FX

US Dollar Index Follows Real Rates Differentials, Inches Down

Mostly lightweight macro releases so far this week, but the IHS Markit Flash PMIs will be released on Wednesday for the US, Eurozone and UK

Published ET

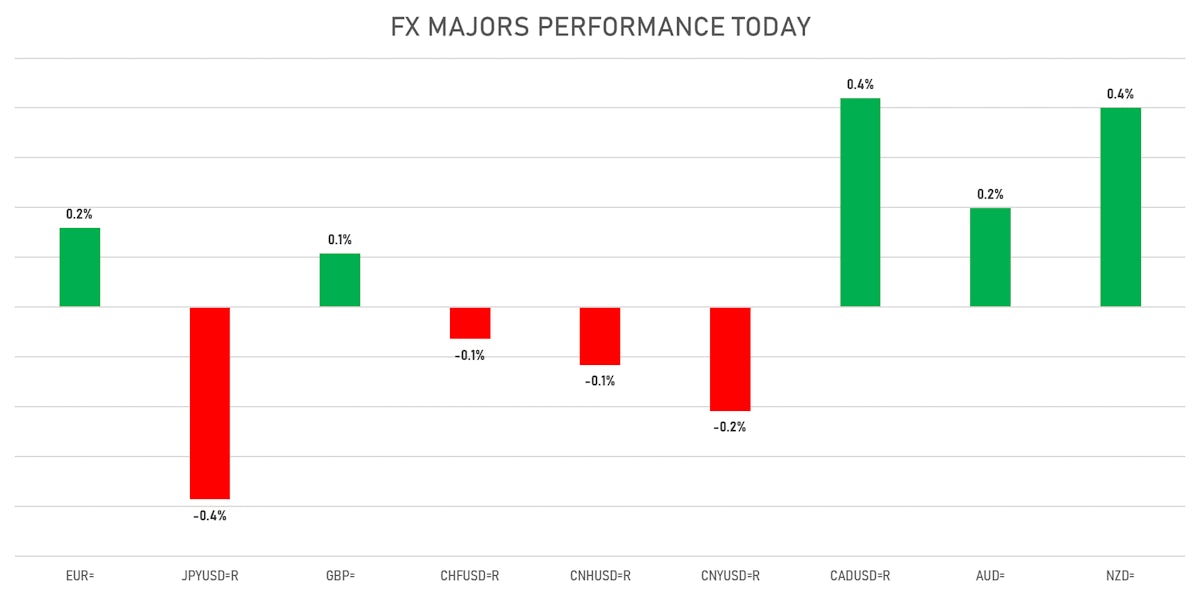

Performance of major currencies against the USD year to date | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.16% at 91.76 (YTD: +2.02%)

- Euro up 0.16% at 1.1934 (YTD: -2.3%)

- Yen down 0.39% at 110.74 (YTD: -6.8%)

- Onshore Yuan down 0.21% at 6.4811 (YTD: +0.7%)

- Swiss franc down 0.06% at 0.9187 (YTD: -3.6%)

- Sterling up 0.11% at 1.3944 (YTD: +2.0%)

- Canadian dollar up 0.42% at 1.2306 (YTD: +3.5%)

- Australian dollar up 0.20% at 0.7550 (YTD: -1.9%)

- NZ dollar up 0.40% at 0.7013 (YTD: -2.4%)

MACRO DATA RELEASES

- Australia, Markit PMI, Composite for Jun 2021 (Markit Economics) at 56.10

- Australia, Markit PMI, Manufacturing for Jun 2021 (Markit Economics) at 58.40

- Australia, Markit PMI, Services for Jun 2021 (Markit Economics) at 56.00

- Denmark, Consumer confidence indicator for Jun 2021 (statbank.dk) at 2.30

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Jun 2021 (DG ECFIN, France) at -3.30 , below consensus estimate of -3.00

- Hungary, Policy Rates, Base Rate for Jun 2021 (Cent. Bank, Hungary) at 0.90 %, above consensus estimate of 0.85 %

- Hungary, Policy Rates, Overnight Deposite Rate for Jun 2021 (Cent. Bank, Hungary) at -0.05 %, in line with consensus estimate

- Japan June flash manufacturing PMI 51.5 vs 53.0 in prior month

- Japan June flash PMI Services PMI 47.2 vs 46.5 in prior month

- Japan June flash PMI Composite PMI 47.8 vs 48.8 in prior month

- United States, Existing-Home Sales, Single-Family and Condos, total for May 2021 (NAR, United States) at 5.80 Mln, above consensus estimate of 5.72 Mln

