FX

US Dollar Index Unchanged, With The Euro Rising And Yen Falling Against The Greenback

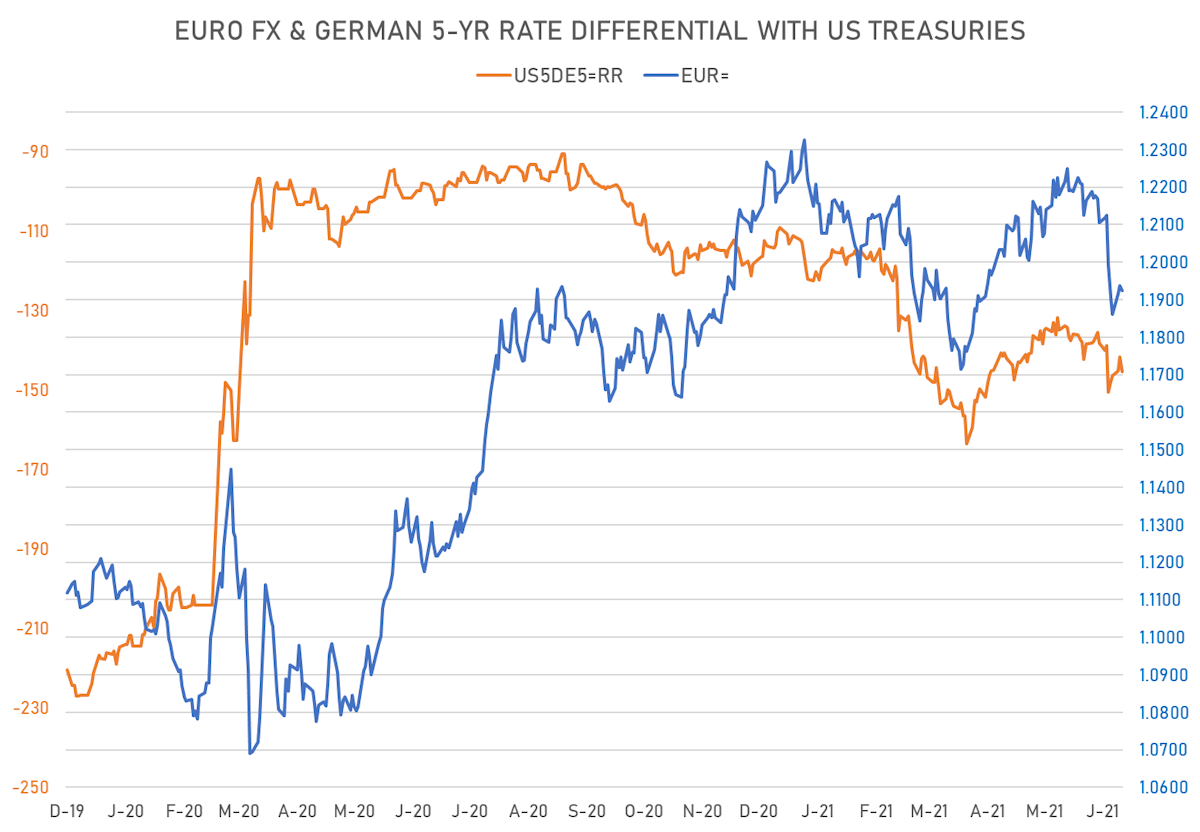

The euro rose today as US Flash PMIs were lower than expected (especially in services), while Eurozone data (most notably German Flash PMIs) beat market estimates

