FX

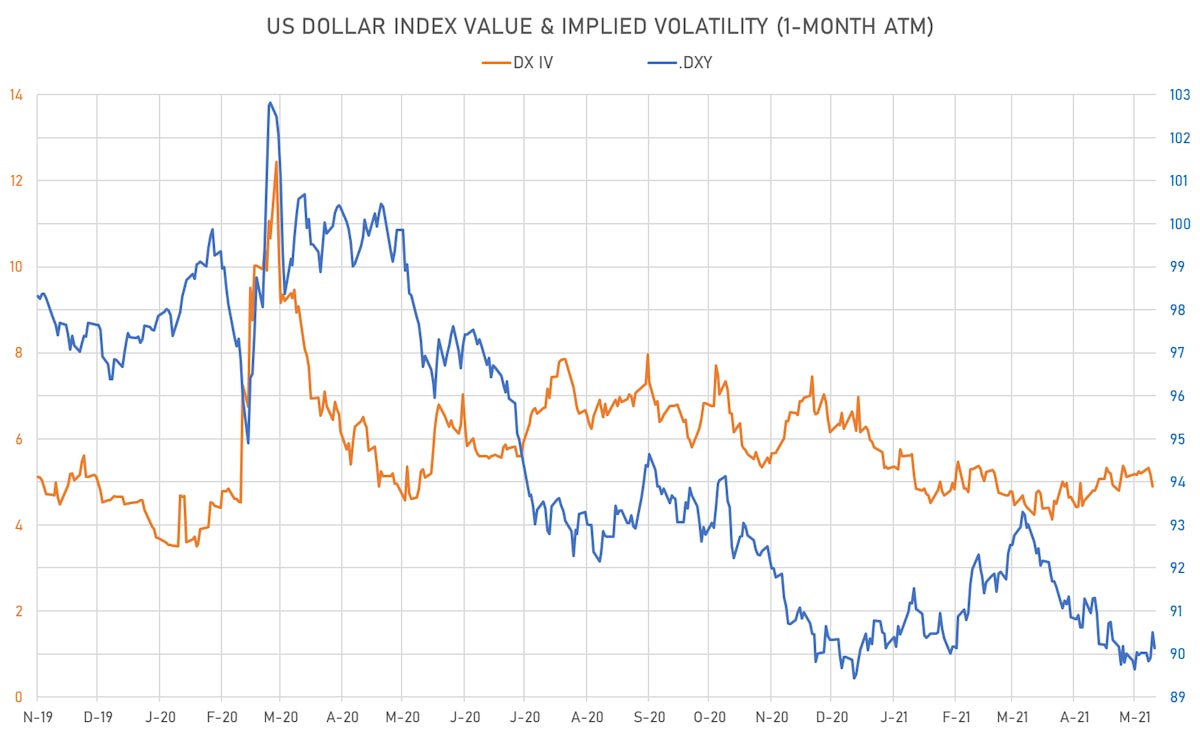

Dollar Index Falls On Weak US Macro Releases

Employment is the primary thing the Fed is watching at the moment and, judging by recent data, it will take a while longer before they start tapering, which should be strong headwind for further dollar progress in the short term

