FX

Major FX Crosses Floating In A Range Until More Clarity Emerges From The Fed And ECB Regarding Rates

In exotic currencies, the Seychelles rupee was up 7.6% today and is the largest gainer this year (+36.1% YTD), as the country will be a big beneficiary of the return of tourism post Covid

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

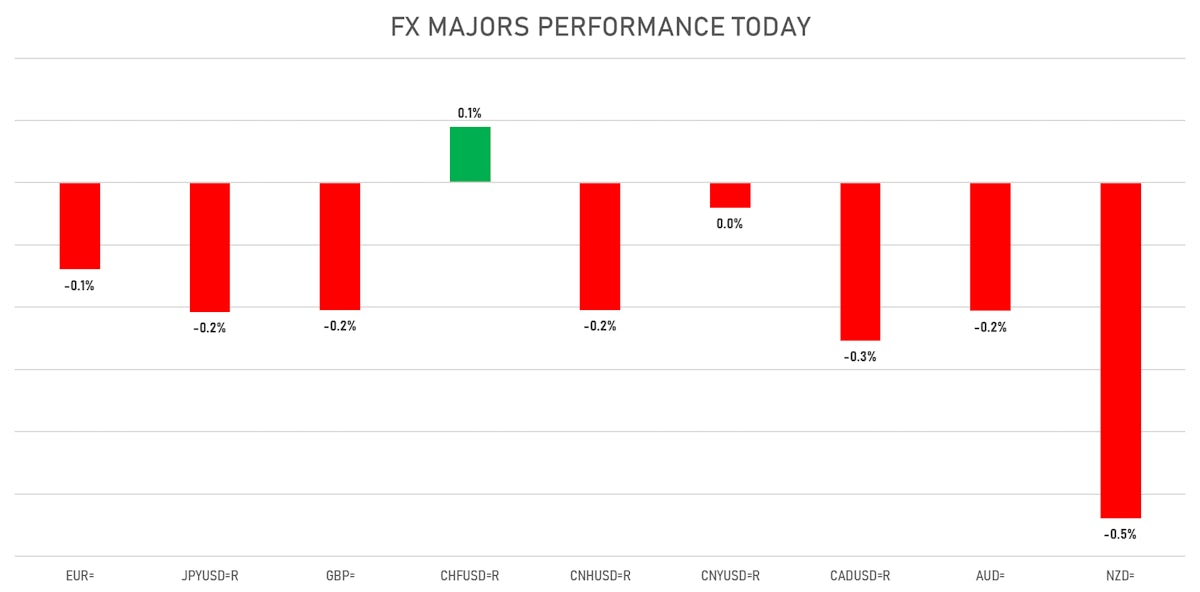

- The US Dollar Index is up 0.14% at 90.08 (YTD: +0.15%)