Published ET

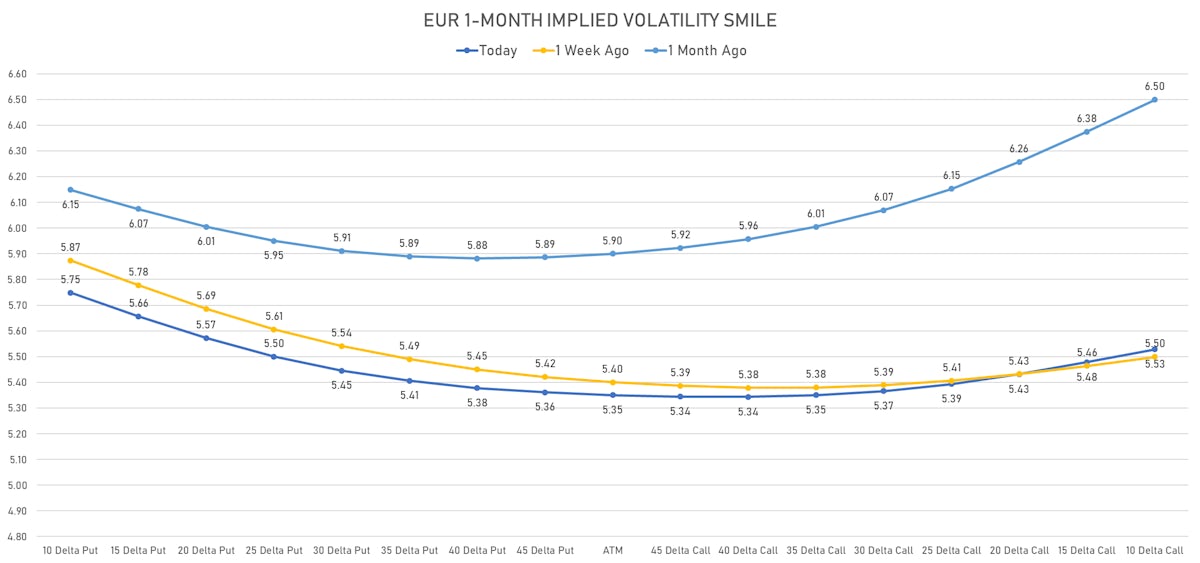

1-month 10-delta risk reversals showing the euro positioning coming closer to home | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

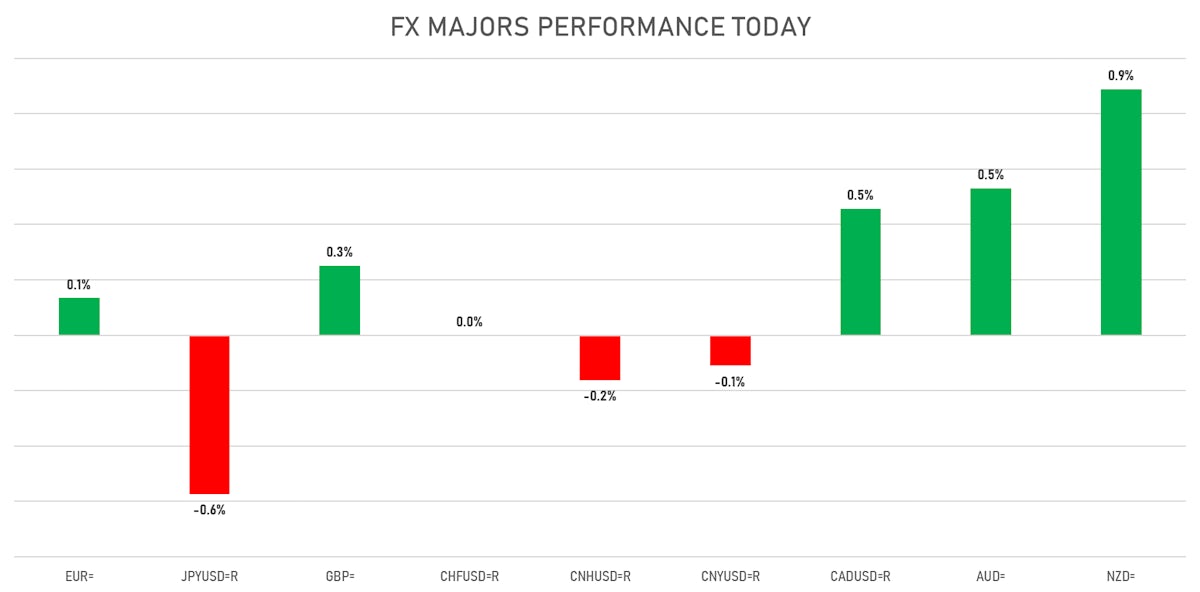

- The US Dollar Index is up 0.05% at 91.80 (YTD: +2.07%)

