FX

The Dollar Index Rises On Favorable Rates Differentials After Good US Macro Data

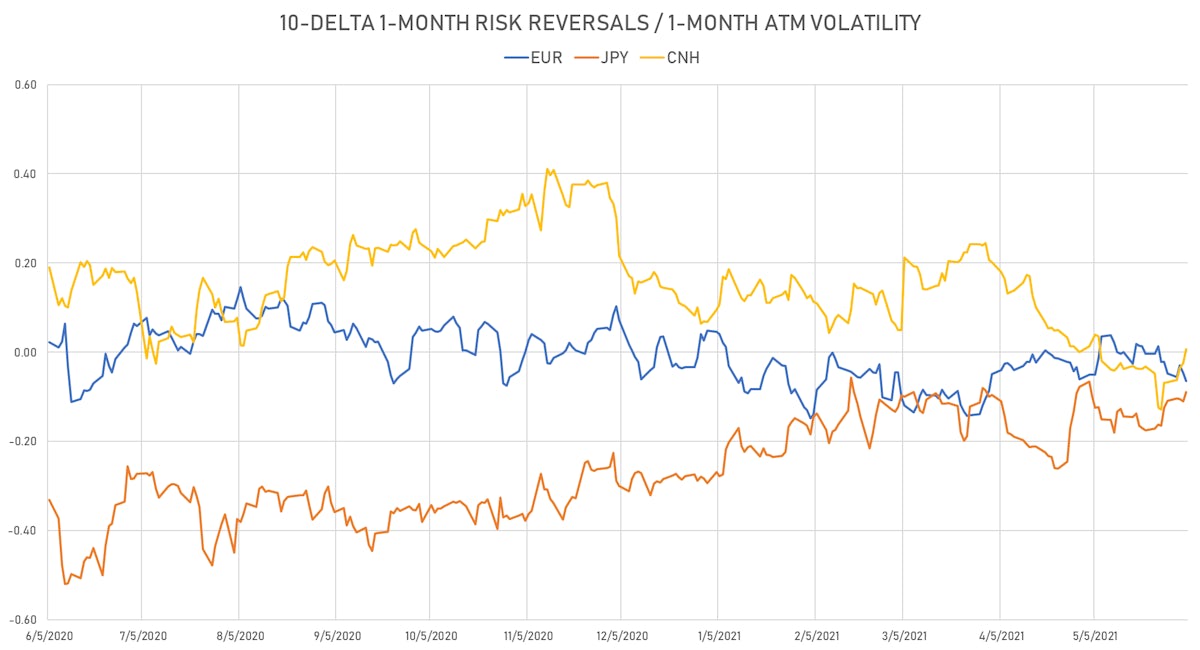

Risk reversals in EUR, JPY show prudent / neutral speculative positioning ahead of payroll data tomorrow

