FX

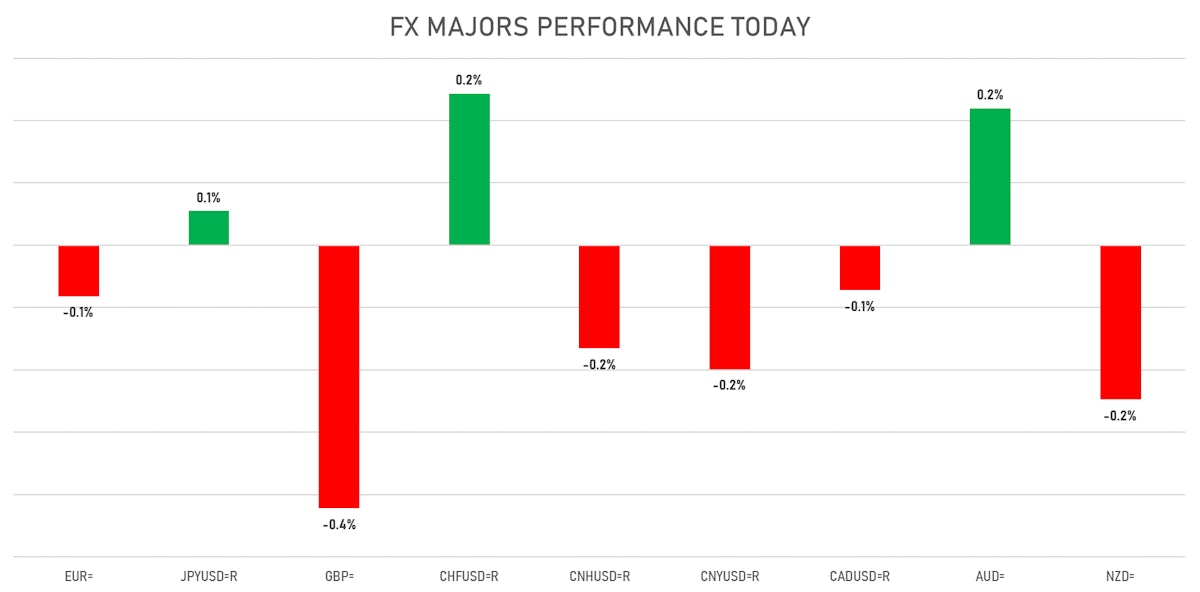

The Dollar Edged Down, With The Swiss Franc Leading Major Currencies

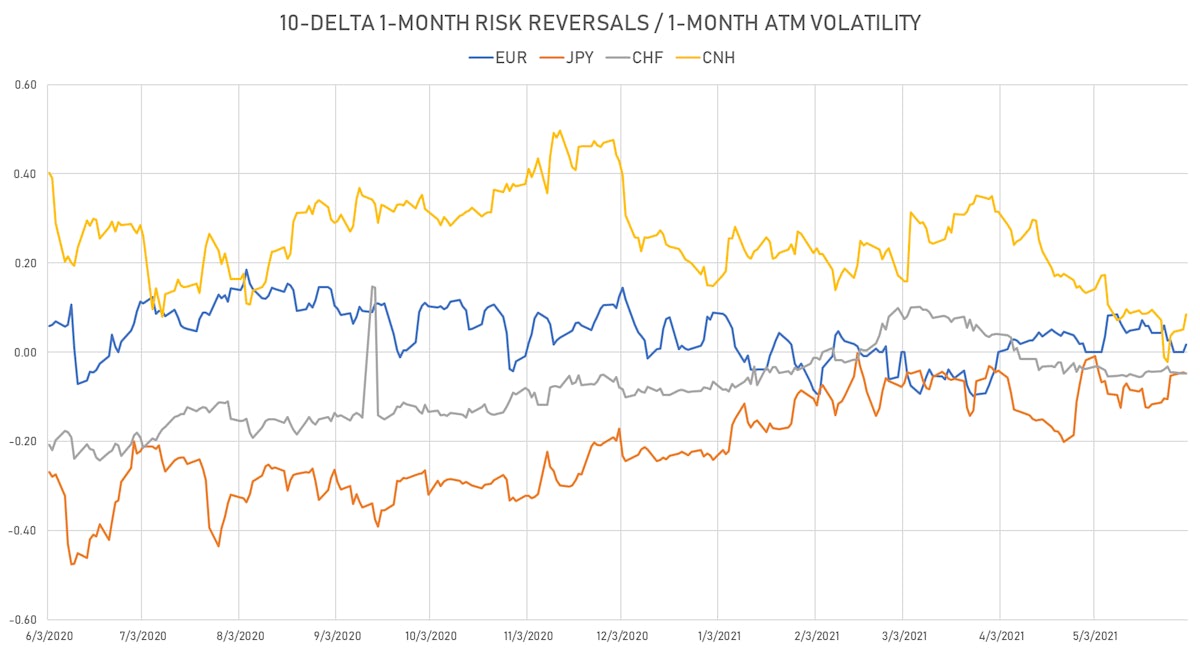

The yuan weakened as the PBOC announced that FX deposit reserve requirements will rise by 2% (to 7%) effective 15 June, which will reduce the