- Euro up 0.13% at 1.1931 (YTD: -2.3%)

- Yen down 0.57% at 110.96 (YTD: -6.9%)

- Onshore Yuan down 0.11% at 6.4727 (YTD: +0.8%)

- Swiss franc unchanged at 0.9180 (YTD: -3.6%)

- Sterling up 0.25% at 1.3964 (YTD: +2.1%)

- Canadian dollar up 0.46% at 1.2303 (YTD: +3.5%)

- Australian dollar up 0.53% at 0.7575 (YTD: -1.5%)

- NZ dollar up 0.89% at 0.7047 (YTD: -1.9%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Apr 2021 (CANSIM, Canada) at -5.70 %, below consensus estimate of -5.00 %

- Czech Republic, Policy Rates, Repo Rate (2 Week) for 23 Jun (Czech National Bank) at 0.50%, in line with consensus estimate

- Euro Zone, PMI, Composite, Output, Flash for Jun 2021 (Markit Economics) at 59.20, above consensus estimate of 58.80

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Jun 2021 (Markit Economics) at 63.10, above consensus estimate of 62.10

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Jun 2021 (Markit Economics) at 58.00, above consensus estimate of 57.80

- France, PMI, Composite, Output, Flash for Jun 2021 (Markit Economics) at 57.10, below consensus estimate of 59.00

- France, PMI, Manufacturing Sector, Total, Flash for Jun 2021 (Markit/CDAF, France) at 58.60, below consensus estimate of 59.00

- France, PMI, Services Sector, Business Activity, Flash for Jun 2021 (Markit/CDAF, France) at 57.40, below consensus estimate of 59.40

- Germany, PMI, Composite, Output, Flash for Jun 2021 (Markit Economics) at 60.40, above consensus estimate of 57.50

- Germany, PMI, Manufacturing Sector, Total, Flash for Jun 2021 (Markit Economics) at 64.90, above consensus estimate of 63.00

- Germany, PMI, Services Sector, Business Activity, Flash for Jun 2021 (Markit Economics) at 58.10, above consensus estimate of 55.50

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Flash for Jun 2021 (Markit Economics) at 51.50

- Russia, Production, IP Total , Change Y/Y for May 2021 (RosStat, Russia) at 11.80 %, above consensus estimate of 10.50 %

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for May 2021 (Statistics, SA) at 5.20 %, below consensus estimate of 5.20 %

- Thailand, Policy Rates, 1-Day Repurchase Rate (Key Policy Rate) for 23 Jun (Bank of Thailand) at 0.50 %, in line with consensus estimate

- United Kingdom, Markit/CIPS PMI, Composite, Flash for Jun 2021 (Markit Economics) at 61.70, below consensus estimate of 62.80

- United Kingdom, Markit/CIPS PMI, Manufacturing Flash for Jun 2021 (Markit Economics) at 64.20, above consensus estimate of 64.00

- United Kingdom, Markit/CIPS PMI, Services, Flash for Jun 2021 (Markit Economics) at 61.70, below consensus estimate of 63.00

- United States, New Home Sales for May 2021 (U.S. Census Bureau) at 0.77 Mln, below consensus estimate of 0.87 Mln

- United States, PMI, Composite, Output, Flash for Jun 2021 (Markit Economics) at 63.90, below the consensus estimate of 67.60

- United States, PMI, Manufacturing Sector, Total, Flash for Jun 2021 (Markit Economics) at 62.60, above consensus estimate of 61.50

- United States, PMI, Services Sector, Business Activity, Flash for Jun 2021 (Markit Economics) at 64.80, below consensus estimate of 70.00

