FX

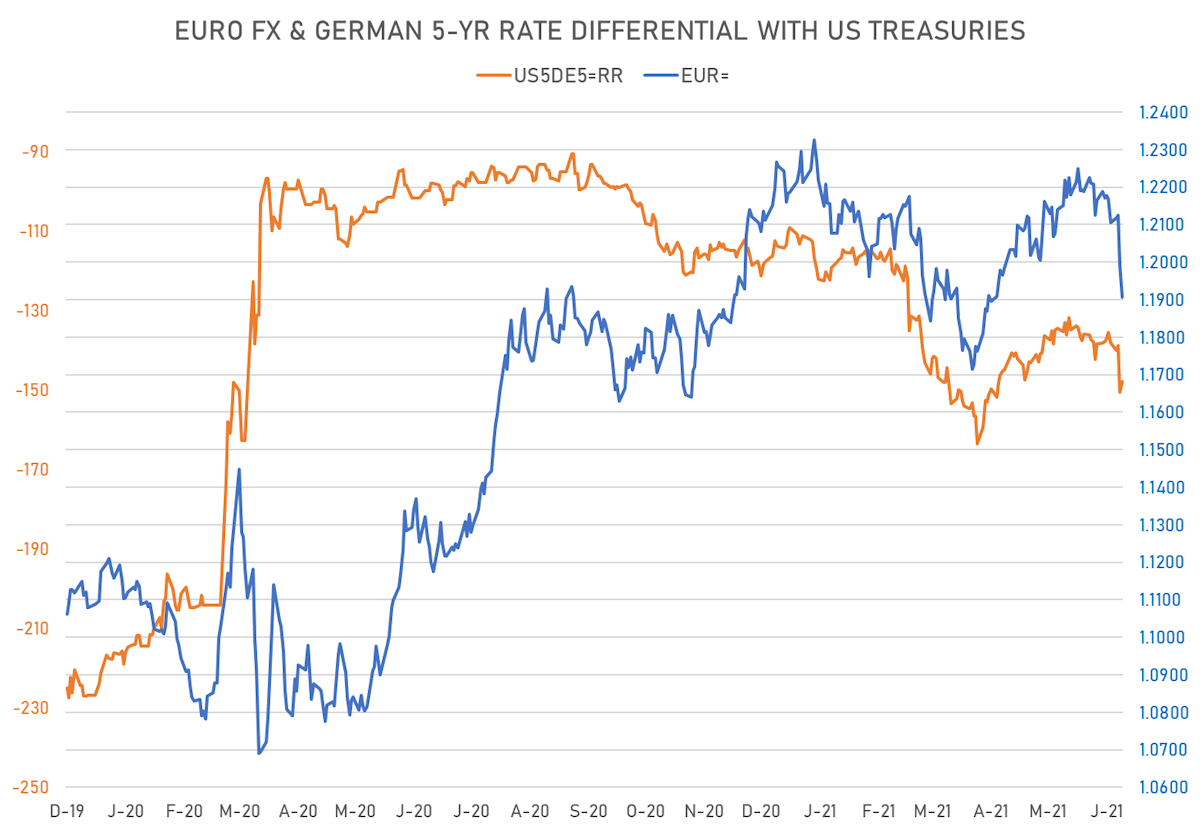

Dollar Index Rises Further As Speculative Positioning Against The Euro Gathers Steam

Goldman Sachs closed their long recommendation in the EUR and CAD, recognizing that in the short- to medium-term the dollar is likely to be stronger than expected (they previously had a forecast of 1.28 for the euro at year end)

