FX

US Dollar Index Edges Down, Good Macro Data Lifts The Euro

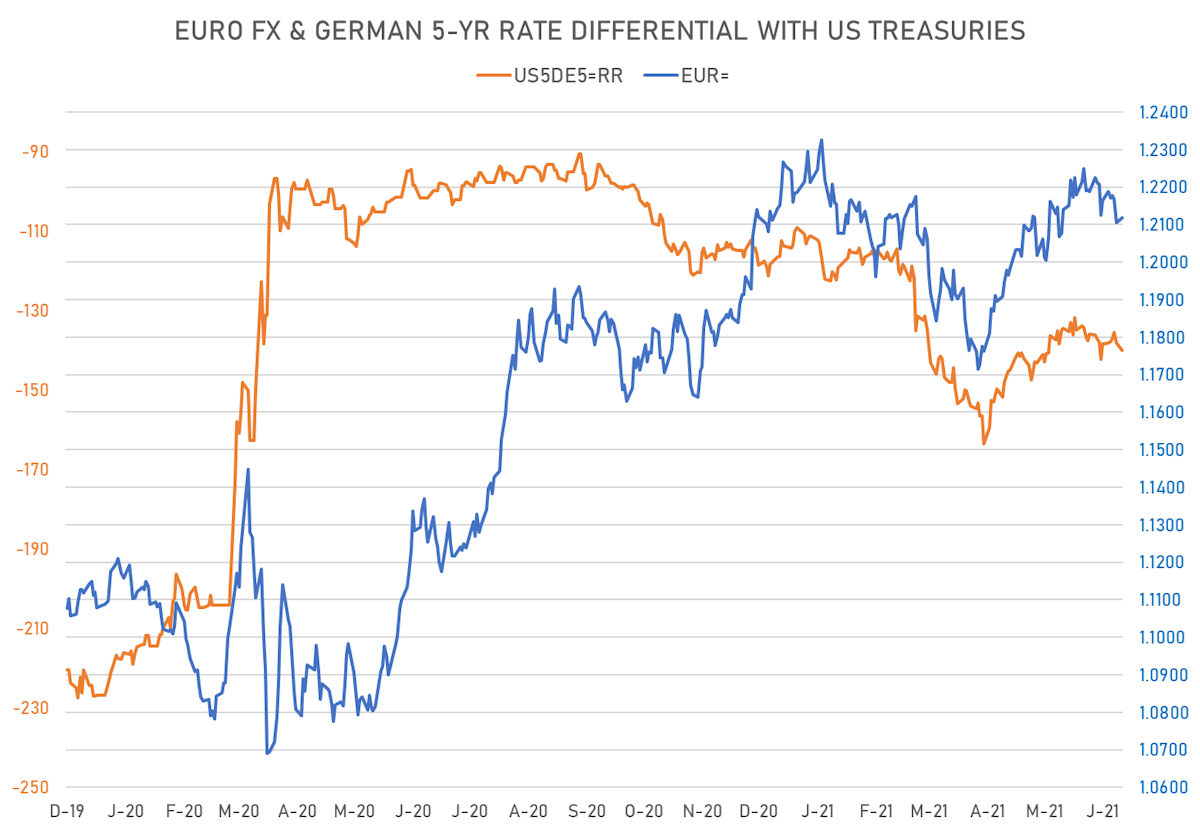

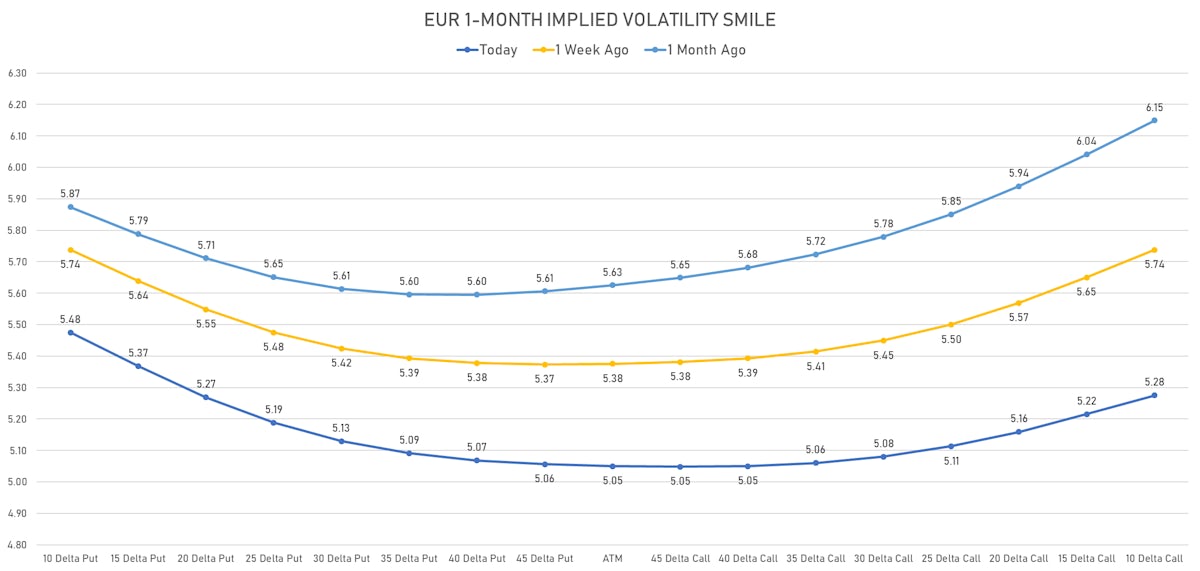

EUR implied volatility is very low and now skewed to the downside (puts