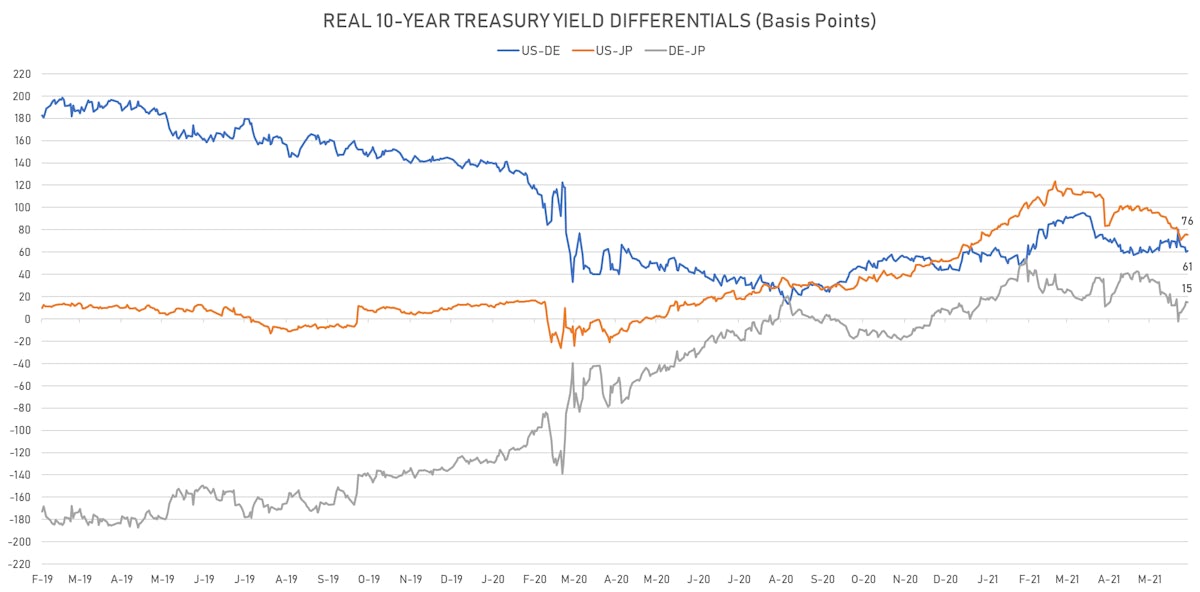

KEY GLOBAL RATES DIFFERENTIALS

- 10Y real yields in the US dropped, tightening the differentials with foreign real rates

- 5Y German-US interest rates differential 3.6 bp wider at -145.3 bp (YTD change: -34.2 bp), negative for the euro

