FX

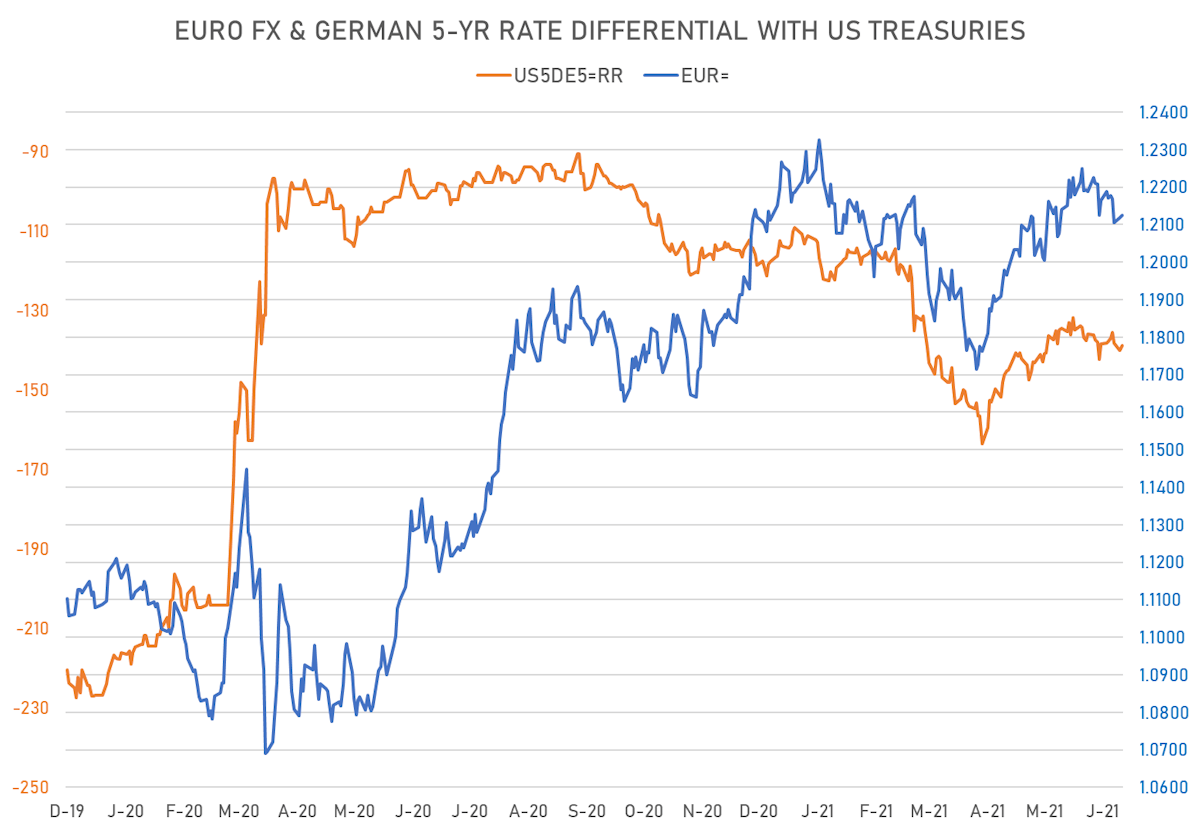

US Dollar Index Unchanged; Euro, Japanese Yen Up Slightly Today On Favorable Rates Differentials