Published ET

Euro spot price intraday | Source: Refinitiv

QUICK SUMMARY

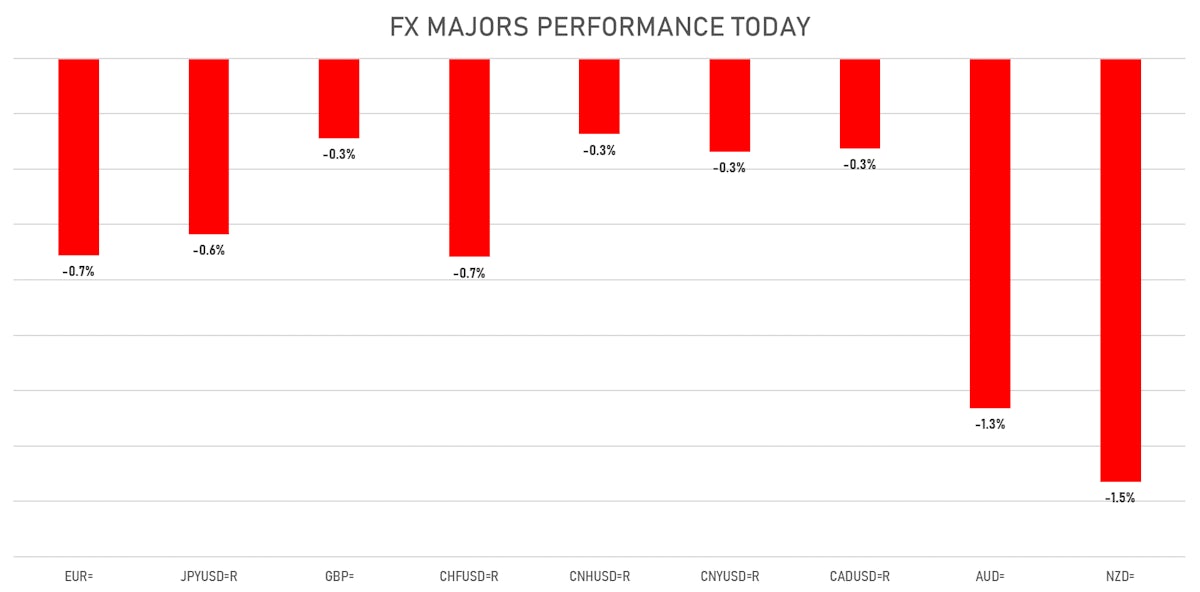

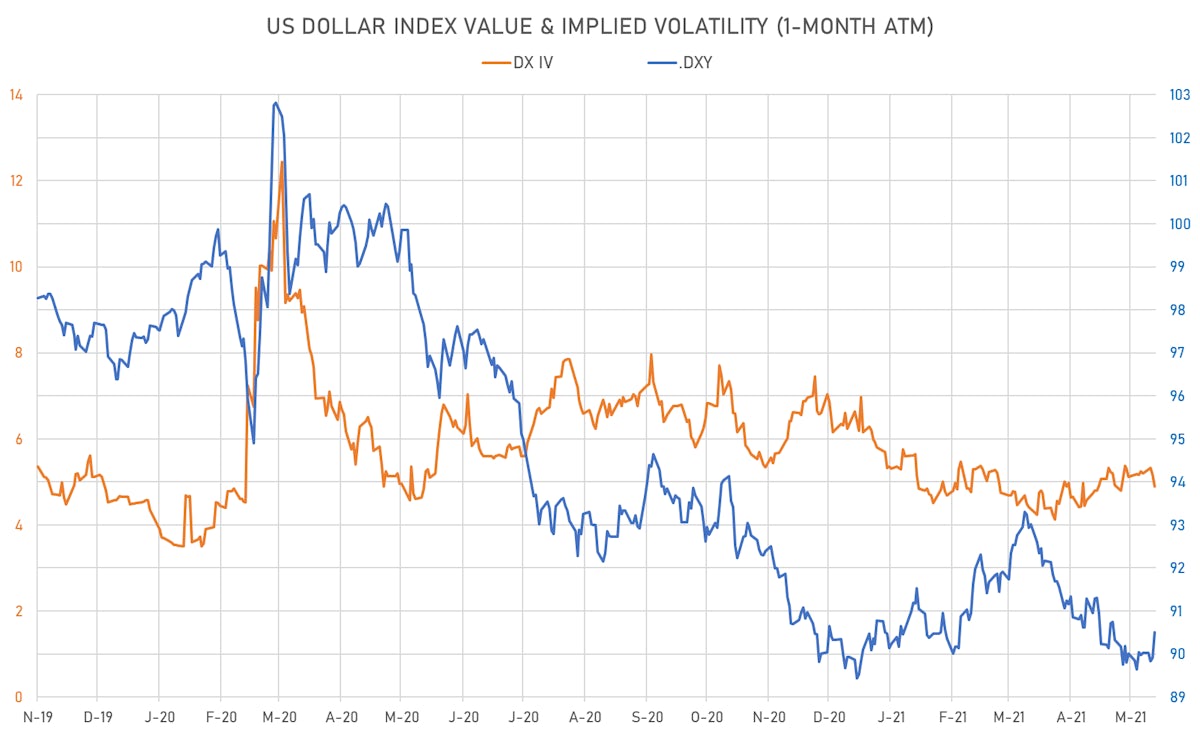

- The US Dollar Index is up 0.67% at 90.51 (YTD: +0.64%)

- Euro down 0.71% at 1.2124 (YTD: -0.7%)