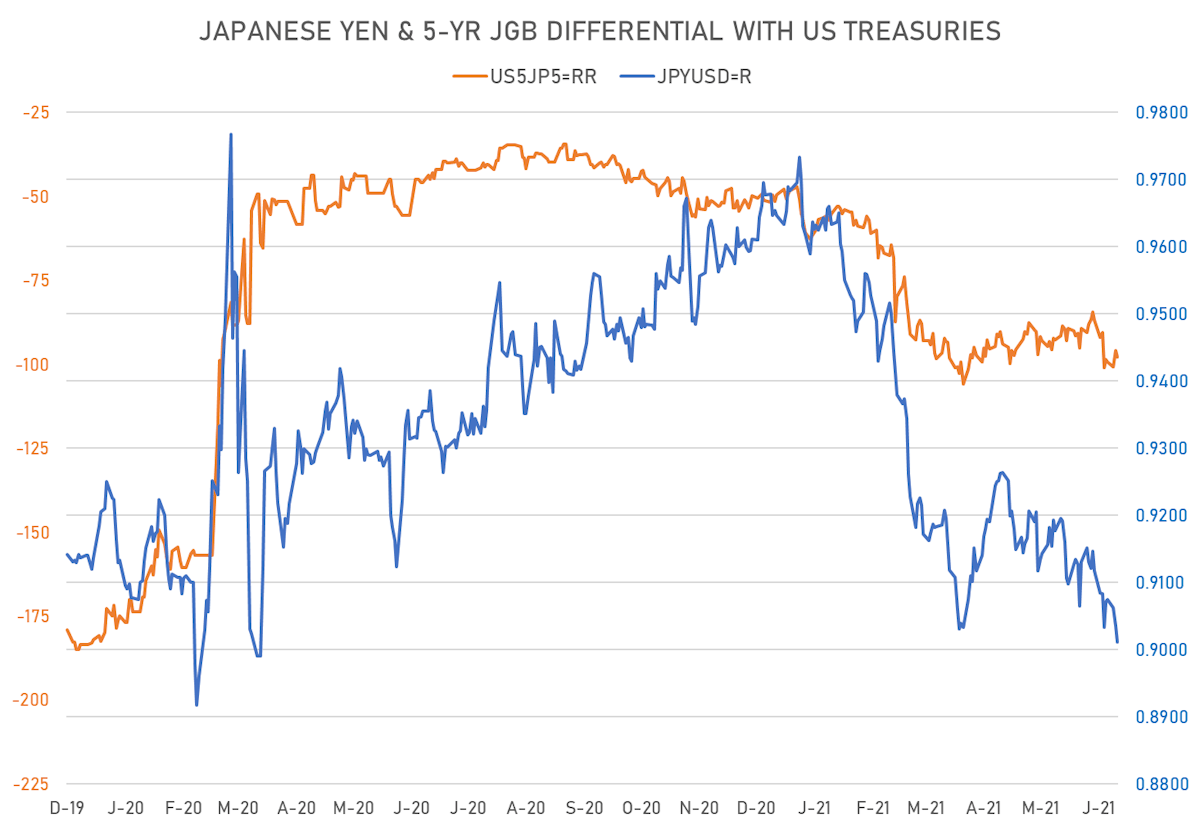

- 5Y Japan-US interest rates differential 2.1 bp wider at -97.9 bp (YTD change: -49.6 bp), negative for the yen