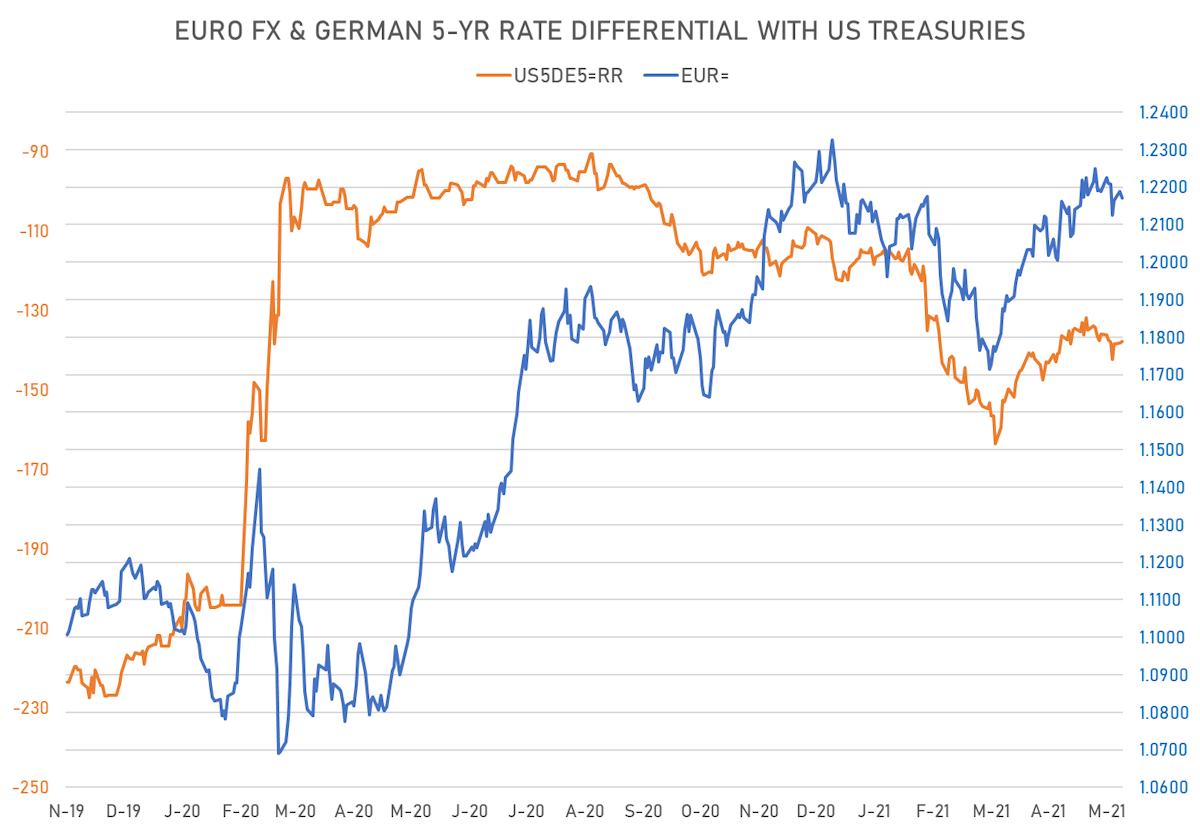

- Euro down 0.14% at 1.2172 (YTD: -0.3%)

- Yen down 0.21% at 109.48 (YTD: -5.7%)

- Onshore Yuan down 0.04% at 6.4000 (YTD: +2.0%)

- Swiss franc up 0.09% at 0.8969 (YTD: -1.3%)

- Sterling down 0.20% at 1.4149 (YTD: +3.5%)

- Canadian dollar down 0.25% at 1.2113 (YTD: +5.1%)

- Australian dollar down 0.21% at 0.7737 (YTD: +0.6%)

- NZ dollar down 0.54% at 0.7191 (YTD: +0.1%)

MACRO DATA RELEASES

- Brazil, Retail Sales, Change Y/Y for Apr 2021 (IBGE, Brazil) at 23.80, above consensus estimate of 19.80

- Canada, Trade Balance, Total, fob for Apr 2021 (CANSIM, Canada) at 0.59, above consensus estimate of -0.70

- Chile, Policy Rates, Monetary Policy Interest Rate for Jun 2021 (Central Bank, Chile) at 0.50%

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q1 2021 (Eurostat) at -0.30, above consensus estimate of -0.60

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q1 2021 (Eurostat) at -1.30, above consensus estimate of -1.80

- Germany, Production, Total industry including construction, Change P/P for Apr 2021 (Destatis) at -1.00, below consensus estimate of 0.50

- Germany, ZEW, Current Economic Situation, Germany, balance for Jun 2021 (ZEW, Germany) at -9.10, above consensus estimate of -27.80

- Germany, ZEW, Economic Expectations, Germany, balance for Jun 2021 (ZEW, Germany) at 79.80, below consensus estimate of 86.00

- New Zealand, Reserve Assets, Current Prices for May 2021 (RBNZ) at 18,795.00

- South Africa, GDP, Total, at market prices, Change Y/Y for Q1 2021 (Statistics, SA) at -3.20, below consensus estimate of -3.20

- South Africa, Value Added, Economic Activity, GDP at market prices, annualized, Change Q/Q for Q1 2021 (Statistics, SA) at 4.60, above consensus estimate of 2.50

- Taiwan, CPI, Change Y/Y, Price Index for May 2021 (DGBAS, Taiwan) at 2.48, above consensus estimate of 2.20

- United States, Trade Balance, Total, Goods and services for Apr 2021 (U.S. Census Bureau) at -68.90, above consensus estimate of -69.00

