FX

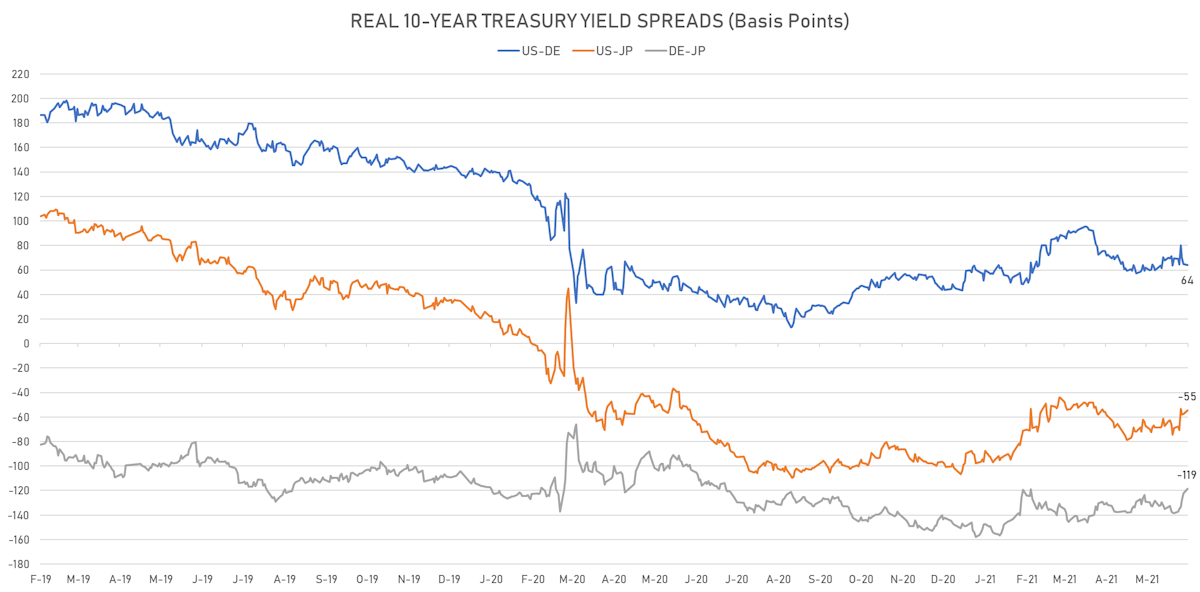

Euro Bounces On Monday, Follows German Rates Differentials With US

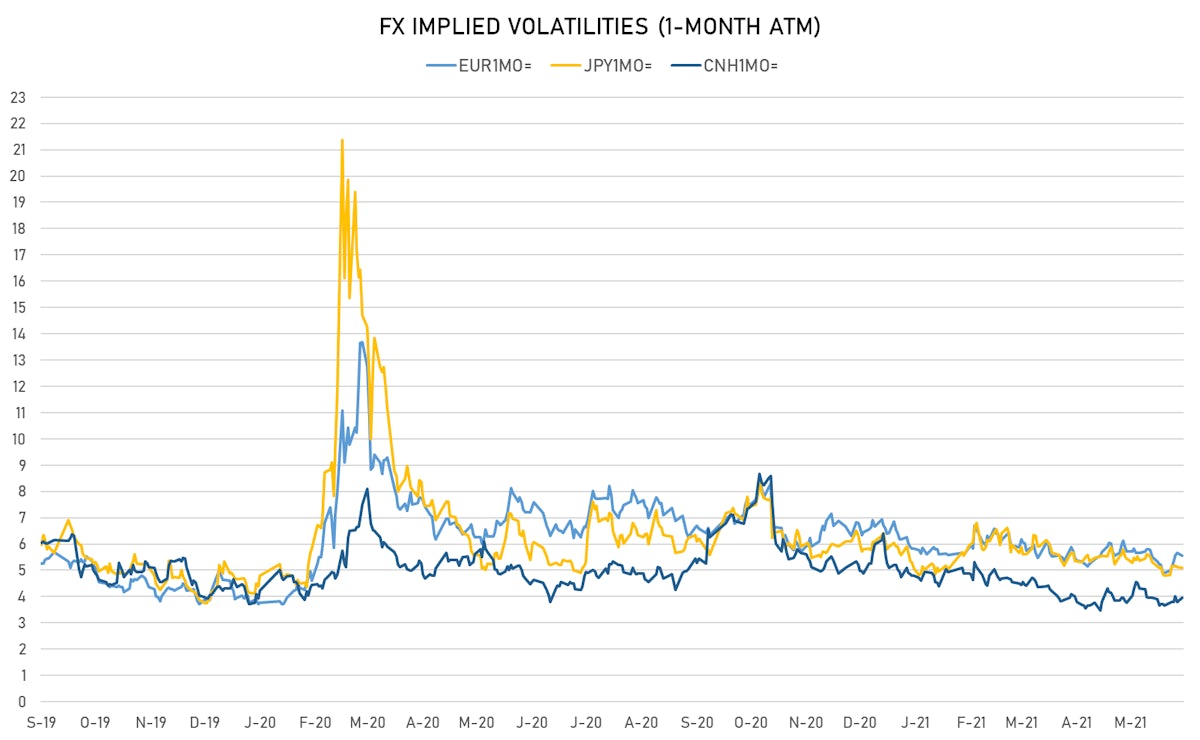

