FX

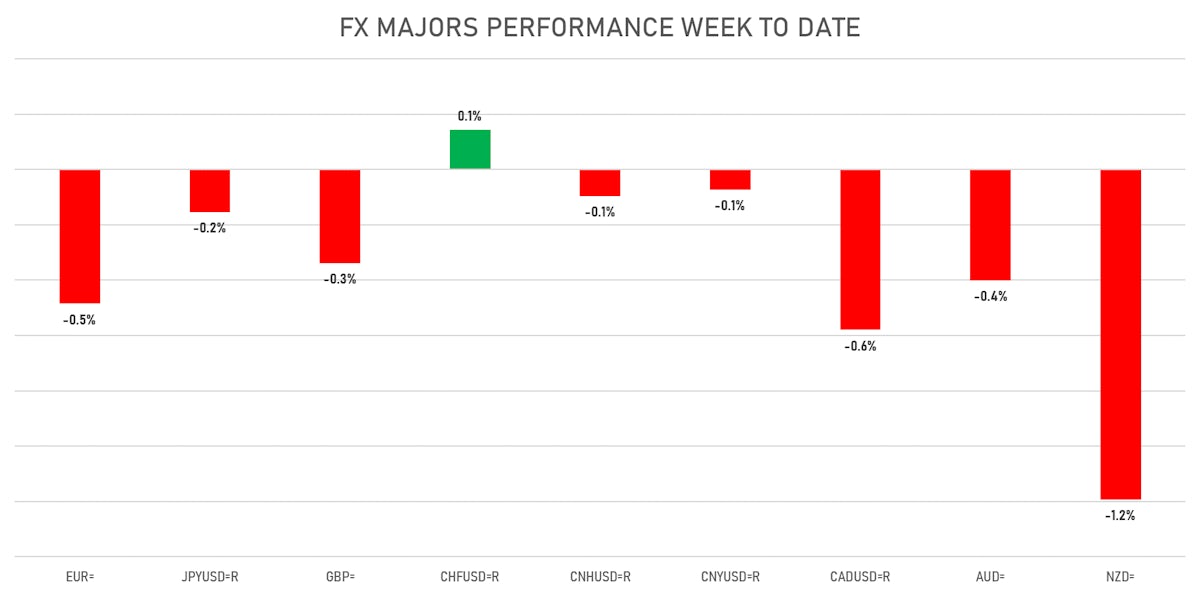

The Dollar Ends The Week With Gains Against Most Major Currencies

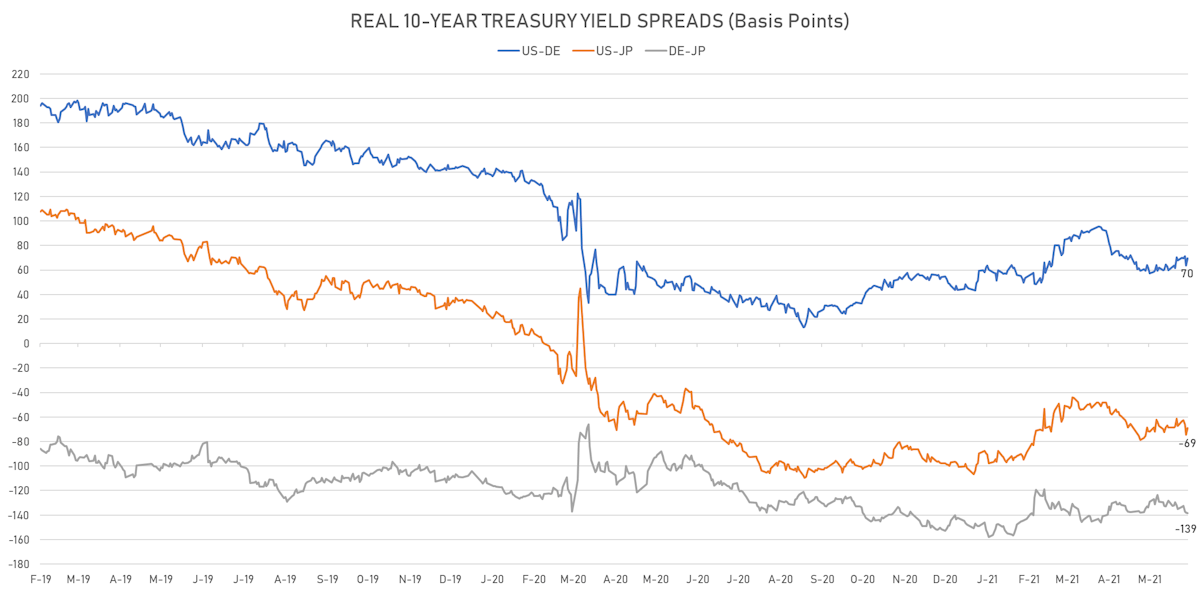

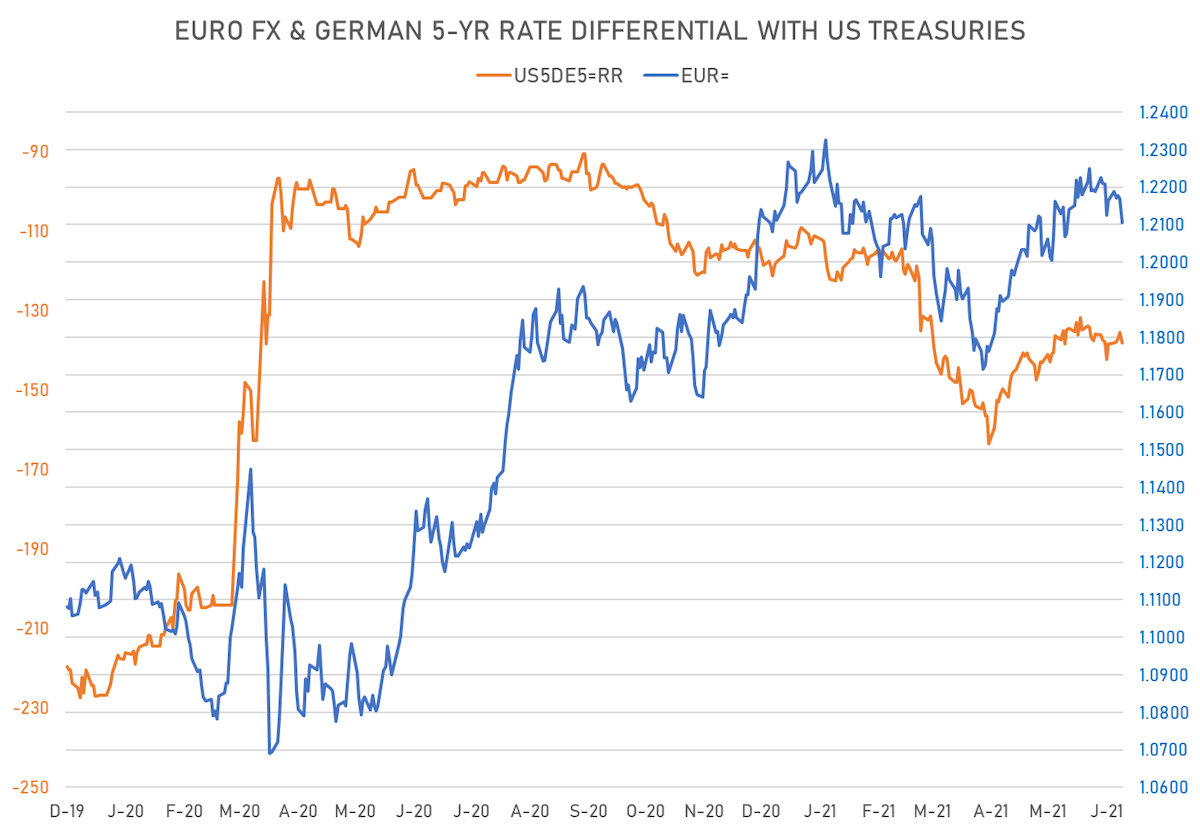

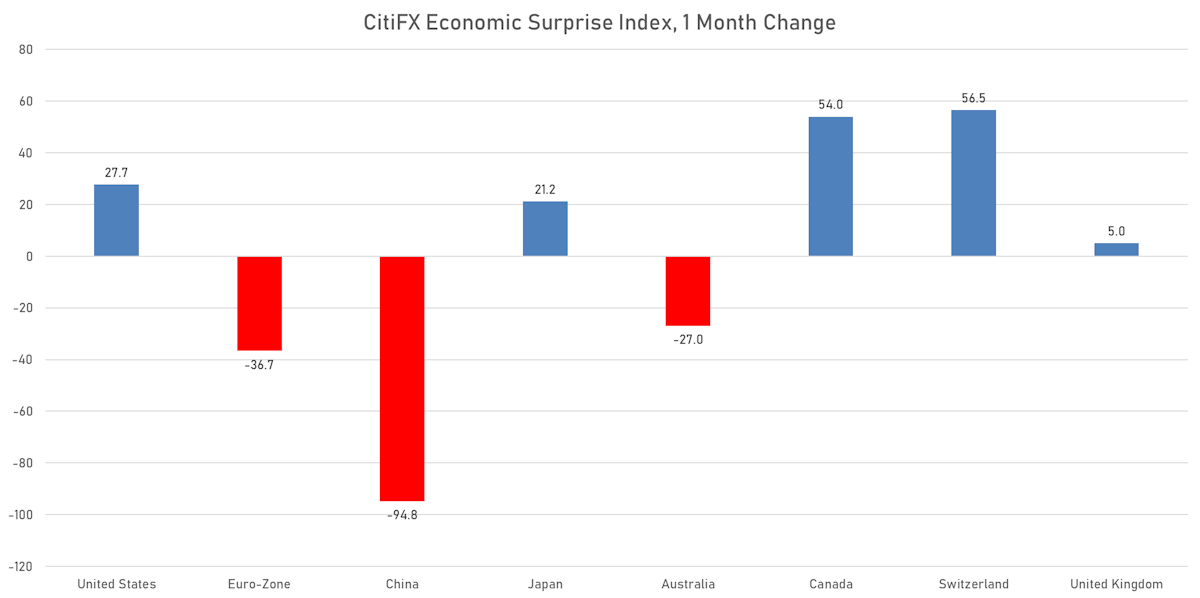

Real rates differentials have been favorable to the dollar, with US macro momentum picking up again, while the reverse happened in Europe with a sharp rise in expectations over the last couple of months leading to negative surprises

Published ET

CitiFX Economic Surprises Indices | Sources: ϕpost, Refinitiv data

QUICK DAILY SUMMARY

- The US Dollar Index is up 0.53% at 90.56 (YTD: +0.69%)

- Euro down 0.59% at 1.2106 (YTD: -0.9%)

- Yen down 0.04% at 109.65 (YTD: -5.8%)