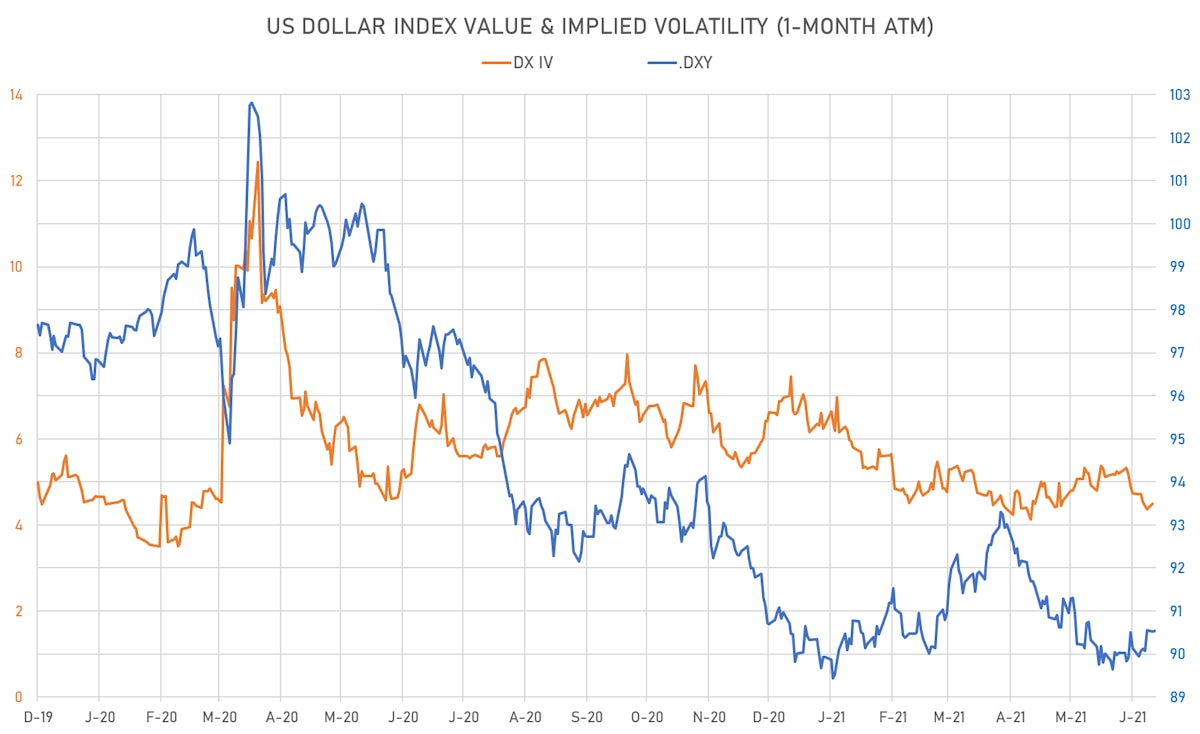

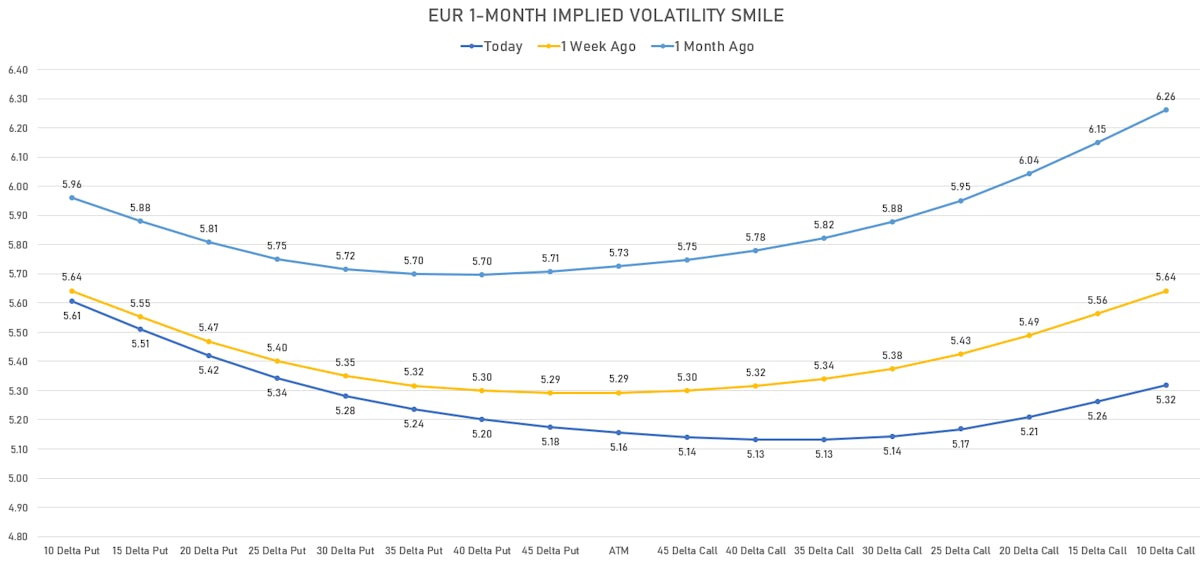

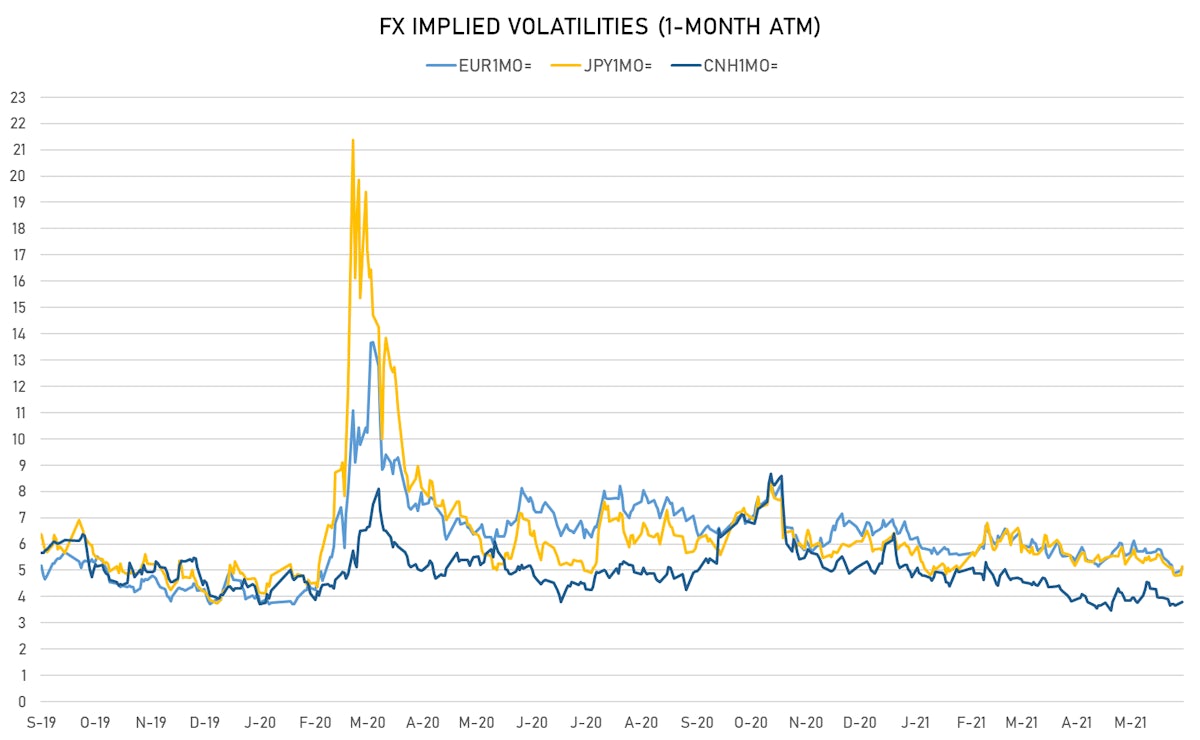

1-month implied volatility is still below 1-month realized volatility for both euros and yens, with very little directional positioning ahead of the next FOMC announcement

Published ET

FX options markets have turned negative on the euro over the past month | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

