FX

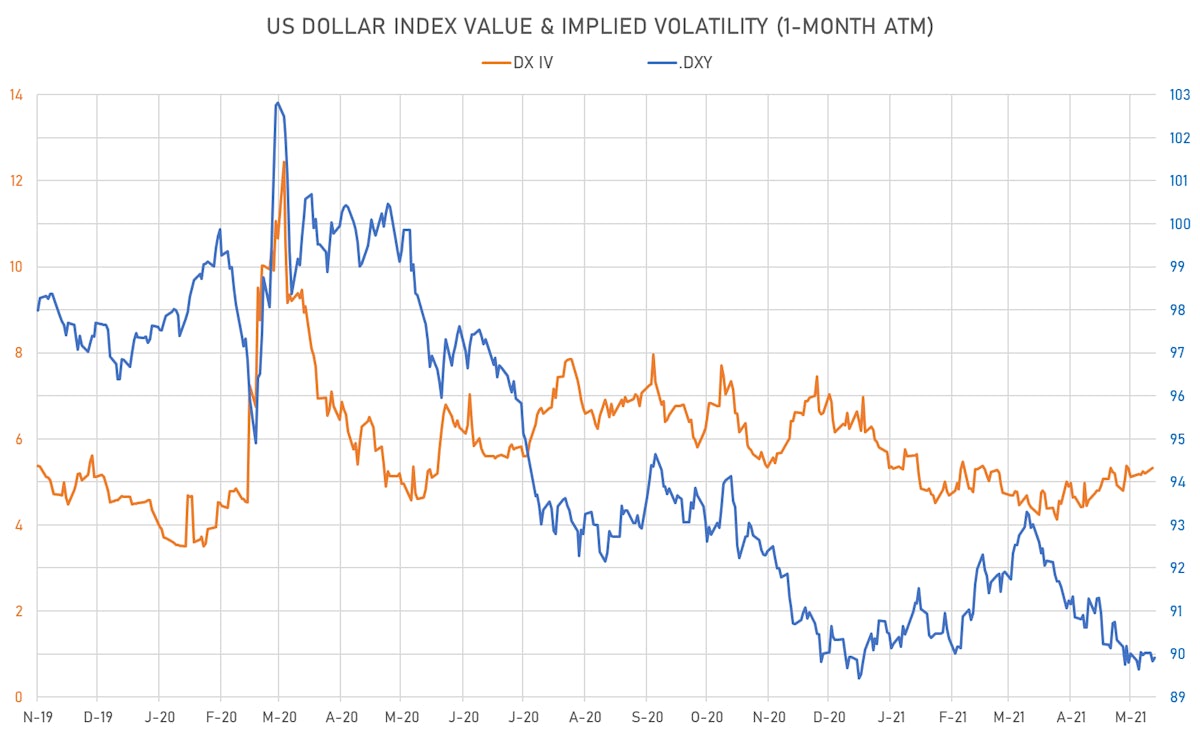

Dollar Index Barely Up On Little Macro Data Today, As FX Markets Are Waiting For A Sense Of Direction

Risk reversals in major currencies have converged towards zero in the last couple of weeks, with the positive European momentum stalling

