FX

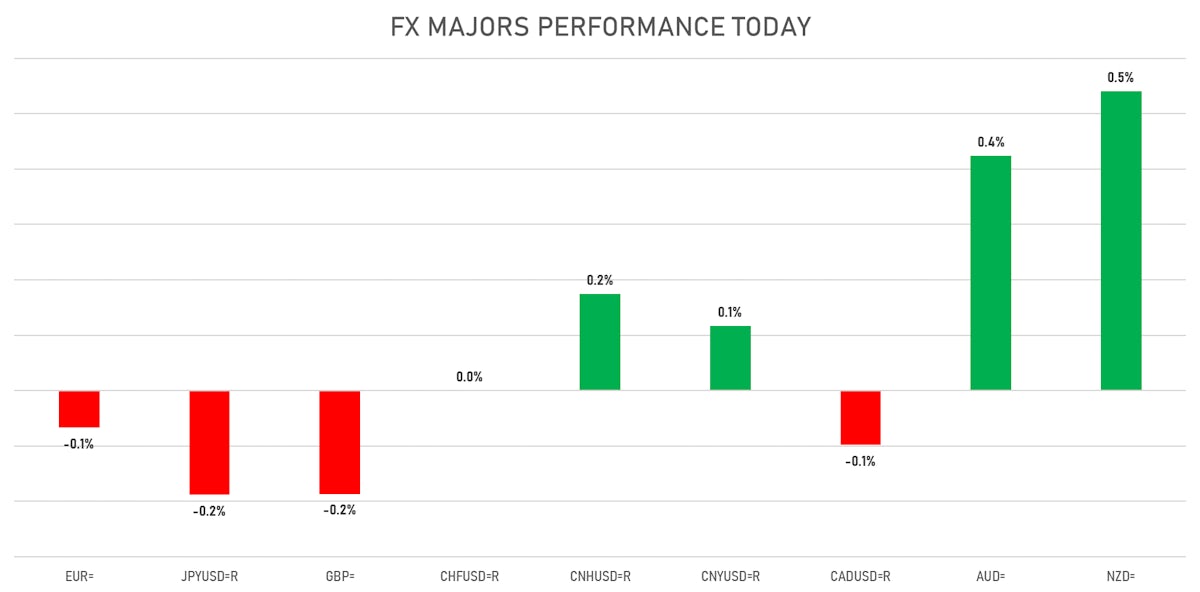

Aussie And Kiwi Up On Otherwise Flat Day For Major Currencies

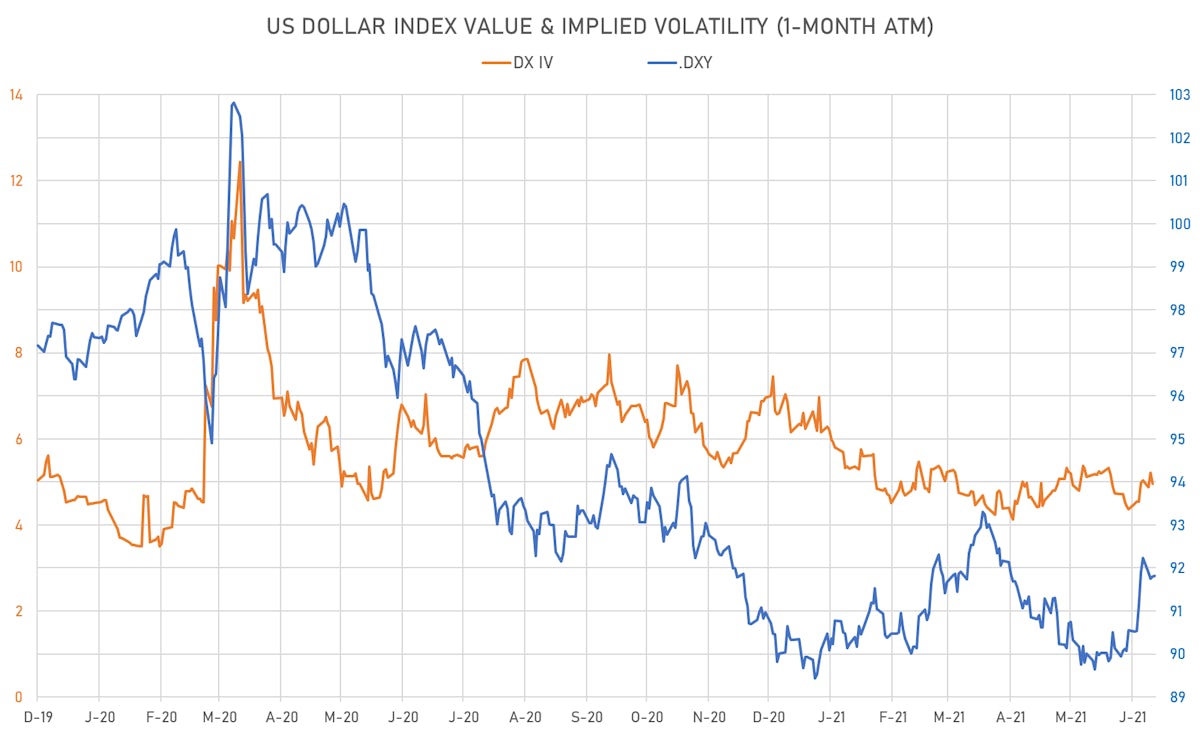

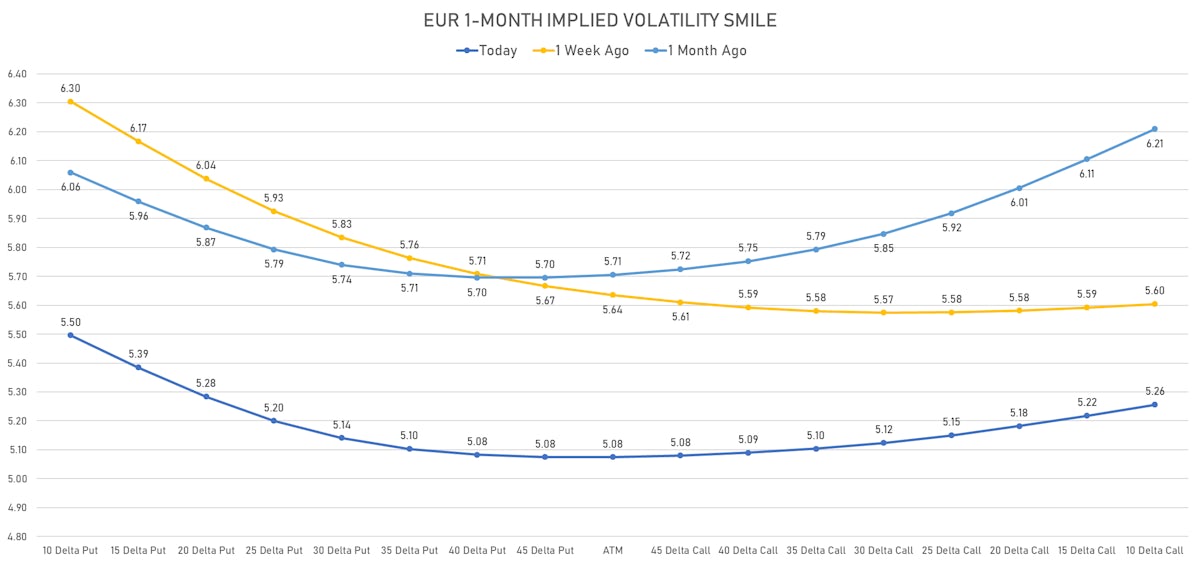

Realized and implied volatilities are way down this week, with light options skewness in favor of the USD

Published ET

No strong sense of direction in risk reversals at the moment | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.01% at 91.81 (YTD: +2.09%)

- Euro down 0.07% at 1.1930 (YTD: -2.3%)

