp)

- Ethiopia (rated CCC): down 5.0 basis points to 406 bp (1Y range: 383-442bp)

- Lebanon (rated CC): down 43.0 basis points to 3,381 bp (1Y range: 3,196-3,683bp)

- Nigeria (rated B): down 4.5 basis points to 352 bp (1Y range: 333-383bp)

- Peru (rated BBB+): down 1.6 basis points to 94 bp (1Y range: 52-97bp)

- Government of Chile (rated A-): down 1.7 basis points to 66 bp (1Y range: 43-87bp)

- Saudi Arabia (rated A): down 1.8 basis points to 59 bp (1Y range: 53-136bp)

NOTABLE OTHER MOVERS TODAY

- Mauritania ouguiya up 1.7% (YTD: +1.7%)

- Jamaican Dollar up 1.1% (YTD: -4.0%)

- Peru Sol up 0.8% (YTD: -5.2%)

- Pakistani rupee up 0.8% (YTD: +4.0%)

- Falklands Pound up 0.6% (YTD: +4.2%)

- Gibraltar Pound up 0.6% (YTD: +4.2%)

- Iceland Krona down 0.5% (YTD: +5.6%)

- Turkish Lira down 0.6% (YTD: -13.2%)

- New Zealand $ down 0.6% (YTD: +0.9%)

- Solomon Island Dollar down 0.6% (YTD: +0.2%)

YTD BIGGEST FX WINNERS & LOSERS

- Seychelles rupee up 26.5%

- Mozambique metical up 22.4%

- Ethiopian Birr down 10.2%

- Argentine Peso down 11.1%

- Turkish Lira down 13.2%

- Haiti Gourde down 19.1%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 64.4%

- Libyan Dinar down 70.0%

- Sudanese Pound down 86.8%