implied volatility higher than calls)

Published ET

Source: Credit Suisse Derivatives Strategy

QUICK SUMMARY

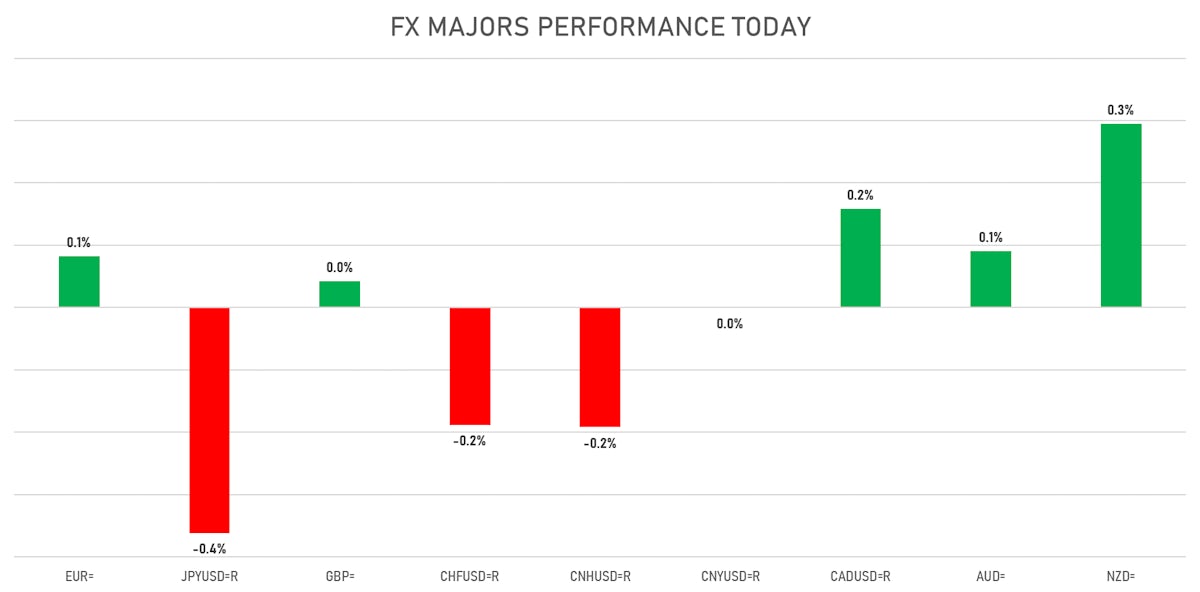

- The US Dollar Index is down -0.04% at 90.52 (YTD: +0.65%)