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

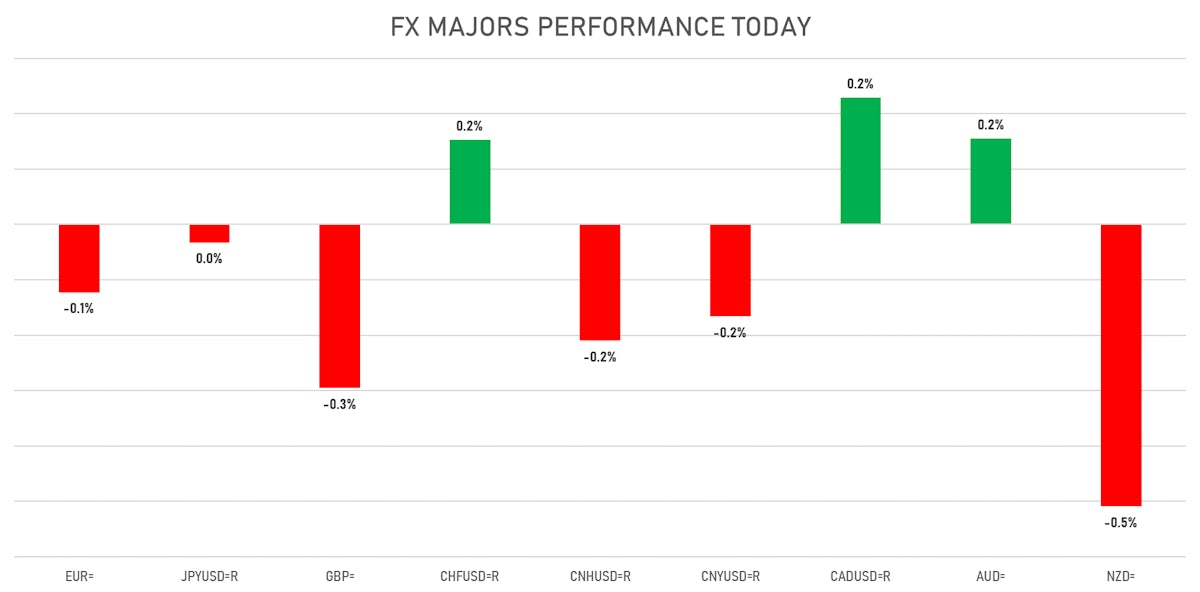

- The US Dollar Index is up 0.09% at 89.91 (YTD: -0.03%)

- Euro down 0.12% at 1.2210 (YTD: 0.0%)