- Yen down 0.19% at 110.87 (YTD: -6.9%)

- Onshore Yuan up 0.12% at 6.4701 (YTD: +0.8%)

- Swiss franc unchanged at 0.9178 (YTD: -3.6%)

- Sterling down 0.19% at 1.3921 (YTD: +1.8%)

- Canadian dollar down 0.10% at 1.2319 (YTD: +3.4%)

- Australian dollar up 0.42% at 0.7585 (YTD: -1.4%)

- NZ dollar up 0.54% at 0.7061 (YTD: -1.7%)

MACRO DATA RELEASES

- France, Business Sentiment, Composite business climate, manufacturing industry for Jun 2021 (INSEE, France) at 107.00, below consensus estimate of 109.00

- Germany, Climate Germany (Incl. Services), Volume Index for Jun 2021 (IFO, Univ. of Munich) at 101.80, above consensus estimate of 100.60

- Germany, IFO Business Climate Germany Expectation (Incl.Services), Volume Index for Jun 2021 (IFO, Univ. of Munich) at 104.00 , above consensus estimate of 103.90

- Germany, IFO Business Climate Germany Situation (Incl. services), Volume Index for Jun 2021 (Ifo, Univ. of Munich) at 99.60, above consensus estimate of 97.80

- Japan, CPI, Tokyo, All Items, General, Change Y/Y for Jun 2021 (MIC, Japan) at 0.00 %

- Japan, CPI, Tokyo, All Items, Less fresh food, Change Y/Y for Jun 2021 (MIC, Japan) at 0.00 %, above consensus estimate of -0.10 %

- Mexico, Policy Rates, Reference Rate (Overnight Lending Rate) for Jun 2021 (Banco de Mexico) at 4.25 %, above consensus estimate of 4.00 %

- Philippines, Policy Rates, Reverse Repo, O/N (Borrowing) Key Rate for 25 Jun (Bangko Sentral ng) at 2.00 %, in line with consensus estimate

- Spain, GDP, Change P/P for Q1 2021 (INE, Spain) at -0.40 %, above consensus estimate of -0.50 %

- United Kingdom, Policy Rates, Bank Rate for Jun 2021 (Bank of England) at 0.10 %, in line with consensus

- United Kingdom, Policy Rates, GB BOE QE Corporate Bond Purchases, Current Prices for Jun 2021 (Bank of England) at 20.00 Bln GBP, in line with consensus

- United States, GDP, Total-final (Unrevised), Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 6.40 %, in line with consensus

- United States, Jobless Claims, National, Initial for W 19 Jun (U.S. Dept. of Labor) at 411.00 k, above consensus estimate of 380.00 k

- United States, Manufacturers New Orders, Durable goods total, Change P/P for May 2021 (U.S. Census Bureau) at 2.30 %, below consensus estimate of 2.80 %