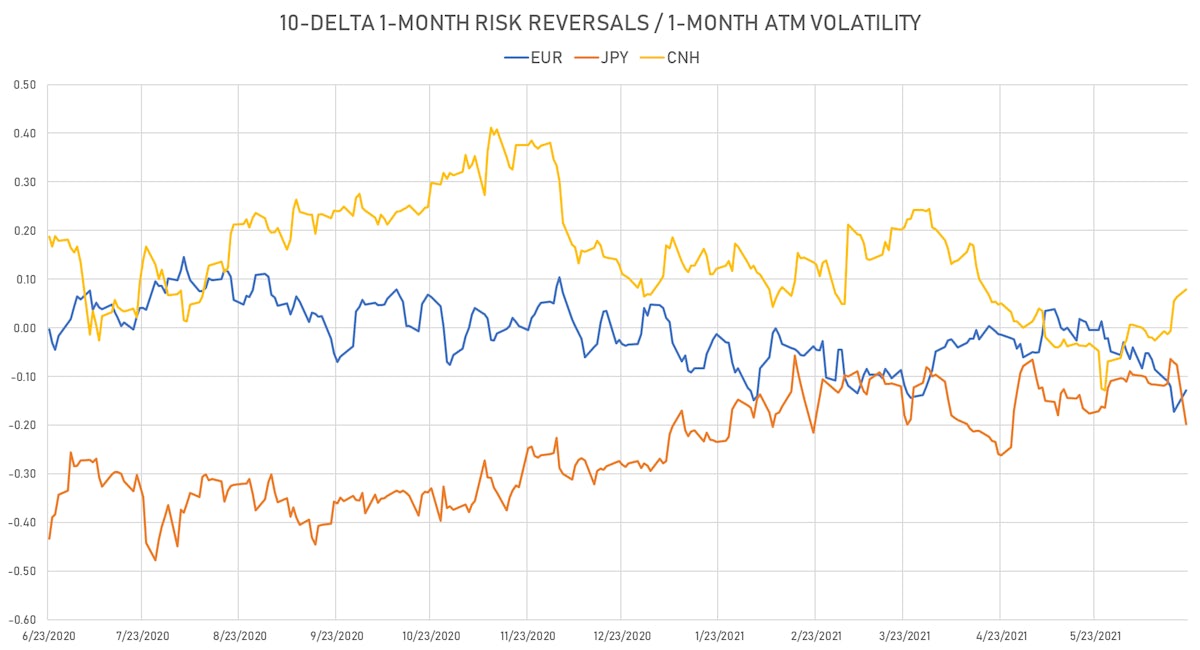

Risk reversals showing downside bets in the euro dropped slightly, while implied volatilities are still up a lot since last week