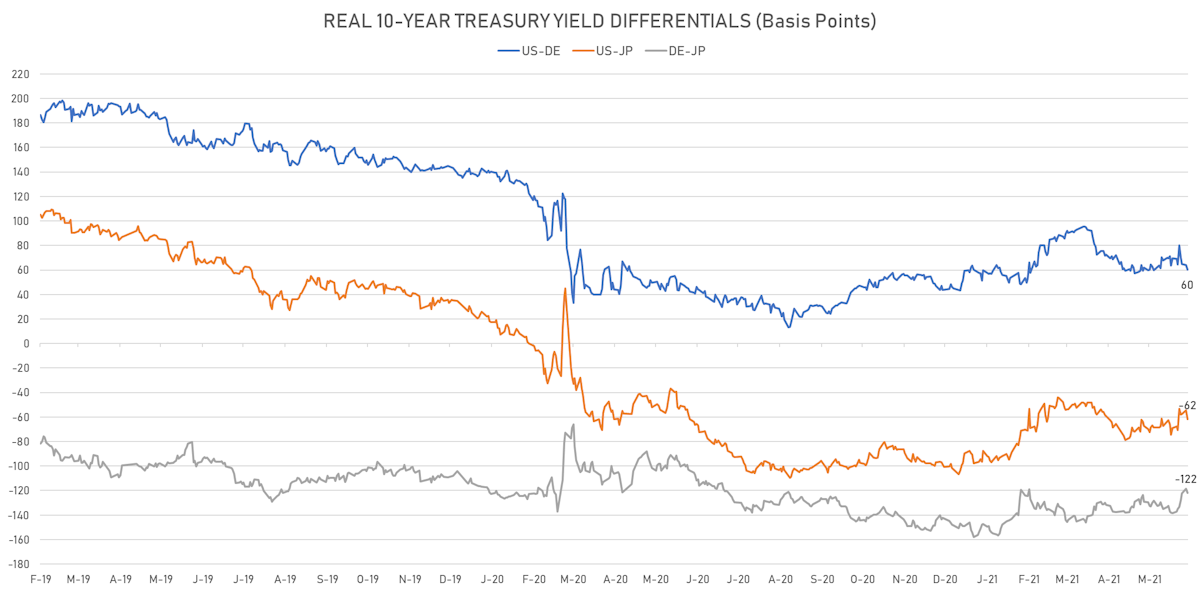

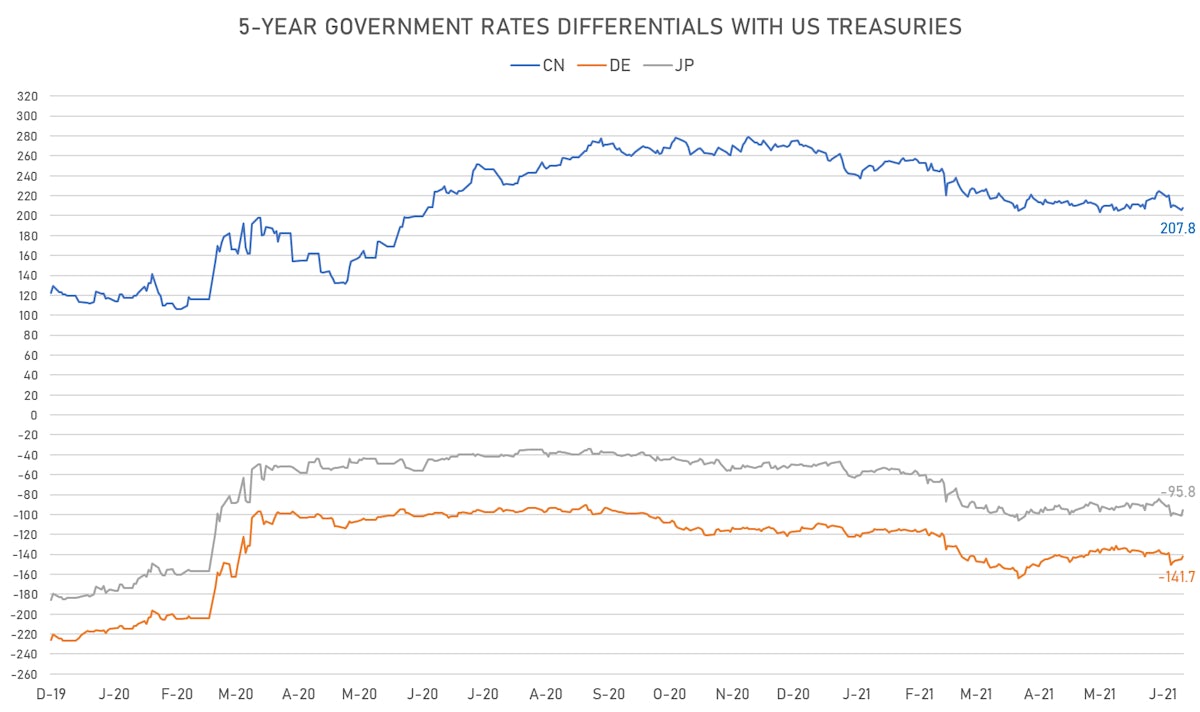

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 3.5 bp tighter at -141.7 bp (YTD change: -30.6 bp), positive for the euro

- 5Y Japan-US interest rates differential 5.1 bp tighter at -95.8 bp (YTD change: -47.5 bp), positive for the yen

- 5Y China-US interest rates differential 2.3 bp wider at 207.8 bp (YTD change: -49.3 bp), positive for the yuan