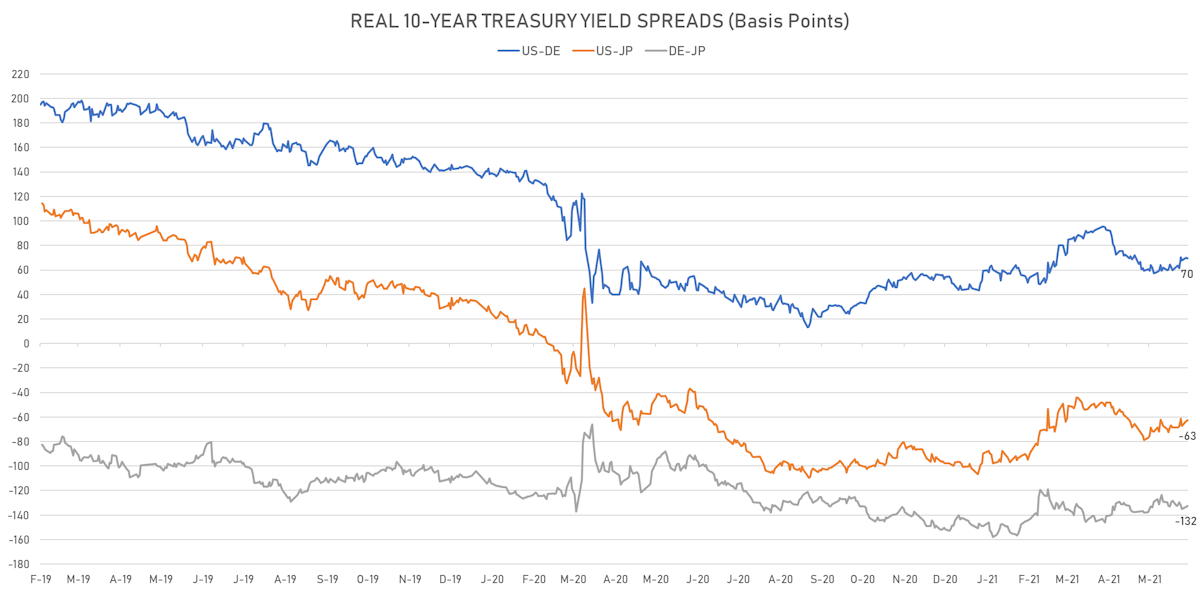

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 0.6 bp tighter at -137.7 bp (YTD change: -26.6 bp), positive for the euro