- Onshore Yuan down 0.19% at 6.3967 (YTD: +2.0%)

- Swiss franc down 0.26% at 0.8979 (YTD: -1.4%)

- Sterling down 0.08% at 1.4106 (YTD: +3.2%)

- Canadian dollar down 0.36% at 1.2153 (YTD: +4.8%)

- Australian dollar down 0.30% at 0.7706 (YTD: +0.2%)

- NZ dollar down 0.75% at 0.7125 (YTD: -0.8%)

MACRO DATA RELEASES

- Russia, Central bank key rate for Jun 2021 (Central Bank, Russia) at 5.50% (up 50bp), in line with consensus estimate

- United Kingdom, GDP Estimated YY, Change Y/Y for Apr 2021 (ONS, United Kingdom) at 27.60, in line with consensus estimate

- United Kingdom, GDP Estimated, Change M/M for Apr 2021 (ONS, United Kingdom) at 2.30, above consensus estimate of 2.20

- United Kingdom, GDP estimate 3m/3m for Apr 2021 (ONS, United Kingdom) at 1.50, in line with consensus estimate

- United Kingdom, Production, Manufacturing, Change P/P for Apr 2021 (ONS, United Kingdom) at -0.30, below consensus estimate of 1.50

- United States, University of Michigan, Total-prelim, Volume Index for Jun 2021 (UMICH, Survey) at 86.40, above consensus estimate of 84.00

WEEKLY CFTC POSITIONING DATA

- ALL: increase in net short US$ positioning

- G10: increase in net short US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net short US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 2.7 bp wider at -138.2 bp (YTD change: -27.1 bp), negative for the euro