- Euro up 0.08% at 1.2116 (YTD: -0.8%)

- Yen down 0.36% at 110.06 (YTD: -6.2%)

- Onshore Yuan down 0.00% at 6.3967 (YTD: +2.0%)

- Swiss franc down 0.19% at 0.8992 (YTD: -1.6%)

- Sterling up 0.04% at 1.4112 (YTD: +3.2%)

- Canadian dollar up 0.16% at 1.2139 (YTD: +4.9%)

- Australian dollar up 0.09% at 0.7713 (YTD: +0.2%)

- NZ dollar up 0.29% at 0.7146 (YTD: -0.5%)

MACRO DATA RELEASES

- Brazil, Central Bank Economic Activity Index (IBC-Br), Change P/P for Apr 2021 (Central Bank, Brazil) at 0.44, below consensus estimate of 0.55

- Canada, Manufacturers Shipments, Change P/P for Apr 2021 (CANSIM, Canada) at -2.10, below consensus estimate of -1.10

- Czech Republic, Current Account, Balance, Current Prices for Apr 2021 (Czech National Bank) at 37.31, above consensus estimate of 20.50

- Euro Zone, Production, Total, excluding construction (EA19), Change P/P for Apr 2021 (Eurostat) at 0.80, above consensus estimate of 0.40

- Euro Zone, Production, Total, excluding construction (EA19), Change Y/Y for Apr 2021 (Eurostat) at 39.30, above consensus estimate of 37.40

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for May 2021 (MOSPI, India) at 6.30, above consensus estimate of 5.30

- India, Wholesale Prices, Change Y/Y, Price Index for May 2021 (Econ Adviser, India) at 12.94, below consensus estimate of 13.07

- Japanese industrial production at 2.9%, above consensus estimate of 2.5%

- Japanese capacity utilization growth comes in at 1.1% (vs 5.6% prior)

- Poland, Current Account, Balance, Current Prices for Apr 2021 (Central Bank, Poland) at 1,740.00, above consensus estimate of 1,203.00

- Portugal, CPI, All items, national, Change P/P, Price Index for May 2021 (INE, Portugal) at 0.20

- Portugal, CPI, All items, national, Change Y/Y, Price Index for May 2021 (INE, Portugal) at 1.20

- South Korea, Exports, Total, FOB(Free On Board), Change Y/Y for May 2021 (KOR Customs Service) at 45.60

- South Korea, Imports, Total, CIF(Cost Insurance Freight), Change Y/Y for May 2021 (KOR Customs Service) at 37.90

