FX

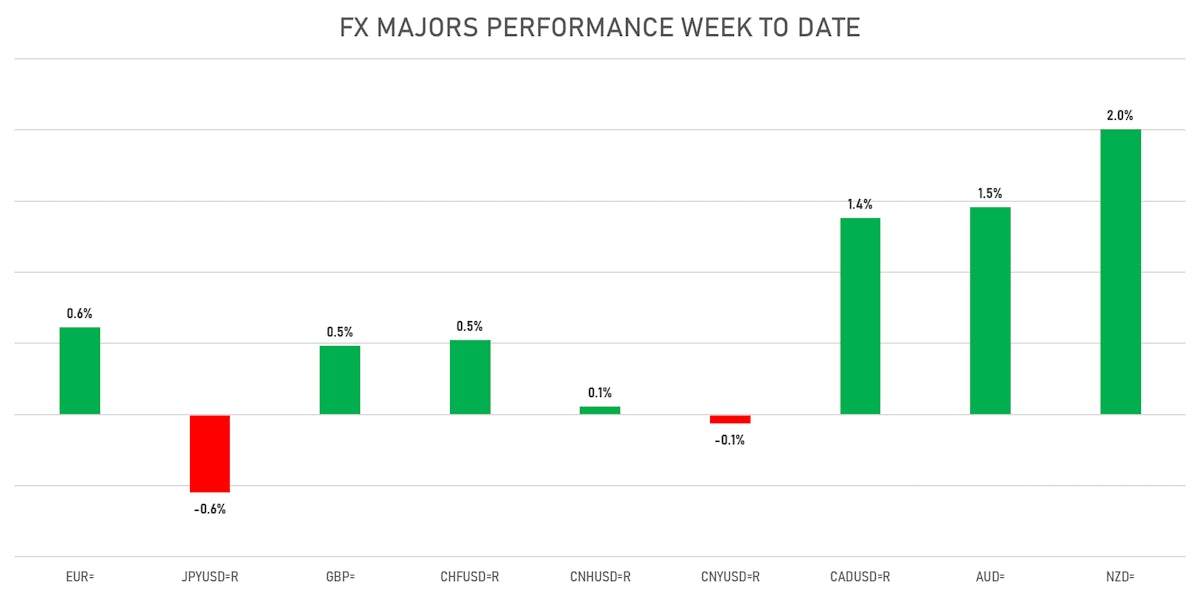

Most Major Currencies Rose Against The US Dollar This Week, JPY The Exception

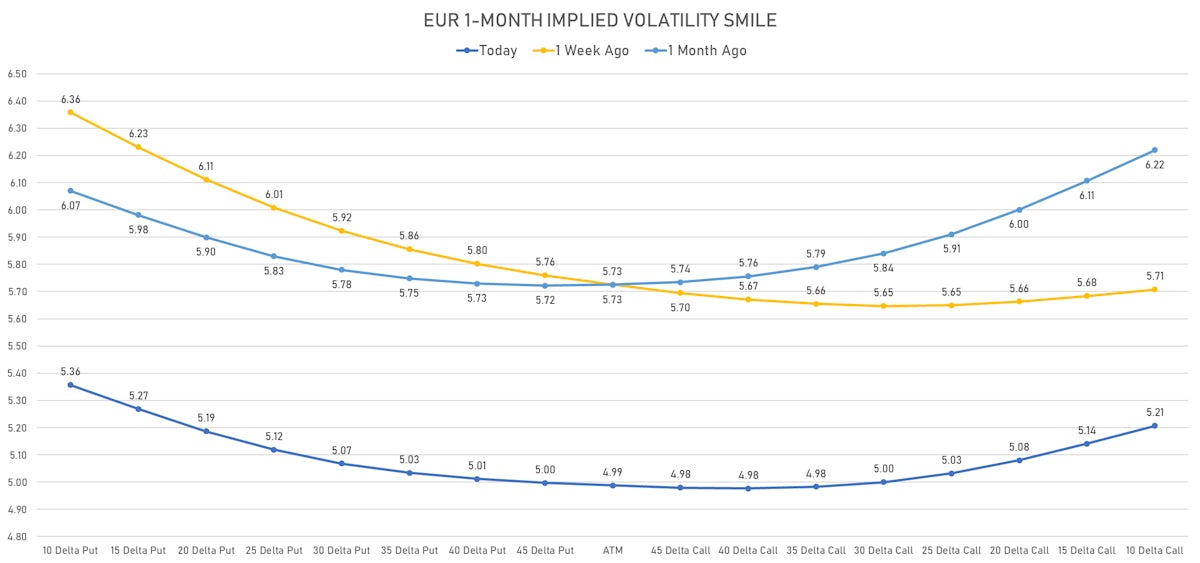

Speculative positions in the FX options market have come closer to neutral this week, most notable in the euro after the big drop last week

Published ET

JPY, CNH, EUR 1-Month 10-Delta Risk Reversals | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.04% at 91.85 (YTD: +2.13%)

- Euro up 0.07% at 1.1933 (YTD: -2.3%)