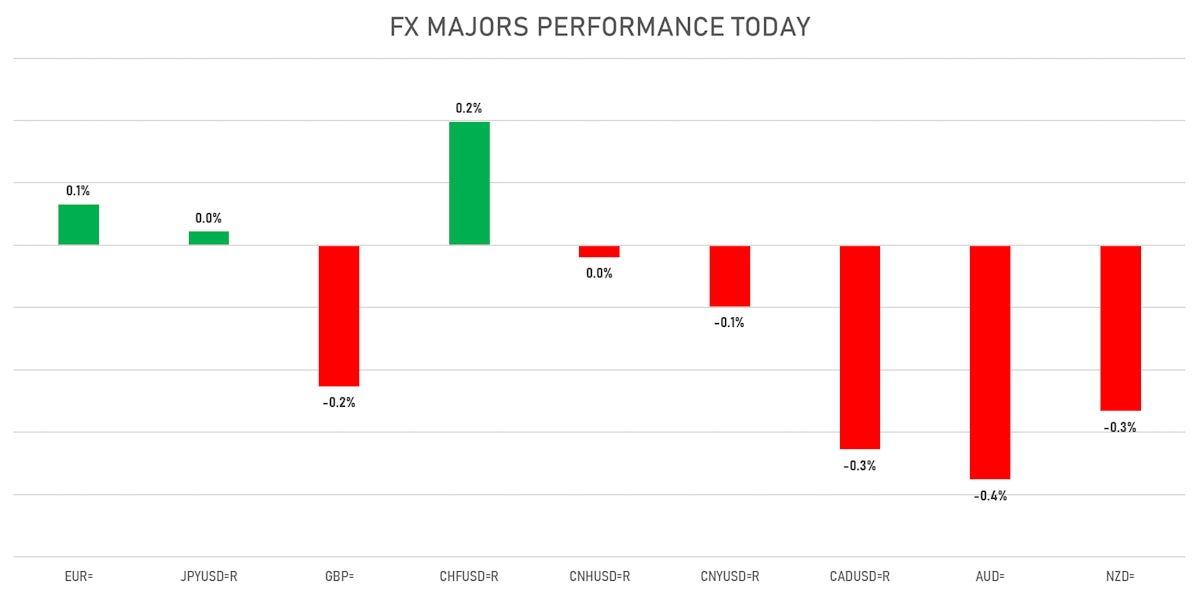

- The US Dollar Index is up 0.02% at 90.54 (YTD: +0.67%)

- Euro up 0.07% at 1.2126 (YTD: -0.7%)

- Yen up 0.02% at 110.05 (YTD: -6.2%)

- Onshore Yuan down 0.10% at 6.4052 (YTD: +1.9%)

- Swiss franc up 0.20% at 0.8983 (YTD: -1.4%)

- Sterling down 0.23% at 1.4080 (YTD: +3.0%)

- Canadian dollar down 0.33% at 1.2183 (YTD: +4.5%)

- Australian dollar down 0.38% at 0.7682 (YTD: -0.2%)

- NZ dollar down 0.27% at 0.7121 (YTD: -0.9%)

MACRO DATA RELEASES

- Canada, Housing Starts, All areas for May 2021 (CMHC, Canada) at 275.90

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for May 2021 (ECB) at 885.46

- Finland, Official reserve assets, Current Prices for May 2021 (Bank of Finland) at 11,170.00

- France, HICP, Change Y/Y, Price Index for May 2021 (INSEE, France) at 1.80, in line with expectations

- France, HICP, Final, Change P/P, Price Index for May 2021 (INSEE, France) at 0.30, below consensus estimate of 0.40

- Germany, HICP, Final, Change Y/Y, Price Index for May 2021 (Destatis) at 2.40, in line with expectations

- Indonesia, Trade Balance, Current Prices for May 2021 (Statistics Indonesia) at 2.37, above consensus estimate of 2.30

- Italy, HICP, Final, Change P/P, Price Index for May 2021 (ISTAT, Italy) at -0.10, below consensus estimate of 0.00

- Italy, HICP, Final, Change Y/Y, Price Index for May 2021 (ISTAT, Italy) at 1.20, below consensus estimate of 1.30

- Japan, Exports, Change Y/Y for May 2021 (MoF, Japan) at 49.60, below consensus estimate of 51.30

- Japan, Imports, Change Y/Y for May 2021 (MoF, Japan) at 27.90, above consensus estimate of 26.60

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Apr 2021 (Cabinet Office, JP) at 0.60, below consensus estimate of 2.70

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Apr 2021 (Cabinet Office, JP) at 6.50, below consensus estimate of 8.00