- Swiss PPI month on month at 0.8% vs 0.7% prior, YoY 3.2% vs 1.8% prior

KEY GLOBAL RATES DIFFERENTIALS

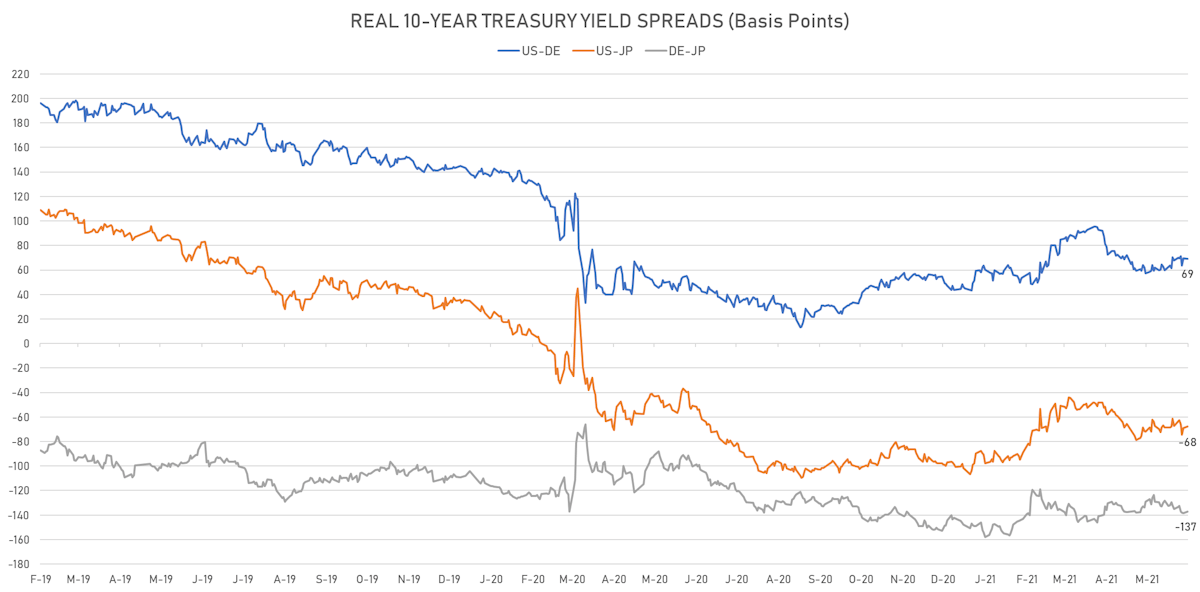

- 5Y German-US interest rates differential 1.8 bp wider at -140.0 bp (YTD change: -28.9 bp), negative for the euro