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

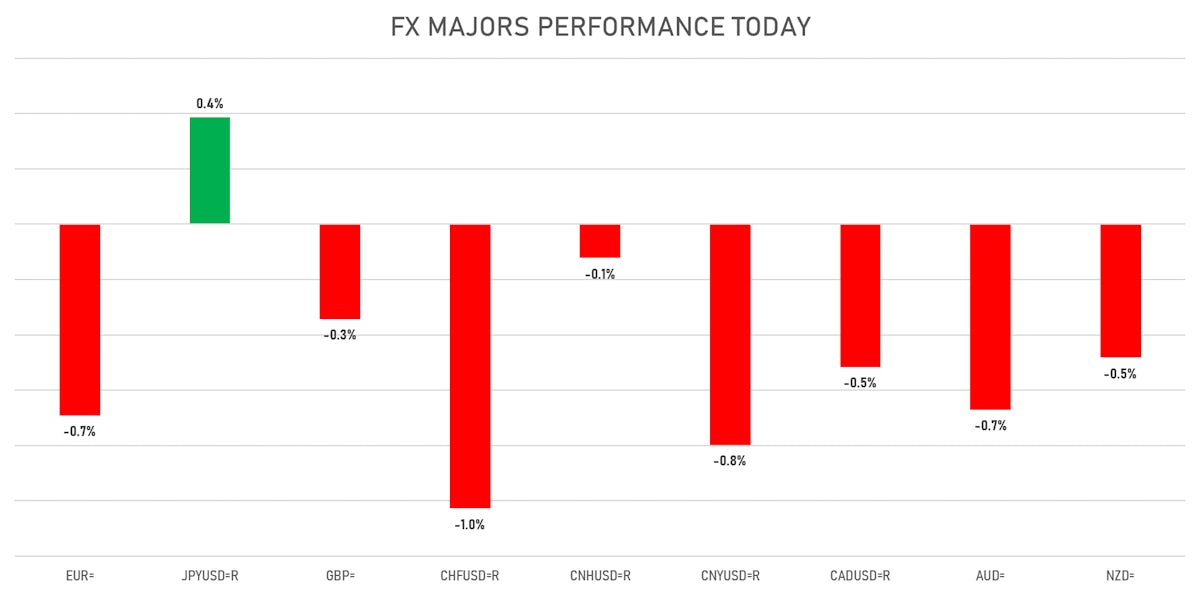

- The US Dollar Index is up 0.83% at 91.89 (YTD: +2.17%)

- Euro down 0.69% at 1.1911 (YTD: -2.5%)

- Yen up 0.39% at 110.27 (YTD: -6.4%)

- Onshore Yuan down 0.80% at 6.4477 (YTD: +1.2%)

- Swiss franc down 1.03% at 0.9176 (YTD: -3.6%)

- Sterling down 0.34% at 1.3939 (YTD: +1.9%)

- Canadian dollar down 0.52% at 1.2343 (YTD: +3.2%)

- Australian dollar down 0.67% at 0.7559 (YTD: -1.8%)

- NZ dollar down 0.48% at 0.7015 (YTD: -2.4%)

MACRO DATA RELEASES

- Australia, Employment, Absolute change for May 2021 (AU Bureau of Stat) at 115.20 k, above consensus estimate of 30.00 k

- Australia, Unemployment, Rate for May 2021 (AU Bureau of Stat) at 5.10 %, below consensus estimate of 5.50 %

- Botswana, Policy Rates, Bank Rate for Jun 2021 (Bank of Botswana) at 3.75 %

- Egypt, Policy Rates, Overnight Deposit Rate for 21 Jun (Central Bank, Egypt) at 8.25 %

- Egypt, Policy Rates, Overnight Lending Rate for 21 Jun (Central Bank, Egypt) at 9.25 %

- Euro Zone, CPI, Change P/P, Price Index for May 2021 (Eurostat) at 0.30 %, in line with consensus estimate

- Euro Zone, CPI, Change Y/Y for May 2021 (Eurostat) at 2.00 %, in line with consensus estimate

- Indonesia, 7-Day Reverse Repo for Jun 2021 (Bank Indonesia) at 3.50 %, in line with consensus estimate

- Indonesia, Deposit Facility Rate for Jun 2021 (Bank Indonesia) at 2.75 %, in line with consensus estimate

- Indonesia, Lending Facility Rate for Jun 2021 (Bank Indonesia) at 4.25 %, in line with consensus estimate

- Japan, CPI, Nationwide, All Items, Change Y/Y for May 2021 (MIC, Japan) at -0.10 %

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for May 2021 (MIC, Japan) at 0.10 %, in line with consensus estimate

- Norway, Policy Rates, Central Bank Rate Decision for 18 Jun (Norges Bank) at 0.00 %, in line with consensus estimate

- Switzerland, Policy Rates, SNB Policy Rate for Q2 2021 (Swiss National Bank) at -0.75 %, in line with consensus estimate

- Taiwan, Policy Rates, Discount Rate for Q2 2021 (CBC, Taiwan) at 1.125 %, in line with consensus estimate

- Turkey, CBRT OVERNIGHT BORROWING RATE (EP) for Jun 2021 (Central Bank, Turkey) at 17.50 %

- Turkey, Overnight Lending Rate for Jun 2021 (Central Bank, Turkey) at 20.50 %

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Jun 2021 (Central Bank, Turkey) at 19.00 %, in line with consensus estimate