supply of foreign currency sellers in onshore markets

Published ET

CNH Hourly Spot Price and 1-Month 10-Delta Risk Reversal | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is down -0.22% at 89.83 (YTD: -0.12%)

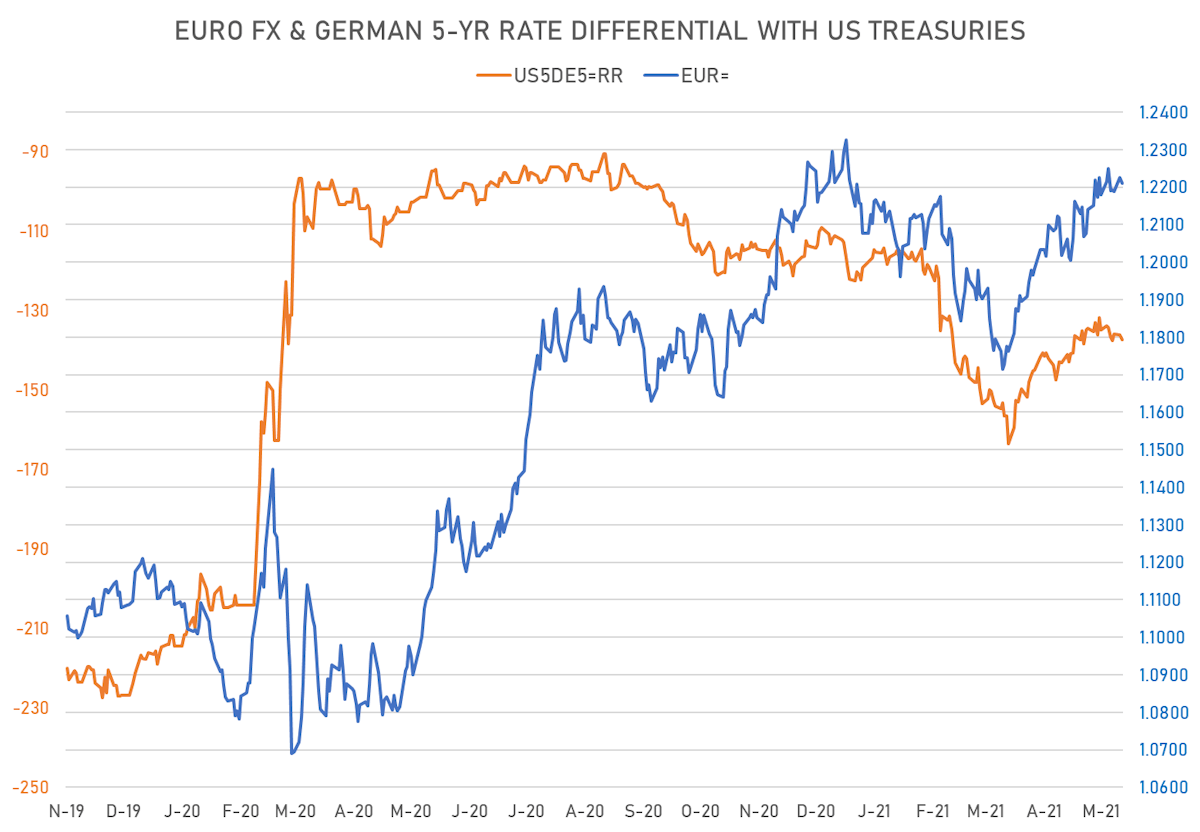

- Euro down 0.08% at 1.2215 (YTD: +0.0%)