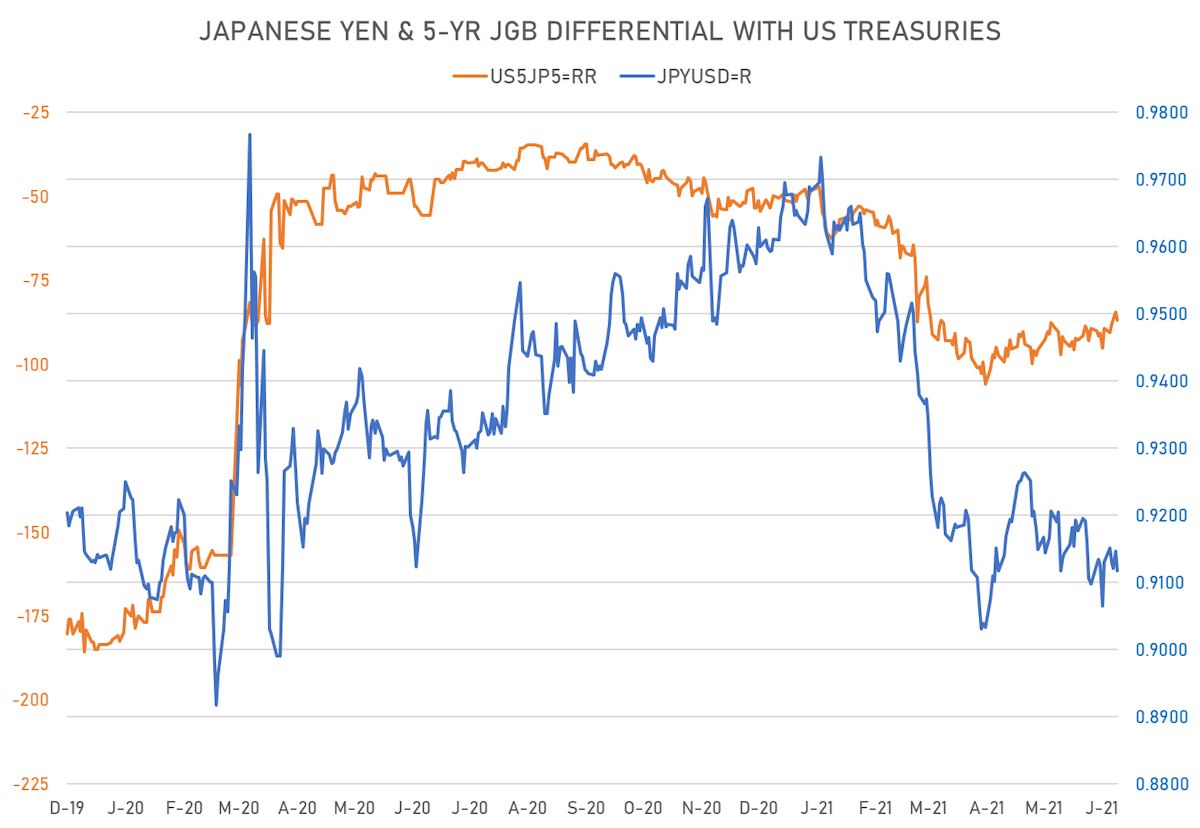

- 5Y Japan-US interest rates differential 2.6 bp wider at -87.0 bp (YTD change: -38.7 bp), negative for the yen