- Turkey, Policy Rates, Late Liquidity Window Rate for Jun 2021 (Central Bank, Turkey) at 23.50 %

- Ukraine, UA Central Bank Interest Rate for 17 Jun (NBU, Ukraine) at 7.50 %, in line with consensus estimate

- United States, Jobless Claims, National, Initial for W 12 Jun (U.S. Dept. of Labor) at 412.00 k, above consensus estimate of 359.00 k

- United States, Philadelphia Fed, General business activity for Jun 2021 (FED, Philadelphia) at 30.70, below consensus estimate of 31.00

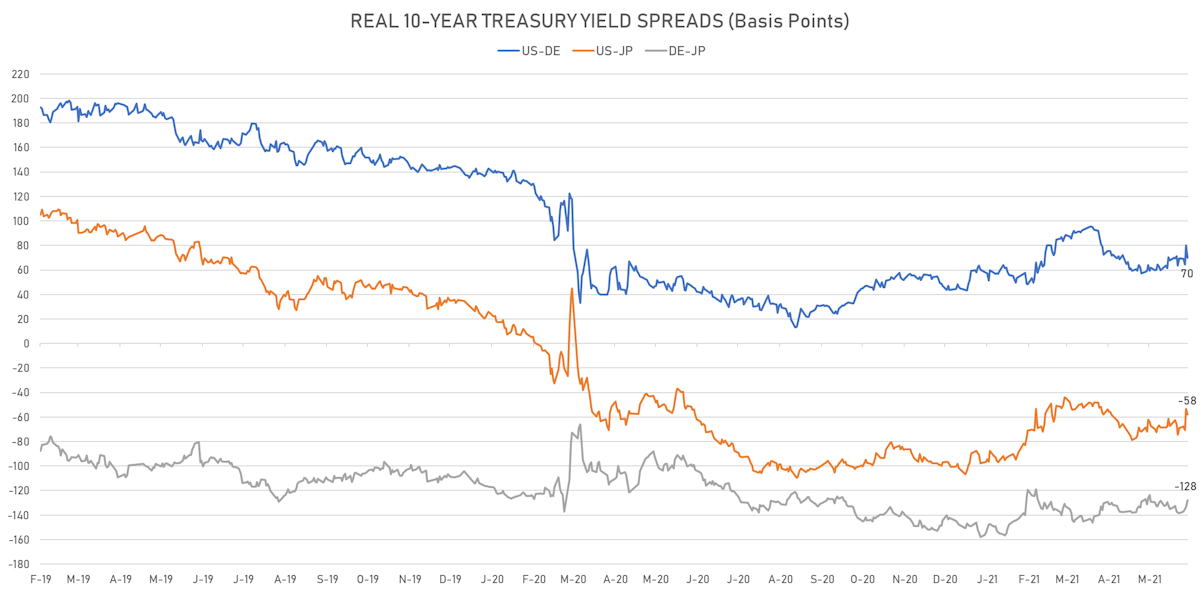

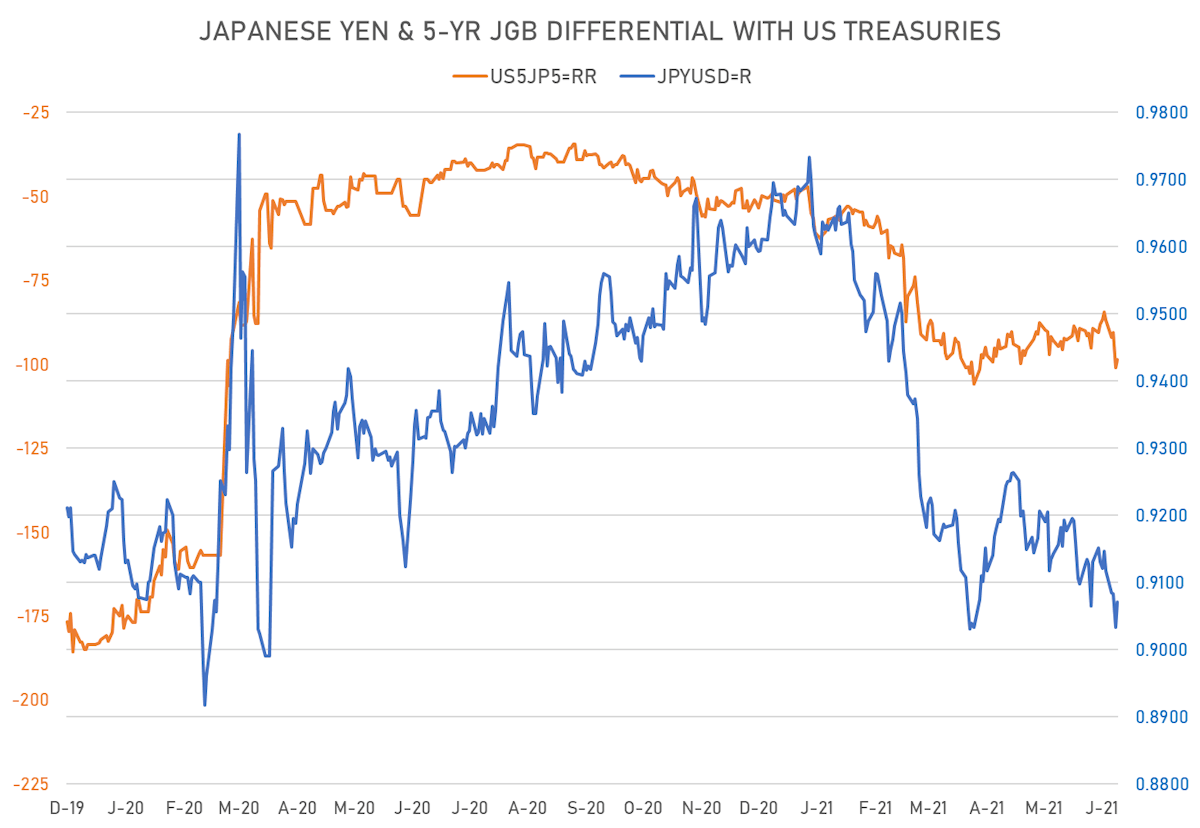

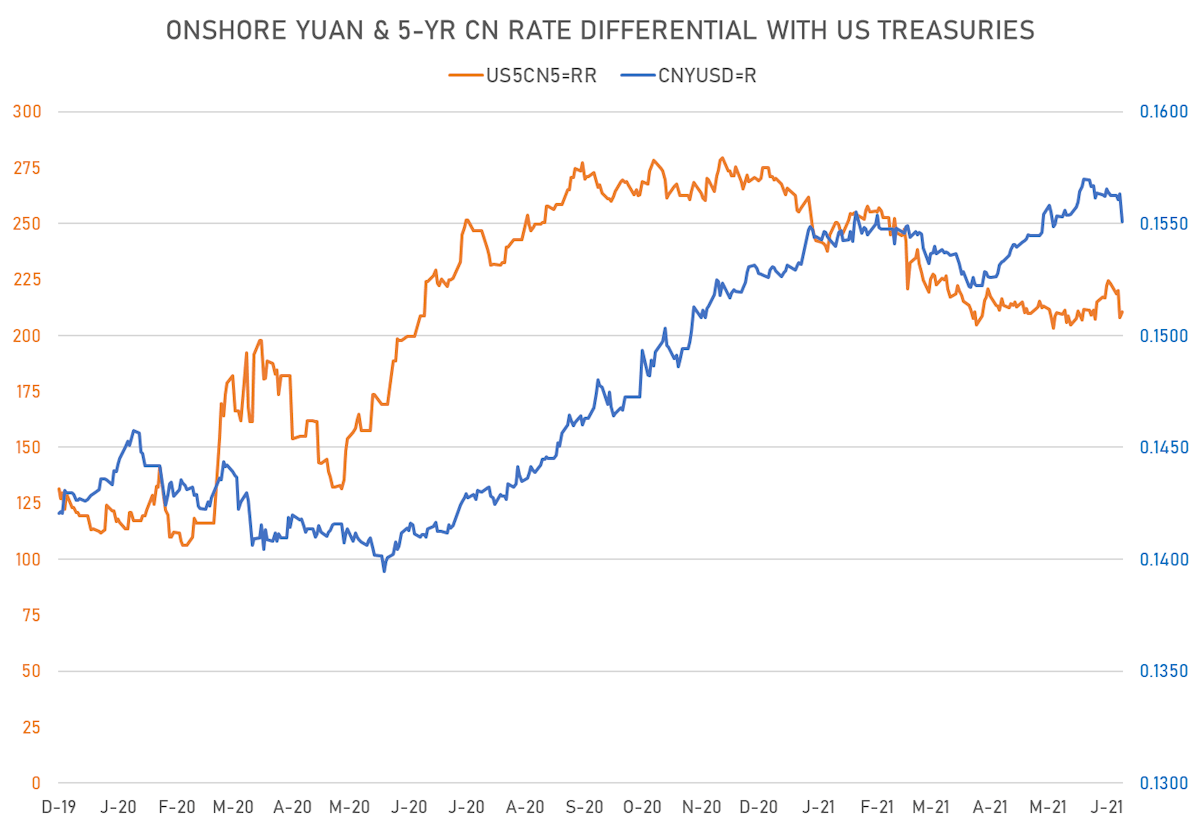

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 2.6 bp tighter at -147.9 bp (YTD change: -36.8 bp)