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

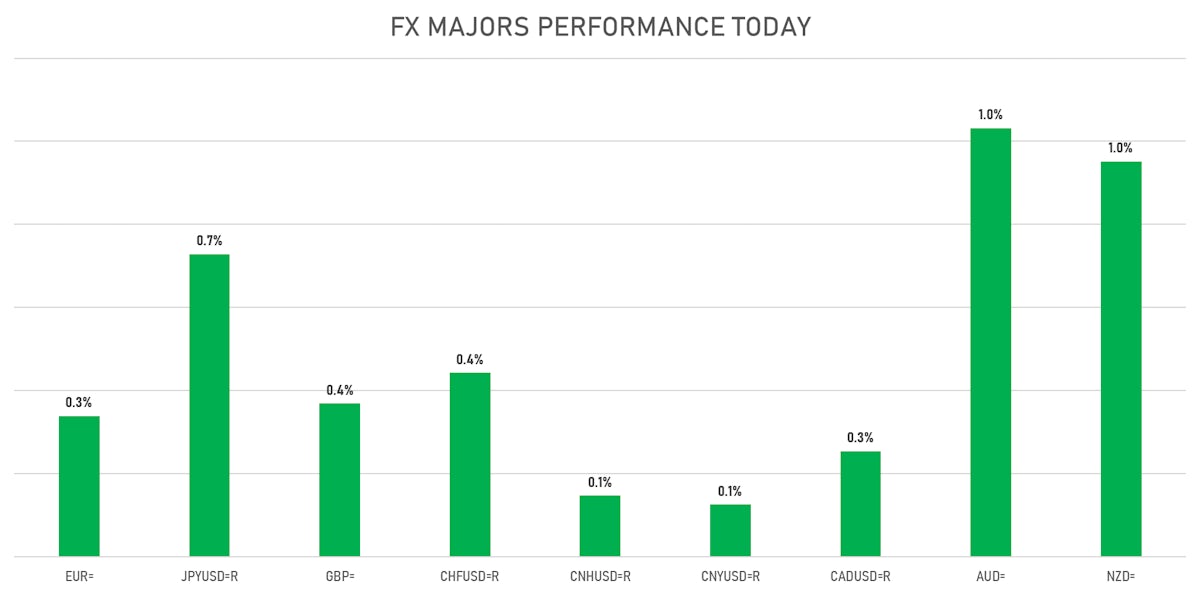

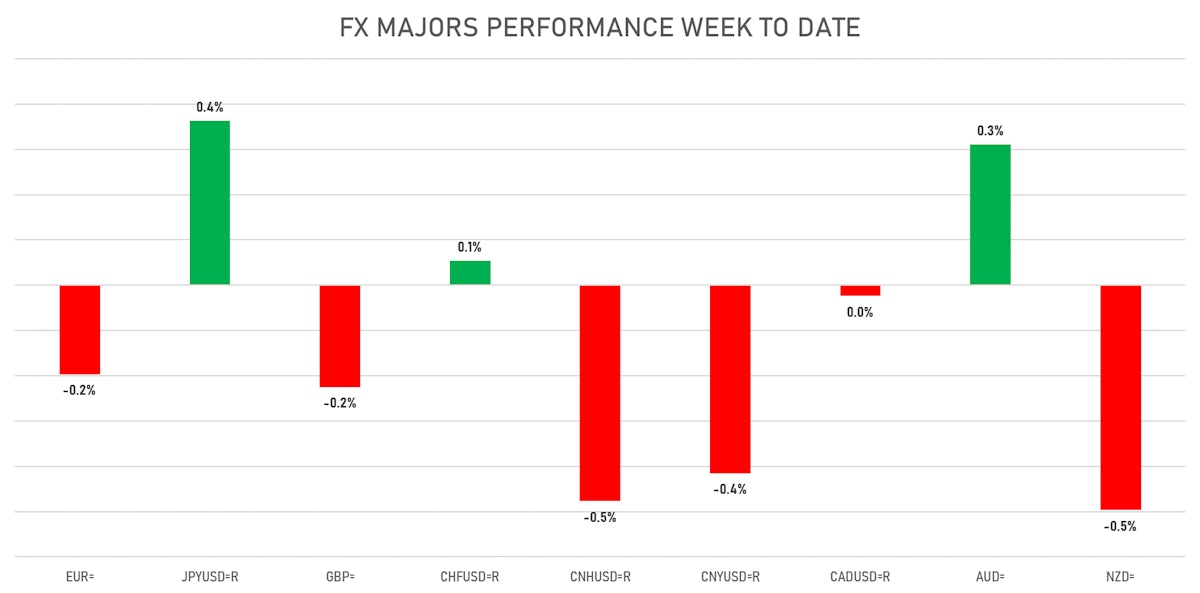

- The US Dollar Index is down -0.42% at 90.14 (YTD: +0.22%)

- Euro up 0.34% at 1.2165 (YTD: -0.4%)

- Yen up 0.73% at 109.49 (YTD: -5.7%)

- Onshore Yuan up 0.13% at 6.3945 (YTD: +2.1%)