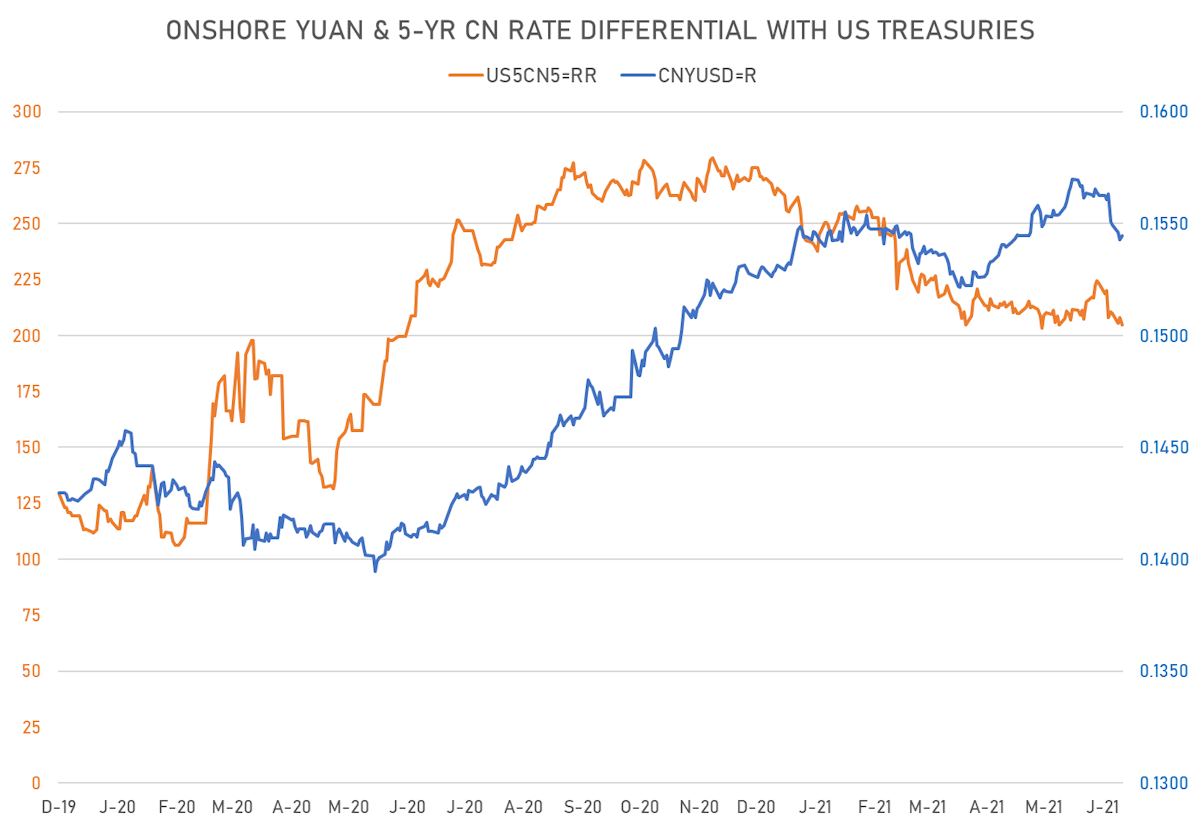

- 5Y China-US interest rates differential 3.2 bp tighter at 204.6 bp (YTD change: -52.5 bp), negative for the yuan