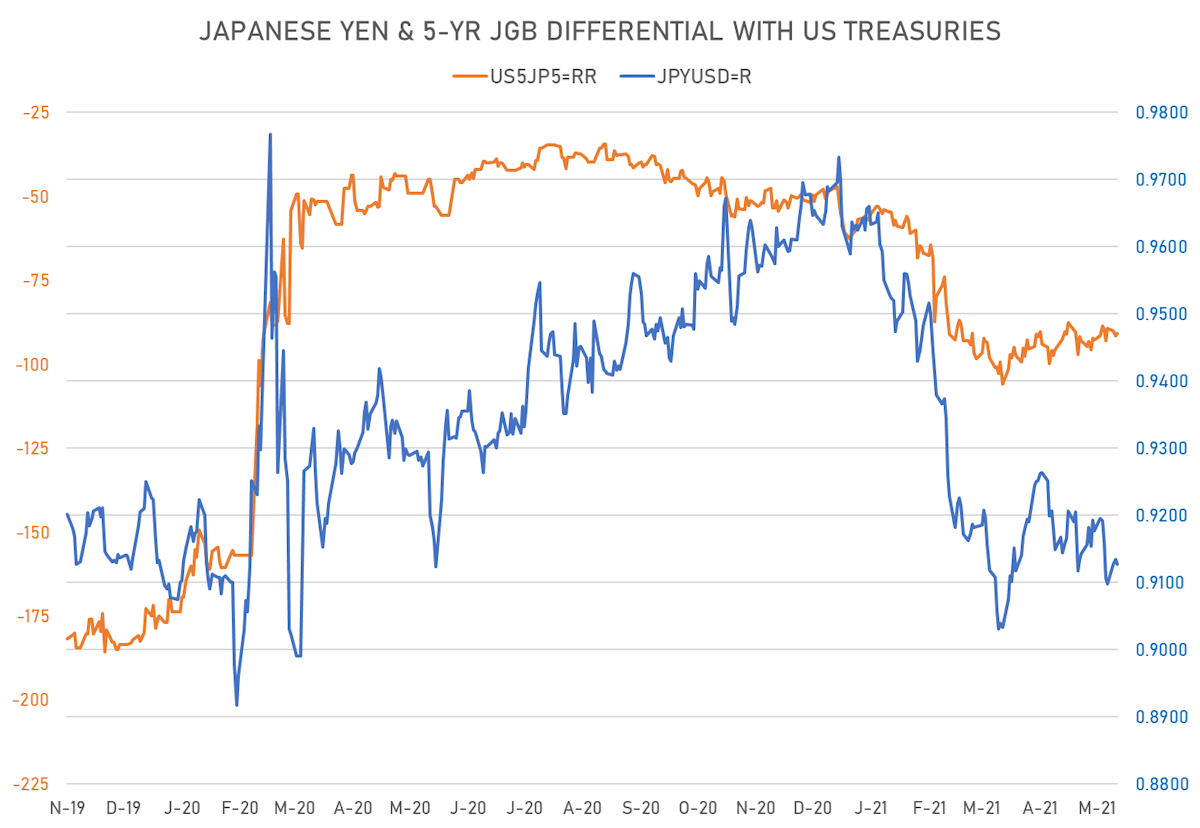

- Yen down 0.03% at 109.59 (YTD: -5.8%)

- Onshore Yuan down 0.17% at 6.3805 (YTD: +2.3%)

- Swiss franc up 0.15% at 0.8981 (YTD: -1.4%)

- Sterling down 0.30% at 1.4167 (YTD: +3.6%)

- Canadian dollar up 0.23% at 1.2034 (YTD: +5.8%)

- Australian dollar up 0.16% at 0.7746 (YTD: +0.7%)

- NZ dollar down 0.51% at 0.7231 (YTD: +0.6%)

MACRO DATA RELEASES

- Australia, GDP, Change P/P for Q1 2021 (AU Bureau of Stat) at 1.80, above consensus estimate of 1.60

- Australia, GDP, Change Y/Y for Q1 2021 (AU Bureau of Stat) at 1.10, above consensus estimate of 0.70

- Brazil, Production, General industry, Change P/P for Apr 2021 (IBGE, Brazil) at -1.30, below consensus estimate of 0.10

- Brazil, Production, General industry, Change Y/Y for Apr 2021 (IBGE, Brazil) at 34.70, below consensus estimate of 37.00

- Indonesia, CPI, Change Y/Y for May 2021 (Statistics Indonesia) at 1.68, above consensus estimate of 1.67

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for May 2021 (Markit Economics) at 55.30