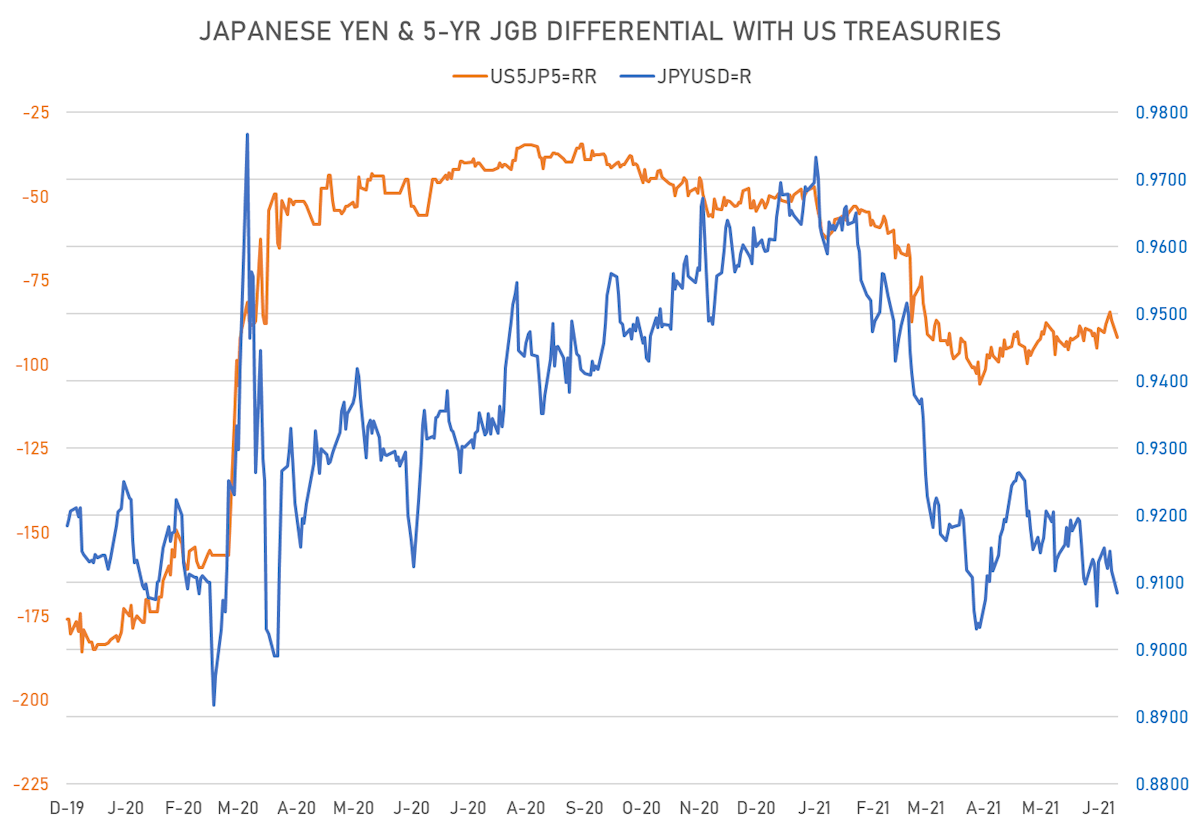

- 5Y Japan-US interest rates differential 4.9 bp wider at -91.9 bp (YTD change: -43.6 bp), negative for the yen