- Japan, Trade Balance, Current Prices for May 2021 (MoF, Japan) at -187.10, below consensus estimate of -91.20

- New Zealand, Milk Auction, Average Price, Constant Prices for W 15 Jun (Global Dairy Trade) at 4,083.00

- Poland, CPI, Change P/P, Price Index for May 2021 (CSO, Poland) at 0.30

- Poland, CPI, Change Y/Y, Price Index for May 2021 (CSO, Poland) at 4.70

- Russia, GDP, Change Y/Y for Q1 2021 (RosStat, Russia) at -0.70

- United Kingdom, Unemployment, Claimant count, Absolute change for May 2021 (ONS, United Kingdom) at -92.60

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Apr 2021 (ONS, United Kingdom) at 4.70, in line with expectations

- United States, Production, Change P/P for May 2021 (FED, U.S.) at 0.80, above consensus estimate of 0.60

- United States, Retail Sales, Total including food services, Change P/P for May 2021 (U.S. Census Bureau) at -1.30, below consensus estimate of -0.80

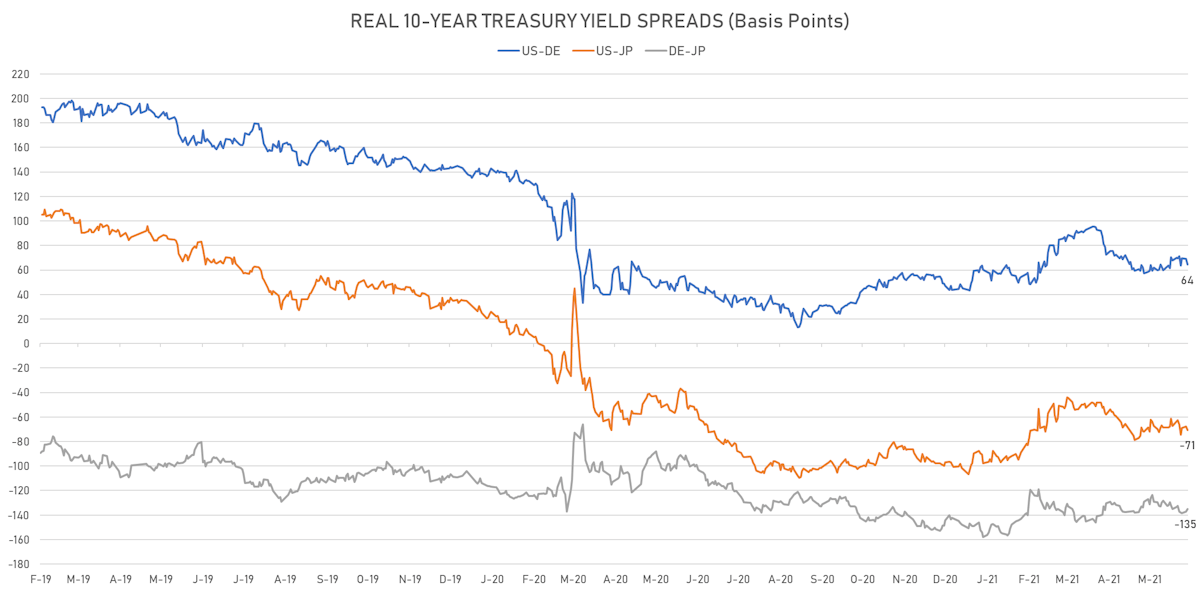

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 1.3 bp tighter at -138.7 bp (YTD change: -27.6 bp), positive for the euro