- Swiss franc up 0.44% at 0.8992 (YTD: -1.6%)

- Sterling up 0.37% at 1.4155 (YTD: +3.5%)

- Canadian dollar up 0.25% at 1.2072 (YTD: +5.5%)

- Australian dollar up 1.03% at 0.7737 (YTD: +0.6%)

- NZ dollar up 0.95% at 0.7211 (YTD: +0.4%)

MACRO DATA RELEASES

- Brazil, PMI, Composite, Output, Total for May 2021 (Markit Economics) at 49.20

- Brazil, PMI, Services Sector, Business Activity for May 2021 (Markit Economics) at 48.30

- India, Policy Rates, Cash Reserve Ratio for 04 Jun (RBI) at 4.00, in line with consensus

- India, Policy Rates, Repo Rate for 04 Jun (RBI) at 4.00, in line with consensus

- India, Policy Rates, Reverse Repo Rate for 04 Jun (RBI) at 3.35, in line with consensus

- Philippines, CPI, Total, inflation rate, Change Y/Y for May 2021 (PSA) at 4.50, in line with consensus

- United States, Employment, Nonfarm payroll, total, Absolute change for May 2021 (BLS, U.S Dep. Of Lab) at 559.00, below consensus estimate of 650.00

- United States, Manufacturers New Orders, Total manufacturing, Change P/P for Apr 2021 (U.S. Census Bureau) at -0.60, below consensus estimate of -0.20

- United States, Unemployment, Rate for May 2021 (BLS, U.S Dep. Of Lab) at 5.80, below consensus estimate of 5.90