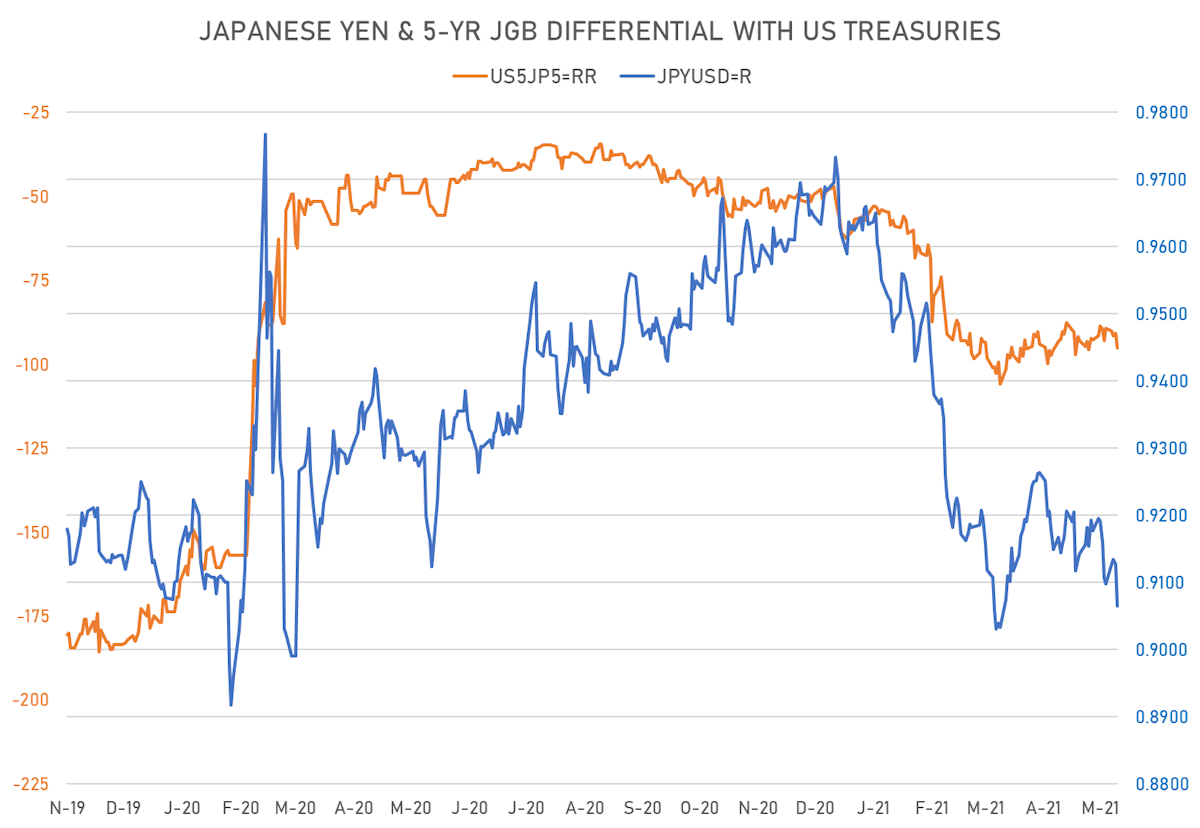

- Yen down 0.63% at 110.17 (YTD: -6.3%)

