FX

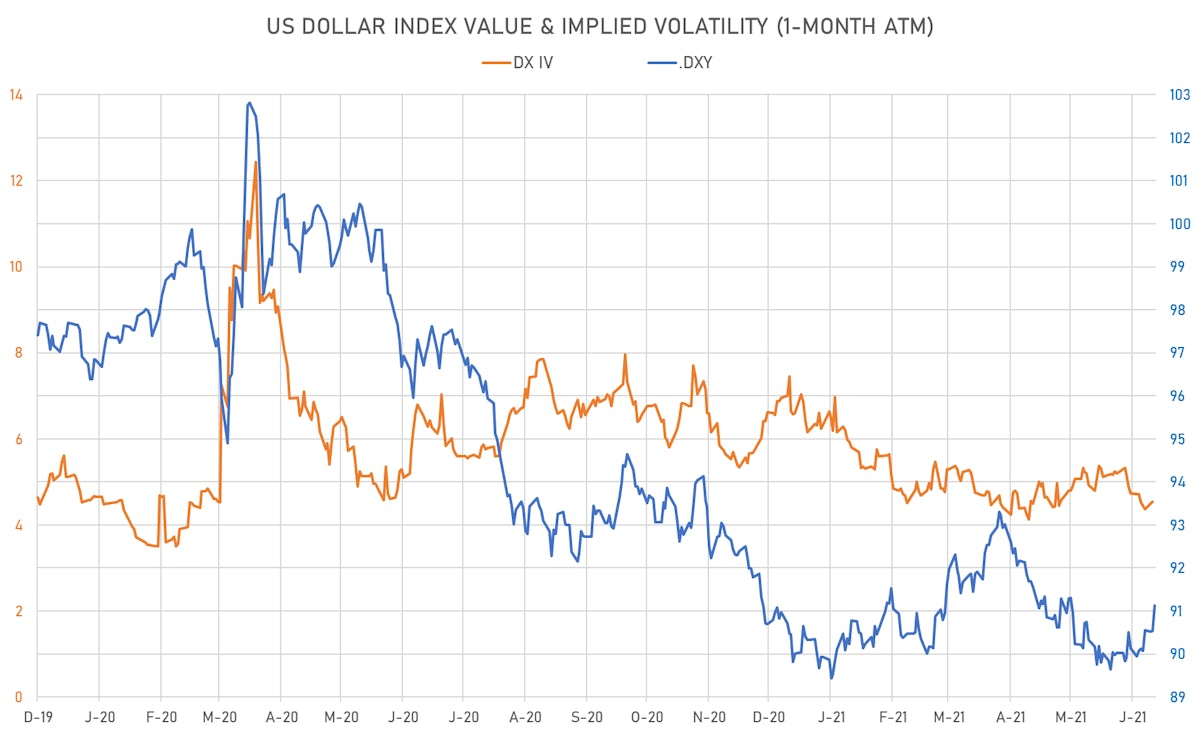

FX Follows Rates, US Dollar Index Rises Strongly After Post-FOMC Announcement

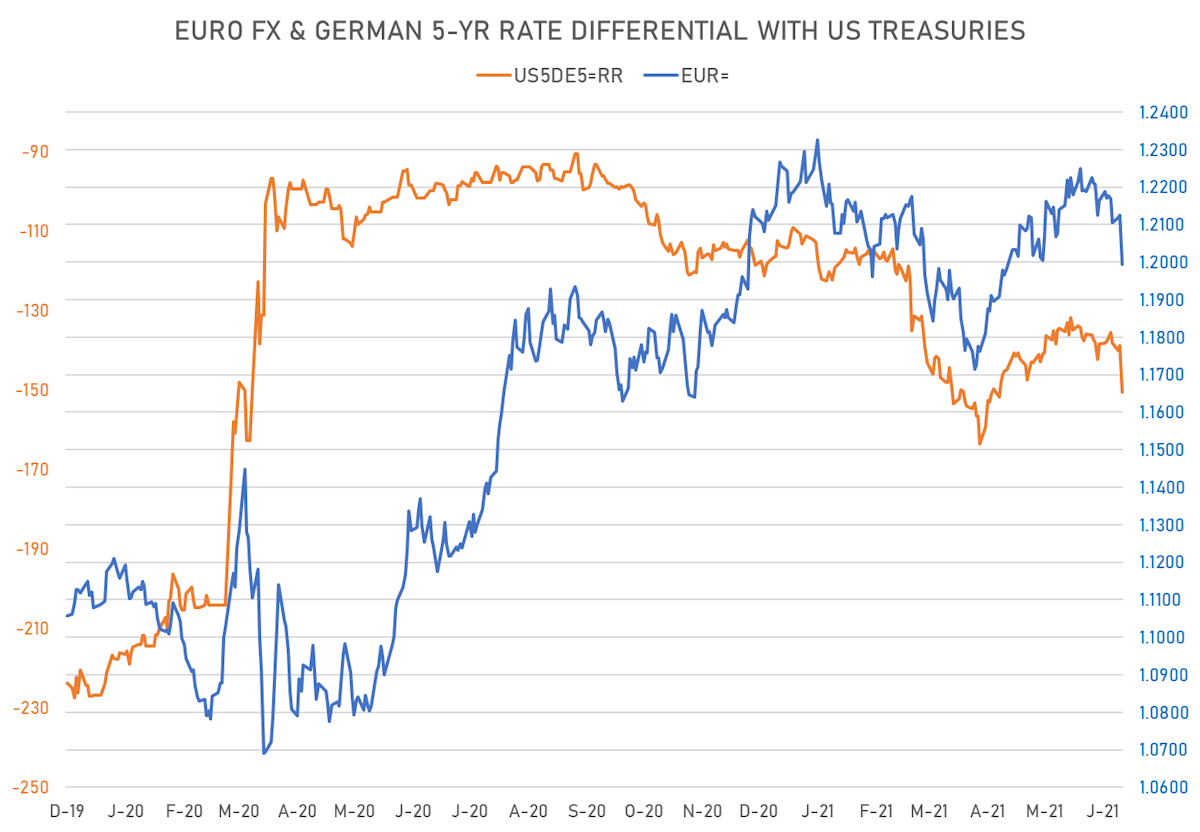

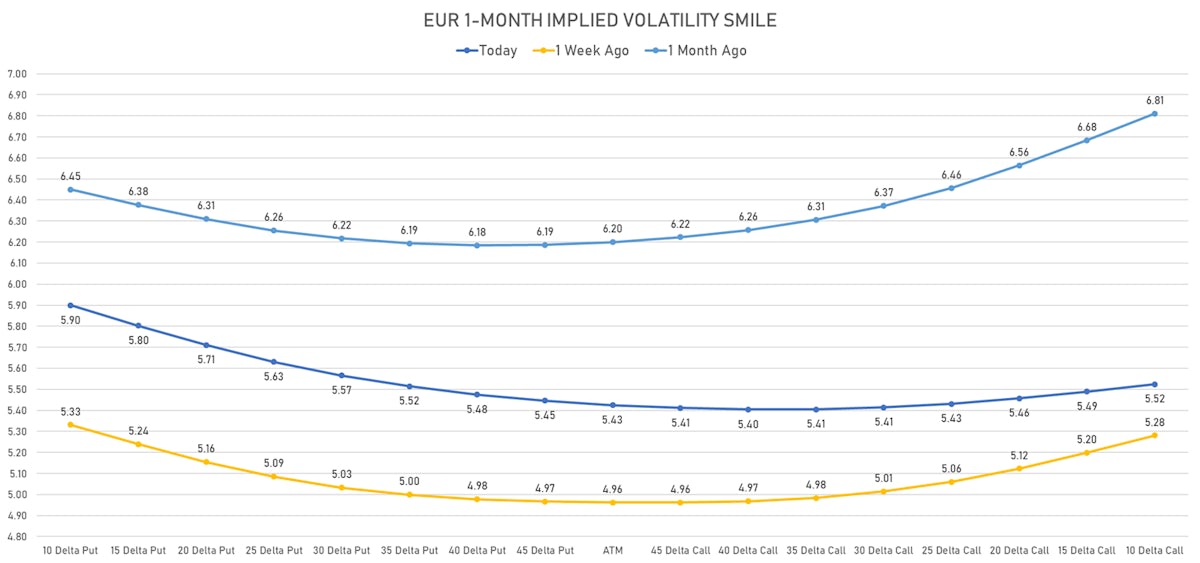

It's interesting to note that recent speculative positioning in EUR options pointed to real downside risk (risk reversals