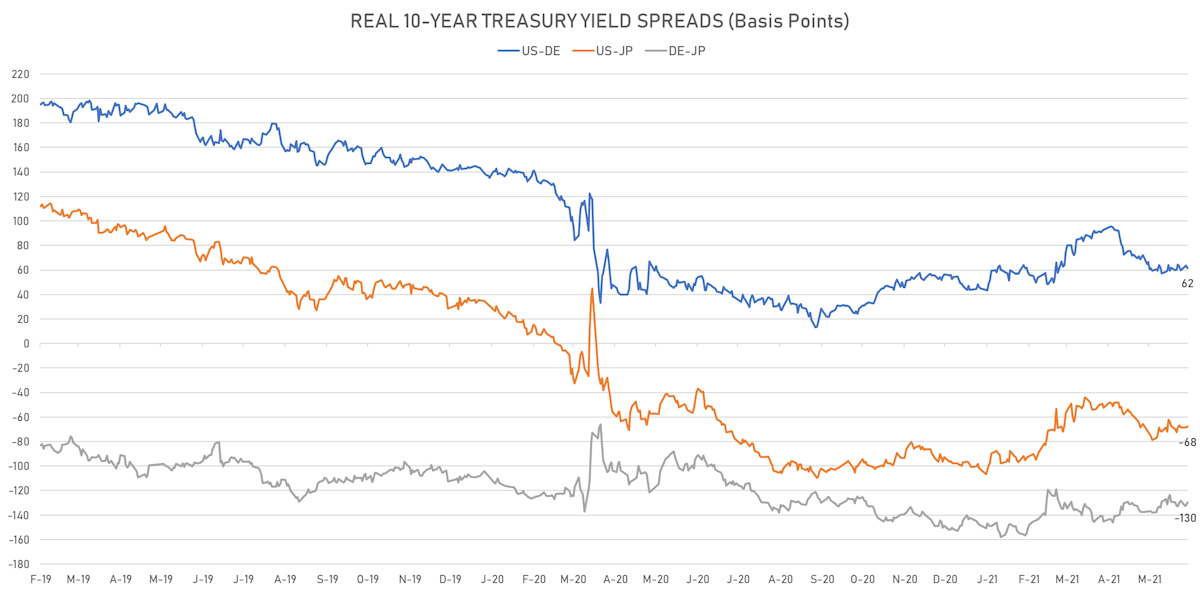

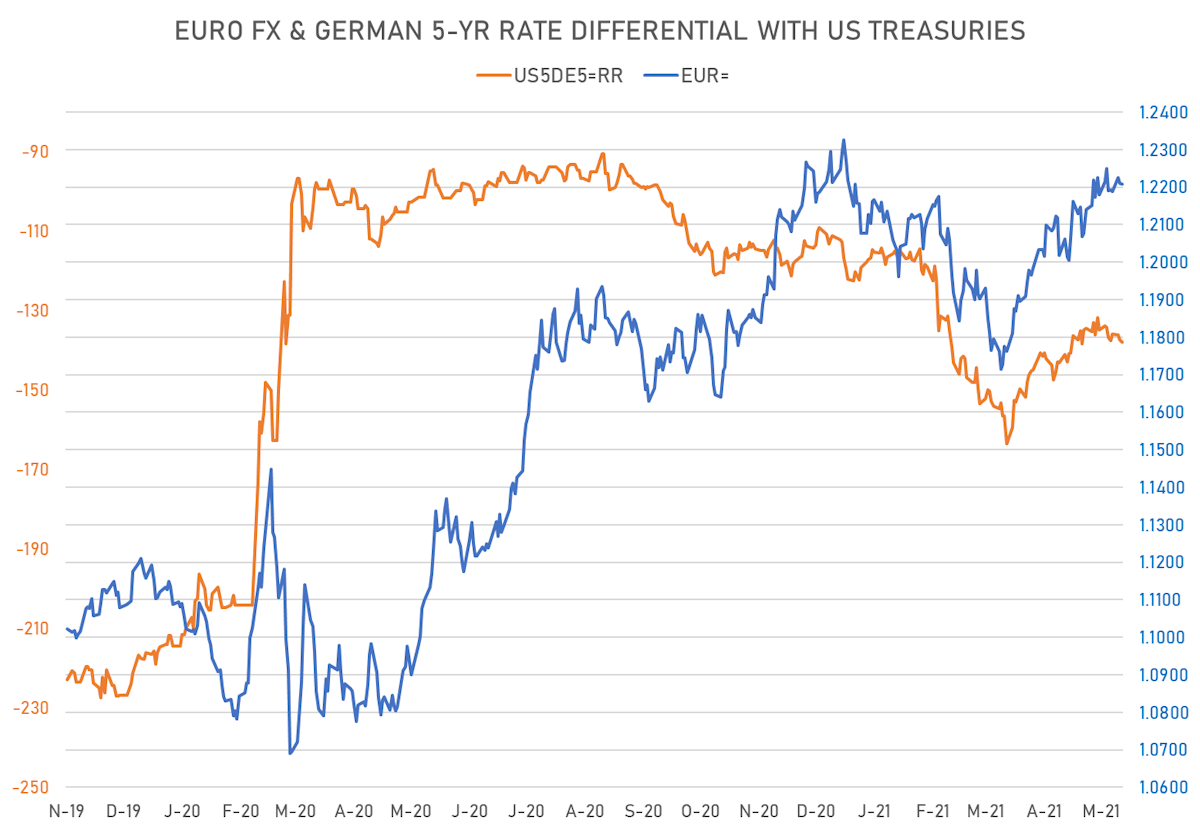

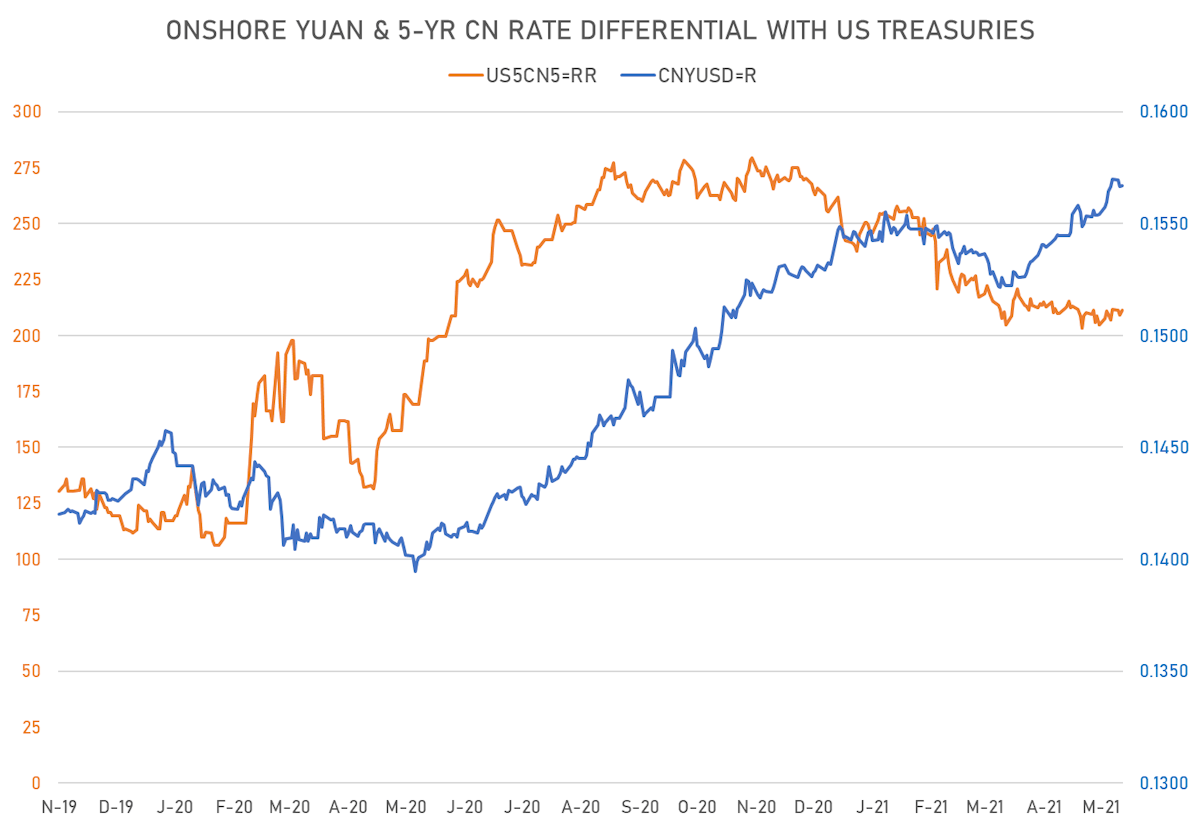

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 0.6 bp wider at -137.9 bp (YTD change: -26.8 bp), negative for the euro

- 5Y Japan-US interest rates differential 0.8 bp tighter at -90.7 bp (YTD change: -42.4 bp), positive for the yen

- 5Y China-US interest rates differential 2.1 bp tighter at 211.3 bp (YTD change: -45.8 bp), negative for the yuan