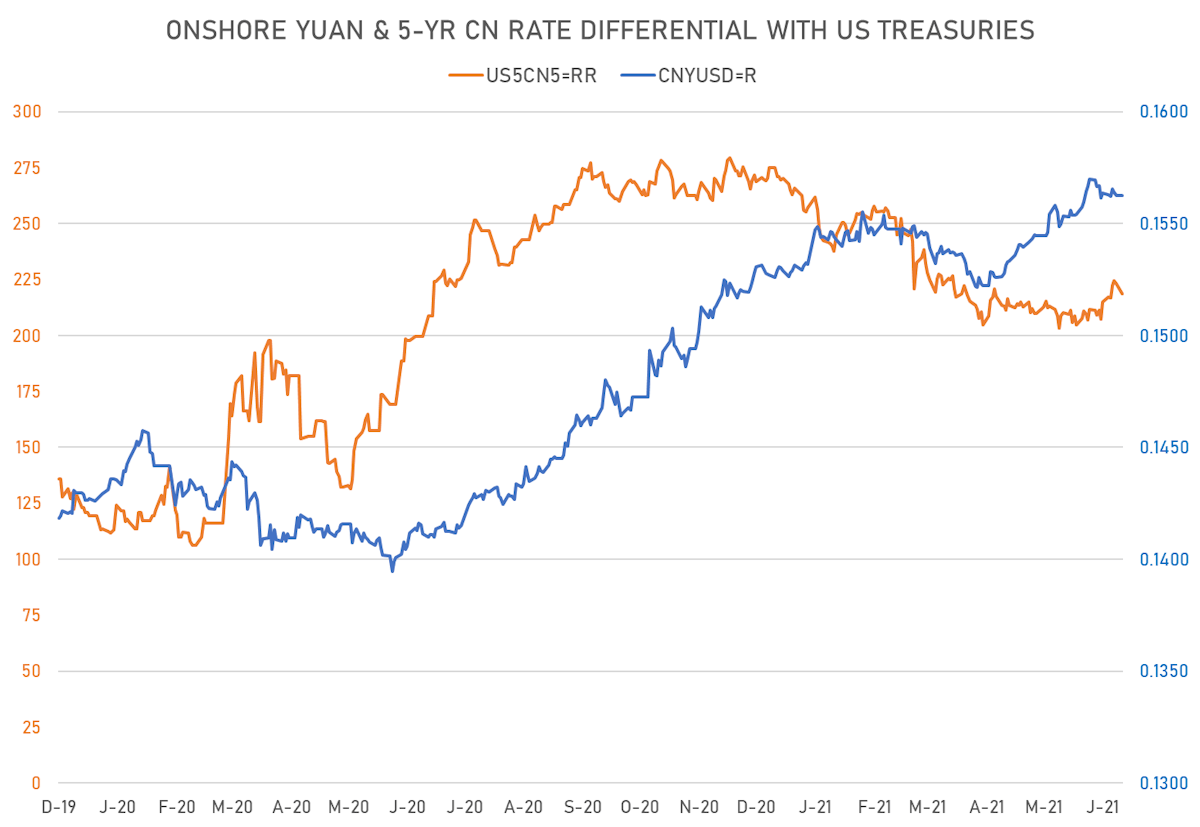

- 5Y China-US interest rates differential 4.3 bp wider at 218.7 bp (YTD change: -38.4 bp), positive for the yuan