- Yen up 0.05% at 109.48 (YTD: -5.7%)

- Onshore Yuan down 0.20% at 6.3796 (YTD: +2.3%)

- Swiss franc up 0.24% at 0.8973 (YTD: -1.3%)

- Sterling down 0.42% at 1.4149 (YTD: +3.5%)

- Canadian dollar down 0.07% at 1.2073 (YTD: +5.5%)

- Australian dollar up 0.22% at 0.7751 (YTD: +0.7%)

- NZ dollar down 0.25% at 0.7250 (YTD: +0.9%)

MACRO DATA RELEASES

- Australia, Current Account, Balance for Q1 2021 (AU Bureau of Stat) at 18.30, above consensus estimate of 17.90

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Apr 2021 (AU Bureau of Stat) at -8.60, above consensus estimate of -10.00

- Australia, Net exports, Goods and Services, Total, Contributions to GDP Growth for Q1 2021 (AU Bureau of Stat) at -0.60, above consensus estimate of -1.10

- Australia, Policy Rates, Cash Target Rate for Jun 2021 (RBA, Australia) at 0.10, in line with consensus

- Brazil, GDP, Market prices, chain-weighted, Change P/P for Q1 2021 (IBGE, Brazil) at 1.20, above consensus estimate of 1.00

- Brazil, GDP, Market prices, chain-weighted, Change Y/Y for Q1 2021 (IBGE, Brazil) at 1.00, above consensus estimate of 0.80

- Brazil, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 53.70

- Canada, GDP, All industries, Change P/P for Mar 2021 (CANSIM, Canada) at 1.10, above consensus estimate of 1.00

- Canada, GDP, Total at market prices, annualized, Change P/P for Q1 2021 (CANSIM, Canada) at 5.60, below consensus estimate of 6.70

- Canada, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 57.00

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for May 2021 (Markit Economics) at 52.00, above consensus estimate of 51.90

- Euro Zone, CPI, Change Y/Y for May 2021 (Eurostat) at 2.00, above consensus estimate of 1.90

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for May 2021 (Eurostat) at 0.90, in line with consensus

- Euro Zone, PMI, Manufacturing Sector, Total, Final for May 2021 (Markit Economics) at 63.10, above consensus estimate of 62.80

- Euro Zone, Unemployment, Rate for Apr 2021 (Eurostat) at 8.00, below consensus estimate of 8.10

- France, PMI, Manufacturing Sector, Total, Final for May 2021 (Markit Economics) at 59.40, above consensus estimate of 59.20

- Germany, PMI, Manufacturing Sector, Total, Final for May 2021 (Markit Economics) at 64.40, above consensus estimate of 64.00

- Germany, Unemployment, Change, Absolute change for May 2021 (Deutsche Bundesbank) at -15.00, below consensus estimate of -9.00

- Germany, Unemployment, Rate, Registered for May 2021 (Deutsche Bundesbank) at 6.00, in line with consensus

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for May 2021 (Markit Economics) at 50.80, below consensus estimate of 52.00

- Italy, GDP, Final, Change P/P for Q1 2021 (ISTAT, Italy) at 0.10, above consensus estimate of -0.40

- Italy, GDP, Final, Change Y/Y for Q1 2021 (ISTAT, Italy) at -0.80, above consensus estimate of -1.40

- Italy, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 62.30, above consensus estimate of 62.00

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for May 2021 (Markit Economics) at 53.00

- Mexico, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 47.60

- New Zealand, Milk Auction, Average Price, Constant Prices for W 01 Jun (GlobalDairy Trade) at 4,128.00

- Russia, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 51.90

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for May 2021 (Markit Economics) at 53.70

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for May 2021 (Markit Economics) at 49.30

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for May 2021 (Nationwide, UK) at 1.80, above consensus estimate of 0.80

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for May 2021 (Nationwide, UK) at 10.90, above consensus estimate of 9.20

- United Kingdom, PMI, Manufacturing Sector for May 2021 (Markit Economics) at 65.60, below consensus estimate of 66.10