Published ET

EUR Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

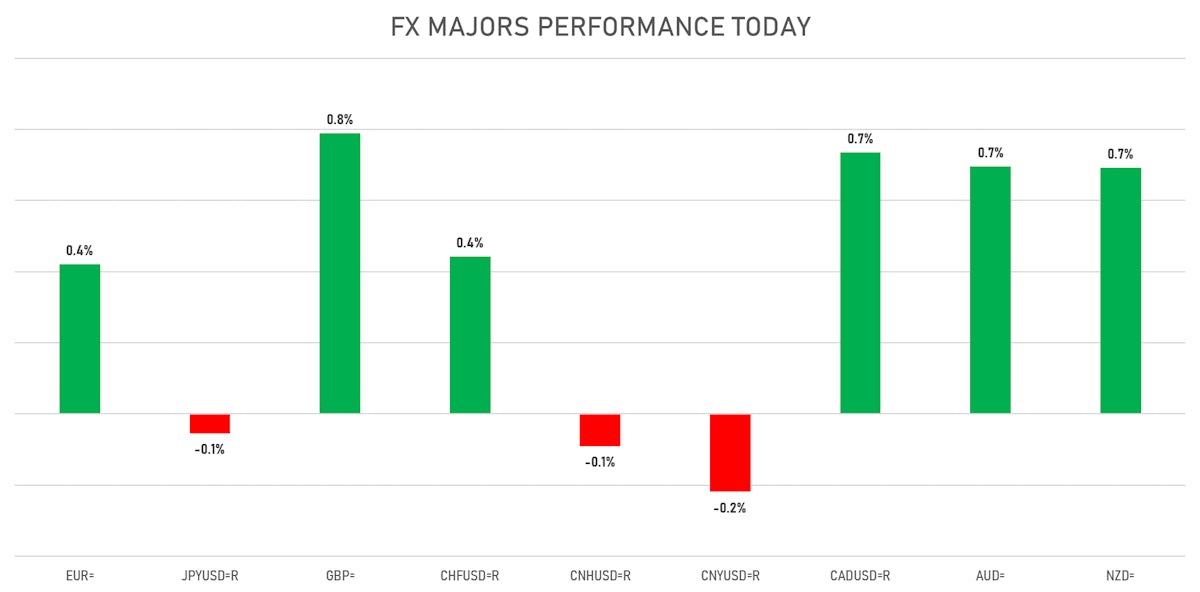

- The US Dollar Index is down -0.35% at 91.90 (YTD: +2.18%)

- Euro up 0.42% at 1.1910 (YTD: -2.5%)

- Yen down 0.06% at 110.25 (YTD: -6.3%)

- Onshore Yuan down 0.22% at 6.4659 (YTD: +0.9%)

- Swiss franc up 0.44% at 0.9186 (YTD: -3.6%)

- Sterling up 0.79% at 1.3918 (YTD: +1.8%)

- Canadian dollar up 0.74% at 1.2374 (YTD: +2.9%)

- Australian dollar up 0.70% at 0.7529 (YTD: -2.1%)

- NZ dollar up 0.69% at 0.6981 (YTD: -2.8%)

MACRO DATA RELEASES

- Hungary, Current Account, Balance, Current Prices for Q1 2021 (Cent. Bank, Hungary) at 0.54 Bln EUR

- Poland, Producer Prices, Total industry, Change Y/Y for May 2021 (CSO, Poland) at 6.50 %, above consensus estimate of 6.00 %

- Poland, Production, Change Y/Y for May 2021 (CSO, Poland) at 29.80 %, above consensus estimate of 29.00 %

- Taiwan, Export Orders Received, Change Y/Y for May 2021 (MoEA, Taiwan) at 34.50%, below consensus estimate of 40.15 %