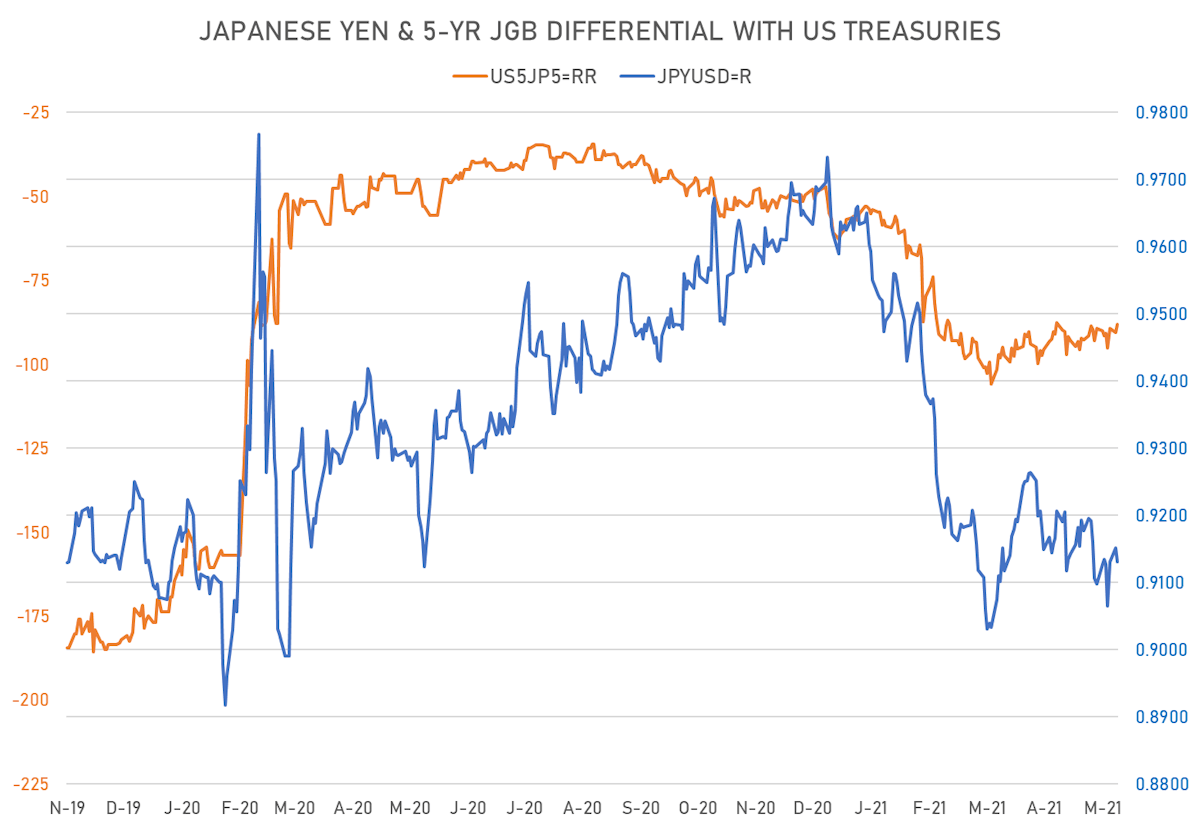

- 5Y Japan-US interest rates differential 2.6 bp tighter at -88.0 bp (YTD change: -39.7 bp), positive for the yen

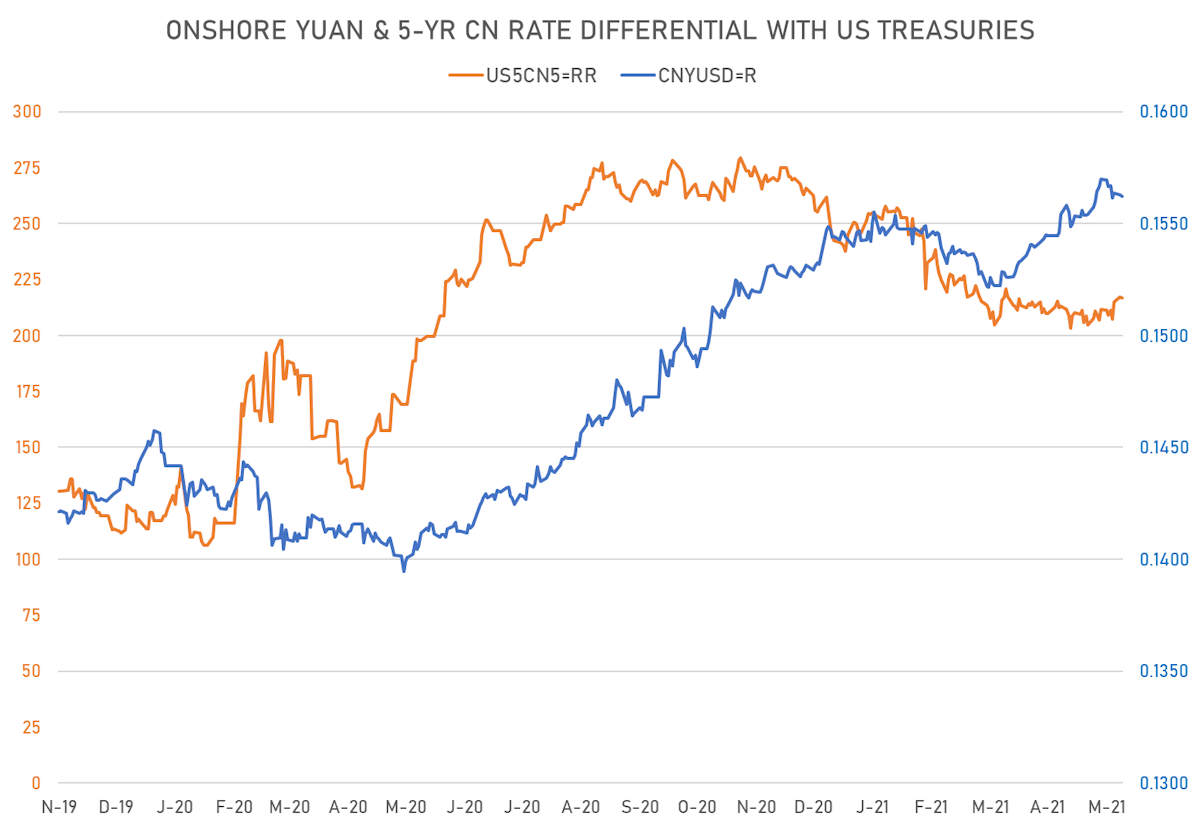

- 5Y China-US interest rates differential 0.5 bp wider at 216.7 bp (YTD change: -40.4 bp), positive for the yuan