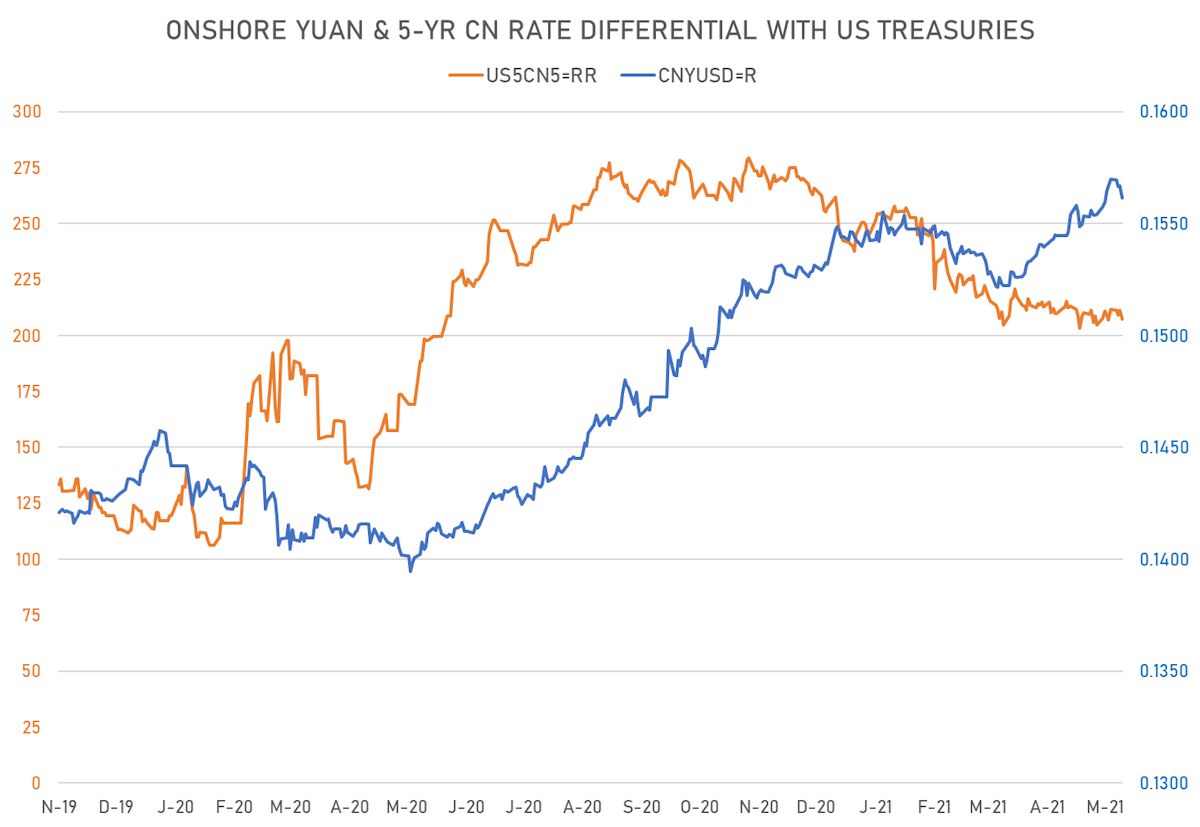

- Onshore Yuan down 0.34% at 6.4044 (YTD: +1.9%)

- Swiss franc down 0.72% at 0.9036 (YTD: -2.0%)

- Sterling down 0.29% at 1.4105 (YTD: +3.2%)

- Canadian dollar down 0.33% at 1.2110 (YTD: +5.1%)

- Australian dollar down 1.26% at 0.7656 (YTD: -0.5%)

- NZ dollar down 1.53% at 0.7144 (YTD: -0.6%)

MACRO RELEASES

- Australia, Current Account, Goods and Services, Net for Apr 2021 (AU Bureau of Stat) at 8,028.00, above consensus estimate of 7,900.00

- Australia, Retail Sales, Total, Final, Change P/P for Apr 2021 (AU Bureau of Stat) at 1.10, in line with consensus

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for May 2021 (Markit Economics) at 55.10

- Euro Zone, PMI, Composite, Output, Final for May 2021 (Markit Economics) at 57.10, above consensus estimate of 56.90

- Euro Zone, PMI, Services Sector, Business Activity, Final for May 2021 (Markit Economics) at 55.20, above consensus estimate of 55.10

- France, PMI, Composite, Output, Final for May 2021 (Markit/CDAF, France) at 57.00, in line with consensus

- France, PMI, Services Sector, Business Activity, Final for May 2021 (Markit Economics) at 56.60, in line with consensus

- Germany, PMI, Composite, Output, Final for May 2021 (Markit Economics) at 56.20, in line with consensus

- Germany, PMI, Services Sector, Business Activity, Final for May 2021 (Markit Economics) at 52.80, in line with consensus

- India, IHS Markit, PMI, Services Sector, Business Activity for May 2021 (Markit Economics) at 46.40, below consensus estimate of 49.00

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for May 2021 (Markit Economics) at 46.50

- Russia, PMI, Services Sector, Business Activity for May 2021 (Markit Economics) at 57.50

- Saudi Arabia, IHS Markit, PMI, Composite, Output, IHS Markit PMI for May 2021 (Markit Economics) at 56.40