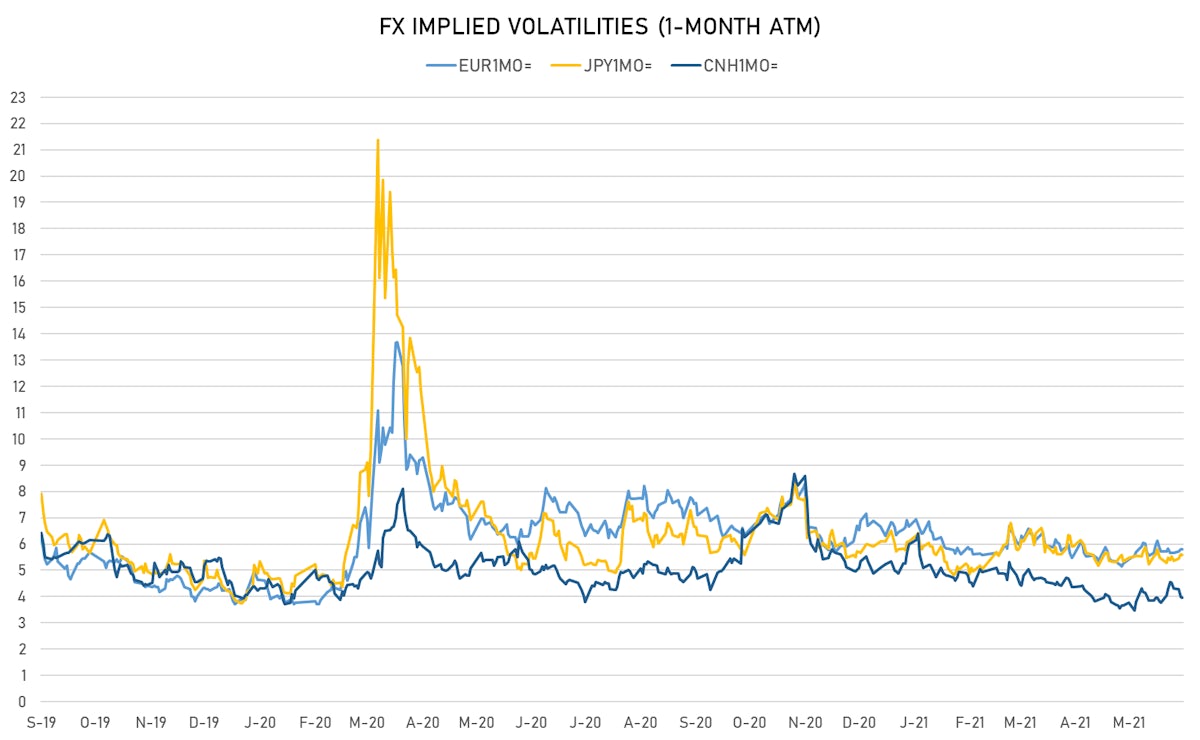

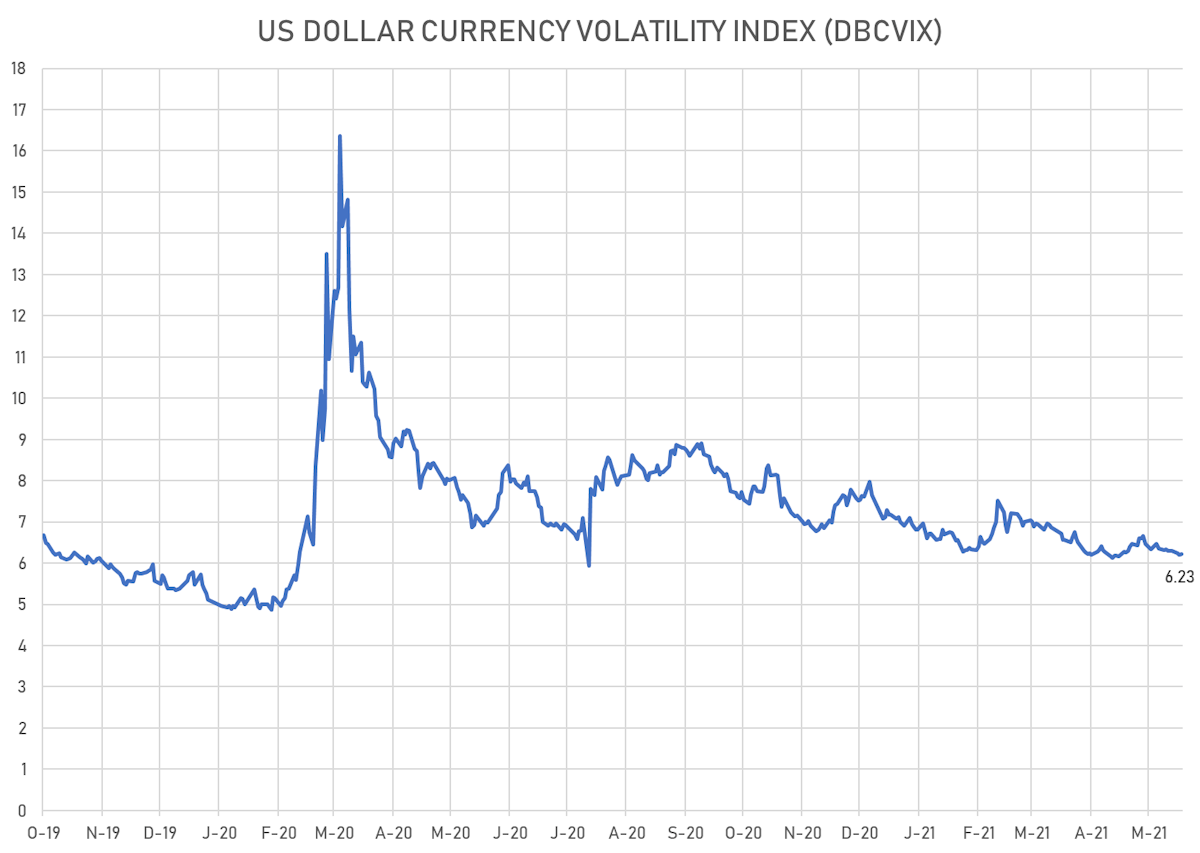

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.23, up 0.02 on the day (YTD: -0.94)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.79, unchanged (YTD: -0.9)

- Japanese Yen 1M ATM IV currently at 5.58, unchanged (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 3.96, unchanged (YTD: -2.0)