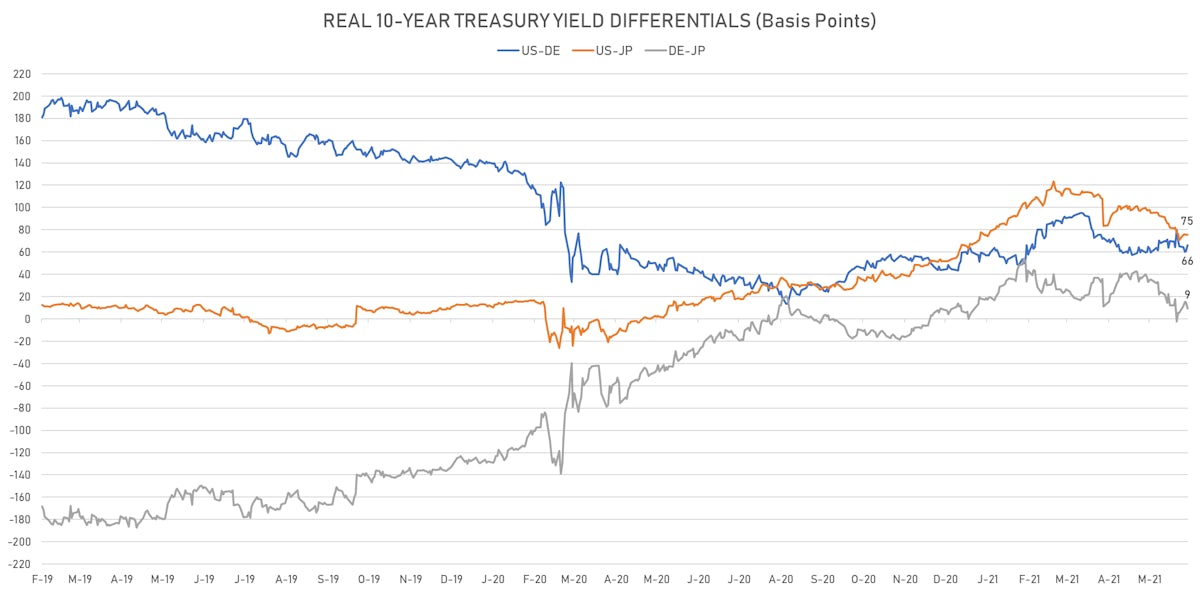

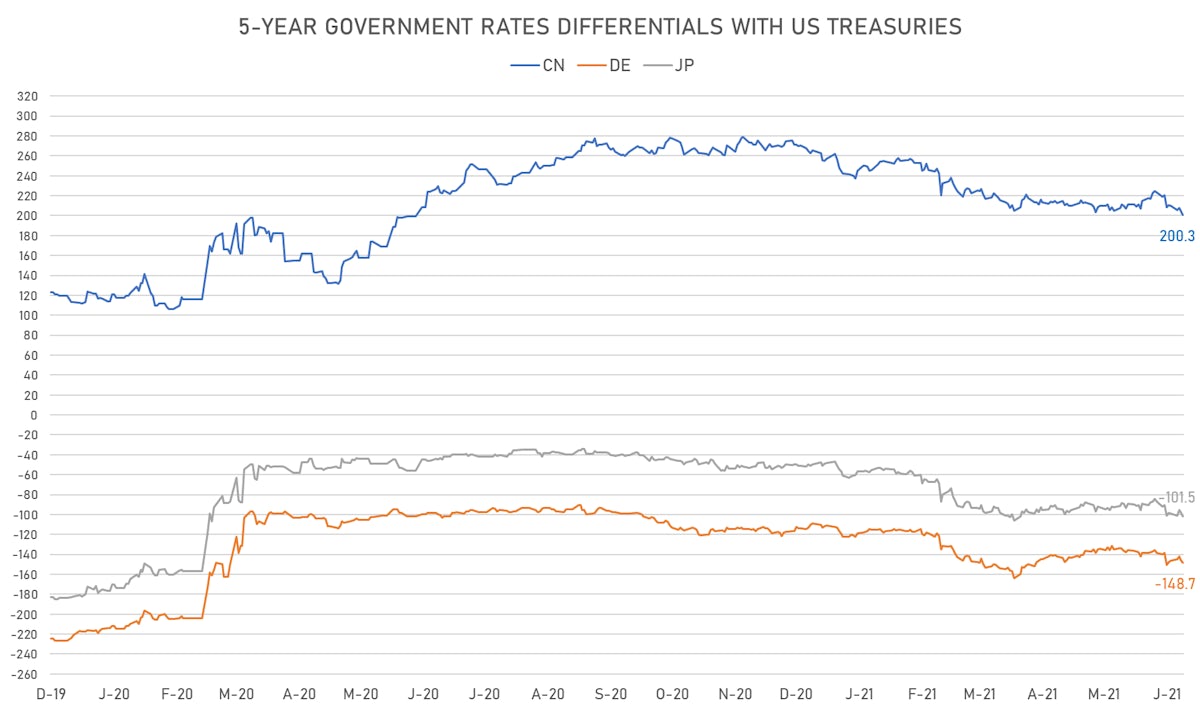

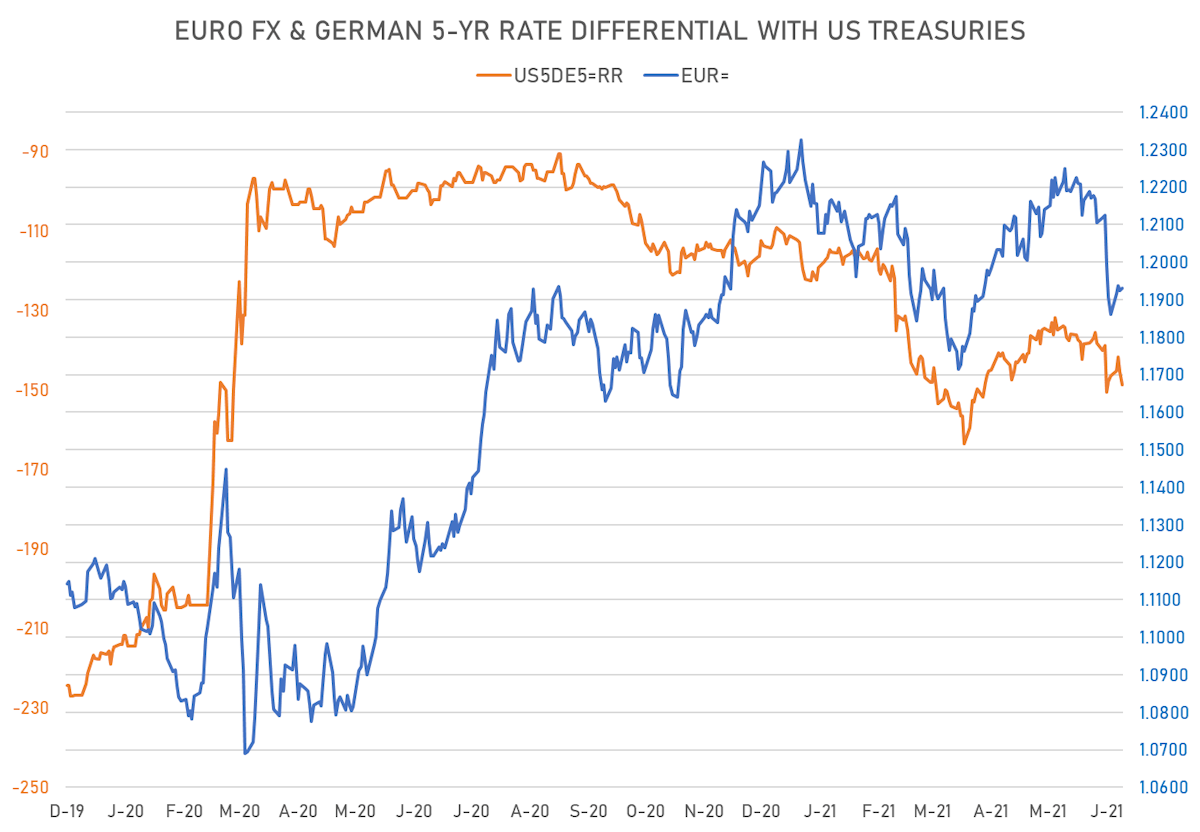

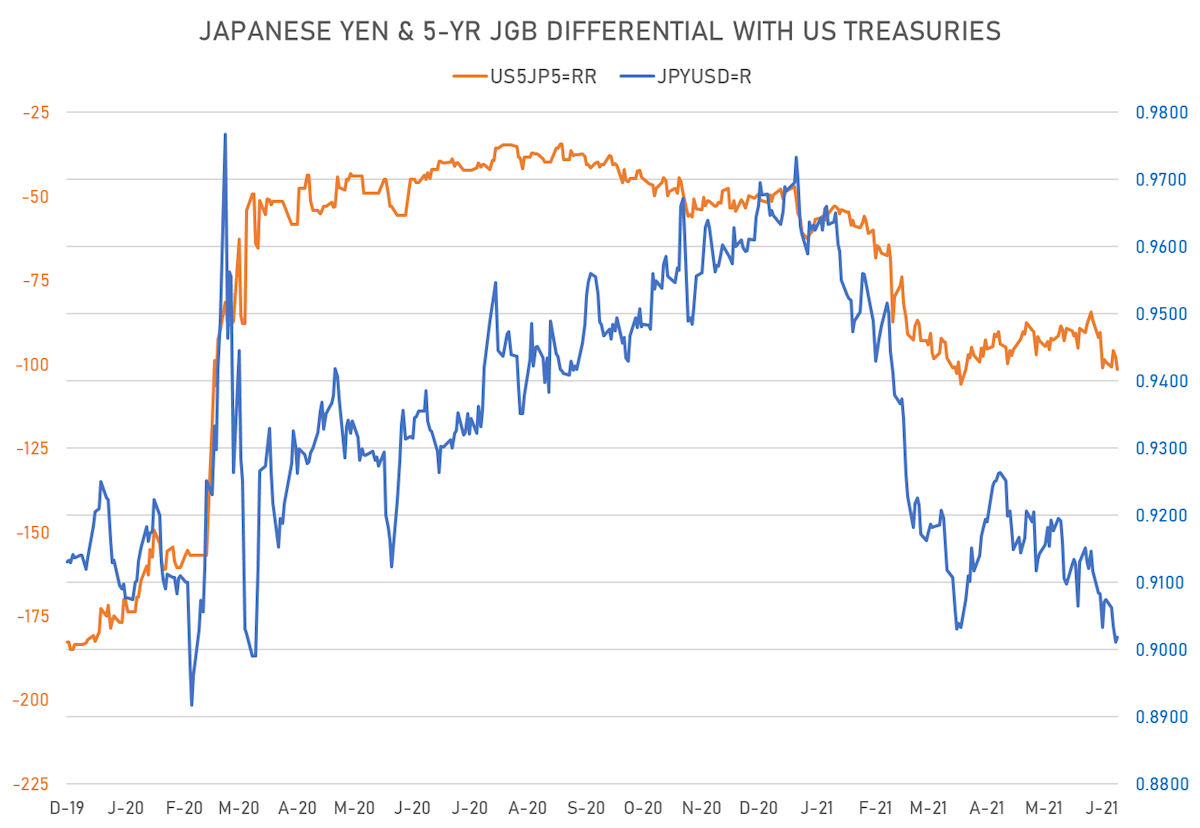

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 3.4 bp wider at -148.7 bp (YTD change: -37.6 bp), negative for the euro

- 5Y Japan-US interest rates differential 3.6 bp wider at -101.5 bp (YTD change: -53.2 bp), negative for the yen

- 5Y China-US interest rates differential 4.3 bp tighter at 200.3 bp (YTD change: -56.8 bp), negative for the yuan