turning negative), unlike positioning in equities (SPX put options implied vols got cheaper over the past weeks)

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

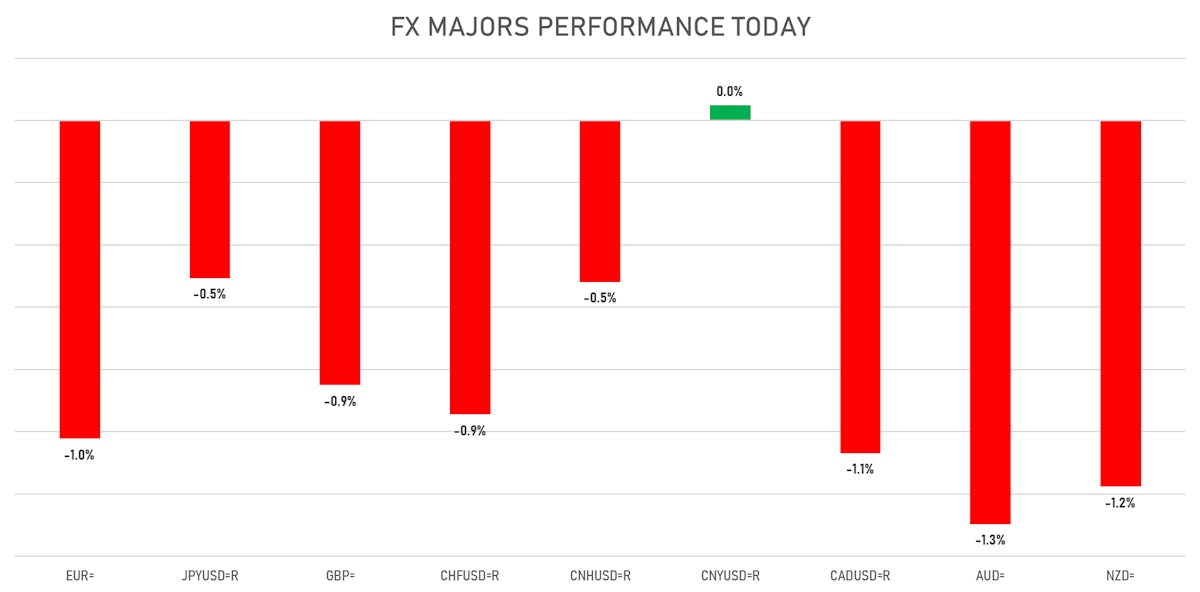

- The US Dollar Index is up 0.65% at 91.13 (YTD: +1.33%)

- Euro down 1.02% at 1.1994 (YTD: -1.8%)

- Yen down 0.51% at 110.64 (YTD: -6.7%)

- Onshore Yuan up 0.05% at 6.3969 (YTD: +2.0%)

- Swiss franc down 0.95% at 0.9084 (YTD: -2.6%)

- Sterling down 0.85% at 1.3992 (YTD: +2.3%)

- Canadian dollar down 1.07% at 1.2274 (YTD: +3.7%)

- Australian dollar down 1.30% at 0.7611 (YTD: -1.1%)

- NZ dollar down 1.18% at 0.7056 (YTD: -1.8%)