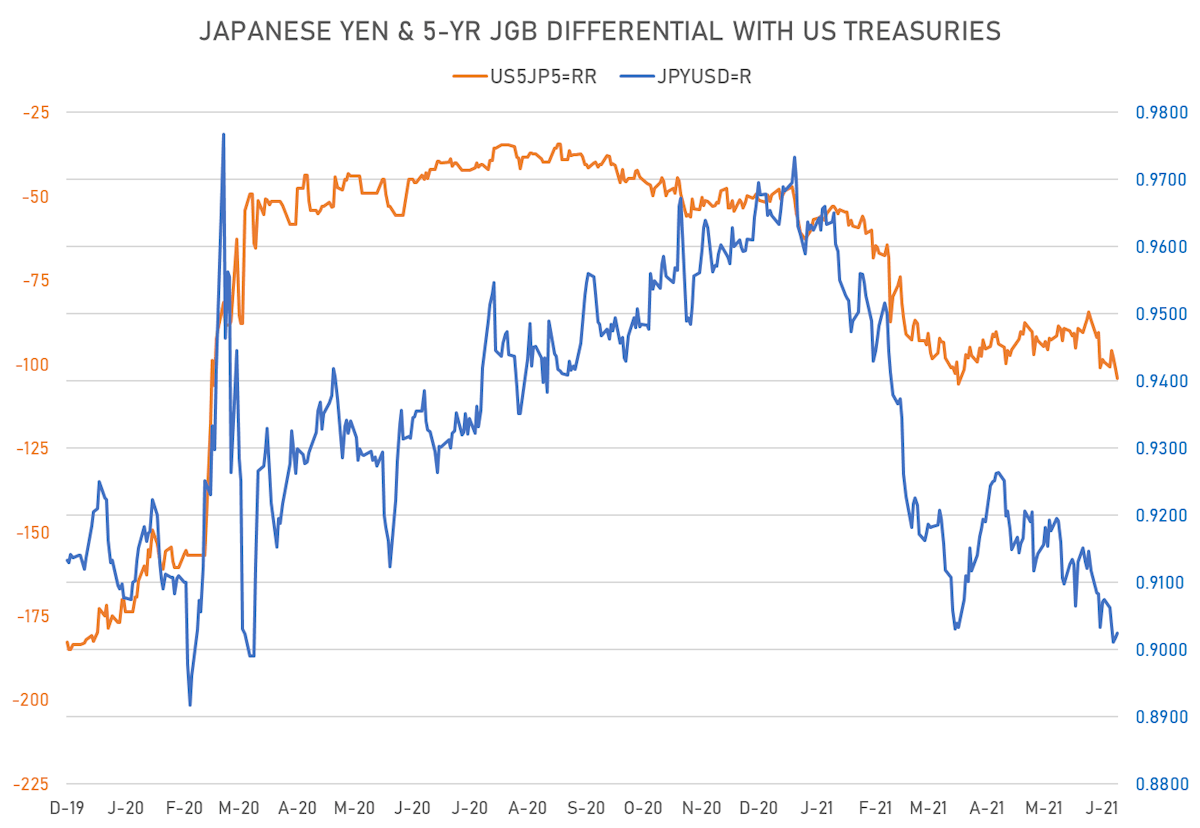

- Yen up 0.14% at 110.77 (YTD: -6.8%)

- Onshore Yuan up 0.26% at 6.4545 (YTD: +1.1%)

- Swiss franc up 0.13% at 0.9175 (YTD: -3.5%)

- Sterling down 0.59% at 1.3876 (YTD: +1.5%)

- Canadian dollar up 0.09% at 1.2292 (YTD: +3.6%)

- Australian dollar up 0.15% at 0.7586 (YTD: -1.4%)

- NZ dollar up 0.40% at 0.7072 (YTD: -1.6%)

MACRO DATA RELEASES

- Brazil, Current Account, Balance, Current Prices for May 2021 (Central Bank, Brazil) at 3.80 Bln USD, below consensus estimate of 4.00 Bln USD

- Brazil, Financial Account, Direct Investment, In Reporting Economy, Net incurrence of liabilities, Current Prices for May 2021 (Central Bank, Brazil) at 1.20 Bln USD, below consensus estimate of 2.50 Bln USD

- Euro Zone, Money Supply, M3, Change Y/Y for May 2021 (ECB) at 8.40 %, below consensus estimate of 8.50 %

- Germany, GfK Consumer climate indicator for Jul 2021 (GfK Group) at -0.30 , above consensus estimate of -4.00

- Italy, Consumer confidence for Jun 2021 (ISTAT, Italy) at 115.10 , above consensus estimate of 112.00

- Mexico, IGAE, Change Y/Y for Apr 2021 (INEGI, Mexico) at 22.30 %, above consensus estimate of 21.70 %

- Singapore, Production, Change P/P for May 2021 (Statistics Singapore) at 7.20 %, above consensus estimate of -0.90 %

- Singapore, Production, Change Y/Y for May 2021 (Statistics Singapore) at 30.00 %, above consensus estimate of 23.60 %

- United Kingdom, CBI Distributive Trades, Retailing, Volume of sales, balance for Jun 2021 (CBI, UK) at 25.00 , above consensus estimate of 14.00

- United States, Change P/P for May 2021 (BEA, US Dept. Of Com) at -2.00 %, above consensus estimate of -2.50 %

- United States, Personal Consumption Expenditure, Change P/P for May 2021 (BEA, US Dept. Of Com) at 0.00 %, below consensus estimate of 0.40 %

- United States, Personal Consumption Expenditure, Change P/P for May 2021 (BEA, US Dept. Of Com) at -0.40 %

- United States, Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for May 2021 (BEA, US Dept. Of Com) at 0.50 %, below consensus estimate of 0.60 %

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Jun 2021 (UMICH, Survey) at 85.50 , below consensus estimate of 86.50

WEEKLY CFTC DATA

- ALL: reduced their net short US$ positioning

- G10: reduced their net short US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: increase in net short US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