- 5Y Japan-US interest rates differential 2.6 bp tighter at -98.5 bp (YTD change: -50.2 bp)

- 5Y China-US interest rates differential 2.6 bp wider at 210.7 bp (YTD change: -46.4 bp)

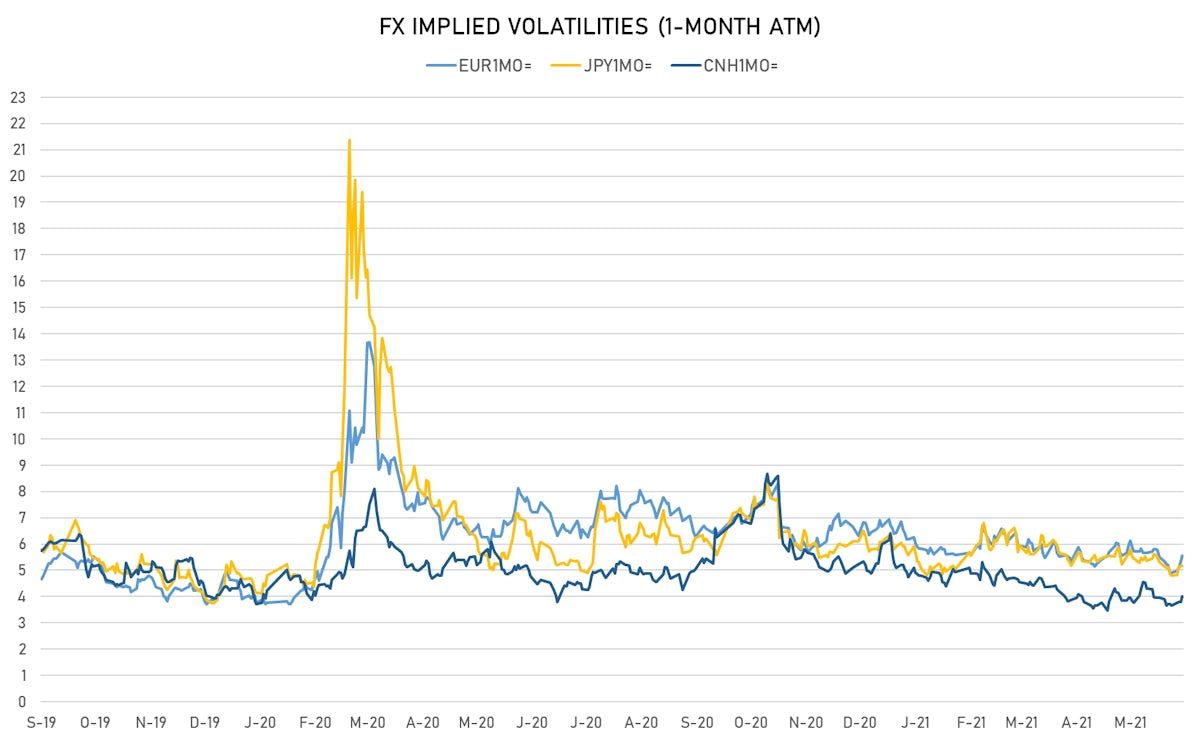

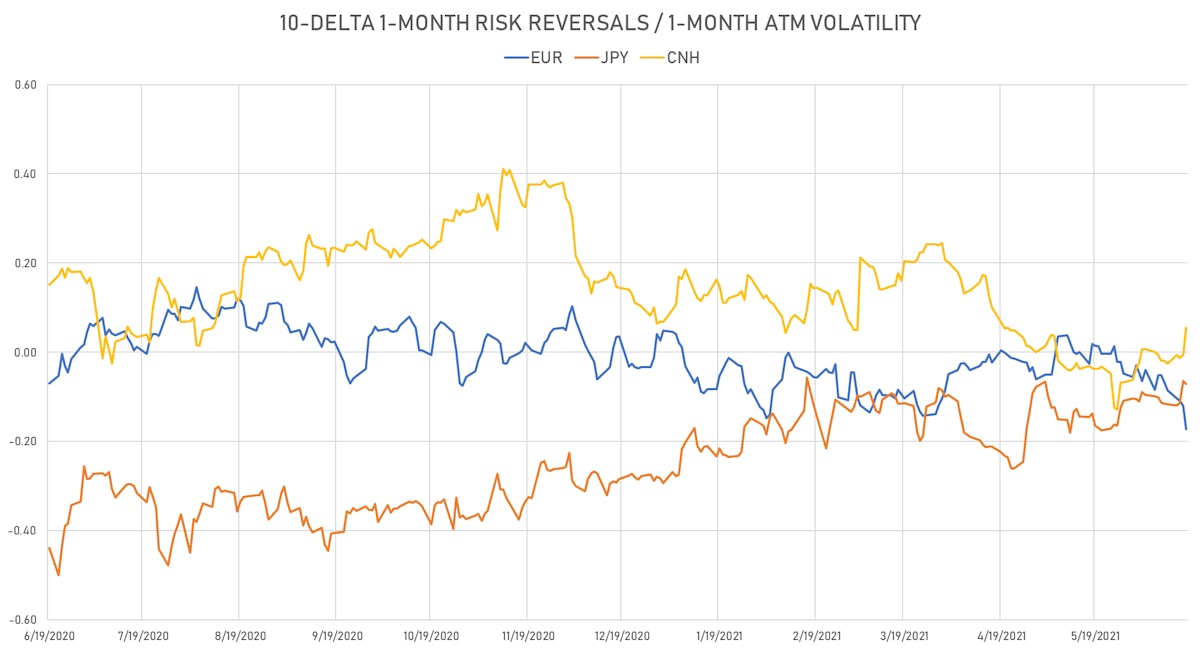

VOLATILITIES

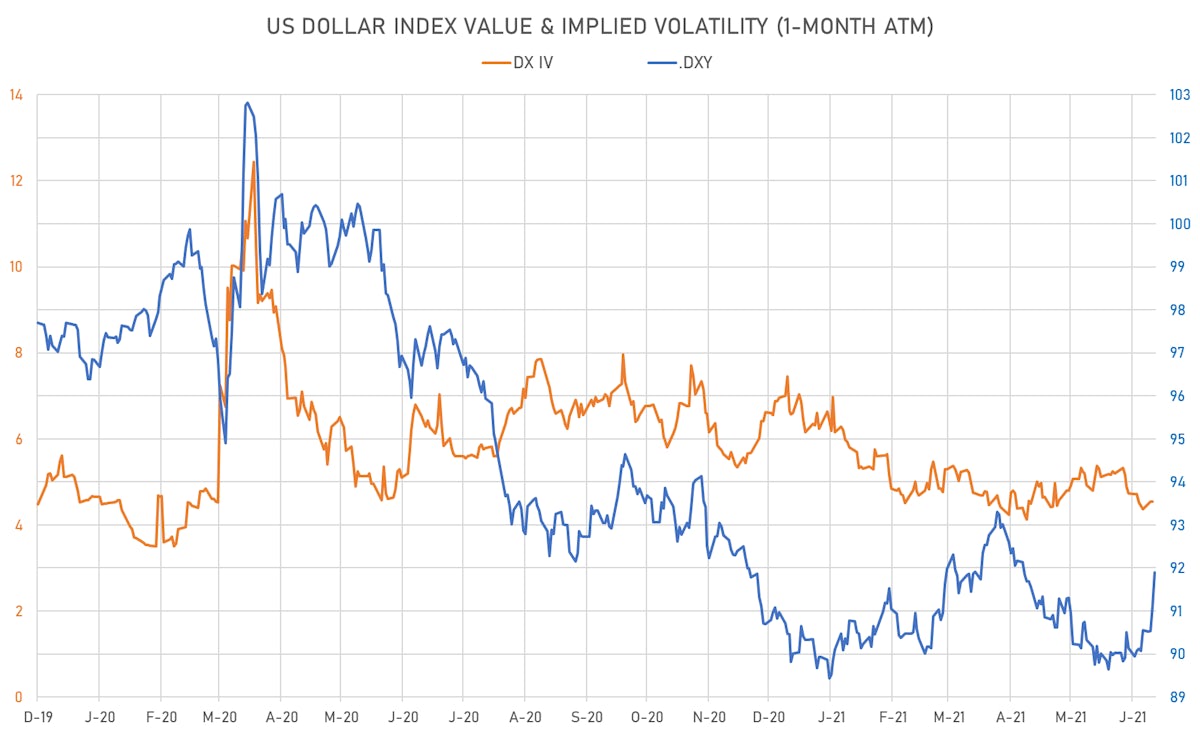