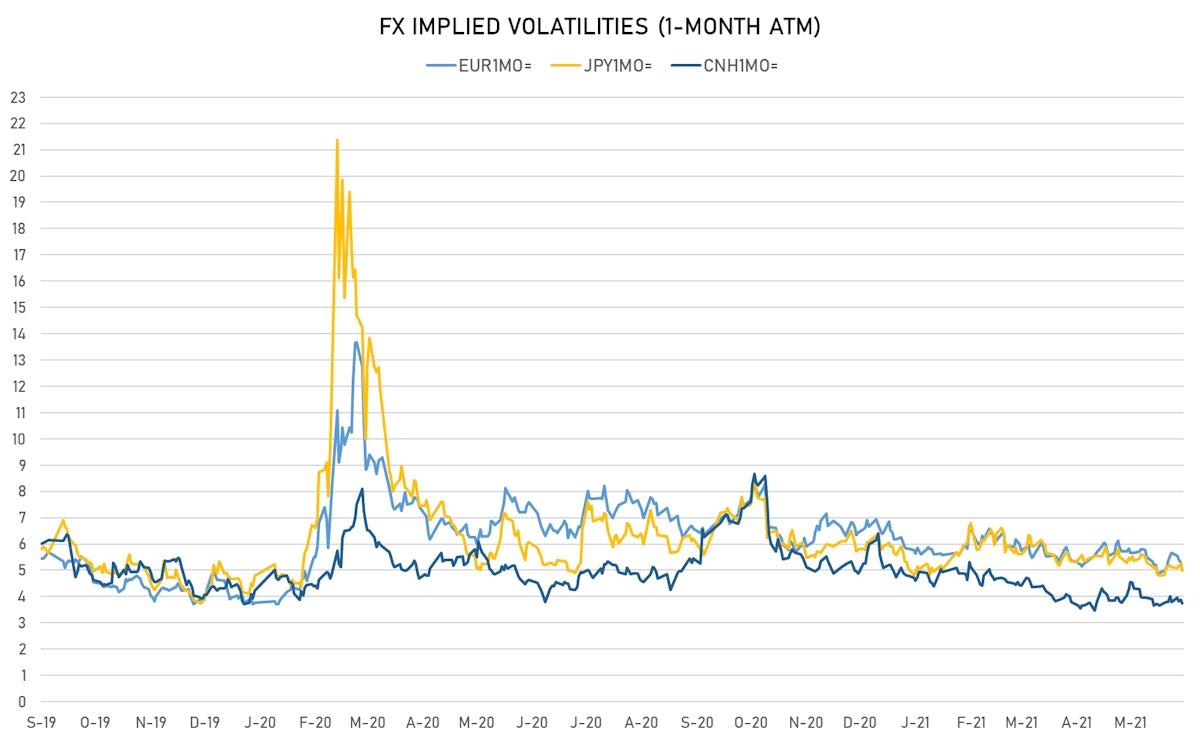

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 5.93, down -0.09 on the day (YTD: -1.24)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.00, down -0.3 on the day (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 4.99, down -0.3 on the day (YTD: -1.1)

- Offshore Yuan 1M ATM IV currently at 3.73, down -0.1 on the day (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS

- Argentina (rated CCC): up 37.4 basis points to 1,860 bp (1Y range: 1,049-1,968bp)

- Oman (rated BB-): up 3.8 basis points to 240 bp (1Y range: 228-485bp)

- Bahrain (rated B+): up 2.7 basis points to 198 bp (1Y range: 172-347bp)

- Colombia (rated BBB-): down 1.8 basis points to 137 bp (1Y range: 83-164bp)

- Brazil (rated BB-): down 3.3 basis points to 159 bp (1Y range: 141-264bp)

- Mexico (rated BBB-): down 2.1 basis points to 94 bp (1Y range: 79-164bp)

- Russia (rated BBB): down 1.9 basis points to 81 bp (1Y range: 72-129bp)

- Government of Chile (rated A-): down 1.5 basis points to 60 bp (1Y range: 43-84bp)

- Peru (rated BBB+): down 2.4 basis points to 85 bp (1Y range: 52-98bp)

- Saudi Arabia (rated A): down 2.6 basis points to 54 bp (1Y range: 53-105bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 5.4% (YTD: +43.0%)

- Mexican Peso up 2.6% (YTD: +0.3%)

- Haiti Gourde up 2.3% (YTD: -22.0%)

- Surinamese dollar up 1.4% (YTD: -30.9%)

- Azerbaijani New Manat up 1.2% (YTD: 0.0%)

- Vanuatu Vatu up 1.1% (YTD: -1.1%)

- Armenian Dram up 1.0% (YTD: +3.1%)

- Chilean Peso up 1.0% (YTD: -3.2%)

- Sudanese Pound down 1.3% (YTD: -87.6%)

- Rwanda Franc down 1.6% (YTD: -1.5%)