VOLATILITIES

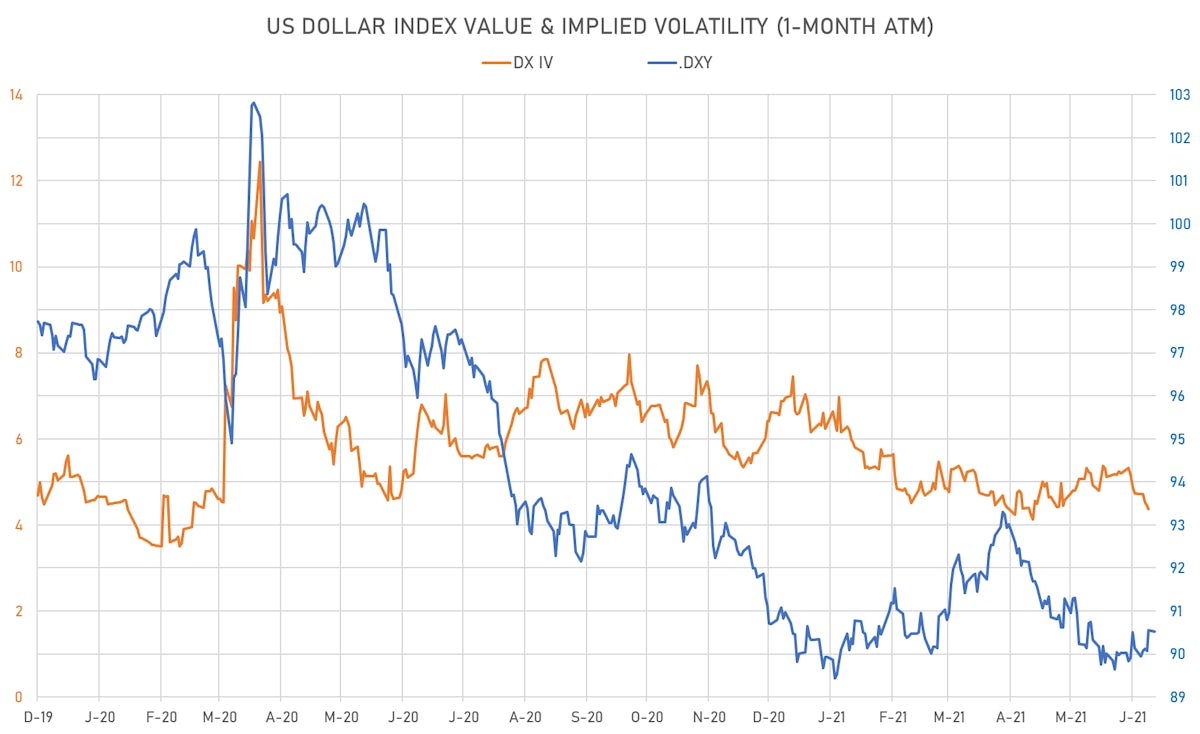

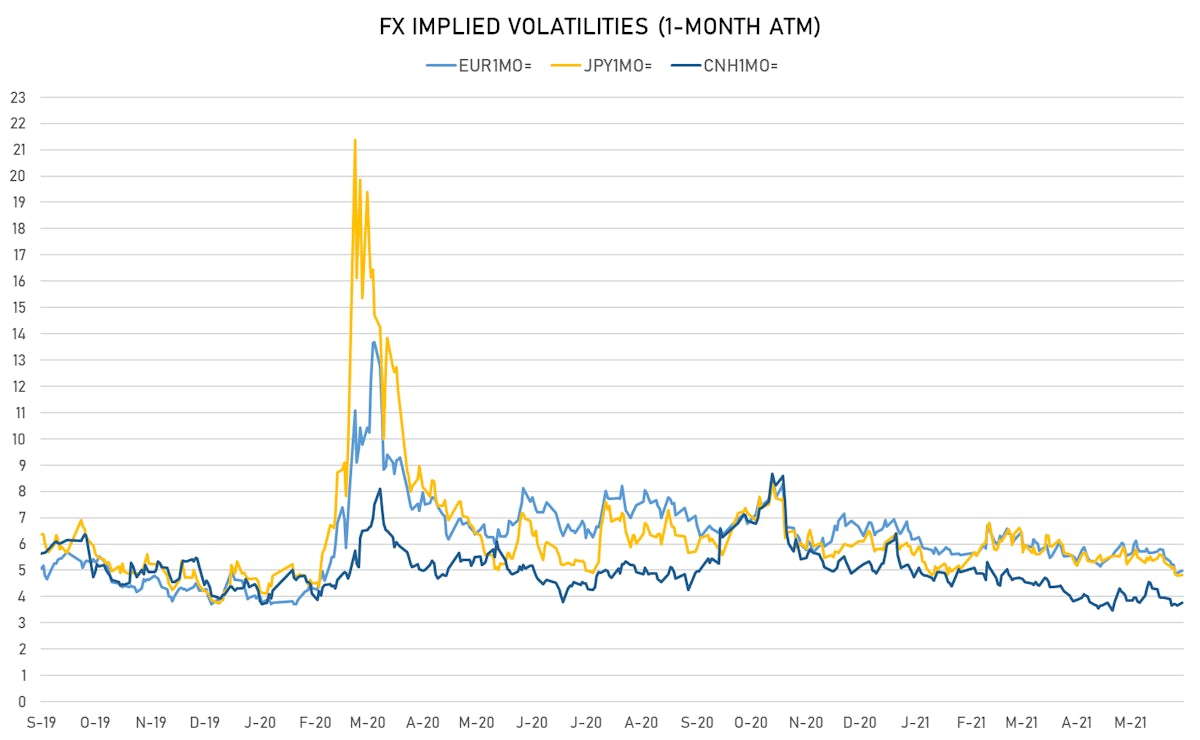

- Deutsche Bank USD Currency Volatility Index currently at 5.65, up 0.02 on the day (YTD: -1.52)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.98, up 0.1 on the day (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 4.83, unchanged (YTD: -1.3)

- Offshore Yuan 1M ATM IV currently at 3.76, up 0.1 on the day (YTD: -2.2)