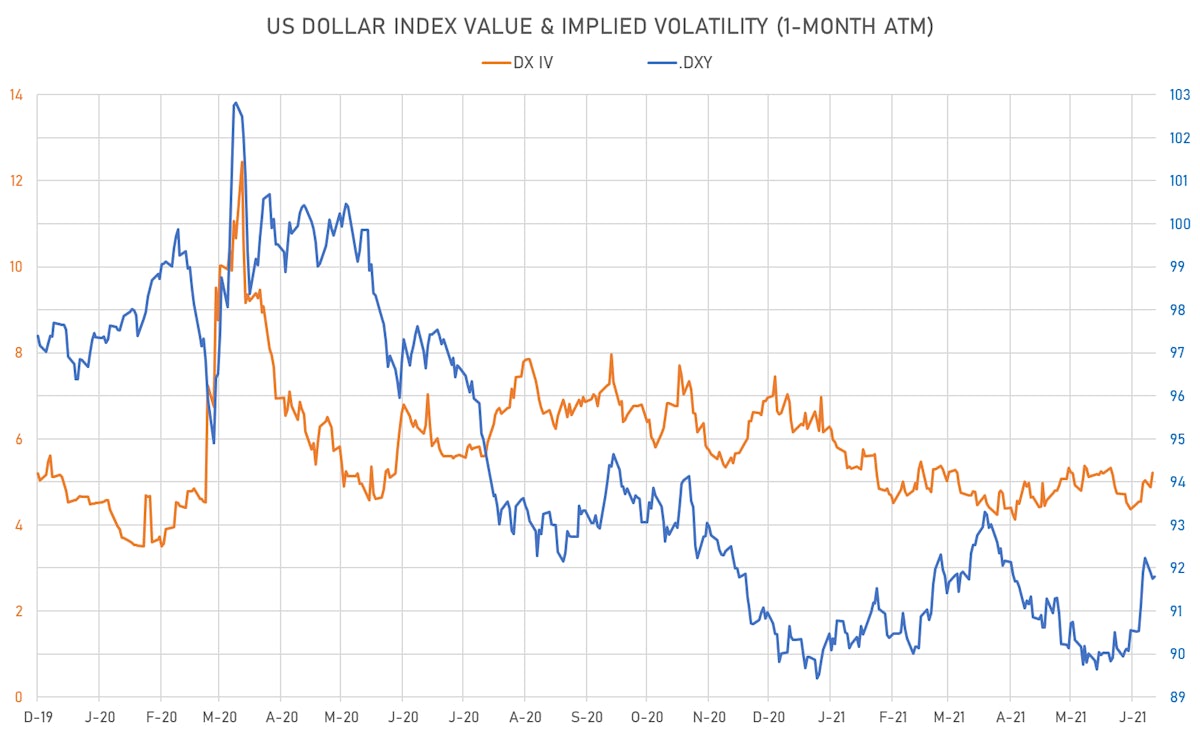

VOLATILITIES

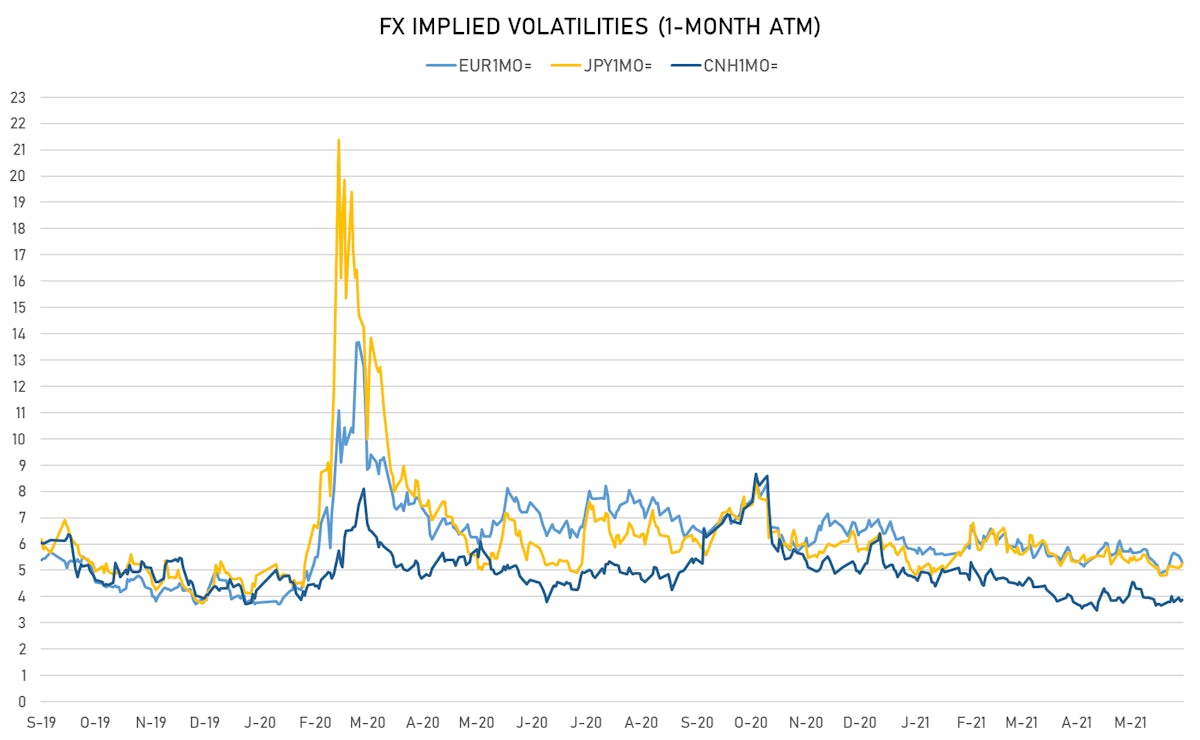

- Deutsche Bank USD Currency Volatility Index currently at 6.02, up 0.04 on the day (YTD: -1.15)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.28, down -0.2 on the day (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.25, up 0.1 on the day (YTD: -0.9)

- Offshore Yuan 1M ATM IV unchanged at 3.86 (YTD: -2.1)