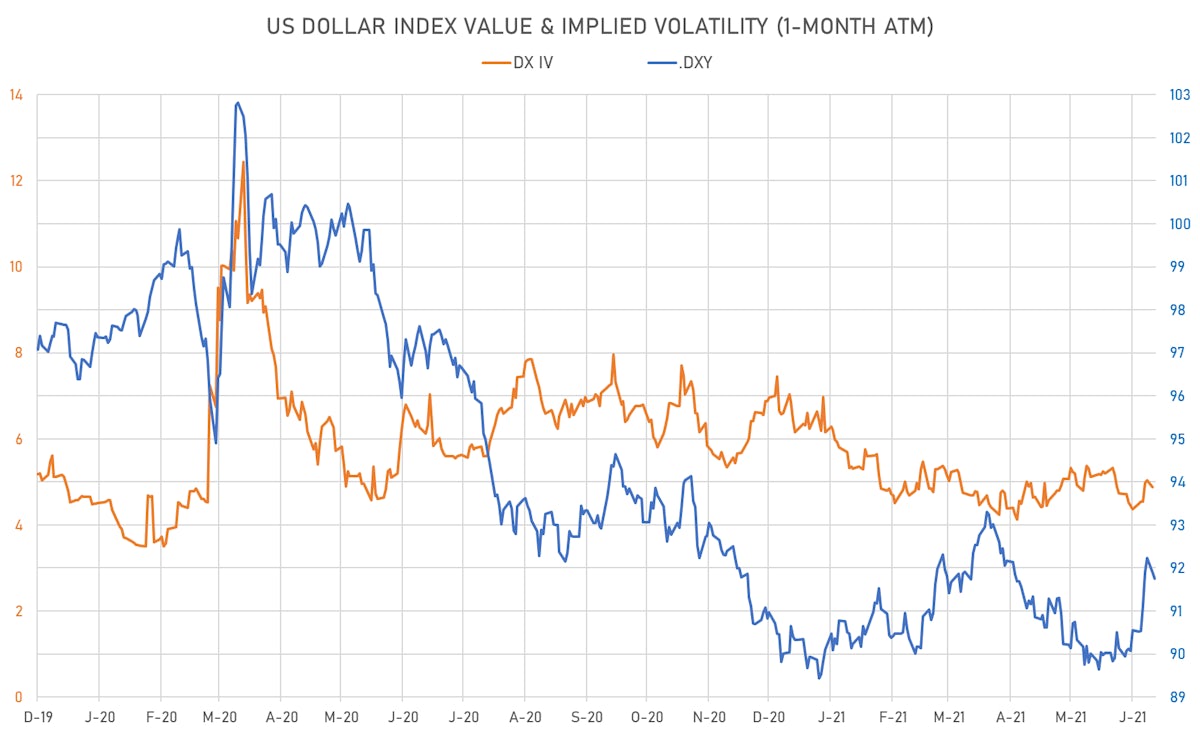

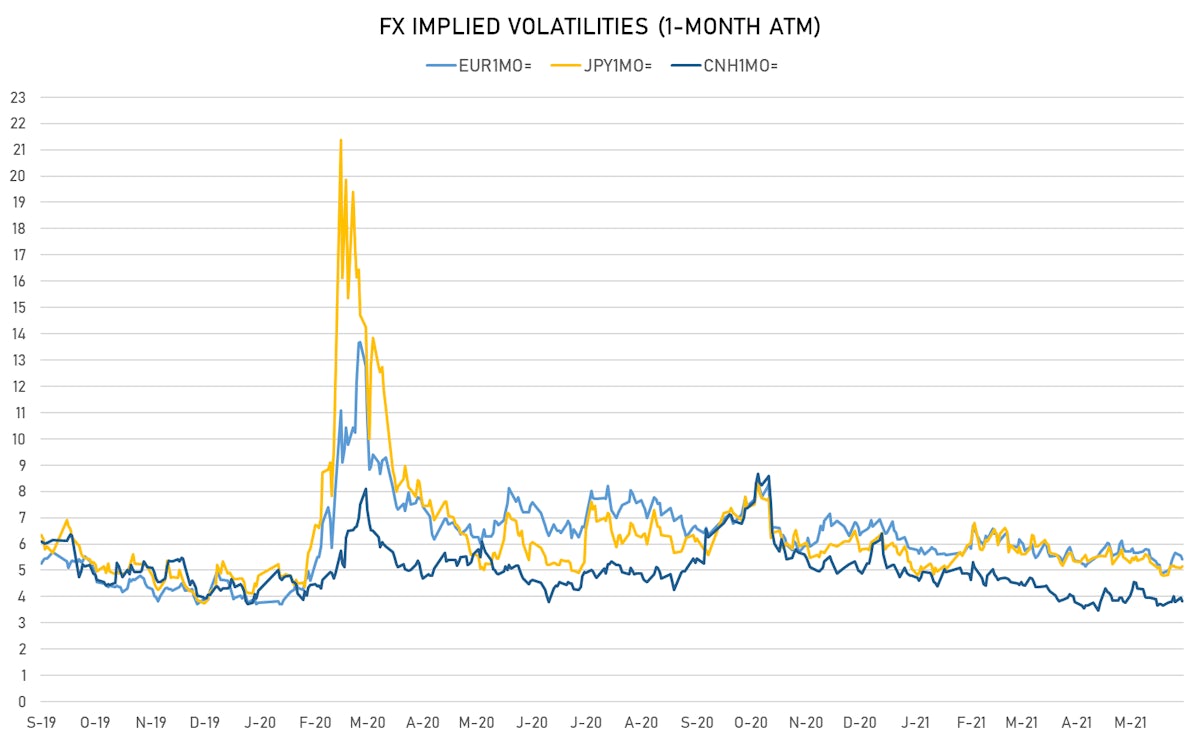

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 5.98, down -0.11 on the day (YTD: -1.19)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.43, down -0.1 on the day (YTD: -1.2)

- Japanese Yen 1M ATM IV currently at 5.15, up 0.1 on the day (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.83, down -0.1 on the day (YTD: -2.2)