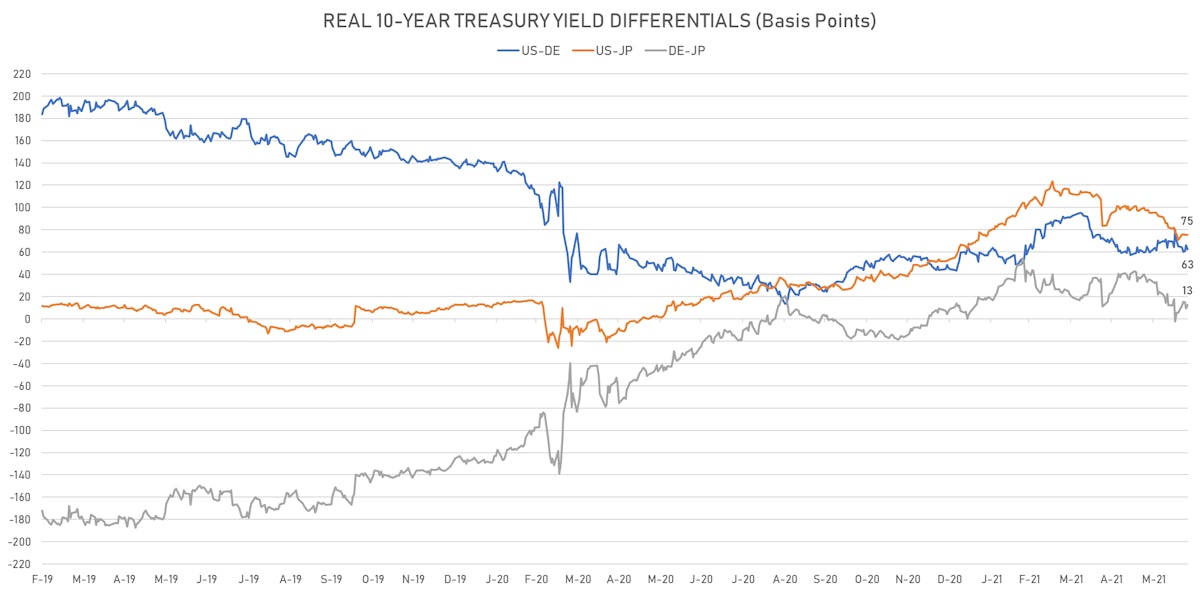

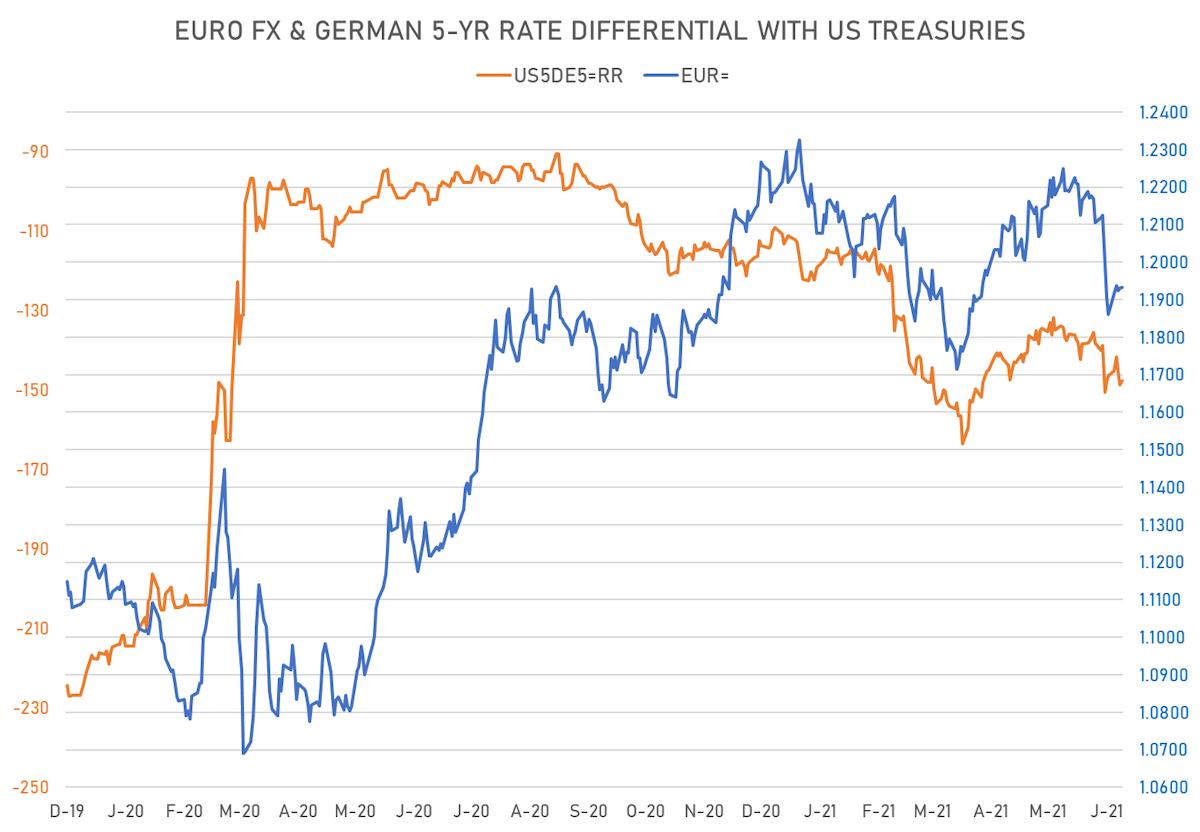

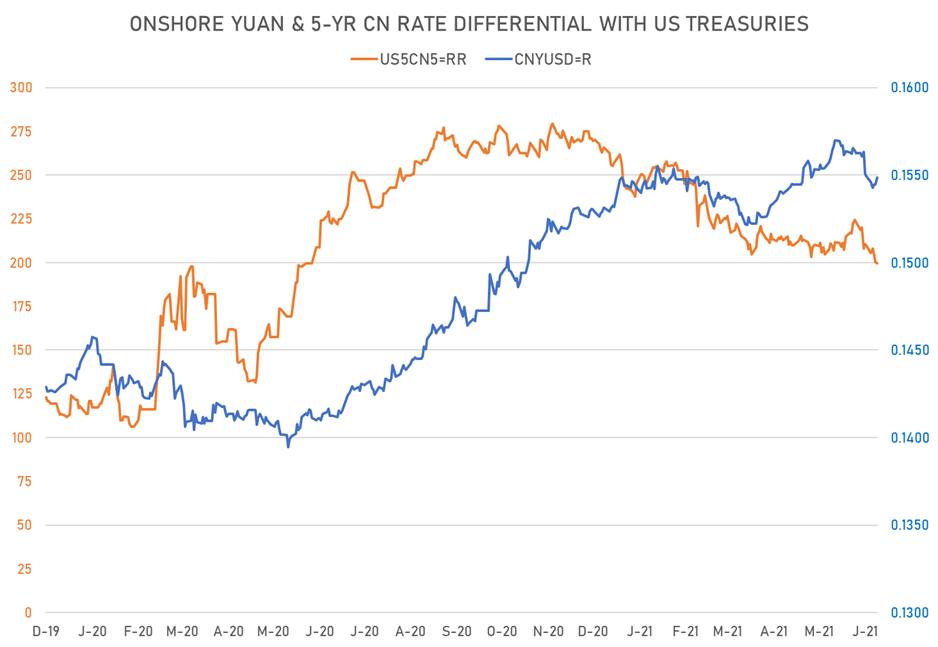

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 1.0 bp tighter at -147.7 bp (YTD change: -36.6 bp), positive for the euro

- 5Y Japan-US interest rates differential 2.7 bp wider at -104.2 bp (YTD change: -55.9 bp), negative for the yen

- 5Y China-US interest rates differential 0.7 bp tighter at 199.6 bp (YTD change: -57.5 bp), negative for the yuan