MACRO DATA RELEASES

- Brazil, Policy Rates, SELIC Target Rate for 16 Jun (Central Bank, Brazil) at 4.25 %, in line with consensus

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for May 2021 (CANSIM, Canada) at 0.40 %, in line with consensus

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for May 2021 (CANSIM, Canada) at 2.80 %, above consensus estimate of 2.40 %

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for May 2021 (NBS, China) at 15.40 %, below consensus estimate of 16.90 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for May 2021 (NBS, China) at 12.40 %, below consensus estimate of 13.60 %

- Namibia, Policy Rates, Bank Rate for Jun 2021 (Bank of Namibia) at 3.75 %

- New Zealand, GDP, Change P/P for Q1 2021 (Statistics, NZ) at 1.60 %, above consensus estimate of 0.50 %

- New Zealand, GDP, Change P/P for Q1 2021 (Statistics, NZ) at 1.40 %, above consensus estimate of 0.50 %

- Uganda, Policy Rates, Central Bank Rate for 16 Jun (Bank of Uganda) at 6.50 %

- United Kingdom, CPI, All items (CPI), Change Y/Y for May 2021 (ONS, United Kingdom) at 2.10 %, above consensus estimate of 1.80 %

- United States, Fed Interest On Excess Reserves for 17 Jun (FED, U.S.) raised to 0.15 %

- United States, Housing Starts for May 2021 (U.S. Census Bureau) at 1.57 Mln, below consensus estimate of 1.63 Mln

- United States, Policy Rates, Fed Funds Target Rate for 17 Jun (FOMC, U.S.) at 0.125 %, in line with consensus

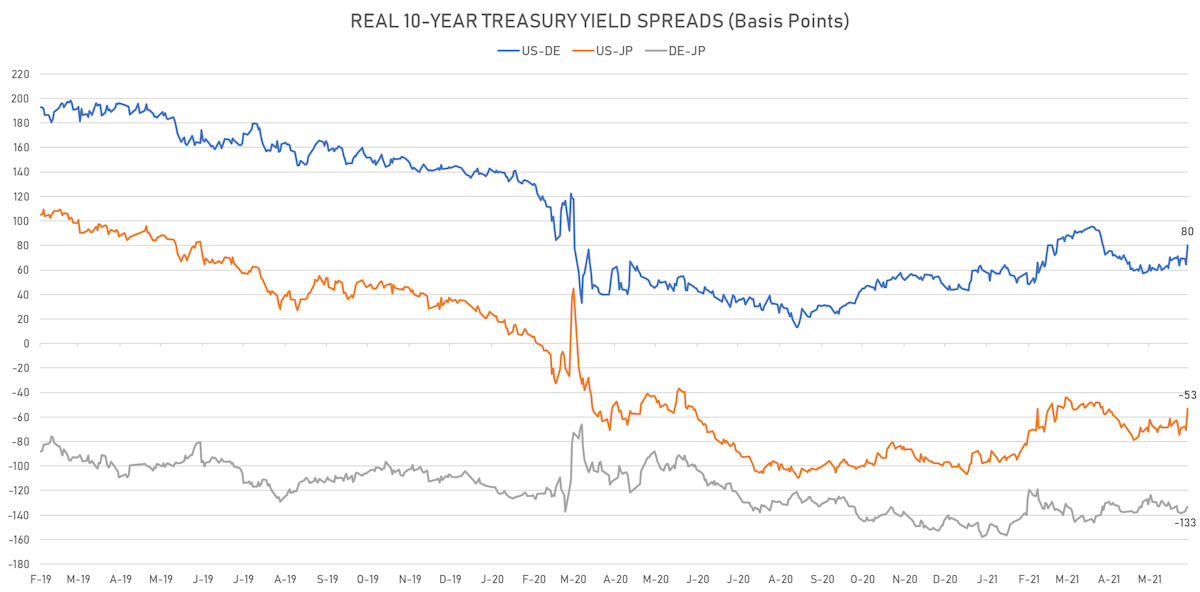

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 11.8 bp wider at -150.5 bp (YTD change: -39.4 bp), negative for the euro