- United States, ISM Manufacturing, PMI total for May 2021 (ISM, United States) at 61.20, above consensus estimate of 60.90

- United States, PMI, Manufacturing Sector, Total, Final for May 2021 (Markit Economics) at 62.10

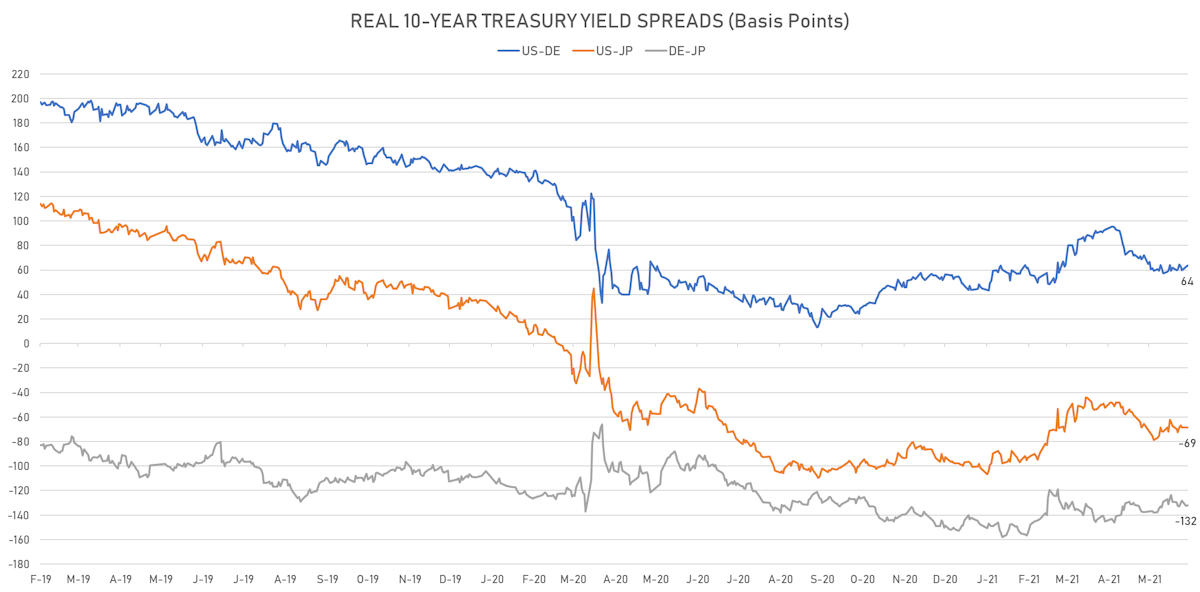

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 1.2 bp wider at -137.3 bp (YTD change: -26.2 bp), negative for the euro