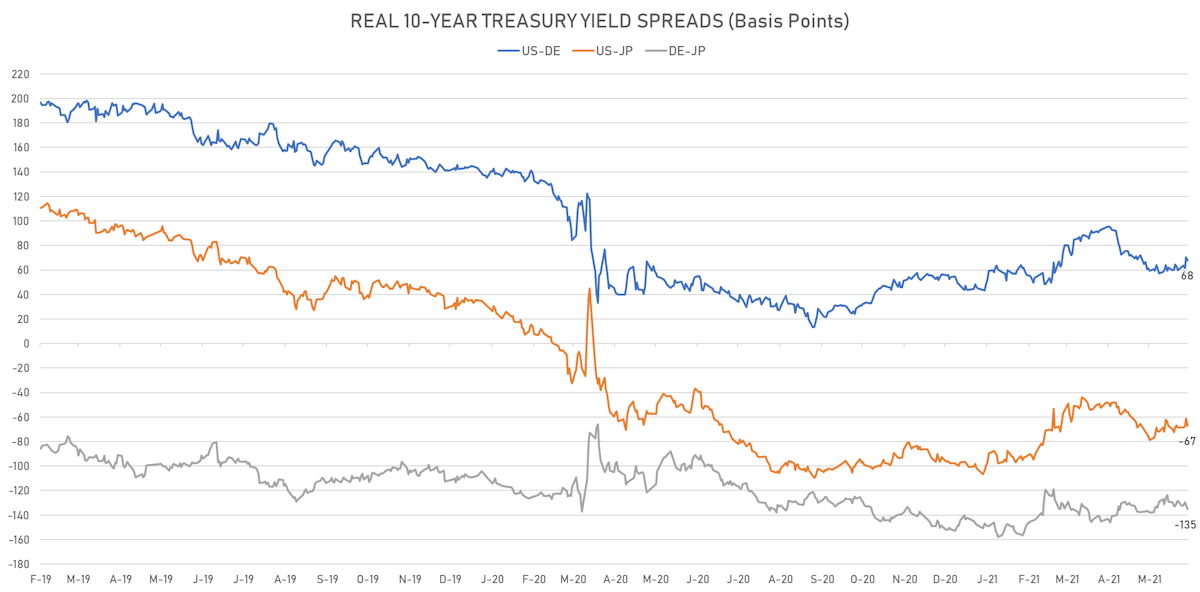

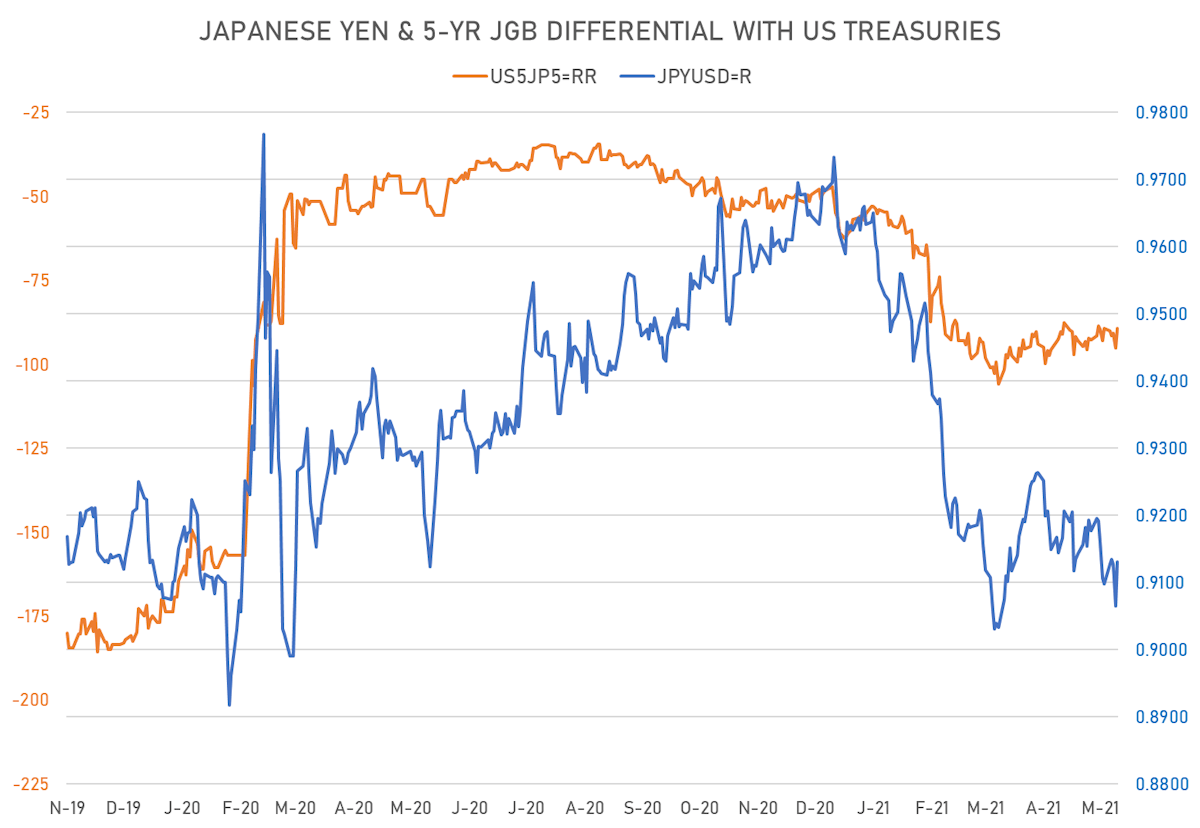

KEY GLOBAL RATES DIFFERENTIALS

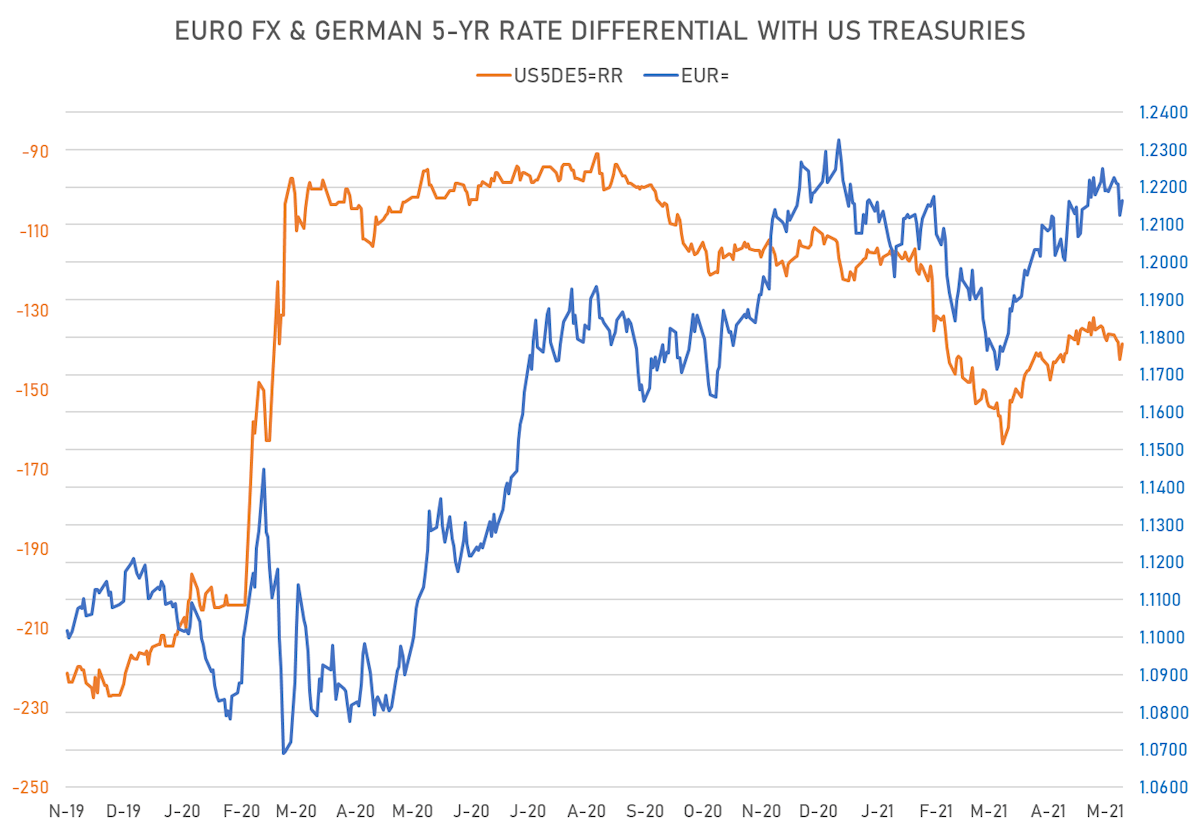

- 5Y German-US interest rates differential 4.0 bp tighter at -138.3 bp (YTD change: -27.3 bp), positive for the euro

- 5Y Japan-US interest rates differential 5.9 bp tighter at -89.2 bp (YTD change: -41.0 bp), positive for the yen

- 5Y China-US interest rates differential 7.6 bp tighter at 215.0 bp (YTD change: -42.2 bp), negative for the yuan