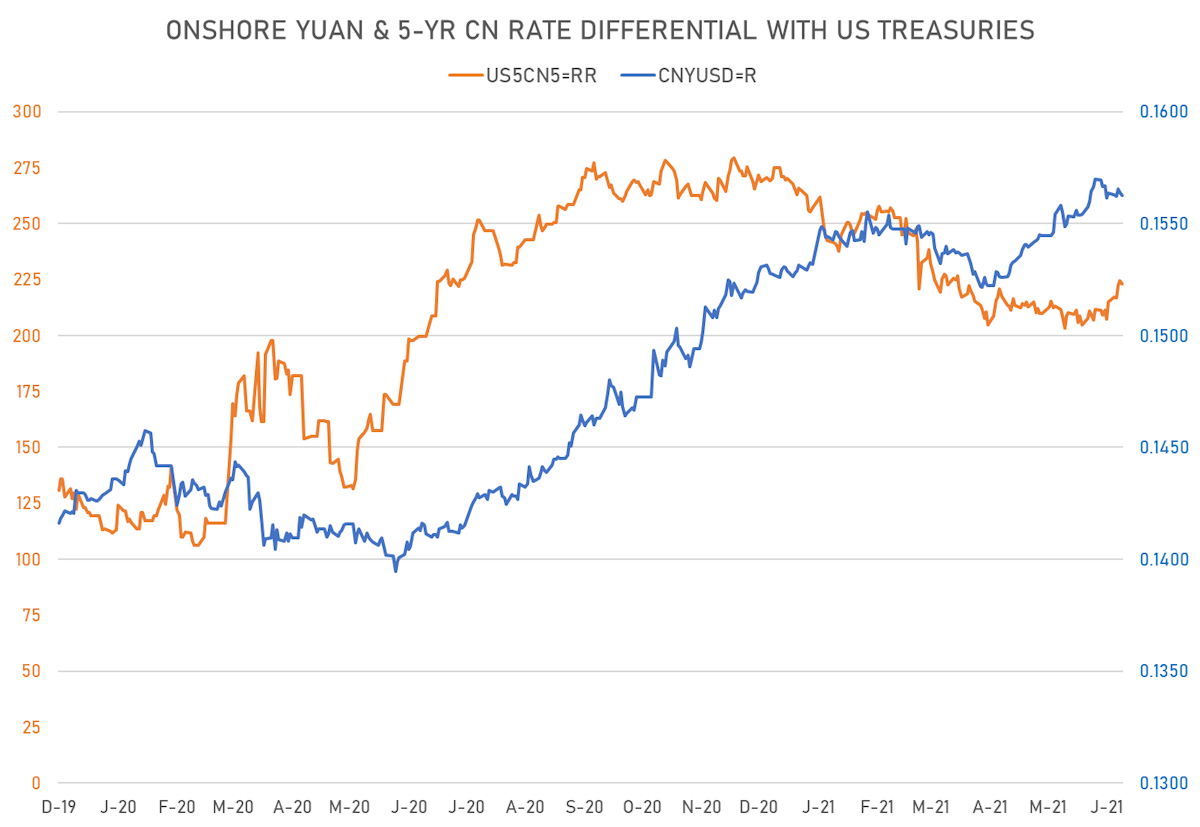

- 5Y China-US interest rates differential 1.4 bp wider at 223.0 bp (YTD change: -34.1 bp), positive for the yuan