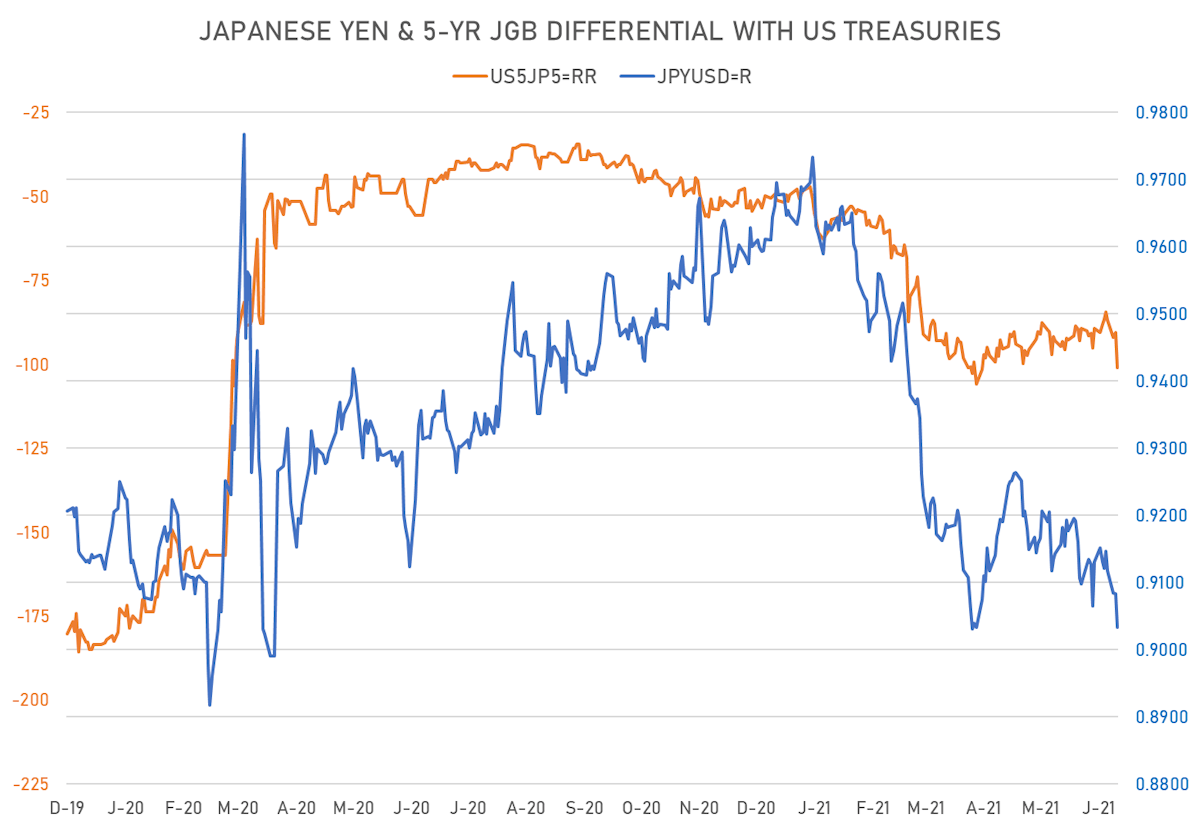

- 5Y Japan-US interest rates differential 10.5 bp wider at -101.1 bp (YTD change: -52.8 bp), negative for the yen