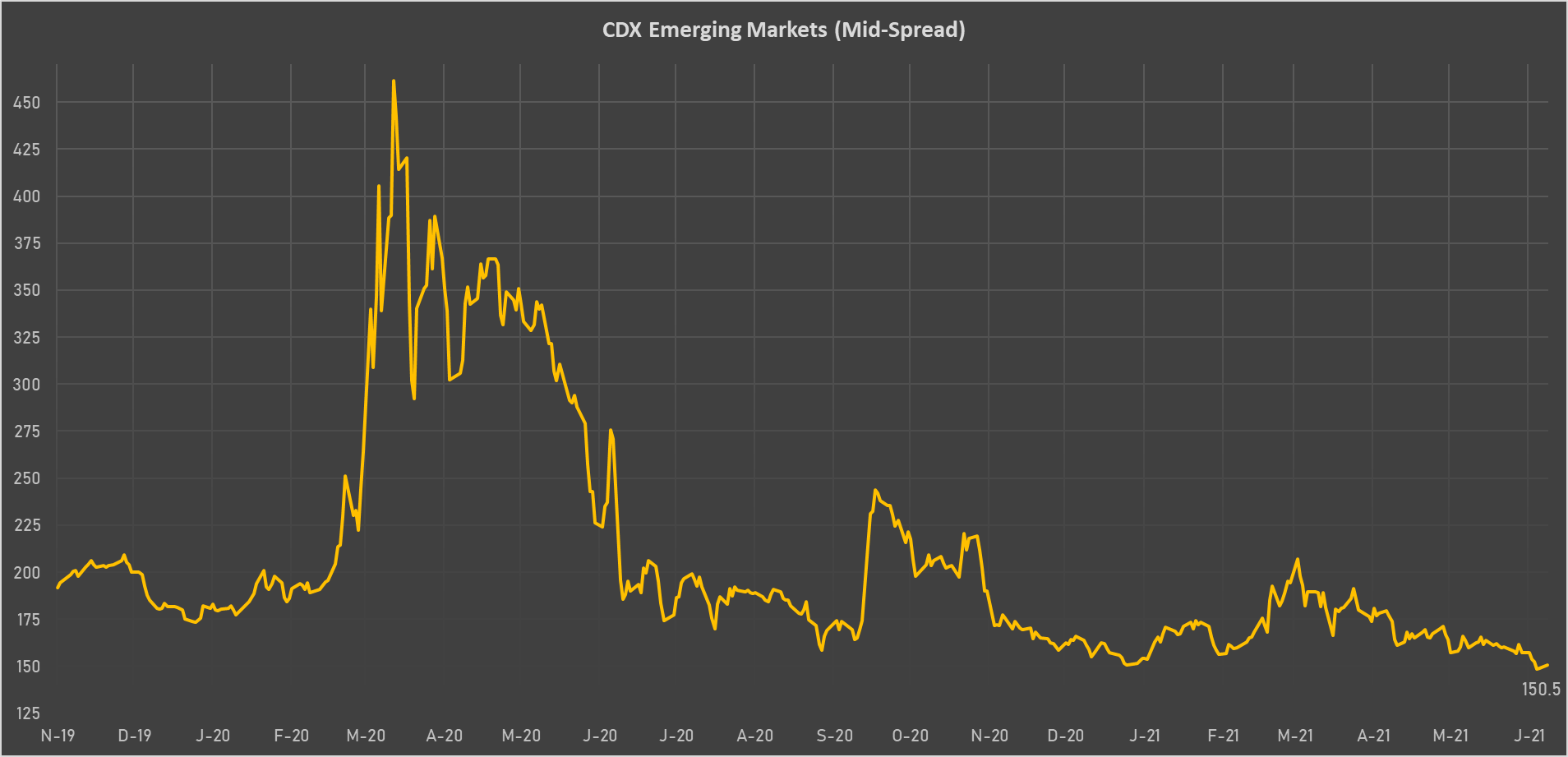

NOTABLE MOVES IN SOVEREIGN CDS

- South Africa (rated BB-): up 3.0 basis points to 182 bp (1Y range: 178-328bp)

- Brazil (rated BB-): up 2.6 basis points to 161 bp (1Y range: 141-264bp)

- Government of Chile (rated A-): up 0.8 basis points to 64 bp (1Y range: 43-85bp)

- Mexico (rated BBB-): up 0.9 basis points to 91 bp (1Y range: 79-164bp)

- Russia (rated BBB): up 0.7 basis points to 86 bp (1Y range: 72-129bp)

- Saudi Arabia (rated A): down 0.6 basis points to 55 bp (1Y range: 53-105bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 58 bp (1Y range: 50-62bp)

- Egypt (rated B+): down 5.7 basis points to 320 bp (1Y range: 283-472bp)

- Argentina (rated CCC): down 33.8 basis points to 1,691 bp (1Y range: 1,049-6,788bp)

- Indonesia (rated BBB): down 2.3 basis points to 72 bp (1Y range: 66-132bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 15.1% (YTD: +45.5%)

- Eritrean Nakfa up 2.8% (YTD: 0.0%)

- CFA Franc BEAC up 2.4% (YTD: +1.9%)

- Brazilian Real up 1.2% (YTD: +2.7%)

- Turkish Lira down 1.1% (YTD: -12.3%)

- Haiti Gourde down 1.1% (YTD: -20.5%)

- Georgian Lari down 1.1% (YTD: +2.7%)

- Samoa Tala down 1.5% (YTD: -0.2%)

- Aruba florin down 2.2% (YTD: 0.0%)

- Mozambique metical down 3.5% (YTD: +15.4%)