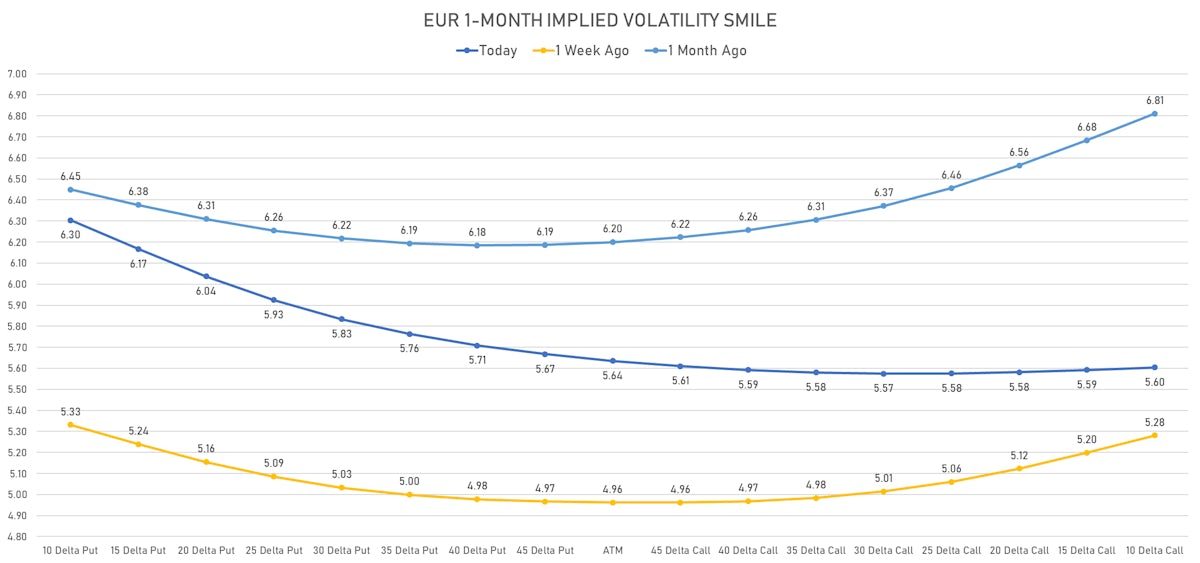

- Risk reversals (see below) speculative positioning is currently short euro, with more limited changes in JPY and CNY

- Euro out-of-the-money puts have seen a strong increase in their implied volatilities over the past week

- Deutsche Bank USD Currency Volatility Index currently at 6.05, up 0.31 on the day (YTD: -1.12)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.55, up 0.2 on the day (YTD: -1.1)

- Japanese Yen 1M ATM IV currently at 5.18, up 0.0 on the day (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 4.00, up 0.2 on the day (YTD: -2.0)