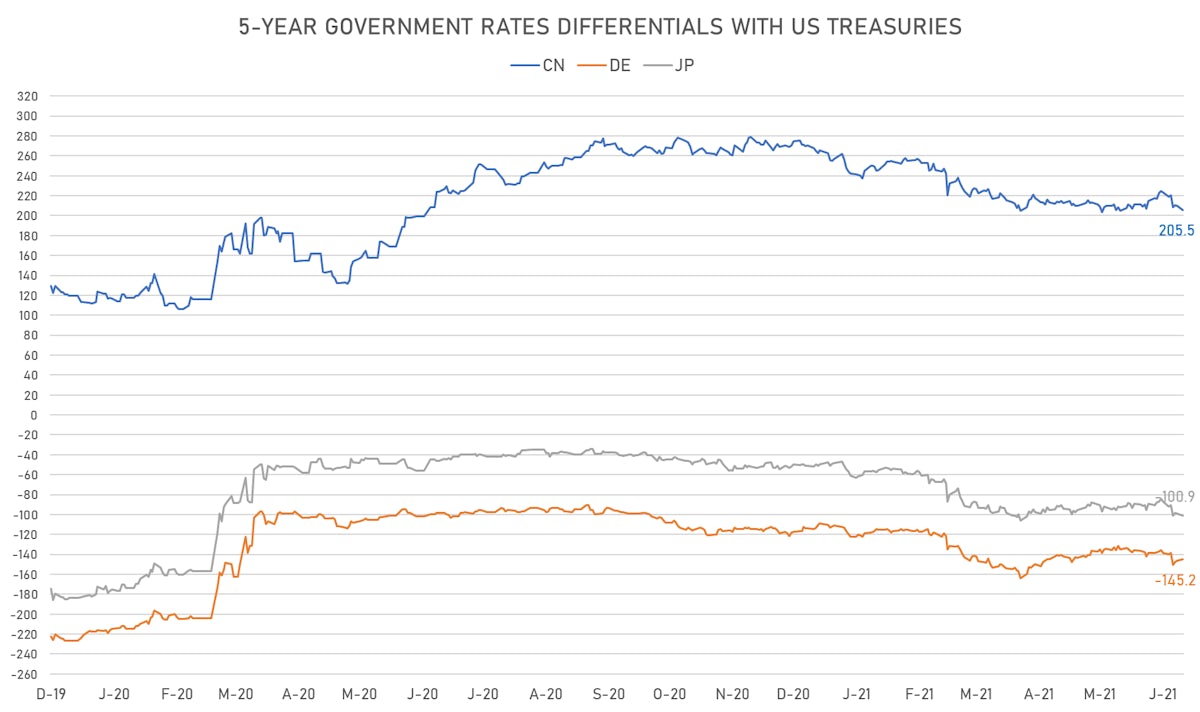

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 1.3 bp tighter at -145.2 bp (YTD change: -34.1 bp), positive for the euro

- 5Y Japan-US interest rates differential 1.6 bp wider at -100.9 bp (YTD change: -52.6 bp), negative for the yen

- 5Y China-US interest rates differential 4.3 bp tighter at 205.5 bp (YTD change: -51.6 bp), negative for the yuan