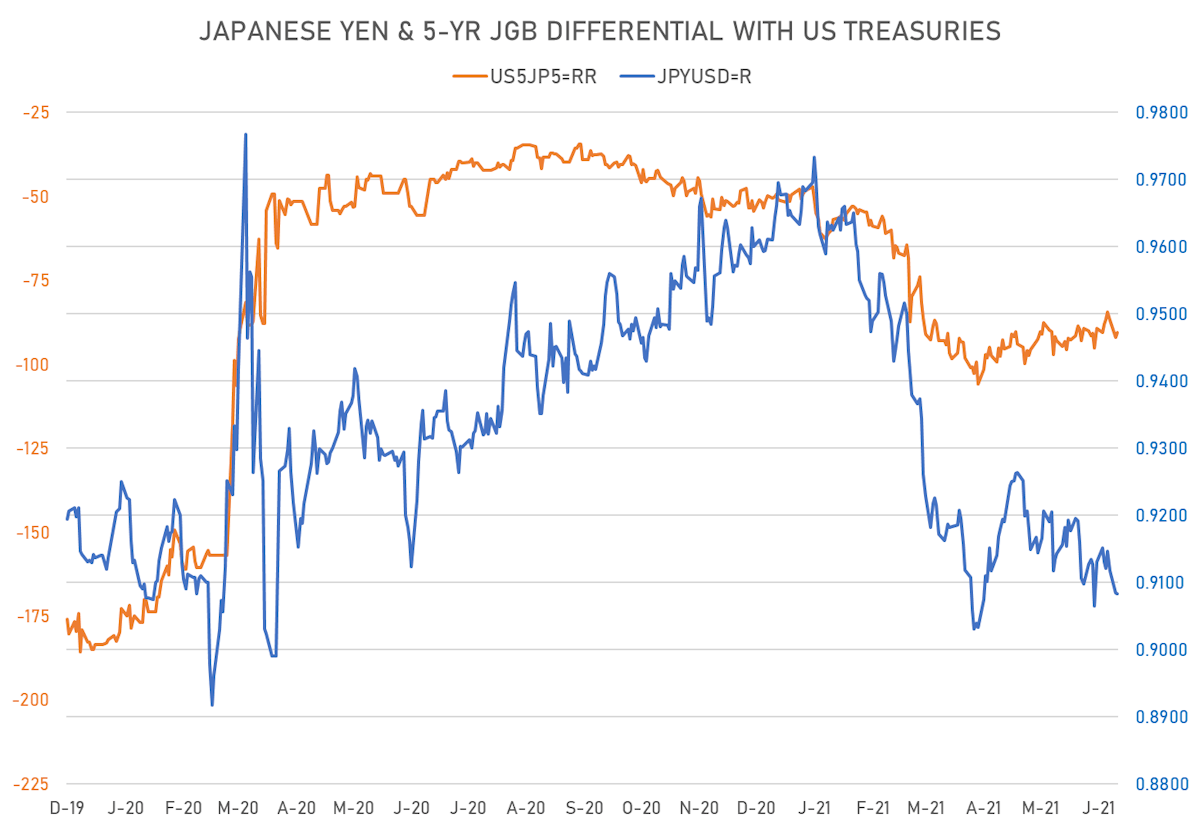

- 5Y Japan-US interest rates differential 1.3 bp tighter at -90.6 bp (YTD change: -42.3 bp), positive for the yen