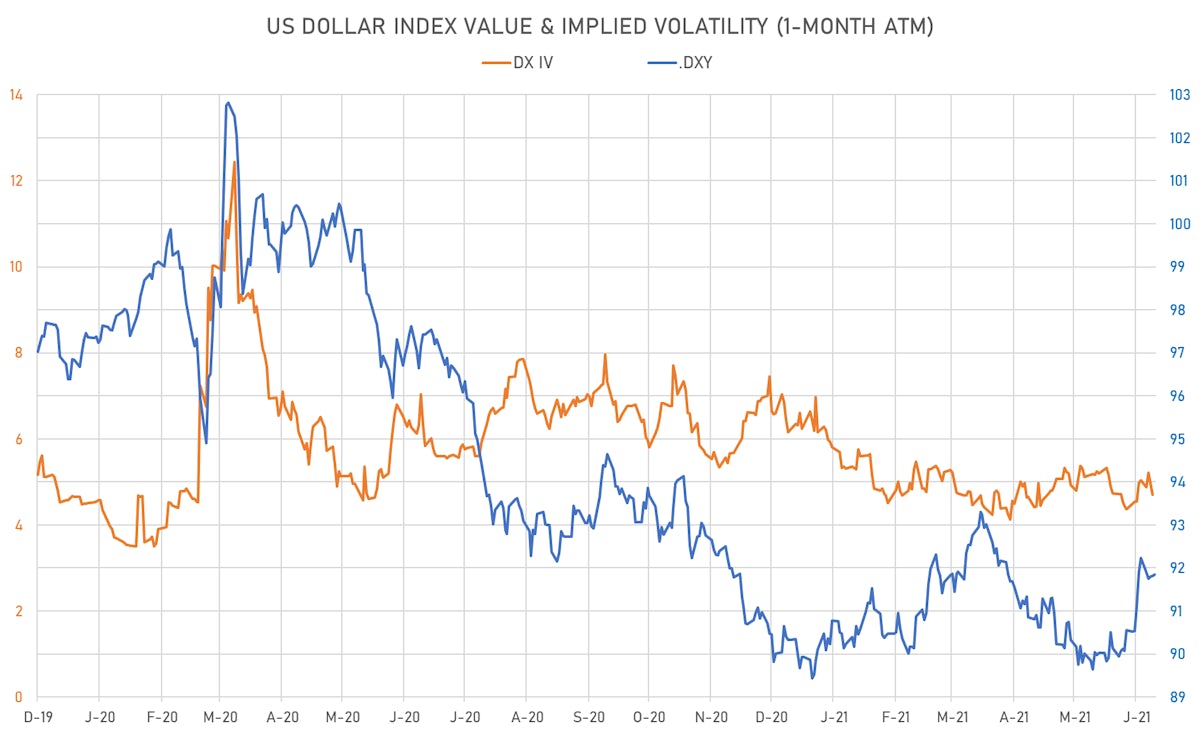

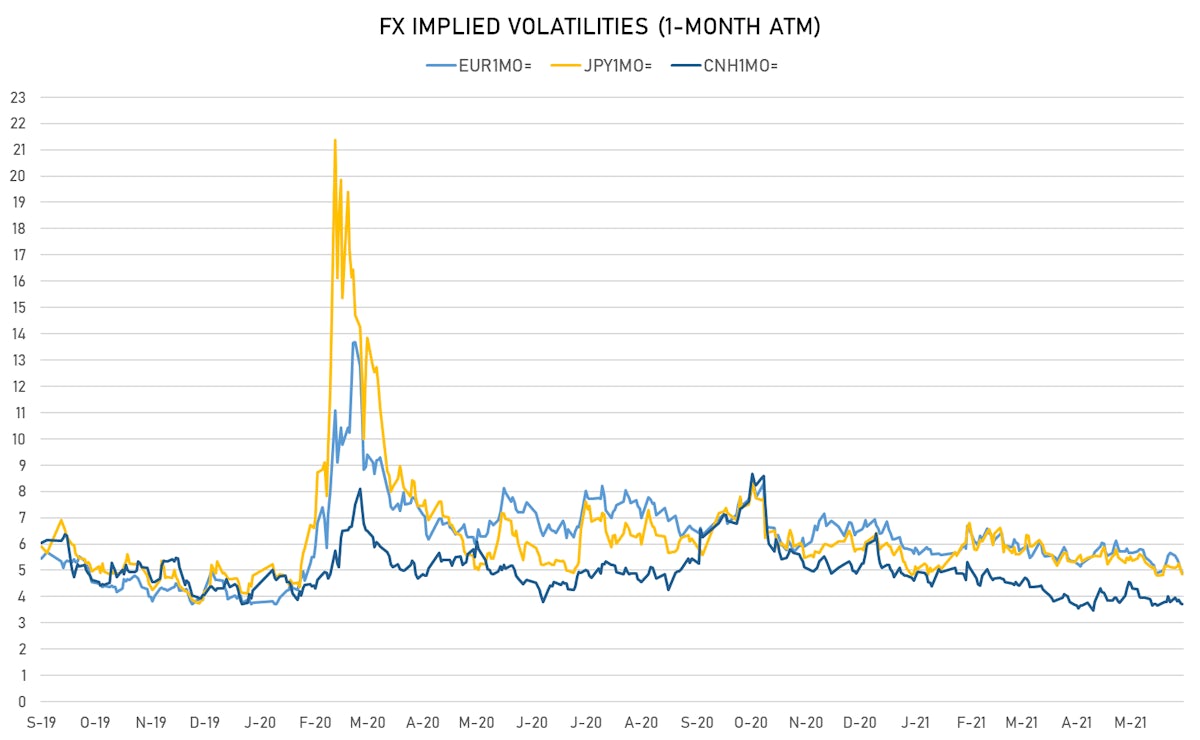

VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 5.89, down -0.04 on the day (YTD: -1.28)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.91, down -0.1 on the day (YTD: -1.8)

- Japanese Yen 1M ATM IV currently at 4.85, down -0.1 on the day (YTD: -1.3)

- Offshore Yuan 1M ATM IV currently at 3.72, unchanged (YTD: -2.3)

NOTABLE MOVES IN SOVEREIGN CDS

- Morocco (rated BB+): up 3.1 basis points to 87 bp (1Y range: 84-127bp)

- Argentina (rated CCC): up 39.7 basis points to 1,894 bp (1Y range: 1,049-1,968bp)

- Peru (rated BBB+): down 1.3 basis points to 84 bp (1Y range: 52-98bp)

- Panama (rated BBB-): down 1.1 basis points to 64 bp (1Y range: 44-112bp)

- Saudi Arabia (rated A): down 1.2 basis points to 53 bp (1Y range: 53-105bp)

- Colombia (rated BBB-): down 3.3 basis points to 134 bp (1Y range: 83-164bp)

- Mexico (rated BBB-): down 2.4 basis points to 92 bp (1Y range: 79-164bp)

- Bahrain (rated B+): down 5.5 basis points to 192 bp (1Y range: 172-347bp)

- Government of Chile (rated A-): down 1.7 basis points to 59 bp (1Y range: 43-84bp)

- Oman (rated BB-): down 13.7 basis points to 226 bp (1Y range: 228-485bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 20.8% (YTD: +43.0%)

- CFA Franc BEAC up 3.5% (YTD: +0.4%)

- Eritrean Nakfa up 2.8% (YTD: 0.0%)

- Armenian Dram up 2.7% (YTD: +4.9%)

- Nicaragua Cordoba up 2.5% (YTD: 0.0%)

- Mexican Peso up 1.9% (YTD: +0.3%)

- Surinamese dollar up 1.9% (YTD: -31.9%)

- Turkish Lira down 1.5% (YTD: -15.3%)

- Vanuatu Vatu down 2.0% (YTD: -3.5%)

- Mozambique metical down 2.2% (YTD: +15.4%)