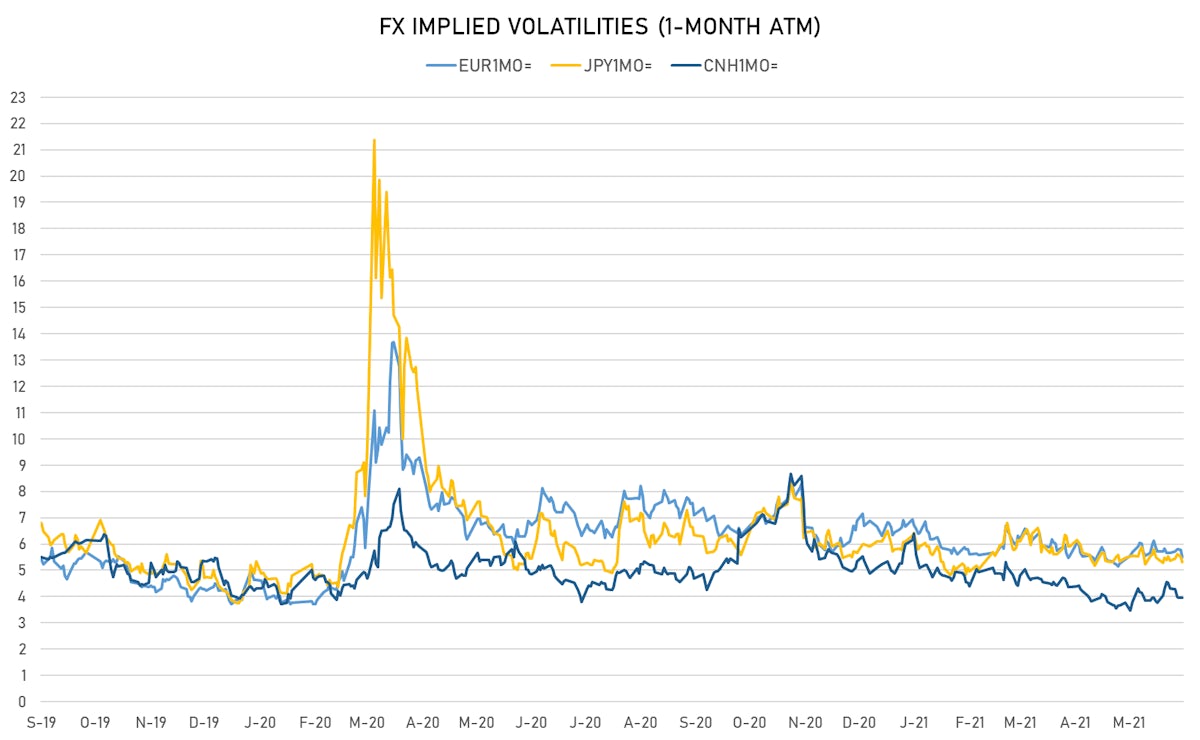

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 6.24, down -0.02 on the day (YTD: -0.93)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.50, down -0.3 on the day (YTD: -1.2)

- Japanese Yen 1M ATM IV currently at 5.30, down -0.2 on the day (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 3.94, unchanged (YTD: -2.0)

SPECULATIVE POSITIONING

- There is currently a divergence between the CFTC data and options markets: the CFTC commitment of traders report shows that US$ short interest is rising, but looking at options there has been a strong reduction in directional positioning.

WEEKLY CFTC DATA

- ALL: increase in net short US$ positioning

- G10: increase in net short US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

NOTABLE MOVES IN SOVEREIGN CDS

- Indonesia (rated BBB): up 0.8 basis points to 75 bp (1Y range: 66-132bp)

- Pakistan (rated B-): down 3.0 basis points to 385 bp (1Y range: 362-512bp)

- Panama (rated BBB-): down 0.5 basis points to 68 bp (1Y range: 44-112bp)

- Saudi Arabia (rated A): down 0.5 basis points to 58 bp (1Y range: 53-106bp)

- Turkey (rated BB-): down 4.0 basis points to 403 bp (1Y range: 282-597bp)

- Brazil (rated BB-): down 1.7 basis points to 162 bp (1Y range: 141-268bp)

- Government of Chile (rated A-): down 0.8 basis points to 65 bp (1Y range: 43-87bp)

- Colombia (rated BBB-): down 2.1 basis points to 135 bp (1Y range: 83-168bp)

- Peru (rated BBB+): down 1.6 basis points to 89 bp (1Y range: 52-97bp)

- Russia (rated BBB): down 1.9 basis points to 92 bp (1Y range: 72-129bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 9.5% (YTD: +38.5%)

- Cape Verde Escudo up 2.8% (YTD: +2.8%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Swaziland Lilageni up 1.5% (YTD: +9.4%)

- Lesotho Loti up 1.5% (YTD: +9.4%)

- Colombian Peso up 1.5% (YTD: -5.0%)

- South Africa Rand up 1.4% (YTD: +9.3%)

- Bolivian Boliviano down 1.6% (YTD: -1.6%)

- Nicaragua Cordoba down 2.4% (YTD: -2.4%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 38.5%

- Mozambique metical up 20.9%

- Namibian Dollar up 9.4%

- Ethiopian Birr down 10.2%

- Argentine Peso down 11.3%

- Turkish Lira down 14.3%

- Haiti Gourde down 21.6%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 64.4%

- Sudanese Pound down 87.1%