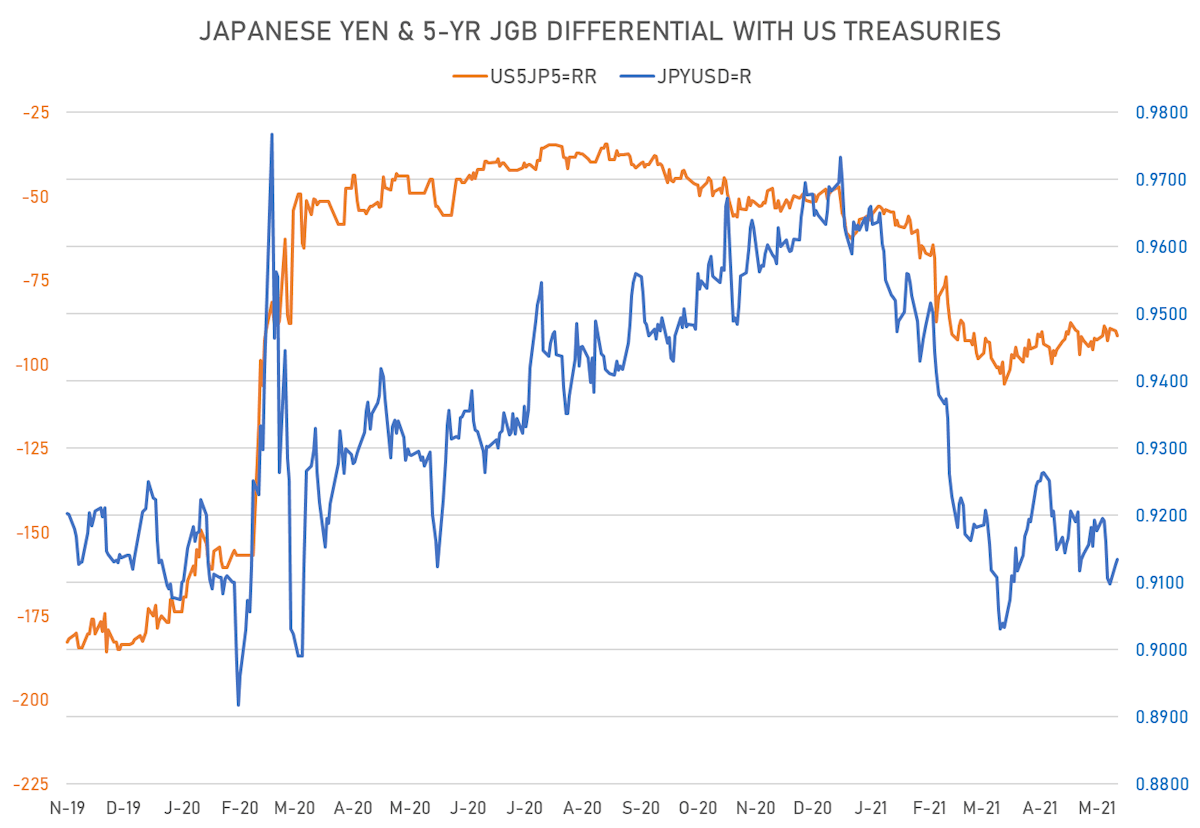

- 5Y Japan-US interest rates differential 1.5 bp wider at -91.5 bp (YTD change: -43.2 bp), negative for the euro