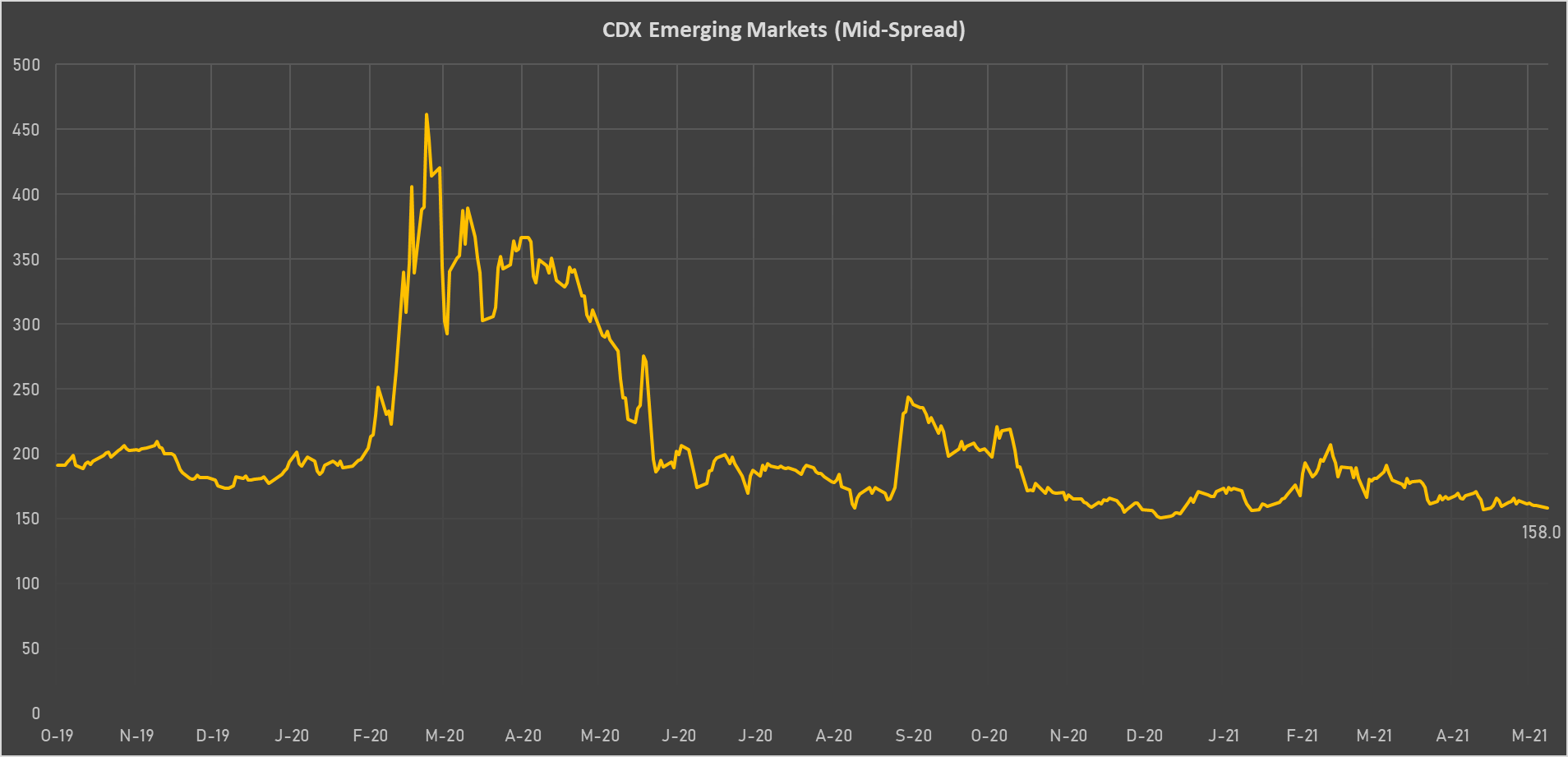

NOTABLE MOVES IN SOVEREIGN CDS

- Turkey (rated BB-): up 3.1 basis points to 402 bp (1Y range: 282-597bp)

- Egypt (rated B+): down 1.7 basis points to 324 bp (1Y range: 283-534bp)

- Mexico (rated BBB-): down 0.6 basis points to 90 bp (1Y range: 79-169bp)

- Indonesia (rated BBB): down 0.6 basis points to 74 bp (1Y range: 66-142bp)

- Argentina (rated CCC): down 18.7 basis points to 1,799 bp (1Y range: 1,049-6,788bp)

- Panama (rated BBB-): down 0.9 basis points to 68 bp (1Y range: 44-112bp)

- Peru (rated BBB+): down 1.4 basis points to 89 bp (1Y range: 52-97bp)

- Government of Chile (rated A-): down 1.1 basis points to 64 bp (1Y range: 43-87bp)

- Colombia (rated BBB-): down 2.4 basis points to 135 bp (1Y range: 83-168bp)

- Brazil (rated BB-): down 3.8 basis points to 163 bp (1Y range: 141-268bp)

LARGEST FX MOVES TODAY

Brazilian Real up 2.8% (YTD: +2.3%)

Lesotho Loti up 1.7% (YTD: +8.7%)

Mauritius Rupee up 1.7% (YTD: -2.4%)

Haiti Gourde down 3.9% (YTD: -21.4%)

Seychellesrupee down 11.3% (YTD: +26.5%)