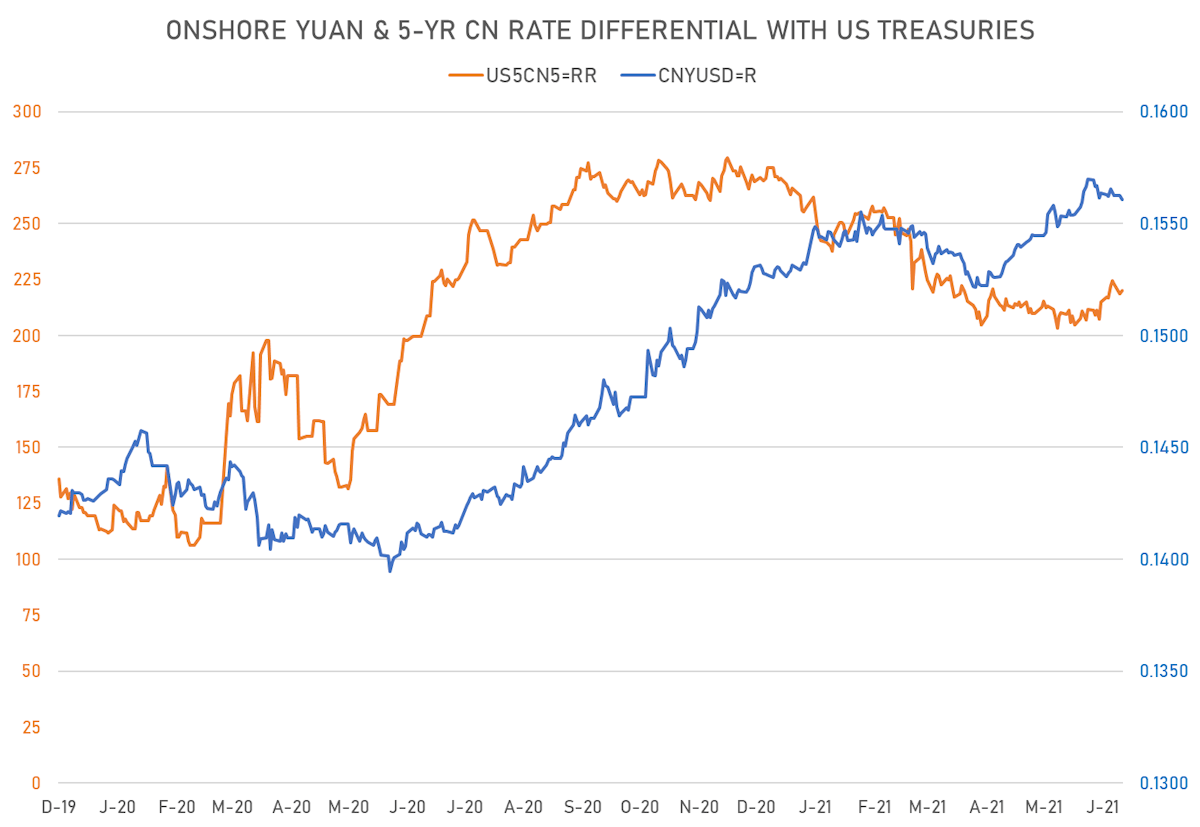

- 5Y China-US interest rates differential 1.5 bp tighter at 220.2 bp (YTD change: -36.9 bp), negative for the yuan

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 5.67, up 0.02 on the day (YTD: -1.50)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.08, up 0.1 on the day (YTD: -1.6)

- Japanese Yen 1M ATM IV currently at 5.15, up 0.3 on the day (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.80, unchanged today (YTD: -2.2)