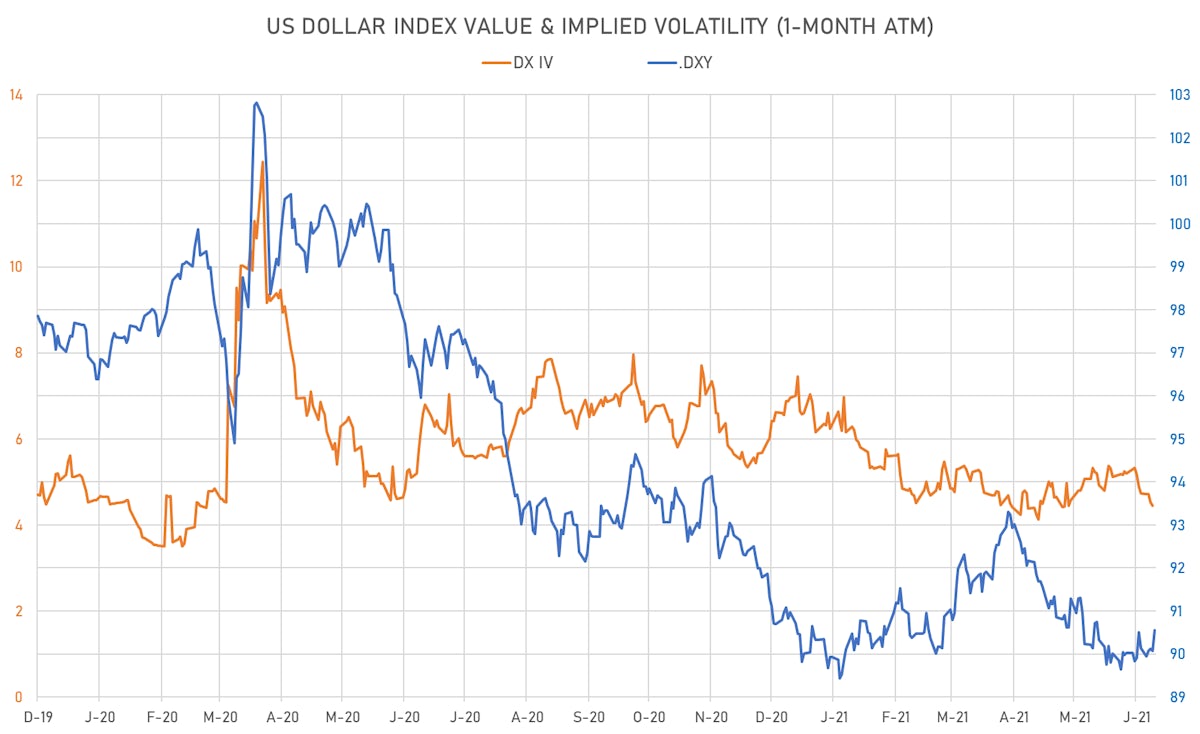

VOLATILITIES

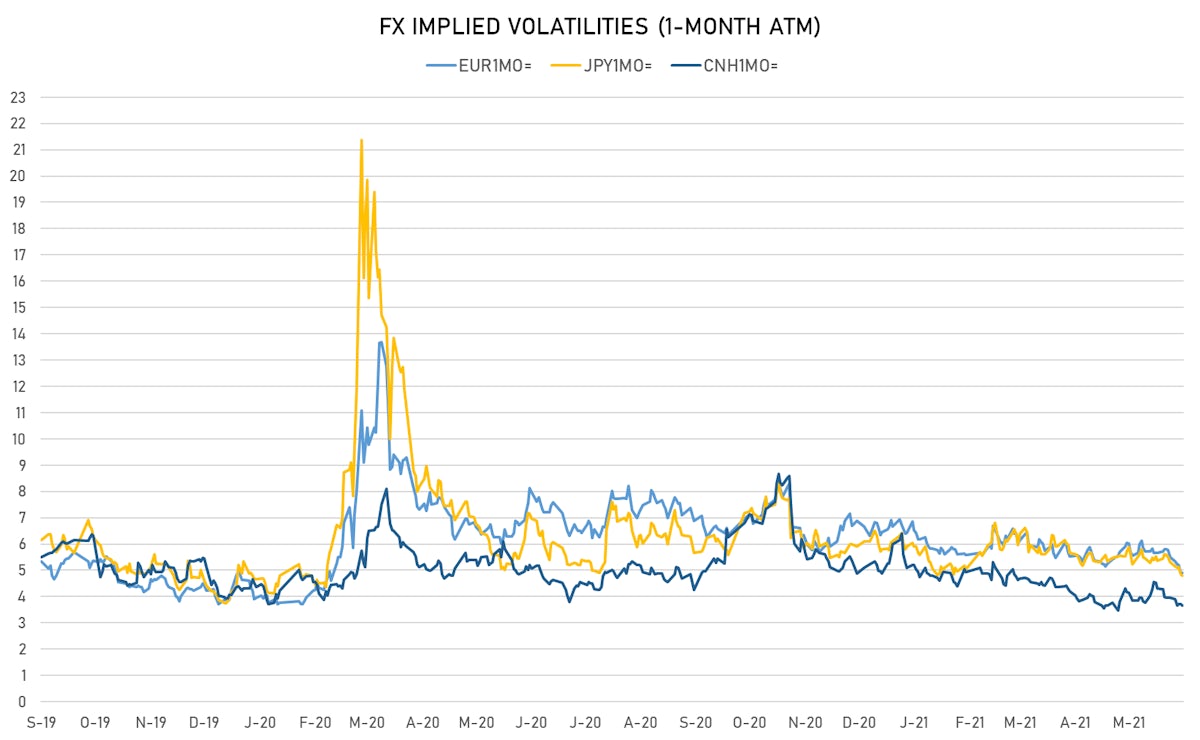

- Deutsche Bank USD Currency Volatility Index currently at 5.63, down -0.19 on the day (YTD: -1.54)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.90, unchanged (YTD: -1.8)

- Japanese Yen 1M ATM IV currently at 4.80, unchanged (YTD: -1.3)

- Offshore Yuan 1M ATM IV currently at 3.65, down -0.1 on the day (YTD: -2.3)