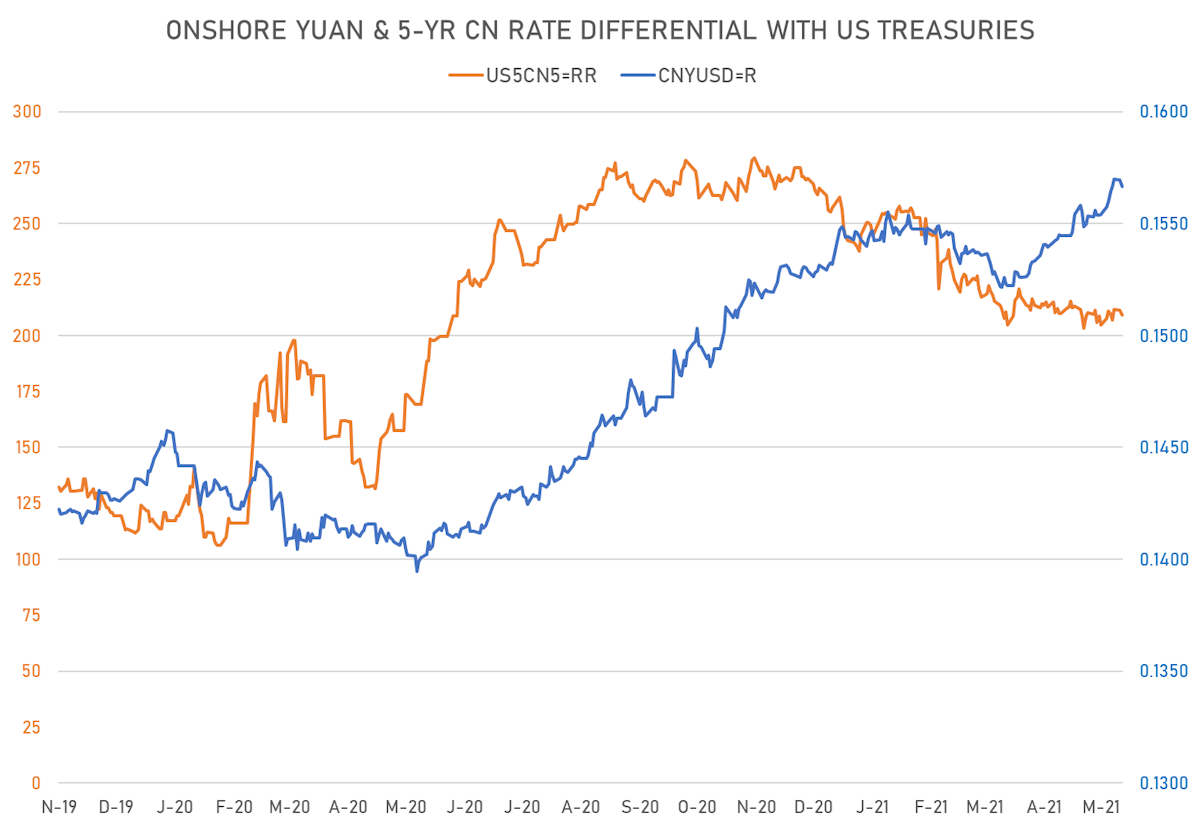

- 5Y China-US interest rates differential 2.1 bp wider at 209.2 bp (YTD change: -47.9 bp), positive for the yuan