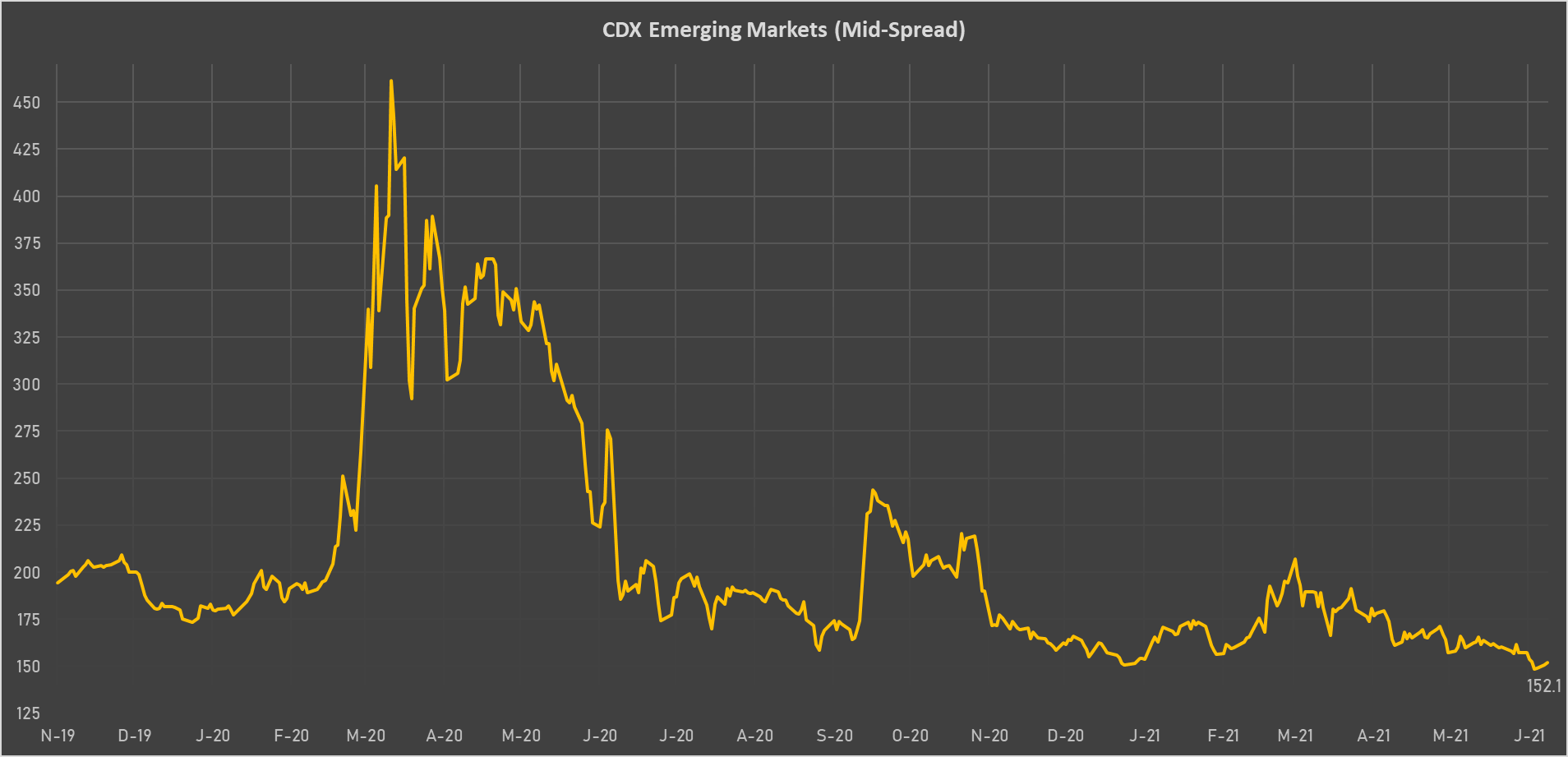

NOTABLE MOVES IN SOVEREIGN CDS

- Turkey (rated BB-): up 11.2 basis points to 384 bp (1Y range: 282-597bp)

- Saudi Arabia (rated A): up 1.2 basis points to 56 bp (1Y range: 53-105bp)

- Peru (rated BBB+): up 2.0 basis points to 92 bp (1Y range: 52-98bp)

- Morocco (rated BB+): up 1.5 basis points to 88 bp (1Y range: 86-127bp)

- South Africa (rated BB-): up 3.2 basis points to 185 bp (1Y range: 178-328bp)

- Russia (rated BBB): up 1.3 basis points to 87 bp (1Y range: 72-129bp)

- Mexico (rated BBB-): up 1.3 basis points to 92 bp (1Y range: 79-164bp)

- Colombia (rated BBB-): up 1.3 basis points to 128 bp (1Y range: 83-164bp)

- Panama (rated BBB-): up 0.5 basis points to 66 bp (1Y range: 44-112bp)

- Vietnam (rated BB): down 1.3 basis points to 101 bp (1Y range: 90-179bp)

LARGEST FX MOVES TODAY

- Georgian Lari up 1.3% (YTD: +4.0%)

- Liberian Dollar up 0.8% (YTD: -3.6%)

- Tunisian Dinar down 0.8% (YTD: -2.3%)

- Cape Verde Escudo down 0.9% (YTD: -0.9%)

- Chilean Peso down 1.1% (YTD: -2.3%)

- Turkish Lira down 1.1% (YTD: -13.2%)

- Colombian Peso down 1.2% (YTD: -7.3%)

- Pakistani rupee down 1.2% (YTD: +1.9%)

- Haiti Gourde down 2.0% (YTD: -22.2%)

- CFA Franc BEAC down 2.8% (YTD: -0.9%)