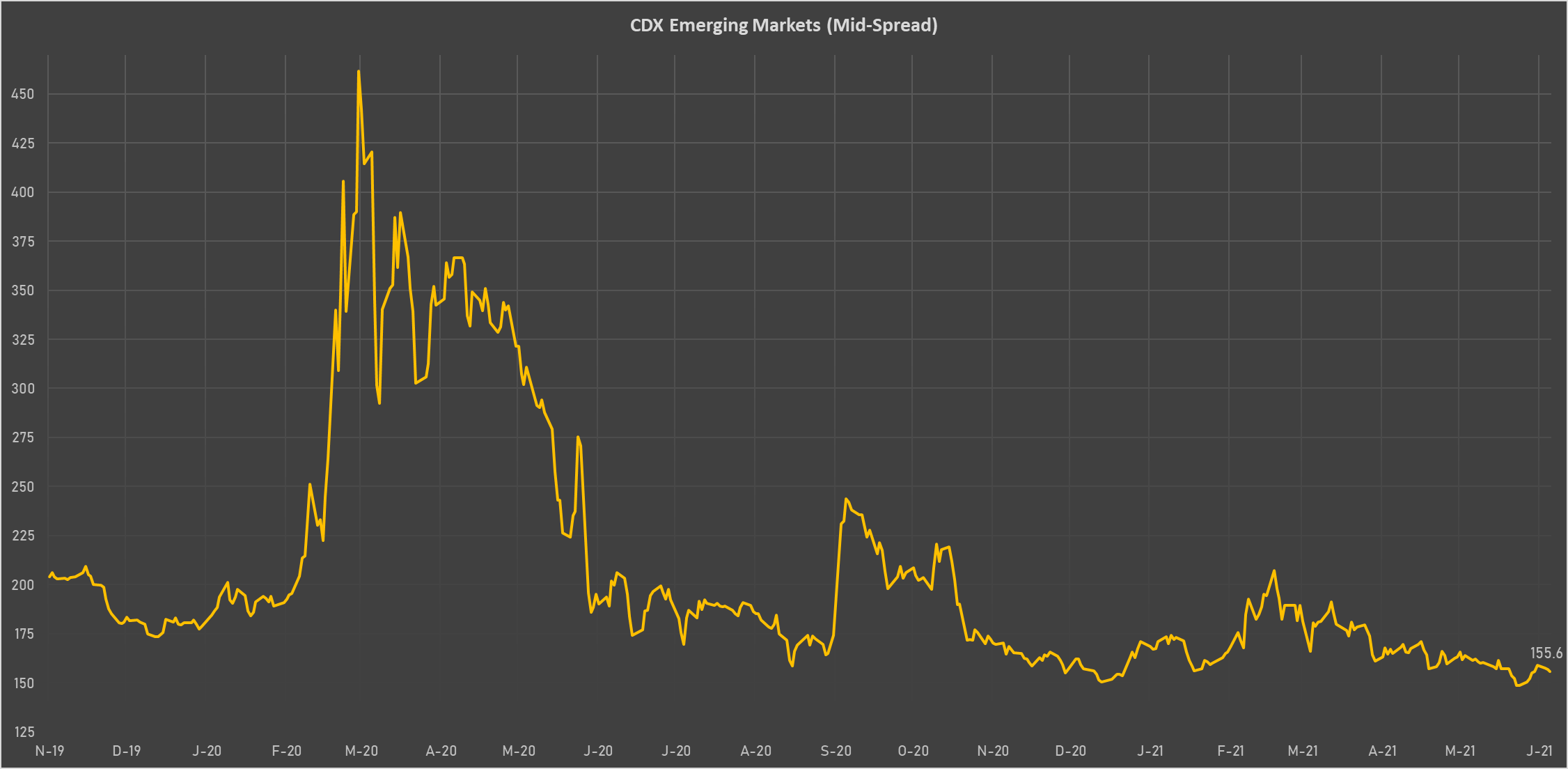

NOTABLE MOVES IN SOVEREIGN CDS

- Saudi Arabia (rated A): up 1.4 basis points to 57 bp (1Y range: 53-105bp)

- Government of Chile (rated A-): down 1.0 basis points to 62 bp (1Y range: 43-84bp)

- Brazil (rated BB-): down 3.0 basis points to 162 bp (1Y range: 141-264bp)

- Egypt (rated B+): down 5.9 basis points to 322 bp (1Y range: 283-448bp)

- Oman (rated BB-): down 6.2 basis points to 236 bp (1Y range: 228-485bp)

- Mexico (rated BBB-): down 2.6 basis points to 96 bp (1Y range: 79-164bp)

- Morocco (rated BB+): down 2.4 basis points to 84 bp (1Y range: 84-127bp)

- Russia (rated BBB): down 2.5 basis points to 83 bp (1Y range: 72-129bp)

- South Africa (rated BB-): down 6.7 basis points to 184 bp (1Y range: 178-328bp)

- Peru (rated BBB+): down 3.6 basis points to 87 bp (1Y range: 52-98bp)

LARGEST FX MOVES TODAY

- Solomon Is Dollar up 2.7% (YTD: -0.1%)

- Mexican Peso up 1.5% (YTD: -1.4%)

- Chilean Peso up 1.5% (YTD: -3.5%)

- Vanuatu Vatu up 1.5% (YTD: -1.2%)

- Turkish Lira up 1.3% (YTD: -14.1%)

- Jamaican Dollar up 1.2% (YTD: -4.4%)

- Gibraltar Pound up 1.0% (YTD: +2.5%)

- Surinamese dollar down 1.7% (YTD: -33.2%)

- Haiti Gourde down 3.7% (YTD: -22.2%)

- Seychelles rupee down 17.1% (YTD: +18.4%)