VOLATILITIES

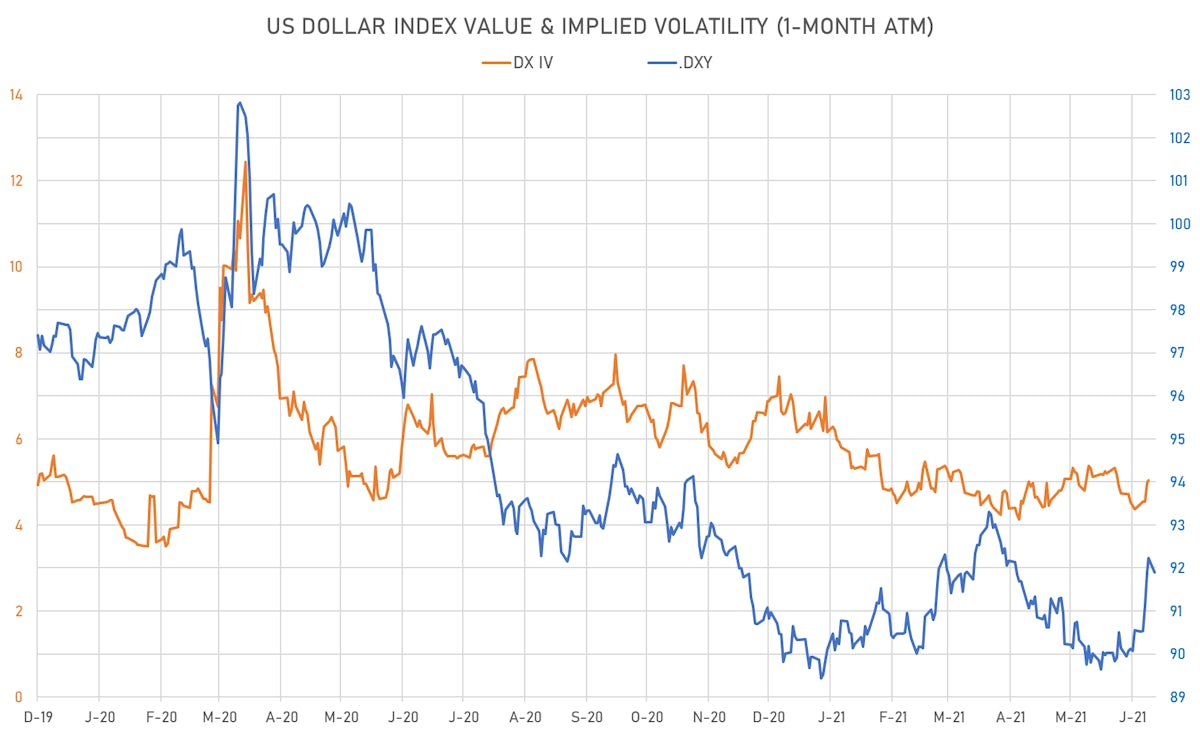

- Deutsche Bank USD Currency Volatility Index currently at 6.09, up 0.04 on the day (YTD: -1.08)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.55, down -0.1 on the day (YTD: -1.1)

- Japanese Yen 1M ATM IV currently at 5.10, unchanged (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.95, up 0.2 on the day (YTD: -2.0)