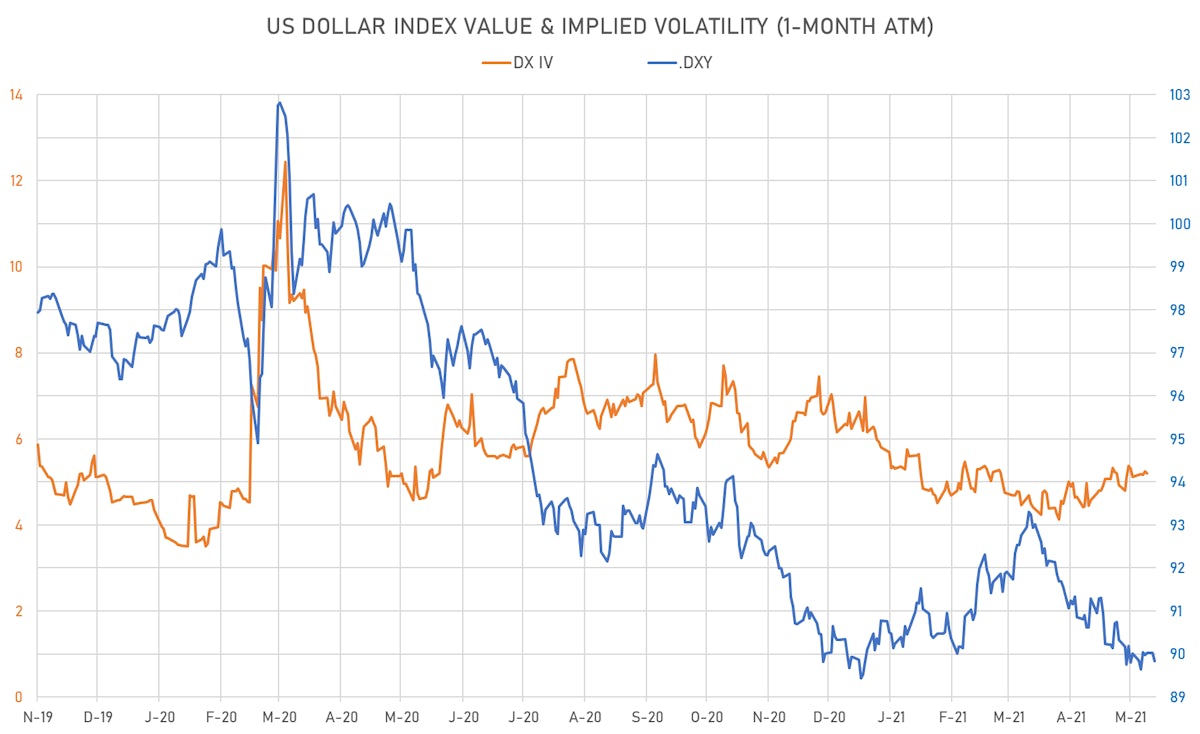

VOLATILITIES

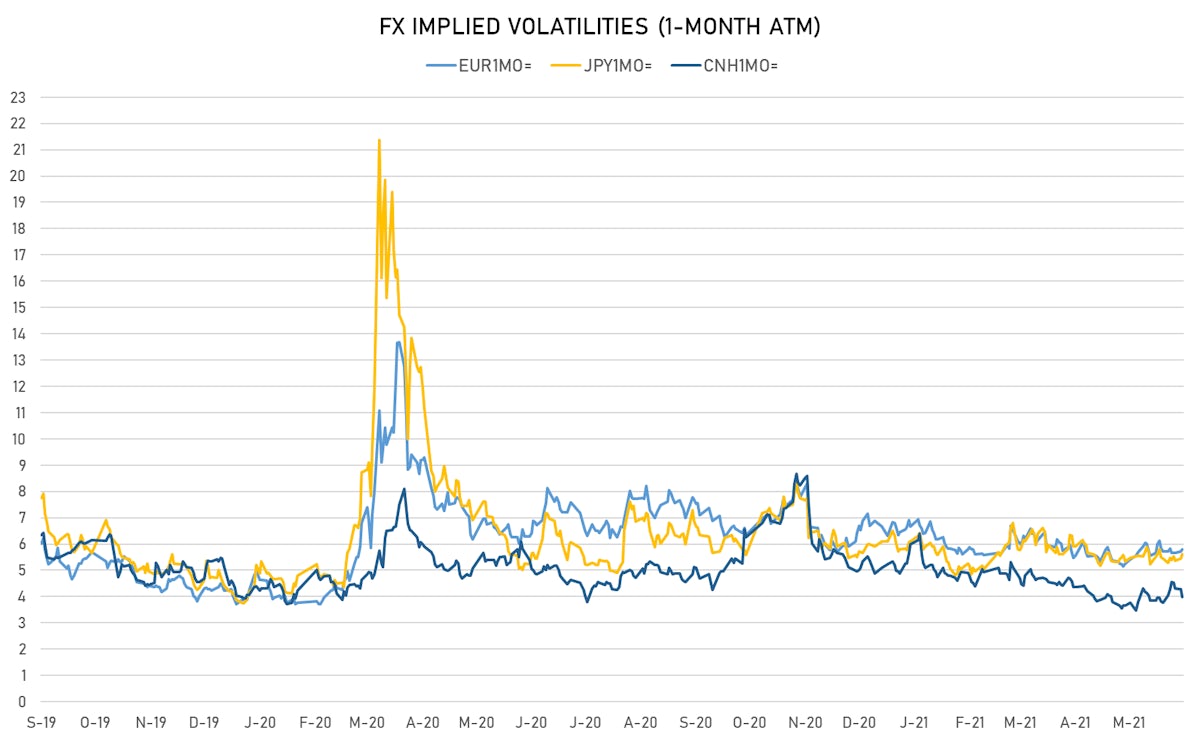

- Deutsche Bank USD Currency Volatility Index currently at 6.21, down -0.03 on the day (YTD: -0.96)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.79, up 0.1 on the day (YTD: -0.9)

- Japanese Yen 1M ATM IV currently at 5.60, up 0.1 on the day (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 3.98, down -0.3 on the day (YTD: -2.0)