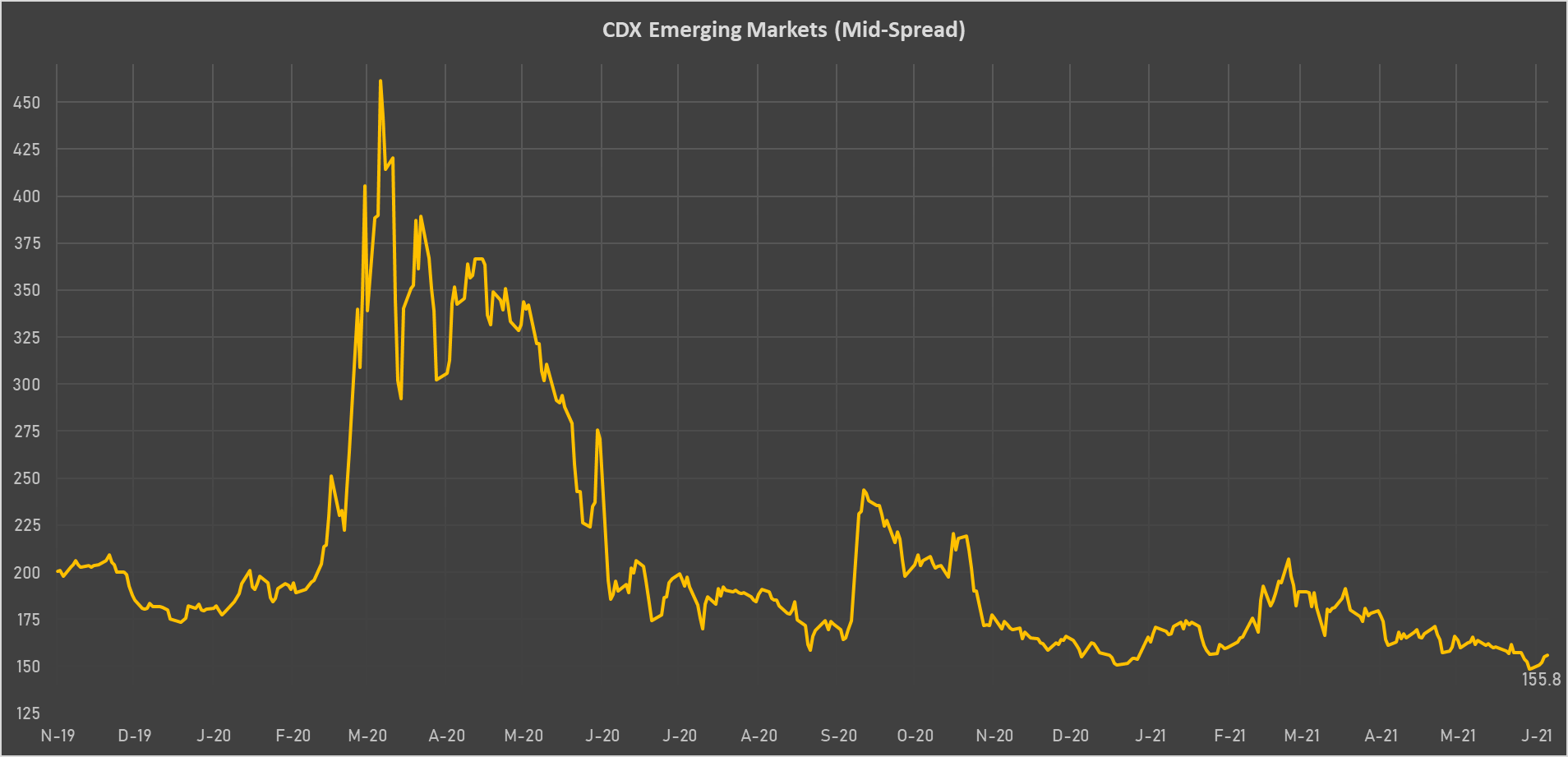

NOTABLE MOVES IN SOVEREIGN CDS

- South Africa (rated BB-): up 4.9 basis points to 189 bp (1Y range: 178-328bp)

- Mexico (rated BBB-): up 1.5 basis points to 94 bp (1Y range: 79-164bp)

- Indonesia (rated BBB): up 1.0 basis points to 74 bp (1Y range: 66-132bp)

- Ecuador (rated WD): up 2.0 basis points to 165 bp (1Y range: 157-181bp)

- Russia (rated BBB): up 1.0 basis points to 87 bp (1Y range: 72-129bp)

- Pakistan (rated B-): up 4.5 basis points to 386 bp (1Y range: 362-512bp)

- Nigeria (rated B): up 4.0 basis points to 351 bp (1Y range: 333-383bp)

- Ethiopia (rated CCC): up 4.5 basis points to 404 bp (1Y range: 383-442bp)

- Kenya (rated B+): up 4.5 basis points to 415 bp (1Y range: 394-454bp)

- Egypt (rated B+): down 6.1 basis points to 318 bp (1Y range: 283-460bp)

LARGEST FX MOVES TODAY

- Qatari Riyal up 2.1% (YTD: 0.0%)

- Indian Rupee down 1.3% (YTD: -1.5%)

- Polish Zloty down 1.3% (YTD: -2.3%)

- Turkish Lira down 1.3% (YTD: -14.7%)

- Comoro Franc down 1.5% (YTD: -2.8%)

- CFA Franc BCEAO down 1.5% (YTD: -2.7%)

- Colombian Peso down 1.5% (YTD: -8.1%)

- Hungarian Forint down 1.6% (YTD: -0.5%)

- Pacific Franc down 1.8% (YTD: -2.6%)

- Botswana Pula down 1.8% (YTD: -0.2%)