- South Africa, Standard Bank PMI for May 2021 (Markit Economics) at 53.20

- Turkey, CPI, Change P/P, Price Index for May 2021 (TURKSTAT) at 0.89, below consensus estimate of 1.46

- United Kingdom, Reserves, Gross, Government, Current Prices for May 2021 (HM Treasury) at 18,0463.01

- United States, ISM Non-manufacturing, NMI/PMI for May 2021 (ISM, United States) at 64.00, above consensus estimate of 63.00

- United States, Jobless Claims, National, Initial for W 29 May (U.S. Dept. of Labor) at 385.00, below consensus estimate of 390.00

- United States, PMI, Composite, Output, Final for May 2021 (Markit Economics) at 68.70

- United States, PMI, Services Sector, Business Activity, Final for May 2021 (Markit Economics) at 70.40

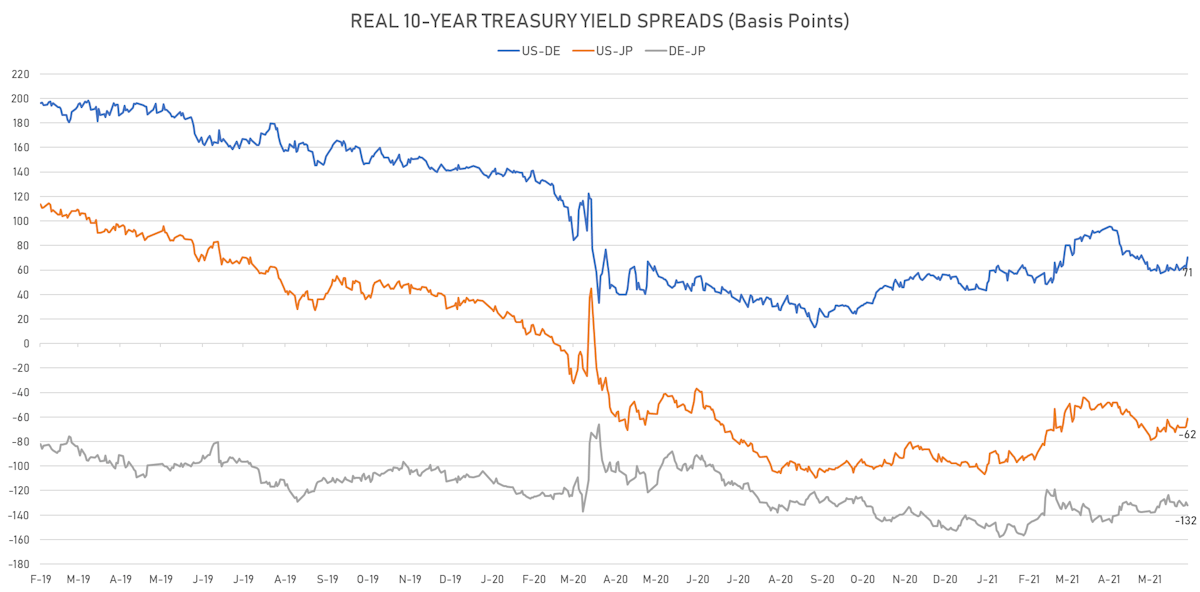

KEY RATES DIFFERENTIALS

- 5Y German-US interest rates differential 4.5 bp wider at -142.4 bp (YTD change: -31.3 bp), negative for the euro

- 5Y Japan-US interest rates differential 4.5 bp wider at -95.2 bp (YTD change: -46.9 bp), negative for the yen

- 5Y China-US interest rates differential 4.0 bp wider at 207.3 bp (YTD change: -49.8 bp), positive for the yuan