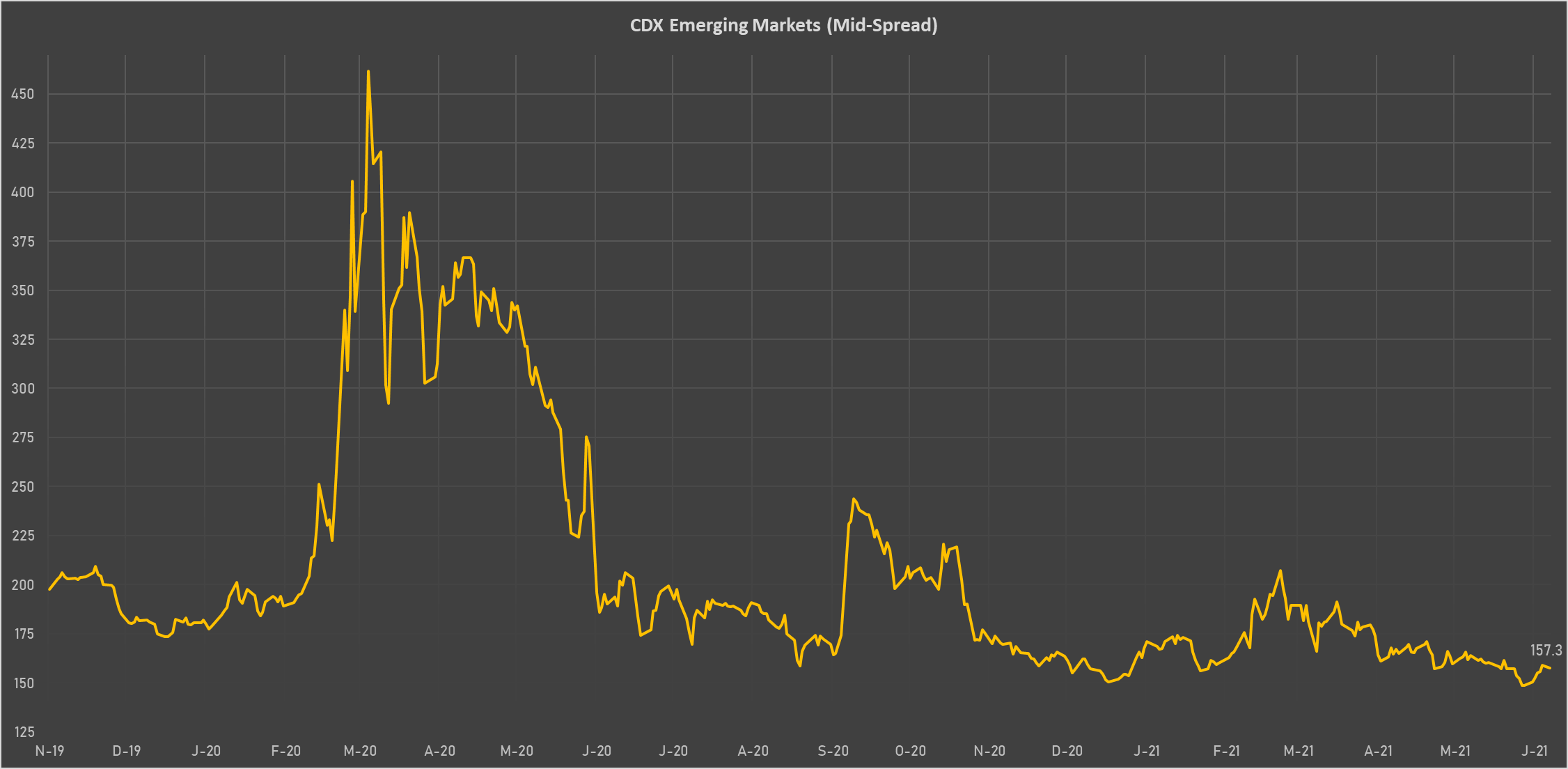

NOTABLE MOVES IN SOVEREIGN CDS

- Colombia (rated BBB-): up 7.5 basis points to 139 bp (1Y range: 83-164bp)

- Argentina (rated CCC): up 63.5 basis points to 1,795 bp (1Y range: 1,049-1,968bp)

- Mexico (rated BBB-): up 3.3 basis points to 97 bp (1Y range: 79-164bp)

- Slovenia (rated A): up 1.5 basis points to 51 bp (1Y range: 47-55bp)

- Egypt (rated B+): up 9.3 basis points to 327 bp (1Y range: 283-448bp)

- Brazil (rated BB-): up 2.3 basis points to 166 bp (1Y range: 141-264bp)

- Indonesia (rated BBB): up 1.0 basis points to 75 bp (1Y range: 66-132bp)

- Vietnam (rated BB): up 1.2 basis points to 104 bp (1Y range: 90-174bp)

- Saudi Arabia (rated A): up 0.6 basis points to 56 bp (1Y range: 53-105bp)

- Russia (rated BBB): up 0.8 basis points to 88 bp (1Y range: 72-129bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 4.9% (YTD: +45.5%)

- Surinamese dollar up 2.8% (YTD: -32.0%)

- Tonga Pa'Anga up 1.8% (YTD: +3.1%)

- Brazilian Real up 1.5% (YTD: +3.6%)

- Samoa Tala up 1.4% (YTD: +0.2%)

- Papua New Guinea up 1.3% (YTD: +0.9%)

- Swedish Krona up 1.2% (YTD: -3.5%)

- North Macedonian denar down 2.0% (YTD: -3.0%)

- Solomon Is Dollar down 3.0% (YTD: -2.7%)

- CFA Franc BEAC down 4.3% (YTD: -2.6%)