- CNH risk reversals up noticeably today

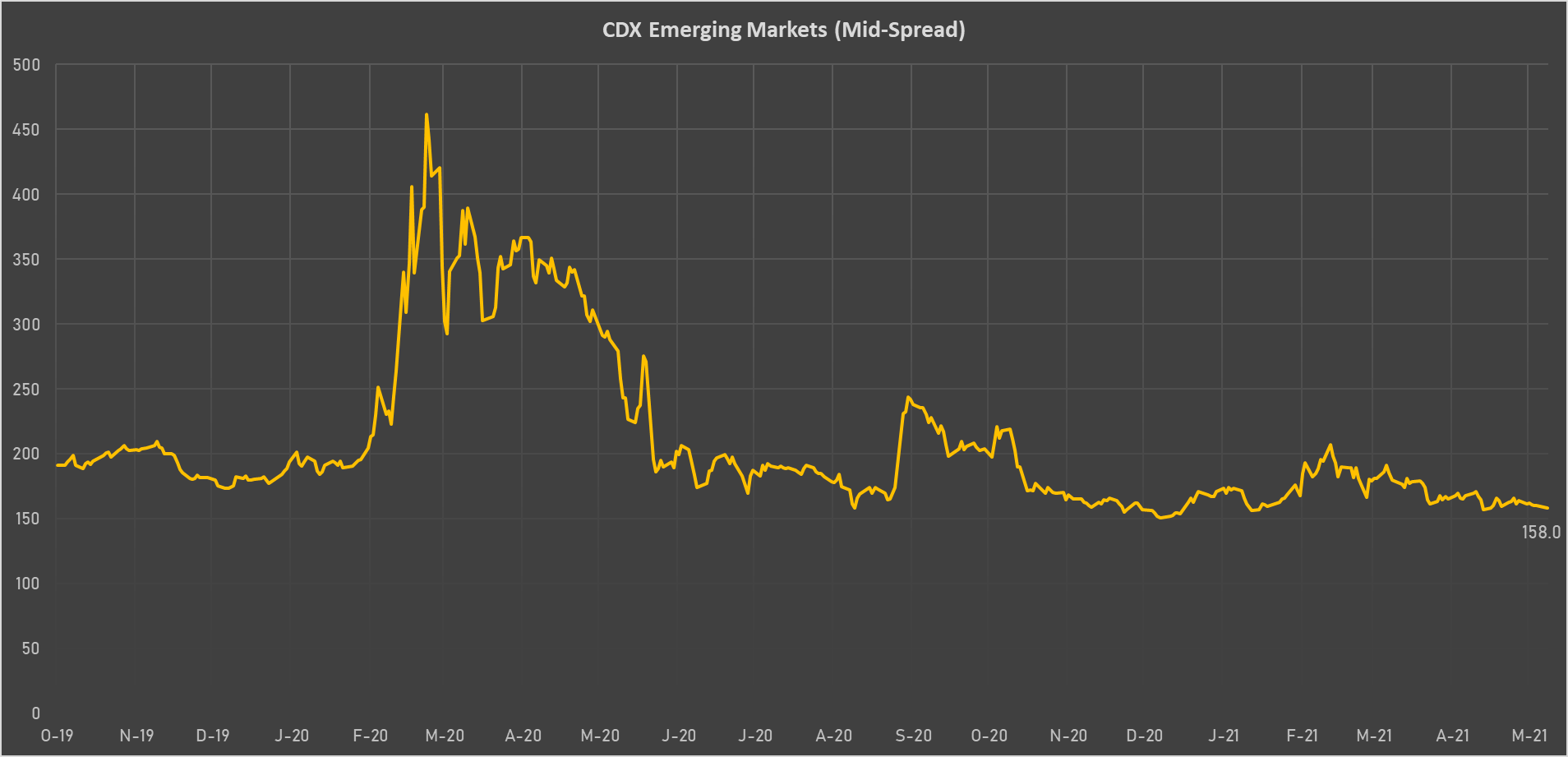

NOTABLE MOVES IN SOVEREIGN CDS

- Government of Chile (rated A-): down 1.0 basis points to 65 bp (1Y range: 43-87bp)

- Colombia (rated BBB-): down 2.2 basis points to 138 bp (1Y range: 83-168bp)

- Panama (rated BBB-): down 1.1 basis points to 69 bp (1Y range: 44-112bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 60 bp (1Y range: 50-62bp)

- Brazil (rated BB-): down 3.2 basis points to 167 bp (1Y range: 141-268bp)

- Turkey (rated BB-): down 8.0 basis points to 399 bp (1Y range: 282-597bp)

- Russia (rated BBB): down 2.2 basis points to 93 bp (1Y range: 72-129bp)

- Saudi Arabia (rated A): down 1.6 basis points to 58 bp (1Y range: 53-131bp)

- South Africa (rated BB-): down 5.3 basis points to 185 bp (1Y range: 190-329bp)

- Peru (rated BBB+): down 3.4 basis points to 90 bp (1Y range: 52-97bp)

LARGEST FX MOVES TODAY

- Eritrean Nakfa up 2.6%

- Nicaragua Cordoba up 2.4%

- Tonga Pa'Anga up 1.6%

- Qatari Riyal up 1.6%

- Mauritania Ouguiya up 1.5%

- Bolivian Boliviano down 1.6%

- Aruba Florin down 2.2%

- Cape Verde Escudo down 3.6%

- Sao Tome Dobra down 7.4%

- Seychelles Rupee down 11.3%