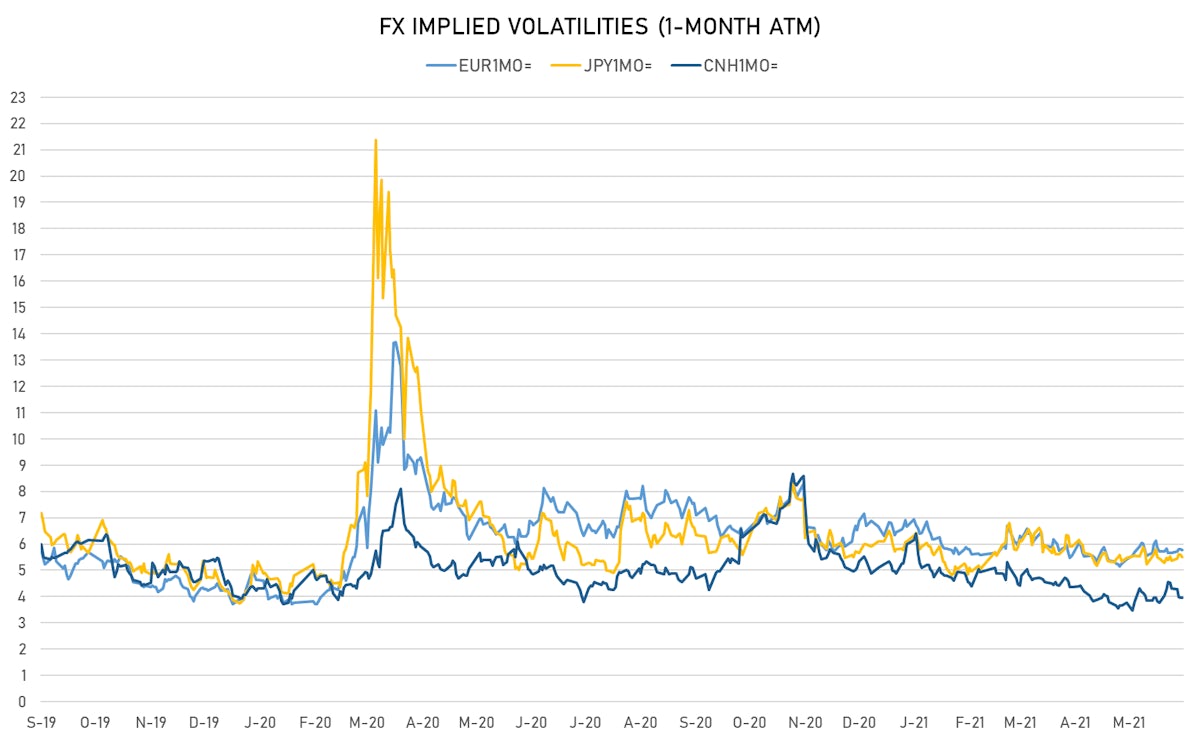

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.26, up 0.03 on the day (YTD: -0.91)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.78, unchanged (YTD: -0.9)

- Japanese Yen 1M ATM IV currently at 5.49, down -0.1 on the day (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.95, unchanged (YTD: -2.0)