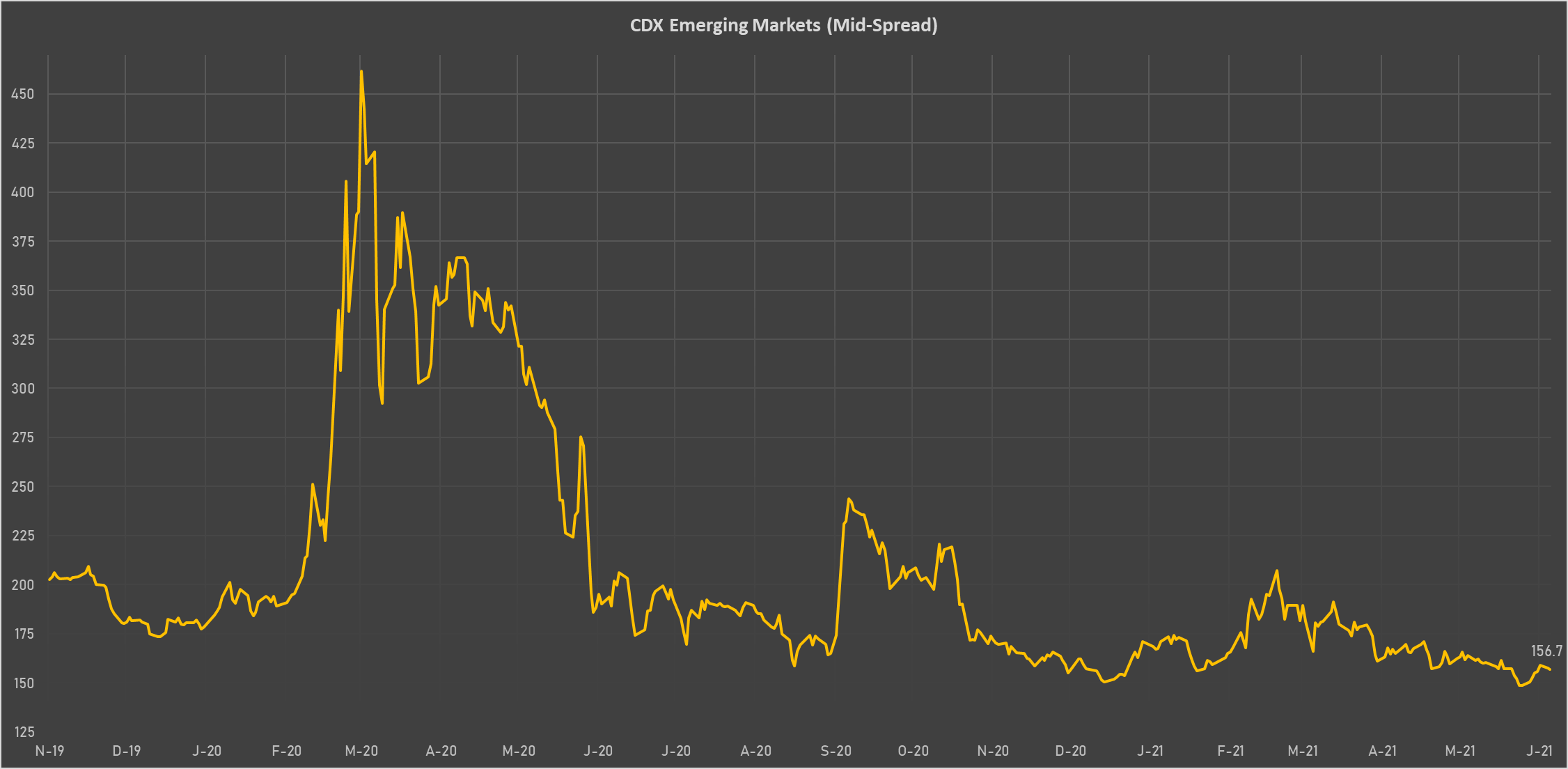

NOTABLE MOVES IN SOVEREIGN CDS

- Argentina (rated CCC): up 37.3 basis points to 1,821 bp (1Y range: 1,049-1,968bp)

- Oman (rated BB-): up 3.6 basis points to 243 bp (1Y range: 228-485bp)

- Mexico (rated BBB-): up 1.3 basis points to 98 bp (1Y range: 79-164bp)

- Colombia (rated BBB-): up 1.7 basis points to 140 bp (1Y range: 83-164bp)

- Bahrain (rated B+): up 1.4 basis points to 198 bp (1Y range: 172-347bp)

- Panama (rated BBB-): down 0.8 basis points to 65 bp (1Y range: 44-112bp)

- Saudi Arabia (rated A): down 0.9 basis points to 55 bp (1Y range: 53-105bp)

- Government of Chile (rated A-): down 1.2 basis points to 63 bp (1Y range: 43-84bp)

- Russia (rated BBB): down 1.7 basis points to 86 bp (1Y range: 72-129bp)

- Peru (rated BBB+): down 2.3 basis points to 91 bp (1Y range: 52-98bp)

LARGEST FX MOVES TODAY

- Solomon Is Dollar up 3.0% (YTD: +0.2%)

- Turkish Lira up 1.3% (YTD: -14.1%)

- Jamaican Dollar up 1.2% (YTD: -4.4%)

- Brazilian Real up 1.1% (YTD: +4.7%)

- Hungarian Forint up 0.9% (YTD: +1.2%)

- Chilean Peso up 0.8% (YTD: -4.1%)

- Albanian Lek up 0.7% (YTD: -1.1%)

- Mexican Peso up 0.7% (YTD: -2.3%)

- Seychelles rupee down 2.1% (YTD: +39.8%)

- Haiti Gourde down 5.8% (YTD: -23.8%)