VOLATILITIES

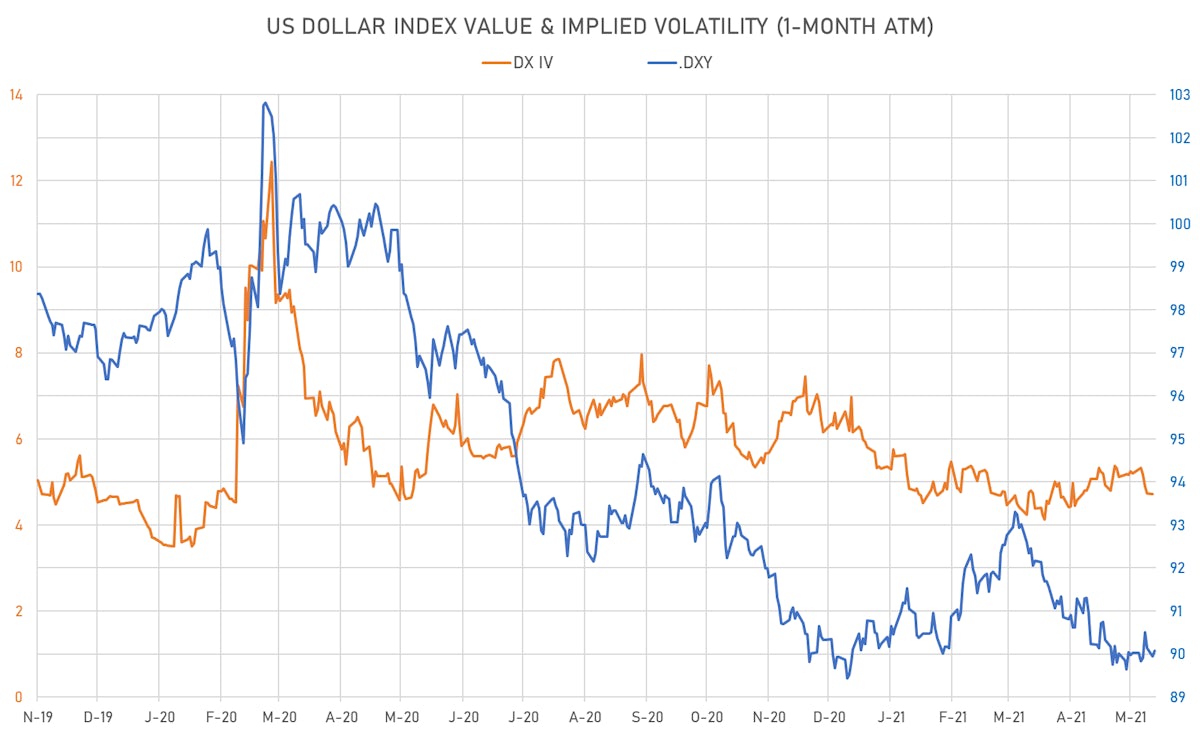

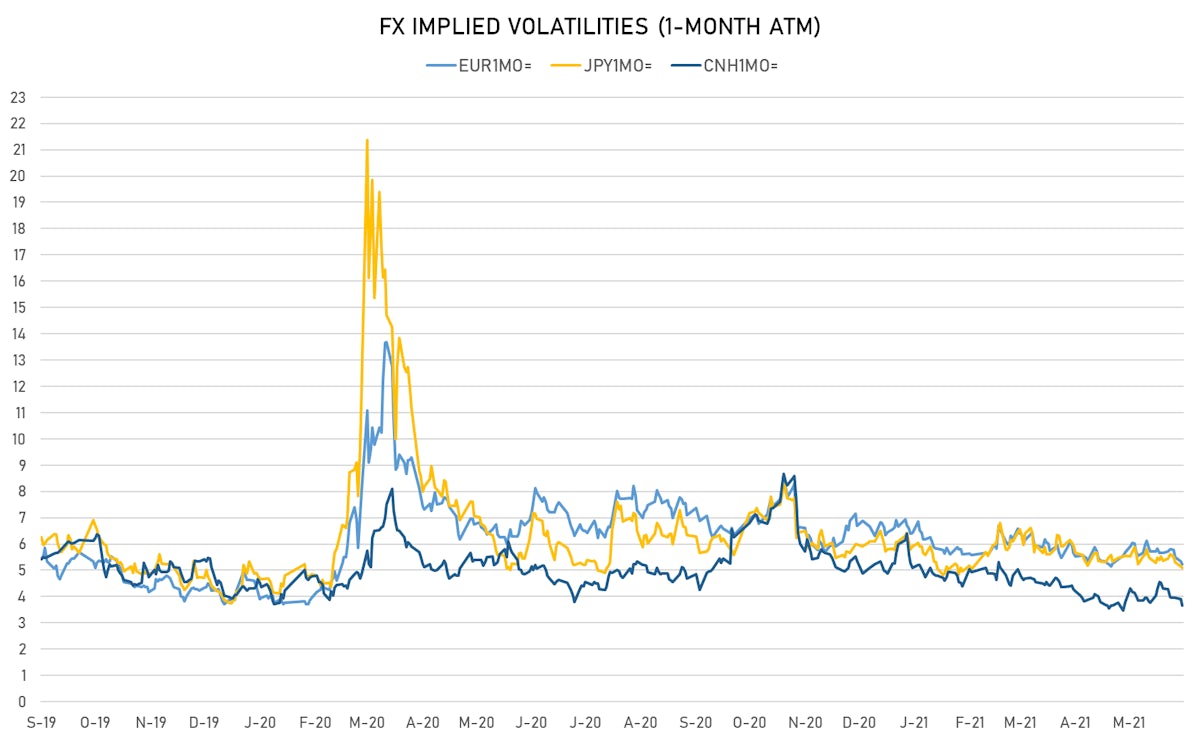

- Deutsche Bank USD Currency Volatility Index currently at 5.88, down -0.08 on the day (YTD: -1.29)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.24, down -0.1 on the day (YTD: -1.4)