- Pretty neutral positioning in options markets ahead of Friday's payroll report

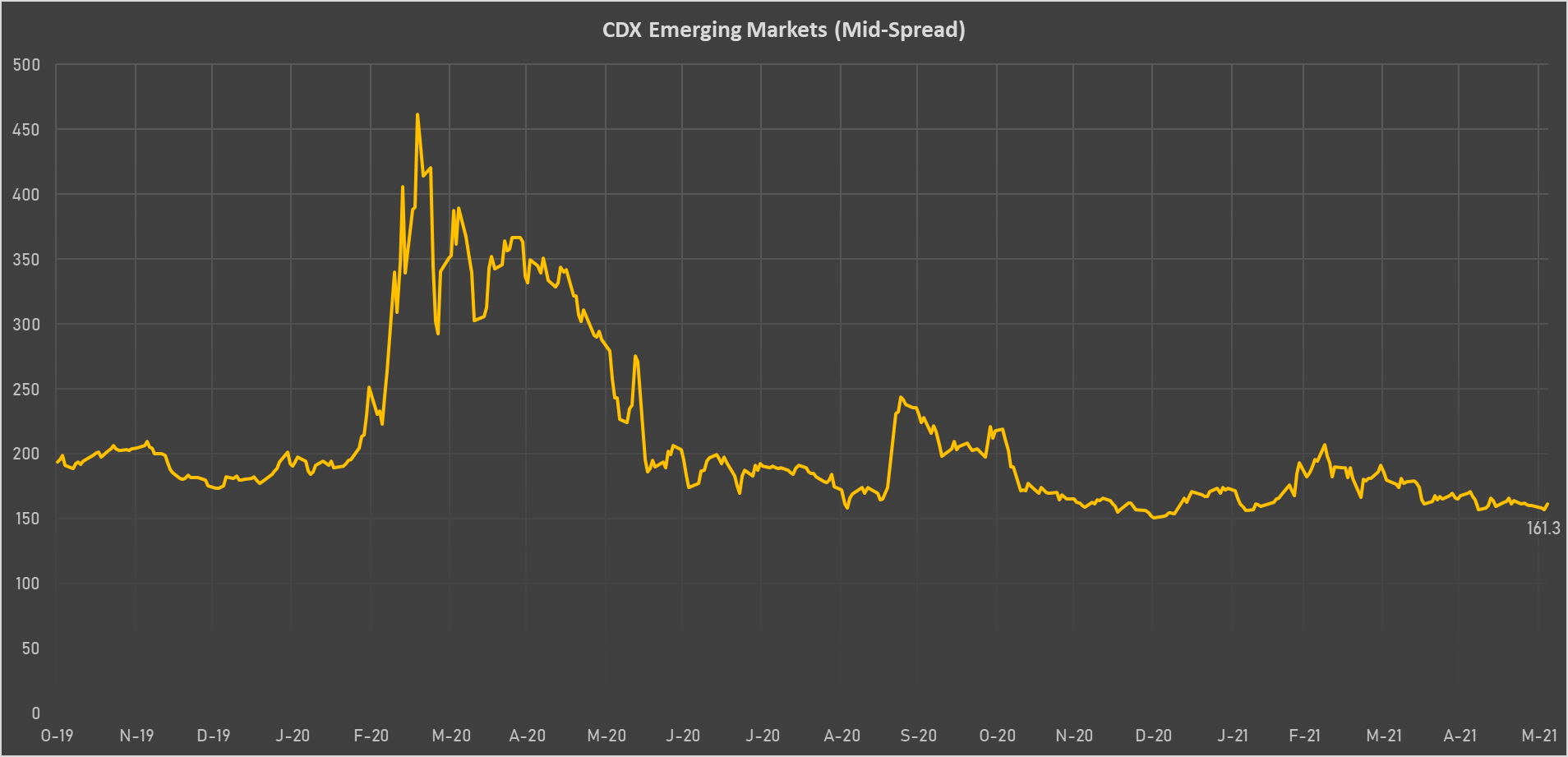

NOTABLE MOVES IN SOVEREIGN CDS

- Oman (rated BB-): up 8.0 basis points to 248 bp (1Y range: 228-518bp)

- Mexico (rated BBB-): up 1.9 basis points to 92 bp (1Y range: 79-169bp)

- Government of Chile (rated A-): up 1.3 basis points to 66 bp (1Y range: 43-87bp)

- Slovenia (rated A): up 1.0 basis points to 52 bp (1Y range: 47-55bp)

- Colombia (rated BBB-): up 2.1 basis points to 138 bp (1Y range: 83-168bp)

- Panama (rated BBB-): up 1.1 basis points to 69 bp (1Y range: 44-112bp)

- Russia (rated BBB): up 1.3 basis points to 94 bp (1Y range: 72-129bp)

- Turkey (rated BB-): up 4.9 basis points to 407 bp (1Y range: 282-597bp)

- Peru (rated BBB+): up 1.0 basis points to 90 bp (1Y range: 52-97bp)

- Saudi Arabia (rated A): up 0.6 basis points to 58 bp (1Y range: 53-114bp)

LARGEST FX MOVES TODAY

- Georgian Lari up 5.0% (YTD: +6.0%)

- Bolivian Boliviano up 1.6% (YTD: 0.0%)

- Brazilian Real up 1.4% (YTD: +2.3%)

- Chilean Peso up 1.3% (YTD: -1.1%)

- Qatari Riyal down 1.2% (YTD: -1.2%)

- Australian Dollar down 1.3% (YTD: -0.5%)

- Trinidad & Tobago Dollar down 1.5% (YTD: 0.0%)

- New Zealand $ down 1.5% (YTD: -0.6%)

- Turkish Lira down 2.0% (YTD: -14.7%)

- Haiti Gourde down 4.5% (YTD: -21.8%)