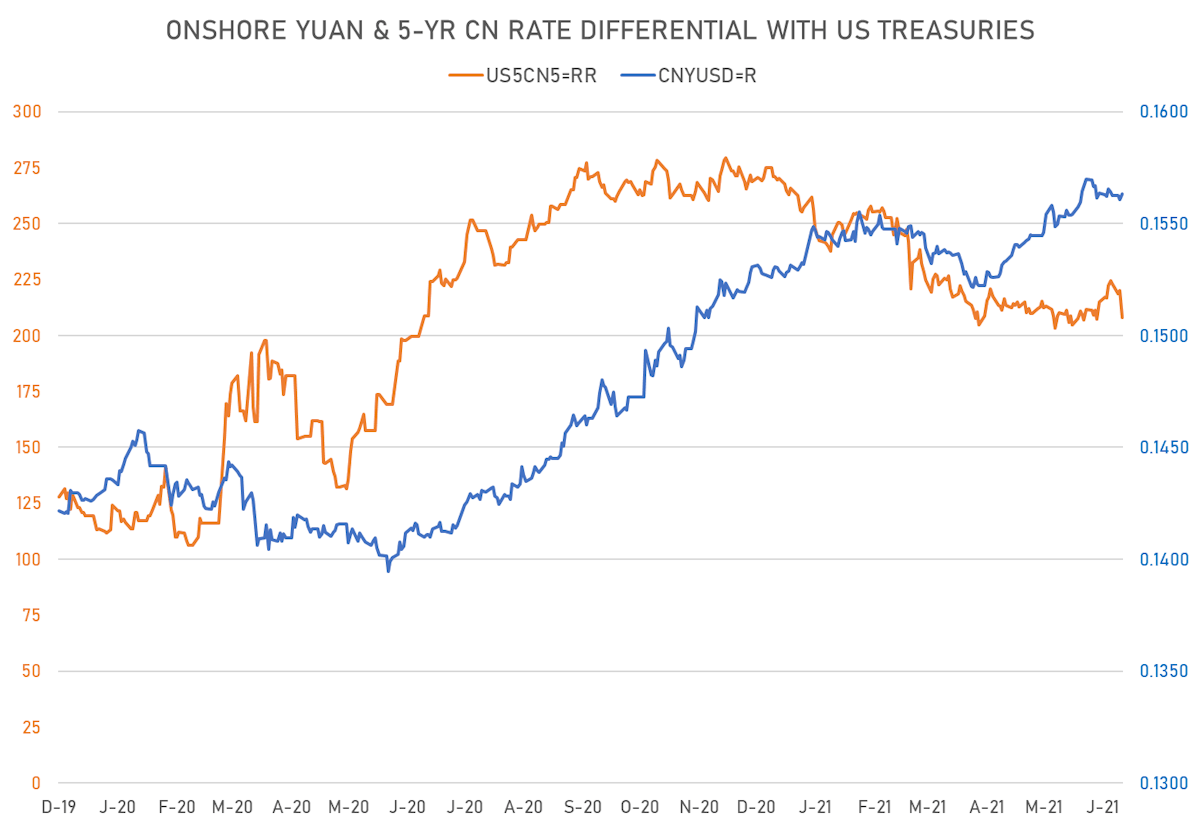

- 5Y China-US interest rates differential 12.1 bp tighter at 208.1 bp (YTD change: -49.0 bp), negative for the yuan