- Japanese Yen 1M ATM IV unchanged at 5.10 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.65, down -0.3 on the day (YTD: -2.3)

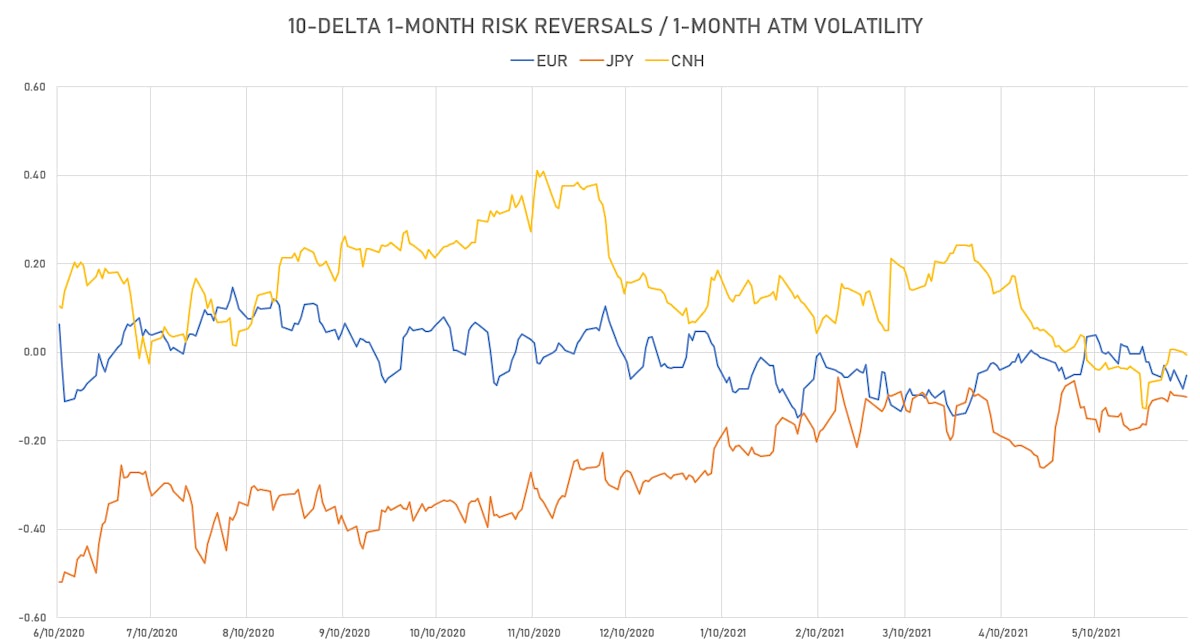

- Very little change in option positioning: risk reversals close to zero, pointing to the absence of a favored speculative direction