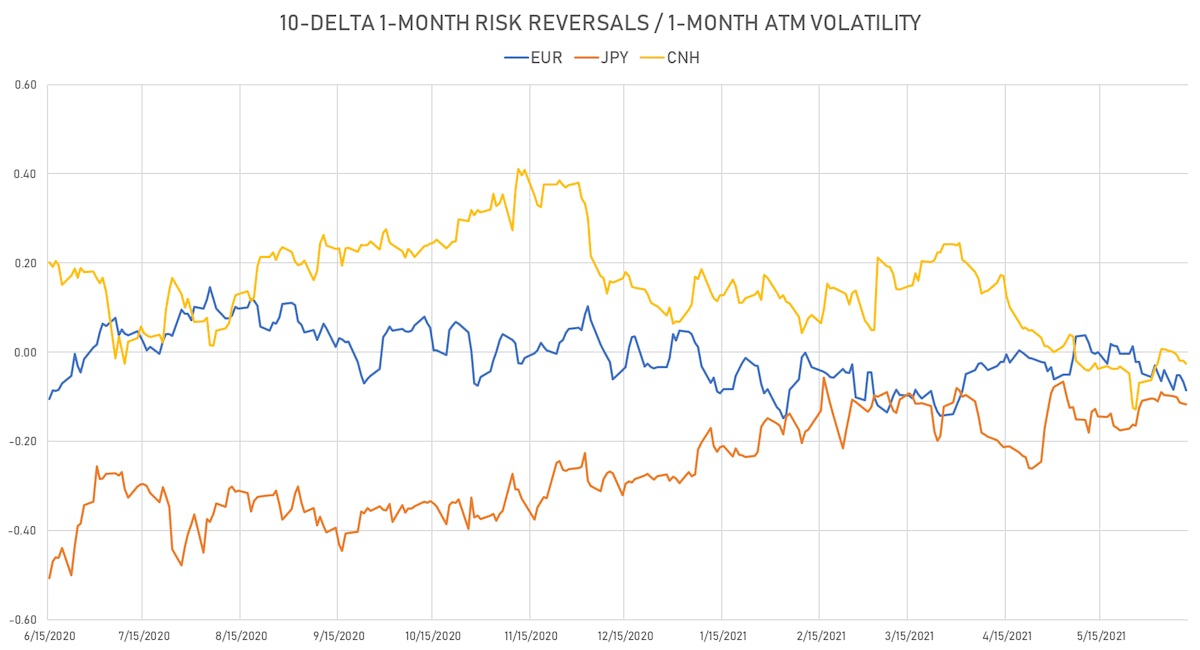

- Risk reversals point to a light accumulation of negative positioning on the EUR since the beginning of June

NOTABLE MOVES IN SOVEREIGN CDS

- Government of Chile (rated A-): down 0.6 basis points to 63 bp (1Y range: 43-87bp)

- Russia (rated BBB): down 0.8 basis points to 84 bp (1Y range: 72-129bp)

- Colombia (rated BBB-): down 1.5 basis points to 124 bp (1Y range: 83-168bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 58 bp (1Y range: 50-62bp)

- Saudi Arabia (rated A): down 1.0 basis points to 55 bp (1Y range: 53-105bp)

- Bahrain (rated B+): down 3.9 basis points to 197 bp (1Y range: 172-347bp)

- Peru (rated BBB+): down 1.9 basis points to 89 bp (1Y range: 52-98bp)

- Indonesia (rated BBB): down 2.0 basis points to 72 bp (1Y range: 66-132bp)

- Oman (rated BB-): down 6.7 basis points to 233 bp (1Y range: 228-491bp)

- Morocco (rated BB+): down 5.2 basis points to 86 bp (1Y range: 86-127bp)

LARGEST FX MOVES TODAY

- Nicaragua Cordoba up 2.5% (YTD: 0.0%)

- Turkish Lira up 2.5% (YTD: -11.3%)

- Haiti Gourde up 2.2% (YTD: -19.7%)

- Ethiopian Birr down 1.4% (YTD: -10.2%)

- North Macedonian denar down 1.5% (YTD: -1.5%)

- Rwanda Franc down 1.7% (YTD: -1.5%)

- Colombian Peso down 1.8% (YTD: -6.2%)

- Qatari Riyal down 2.1% (YTD: -2.1%)

- Cape Verde Escudo down 3.6% (YTD: 0.0%)

- Seychelles rupee down 8.2% (YTD: +26.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 26.5%

- Mozambique metical up 19.6%

- Turkish Lira down 11.3%

- Argentine Peso down 11.6%

- Haiti Gourde down 19.7%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 64.4%

- Libyan Dinar down 70.0%

- Sudanese Pound down 87.2%