VOLATILITIES

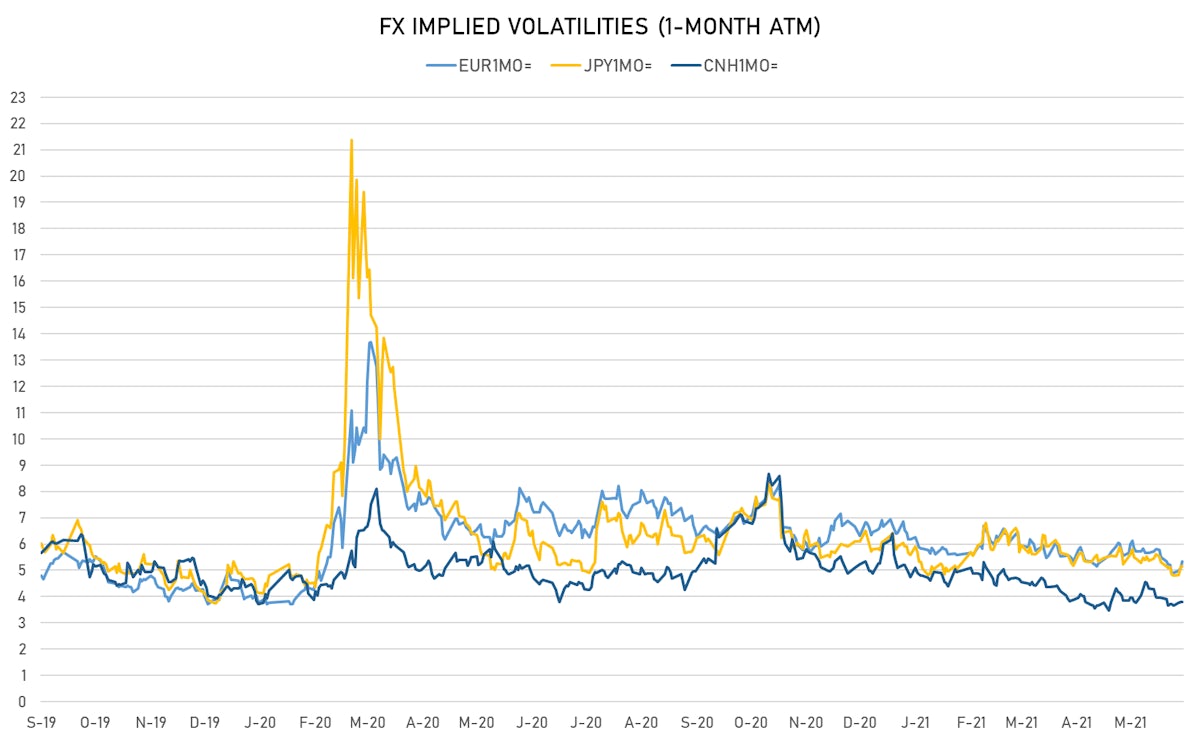

- Deutsche Bank USD Currency Volatility Index currently at 5.74, up 0.07 on the day (YTD: -1.43)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.33, up 0.2 on the day (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.15, unchanged (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.79, unchanged (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS

- Oman (rated BB-): up 6.3 basis points to 239 bp (1Y range: 228-491bp)

- Colombia (rated BBB-): up 2.0 basis points to 130 bp (1Y range: 83-164bp)

- Egypt (rated B+): up 4.3 basis points to 324 bp (1Y range: 283-472bp)

- Brazil (rated BB-): up 1.2 basis points to 163 bp (1Y range: 141-264bp)

- Panama (rated BBB-): up 0.5 basis points to 66 bp (1Y range: 44-112bp)

- Government of Chile (rated A-): up 0.4 basis points to 64 bp (1Y range: 43-85bp)

- South Africa (rated BB-): down 1.5 basis points to 184 bp (1Y range: 178-328bp)

- Russia (rated BBB): down 1.6 basis points to 86 bp (1Y range: 72-129bp)

- Saudi Arabia (rated A): down 1.1 basis points to 55 bp (1Y range: 53-105bp)

- Morocco (rated BB+): down 4.4 basis points to 84 bp (1Y range: 86-127bp)

LARGEST FX MOVES TODAY

- Surinamese dollar down 1.6% (YTD: -33.5%)

- South Africa Rand down 1.6% (YTD: +5.0%)

- Swedish Krona down 1.7% (YTD: -2.6%)

- Turkish Lira down 1.9% (YTD: -13.9%)

- Norwegian Krone down 2.0% (YTD: +1.1%)

- Mexican Peso down 2.2% (YTD: -2.5%)

- Yemen Rial down 2.9% (YTD: -2.3%)

- CFA Franc BEAC down 2.9% (YTD: -1.1%)

- Bosnian Mark down 3.0% (YTD: -4.2%)

- Seychelles rupee down 17.0% (YTD: +19.3%)