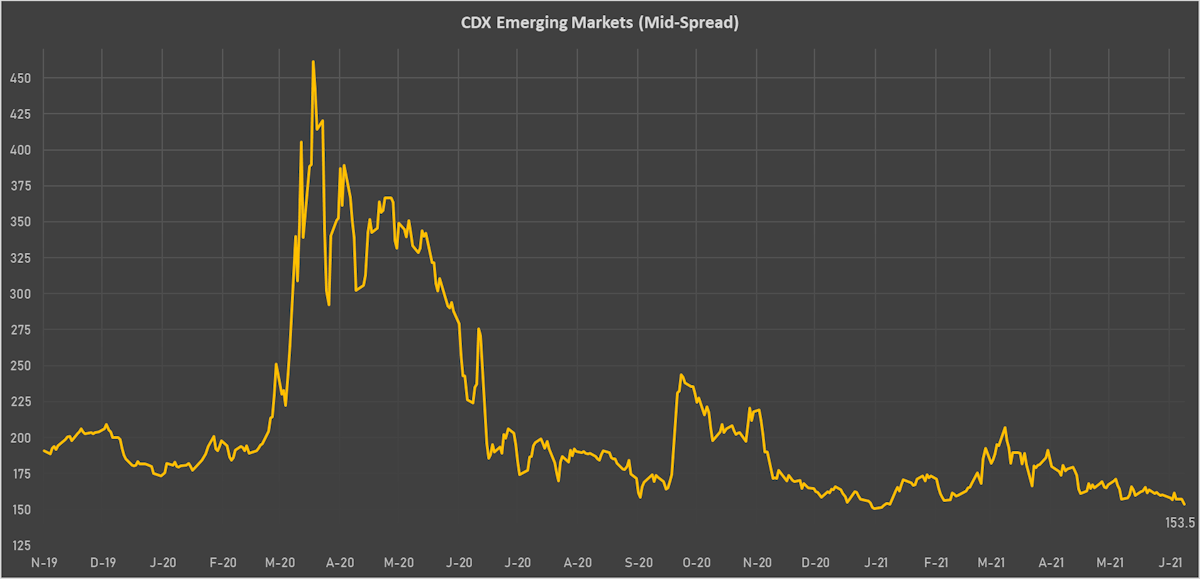

NOTABLE MOVES IN SOVEREIGN CDS

- Slovenia (rated A): down 0.5 basis points to 51 bp (1Y range: 47-55bp)

- Argentina (rated CCC): down 17.8 basis points to 1,789 bp (1Y range: 1,049-6,788bp)

- Turkey (rated BB-): down 5.0 basis points to 392 bp (1Y range: 282-597bp)

- Saudi Arabia (rated A): down 0.8 basis points to 57 bp (1Y range: 53-105bp)

- Panama (rated BBB-): down 1.1 basis points to 67 bp (1Y range: 44-112bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 59 bp (1Y range: 50-62bp)

- Government of Chile (rated A-): down 1.1 basis points to 63 bp (1Y range: 43-87bp)

- Colombia (rated BBB-): down 2.5 basis points to 131 bp (1Y range: 83-168bp)

- Peru (rated BBB+): down 3.1 basis points to 94 bp (1Y range: 52-98bp)

- Oman (rated BB-): down 11.5 basis points to 236 bp (1Y range: 228-518bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 7.6% (YTD: +36.1%)

- Cape Verde Escudo up 3.8% (YTD: +3.8%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Afghani up 1.4% (YTD: -1.6%)

- Rwanda Franc up 1.3% (YTD: +0.3%)

- Nicaragua Cordoba down 2.5% (YTD: -2.5%)

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

- Venezuela Bolivar down 3.1% (YTD: -65.6%)